Researching stocks is one of the most difficult tasks that every stock trader has to focus on. However, there is just too much information to analyze, and the time it takes to miss a good trade is short. Therefore, there is a need for the best stock research tools that make this process simpler.

This guide provides a comprehensive view of the best stock research tools available. We focus on their core qualities and the reasons they have been added to our list. We also discuss various types of stock research platforms available and the key benefits of using such tools when trading stocks.

Best Stock Research Tools of 2024

Here is a comprehensive list of the top 10 best stock research tools that have attracted customer attention this year. They are intuitive, feature suitable pricing models, and offer information from multiple perspectives.

- Benzinga Pro – Overall Best Stock Research and Analysis Tool of 2024

- eToro – Crypto Trading Platform Offering Comprehensive Stock Research and Analysis

- AvaTrade – Leading Resource for Stock Research and Analysis

- Admiral Markets – Offering Real-Time News And Global Sentiment Indicators for Stock Trading and Analysis

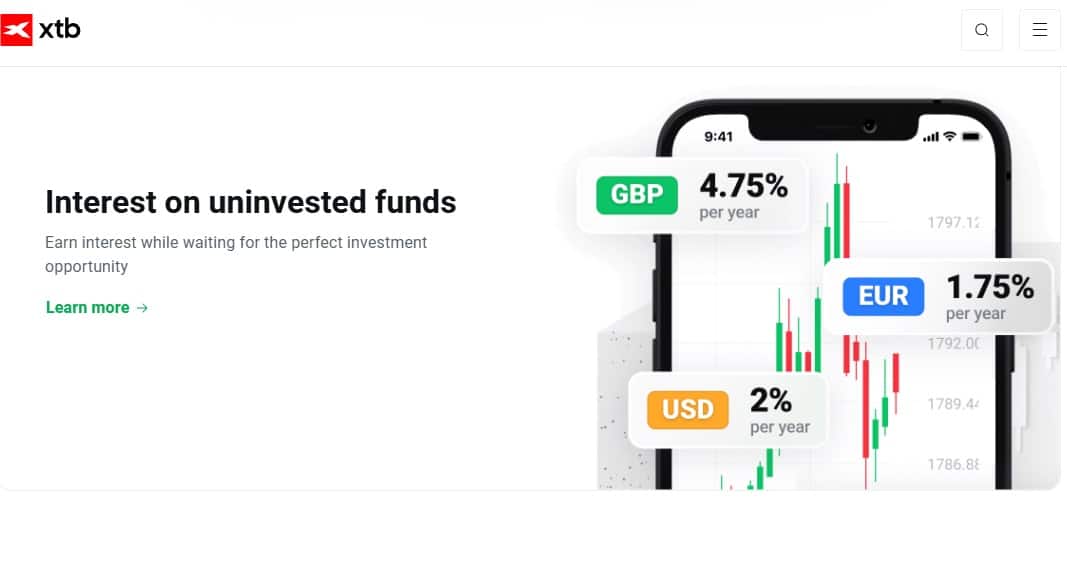

- XTB – Offers Stock Research Tools Such as Heatmaps and an xStation 5 Platform

- Trade Nation – Featuring Variety of Market Analysis, Technical and Fundamental Analysis Tools

