Solana is one of the largest cryptocurrency in the world, and it has a market cap of over $61 billion. It was launched in April 2020 and has risen drastically to become the seventh largest cryptocurrency. It rose from about $1.50 in January 2021 to $214 at its peak last month showing an outstanding rise in price.

Solana is a fourth generation blockchain platform for decentralized applications. It is an open-source project built by developers at Solana Labs based in San Francisco and maintained by Solana Foundation. Solana has advantages over Ethereum such as its faster operations and lower transaction fees. This is important because Ethereum is currently the largest decentralized apps platform, and hence to rival Ethereum, Solana is offering significantly lower cost of transactions and faster operations.

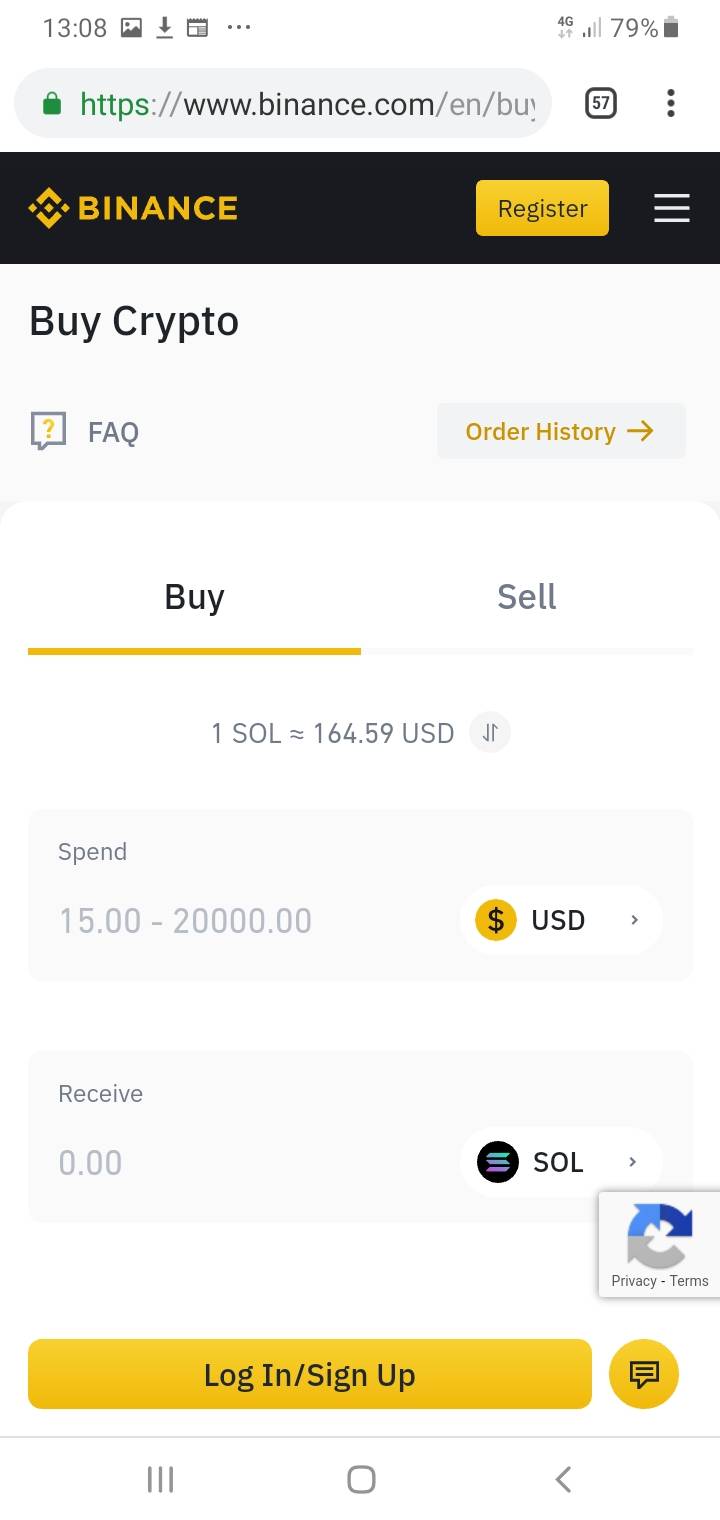

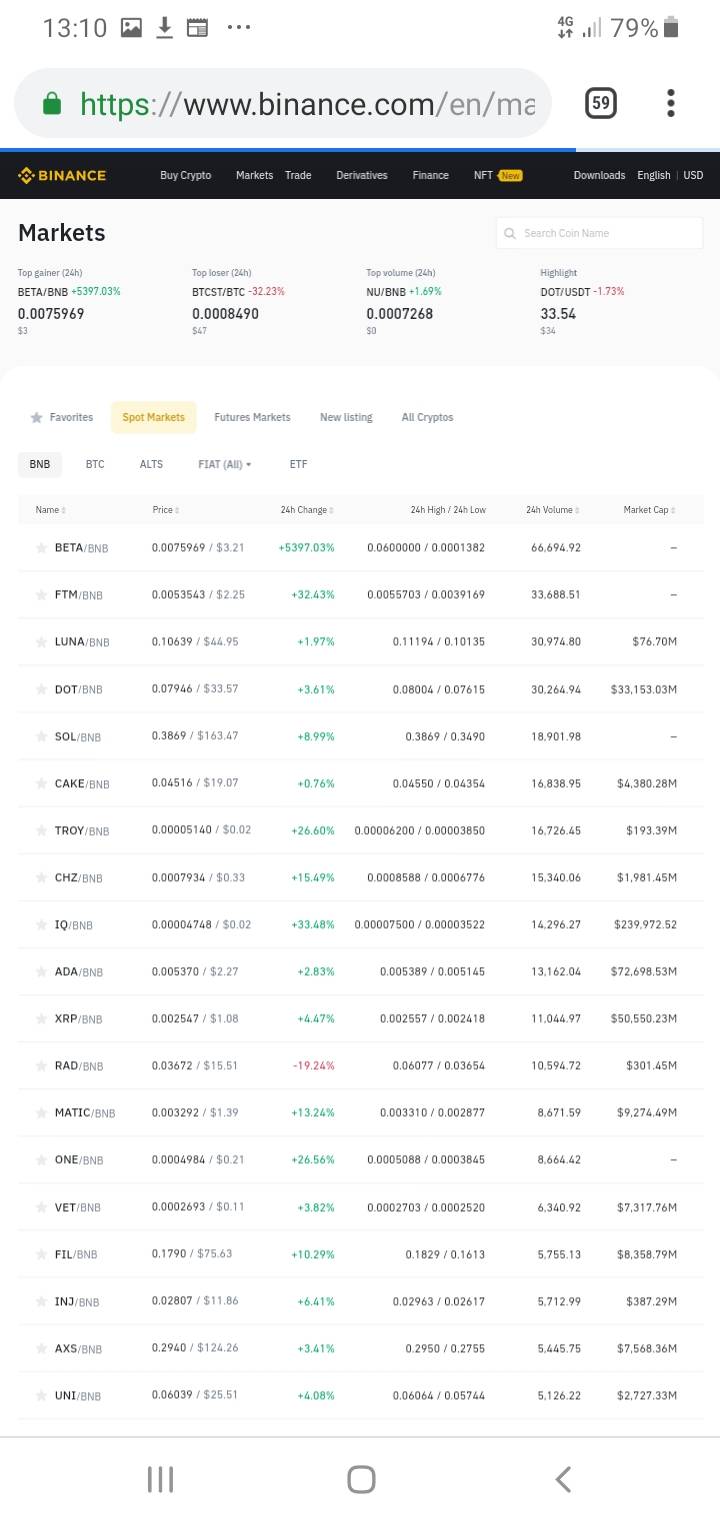

Solana is a PoS (proof of stake) blockchain platform. Proof of stake blockchain consumes less electricity and hence is more environmentally friendly compared to Proof of work blockchain like Bitcoin. In a decentralized blockchain system, validation of transactions requires a lot of nodes from computers. It is possible for someone to attempt to take control of the decentralized network. This can be prevented by making computers solve a mathematics puzzle which will be hard work and hence expensive for someone to attack the network. This system is the Proof of work, though effective but costly as it consumes a lot of electricity. On the other hand, proof of stake solves this problem by requiring nodes that validate transactions have something at stake. This also requires electricity, however the level required is much lower than that of proof of work. Solana requires validation nodes to stake SOL tokens. Both proof of work and proof of stake offers reward for validation of transactions. On Solana validators are rewarded in SOL while on PoW system like Bitcoin rewards miners with BTC. End users on Solana don’t have to run validator mode to earn SOL because they can delegate their stake to a validator who will give them the rewards for a fee. An advantage of the PoW mechanism is that it also serves as a form of clock for the network, as all the network nodes can agree on the correct order of transactions. This is difficult on PoS mechanisms however Solana uses a system called Proof of History which helps the network determine the time of transactions efficiently. Most modern blockchain uses Proof of Stake and Ethereum is planning to switch to Proof of Stake from the Proof of Work system. For the end user, Solana is a platform where SOL can be used to interact with various decentralized applications most of which are finance related. These apps allow for users to lend and borrow money, cryptocurrency trading, investment in various assets, trading NFTs and even to find a dating partner. So a wide variety of apps are featured on Solana. You can interact with many apps on Solana once you have a wallet that can hold SOL and Solana based tokens. Transactions on Solana involves a small transaction cost compared to Ethereum. The initial coin offering of Solana was $0.22 and has risen to it’s current price of $170 reaching a peak of $214 last month. The growth of Solana has been impressive, and it has the backing of FTX Exchange which is one of the popular cryptocurrency exchanges. Solana currently has the third largest TVL (total value locked) with about $7.9 billion locked into the projects on its platform. Solana is a valuable cryptocurrency to have and trade, hence in this article, we will be discussing on how to buy and sell Solana. A broker is important in trading Solana tokens and most investors prefer to buy and sell Solana through a broker also known as an exchange. While Solana can be sold via peer to peer transaction, trading via exchanges is the preferred option for many cryptocurrency investors. There