Tezos addresses the lack of flexibility and scalability in Bitcoin and other blockchains that need hard forks for upgrade purposes. It uses an on-chain governance model to enable the amendment of proposals upon receiving a favorable vote from the community instead of going through lengthy and complex hard fork procedures that rely on large development teams and mining communities.

The energy-efficient proof-of-stake algorithm used by the Tezos network has made it popular among altcoins. Given rising concerns about the energy requirements for alternative proof-of-work platforms, many famous brands selected Tezos to build their NFT platforms, including Quincy Jones, Red Bull Racing, and McLaren Racing.

On this Page:

How to Buy Tezos

- Choose a Tezos exchange – we recommend Binance as one of the top options

- Create an account by entering your personal details. Verify the account by providing the required documents.

- Deposit funds into your account using any of the supported payment options.

- Search ‘Tezos ‘ in the drop-down menu to begin with other order creation process.

- Click ‘Open Trade’ and select an amount of Tezos to buy.

Compare Crypto Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Where to Buy Tezos – Best Platforms

Tezos had a highly successful initial coin offering (ICO) in July 2017 that triggered a massive price gain in its token value, XTZ. Today, from crypto-focused exchanges to derivatives brokers, there is no shortage of companies offering Tezos (XTZ) trading.

Deciding the best place to buy Tezos (XTZ) can be difficult. In this guide, we took our time to review several platforms, and we came up with this shortlist. Our list of places to buy Tezos in 2024 includes their features, fees, and why each one is unique.

Best Brokers to Buy Tezos

1 – Binance

Binance is, without a doubt, one of the best platforms to use when purchasing Tezos. This is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets and a smooth trading service that makes it simple to make money.

The advantages of Binance are pretty astounding. The trading commission is a flat 0.1 percent, which is low. Expert traders can use sophisticated tools, including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. Combining this with Binance’s high liquidity makes it easy to see why it’s so popular.

Binance, on the other hand, is a crypto-only exchange. There’s no copy-trading, forex, commodities, etc.

The exchange also charges high credit card transaction fees, and the primary portal isn’t particularly user-friendly. Furthermore, the Binance interface is not particularly user-friendly for newcomers. The charts and menu options may be bewildering for first-time Tezos (XTZ) buyers.

At 11:00 AM on September 24, 2019, Binance listed Tezos and opened trading for the XTZ/BNB, XTZ/BTC, XTZ/USDT, and XTZ/BUSD trading pairs (UTC). Users can now begin preparing to trade by depositing XTZ.

Pros & Cons of the Binance platform:

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Fewer deposit methods

- High fees for credit card deposits

- No copy trading

2 – Bitfinex

Bitfinex was founded by Giancarlo Devansini and Raphael Nicolle in the British Virgin Islands 2012. It’s headquartered in Hong Kong. Initially, the company operated solely as a peer-to-peer margin lending platform for Bitcoin. Some iFinex inc founders and management are also connected to Tether, the US-pegged Stablecoin.

The cryptocurrency exchange has evolved to be one of the largest, with operations in the UK (GBP), Europe (EUR), Japan (JPY), and others. Its services are best suited for traders with a certain level of experience or expertise. Additionally, the platform provides margin trading, staking, and lending options for cryptocurrencies.

Fee – Taker costs range between 0.2 and 0.055 percent, whereas Maker fees range between 0.1 and 0.0 percent. There is no trading cost for big orders placed through the OTC desk. Bank wire transfers incur a 0.1 percent deposit and withdrawal fee. For foreign withdrawals, this can be increased to 1%.

Bitfinex listed Tezos (XTZ) on August 08, 2020, and supported trading pair, including XTZ/USDT and XTZ/BTC.

Pros & Cons of the Bitfinex platform:

- Established since 2012

- Suited for advanced traders

- Over 100 supported coins

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- High trading feesHacked on more than one occasion

3 – KuCoin

KuCoin, which debuted in 2017, is a cryptocurrency exchange that provides third-party brokerage services. KuCoin is a secure and simple-to-use cryptocurrency exchange platform where users worldwide may trade crypto assets. Furthermore, the platform is situated in Seychelles, and the founding members have previous expertise running businesses like Ant Financial and iBox PAY.

Kucoin is often referred to as “The People’s Exchange.” The platform includes a trading bot, margin trading, futures trading, loans, and other services. Furthermore, according to the platform, one of every four HODLers uses KuCoin.

