Over the past year, many people have been giving themselves the same question – should I buy Bitcoin now? Some investors still hesitate if the leading cryptocurrency can be a good investment and if it’s a good time to invest in BTC.

While Bitcoin has lost more than half of its value after its historical all-time high, its YTD return rate is over 84%. This is high compared to other financial markets, such as the S&P500 which has a 19% YTD return. There are also several reasons to believe that Bitcoin can recover from the bearish market and hit another all-time high soon.

In this guide, we will explore investment in Bitcoin, analyze its previous price performance, and the probability of hitting another ATH in the near future. Overall we introduce 8 reasons why should you invest in Bitcoin today.

First, What Happened to The Bitcoin Price So Far This Year?

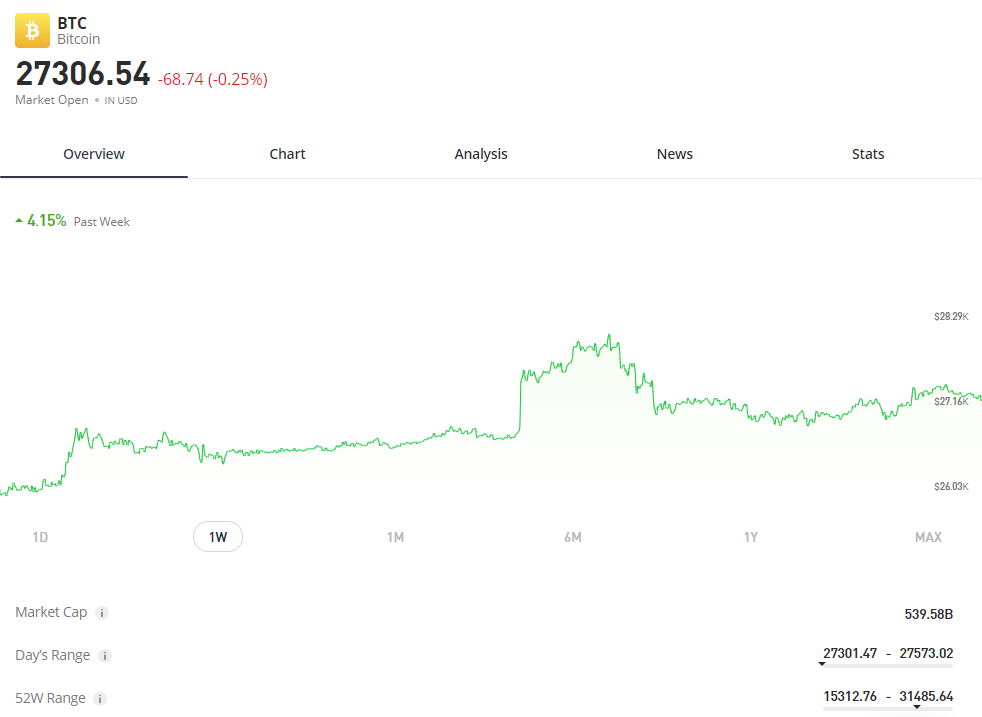

Bitcoin entered 2023 with a price of slightly over $16,000, which was more than 76% lower compared to its all-time high that the cryptocurrency hit in 2021. Among the negative factors affecting Bitcoin’s and the whole crypto market’s value include the collapses of crypto exchanges, taxes on Bitcoin earnings, implementation of stronger regulations, etc. While 2022 was a bearish year for the crypto market, 2023, at least when it started, was deemed to be a good one.

