Although leading Defi coin Aave first hit public exchanges as recently as October 2020 – the crypto-asset is already experiencing significant gains. In fact, in its first seven months of trading, the price of Aave has increased by over 800%. This guide shows you how to buy Aave with a regulated, commission-free broker.

How to Buy Aave – Quick Guide

We are looking at how to buy Aave right now without reading our comprehensive guide. If so, follow the steps below to invest in Aave in less than 10 minutes!

- Open an account: You must open an account with a low-cost and trusted broker to buy Aave online. We like Capital.com, as the broker allows you trade AAVE CFDs without commission.

- Upload ID: Capital.com is legally required to follow KYC rules. As such, you must upload a copy of your government-issued ID.

- Deposit: You can deposit funds into your Capital.com account with a debit/credit card, bank transfer, or e-wallet.

- Buy Aave: Enter ‘Aave’ into the search bar and click ‘Buy.’ Finally, enter the amount of Aave you wish to buy and confirm the order.

Once your Aave investment is complete, Capital.com will add the token CFDs to your portfolio. At any time, you can sell your coins back to US dollars.

Where to Buy Aave

We were wondering where to buy Aave. In this section of our How to Buy Aave Guide, we will discuss the best trading platforms to gain exposure to this crypto asset.

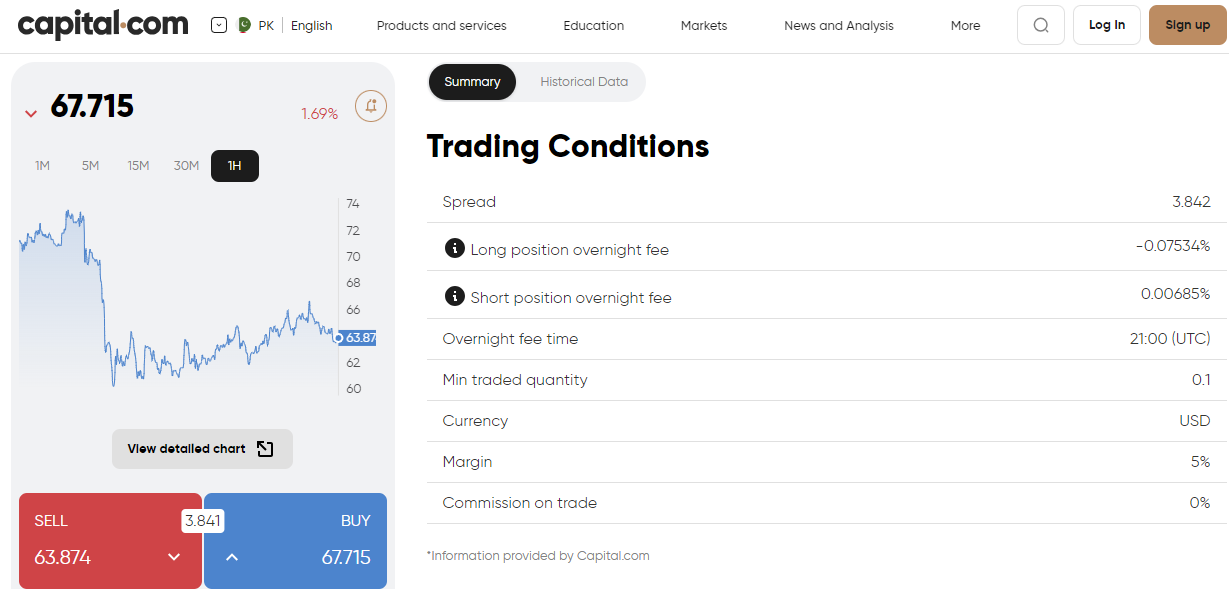

1. Capital.com – Trade Aave CFDs Commission-Free

We briefly mentioned Capital.com when we discussed trading Aave via a CFD instrument. This top-rated CFD trading platform offers Aave and hundreds of other cryptocurrency pairs. Capital.com offers heaps of other Defi coins, too – so this could be your go-to platform if you want to diversify across several decentralized finance projects.