Kucoin has its cryptocurrency, known as Kucoin Shares (KSC). If you hold KSC coins, you will save trading costs and gain more cryptocurrency. KuCoin is also one of the top ten cryptocurrency exchanges in the world, according to CoinMarketCap.

KuCoin listed Tezos (XTZ) on June 28, 2019, and supported trading pair, including XTZ/BTC and XTZ/USDT.

Pros & Cons of the KuCoin platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- KuCoin Shares allow users to invest in the success of KuCoin.

- User-friendly exchange

- Low trading and withdrawal fees

- Users can trade using Arwen without transferring funds into a third-party wallet.

- A vast number of pairs are available to trade.

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilize.

- Lacks the trading volumes found on some of the more established platforms.

- No fiat trading pairs

4 – Bybit

Bybit is a relatively new trading platform that launched in March 2018. It offers an industry-leading leverage trading exchange focusing on cryptocurrency derivatives, trading important coins, including Bitcoin,

Takers are charged a fee of 0.075 percent on each order, a standard market rate. Makers, on the other hand, pay a 0.025 percent fee – so if you are the maker in a $1000 trade, you would only pay $997.50, which we thought was a fair price. Regardless of the currency used in the transaction, the fees are the same. There is also a 0.0005 Bitcoin fee for BTC transfers, which is lower than the global industry standard.

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage up to 100 times.

- Order books with high liquidity and low spreads

- Affiliate and referral program (30% commission)

Pros & Cons of the Bybit Platform

- Dependable and respectable trading platform.

- By volume, it is the world’s fourth-largest derivatives exchange.

- Various markets are available, including spot, perpetual, and futures.

- A sophisticated and feature-rich trading platform

- A mobile app that is simple to use and responsive

- Difficult for newcomers to navigate.

- A limited number of spot trading pairs against BTC.

5 – Coinbase

Coinbase, the largest cryptocurrency trading platform in terms of users, was founded in 2012 in San Francisco.

Coinbase became the first crypto trading company in the United States to be listed on the stock exchange, with an IPO priced at roughly $86 billion. While Bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking.

Use the Coinbase Pro exchange for trading, as it has lower fees than the main Coinbase site, which is more of a broker.

The Coinbase Pro exchange – where you set limits or market orders yourself – has these trading pairs for Tezos – XTZ/BTC, XTZ/USD, XTZ/EUR, and XTZ/GBP. So you can trade it against fiat currency, and withdrawals to and from your bank account in those currencies are instant.

The maker/taker fee is 0.5% until you trade over $10k in volume within 30 days, then it drops to 0.35%. Maker fees (for limit orders) drop to zero for free crypto trading if your 30-day volume is over $300 million.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

What is Tezos (XTZ)?

The native currency of the Tezos Blockchain platform is XTZ or Tez. According to the developers, Tezos is an ancient Greek word for “smart contract.” Tezos was designed to make use of smart contracts just like Ethereum. However, it takes the concept of smart contracts one step further by letting participants directly control the network rules.

During the cryptocurrency boom in 2017, the native token of the Tezos platform, XTZ, gained much attention and media coverage for its initial coin offering in July 2017. The coin has undergone many upgrades since its launch and all of them were performed by submitting proposals for change and getting votes on those changes. The protocol will incorporate the code changes if the proposal receives enough votes. About seven proposals have been approved to date on the Tezos network.

Tezos is a blockchain network tied to a digital token called a “Tez” or a “Lizzie.” Tezos is not based on tez mining. Instead, token holders are rewarded for participating in its proof-of-stake consensus method.

Tezos was built by Arthur Breitman, who had previously worked at Waymo, Google, Goldman Sachs, and Morgan Stanley. In 2017, with his wife, Kathleen Breitman, Arthur developed the Tezos Foundation, which raised $232 million in a fundraiser and created a proof-of-stake blockchain.

Tezos had a highly successful initial coin offering (ICO) in July 2017 that triggered a massive price gain in its token value, XTZ. However, the ICO was followed by lawsuits for the subsequent public disagreements between its founders and the non-profit Tezos Foundation. These disagreements led to delays in the deployment of Tezos, which ended up declining prices.

Nevertheless, Tezos eventually launched officially in 2018. In August 2020, the Tezos Founders and the Tezos Foundation settled the lawsuit against them, alleging the unauthorized sale of a security for $25 million paid by the Foundation.