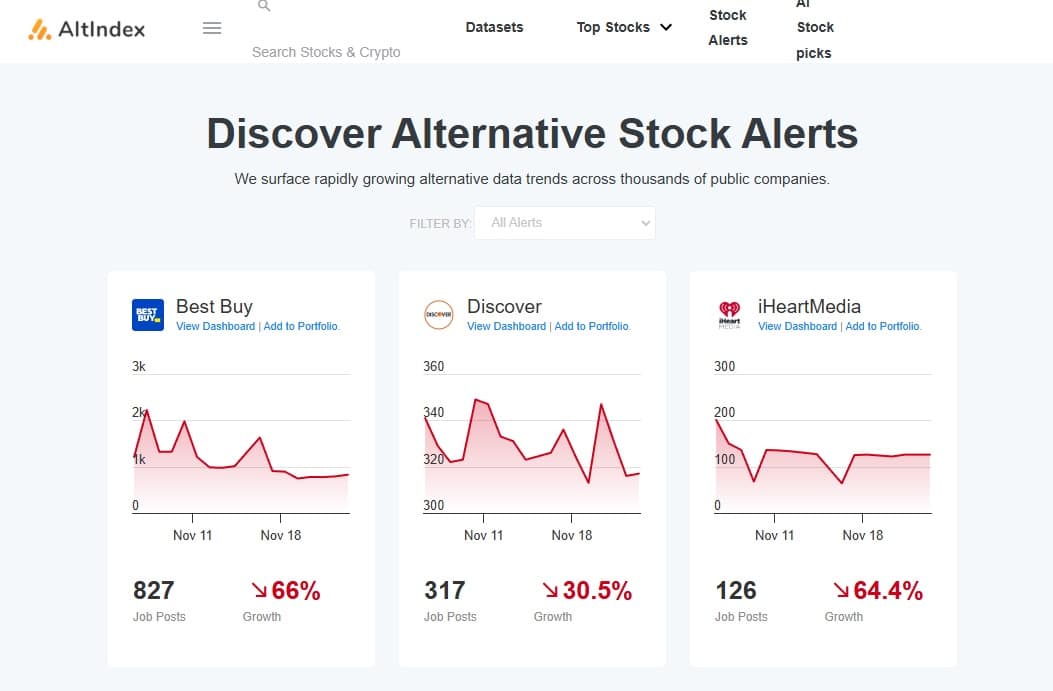

- AltIndex – Stock Research Platform Focusing on Social Media Sentiment About a Stock

- Seeking Alpha – Stock Research Platform Featuring Financial Articles from Analysts

- Stock Rover – Offering In-depth Fundamental Analysis of a Stock

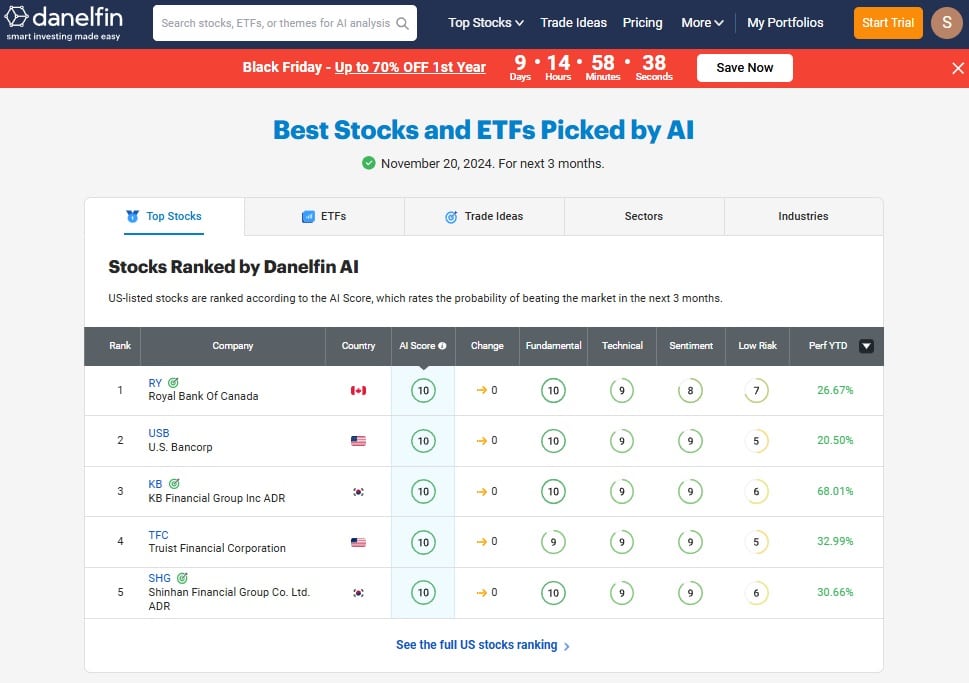

- Danelfin – Award-Winning Financial Research Platform Offering Reports on Multiple ETFs

Visit the Best Stock Research Tools Provider

Review of the Top Stock Research Tools of 2024

This section dives into the comprehensive analysis we have done for each platform. In these reviews, we focus on the stock-research-specific tools, the UI, and the pricing models.

Benzinga Pro – Overall Best Stock Research and Analysis Tool of 2024

Benzinga Pro has carved its niche in the stock research space by being a comprehensive platform featuring unique tools to analyze assets.