As noted earlier, Capital.com allows you to go long or short – so you’ll benefit from enhanced trading flexibility. You can also apply leverage when trading Aave CFDs, although your eligibility and limits will depend on your living location.

Either way, Capital.com does not charge any commission when you trade on its platform – and in most cases, you’ll benefit from industry-leading spreads. Capital.com is very simple to use – in terms of getting started and the trading platform itself. We also like that you can access an accessible paper trading facility. This will allow you to trade Aave in actual market conditions – but without having to risk any money.

If you want to go straight to actual trading conditions, you only need to meet a minimum deposit of $20. Supported deposit types at Capital.com include e-wallets, debit/credit cards, and bank transfers. The platform is regulated by two reputable financial bodies – the FCA and CySEC.

Pros:

Cons:

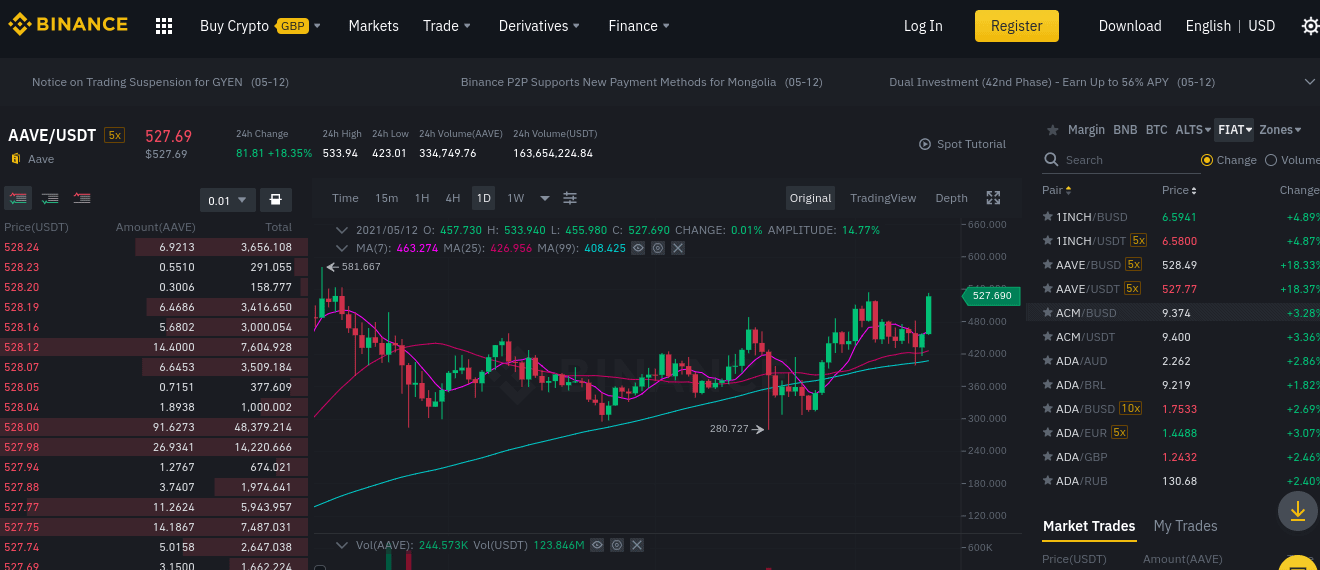

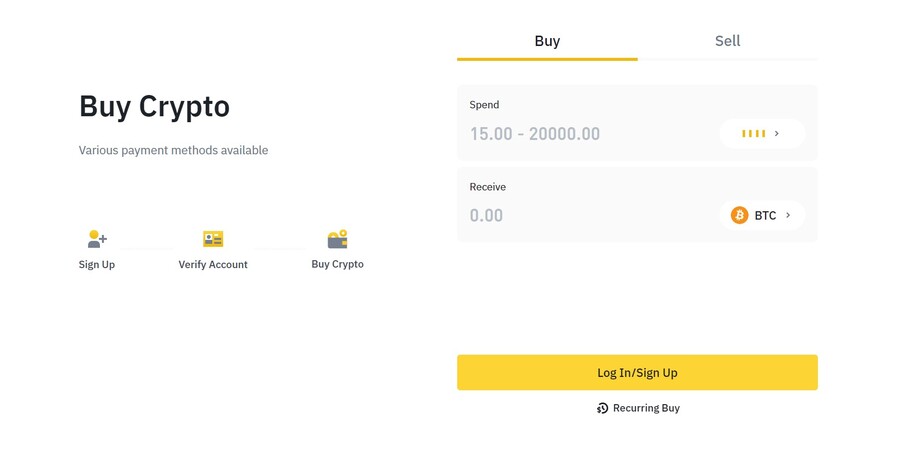

71.2% of retail investor accounts lose money when spread betting and trading CFDs with this provider. If you want to buy Aave without providing any personal information or ID documents, the only way you can do this is to use a cryptocurrency exchange. Binance is arguably the best option, as the exchange has an excellent reputation in the broader cryptocurrency trading industry. It’s often home to an enormous trading volume and hosts hundreds of markets. In the case of Aave, you can buy this Defi coin in exchange for Bitcoin, Binance Coin, Ethereum, and Tether. As you can see, the platform doesn’t offer an Aave pair with a fiat currency like the US dollar. As such, you must deposit a digital currency into Binance and then trade it for Aave. On the other hand, Binance does allow you to deposit funds with a debit or credit card. But, you won’t benefit from an anonymous account – as you must upload a copy of your government-issued ID. Debit/credit card deposits are typically expensive anyway, with the platform charging 3-4% in the region. Conversely, Binance charges a trading commission of just 0.1% per slide. Pros Cons