The price of XTZ started its bullish trend at the start of 2020, and it has been continuously surging. XTZ started its journey on the Binance exchange in March 2020. Since then, the coin has been in a bullish trend overall. The outlook for Tezos began to improve at the beginning of 2020. However, being a cryptocurrency, the prices remained highly volatile and speculative.

XTZ has performed exceptionally well since the start of 2021. During the first four months of that year, the cryptocurrency surged by about 80% and moved from $1.96920 to $7.55000. The next three months did not favor XTZ as the coin initially moved to the $8.37620 level in May but faced resistance there, experienced a massive sell-off, and declined to as low as $2.10530 in July.

However, since August 2021, the price has been rising continuously, and in October, the coin reached its all-time high at $9.15000. Afterward, the token saw a big drop in its price. As of 08 February 2023, the price of Tezos is $1.18.

Is it Worth Buying Tezos in 2024?

Tezos, a cryptocurrency that has made significant strides since its inception, is currently at the forefront of the market. XTZ, its native token, is emerging as a robust contender against Ethereum, bolstered by its rapidly expanding ecosystem.

Tezos has made remarkable strides in narrowing the gap with Ethereum’s dominance. It currently boasts over 140 active projects and decentralized applications under development on its platform.

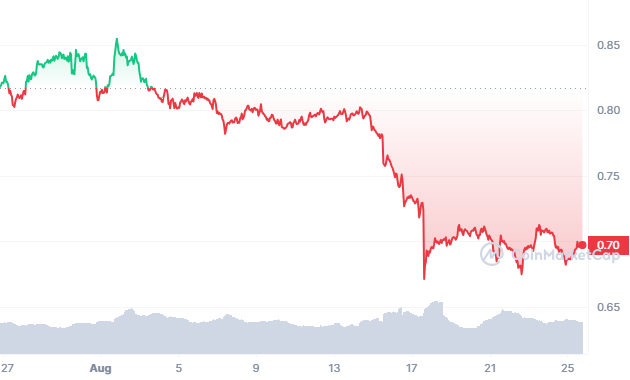

Tezos, undergoing a series of upgrades that contribute to its value ascent, has garnered substantial attention. Currently, the price of Tezos stands at $0.706453, accompanied by a 24-hour trading volume of $ 29.17 million.

Tezos has experienced a significant surge in its market capitalization, reaching an impressive value of $ 662.82 million. This places Tezos as a prominent player with a market dominance of 0.06%. Although there has been a slight decrease of -0.23% in the past 24 hours,

Tezos has witnessed price fluctuations since its inception. On December 17, 2017, it reached a record high of $12.26, while its lowest point was on December 7, 2018, at $0.319784. Following that, Tezos experienced its lowest price since reaching the all-time high at $0.319784 and peaked at $9.08 in this cycle.

Tezos currently holds a circulating supply of 946.95 million XTZ tokens, which is just shy of its maximum supply of 937.87 million XTZ. The annual supply inflation rate stands at 4.63%, resulting in the minting of approximately 41.90 million XTZ tokens in the previous year. Amongst Proof-of-Stake coins, Tezos claims the respectable #13 spot, while also commanding the top position in the Tezos Network sector and achieving a commendable rank of #29 in the Layer 1 sector.

Will the Price of Tezos (XTZ) Go Up in 2024?

In the realm of blockchain technology, Tezos has demonstrated its commitment to evolution through a series of notable network upgrades. Commencing in May 2019 with the approval of the Athens upgrade, gas limits per block surged while roll sizes scaled down from 10,000 to 8,000 Tez.

In the subsequent phases of development, Babylon 2.0/2.1 emerged as a major milestone in October 2019. It introduced a more robust consensus algorithm and simplified the process of smart contract development. Following this, Carthage 2.0, launched in March 2020, brought about notable improvements such as increased gas limits and resolution of minor glitches. Finally, Delphi, implemented in September

Edo, unveiled in February 2021, introduced privacy-focused smart contracts, shorter cycle lengths, and a 5th Adoption Period. Florence, emerging in May 2021, expanded operation size and redefined voting procedures, while Granda, in August 2021, accelerated block generation and curtailed gas consumption.

Strategic collaborations and projects have greatly contributed to the success of Tezos. One noteworthy partnership that took place in September was with EQIFI, a decentralized finance platform, which facilitated asset loan services and strengthened Tezos’s position. In terms of market performance, Tezos witnessed an impressive surge in value during February 2023, reaching $1.18 before experiencing a slight decrease to $1.12.

Heightened trading volume and sustained investor interest in Tezos indicate optimism for its continued rise in 2023. Moreover, Swiss cryptocurrency entities that utilize Tezos for tokenized asset launches have enhanced their potential. In this ever-evolving landscape, Tezos (XTZ) stands out as an enticing investment option for the promising days ahead.

In the second quarter of 2023, Tezos accomplished significant milestones in its roll-up infrastructure roadmap. The platform made remarkable progress by introducing both WASM rollups and an EVM-compatible rollup on the testnet. It is worth mentioning the collaborative effort of multiple teams dedicated to constructing these rollups. In a strategic shift, core developers have adopted a hybrid approach that combines optimistic and zk rollups.

The recent implementation of the 14th network upgrade, Nairobi, has resulted in significant improvements. These enhancements encompass increased transactions per second (TPS), innovative roll-up functionalities, and enhanced attestations.

The Tezos core developers have recently introduced the Data Availability Layer (DAL), which works alongside the Tezos Layer-1. This innovative layer utilizes Tezos validators to ensure seamless data availability while simultaneously enhancing bandwidth and storage capacity.

The Tezos ecosystem is witnessing a surge in decentralized finance (DeFi) traction, with a nearly twofold increase in Total Value Locked (TVL) over the past year. Anticipated launches of novel DEXs, lending protocols, and perpetual protocols indicate this growth.

Furthermore, the introduction of the Tezos Ecosystem DAO is geared towards managing and distributing XTZ tokens to support community-driven initiatives. This move fosters greater community involvement and further the expansion of the Tezos ecosystem.

Throughout 2023, the series of developments on the Tezos platform will likely impact its price dynamics significantly. This technical progress may contribute to positive sentiment in the market, potentially driving demand and positively influencing the price.

The current sentiment surrounding the price projection of Tezos is bearish, with the Fear & Greed Index indicating a neutral stance at 54. According to analysts’ forecasts, it is expected that Tezos will trade between $0.577902 and $1.714263 in the upcoming year. An optimistic prediction suggests a significant surge of 117.04%, potentially propelling Tezos to reach $1.714263 by 2024.

Tezos’ trajectory in 2023 presents a combination of promise and challenges. The cryptocurrency’s expanding ecosystem and persistent upgrades position it as a formidable competitor in the market. However, investors seeking to seize Tezos’ future growth potential should carefully take into account prevailing market sentiments and potential price fluctuations.

When you’re considering an investment, follow these things:

Every cryptocurrency comes with risks, which is especially true in the case of Tezos (XTZ). So, whenever you invest, you mustn’t get drawn into FOMO. Apart from following others, you must research before investing in any digital asset.

1 – Research, research, research: Before investing your money, excellent and comprehensive research about the product must be done to avoid risks associated with them.

Here are the different methods we looked into:

- Exploring social media platforms

- Analyzing upcoming events

- Research the fundamentals

- Discover trending topics

- Utilize the power of niche forums

- Go to crypto meetups

- Observe the transaction volume

- Monitor the market:

Monitoring the market is a second step in knowing more about your selected product or digital asset. The market could move in a different direction from your expectations, and keeping your calm when the market is moving in another direction is also an essential factor. The best way to monitor the market is to go through the review sites and recommendations on them.

Buying Tezos (XTZ) as a CFD Product

Contracts for differences (CFDs) are derivatives that allow you to speculate on multiple financial markets without owning the underlying asset. It is widely used in established markets such as foreign exchange currency pairings, stocks, bonds, indices, and commodities.

Trading CFDs entails more than simply buying and selling; it also entails agreeing to swap the difference in an asset’s price when the contract is opened and expires.

CFD trading has entered the cryptocurrency industry, and Tezos (XTZ) is now available as a CFD product. If you’re having trouble understanding bitcoin trading and where to keep your crypto funds, you may use CFDs to profit from Tezos (XTZ).

We recommend trading altcoins with leverage on Binance or CryptoRocket. Binance supports more altcoins, including XTZ. CryptoRocket supports fewer altcoins – currently about 40 – but does support trading XTZ with leverage on its XTZUSD pair.