are a variety of exchanges to buy and sell Solana and to help you decide, we will help you by providing a list of some excellent exchanges that have been properly vetted by industry experts. These exchanges have been analyzed and thoroughly examined by experts and experienced traders as being reliable. These brokers are some of the leading crypto brokers in the world, and they operate in many countries across the globe. They offer a wide range of features that ensures you have a pleasant and easy experience while trading cryptocurrency. Also, they are required to comply with regulations and guidelines and hence they can be trusted and are safer to trade with. You can assess a wide range of services on these brokers and exchange your SOL for other crypto or fiat that is available on these platforms. Many traders prefer to trade their SOL for the stablecoins such as Tether (USDT). This is because stablecoins experience little to no volatility in their price. There are various factors you should consider while choosing a broker to trade Solana. One of which is a user-friendly trading interface that makes trading easy for you. Also, the available trade pairs offered by these platform is another important consideration especially if you have some preferred trade pairs you want to trade in. Hence, you have to be sure your broker offers that trade pair you want. Other factors include their compliance with regulations, security of the broker, the availability of a good and reliable customer service, the amount of liquidity etc. Having high liquidity for Solana will make it easy for you to trade SOL and hence you should be aware of the liquidity of the broker you want to use. The brokers listed above serve millions of customers across the globe and allows you to stake crypto assets, pay for services via the exchange, and also you can do future trading which allows you to use higher leverage with higher potential profit or loss. The brokers are well known by investors and experienced crypto traders as providing excellent services to clients. Therefore, you should consider this brokers while deciding on the broker you want to use for your Solana trading. Selling Solana (SOL) is a relatively easy process. Selling Solana and other crypto depends on the demand. And demand for Solana has been historically high and this is supported by the astronomical rise in price of SOL over the last year. Institutional investors have been flocking to Solana recently with SOL products being over 80% of inflows to cryptocurrency products at a point. Also, there is demand for Solana due to the DeFi projects built on it. Solana currently has the third largest TVL (total value locked) with about $7.9 billion locked into the projects on its platform, while the total value locked (TVL) of the DeFi sector is over $80 billion. This allows traders to borrow tokens and conduct their transactions on Solana DeFi projects. Binance is a broker that will feature in many guides that talks about trading cryptocurrency, as it is consistently one of the top 10 crypto exchange in the world. The Binance platform is an inclusive one that caters to both new and experienced brokers as the features are inclined to streamline trading and other activities. Hence, you should consider Binance to exchange Solana (SOL) or other crypto. Before you can sell an asset you have to own that asset in the first instance, and hence buying Solana is the first step before you can sell it. You can buy Solana (SOL) on Binance or perhaps buy it on another platform and send it to Binance to sell. To buy Solana (SOL) on Binance, you will need to have an account and be verified. So to use Binance as your broker, you will first open an account on the platform and then go through the process of verification. After you are verified by Binance you can then deposit funds into your account and start trading. Binance is a broker that offer many methods of payment