The key feature that enables it to deliver high-quality information is its real-time news feed. Fast, precise, and focused on providing maximum information in minimum time, these news updates emphasize charts and real-time market developments.

Users also gain access to analysis tools, including a stock screener, which allows them to filter stocks based on over 30 attributes. These include options like float, margins, moving averages, and more, catering to individual preferences.

For those who don’t have time to remain glued to their screens, Benzinga Pro offers the unique Audio Squawk feature. This feature provides live updates by reading out key headlines about stock-related events, charting tools, and sentiment indicators. It ensures that investors never miss critical information, even while on the move.

Standard market research and analysis tools are also available, with a focus on precise charting tools and sentiment indicators, offering robust assessments of stock performance.

Packaged in a simple user interface, Benzinga Pro ensures that even beginners can easily access its features. The platform simplifies complex information, with customization options allowing users to display only the key details they need.

The pricing structure of Benzinga Pro is straightforward. The Basic Plan costs $37 per month, while the Essential Plan is priced at $197 per month and includes an Options Newsletter along with an enhanced options trading newsletter.

For those seeking a more advanced experience, the Streamlined Plan is available for $147 per month. It includes all the basic features plus advanced newsfeeds, audio squawk for equity and options, and high-beta squawk.

Overall, this stock analysis tool is a valuable addition for investors seeking a robust and efficient system.

- Real-time, fast news updates.

- Advanced stock screener tools.

- Unique audio squawk feature.

- Beginner-friendly user interface.

- Higher cost for advanced plans.

- Limited features in the basic plan.

eToro – Crypto Trading Platform Offering Comprehensive Stock Research and Analysis

eToro is a comprehensive crypto trading platform focusing on many user-inclusive facilities. However, it’s the stock research of this platform that has gotten the most attention as of late.

Launched in 2019, the research tab is a robust addition to eToro powered by TipRanks. Offering highly valuable insights, this section focuses on the key aspects of the stocks that often most tend to ignore.

The top analysis feature among them is the Analyst recommendations feature. This is suitable for those looking for a quick analysis by professional analysts. Information provided includes buying, holding, or selling a particular stock.

Financial analysts also recommend the estimated price ranges of a particular asset based on professional predictions. Those looking to dive even deeper into the market fundamentals will find features like the Hedge Fund Activity Tracker, which tracks the actions hedge funds are taking according to a stock. The platform even covers insider transactions, covering how a company’s insiders trade.

Technical analysis tools, which consist of a suite of traditional indicators, are also available to let users assess market conditions. These include Bollinger bands, Relative Strength Index, and MACD.

Beginners will also find educational resources on the platform, such as webinars and Ebooks, as well as simplified tutorials.

Since eToro is primarily a trading platform, its pricing model is not made for its stock analysis features. Those who start trading via the platform upon account creation can get access to these services.

Overall, eToro is a platform that offers stock research and analysis services that are complementary to trading tools. Despite that, the offers are of high quality, which is why it is one of the top platforms in this regard.

- Real-time stock insights are available.

- Analyst recommendations by TipRanks.

- Comprehensive technical analysis tools.

- Beginner-friendly educational resources.

- No separate pricing for research.

- Primarily focused on trading features.

AvaTrade – Leading Resource for Stock Research and Analysis

With its focus on comprehensive resources for fundamental and technical analysis, AvaTrade is a suitable tool for stock research and analysis.

The platform’s fundamental analysis resources include educational guides that cover the basics of assets and help investors discern their intrinsic value. These resources address economic indicators, industry trends, and company financials. Market news and insights are also provided, focusing on updated earnings reports and economic events that could influence stock prices.

AvaTrade offers a wide range of technical analysis tools, including traditional indicators like Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI). The platform also supports MetaTrader 4 and MetaTrader 5, which provide advanced charting tools with multiple timeframes and detailed analysis reports.

Additional analysis tools are available through AvaTradeGO, a mobile trading app featuring tools for market analysis and charting.

Educational resources are provided via AvaAcademy, which covers both fundamental and technical analysis. The platform also features market analysis articles written by highly proficient experts, further enhancing its appeal.

Another key highlight of AvaTrade is its Market Sentiment Indicators, which are accessible through Client Positioning Data. This feature provides information on the percentage of traders holding long or short positions on various stocks, offering valuable insights to help users make better trading decisions.