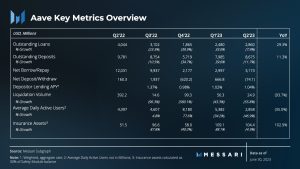

Your Capital is at risk. Now that you know where to buy Aave, let’s walk through the process using the Binance exchange. Head over to the Binance homepage and open an account. You must provide personal details such as your full name, nationality, home address, date of birth, email, and telephone number. In the next stage of the account opening process, Binance will ask you to upload a copy of your: Unlike many cryptocurrency brokers, Binance can often verify your documents instantly. You will, of course, need to deposit funds if you wish to buy Aave at Binance. You can do this instantly by choosing from a debit/credit card (Visa, MasterCard, Maestro) or a bank transfer. Now that your Binance account has trading capital, you can buy Aave. The easiest way to do this is to search for the digital currency and click the ‘Trade’ button and search for AAVE under the ‘Spot’ tab. Entern the number of Aave coins you wish to buy and submit the order. Alternatively, you can buy Aave directly with a credit card. Head to ‘Deposit’ and select the option to buy with USD. Select Aave from the list. You may be prompted that you can’t buy this coin with USD. In that case, Binance will automatically let you buy USDT stablecoin, which will then convert it to Aave. This option is an easier and faster way to buy crypto, but it comes with slightly higher fees than if you deposit your money via bank transfer. Assuming you have bought your Aave tokens at Binance, they will now appear in your investment portfolio. Binance supports cryptocurrency trading markets 24/7 – so you can cash out whenever you see fit. Simply select ‘Sell’ Aave via your Binance wallet to convert the tokens back to stablecoins or fiat. You can then withdraw the money from Binance or use it to invest in other financial products. Aave is a decentralized finance (Defi) platform with its native digital currency of the same name. The project was first launched in 2017, with its respective ICO generating a modest $16 million. Fast forward to 2021, and Aave is a multi-billion dollar cryptocurrency. Unlike traditional peer-to-peer loan platforms, Aave does not hold or store client funds. Instead, the platform operates via a non-custodial- protocol, meaning that both lenders and borrowers are connected in a genuinely P2P manner. On the one hand, the broader cryptocurrency industry has enjoyed a prolonged upward trajectory since the pandemic came to fruition in 2020. Not only in the case of Bitcoin but thousands of other digital currencies. Although we cover the price history of Aave in the next section, we should note that holding this digital currency can generate growth in more than one way. On top of an increased token price in the open market, you can also earn interest. This will be achieved by lending your Aave tokens to other users of the provider’s decentralized platform. As such, you can earn regular income on your holdings while benefiting from long-term appreciation. If you want to buy Aave, you will use a crypto-to-fiat pegged order. Given the dollar’s position as the global reserve currency, this order will see you get Aave/USD trading pair. Aave’s price performance has been characterized by brief uptrends and dip lows. Despite facing challenges in the bear zone at present, Aave has managed to achieve an 11% year-to-date increase. As of August 01, 2023, Aave’s current price is $64.32, showing a decrease of -2.05% over the past 24 hours. Alongside this, it has a trading volume of $491.08M and a market capitalization of $931.99M. However, Aave’s market dominance remains comparatively low at 0.08%. Taking a trip down memory lane, Aave experienced notable price fluctuations. On May 18, 2021, it reached its highest point at $664.97. However, on November 5, 2020, it hit its lowest point at $26.03. Following the peak, the price dropped to $45.88 before starting a new cycle and eventually reaching a post-cycle low of $115.27. Investor sentiment toward Aave’s future performance is currently bearish. Furthermore, the Fear & Greed Index, which measures market sentiment, indicates a neutral reading of 53. The circulating supply of Aave currently stands at 14.49 million out of a maximum supply of 16.00 million AAVE. Notably, the yearly supply inflation rate is reported to be 3.70%, creating 516,481 AAVE in the last year. Regarding market rankings, Aave holds the sixth position in the DeFi Coins sector and is fifteenth among Ethereum (ERC20) Tokens sector projects. The general sentiment in predicting the price of Aave leans towards bearish. However, there are 3 technical analysis indicators indicating bullish signals, while 27 indicators suggest bearish signals. It’s impossible to make an Aave price prediction without conviction, as the digital currency is still in its infancy. While the network is continuously evolving, which may have a positive impact on the price of Aave. In the second quarter of 2023, Aave experienced significant developments. During this period, its interest revenue surged by 14% compared to the previous quarter, amounting to an impressive $2.6 million. This substantial growth can be attributed to the active use of Ethereum Mainnet. Among Aave’s