Curve is a decentralized exchange, and the automated market maker system is powered by the Curve Dao token (CRV). The platform’s CRV token is an ERC-20 token built on the Ethereum network and generated with the Ethereum-based development tool Aragon to connect smart contracts and automatically manage liquidity between trading pairs. When it comes to cutting-edge uses of blockchain technology, the field of decentralized finance (DeFi) is one of the most interesting.

The Curve DAO and its token, CRV, can assist you in investing in this new technology. Instead of being a network for trading multiple crypto assets, Curve was specifically developed to allow users to swap stablecoins. It was also designed to enable all CRV holders a say in choices, from how Curve users are reimbursed to greater technological advancements.

On this Page:

How to Buy Curve – Quick Guide

- Choose a platform or an exchange that offers Curve – we suggest Binance or Coinbase.

- Open an account and get it verified.

- Deposit into your account through bank transfer, credit card, Paypal, or other payment options.

- Purchase Tether (USDT) or another stablecoin.

- Look up ‘Curve’ in the drop-down menu, and click on it to open the chart.

- Lastly, click on ‘Buy’ and select the amount of Curve you want to buy, converting from USDT.

Where to Buy CRV – Best Platforms

Curve coin is software that employs numerous cryptocurrencies to run an automated market-making service centered on stablecoins (cryptocurrencies programmed to mimic other assets). Curve, one of several new decentralized finance (DeFi) protocols built on Ethereum, promotes trading by utilizing pools of cryptocurrencies given by users, who can earn fees through their deposits. Like Uniswap or Balancer, Curve allows cryptocurrency users to earn fees on their assets while allowing traders to buy and sell them at possibly better prices.

After extensive research, we narrowed down the best platforms to buy CRV. Our list of places to purchase CRV in 2024 covers their features, fees, and why each one is unique.

1 – Binance

Binance is one of the largest cryptocurrency exchanges by daily transaction volume, having reached over $20 billion in deals per day.

Binance has some of the lowest fees in the cryptocurrency sector, so traders wishing to avoid the exorbitant fees charged by other brokers or exchanges should take a hard look here. The exchange should be helpful to a broad spectrum of cryptocurrency traders, particularly those who wish to go deeper into the sector than just the top few coins.

While the prices are reasonable, clients may pay for it with little to no customer service. Just don’t confuse this US-based exchange with its parent business, Binance, which operates outside the US. Overall, Binance – which we’ll discuss here as the US operation – provides an appealing approach to get started with cryptocurrencies.

Besides low fees, Binance’s most highlighted features involve extensive charting options and hundreds of cryptocurrencies. Binance is a crypto-only exchange, and it doesn’t offer copy trading, forex, commodities, etc. Furthermore, it uses two-factor authentication (2FA) verification and FDIC-insured US dollar (USD) deposits. In the US, Binance Exchange uses device management via address-allow listing and cold storage to guard its clients.

Binance listed the Curve token back in August 2020 and offered to trade several pairs like CRV/BNB, CRV/BTC, CRV/BUSD, and CRV/USDT.

Fees: 0.015 percent to 0.10 percent for purchase and trading fees, 3.5 percent or $10 for debit card purchases, whichever is greater, or $15 per US wire transfer.

Pros & Cons of the Binance platform:

- Over 500 coins are available for trading.

- A broader selection of cryptocurrencies.

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – Leverage on long and short trades

- A wide range of transaction types are available.

- US customers can’t use the Binance platform, and the Binance.US exchange is minimal.

- High fees for credit card deposits

- Lack of copy-trading feature

2 – Coinbase

Coinbase was established in San Francisco back in 2012. In terms of users, Coinbase is one of the largest cryptocurrency trading platforms. It’s the first big cryptocurrency company to go public in the US, debuting on the Nasdaq in April at $381 with an initial market worth of $99.6 billion.

Coinbase is a large company with over 73 million active users and a platform worth $255 billion. For simple buy and sell orders, beginners will most likely prefer the original Coinbase platform. Coinbase Pro, available to all Coinbase users, allows advanced users to access extra tools and order types.