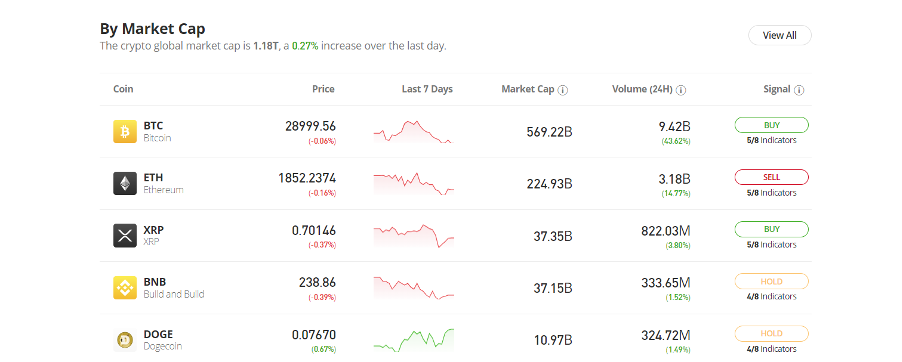

Bitcoin and other cryptocurrencies recovered significantly compared to their prices at the beginning of the year. First, Bitcoin again hit $20,000 and has been trading above the $20,000 mark so far. However, it had some ups and downs during the last 7 months. In April, Bitcoin even hit $30,000, which gave hope to investors that BTC could hit $60,000 by the end of the year if it kept the resistance level of $30,000.

Shortly Bitcoin again lost its value and dropped down to $26,300 in 2 months before reaching another highest peak for the year. On July 14, Bitcoin hit $30,000 and reached as high as $31,000, which indicates a 93% YTD return rate for this cryptocurrency. In July, bitcoin was one of top crypto gainers, along with Bitcoin Gold, Bitcoin SV, eCash, and Cake.

In August, Bitcoin crashed on rumors of Elon’s SpaceX selling its Bitcoin holdings, which were unfounded – Bitcoin quickly bounced to the $26,000 level. Some bullish market developers later allowed Bitcoin to cross the $28k mark briefly, after which it dropped to around $27.6k.

In October, Bitcoin started to trend sideways, with $28.2k acting as its current resistance. Experts believe that it might be some time before Bitcoin is able to cross the $30k threshold.

Will Bitcoin Go Up to 60K?

2022 was a tough year for Bitcoin and the whole cryptocurrency market, which significantly lost its value after such events as the collapse of the FTX exchange, the crash of the Terra Luna, and other high-profile crypto projects. After entering 2023, Bitcoin managed to survive and started its recovery path due to such factors as the bank crisis in the US, inflation cooling, and the dollar index weakening.

Bitcoin started 2023 with a price of $16,000, which is 76% lower compared to its all-time high of 2021. However, the cryptocurrency managed to hit the $30,000 mark back in April, and the current all-time high of 2023 was hit in July, reaching $31,000. This shows a tremendous growth of 90%, meaning that Bitcoin brought huge returns for the investors who decided to buy the dip.

However, Bitcoin wasn’t able to stay above this mark for long as regulatory issues coupled with massive sell-offs by major holders led to Bitcoin starting to consolidate around the $27.8k mark.

Can Bitcoin repeat its all-time high and get back to the $60,000 level? While it’s hard to be precisely sure, crypto analysts believe that if Bitcoin can stick to the price of $30,000, the leading cryptocurrency can get back to $60,000 again. One reason to believe this is that Bitcoin can get more potential in the current economic condition as more people seek alternatives to the traditional bank system.

Another reason that gives analysts hope for the Bitcoin price recovery is its next halving event which is expected to be in 2024. The previous performance indicates that Bitcoin performed well after cutting its supply, and the halving events have been one of the best drivers for Bitcoin’s bullish direction.

So, Bitcoin’s supply halving, the possible rise in money transfers with Bitcoin, and more use cases for this cryptocurrency are among the reasons to believe Bitcoin can get back to $60,000. But the opposite can also happen and there are some factors that can lead to Bitcoin decrease. One of these reasons can be crypto regulations, while people losing interest in crypto can also be a factor for another crash of the market.