that you can choose from. These included credit/debit card, payment services such as PayPal, Skrill or Neteller. With funds in the account then you can buy stablecoin such as USDT and then buy Solana (SOL) or you can buy Solana (SOL) directly with the fiat currency. Also, a demo account can be created on the Binance platform, this allows you to trade on the platform with virtual money of $100,0000 assigned to you. This implies that you can buy and sell Solana in the platform and decide if it is to your satisfaction. The Binance platform is simple and easy to use which means that you won’t have difficulty navigating the platform while buying and selling Solana and this can be easily seen while trading with a demo account. Buy Solana We have discussed the process involved in buying Solana (SOL), now an important aspect of selling is to know the time to sell your Solana. This is important because traders buy and sell Solana with the goal of making profits. Cryptocurrency are volatile assets and hence could experience rapid rise or fall in price within a short time. As you engage in buying and selling Solana, it is important that you should have a sell target, at which you sell your Solana (SOL). Even if you are a long term investor in Solana, you should have an idea of the price at which you will be inclined to sell. Having a sell target is important to protect yourself from a market downturn, as the rise in price won’t continue indefinitely. It is natural to feel to expect the rise in price to continue indefinitely and then be shocked when a market reverses leading to panic selling. Having a predetermined target for selling will help protect you from such experiences. If you trade with Binance, you will have access to trading charts for every crypto asset including Solana and hence make better decisions while trading. These trading charts allows you to study the historical data including past and present price on the time frame you want. The charts include candlesticks and patterns and can help you decide the time to buy or sell Solana. Solana chart on Binance While trading with a broker, you could also have other cryptocurrency assets in your portfolio. With brokers, there is usually a minimum withdrawable amount and this implies that you need that amount in Solana before selling. So it is important to be aware of the total value of your portfolio, as this will make your trading experience much easier. To know the value of your portfolio is usually very easy, especially if you are trading on a user-friendly platform. There you can check your Solana holding and also your other crypto holdings. Then you can sell Solana at a time of your choosing after exceeding the minimum amount that can be withdrawn. Binance overview Selling your Solana asset will involve you closing your active positions. If you bought Solana, and you’ve achieved your target price, then to close your active position means you sell your Solana. The difference between the price at opening and closing of your position is your gross profit or loss. While trading Solana, closing your position will often imply selling your coin at that time and this cannot be done if Solana is not converted to fiat or stablecoin. Solana is a cryptocurrency and is therefore volatile in nature, hence it is important to close your active position as soon as it is favorable or necessary. You can then convert your Solana to fiat currency or stablecoin such as USDT and hence preserve the value of Solana as at the closing position. This is necessary because if you delay in selling your Solana at your target price, there could be a significant change in price soon after which could result in a loss of potential profit. Hence, it is important that you convert your Solana to fiat or stablecoin as soon as you want to close your active position. After closing your active position and selling your cryptocurrency for fiat or stablecoin, the equivalent