Taxation on Tezos Earnings:

As the cryptocurrency market is new and finding its ground, regulatory agencies, including the SEC, want to regulate it. Furthermore, the Internal Revenue Service has been trying to set up a cryptocurrency tax regime. Cryptocurrencies and digital assets are treated as properties and fall under the capital gain tax bracket. However, some earnings from cryptocurrencies are also considered income and fall under the income tax bracket in certain situations. The following are the taxable events that qualify for capital gains and income taxes when trading digital assets.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21, and IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals with bitcoin as a capital asset but not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Block rewards from cryptocurrency mining

- Crypto assets are earned from liquidity pools (LPs) or staking.

- Receiving crypto for services rendered

- Getting crypto from an airdrop

- Earning interest from lending to decentralized finance (DeFi) platforms

Be aware that you can write off your capital gains tax through losses incurred from trading. You can also save up to $3,000 of your income taxes, depending on how long you have held on to an asset.

Taxation on Tezos (XTZ)

Calculating Your Capital Gains Tax

The crypto market has grown exponentially in the past year, and government agencies are trying to know it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things essentially decide the number of capital gains tax rates for cryptocurrencies: your income tax bracket and how long you have held on to your crypto asset. This will help you calculate your:

a.) Capital Gains on Short-Term Investments

The short-term capital gains tax largely depends on how long you have been trading or holding cryptocurrencies. You will be taxed under your normal tax bracket if you have made gains or losses from trading or holding crypto for less than a year. Losses you incur for that trading year can prove useful. Leveraging a tax-loss harvesting strategy, you can write off up to $3,000 of your taxes. You also enjoy the privilege of post-dating your taxes to the next year.

b.) Capital Gains on Long-Term Investments

Long-term capital gains apply if you have been trading cryptocurrencies for over a year. You will pay taxes between 0 to 20% depending on your income. We have itemized the income tax brackets on this link.

Automated Trading With Robots

A trading robot is a computer program that, on a computerized basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values move, robots outperform humans during periods of substantial market volatility. This is because they rely on trading strategies to generate profits even when the market is down.

In addition, the most successful Bitcoin bots worldwide are known for their lightning-fast research and execution. As a result, they can complete a huge number of transactions daily and thereby take advantage of any trading opportunities.

Trading Tezos (XTZ) can be challenging for anyone, and there is no assurance that your market analysis will result in a profit. There are other sure ways to grow your capital with little to no effort to get around this problem. Ideally, the bots make a profit bigger in risk-adjusted terms than if you had just bought and held the same coins throughout.

Tezos (XTZ) Mining: Can You Mine Tezos?

No, Tezos relies on a proof-of-stake mechanism and not a proof-of-work mechanism, which means it cannot be mined. After that, you have two options: assign those tokens to somebody interested in contributing to the blockchain, or set up a node and stake yourself if you have 10,000 tokens. Delegating or staking earns you roughly 5.5 percent interest. In this strategy, the transaction charge isn’t a substantial source of revenue.

Decreasing Risk in Tezos (XTZ) Investment:

Every investor needs to find ways to protect themselves from any big loss. If you want to cap your risks, then follow these rules:

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order restricts an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings daily if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it, and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders who follow a long-term strategy dislike such orders since they reduce profits.

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in various narratives (Oracles, Defi, or insurance). Trade reduces risk when trading only when extreme patterns form or a coin has reached its bottom.

Fundamental & Technical analysis: I prefer to focus on coins with solid fundamentals when investing. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do a technical analysis. I consider things like where the currency is in its life cycle.

Are there any trading patterns? There is support and resistance, recent price history, news, and forthcoming events for the coin. If I invest in fundamentally good coins, I can stay calm even if the price changes because I know the price will eventually rise.

Tezos vs. Other Cryptocurrencies

Tezos (XTZ) vs. Ethereum (ETH)

The main difference between Ethereum and Tezos is the way to power their blockchain. Ethereum has a Proof of Work mechanism similar to Bitcoin, which is very costly as it demands a lot of energy. On the other hand, Tezos uses a Proof of Stake mechanism that solves the issue of higher energy consumption.

The Ethereum blockchain uses a proof of work mechanism, which means that while upgrading the network, it has to go through a hard fork. Sometimes there are disputes over network upgrades, like when Bitcoin users disagree on how many transactions should be processed on each block, resulting in Bitcoin forking into Bitcoin and Bitcoin Cash. Such concerns can threaten Ethereum because cryptocurrency forks frequently divide the uses of the cryptocurrency and reduce network size. However, Tezos has no such fears as it uses the PoS mechanism and all the upgrades are approved via voting.