Crypto analysts, investors, and entrepreneurs have different predictions for Bitcoin. Many believe that Bitcoin can even hit $100,000 if it manages to recover its previous all-time high of $69,000. Others even predict that Bitcoin can reach $1,000,000 by the year 2025. In contrast, there are other analysts who have the opposite view and who claim Bitcoin’s current bullish trend is a trap and that the crypto will again lose its value and reach $5,000.

Should You Buy Bitcoin – 8 Reasons Why You Should Consider Investing in Bitcoin

If you constantly ask yourself “Why should I buy Bitcoin right now”, this section can help you to find the answer to your question. Bitcoin remains one of the best long-term investments, and below we have explored 8 good reasons why it is worth buying Bitcoin right now.

1. Bitcoin is an Excellent Way to Protect Your Money From Inflation

One of the best reasons to buy Bitcoin is that it is a great source to store value especially when compared to traditional currencies, such as the US dollar. The problem with storing value through other fiat currencies is the continuous inflation rate because fiat currencies have an unlimited supply. Governments can decide to print money and in this way devalue it.

However, Bitcoin has a limited supply of 21 million coins, and it’s a permanent rule for Bitcoin. It means that there can only exist a limited number of Bitcoins, and its supply will never increase once all the cryptocurrencies are mined and in circulation. Moreover, when all the coins are mined Bitcoin’s value can grow alongside the increase in its demand.

In contrast to this, governments keep printing new money, which causes inflation leading to an increase in the price of goods and services. This makes USD not an effective way of saving your money as it will lose its value along with the increase of inflation.

In this sense, Bitcoin is quite similar to gold. Gold is also a way of storing value as it has a limited supply. Even today, it is highly popular to use gold for storing value. Similar to Bitcoin, gold is also mined and entered into circulation, but once all the gold is mined its supply will reach the maximum. This is the reason why many investors consider Bitcoin as the new gold.

2. Bitcoin is Safe and Secure

Bitcoin’s greatest advantage over other means of storing value is that it is highly secure and safe. This is because Bitcoin operates on blockchain technology which is decentralized. Decentralization means that it is not controlled by a single entity like the government, your bank, or any other financial institution.

This, first of all, makes your money more controllable. On a blockchain, it only belongs to you, and no one can decide how to decide what to do with it other than you. But bear in mind that you need to keep your private keys secure and never trust them to anyone else. The fact that all the transactions, distributions, rewards, and other activities in Bitcoin are conducted only through Blockchain makes it also less vulnerable.

For example, when you trust your assets to a bank, all your funds are controlled by a single entity. And if someone manages to hack the servers, they can easily steal your money from your bank account. In contrast, Bitcoin uses advanced security to keep your funds secure, and it’s almost near to impossible to hack the blockchain.

Bitcoin is safe even when we compare it with gold because gold can still be stolen or damaged, whereas this can hardly ever happen to Bitcoin as it is saved on Bitcoin wallets. You can safely store your Bitcoins in your hardware wallet and not worry that someone can hack it. This is because hardware wallets are physical devices that store your private keys offline, which makes it hard for anyone to steal your bitcoins.

3. It is a Deflationary Currency

The next reason to use Bitcoin for storing value is its deflationary feature. Cryptocurrencies are either inflationary or deflationary. While the first one usually refers to the crypto projects with an unlimited supply of coins, deflationary cryptocurrencies gradually reduce their supply through burning events. Inflationary cryptocurrencies also increase the number of coins in circulation.

In this sense, Bitcoin is also sometimes considered inflationary as every time a new block is mined, new BTCs enter into circulation. However, Bitcoin has a limited supply, and the number of Bitcoins that are mined for each block is reduced every four years. Though Bitcoin’s supply grows, its growth is halved through a special event called Bitcoin’s halving. This is why many prefer to call Bitcoin a deflationary cryptocurrency.

Bitcoin’s reduction also makes it harder to mine new blocks and get new Bitcoins making it more valuable. Bitcoin mining happens in the following way. As it operates on blockchain technology, there is no central party to operate all this process and verify transactions. Hence, there are network validators who verify new transactions.

All the transactions in Bitcoin are collected in one block, which needs to be mined, after which the transactions will be verified. A new block is mined every ten minutes, and miners use advanced hardware technology to be able to do that. To mine a new block, they must solve complicated computational tasks which require powerful computer power and electricity.

After mining a new block, a lucky miner gets rewarded with new bitcoins, and they also get the fees from the transactions. However, they also spend a lot on electricity supply, which they need to pay for. So mining Bitcoin comes with huge expenses; that’s why it should be worth it. Moreover, when halving events occur, the number of Bitcoins that the miner gets is reduced twice. It means that they spend the same resources to mine a new block, but the number of Bitcoins they get is halved.

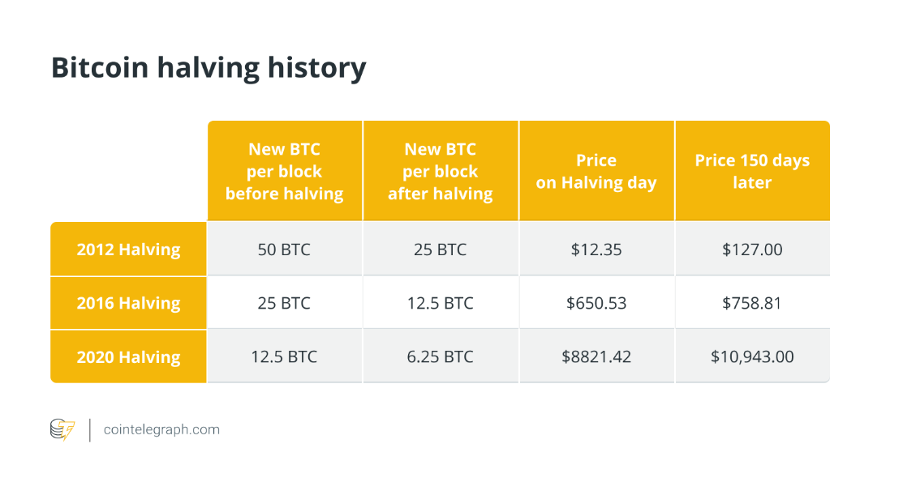

For example, in 2012, the reward for each block was 25 BTC, which was reduced to 12.5 BTC in 2016 and to 6.25 BTC in 2020. The next halving is going to be in 2024, and the miners will get 3.125 BTC for each mined block instead of 6.25 BTC they get now. This halving is permanent, and it will continue until all the Bitcoins are mined. When the last block is mined, Bitcoin’s supply will be 21 million, and this number will not increase ever.

Bitcoin’s halving history shows that every time when the halving occurs, Bitcoin’s value increases respectively. As you may see from the chart, in 2012, when Bitcoin was reduced to 25 BTC per block, its’ price hit $127 150 days after that. The same happened after the 2016 halving, and the price surged to $758. Finally, the 2020 halving resulted in a price growth of more than $10,000. Experts believe that the same will happen after the 2024 halving, which makes this the right time to invest in BTC before the price growth.

We’ve recently also reviewed some Bitcoin inspired projects that add staking utility, including Bitcoin BSC (BTCBSC).

4. Low Fees and Direct Transfer

Apart from being a store of value, Bitcoin is also a payment system and has some great advantages over traditional money. One of these pluses is the fact that the transaction fees are quite low compared to fiat transactions when you are transferring money between different countries. For international transactions, people usually pay high fees as there are intermediaries between you and the receiver.

So, these transactions usually cost high, and you can actually save money by doing this in Bitcoin. This is another great use case for Bitcoin, and it has the potential to become one of the most popular payment methods. Obviously, this will lead to more demand for the cryptocurrency, and with its scarcity, it can grow in value. Bitcoin transactions can also be high depending on some factors, such as its value, network congestion, etc. However, it will still be more effective than using traditional methods.

Another good thing associated with Bitcoin’s decentralized nature is that the transactions are direct. Everything is controlled and registered on the blockchain, and the transactions get verified by the miners. So there is no need for a third party between the sender and receiver which not only reduces the cost but also makes it possible to easily send and receive money from any part of the world.

Decentralization comes with a number of benefits. First, it is very quick; the only thing you need to do is to send the amount of Bitcoin to the receiver’s wallet. For this, you will be charged only a small fraction of Bitcoin, which goes to the miners for their service of transaction verification. As long as the transactions are direct, you don’t need to wait for several days for the transaction to be verified by both parties. With Bitcoin, it will be verified in a matter of minutes.

The next good thing is that you can send as much Bitcoin as you want, and there is no limit on your transaction which may not be possible with traditional payment systems. Bitcoin also enables you to send at any time from any place, which makes Bitcoin transactions even more convenient.

Eventually, transactions in Bitcoin are transparent, and everything is registered on the blockchain, which makes blockchain hard to deceive. Hence, Bitcoin transfers are more secure compared to other transactions using traditional methods. With all these benefits, Bitcoin has the potential to become a well-established payment method in the future and increase in value if more people prefer BTC for money transfers.

5. Institutional Adoption of Bitcoin

Institutional interest in Bitcoin has grown significantly, which gives Bitcoin more legitimacy for real-world usage. A few years ago, financial institutions were still careful with Bitcoin but a lot of things have changed now. Bitcoin, once referred to as a “scam” by many popular institutions and investors, has now drawn a lot of attention to itself. For example, the CME group, which is a popular derivates exchange, backed the first Bitcoin futures market in 2017.

Also, many companies, such as Fidelity and Black Rock, have requested SEC for Bitcoin ETF. While SEC previously denied all these proposals for Bitcoin ETF for a long time, the good news is that it has recently approved Black Rock investment company, Bitwise and other companies for spot Bitcoin ETF. Meanwhile, SEC announced that similar applications from Wise Origin WisdomTree, Bitcoin Trust, VanEck, and Invesco Galaxy are currently in review.

The institutional interest is growing not only in Bitcoin but also in the technology behind the Bitcoin – blockchain. One of the examples is Ripple’s blockchain project which is already used by different banks and financial institutions to send transactions faster and with transparency. Other benefits include low transaction costs, scalability, low power consumption, etc.

Amon the banks using Ripple’s technology include the Canadian Imperial Bank of Commerce, Santander Bank in the USA, PNC Bank in the USA, Siam Commercial Bank in Thailand, Standard Chartered Bank in the UK, Cuallix in Mexico, etc. Banks usually use XRP for cross-border transactions as long as XRP enables them to make transactions in real-time. Also see our ‘should I buy XRP now‘ article.

6. Bitcoin Regulation May Lead to Significant BTC Price Increase

Many people think that Bitcoin regulations are something to worry about as they believe this means that financial institutions are trying to take more control over Bitcoin transactions. However, this can actually be good for Bitcoin and other cryptocurrencies. In some countries, these regulations are very strict. And some countries, like Egypt, China, Nepal, and others, even consider Bitcoin and other cryptocurrencies illegal.

However, in most other countries, Bitcoin is being actively adopted into real life as a means of exchange and as a means to store value. Considering this fact, countries like the United States are trying to make improvements in the classification of digital currencies. For example, these regulations help to take more control over the taxes on Bitcoin earnings. And they make Bitcoin and other digital currencies more legitimate.

While some countries are completely banning Bitcoin from usage, others are seeking methods and improvements to make cryptocurrencies more regulated and to securely incorporate them into daily life. Hence, increasing regulations may convince many people to refrain from calling Bitcoin a scam and change their opinion about cryptocurrencies. It can also be a reason why Bitcoin demand will grow in the future and consequently lead to its price increase.

7. More Businesses Now Accept Bitcoin as a Payment Method

With its fast and secure transactions, decentralized feature, and popularization, Bitcoin is also getting more adoption among businesses. It means that you can use Bitcoin or other cryptocurrencies to purchase goods and services from different companies. Different business sections have now made possible transactions with Bitcoin, including entertainment, food, travel, technology, and other industries.

One of the most popular tech companies accepting Bitcoin is Microsoft which enables you to buy digital products with BTC from the Microsoft Store. Another popular name is Starbucks, where you can buy coffee and other products with Bitcoin and Ethereum. AMC is a movie theatre that supports buying tickets for movies using 5ive different cryptocurrencies, including also Bitcoin.

Bitcoin is also accepted by PayPal, Overstock, Twitch, Time Magazine, Shopify, and many others. Some companies even use Bitcoin to pay their employees or enable them to get a portion of their salary in Bitcoin. This means that Bitcoin is getting more and more adoption in our daily life. It not only helps Bitcoin to be integrated into the real world but also increases trust in this cryptocurrency as a new medium of exchange and a store of value.

8. Scarcity – Bitcoin Has a Limited Supply

And last but not least, Bitcoin’s scarcity is one of the reasons why you need to consider investing in this cryptocurrency. Bitcoin has a limited supply of 21 million tokens, with 19 million in circulation. Bitcoin’s low supply is one of the reasons why it is so valuable because scarcity attracts more people. With more people buying BTC, the demand for the coin grows, and as long as the demand and supply are the main forces of the crypto market, this results in price growth.

Bitcoin is the digital version of gold; however, compared to gold, Bitcoin has some advantages. While gold is also scarce, and that’s why it is often used as a store of value, it does not have a limited supply. There is always the probability that a new gold supply can be discovered and mined, which will lead to a gold supply increase. This can result in a price decrease.

Whereas in the case of Bitcoin, it is an unchanged fact that BTC will only have 21 million coins in circulation. Additionally, Bitcoin can be easily bought, transferred, sent, and received. With gold being hard to move, people will need some kind of alternative to gold in the online space. And bitcoin has the most potential to take this role.

Currently, gold has a market capitalization of over $13 trillion. If Bitcoin becomes the digital store of value, it has the chance to duplicate gold’s market cap. If this happens, the price for each Bitcoin will increase to over $600,000. Considering this fact, we can say that Bitcoin is definitely a buy right now. However, Bitcoin still has a long way to reach this, and you need to also consider that this is just a prediction that can take many years to happen in the volatile crypto market.

Is Now the Time to Buy Bitcoin?

While the answer to this question depends on such factors as your investment goals, budget, and other factors, we can say that now can be a really good time to buy Bitcoin in the sense of long-term investment. One of the reasons to believe so is that the halving of Bitcoin is approaching, during which the number of BTCs distributed to the miner for each block will be halved to 3.125 BTC.

This will significantly reduce the supply of Bitcoin and create scarcity for this cryptocurrency. Scarcity will draw more interest to Bitcoin and may increase its demand. And if more people start investing in Bitcoin, this will accordingly lead to Bitcoin’s price increase. The same cycle was repeated a couple of times in Bitcoin’s history.

For example, in 2016, when Bitcoin was halved from 25 BTC to 12.5 BTC, Bitcoin first time hit the $1000 mark, and at the end of 2017, Bitcoin hit an all-time high of $19,000. The next halving took place in 2020, after which Bitcoin first hit $60,000 in the middle of 2021 and finally reached its highest all-time high of $69,000 by the end of 2021. Hence, it is highly likely that after the upcoming halving, the cycle will repeat, and BTC can hit another all-time high.

Right now, Bitcoin is trading over 58% down compared to its all-time high, but the cryptocurrency has always proved to be a good investment for long-term investors. While it is possible for Bitcoin to be in the bearish market for several years, long-term holders get paid off with the following bullish market.

How to Buy Bitcoin – The Easiest Way

Now that we have answered the question of why should you buy Bitcoin, it’s time to explain how you can invest in this cryptocurrency. First of all, you will need to find a reliable cryptocurrency broker that supports Bitcoin and operates in your country. We have analyzed multiple crypto brokers and exchanges and consider eToro the safest and most effective way to buy Bitcoin.

eToro is a heavily regulated platform, and it offers a secure platform to buy Bitcoin and tens of other cryptocurrencies. This Bitcoin exchange operates in over 100 countries and has almost 37 million registered users. eToro stands out with its simple-to-user platform, competitive pricing structure, and functionality.

Opening an account with eToro takes a few minutes, and there are multiple methods to charge your account, including bank cards, Skrill, PayPal, and wire transfer options. The minimum deposit to buy Bitcoin on eToro is $10, and the minimum trade is also $10. It means that you can start investing in Bitcoin with as little money as $20.

Among the best features of this crypto broker are the CopyTrader and CopyPortfolio tools which are great for beginners. These tools enable you to mirror the trades of an advanced broker with one click without spending too much time exploring the crypto market and diversifying your portfolio.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Here is a step-by-step walkthrough to start buying Bitcoin with eToro.

Step 1 – Open an Account

To start with, visit eToro’s platform and create an account for you. For this step, you will need to provide the required personal information and create a password. After filling in all the necessary data, you can jump to the verification process. The KYC is mandatory when you trade with eToro as the broker is regulated, which guarantees the safety of your fund. You can quickly verify your identity by providing a government-issued ID or a copy of your passport.

Step 2 – Deposit Funds

The next step is to transfer funds to your eToro account, for which you need to click on the Deposit Funds button. Select the payment method you would like to use for depositing money to start the process. The good thing is that eToro does not charge any deposit fees for charging your account, irrespective of the payment method you choose.

Still, the bank card option is the quickest way to charge your account, as it takes up to 2 hours to process the payment. In contrast, the wire transfer option may take up to 7 business days. It should be also noted that a small conversion fee is charged if you are using any currency other than USD.

Step 3 – Search for Bitcoin

Now that you have funds in your account, you can get to the buying process. Browse the crypto markets section to find Bitcoin, or simply type BTC in the search area. After clicking on the first result, you will be navigated to Bitcoin’s separate page with various charts, graphs, and other data to help you do a quick market analysis before investing in it. You can also read the news, take a look at the posts made by other traders and even participate in discussions.

Step 4 – Buy Bitcoin

When you are ready to buy Bitcoin, click on the “Trade” button to initiate the transaction. In the appropriate sections, type the number of Bitcoins you want to buy or the amount of money you want to use to buy Bitcoin. eToro also enables you to select between a standard order and buy BTC at its current price or limit order and set conditions for when you want to buy the coins. When the conditions are met, your broker will take care that the transaction is made.

After you have submitted everything correctly, finalize the transaction. When the transaction is verified, you will see the number of BTCs you have bought on your eToro account. You can later sell your coins by visiting the “Portfolio” section and clicking on the “Trade” button next to the crypto’s name.

Bitcoin Alternative – Could Bitcoin Minetrix Token Be the Next Bitcoin?

Seeing the precarious position Bitcoin has been in the past few days, it is optimal to look for alternative tokens. One of them that is taking the market by storm currently is Bitcoin Minetrix. Created on the top of the Ethereum blockchain, Bitcoin Minetrix is a unique stake-to-mine project that is converging the process of staking and mining, making mining more inclusive.

The primary goal of this project is to bring homogeneity and inclusiveness to the cloud mining ecosystem. Cloud mining has several perks. It makes it easy for people to enter because there is no hardware requirement. This cost-efficiency has the added benefit of requiring less space and creating less noise.

However, legacy cloud mining systems have attracted several bad actors. Technical issues are prevalent, and sometimes, investors can lose their funds. Bitcoin Minetrix is a unique cryptocurrency project that aims to tokenize the cloud mining ecosystem via blockchain technology to deal with these shortfalls.

Investors can buy BTCMTX tokens (native crypto of the Bitcoin Minetrix ecosystem) and stake them to earn mining credits. These mining credits themselves are non-transferable ERC-20 tokens that can be burned to get hash power or mining yields. Once the mining time is complete, Bitcoin Minetrix will transfer mined Bitcoin inside the staker’s crypto wallet.

Another major upside of this project is the staking utility. While Bitcoin Minetrix is working on its decentralized cloud mining technology, investors can stake their tokens to earn APY rewards.

Investors can get access to these rewards during presale as well. All they need to do is go to bitcoinminetrix.com and choose the “Buy and Stake” option. At present, there is a possibility to earn up to 1900% APY. Interested parties may want to invest early as the APY will reduce once more tokens are staked.

Summary – Should You Invest in Bitcoin Now?

To conclude, Bitcoin still remains an excellent investment and has great potential for growth in the upcoming years. In this ‘should I buy Bitcoin’ guide, we have spoken about different reasons why should you invest in BTC in 2024, starting from its scarcity and great demand to getting more institutional adoption. Bitcoin is also a great asset to store value and has several pluses compared to other such assets, such as gold, silver, etc.

Meanwhile, you need to consider the volatility of the crypto market and don’t exclude the probability of Bitcoin losing its value. A great way to manage those risks is to diversify your portfolio with the top altcoins. BTCMTX is a new stake-to-mine cryptocurrency that has leveraged its unique perk to gain an upper hand as a presale in 2024.

Most Searched Crypto Launch - Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards - pepeunchained.com

- $40+ Million Raised at ICO - Ends December

FAQs

Will Bitcoin go up in 2023?

While it is highly likely that Bitcoin can go up in 2030 and even hit $60,000 again, no one can precisely say if this will happen. The problem is the volatility of the crypto market, as Bitcoin is decentralized and is only affected by the demand and supply forces. So, anything can happen that can lead to more people buying or selling Bitcoin and accordingly increase or decrease its value.

At what point should I buy Bitcoin?

Considering that there are similar factors that can affect Bitcoin price and lead to its growth, now is an excellent time to buy Bitcoin. One of the reasons is that the next halving of Bitcoin is approaching, which will make Bitcoin supply even scarcer. Bitcoin’s previous price performance has shown that the crypto grows significantly every time its halving occurs.

What will Bitcoin be worth in 2025?

It is hard to say where Bitcoin will be in 2025 as any unpredictable event can occur in the crypto space and lead to a price increase or decrease. However, many market analysts believe that BTC can hit a new all-time high this year, and by 2025 its value can even hit $100,000 or even higher.

Can Bitcoin go to zero?

While it is hard to be completely sure about this, it is more likely that Bitcoin will increase over the next years than go to zero. There are several reasons to believe that Bitcoin won’t go to zero: it is an excellent store of value, has high demand, is the leading cryptocurrency right now, has scarce supply, and many others.

How much should I invest in Bitcoin to make money?

One of the best things about investing in Bitcoin is that you don’t necessarily need to buy one whole Bitcoin. You can buy a portion of it by paying as little as $10 with a popular broker eToro. Meanwhile, analysts recommend you invest 10% of your portfolio in Bitcoin to manage the volatility risks.

How many Bitcoin are left to mine?

Bitcoin has a limited supply, and only 21 million Bitcoins can ever exist. Almost 19.5 million Bitcoins are already mined and brought into circulation, which makes 92% of the whole Bitcoin supply. It means that less than 2 million Bitcoin is left to be mined, and the amount of BTC for each block is halved every 4 years. With this pace, the last Bitcoin will be mined somewhere in the year 2140.