price should reflect in your portfolio. Slippage occurs when the cryptocurrency asset you want to sell settles for a price different from the initial price target. This can be related to the volatile nature of cryptocurrency and hence a second could make some difference in the price of cryptocurrency and hence cause you to sell at a price different from your target price. Slippage more commonly occurs while selling cryptocurrency at market price. This phenomenon of slippage can actually be positive or negative. There is positive slippage if the price you sell your Solana ends up being higher than your initial target price. Whereas, there is negative slippage when the price you sell your Solana is lower than your initial target price. To close an active position can be done via your account on your broker’s platform. You then check your portfolio which contains all your cryptocurrency assets and access your Solana asset. While on the trading segment for Solana, you can then choose the amount of Solana you want to sell and whether you’re selling for fiat or stablecoin. You can search for Solana pairs available with your broker and choose the best one for you. After this, then you can sell your Solana and the price you sold it for will reflect on your portfolio. This will reflect on your balance which can then be withdrawn via your preferred withdrawal method, and depending on the withdrawal method and broker, charges may apply. Closing trade on Binance After selling your Solana asset at hopefully your target price, if you follow our advice, then the next consideration you will have is withdrawal of your assets. One of the important factors to consider while choosing a broker to buy and sell Solana is the ease of withdrawal, base withdrawal sum, and charges on withdrawal. Binance is a broker that meets these criteria in order to give you a great trading experience. Hence, you should read on withdrawal requirements of your broker, as they differ from one broker to another, and are subject to change. Also, you can read customer reviews on the ease of withdrawal, especially on your broker of choice. The goal of trading is to make profit, and after making profit you will want to have easy access to your money, hence this is important. Presently, there is no taxation on cryptocurrency in the United States of America. However, a new bill is undergoing review which will impose tax reporting obligations on cryptocurrency businesses and include taxation on capital gains and different degree of taxation on short and long capital gain while trading cryptocurrency. Short term capital gain refers to gain made while trading within a year while long term capital gain is gain achieved over a year while trading. There exists difficulty with taxation on cryptocurrency businesses due to its decentralization which is one of its appeal to enthusiasts. Also, the US government has expressed concern over cryptocurrency being used for illegal activities especially considering its decentralization. Hence, the government is looking towards implementing regulations that will help reduce the use of cryptocurrency for illegal activities. There are several crypto exchanges available around the world, and the best crypto exchange for you will depend on your needs and peculiarities. So you should endeavor to find crypto exchanges that offer the services you are interested in. Cryptocurrencies are made accessible to you by these crypto exchanges, though some are centralized exchanges while others are decentralized. The crypto exchanges provide the platform through which you can trade different assets, though there might be some variations in the services of various crypto exchanges. As a result of the fact that there are several crypto exchanges in the world, attempting to review all of them in order to make a decision would be a Herculean task. It would definitely not be advisable for you to attempt such either, and