various Layer-2 implementations, it was observed that the leveraged stETH-ETH strategy generated the highest profits. Aave’s total value supplied continued to grow in Q2, with a 9% increase in USD terms and a 3% increase in ETH terms, outpacing the broader market. Notably, stETH emerged as a significant gainer, capturing an additional 5% deposit market share. The stablecoin deposits remained steady, but there was a shift in preference towards USDT, which experienced a 63% surge year-to-date, reaching $772 million in deposits. In Q2 alone, approximately $93 million in USDT deposits flooded Aave. Aave’s usage trends experienced a significant decline in the second quarter. Specifically, the number of daily active borrowers dropped by 45%, while depositors decreased by 54%. Additionally, there was a noticeable shift in usage between Aave’s V2 and V3 markets. Aave experienced a notable 14% increase in protocol interest revenues, amounting to $2.7 million. Out of this, Ethereum (ETH) revenue played a significant role by contributing 43% towards the total quarterly interest revenue. The leveraged stETH-ETH strategy showed varying profitability across Aave’s different markets. The spread on Aave V3 Ethereum turned positive, indicating increased profitability QoQ. Borrow rates for ETH and BTC continued to diverge, with the difference expanding due to factors such as the growing popularity of liquid staking tokens and the price appreciation of BTC. The safety module’s weighted Annualized Percentage Yield (APY) for depositors experienced a slight QoQ reduction, and as of quarter-end, approximately 1.2 million AAVE remained in the Ecosystem Reserve. In June, BDG Labs introduced Aave Forest, a proposed framework aimed at enhancing the security of the Aave protocol. This initiative indicates the community’s strong commitment to improving security measures. Subsequently, on July 15, Aave launched its native over-collateralized stablecoin called GHO. This innovative feature allows the protocol to retain 100% of the interest revenue generated. A new feature called Portals was introduced in Aave V3. This toolbox has been specifically designed to facilitate liquidity sourcing on-demand, and its primary aim is to support the adoption of GHO through seamless cross-chain transfers. The potential impact of the mentioned developments on the price of Aave (AAVE) or its overall potential depends on various factors, including market sentiment, adoption of Aave’s features and updates, regulatory developments, and broader crypto market trends. Positive developments like increased interest revenue, new product launches (such as GHO), and enhanced security measures (Aave Forest) could be viewed positively by investors and the community, potentially boosting confidence in the Aave protocol and its native token (AAVE). However, how the price will react in the upcoming days and months remains to be seen. With a market valuation of over $6 billion, dozens of online providers now allow you to gain access to Aave. To ensure you know where to buy Aave most safely and cost-effectively, we discuss some of the best ways to buy Aave online. Traditional CFD (Contracts-for-Difference) platforms have recognized the growing demand for Defi coins from trades. As such, the likes of Capital.com now allow you to trade Aave in the form of leveraged CFDs. This is a great option to consider if you are looking to speculate on the future value of Aave in the short term. As the CFD will simply track the current market value of Aave in real-time, the underlying coins do not exist. This means you don’t need to worry about storing your Aave coins in a private wallet. If you opt to trade Aave CFDs, you’ll likely be able to do so with leverage, boosting your stake. Your access to leverage, alongside your limits, will be dependent on your country of residence. Another benefit of trading Aave CFDs is that you can go long or short. This means that you can profit from both rising and falling markets – which is especially useful in the volatile world of Defi coins. There are well over 100+ cryptocurrency exchanges that allow you to buy Aave. In most cases, exchanges will operate without a regulatory license, so you are rarely asked to provide any information or KYC documents. On the other hand, a small number of cryptocurrency exchanges – such as Binance- allow you to add funds with Visa or MasterCard. However, the debit/credit card fees will cost you over 3-4% per transaction – which is super expensive. You can buy Aave using several different payment methods. Let’s explore some of the top options. Another way to buy Aave is with a credit card or debit card. Most cryptocurrency exchanges, including Capital.com and Binance, accept Visa and Mastercard credit and debit cards. Funds appear in your account immediately, so buying Aave in minutes is a great option. You can also do that if you want to pay for Aave with a bank transfer. Capital.com and Binance accept bank transfers, although you should expect the funds to arrive in a few days. Also, note that some Aave brokers require a higher minimum deposit when funding your account with a bank transfer. You’ll need an Aave wallet to store any Aave tokens you purchase. There