Coinbase is a decentralized organization with no central offices. It has users in over 100 countries, and clients exchange about $327 billion per quarter. Moreover, the exchange oversees a thriving Bitcoin ecosystem that serves 9,000 financial institutions. Coinbase permits you to trade cryptocurrencies such as bitcoin, Ethereum, litecoin, and over 50 more. Furthermore, It can also be used to exchange one cryptocurrency for another and transfer and receive cryptocurrency.

Coinbase Pro exchange allows you to set limits or market orders for CRV coins. The maker/taker fee varies, such as 0.5%, until you trade over $10k in volume within 30 days. Then it decreases to 0.35%. Maker fees (for limit orders) drop to zero for free crypto trading if your 30-day volume is over $300 million.

The good news is, Coinbase listed a series of coins, including CRV, in March 2021. Therefore, you can trade CRV-USD, CRV-BTC, CRV-EUR, and CRV-GBP with the Coinbase platform.

Opening an account with Coinbase

Signing up for Coinbase is simple, identical to setting up a new bank or brokerage account online. To open a fully verified account, plan on inputting your contact details, especially your Social Security number.

New account holders must upload a photo of a government ID to confirm they are who they say they are. If you’ve heard that cryptocurrency is anonymous, this is proof that Coinbase may trace your transactions for tax filing and other regulatory purposes.

After you’ve created your account and validated your details, you’ll be able to purchase and sell cryptocurrencies up to the limitations of your Coinbase account.

Pros & Cons of the Coinbase platform:

- Offers access to nearly 100 cryptocurrencies.

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Cryptocurrency is insured in the event the website is hacked.

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee (unless the trading volume is very high)

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

3 – Bitfinex

Bitfinex is a cryptocurrency exchange based in Hong Kong that has operated since late 2012. Bitfinex has the world’s most liquid order book. For traders, high volume is vital because it provides a low spread, the gap between the best bid and ask prices.

KuCoin claims to provide the highest level of security and a cryptocurrency variety of around 400. It is a user-friendly exchange with a simple layout despite its extensive functionality. In addition, Kucoin Exchange has some of the lowest costs in the cryptocurrency business.

Founders – Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the world’s most popular cryptocurrency exchanges. KuCoin has become one of the most popular cryptocurrency exchanges, with over 8 million registered users from 207 countries and territories worldwide. KuCoin raised $20 million in round A funding from IDG Capital and Matrix Partners in November 2018 and was listed as one of the Best Crypto Exchanges of 2021 by Forbes Advisor in 2021.

KuCoin Deposit – There is only one option for depositing and withdrawing money from Kucoin. You must fund your cryptocurrency account because the network does not accept fiat currency.

- Only cryptocurrency deposits and withdrawals are accepted.

- Payments via debit/credit card, bank account, or e-wallet are not accepted.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

Bank wires carry a 0.1 percent deposit and withdrawal fee, which might increase to 1% if you need an expedited withdrawal. Deposits of cryptocurrency usually are free of charge. However, withdrawals may incur a modest cost depending on the currency withdrawn.

Bitfinex listed Curve (CRV) back on November 29, 2021. CRV will be available to trade with US Dollars (CRV/USD) and Tether tokens (CRV/USDt).

Pros & Cons of the Bitfinex platform:

- Suitable for seasoned traders.

- Over 100 crypto coins are supported.

- Ethical- reimbursed all damages incurred by traders due to the exchange’s 2016 bitcoin breach.

- Liquidity is very high.

- Allows for wire deposits and withdrawals from banks.

-

There is no regulation.

-

Citizens of the United States are not accepted.

-

Expensive trading commissions

-

Email is the only way to contact the support team.

4 – KuCoin

KuCoin established itself as a one-stop shop for all sorts of cryptocurrency activities. Since its inception in August 2017, the KuCoin exchange has developed to include over 200 cryptocurrencies and 400 markets, making it one of the most vibrant crypto hubs online.

It provides bank-level security, a slick interface, a user-friendly UX, and a wide range of crypto services, including:

- Margin and futures trading

- A built-in P2P exchange

- Ability to buy crypto with a credit or debit card

- Instant-exchange services

- Ability to earn crypto by lending or staking via its Pool-X

- Opportunity to participate in new initial exchange offerings (IEOs) via KuCoin Spotlight

Besides, KuCoin has some of the lowest fees because it lists small-cap cryptocurrencies with significant upside potential, has a vast range of coins, lesser-known cryptos, and solid profit-sharing incentives. For example, up to 90% of trading fees are returned to the KuCoin community via KuCoin Shares (KCS) tokens.