AvaTrade’s fee structure is similar to eToro’s, focusing on trading rather than standalone analysis. While this approach makes the platform affordable, it may necessitate using multiple platforms for comprehensive stock research and analysis.

- Comprehensive fundamental analysis resources.

- Advanced technical analysis tools.

- Mobile-friendly with AvaTradeGO app.

- Market sentiment through client positioning.

- Focus on trading, not research.

- It may require supplementary platforms.

Admiral Markets – Offering Real-Time News And Global Sentiment Indicators for Stock Trading and Analysis

Admiral Markets, also known as Admirals, is a trading platform offering a premium analytics portal that provides users with access to a variety of stock research tools.

The analytics portal consolidates information from leading financial firms such as Dow Jones, Trading Central, and Acuity. As a result, users gain access to real-time market news, technical analysis features, an economic calendar, and a global sentiment indicator.

The technical and fundamental analysis features of Admiral Markets offer daily market analysis focusing on charts, volume, and price movements. Through the platform’s fundamental analysis reports, users can access company-specific information and macroeconomic factors to help them decide whether to trade or avoid particular stocks.

Education is also a top priority for Admiral Markets. Users have access to webinars and tutorials to enhance their understanding of the stock markets. For those who prefer reading, the platform offers the latest news and analysis in the form of articles and eBooks. These features are part of Admiral Markets’ “Free Academy,” which is accessible even to non-users who provide their email and subscribe to the newsletter.

Admiral Markets’ pricing model is tied to trading, not stock research and analysis. Fees are commission-based and vary depending on whether MT4 or MT5 accounts are used and the instruments being traded.

Overall, Admiral Markets primarily focuses on trading. However, its emphasis on stock research and analysis is a valuable addition. With insights from financial analysts at leading firms, investors should find it easier to analyze and trade stocks on this platform.

- Access to premium analytics tools.

- Consolidates insights from leading firms.

- Educational resources, including a Free Academy.

- Real-time market news and sentiment indicators.

- Trading-focused platform mostly.

- Analysis tools may require technical expertise.

- Commission-based fees vary by account type.

- Limited customization for advanced traders.

XTB – Offers Stock Research Tools Such as Heatmaps and an xStation 5 Platform

XTB is a CFD broker. However, its stock research and analysis services are highly detailed, making it an excellent resource for information that can aid investors’ decision-making.

This feature is delivered through xStation 5, a trading platform renowned for its sophisticated charting capabilities. It allows users to analyze stock prices across multiple timeframes. A variety of traditional and unconventional trading indicators are available, ensuring that the analysis users receive is comprehensive and detailed.

XTB also emphasizes layout customization, enabling users to personalize their workspace. They can arrange charts, watchlists, and other tools according to their specific requirements.

The platform’s market analysis tools are equally robust, offering features such as market sentiment, top movers, a stock screener, and heat maps. Market sentiment provides insights into the percentage of traders holding long or short positions on specific stocks. The top movers tool highlights the instruments with the most significant gains or losses, while the stock screener allows users to filter stocks based on specific parameters, streamlining the research process.

Heatmaps, a unique addition, offer a visual representation of market performance across various sectors, making it easier for investors to identify opportunities and trends.

XTB also offers educational resources under the “Education” tab, which is divided into two sections. One section is a knowledge base that includes everything from standard tutorials to complex analyses of certain stocks. The other focuses on market news, with features like “Stocks of the Week” and “Daily Summary” highlighting the best- and worst-performing stocks.

The platform’s fee structure aligns with standard trading platforms. There are no fees for research and analysis services—fees are only charged for trading activities.

- Sophisticated charting and analysis tools.

- Customizable workspace for efficiency.

- Comprehensive market analysis features.

- Free research and analysis tools.

- Primary focus on CFD trading.

- Limited focus on long-term investment tools.

- Advanced tools may overwhelm beginners.

- Trading fees may vary by account type.

Trade Nation – Featuring Variety of Market Analysis, Technical and Fundamental Analysis Tools

Trade Nation is a high-quality platform that offers a variety of market analysis tools, including technical and fundamental analysis. However, its standout feature is a dedicated section known as Market Information.