are dozens of cryptocurrency wallets, but not every wallet can store altcoins like Aave. In addition, not every crypto wallet is equally secure. So, let’s look at some of the best Aave wallets you can use for free. Consider Binance’s Trust Wallet. This wallet supports over 500 cryptocurrencies, including Aave, and has a built-in marketplace for decentralized financial apps (dApps). That means you can use options to earn interest on your cryptocurrency or get a loan using your digital tokens as collateral. The Trust wallet also allows you to instantly exchange between cryptocurrencies using BinanceDEX, Binance’s decentralized crypto exchange. Capital.com and Binance are two of the top options, but more straightforward wallets are also available if you just want a place to store your Aave tokens. For example, Mycelium allows you to store Aave easily and is very beginner-friendly. You can also consider a cold storage wallet, also known as a hardware wallet, like Trezor, if you’re worried about the security of your cryptocurrency. Even though deliberations on taxing cryptocurrencies are ongoing in several countries, the US’s Internal Revenue Service (IRS) classifies blockchain-based assets as ‘property.’ Subjecting them to capital gains tax and income tax. The section lists some instances where you must report your crypto gains to the tax authorities. However, you can leverage your losses from trading cryptocurrencies to offset some of your tax obligations up to $3000, depending on how long you owned the digital asset. Determining how much you will pay in short and long-term capital gains tax depends on how long you hold the assets. This will help you efficiently work out your: Short-term capital gains tax is heavily billed compared to the long-term tax. If you held the asset for less than a year, you would be taxed according to your regular income tax bracket if you had the crypto asset for less than a year. Meanwhile, you can use some of your losses to reduce this to at most $3000, and you enjoy the privilege of carrying your tax forward into the coming year. Long-term capital gains tax only comes into play if you have held your digital asset for over a year. Based on your income tax bracket, this will see you pay between 0%, 15%, or 20%. Long-term holding of a crypto asset yields less in taxes than selling under a year and paying up to 35% in taxes. Cryptocurrencies are highly volatile, which makes them high-risk investments. Despite this, the nascent crypto industry has generally outperformed the broader financial space. However, you can use crypto trading robots if you are searching for the best way to mitigate risks while profiting off the exponential rallies that characterize the crypto market. Crypto robots are automated software that can gather data, organize them, and identify profitable trading positions. Using cutting-edge technologies like artificial intelligence (AI) and natural language processing (NLP), crypto robots can make trading decisions and set limit orders with little human intervention. They are also ideal for new and experienced crypto traders and offer greater market insight than a team of trading professionals normally would. Cutting through the veil that conceals cogent information, crypto trading bots can better get a fuller perspective on how the market is performing and properly select the best strategy to employ. This ability makes them ideal risk mitigation tools large financial houses use in the economic space. Some of the best and most genuine crypto robots currently in the market are: Mining is a process that brings new coins into circulation. This system is employed by proof-of-work (PoW) consensus protocols like Bitcoin and other PoW-powered platforms. However, the process is energy-intensive and slow in validating transactions. Aave cannot be mined, despite being on the Ethereum network, as it is not a PoW protocol. The best way of generating new AAVEs is through crypto staking. Staking entails locking up or pledging your digital asset for a certain period to ensure the network’s security. In return for these services, stakers get new coins as interest. As much as cryptocurrencies promise higher returns on investment, they also come with massive risks. To decrease the likelihood of losing your capital, we recommend taking the following steps: Conduct research: Research should be the foundation of all your investment especially concerning cryptocurrencies. Always research the value proposition of a protocol to gauge the future use case and real-world applications. You also need to look at the digital asset’s technical performance over some time. Fundamental developments surrounding integrations and adoptions will also help you gauge if the project will succeed. Allocate a small percentage to Crypto: We recommend setting aside 1 to 10% to invest in cryptocurrencies. Use Stop-loss: Stop-loss is a valuable tool for traders and must be put in your trading arsenal. Stop loss will help mitigate the loss of your capital in a market downtrend. Always use stop-loss, mainly if you use leverage in a trading position. Invest in multiple ecosystems: The crypto market is full of top-performing ecosystems ranging from oracles, DeFi, NFTs, Metaverse, and the regular crypto space. Diversification will help you consistently make gains, even if one ecosystem has a downtrend. Aave is one of the top 3 DeFi lending platforms, according to DeFi Pulse. However, it is not the only top-performing crypto asset in the ecosystem. Ethereum is the foremost altcoin, controlling 97% of the entire DeFi ecosystem. It is home to some of the most extensive DeFi protocols and has over 19% crypto market share. Aave is resident on the Ethereum blockchain and was initially meant to enable lending on only Ethereum. However, it has since expanded its services to other protocols making it a universal protocol. Ethereum’s strong influence in the crypto market means Aave will always have a share in the market. Bitcoin is the foremost cryptocurrency, and its market cap of over $1 trillion goes to state this. The virtual currency is considered the benchmark for the entire crypto ecosystem and the digital format for gold. With only 21 million coins to ever be mined, Bitcoin is seen as a great store of value and deflationary. This advantage has seen BTC price surge to astronomical levels as investors look to hedge against inflation. Aave may be a top-performing crypto asset, but it has a long way to go in standing shoulder-to-shoulder beside Bitcoin. Solana has been a breakout star this year so far. Previously idling in the top 50 crypto ranks, the Ethereum competitor has broken into the top 5 most valuable crypto assets. Solana’s meteoric success primarily lies in its highly scalable, environmentally friendly, and economical blockchain architecture. The digital asset has hit record highs repeatedly this year, making it a top contender for the DeFi throne. Dogecoin has been one of the standout stars this year, despite lacking any clear real-world use case. Making a steady increase of 15,000% in the early months of the year, Dogecoin has fledged out a strong community and has the backing of internet maestro and Tesla boss Elon Musk. The popular meme coin surged to an ATH of 74 cents during the crypto boom in April. Dogecoin has remained in investors’ good books despite underperforming in the year’s second half. Like several crypto protocols, Aave blockchain has experienced a flurry of bulls and bears season. But the ERC-20 token has always rebounded in major uptrends. Dipping to a mid-year low of $186.97 on June 26, Aave recovered to $414.59 in mid-September. Despite showing a downward spiral, experts believe Aave to be one of the frontiers DeFi users will use to better plug into the burgeoning sub-sector. Its flash loan capability makes it a popular destination for arbitrage traders. Presently, Aave is valued at $64.26, with a 24-hour trading volume of $84 million. Over the past day, Aave has experienced a 1.09% decrease in value. In the CoinMarketCap standings, it holds the #45 position, boasting a real-time market capitalization of $932 million. The circulating AAVE coin supply is 14,507,986 out of a maximum supply of 16,000,000 AAVE coins. If the market turns even more positive than it is at this time of the month, Aave can witness a bullish flipping that will push Avalanche’s price to $87.75 by the end of this year. While this is not a significant surge, remember that the market has changed, and witnessing parabolic gains is impossible in old cryptos unless you count presale cryptocurrency assets. We expect that the last embers of the crypto winter will die by the beginning of 2024, marking the end of the longest crypto winter in the market. People will again start to trade in cryptos, and Aave, a DeFi asset and crypto with immense utility, will see a new influx of buyers. That renewed interest will push the price to $215 by the end of 2024. 2025 will see mass adoption of DeFi and other cryptocurrencies. To support these new concepts, governments will introduce new regulations in the crypto space, giving OG cryptos like Aave a safe space to grow. That interest may push Avalanche’s price close to $320 by the end of 2025. The crypto space is changing fast. So, it is likely that Aave will consolidate as one of the biggest cryptocurrencies in the market three years from now. That fact alone, coupled with new developments and more legacy technologies accepting this crypto, will increase the Aave price pump. Update: Check out the video below for a more recent price prediction. Jacob Crypto Bury has one of the best Crypto Youtube channels for altcoin price predictions. Although Aave has grown to rapid heights in recent months – both in terms of market cap and the value of its token, its Reddit community is still relatively small. The Aave Reddit group has just 9,300+ members at the time of writing. Nevertheless, this is perhaps still the best online platform to e-meet and discuss Aave from the comfort of your home. Aave has been one of the best-performing digital coins over the past seven months – with the Defi coin seeing gains of over 860%. You can easily buy Aave by using a regulated online broker – as you can deposit funds with fiat currency. Capital.com, for example, allows you to buy digital currencies as CFDs commission-free. The broker supports deposits in debit/credit cards and e-wallets.