Trading Fees – Kucoin’s trading fee structure is pretty straightforward. The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online. If you own the platform’s native Kucoin Shares tokens, you can further minimize your fees.

KuCoin listed Curve (CRV) on January 21, 2021, and supported trading pair, including CRV/USDT.

Pros & Cons of the Kucoin platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- Ability to stake and earn crypto yields

- No bank deposits

- Complicated interface for newbies

- No fiat trading pairs

5 – Bybit

Bybit, founded in 2018, is a forward-thinking, rapidly expanding cryptocurrency derivatives exchange. A team of individuals with experience in investment banking and the forex sector formed the

With over 1.6 million Bybit users worldwide, whether retail or professional clients, Bybit stays customer-focused and strives to give the greatest user experience possible. There are numerous similarities between the exchangers. Bybit has included several distinguishing characteristics that may make them appealing.

Bybit exchange provides three contract alternatives for trade derivatives products, including Bitcoin and other cryptocurrencies:

- Inverse Perpetual

- USDT Perpetual

- Inverse Futures

It provides access to various trading tools, including cross and isolated-margin trading. In addition, Bybit provides 100X leverage trading, which is not adjustable when used with the cross-margin option. Limit orders, conditional or conditional limit orders, stop-loss orders, and advanced orders such as Good till Cancelled, Immediate or Cancel (IOC order), and Fill or Kill are all supported by Bybit.

Moreover, Bybit offers a variety of data analysis tools for accessing data, including price moving averages, moving average indicators, and monthly price ranges. It also contains funding information, individual index prices, a rolling volatility chart, BTC daily realized volatility, market analysis, and recent news. It offers the crypto community a superb trading experience with an easy-to-use user interface.

Market takers pay 0.075 percent, while market makers pay -0.025 percent. As a result, they will be compensated when a market maker opens a transaction. This low cost encourages market makers to stay active and fill the order book.

Pros & Cons of the Bybit platform:

- A new user does not require KYC. It is simple to begin trading.

- Bybit leverage is exceptionally high, with low trading fees and a market maker rebate.

- Contracts for Derivatives are settled in Coins and USDT.

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Crypto derivatives are extremely risky

- Not suited to spot trading

- May share your data with third parties for marketing

What is Curve (CRV)?

Curve is a software that runs an automated market-making service focusing on stablecoins using different cryptocurrencies (cryptocurrencies designed to mimic other assets). The curve is one of many new decentralized finance (DeFi) protocols built on Ethereum that allow users to trade using pools of cryptocurrencies provided by users, who can earn fees through their deposits. Like Uniswap and Balancer, Curve enables cryptocurrency users to earn fees on their assets while allowing traders to purchase and sell them at possibly lower prices.

Curve’s focus on markets for stablecoins like Maker and USDT, which monitor the price of US dollars, and stablecoins like wBTC and renBTC, which track the price of Bitcoin, sets it apart from similar platforms. Curve’s goal is to allow stablecoins to be traded with cheap fees and minimum price movement because of the range of options available on the market, each with its own risk.

Like other Ethereum-based DeFi protocols in its class, Curve is unique in that anybody can offer liquidity to the market. The curve allows users with assets supported by its markets to supply liquidity, whereas traditional market makers often employ exchange-provided assets or holdings to provide liquidity to a market. The potential profits from liquidity provisioning motivate people to undertake it. Fees are collected by these decentralized liquidity pools, which are subsequently passed on to liquidity providers.

Curve’s trading platform is controlled by a mathematical function that allows stablecoins to trade for each other at the best price possible. A bonding curve is a name for this feature. Other DeFi cryptocurrencies, such as Uniswap, a decentralized exchange, use bonding curves. Uniswap’s bonding curve, on the other hand, is focused on providing a wide range of cryptocurrencies, whereas Curve’s bonding curve is solely focused on stablecoins. In reality, this implies that Curve’s bonding curve enables trading larger amounts of stablecoins with less price volatility.

Who Are the Curve, Founders?

Curve’s founder and CEO is Michael Egorov, a Russian physicist with prior experience in cryptocurrency-related businesses. He co-founded and became CTO of NuCypher, a cryptocurrency company that develops privacy-preserving infrastructure and protocols, in 2015. Egorov is also the creator of the decentralized banking and lending network LoanCoin.

Curve’s normal crew is part of the CRV allocation system, and as part of the first launch plan, they will earn tokens on a two-year vesting timeline. In August 2020, Egorov stated that he “overreacted” by securing huge CRV tokens in response to yearning. Finance’s voting power, so granting himself 71 percent of governance.

Governance of Curve

The Curve platform launched its native coin, CRV, in 2020. Approximately 3 billion CRV tokens were created at this time. Approximately 60% of CRV tokens were awarded to users who had locked coins on the platform, with the remaining 30% held for the Curve team and investors. The remaining was set aside for project staff and a reserve for community projects.

Today, 2 million CRV tokens are produced daily, with 750 million issued annually. The tokens will be used to vote on proposals governing the Curve system.

Is it Worth Buying CRV in 2024?

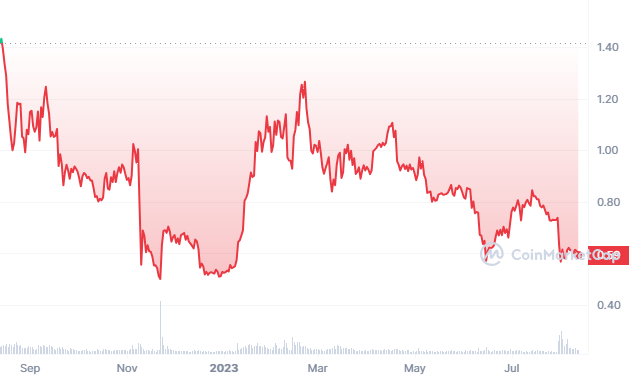

The CRV token entered the market on August 14th, 2020, with an initial value of $12.91 per token. Shortly after its launch, the price surged to a remarkable high of $60.50, establishing a record that remains unbroken. However, the value of the token experienced fluctuations, concluded that year at a modest $0.6283.

In 2021, the CRV market experienced a surge in momentum. On April 15th, the price reached $4.65. Although there was some decline in the following months, a recovery took place in Autumn, driving the value above $5 on October 26th and reaching an impressive $6.39 on November 25th. The year concluded with CRV token stabilizing at $5.35.

Regrettably, 2022 did not prove to be a favorable one for CRV. The cryptocurrency market experienced significant turbulence, marked by numerous crashes. In June, the value of the token plummeted below $1, and although there was a partial recovery in August, it ultimately closed the year at a meager $0.5248. This reflects an astounding annual loss of over 90%.

In 2023, CRV initially showed signs of recovery. It surpassed the $1 mark and reached a high of $1.15 on February 15th. However, the upward trend reversed when Crypto.com suspended its US institutional operations on June 10th. This caused CRV’s value to drop significantly to $0.562.

In late July 2023, a significant turn occurred in the trajectory of CRV. During this time, a hacker identified and exploited a security vulnerability within the Curve DAO decentralized exchange (DEX). The consequence of this malicious act resulted in the theft of over $50 million worth of cryptocurrency.

The hacker discovered a vulnerability in the platform’s programming language, Vyper. By exploiting this flaw, they were able to manipulate the smart contracts that oversee transaction execution based on predetermined conditions. As a consequence, unauthorized individuals gained access to certain liquidity pools within Curve DAO.

Intriguingly, the founder of Curve DAO, Michael Egorov, recently moved a significant amount of CRV tokens to the AAVE crypto lending platform as a safeguard against possible losses resulting from a substantial stablecoin loan worth nearly $65 million.

On July 31st, 2023, Curve DAO made public the occurrence of a hack and the resultant extent of damage. The precise amount of stolen cryptocurrency remains uncertain, with estimates varying from $50 million to $100 million. This disclosure led to panic among the platform’s user base, resulting in a significant decline in Total Value Locked (TVL). The TVL dropped from $3.25 billion on July 29th to $1.7 billion on August 2nd as users withdrew their assets from the platform.

However, as of August 8th, recent data indicates that Curve Finance has managed to recover 73% of the stolen funds, a commendable feat after facing a loss of over $73 million due to the hack. Despite the setback, there’s potential for growth in CRV moving forward. Investors and enthusiasts are advised to keep a close watch on the developments surrounding CRV in the remainder of 2023.

#PeckShieldAlert A total of ~$73.5M worth of cryptos on #Ethereum were stolen in the #Curve Reentrancy exploit. So far, ~73% of them (~$52.3M) have been returned.

The remaining ~$19.7M worth of cryptos on #Ethereum have not yet been returned by the 1st Curve CRV-ETH exploiter… pic.twitter.com/hU4v1UATeh

— PeckShieldAlert (@PeckShieldAlert) August 7, 2023

Will the Price of CRV Go Up in 2024?

All attention in the cryptocurrency market is currently focused on the future price trajectory of Curve DAO Token (CRV) in 2023. Based on the latest data, CRV is presently valued at $0.600379, indicating a 2.05% decrease within the past 24 hours. Notably, it has a trading volume of $284.40 million and a market capitalization of $525.89 million.

CRV, despite holding only a modest market dominance of 0.04%, continues to pique the interest of investors and analysts. Reflecting upon its past, CRV experienced its highest historical price on August 15th, 2020, reaching an unparalleled peak of $10.48.

On November 5th, 2020, the token hit its lowest price ever at $0.332060. However, it then started climbing and reached a peak of $6.76 before the sentiment turned bearish on CRV’s price prediction. The Fear & Greed Index stands at 50, indicating a neutral market sentiment.

Regarding the supply, the current circulating amount of CRV is 875.93 million tokens out of a maximum supply of 3.30 billion. This indicates a yearly supply inflation rate of 67.16%, resulting in an additional 351.91 million CRV tokens over the past year.

CRV, a decentralized finance (DeFi) coin, holds the 11th rank in terms of market cap. Additionally, it stands out as the second-ranking asset within the Yield Farming sector and secures the 24th position among Ethereum-based (ERC20) tokens.

Looking forward, technical indicators suggest potential movement in the price of CRV in the short term. Analysts predict that CRV’s 200-day Simple Moving Average (SMA) will decline in the upcoming month, reaching an estimated value of $0.814890 by September 6th, 2023.

Furthermore, analysts project the short-term 50-day SMA to reach $0.631055 by the same date. These indicators offer valuable insights for traders and investors, shedding light on potential price trends of CRV in the near future.

The market’s momentum can be assessed using a commonly used metric known as the Relative Strength Index (RSI). This index provides insights into the oversold (below 30) or overbought (above 70) conditions of cryptocurrencies. CRV’s current RSI value stands at 39.29, indicating a neutral position within the {CRV market.

When you’re considering an investment, follow these things:

Do you want to buy Bitcoin but aren’t sure how cryptocurrencies work? Put an end to it!

Cryptocurrencies can be an intriguing investment opportunity, but novice investors risk losing money if they are fooled by scammers or back a new coin with no track record.

In this section, we’ll go over what you should learn when investing in the Bitcoin market.

1. The Value of Timing

Digital assets are highly volatile, and cryptocurrencies such as Bitcoin and Ethereum can alter overnight. In general, cryptocurrency investors try to “buy the dip,” which means they buy more cryptocurrencies when their value falls.

2. Purchasing Cryptocurrencies Using Conventional Means

Cryptocurrency exchanges like Coinbase and Binance cater to new investors. They allow you to buy virtual currencies with a debit card, credit card, or bank account. As deposit methods, financial institutions such as PayPal, Skrill, and Neteller are also available.

3. Be wary of swindlers

There may be a lot of talk on social media about an investment strategy that promises big returns on obscure crypto assets. Others make overblown predictions about the price of Bitcoin growing. Unfortunately, people in the Bitcoin industry have lost billions of dollars to Ponzi scams. So, be wary of con artists and do your homework before investing in cryptocurrency.

4. Develop a Business Plan

Successful Bitcoin investors devise a strategy for their holdings. This can involve placing a limit order, which means their Bitcoin will be automatically sold if prices hit a certain level.

5. Choose a Trustworthy Crypto Exchange

Look for cryptocurrency exchanges with a high liquidity level, a varied choice of crypto assets, strong security measures, and dependability. We have quickly outlined the key exchanges and platforms in this article. You can invest in cryptocurrency through any of these methods.

Buying Curve as a CFD Product

In the financial and investment markets, contract for difference trading is known as CFD trading. It’s a strategy that allows somebody to trade and invest in an asset by starting a contract with a broker rather than opening a position directly in a specific market. When the position finishes, the investor and the broker agree to mimic market circumstances and settle their differences.

CFD trading has made its way into the cryptocurrency industry; therefore, it’s now available as a CFD product. If you’re struggling with following Bitcoin trading with the exchange where you keep your crypto funds, you may use CFDs to profit from CRV.

We recommend trading altcoins with leverage on Bybit, Binance, or CryptoRocket. Binance supports more altcoins, including CRV. Whereas, CryptoRocket supports fewer altcoins, currently about 40. CRV isn’t available on Cryporocket, but they are consistently adding new coins.

Bybit and Binance have CRV/USDT trading pairs where you can buy or short Curve on leverage.

Taxation on Curve Earnings

Since cryptocurrency trading is still a new field, misunderstandings surround the taxation of crypto assets. Firstly, investors think the crypto-assets are exempt from taxation since they are considered ‘winning,’ comparable to gambling or playing the lottery. That is not the case. This section looks at the concept of crypto assets and how they are taxed.

What are crypto assets?

Crypto assets are private digital assets that use encryption and are intended to function as a means of exchange. These are digital illustrations of wealth or contractual rights that are cryptographically secured and can be:

- Electronically transferred

- Stored

Cryptocurrencies are stored in a virtual wallet accessible via apps or websites. There is no reserve bank or agency to keep the system running or intervene if something goes wrong. Each transaction is recorded on a public ledger, or ‘blockchain,’ which employs Distributed Ledger Technology (DLT), a digital network that simultaneously maintains transaction details in several locations.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21, IRB 2014-16, presenting direction for individuals and companies on the tax practice of virtual currency transactions. The IRS recognizes virtual currencies as bitcoin property, which implies that they are taxed similarly to stocks or real estate. If you receive BTC for $10k and sell it for $50k, you must pay $40k in capital gains taxes. However, traders with BTC as a capital asset and not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

In the tax realm, profit is referred to as gain. It is the distinction between your tax authority (usually the price you paid for the shares + purchase costs) and the price you obtain when you sell or exchange them.

HMRC does not consider crypto assets to be money or currency. Instead, the Internal Revenue Service (IRS) has distributed crypto assets into four sections: exchange tokens, utility tokens, security tokens, and stablecoins.

Exchange Tokens – These are designed to be used as a form of payment, but they are also becoming very popular as an investment due to prospective value rises. The BTC/USD, the most well-known token, is an example of an exchange token.

Utility Tokens – Utility tokens give the bearer access to specific commodities or services on a platform, typically through DLT. A company or combination will often issue the tokens and pledge to accept them as payment for specific goods or services. Furthermore, utility tokens can be traded on exchanges or in peer-to-peer transactions like exchange tokens.

Security Tokens – A security token grants the bearer specific rights or interests in a business, such as ownership, payback of a set sum of money, or claim to a share of future profits.

Stablecoins – Another popular sort of crypto asset is stablecoins. The concept is that these tokens reduce volatility by being tied to something with a stable worth, for instance, a fiat currency (government-backed, for example, US dollars) or precious metals like gold. The tax treatment of all sorts of tokens is determined by the nature and use of the token, not by its definition.

In the United Kingdom, how are crypto-assets taxed?

Anyone residing in the United Kingdom who owns crypto assets will be taxed on their earnings. This is a Capital Gains Tax (CGT), which means you pay tax on the difference between what you paid for your Bitcoin and how much you sold it.

You only have to pay Capital Gains Tax on gains exceeding your tax-free limit (the Annual Exempt Amount). For 20/21, the capital gains tax-free allowance is £12,300.

For example, suppose you spent £12,000 on a Bitcoin asset. You paid £8,000 for that cryptocurrency. You must pay a Capital Gains Tax of 10% or 20% (depending on your income) on the £4,000 profit gained from the cryptocurrency unless it falls under your tax-free allowance of £12,300.

CGT is due when a sale is made, and a profit is made, and it must be recorded on a self-assessment tax return.

Automated Trading With Robots

Trading robots, sometimes called ‘bots,’ allow you to automate your online trading activities. These computer programs can monitor thousands of assets around the clock, seeking prospective trading opportunities and then placing trades when the timing is perfect. However, there are many rogue suppliers in the trading robot industry, with most platforms advertising profits they will never meet.