Market Information provides comprehensive market sheets covering a wide range of stocks. The first sheet explores instruments with a detailed breakdown on both TN Trader and MT4 platforms.

The section also includes updates on Daylight Saving Times, helping users stay informed about market opening and closing hours. The Market Holidays feature highlights upcoming holidays when markets will be closed, and Trade Nation ensures users remain updated as these schedules often change.

Information on Market Expiries is also available, detailing future contracts with open positions that are automatically closed. Additionally, users can find insights into Dividend Projections and specific markets.

Trade Nation’s Learn section is equally comprehensive—not just for the standard articles it offers but for its wide-ranging topics. These include trading strategies, trading patterns, forex trading, and trading styles. A complete Trading Glossary is also available, making it an excellent resource for beginners who want to learn how to trade.

The platform’s market analysis and insights extend to specific markets. For instance, it frequently provides updates on gold’s performance and the support levels within the S&P index.

Trade Nation also integrates analysis tools with its trading features, offering customizable charts and other attributes. One of its standout offerings is the Trade Copier, which enables real-time copying of trades. It also delivers detailed trader insights and encourages global community engagement.

- User-friendly, customizable trading platforms.

- Comprehensive market insights and tools.

- Fixed spreads for cost transparency.

- Robust educational resources for traders.

- Limited product portfolio.

- High fees for forex trading.

- No live chat support is available.

- Desktop platform lacks advanced security features.

AltIndex – Stock Research Platform Focusing on Social Media Sentiment About a Stock

The current market conditions have demonstrated that community sentiment is as valuable as financial fundamentals when analyzing a stock’s price action. This realization has been embraced by AltIndex, which offers an alternative approach by analyzing a social media sentiment index to provide stock research reports.

Covering more than a thousand U.S. stocks and all the companies in the S&P 500, the platform focuses on going beyond financial details to assess a company’s performance. AltIndex’s research incorporates social media activity, website visits, app downloads, job postings, Reddit mentions, app reviews, Wikipedia visitors, and much more.

This emphasis on social media fundamentals, rather than standard financial indicators, makes AltIndex a unique stock research and analysis platform. These social media parameters are also used to create lists of top-performing stocks.

However, financial indicators are not entirely neglected. The platform’s Insights and News section features regular articles on the latest market developments. Some articles provide in-depth analysis of specific stock categories, such as the recent focus on AI stock analysis.

Artificial intelligence is leveraged for advanced social sentiment analysis, assigning each stock an AI score based on social metrics and overall performance.

The platform’s pricing structure is inclusive, with free access available. The starter package includes an unlimited dashboard and unlimited analysis. Users who opt for the pro version gain additional stock alerts and curated picks. For hedge funds and other large organizations, the enterprise subscription features a dynamic pricing model tailored to their needs.

- Unique focus on social sentiment.

- Covers over 1,000 U.S. stocks.

- Inclusive pricing, including free access.

- AI-driven stock analysis and scoring.

- Limited reliance on financial fundamentals.

- Social metrics may not suit all investors.

- Enterprise pricing lacks transparency.

- Heavy emphasis on U.S. stocks only.

Seeking Alpha – Stock Research Platform Featuring Financial Articles from Analysts

Seeking Alpha is a stock research and analysis platform that delivers financial articles from top industry analysts and provides a holistic view of each stock.

As mentioned, the platform’s primary focus is on delivering high-quality articles. These are divided into two sections. One is for Trending Analysis, where experts share their insights about specific stocks. These articles often cover everything from analyst opinions to the “stock of the day.” There are also highlights of Alpha Picks of the Week and price prediction articles.

The other section focuses on Trending Financial News, keeping users updated about market developments. The writing style is engaging, with a storytelling approach that makes complex topics easy to understand.

The Stock Analysis section is highly comprehensive, offering everything from stock ideas to market outlooks. Specific investing strategies are highlighted, and users can also find reports on recently released IPOs. A dedicated section for Editor’s Picks showcases top recommendations, while the Cryptocurrency section provides insights into price movements within the most volatile asset class on the market.

For those looking to dive deeper, the Market Data section offers features such as an Earnings Calendar, currency-related updates, and information organized by specific sectors. There is also a separate section dedicated to Dividends and ETFs.

Education is a top priority for Seeking Alpha, with complex topics such as economic recessions explained in simple terms. Users can also access podcasts and videos for real-time expert insights.

The platform’s free plan offers access to one premium article per month, portfolio creation tools for a single portfolio, and real-time stock price movements. The Premium Plan ($249 annually) provides unlimited access to articles and tools. For exclusive coverage and top analysts’ insights, the Pro Plan is available at $1,899 per year for the first year.

- High-quality articles from top analysts.

- Comprehensive stock analysis and insights.

- Dedicated sections for dividends, ETFs, and IPOs.

- Educational resources with simple explanations.

- Pro Plan is expensive at $1,899/year.

- Free plan offers limited access.

Stock Rover – Offering In-depth Fundamental Analysis of a Stock

Those looking to navigate the market on their own terms will appreciate the exclusive fundamental analysis platform, Stock Rover. With a focus on multiple tools providing detailed analysis reports, this platform offers most of what users need to pick the best stocks, from comparative analysis to customizable screens.

With fundamentals being the primary focus of this platform, users can track metrics like the price-to-earnings ratio over time. Features such as portfolio charting are also available, enabling users to compare their portfolios with benchmarks like the S&P 500.

The platform offers four distinct valuation charts: price vs. fundamental, historical range, football field, and scatter plot, adding another dimension to the analysis.

Stock comparison is another key feature, covering insights on stocks, ETFs, and funds. The platform also provides investor warnings and metrics such as fair value and margin of safety. Additionally, users can view stock ratings from various platforms, scored out of 100. These scores are often paired with charts showing metrics like earnings per share, operating income, EBITDA, and revenue.

The screening strategies are robust as well. Stock Rover includes an Investor’s Library featuring numerous pre-built screeners. Users can customize their screeners with multiple parameters and use the Screener Snapshot feature to track changes in screeners over time.

A free plan is available and is well-equipped for beginners. However, the Stock Rover Essentials plan offers additional metrics and watchlist tracking capabilities, while the higher-tier Premium and Premium Plus plans include even more advanced tools.

- Comprehensive fundamental analysis tools.

- Customizable screeners with historical snapshots.

- Advanced portfolio comparison features.

- Free plan available for beginners.

- Higher-tier plans can be expensive.

- May overwhelm beginners with features.

Danelfin – Award-Winning Financial Research Platform Offering Reports on Multiple ETFs

Danelfin is a stock research platform that leverages AI to provide users with a comprehensive view of individual stocks. The scoring system is based on 600 technical indicators, 150 fundamental insights, and over 150 social sentiment metrics.

These elements are brought together to rank the top 10 stocks and ETFs. The list includes assets that are predicted to outperform the market over the next 60 days. This approach makes Danelfin particularly suitable for beginners looking for a simplified market overview without excessive complexity.

Covering thousands of U.S. and European stocks, Danelfin’s core feature is its Trade Ideas section, which highlights U.S.-listed ETFs and stocks with a market capitalization of over $500 million. The AI score provided incorporates fundamental, technical, sentiment, and crisp metrics. For each stock, Danelfin also highlights the year-to-date (YTD) performance, which is essential for assessing how an asset might perform in the future.

Additional insights are offered through blogs, including Danelfin’s investment strategies for U.S.-listed stocks. These strategies are backtested using the Monte Carlo simulation method before being made available to the public.

In terms of pricing, Danelfin offers three subscription models. Free users gain access to information about 10 stocks and a small selection of trading ideas. The Plus plan, the most popular option, includes additional trading ideas and alpha signals. The Pro plan provides the most comprehensive features, including unlimited reports, rankings, portfolios, and trade ideas, as well as daily alerts about historical AI scores.

- AI-powered scoring system for accuracy.

- Simplified market insights for beginners.

- Covers U.S. and European stocks.

- Backtested strategies using Monte Carlo simulation.

- Free plan offers limited features.

- Advanced metrics may overwhelm beginners.

- Focuses on short-term performance (60 days).

What are the Different Types of Stock Research Tools?

Analyzing stocks isn’t just about focusing on a single parameter but on multiple aspects that could influence an asset’s price. Therefore, there are various types of stock research tools available on the market.

Fundamental Analysis

Focusing on a stock’s core fundamentals, such as the sector of the company it belongs to, the company’s financial health, earnings, expenses, assets, and liabilities, is what fundamental analysis tools are designed to do. They provide graphs of all the core data and often deliver reports that people can analyze to dive deep into ratios like profit to earnings, return on equity, and others.