71.2% of retail investor accounts lose money when spread betting and trading CFDs with this provider.

Unlike blue-chip stocks and government bonds, cryptocurrencies like Aave are super speculative. This is especially true when you consider that Defi coins are still largely unproven. As such, whether or not you decide to buy Aave should be based on independent research.

You can buy Aave at an online exchange such as Binance. Another option is to speculate on the future value of Aave via a CFD instrument. When doing this through Capital.com, you can apply leverage, trade at 0% commission, and even short-sell the Defi coin

Aave is a decentralized platform that aims to revolutionize the global lending industry. It connects investors and borrowers without needing a centralized third party. Aave also has its native digital currency - which trades like any other crypto asset.

At the time of writing, a single Aave coin will cost you over $100. The good news is that when using a crypto broker like Capital.com, you can purchase digital currencies as CFDs without commission. As such, the minimum investment per crypto trade is just $25.

The value of Aave will rise and fall on a second-by-second basis. At the time of writing, Aave is trading at over $550.

Like most Defi coins at present, Aave has been enjoying a prolonged upward pricing trajectory. However, whether this trend continues shortly remains to be seen.

This depends on where you are currently storing your Aave tokens. If you invest via an online broker and store your coins on the platform - you can usually cash out instantly by placing a sell order. But, if your Aave tokens are currently being stored in a private wallet, you will first need to transfer them into a third-party exchange.

2. Binance – Top-Rated Cryptocurrency Exchange to Buy Aave

How to Buy Aave – Binance Tutorial

Step 1: Open an Account and Upload ID

Step 2: Deposit Funds

Step 3: How to Buy Aave

Step 4: How to Sell Aave

What is Aave?

Why Buy Aave? Aave Analysis

Aave Price

Aave Price Prediction

Ways of Buying Aave

Trade Aave CFDs

Buy Aave through a Crypto Exchange

Aave Coin Payment Methods

Buy Aave Coin with a Credit Card or Debit Card

Buy Aave Coin with Bank Transfer

The Best Aave Wallets

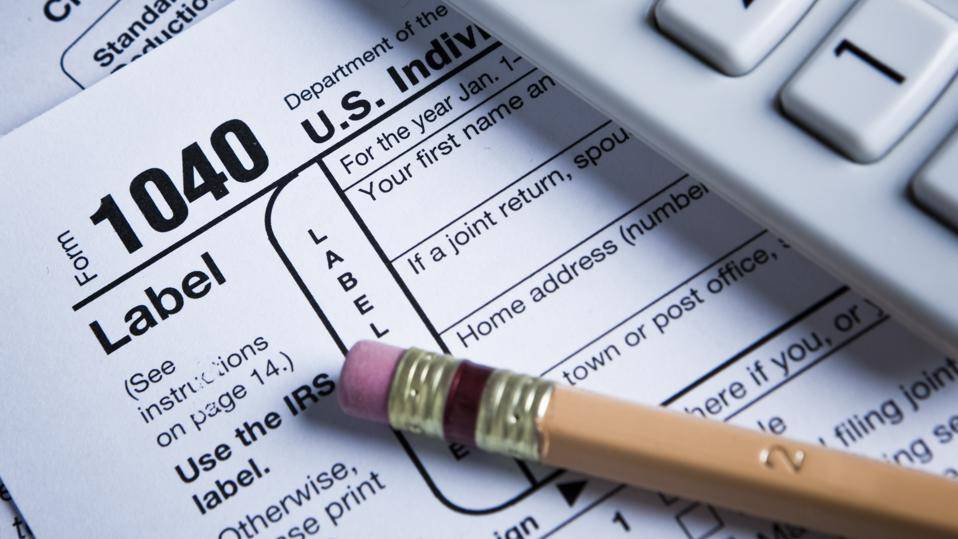

Aave Taxation Earnings

Taxable events classified as capital gains tax:

Taxable events that fall under the income tax bracket:

Calculating Your Capital Gains Tax

a) Short Term Capital Gains Tax

b) Long-Term Capital Gains Tax

Crypto Robots

Can you mine Aave?

Mitigating Risks in Aave Investment

Aave vs. Other Cryptocurrencies

Aave vs. Ethereum

Aave vs. Bitcoin

Aave vs. Solana

Aave vs. Dogecoin

Aave (AAVE) Price Predictions: Where Does Aave Go From Here?

Aave Price Prediction for 2023

Aave Price Prediction for 2024

Aave Price Prediction for 2025

Aave Price Prediction for 2026 and Beyond

Aave Reddit – Keep Up to Date with Aave

Conclusion – Captail.com – Best Broker to Buy Aave

FAQs

Should I buy Aave?

Where can I buy Aave?

What is Aave?

How much Aave should I buy?

How much is Aave worth?

Will Aave go up?

How do you sell Aave?