Join Our Telegram channel to stay up to date on breaking news coverage

The collapse of the giant cryptocurrency exchange FTX has been good for industry competitors, as trading on major exchanges boomed after the incident. Based on recent research by Bank for International Settlements (BIS), the case was the same after the collapse of the Terra Ecosysten.

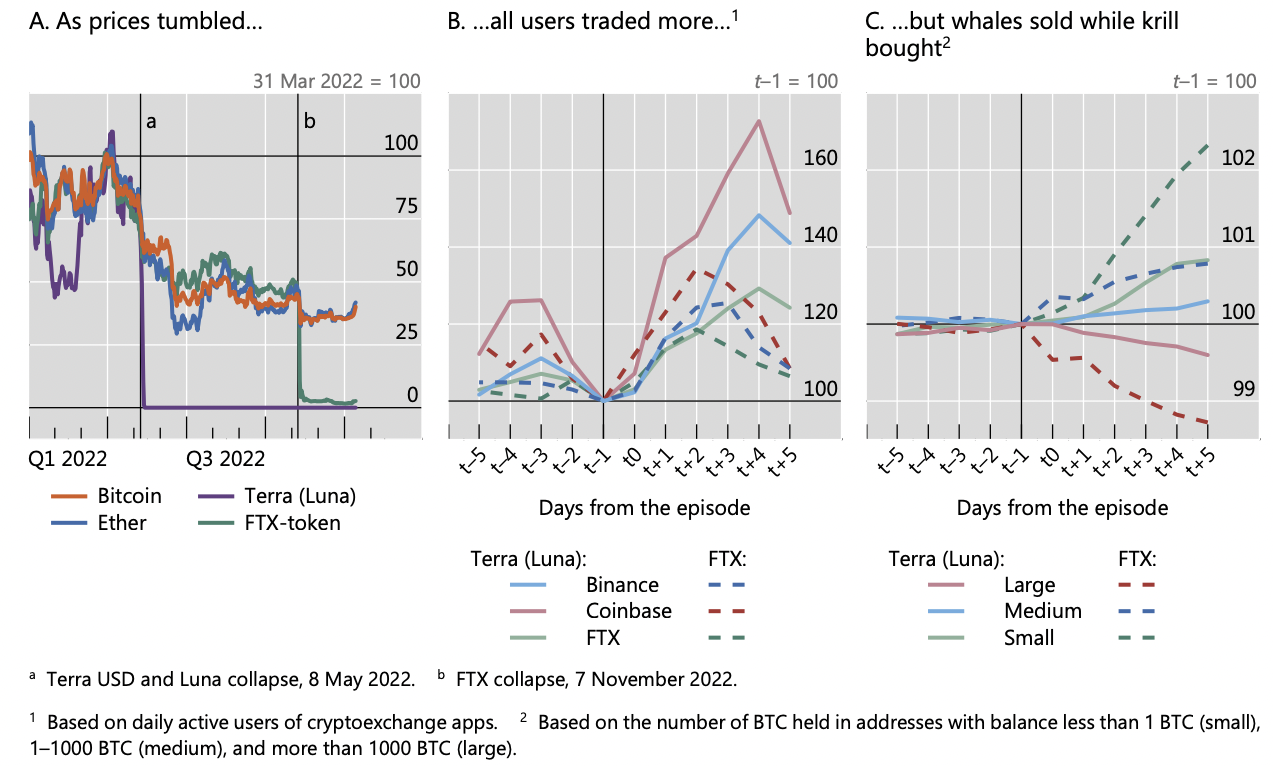

From the report, whales on big exchanges like Binance, FTX, and Coinbase may have exited the platforms “at the expense of smaller holders” by cutting down their Bitcoin (BTC) holdings as retail investors went on a buying frenzy.

An paragraph from the report read:

A new data set on retail holdings of crypto assets reveals that in the wake of the Terra/Luna collapse and the FTX bankruptcy, crypto trading activity increased markedly, with large and sophisticated investors selling and smaller retail investors buying.

In a February 20 newscast on ‘Crypto Shocks and retail losses,’ the BIS reported that while the price of big market cap cryptos like Bitcoin (BTC) and Ethereum (ETH), among others, plunged in 2022, the amount of daily active users on exchanges like Coinbase and Binance skyrocketed as news on the FTX fiasco reached investors’ ears.

On this note, the BIS pointed out that “users tried to weather the storm” by converting their investments into stablecoins and other tokens that looked stable and promising around that time.

Source: BIS Report

Whales On Giant Exchanges Cashed Out

On the other hand, the BIS also highlighted that with whales from giant exchanges cashing out, retail investors flocked to the scene to buy crypto. This means that while one cohort reduced its stockpiles, another increased theirs for a quick profit using the ‘buy the dip’ principle.

In this regard, the BIS notes in the report that analysts had evaluated the number of downloads of cryptocurrency investment applications. The evaluation revealed that approximately three-quarters of users had downloaded an app when BTC was above $20,000. Assuming that every user bought $100 worth of BTC during the first month and every other month after, the transactions must have been explosive.

Furthermore, the BIS report explains that data on major cryptocurrency trading platforms between August 2015 and December 2022 reveals that most crypto app users in almost every economy recorded losses on their BTC stockpiles. An excerpt from the report reads:

The median investor would have lost $431 by December 2022, which corresponds to almost half of their total $900 in funds invested since downloading the application.

Nevertheless, the bank acknowledges while the crypto collapse may have affected individual investors, the aggregate impact on the broader system was limited.

“Nevertheless, despite crypto’s large user base and the substantial losses to many investors, the market turmoil in 2022 had a little discernible impact on broader financial conditions outside the crypto universe, underlining the largely self-referential nature of crypto as an asset class.”

Following the 2022 market crash, several industry leaders and regulators have voiced various concerns. Most of these concerns hinge on the absence of oversight at a major crypto trading platform such as FTX. The concerns spread as wide as asking how the cryptocurrency market could grow so much that it could affect traditional financial markets.

Bolstering the case, several bankruptcy cases are still going on in the U.S. for companies such as FTX, Celsius Network, and Voyager Digital. Meanwhile, the authorities are proceeding with criminal charges against the former CEO of FTX, Sam Bankman-Fried.

The Need For Better Investor Protection

While BTC price hikes have been linked to more entry by retail investors globally, most investors have experienced losing money on their crypto investments. These losses could be worsened by the fact that larger and more nuanced investors sold their stockpiles right before a stark price deep while the smaller investor was still buying.

This, therefore, points to the need for better investor protection in the cryptocurrency sector. Accordingly, the BIS’s analysis suggests that while the steep drop in the size of the crypto sector has not had consequences for the broader financial sector, “if crypto were more intertwined with the real economy and the traditional financial system, then, the aggregate impact of a shock in the crypto world could have been much larger.”

To ascertain the financial system’s stability, the BIS report proposes that societies decide on the ideal policy response for addressing risks in the crypto sector before they become systemic. Preferably, this entails using a globally coordinated approach, with some options being banning certain crypto activities, containing crypto, sector regulation, or a combination of all these interventions.

Read More:

- In 2023 may be the year of the modular blockchains

- Network upgrade and “more clarity” about token distribution are planned by Aptos

- Philippines Crypto Youtuber Rozz Charles Reviews Fight Out – Workout Metaverse NFT Project Early Stage

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage