Amid the ups and downs in the global market, investors are now turning to undervalued, quality, and high-rewarding dividend stocks across a diverse mix of industries to achieve sustainable financial stability.

Dividend stocks are issued shares of companies that regularly distribute an appropriate portion of their earnings to investors/shareholders. In most cases, dividends are paid annually or semi-annually and some even pay every quarter, making it an attractive way to earn a steady income.

However, what’s most important is not really the high yields. Can the companies be consistent in sustaining or increasing the dividends? This makes research a crucial thing to do before diving into the dividend stock market.

With this in mind, we combed the market to identify, compile, and fully review the top ten dividend stocks with durable yields. This detailed guide also covers some of the best places to get accurate dividend stock signals and market insights that can help traders take their investments to the next level. Read on to know more.

Best Dividend Stocks To Buy Now – Quick List

With a host of options available, finding the right dividend stocks can be a laborious task, especially for first-time traders. In this segment of our guide, we have curated a list of the best dividend stocks to buy in 2024, taking into account the companies’ current financial situation and growth potential.

- Chevron (CVX) – Leading Producer of Lubricant & Fuel Oil Additives

- CubeSmart (CUBE) – Popular Real Estate Investment Trust Company

- Broadridge Financial Solutions Inc (BR) – Top Financial Technology Company

- AbbVie (ABBV) – American Biotech Company

- ExxonMobil (XOM) – The Largest US-based Oil & Gas Company

- Microsoft (MSFT) – Global Leader in Software Services

- PepsiCo Inc (PEP) – Manufacturer of Beverages & Convenient Foods Worldwide

- Seagate Technology Holdings (STX) – American Data Storage Company

- Broadcom Inc (AVGO) – Top-Tier Semiconductor Solutions Provider

- Coca-Cola (KO) – World’s Largest Nonalcoholic Beverage Company

Best Dividend Stocks To Buy Now – Fully Reviewed

Let’s take a thorough look at each of the dividend stocks mentioned in the quick list.

Chevron (CVX) – Leading Producer of Lubricant & Fuel Oil Additives

Chevron Corporation has been at the heart of the energy industry for over a century, with its establishment dating back to 1879. Initially named Pacific Coast Oil Co (PCO), this multinational oil and gas company operates in more than 180 countries worldwide, including the United States, executing integrated energy and chemical operations directly or through its affiliates.

Chevron Corporation’s operations go beyond exploring, refining, and producing high-quality petroleum products. The firm also ensures the transportation of refined chemical products through pipelines, marine vessels, and rail cars. In fact, the company’s basic operations are divided into two segments – Upstream and Downstream.

While the Upstream department focuses on the exploration, development, and transportation of crude oil and natural gas, the Downstream segment refines the explored crude oil into gasoline, diesel, marine and aviation fuels, premium base oil, and finished lubricants. Also, driven by its vision to provide affordable, reliable, and clean energy products that deliver the benefits of modern life, Chevron is gearing up to build a lower-carbon system.

For those interested in diversifying into the rapidly evolving energy industry, Chevron stands out as one of the top options to consider. According to multiple sources, its annual dividend per share has increased to 6.5%, a rate that’s 126% higher than what was offered in 2020. Chevron has increased its annual payout more than four times in ten years, helping investors to keep up with rising inflation.

In terms of its financial performance, Chevron recently reported earnings of $4.5 billion for the third quarter of 2024. While this figure is a bit lower than its 2023 third-quarter earnings, Chevron says it is leaving no stone unturned to expand its portfolio, reduce operating costs, and deliver long-term value to shareholders.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

CubeSmart (CUBE) – Popular Real Estate Investment Trust Company

CubeSmart is one dividend stock that may appeal to those optimistic about the real estate industry. Founded in 2004, CubeSmart describes itself as a self-administered real estate company, specializing in the acquisition, operation, and ownership of storage facilities. The company is based in Malvern, Pennsylvania but offers storage locations to customers across the length and breadth of the United States.

From household equipment to furniture items and vehicles like RVs, CubeSmart provides a secure and comfortable way for customers to store their important possessions. CubeSmart facilities, according to information on its website, feature climate-controlled units, electronic gates, loading docks, indoor and outdoor storage, and drive-up access amongst others to fit the diverse needs of customers.

Beyond personal possessions, CubeSmart also offers storage services for business inventory and contractor equipment, catering to firms with limited spaces. The facilities are offered on a month-to-month lease so that users can keep their precious belongings as long as they want. With over 1250 storage facilities, CubeSmart has solidified its position as a strong name in the United States real estate market.

Moreover, CubeSmart shares have earned considerable interest over the past few years – all thanks to its consistency in increasing yields. It has increased its quarterly dividends each year since 2009, earning the status of a “dividend achiever,” a title given to firms with at least 14 consecutive years of dividend increases.

At the time of writing, CubeSmart offers a 12-month trailing dividend yield of 4.13% and a 12-month forward dividend yield of 4.30%. Its annual dividends per share growth rate has also risen by 16.6% over the past ten years. With more increase still on the horizon, CubeSmart could be a good addition to investors’ stock portfolios.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Broadridge Financial Solutions Inc (BR) – Top Financial Technology Company

Broadridge is a global leader in the financial landscape, specializing in critical architecture and industry-specific solutions that power capital markets, investment management, and even corporate governance. With almost six decades of service delivery, the Fintech firm has led the transformation of the financial industry into a digitally-inclined landscape.

Broadridge’s technology platforms process and generate over 7 billion communications yearly. Its high-performance multi-asset trading solution – Tbricks – has been of immense benefit to several European tier 1 clients, helping them to elevate their business performance and improve their investors’ overall experience.

Just recently, the company – as part of its efforts to address industry needs to quote at an unprecedented scale – integrated new enhancements to Tbricks. The upgrade primarily enhances structured trading capabilities, empowering brokers and dealers to quote hundreds of thousands of products across multiple markets and distribution channels.

Meanwhile, Tbricks is not the only Broadridge solution that has gained mainstream adoption. Its flagship Corporate Actions and Income Processing solution has also been widely adopted by leading financial services firms to enhance their operational efficiency and improve their risk management capabilities.

Broadridge’s continuous focus on innovation and expansion to various markets across the financial industry has significantly impacted the performance of its stock. BR has surged by approximately 23% over the past year, recently reaching a peak of $230.15. At press time, the company issues a quarterly dividend of 1.5% to shareholders.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

AbbVie (ABBV) – American Biotech Company

AbbVie has been an active player in the biomedical sector since 2013, manufacturing and selling innovative drugs that cater to the complex health issues of patients. With a team of passionate and seasoned biotechnological experts, the company delivers therapies and solutions that enhance people’s lives and address tomorrow’s medical challenges.

Primarily, AbbVie focuses on core areas like eye care, immunology, neuroscience, oncology, and medical aesthetics amongst others. Since its establishment, the company has spent over $65 billion on scientific research to discover and produce medicines that solve the unmet needs in the aforementioned areas. Some of the medicine products already developed by the biotech company include Skyrizi, Humira, Botox, Imbruvica, Mavyret, Vraylar, Rinvog, and many more.

Humira, for instance, was developed to treat numerous autoimmune diseases, especially rheumatoid arthritis. The product, according to various sources, has generated more than $14 billion in revenue for the company, underscoring its widespread popularity among healthcare providers, patients, and customers.

While its headquarters is in North Chicago, AbbVie has become a strong force to reckon with in the global biomedical sector. It is currently the sixth-largest pharmaceutical company by revenue. And that’s not all! AbbVie also ranks 87 on Forbes’ top 2000 public companies in the world.

Recently, AbbVie took a bold step to expand its neuroscience pipeline by acquiring all outstanding equity of Aliada in a staggering deal worth $1.4 billion. The company’s dividend yield is currently pegged at 3.71%, with a noticeable increment expected soon.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

ExxonMobil (XOM) – The Largest US-based Oil & Gas Company

ExxonMobil is another leading name on our list of the best dividend stocks to buy this year. It focuses majorly on the oil and gas sector, refining and producing low-emission petrochemical products that can power the modern transportation system and improve the quality of life of people.

With a solid presence in more than 60 countries, ExxonMobil ranks high among the biggest publicly traded petroleum enterprises in the world. The company’s operations are segmented into four key areas – Upstream, Energy Products, Chemical Products, and Specialty Products.

While the Upstream segment focuses solely on exploring and producing crude oil and natural gas, the Energy Products segment offers fuels, aromatics, and catalysts through Exxon, Esso, and Mobil brands.

The Chemical Products department is in charge of petrochemicals, manufacturing, and marketing the likes of olefins, polyolefins, and even intermediates. Finally, the Specialty Products segment deals with performance products such as waxes, lubricants, resins, and synthetics. These four segments of the company have been crucial to its strong market position, helping it to meet the world’s energy needs.

ExxonMobil’s petrochemical products have been adopted across the board, thanks to its low-emission components. Just recently, Red Bull KTM Factory Racing announced the firm as its official fuel and lubricant provider. Moreover, its third-quarter 2024 earnings show that it has made significant progress in terms of sales volume.

ExxonMobil currently issues an annual dividend of 3.96% per share, with a yield of 3.25% paid to shareholders every three months. For those enthusiastic about the oil and gas sector, investing in ExxonMobil could be one of the ways to dive in.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Microsoft (MSFT) – Global Leader in Software Services

With its headquarters in Redmond Washington, Microsoft is the largest software developer in the world. It has offices in more than 100 countries, providing a broad range of computer operating systems software, office applications suite, AI-powered tools, and cloud-based solutions to clients.

Microsoft’s operations are divided into three segments – Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The Productivity and Business Processes segment contains products and services embedded in its productivity, communication, and information portfolio. Intelligent Cloud, on the other hand, features hybrid server products that can power modern businesses and applications.

The More Personal Computing business aspect of the firm consists of quality solutions that cater to gaming and window devices. This strategic business diversification approach has contributed significantly to Microsoft’s success, making it one of the most valuable brands in the world today.

Microsoft has also managed to stay on top of the shifting trends, as evident in its recent entry into the AI market. Recently, the CEO of the company, Satya Nadella hinted that artificial intelligence could be the next big thing in the technology space. While aiming to become an industry leader in the sector, Microsoft has released a host of artificial intelligence solutions like Azure AI Foundry, and Windows 365 Link.

Investors aiming to build a long-term profit should consider buying Microsoft. The technology company’s dividend per share is currently 0.80%. While this might be small when compared to others, it offers a more reliable way to earn a constant income.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

PepsiCo Inc (PEP) – Manufacturer of Beverages & Convenient Foods Worldwide

PepsiCo is an American multinational company that specializes in all kinds of convenient foods and beverages. With offices in almost all countries, PepsiCo manufactures, distributes, and sells packaged foods, snacks, and beverages worldwide.

PepsiCo generates most of its revenue from its convenience food line – a segment that accounts for 55% of its total income. It has a solid presence in North and South America, Europe, and Sub-Saharan Africa. Over the past couple of years, PepsiCo has consistently recorded an increase in its yearly generated revenue.

Recently, PepsiCo announced that it has signed an agreement to acquire the remaining 50% interest in Sabra and PepsiCo-Strauss Fresh Dips & Spreads International, making the company the sole owner of the aforementioned establishment.

On November 19, 2024, PepsiCo increased its annualized dividend per share to $5.42, underlying its commitment to amplifying shareholders’ returns. Given the well-established reputation of the company and its attractive payout, investors may consider adding it to their portfolio.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Seagate Technology Holdings (STX) – American Data Storage Company

Seagate Technology Holdings is an international company that supplies data storage technology and infrastructure solutions. Since its establishment in 1978, Seagate has been providing customers with a diverse range of data storage products, legacy applications, external storage solutions, and many more.

The company was the main supplier in the microcomputer market in the 1980s. In November 2000, Seagate signed a privatization deal worth $20 billion with a group of investors led by Silver Lake. This huge financial investment has been crucial to its business expansion and growth.

At the time of writing, Seagate Technology Holdings has manufactured many hardware products such as Hard disk drives (HDDs), Solid state drives (SDDs), storage subsystems, and computing solutions. These products are tailored for consumer and enterprise markets, ensuring optimal performance.

In 2024, the company received the backing of various investors including Strategy Asset Managers which purchased shares worth $667,000. Similarly, firms like Dimensional Fund Advisors, Swiss National Bank, Primecap Management, and Sumitomo Mitsui Trust Group all backed the company with improved stakes.

Meanwhile, the current annual dividend yield for Seagate Technology Holdings is 2.81% per share. Given its strong start to the first quarter of fiscal 2025 and its robust balance sheet, the firm has the financial capacity to sustain its yield and even increase in the long term.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Broadcom Inc (AVGO) – Top-Tier Semiconductor Solutions Provider

Broadcom Inc. is a global designer, developer, manufacturer, and supplier of semiconductors and other software products. Previously known as Broadcom Limited, this semiconductor solutions provider was acquired by Avago Technologies Limited in a deal worth over $37 billion around 2016.

Following its acquisition, the company was rebranded into Broadcom Inc. Its ticker was also changed from BRCM to AVGO on the Nasdaq. The takeover bolstered Broadcom’s business operations, allowing it to diversify into various areas like networking, broadband, storage, software, and more.

However, despite offering tens of enterprise software and security solutions, a larger percentage of Broadcom’s income comes from its automotive semiconductor products. These products have seen widespread adoption in critical markets such as cloud, data center, and networking, boosting the overall revenue of the firm. Cloud developers, for instance, rely on the products to enhance the network connectivity of their AI applications.

Broadcom is currently the fourth-largest semiconductor company in the world, boasting an extensive product portfolio that covers the aforementioned areas. In late 2023, the firm made headlines after it took over VMware – a market leader in the virtualization market – in a $69 billion deal. With this acquisition, Broadcom is well-positioned to fully harness the opportunities in the cloud computing market.

Above all, Broadcom has what it takes to sustain its dominance in the semiconductor sector, making it a worthwhile dividend stock for income-oriented investors. At press time, it offers a dividend yield of 1.29%. This means for every $100 invested in the company’s stock, investors would gain $1.29 in dividends each year.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Coca-Cola (KO) – World’s Largest Nonalcoholic Beverage Company

Listed on the New York Stock Exchange, the Coca-Cola company is an American multinational manufacturer of soft drinks, syrups, and alcoholic beverages. A recent report released by the company shows that it sells beverages in about 200 countries and territories worldwide.

A few years ago, it became the first company in the UK to record an annual sale of £1 billion. While it has faced a lot of challenges and regulatory scrutiny over health issues, environmental concerns, animal testing, and its business model, Coca-Cola has continued to wax stronger.

Coca-Cola recently announced a water security strategy, with a focus on actualizing circular water use in 175 facilities and returning two trillion liters of water to nature by 2030. Also, Coca-Cola is looking forward to making 100% of its packaging recyclable.

As the company continues to push its products worldwide, investors are diversifying into its stock, with the expectation of making huge gains. Currently, it pays an annual dividend yield of 3.04%.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What Are Dividend Stocks?

Dividend stocks have become a popular investment strategy among investors seeking to earn passively at low risk. These financial instruments represent a percentage of ownership of publicly listed companies, issued to raise more capital for innovation, growth, and expansion. In return, investors, known as shareholders, get a portion of the company’s income, either quarterly, semi-annually, or annually.

More so, each company has a payout ratio – a key indicator that shows how much a company is willing to pay its investors in dividends. Well-established companies with healthy balance sheets do offer better dividends and are always willing to increase over time.

However, when a company pays too much money in dividends, it might find it difficult to sustain it, leaving investors heartbroken. This makes it crucial for investors to conduct thorough research into a company’s financial strength before making a decision.

What To Consider For Before Investing In Dividend Stocks

Investing in dividend stocks requires careful preparation, time, and consistent effort. However, before commencing your journey in the high-volatile stock market, here are some of the important things to note:

Evaluate The Financial Strength Of The Company

Having a clear picture of the financial health of a company is important before investing. This has to do with assessing the company’s revenue, profitability, debt and liquidity, cash flow, and other valuation metrics. It is not enough to conclude with just a single metric.

Assessing all the key metrics, especially the ones mentioned above is crucial in understanding the overall well-being of the firm. If the company has sufficient cash flow, generates regular profits, and maintains good debt levels, it will be able to consistently grow its position in the market.

Keep A Diversified Portfolio

Investors can strengthen their chances of making steady profits by building a versatile and diversified portfolio. With the inherent volatility in the stock market, a diversified portfolio unlocks better opportunities and reduces the risks.

Those willing to adopt this powerful strategy can check out dividend stocks spread across top-tier sectors including oil and gas, telecommunications, mining, aerospace, healthcare, insurance, artificial intelligence, Fintech, and more.

Assess Your Risk Tolerance Level

Risk tolerance is another essential thing investors must consider before diving into the stock market. Assessing your financial condition and how much risk you can afford to take can help you develop the perfect plan for building your wealth.

If your risk appetite is high, you may go all out for high-risk dividend stock investments offering bigger returns. Otherwise, settle for low-risk dividend investments and the low returns that come with them.

Check The Sustainability Of The Dividend Yield

Investors are always on the lookout for publicly listed companies that not only pay steady dividends but also increase their payouts regularly. However, in most cases, most of these companies do not really have the financial strength to sustain such an increase in the long term.

With this in mind, investors should always run a few checks on the company’s financials to see if it has a strong balance sheet to maintain its current payouts without running into a crisis.

Tips To Build A Strong & Versatile Dividend Stock Portfolio

Below are key tips for building a strong dividend stock portfolio:

- Choose a reliable stockbroker to buy their stocks.

- Do your due diligence before investing in any company.

- Reinvest your dividends.

- Subscribe to leading stock alert platforms for prompt trading suggestions.

- Spread your investments across various top-tier sectors.

- Avoid chasing high, unsustainable dividend yields.

Where Can I Get Accurate Dividend Stock Signals?

Here are our recommended platforms to get insightful dividend stock signals and insights this year:

Benzinga Pro

Benzinga Pro stands out as a perfect pick for investors seeking real-time data, market-moving news, historical price insights, comprehensive analysis tools, and a host of other educational materials that can help them discover potential trading opportunities and make big gains.

Built on the principles of simplicity and innovation, Benzinga Pro has a news feed feature where users can sort the updates according to sectors, markets, financial classes, or certain companies, guaranteeing quick access to the required information. Investors can also customize Benzinga’s alert offerings in a way that suits their trading objectives, with options ranging from calendar to signals and watchlists.

Signals offered by the platform are based on carefully analyzed data and deep research, an approach that has contributed to its high success rate. For beginners looking for a way to explore the stock market with full confidence, Benzinga Pro offers mentorship programs.

The platform also has a stock scanner that can accurately scour the market and filter stocks based on key metrics like market cap and volume.

In terms of pricing, Benzinga offers three subscription packages – Basic, Essential, and Streamlined – to cater to investors of all levels.

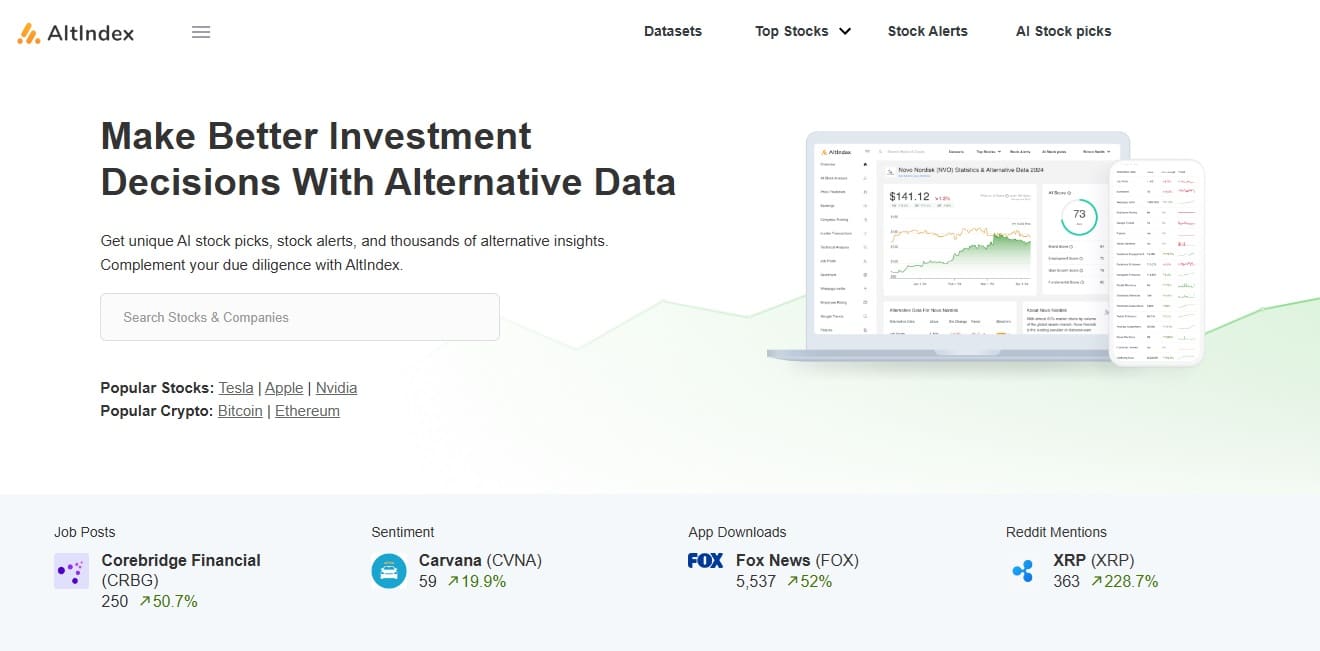

AltIndex

AltIndex is yet another reliable place to get a wide array of stock insights and signals. Central to its offerings is its AI-powered architecture which has been strategically developed to study the general market sentiment on top trending stocks and provide accurate trading suggestions to users.

It uses aggregated data obtained from social media sources like Reddit, Twitter, Google Search, and Facebook to analyze why a stock is trending, taking into account some vital factors like comments, recruitment, layoffs, views, and shares. AltIndex also extends the scope of its research to alternative data points to provide in-depth market analysis that can help both newbies and professional traders identify profitable trading opportunities.

Beyond offering vast market insights based on broad data obtained from supported sources, AltIndex, like Benzinga Pro, also has a stock screener feature to help investors keep up with stocks similar to their portfolios.

Overall, AltIndex offers everything users need to excel in the volatile stock trading world. Its extensive approach ensures that investors can keep an eye on the best dividend stocks to invest in and why.

How To Buy Dividend Stocks – A Step-by-Step Guide

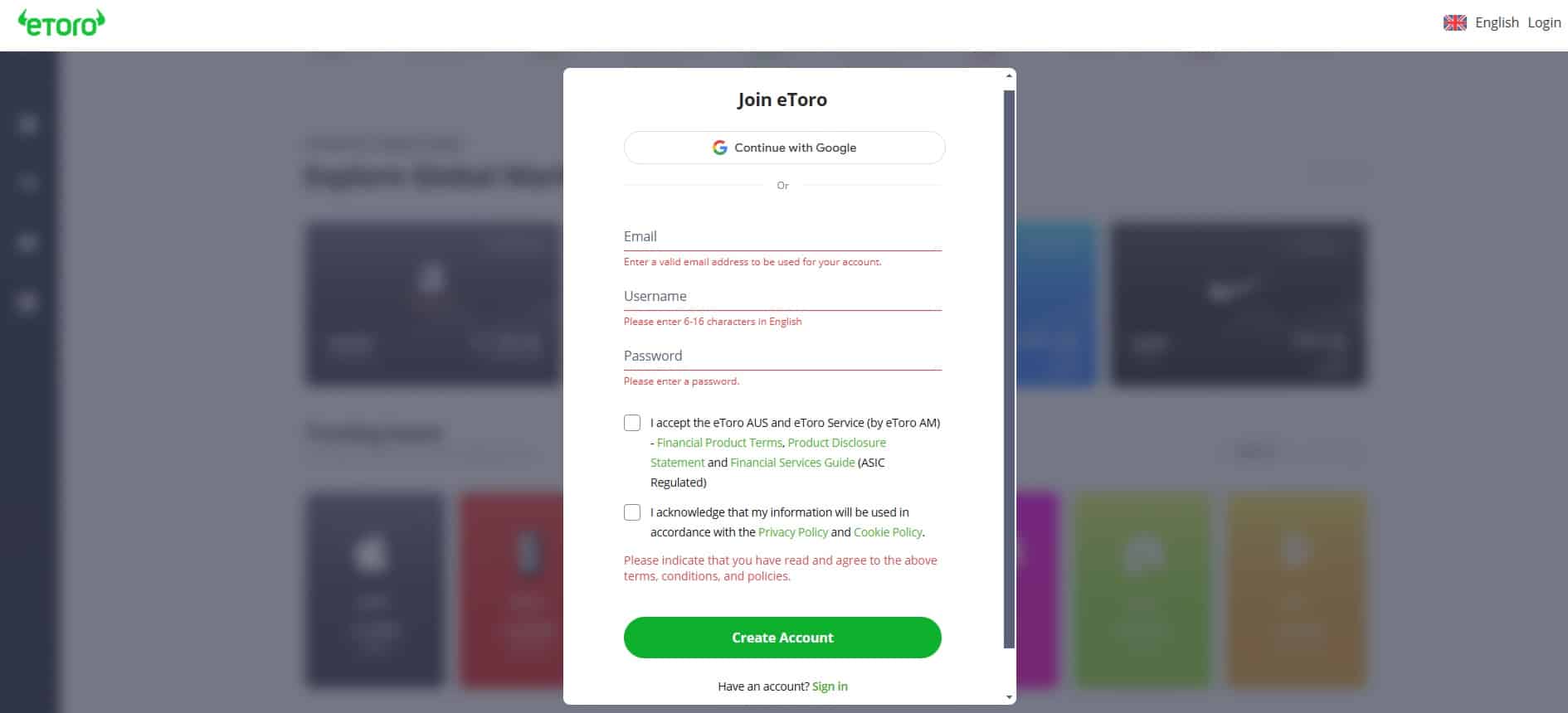

The process of buying dividend stocks is relatively easy as long as you pick the right broker. Let’s take eToro as an example to provide you with a step-by-step guide on how to get your dividend stocks this year.

Step 1: Register/Create an eToro Trading Account

To do this, you will have to visit the eToro website, click on the “Sign Up” button, and provide all the required personal information, especially your email address, name, date of birth, contact information, username, and password.

Step 2: Complete Your KYC Verification

Being a regulated broker, eToro demands that new users verify their identity before they can be able to explore its advanced trading features. The process is simple and swift. All you need to do is upload a government-issued ID such as a driver’s license or passport. You are also required to provide proof of address – it could be a recently issued utility bill or bank statement.

Step 3: Make A Deposit

After a successful verification, the next thing to do is to make a deposit. Click the “Deposit” button to select your preferred mode of payment. eToro accepts credit/debit cards, bank transfers, Paypal, Skrill, Online banking (Trustly), iDEAL, NETELLER, and more.

Step 4: Search for Your Favorite Dividend Stock

Built with users’ convenience in mind, eToro has put in place a responsive search bar to help you find your favorite dividend stock. If you are buying Chevron (CVX) for instance, type the name into the search bar. Alternatively, you can use the “Discover” feature to filter top trending stocks to consider.

Step 5: Buy Stock

The final step is to click the “Invest” button to access the order form. Enter the amount you want to invest and click “Open Trade” to confirm and execute your order. If successful, the stock will appear in your portfolio.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Our Verdict

While there are tens of thousands of dividend stocks on the market, finding the right one can be a daunting task for both experienced traders and newcomers alike. However, the options we have provided in this guide boast healthy balance sheets, pay impressive dividends, and demonstrate strong growth potential.

Those seeking a more comprehensive market insight and recommendation can try out Benzinga Pro. It provides immediate access to real-time expert tips and research tools that can improve investors’ ability to make calculated trading decisions.

FAQs

What are dividend stocks?

Dividend stocks represent a percentage ownership of companies. Investors are paid regularly, either quarterly or annually from the income of the companies based on payout ratios.

Where can I buy dividend stocks?

Among a host of options available, we recommend eToro due to its simple interface, low fees, and advanced functionalities, tailored to help investors stay ahead of market trends and maximize potential trading opportunities.

Where can I get reliable dividend stock signals?

For those seeking signals that could help them put actionable trades during the best market moments, we recommend that they subscribe to Benzinga Pro or AltIndex.