Technical Analysis Platform

Platforms like TradingView are used for the technical analysis of assets. They offer a standard candle chart that comes with multiple charting tools. Investors can assess the future value of an asset by charting their Fibonacci Retracement values or other elements using specific indicators such as the Relative Strength Index, Moving Average Convergence Divergence, Moving Average, Bollinger Bands, and more.

The purpose of these tools is to identify patterns that emerge. For instance, a pattern like a rising channel could indicate the growth of an asset over the short term, while a descending triangle could suggest that the asset is weakening in terms of demand.

Screener Tools

Traders often want to analyze a stock based on simple elements such as market capitalization, sector, financial metrics, dividend yield, and more. Screener tools allow users to filter their charts based on these details, making stock picking much easier.

Sentiment Analysis Tools

There are tools available online that focus on analyzing market sentiments. When a market is particularly volatile, assessing the overall mood of the market is crucial. Therefore, these tools leverage artificial intelligence to derive actionable data by analyzing social media platforms, news sources, and other textual data, which may include comments.

The goal here is to gauge what people feel about a particular stock. Many alternative data analysis platforms offer these tools.

Backtesting and Simulation

Some tools also offer a way for users to test their strategies within a simulated environment, often based on historical data. Also known as paper trading, this facility is suitable for researching the best strategies depending on the assets and broader market economics.

Portfolio Management Software

Most stock research tools include portfolio management software to help investors track their investment portfolios. This software is often equipped with performance metrics, risk assessment, and asset allocation analysis.

News Aggregators and Alert Systems

Most of the stock research and analysis platforms we have covered in this guide also deliver news articles and alert systems. Articles are write-ups that provide market analysis as well as the latest market updates from leading professionals in the industry. Alert systems come into play in the form of market alerts about stock prices or when a significant event has occurred within the said stock that could influence a company’s value.

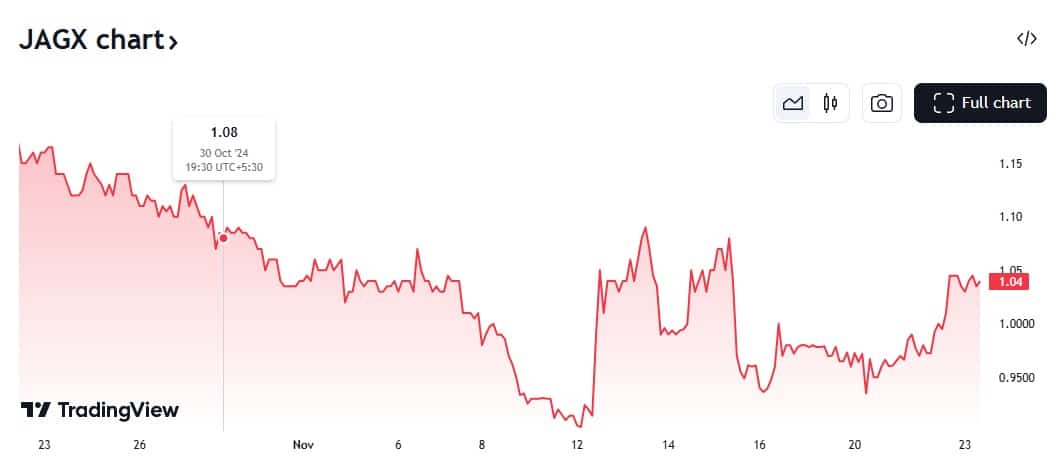

For instance, Jaguar’s recent decision to adopt an ultra-DEI stance in their advertising was a significant event. This caused the stock to drop by more than 11% since October 2024.

There are many stock research platforms that use this approach to deliver stock trading signals.

Economic Indicators

Stock research tools also focus on economic indicators and provide information about unemployment rates, GDP, inflation, etc. These can have a broader impact on the market. For instance, the price of Bitcoin often went up in the past whenever there were rumors about a slowdown in Fed rate hikes.

What are the Benefits of Stock Analysis Tools?

Using stock research tools comes with a host of benefits. Here are some of the crucial ones that people will encounter.