The network size of Ethereum is much bigger than Tezos due to more usability. Furthermore, the number of users can affect the cryptocurrency’s utility and security. The block time at Tezos is 3 seconds, while Ethereum’s is 10 to 19 seconds. Tezos can perform about 30 to 40 transactions per second, while on the Ethereum blockchain, only 10 to 13 transactions can be performed in a second. The transaction fee at Tezos is about $0.00232, whereas the Ethereum transaction fee is around 0.65 ETH.

Tezos (XTZ) vs. Bitcoin (BTC)

Bitcoin uses peer-to-peer technology to manage transactions and issue new bitcoins without a central authority or banks. The network as a whole is in charge of these tasks. Anyone can participate in Bitcoin because it’s open-source, and nobody owns or controls it. Several of Bitcoin’s unique qualities enable it to be used in ways no other payment system has been able to.

Conversely, Tezos can perform about 30 to 40 transactions per second, while the transaction fee at Tezos is about $0.00232.

XTZ Price Predictions: Where Does XTZ Go From Here?

Tezos is currently trading at $0.7072. The token is expected to maintain its present rate of growth this year. Some experts are hopeful that the token will trade around $1 by the end of this year.

Tezos Forecast 2024-2027

The price of Tezos is predicted to be around $2.35 next year. Some experts think that it can even surpass the level of $2.73. In 2025, XTZ is projected to have the following minimum and maximum values: about $3.29 and $3.96, respectively. The token can even go up to $4.82 in the year 2026 and reach $8.05 by the end of 2027.

Summary

Tezos launched a tremendously successful initial coin offering (ICO) in July 2017, which significantly increased the value of its token, XTZ. However, the initial coin offering was followed by lawsuits over subsequent public differences between the Tezos Foundation’s founders and the non-profit Tezos Foundation. These conflicts slowed the implementation of Tezos, which resulted in lower pricing. Tezos did, however, launch formally in 2018. The Tezos Founders and the Tezos Foundation settled a lawsuit brought against them in August 2020, alleging the improper sale of a security for a total of $25 million paid by the Foundation.

If you’re ready, our suggested broker, Binance, can help you finish your crypto journey. It takes a few minutes to set up your account and begin purchasing Tezos (XTZ) using Binance.

You should also remember the following:

- Investing in Tezos and trading it requires substantial research and effort.

- Tezos (XTZ) is a cryptocurrency that carries a significant degree of risk.

- Invest just what you can afford to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should also consult review sites and online specialists for their thoughts on Tezos.

Your Capital is at Risk

FAQs

Any risks in buying Tezos now?

The technical side of Tezos is exhibiting a bullish bias, extending support at $0.50. While technical indicators such as the EMA and RSI support a buying trend, there's a potential for a bullish trend continuation in Tezo's price. It's a safe coin to invest in. Yet, you should conduct proper research before investing in any coin.

Should I buy Tezos (XTZ)?

Tezos is currently trading at $1.18. The token is expected to maintain its present rate of growth this year. Some experts hope the token will trade at around $1.8 by the end of this year. Given Tezos's increased popularity and developments, you should consider adding the coin to your portfolio.

Where can I spend my Tezos (XTZ)?

Tezos (XTZ) is still not as widely used as Bitcoin. However, an increasing number of stores are now accepting it. In any case, you can always convert Tezos (XTZ) into other cryptocurrencies like Bitcoin, Ethereum, or Tether to make payments online.

Is it safe to buy Tezos?

Tezos is a proof-of-stake blockchain platform that supports decentralized applications and smart contracts. Tezos features an on-chain governance model that enables the amendment of proposals upon receiving a favorable vote from the community instead of going through lengthy and complex hard fork procedures that primarily rely on development teams and mining communities. Thus, it's safe to invest in it. However, we recommend not to put all your investment in one basket.

Will Tezos (XTZ) ever hit $100?

The long-term forecast of Tezos supports a strong bullish trend in XTZ against USD, yet, hitting $100 is a very challenging target. Since it’s trading at $6.07 and there’s a long way to travel to reach $100, it may not hit $100 anytime soon. However, in the coming five years, Tezos has the potential to target $50 by 2025.