At its most basic, an algorithmic trading robot is a piece of computer code that can generate and trigger a buy and sell signal in financial markets. The primary components of such a robot are entry rules that indicate when to buy or sell, exit rules that indicate when to close the current position, and position size rules that define the amounts to purchase or sell.

To become an algorithmic trader, you’ll need a computer and an internet connection. A suitable operating system is required to run MetaTrader 4 (MT4), an electronic trading platform that employs MetaQuotes Language 4 (MQL4) to code trading strategies.

Although MT4 is not the only program that can be used to design a robot, it provides many significant advantages.

While foreign exchange (FX) is MT4’s primary asset class, the platform may trade equities, equity indexes, commodities, and Bitcoin via contracts for difference (CFDs). Other advantages of using MT4 (as opposed to other platforms) include:

- Ease of use

- A large number of available FX data sources

- The fact that it is free.

Similarly, the algorithm may be set to buy coins when a critical resistance line is likely breached. In some situations, trading robots may focus solely on the research process. The software will issue an alert when it detects a potential trading opportunity. This is known as a signal,’ and it will frequently include the requisite entry and exit order prices, which the subscriber will then need to place manually.

In any case, auto trading robots such as Bitcoin Evolution and Bitcoin Lifestyle have the potential to help you take your trading to the next level without having to spend hours upon hours studying the market and building methods.

The main issue is that most auto-trading robot platforms are nothing more than a rip-off. Such providers will make big claims of super-high monthly returns, but there is frequently no way to check the authenticity of these statements. You must exercise utmost caution when selecting a trading robot platform.

Curve Mining: Can You Mine CRV?

Yes, the Curve can be mined based on a proof-of-work mechanism, not a proof-of-stake mechanism.

Decreasing Risk in Curve Investment:

As the market expands quickly, many traders forget that cryptocurrency is about more than earnings. And, if you don’t want to lose your deposit on the first day, you must follow risk management guidelines. The appropriate plan will assist you in making a large profit while reducing the risk of future losses. Risk in bitcoin trading refers to the possibility of losing invested funds. As a result, risk management can forecast and mitigate potential losses from a failed transaction.

Thus, Being a trader, you must uncover approaches to protect yourself from huge losses. If you aspire to cap your risks, then grasp these rules:

Stop-loss order

Setting a hard stop loss with every transaction is one of the finest strategies for traders to limit market risk exposure. Stops are essential for various reasons, but it ultimately boils down to one thing: we can never glimpse the future. Regardless of having a rock-solid trade setup, the future is uncertain, currency prices remain unknown to the market, and each transaction is a risk.

Using leverage

Leveraged trading in Crypto is a technology enabling investors to do spot transactions (buy and sell) using borrowed funds from brokers. Typically, these funds exceed the investors’ account balance. As a result, it is an excellent method for raising purchasing power and generating earnings. However, it can result in massive enough losses to wipe away your trading capital if the market moves against your trade.

Market volatility

Volatility is advantageous since it enables traders to profit from modest price fluctuations. For example, if you place a buy or a sell trade, and the market stops moving, no one will profit from this deal. Therefore, forex and crypto trading require market volatility. Little volatility can sometimes result in losses. Not just from the market but also the hefty transaction expenses.

Risk tolerance level

The risk/reward ratio describes the connection between the potential risks and gains in a specific deal. It determines the difference between entry points, stops losses, and takes profit orders based on the RR ratio. The optimum approach in any trading strategy is to maximize reward while minimizing risk.

The primary purpose of any trading strategy is to maximize returns. As a result, a risk/reward ratio of 1:2, with a maximum value of 0.5, is advised. However, there are no hard and fast rules to follow because it depends on the expectation and method employed.

Curve (CRV) vs. Other Cryptocurrencies

Curve vs. Ethereum vs. Bitcoin

Curve (CRV) – Curve’s trading platform is driven by a statistical feature that lets stablecoins trade for each other at the best price possible. This is referred to as a bonding curve. Other DeFi cryptocurrencies use bonding curves, such as the decentralized exchange Uniswap. Unlike Uniswap’s bonding curve, which serves a wide range of cryptocurrencies, the Curve only serves stablecoins. This implies that Curve’s bonding curve allows larger stablecoins to be traded with less price volatility.