Improved Decision Making

Equipped with information about data and analytics, technical indicators, historical prices, and fundamental information, investors have an easier time deciding whether or not to invest in a stock. With a wealth of information, investors can easily assess the risks and rewards associated with a particular stock.

They can also time their investments based on broader market indicators.

Timing Efficiency

As already mentioned at the start of this guide, managing many details when deciding whether to buy stock or not isn’t easy. With stock research and analysis tools, the research and analysis of a stock are streamlined. As data is analyzed quickly, investors receive comprehensive insights in the form of concise reports. These reports can help investors reach decisions faster.

Managing Risks

Stock research platforms are equipped with tools that help investors manage market risks through proper ratings. For instance, tools such as portfolio assessment come equipped with this feature, allowing users to understand the risk of investing in a particular asset in specific sectors or regions.

There are also simulation tools available often that would enable users to test these risks to see whether they may be able to avert them in real-time.

Professional Analysis

There are many platforms that offer professional analysis of the market. Among the stock research platforms we have mentioned here, Seeking Alpha meets this requirement. These professional analysts offer everything from simple tutorials to comments on a specific type of stock. With expert eyes on the asset an investor wants to pick, the same investor will find their investment decision validated.

Tracking and Alerts

Users can easily track market movements with stock analysis tools. They can also keep tabs on news and even changes in stock prices. Stock research tools often send complete assessments and news alerts about events that could impact their portfolio. With real-time tracking, users can keep tabs on their investments and react quickly to market changes to avert losses and make gains.

How Did We Pick the Best Stock Research Tools?

Here are the key factors we analyzed when picking our list of best stock research tools.

Needs and Goals of an Investor

Every stock research tool isn’t fit for everyone. A day trader might need access to a tool that offers real-time data and advanced charting capabilities. For long-term traders, fundamental analysis and historical data might be more important.

And there might be some traders who focus more on sentiment analysis. We kept their needs in mind when creating our list.

Ease of Use

The second factor we analyzed was ease of use. What use is a tool if the users it is intended for have a difficult time understanding how it works? Therefore, our focus was on finding platforms that are easy to work with. Most stock investors aren’t tech-savvy, so we had to consider them. If a platform offers complex technologies, we also focused on whether it provides tutorials to make it easy for traders to learn how to use it.

Data Accuracy

It is important for a stock analysis tool to provide reliable data, as this forms the basis of an investor’s decision. Therefore, we looked at multiple resources to ensure that the same information is provided in most cases. This helped us confirm that the data provided is accurate.

We also focused on the timely dissemination of that information. Stock trading is hectic, and having timely information is crucial. Therefore, we analyzed whether the price charts were updated on time and whether the event reports arrived promptly.

Cost Consideration

A platform should offer affordable services. However, if the services are pricey, they should match the cost. We focused on high-end tools available and evaluated whether they matched their price points.

A costly stock analysis tool is expected to provide more reliable data, so we checked that. We also focused on the free offerings of some of these platforms and assessed if they were sufficient for beginners.

Integration with Other Platforms

We also considered whether the stock analysis tools highlighted can be integrated with other platforms, such as brokerage accounts. Our focus was also on whether additional features, like alerts, technical support, and mobile apps, were provided. These are crucial elements, as they make stock analysis easier and more comprehensive.

Conclusion

In this guide, we have provided a complete view of the best stock research and analysis platforms available on the market. We highlighted their pros and cons as well and concluded the guide by providing a list of types of platforms and how one can select the right platform.

The platform that encapsulates all the qualities of a robust stock research and analysis platform is Benzinga Pro. This platform is comprehensive, has a simple layout, and is affordable.

FAQs

What are stock research tools?

Stock research tools are applications that offer investors analysis, data, and insights on stocks to help them make informed investment decisions.

Are stock research tools important?

To trade better and analyze an asset from different points of view, stock research tools are important. Plus, they help users find investment opportunities and manage investment risks.

Are stock research tools good for beginners?

Most stock research tools are suitable for beginners as they are equipped with good UI and offer a simplistic view of the market. Furthermore, most stock analysis platforms focus on educating people about stock trading.

What is the difference between free and paid stock research tools?

Free tools offer basic data and are suitable for casual investors. Professional investors, however, should focus on more comprehensive data and access advanced analytical capabilities, features that paid stock research tools provide.