Ethereum (ETH) – On the other hand, Ethereum is a technological blockchain home to many cryptocurrencies and applications. Ethereum currently uses a proof-of-work mechanism, which makes it very costly compared to CRV. Currently, Ethereum has the most extensive application ecosystem. Most dApp developers choose Ethereum as their first option while building their smart contracts. This year, the token ETH has risen over +700%.

Bitcoin (BTC) – It’s a decentralized digital currency that may be bought, sold, and exchanged without an intermediary such as a bank. Satoshi Nakamoto, the founder of Bitcoin, initially highlighted the need for “an electronic payment system based on cryptographic proof rather than faith.”

Bitcoin is based on a distributed digital ledger known as a blockchain. Blockchain, as the name implies, is a linked body of data made up of units called blocks that contain data about every activity, including time and date, actual amount, buyer and seller, and a unique identification code for exchange. Entries are linked in chronological sequence to form a digital chain of blocks.

Curve Price Predictions: Where Does CRV Go From Here?

You have landed on the right page if you are looking for Curve token price predictions for 2023 -2030. This section will look at the past pricing of Curve Token (CRV) and see what experts think about its potential price movements.

Well, this prediction, like all others, should be viewed with the understanding that it is merely the opinion and market fundamentals that can enact CRV to trade differently. Let’s get started.

Curve Price Forecast for 2023-2024 – Curve is predicted to have decent growth in its value this year. Experts have predicted that this token will surpass $2.5 by the end of this year, thereby providing considerable returns to its investors.

It is expected to have an average price of $2.50 in 2024. If it continues to grow at the present rate, it might even touch the mark of $3.00 by 2024.

Curve Price Forecast for 2025 – Curve is expected to have an average price of $3.30 in 2025. The token is predicted to reach $4.00 by the end of 2025.

How much will the Curve (CRV) be worth in 2030?

In the next 5 to 10 years, the curve token could reach new all-time highs in terms of pricing. The CRV price is expected to rise exponentially.

A large amount of CRV is locked up in staking, which will help to reduce sell pressure – the fewer CRV coins can be sold, the easier it will be for the price to rise without crashing.

Summary

The curve is a decentralized stable coin exchange that employs an automated market maker (AMM) to control liquidity. Curve, which debuted in January 2020, has been linked with the decentralized finance (DeFi) phenomena, with solid growth in the second half of 2020.

There are several ways to purchase CRV. However, as the most convenient option, we recommend trading with a reputable global exchange, such as Coinbase or Binance. Investors must remember they will first need to purchase a stablecoin, such as Tether (USDT) to convert to CRV, as the token cannot be purchased with fiat currency.

FAQs

Any risks in buying Curve now?

Curve price has rebounded from $0.35 to %4.9, the volume of $591,282,414. The curve has increased by 1235.85 percent in one year and tanks at #77, with a live market cap of $1,699,369,675. It has a total quantity of 3,303,030,299 CRV coins and a circulating supply of 413,487,283 CRV coins. Considering all these factors, CRV's potential for growth is a safe coin to invest in. However, it would be best if you carried out proper analysis before investing in any coin.

Should I buy Curve?

Curve price has rebounded from $0.35 to %4.9, the volume of $591,282,414. The curve has increased by 1235.85 percent in one year and tanks at #77, with a live market cap of $1,699,369,675. It has a total quantity of 3,303,030,299 CRV coins and a circulating supply of 413,487,283 CRV coins. Considering all these factors, CRV's potential for growth is a safe coin to invest in. However, it would be best if you carried proper analysis before investing in any coin.

Is it safe to buy Curve?

Investment in DeFi initiatives like CRV is a cheap and interesting way to learn about the developing real-world applications of cryptocurrencies. However, it's worth noting that CRV's overall market capitalization has dropped by more than 70% since its inception. If you decide to invest in Curve, diversify your portfolio with other DeFi projects to safeguard your initial investment and minimize your losses.

Will Curve ever hit $100?

In the next 5 to 10 years, the curve token could reach new all-time highs in terms of pricing. The CRV price is expected to rise exponentially. CRV is expected to reach a peak of $113.18 by 2030.