probably no need for it. There are some crypto exchanges that are widely recognized and acknowledged by many users as being better than others. This differences might not necessarily be a result of them providing extra services but may result from having a customer-centered approach to service delivery. There are some criteria that should be considered when assessing crypto exchanges, this includes security of the platform, ease-of-use of the interface, customer service, trading platform, community of traders using the platform, etc. Based on the above criteria, some crypto exchanges excel and this also reflects in the number of new customers they attract to their platforms and the volume of trading per day that takes place on these exchanges. Some of these crypto exchanges also provide their customers services such as copy trading and trading bot services. This provides traders the opportunity to simply copy the trading decisions of experienced traders that they trust or those that use trading not services can simply automate their trading process without going through the sometimes grueling process of manual trading. After extensive research and deliberation, these crypto exchanges have been identified as the best exchanges available. It will be prudent for you to consider them first while making your decision about the trading platform you want to use. These crypto exchanges includes: To store your conventional money, you can keep it in a wallet or a safe. For storing cryptocurrency like Solana, which is a digital asset, you need to store it in a digital wallet. There are various ways of storing digital assets by holders of cryptocurrency, and this includes storing in a web-based digital wallet or keeping your crypto in a hardware wallet, also referred to as cold wallets. Both ways of storing has its benefits and risks. Online wallets also referred to as hot wallets are convenient and easy to access, however there is a risk of theft of crypto via hacking due to low security of hot wallets. On the other hand, hardware-based digital wallet or cold wallet, are safe from hacking and are the most secure way of storing your Solana. Depending on your peculiarities, you can store your Solana crypto on any wallet of your choosing as long as you take necessary precautions to protect your crypto holdings. We have another guide here, where we discussed some of the best crypto wallets to store your Solana tokens. The best time to sell Solana is dependent on the kind of investor you are, as different investors have different trading methods. The best time to sell Solana will therefore depend on if you’re taking a short, medium or long term investment strategy. Short term trading implies that you will sell within a week, medium term trading involves selling Solana within weeks to months while long term trading strategy involves holding your Solana for years before selling. To decide on the best time to sell Solana, you need to define your trading strategy, also you need to engage in market research. While opinions of industry experts can serve as a guide for your decisions, you should learn to develop your own trading intuition because these experts tend to be wrong sometimes. Automated trading is a great innovation which assists traders who don’t have the time to directly monitor trades. Because of this, automated trading has freed more time for traders to engage in other activities. These trading bots still requires involvement of the traders to activate trading ranged depending on preferred strategy. An advantage of automated trading is the ability to capitalize on little surges in price of crypto, especially since these can happen when the trader isn’t available. The disadvantage is the possibility of a huge loss if there is downturn in the market and the trader isnt there to make the right decision. There has been an increasing interest in cryptocurrency, with many looking to profit from the rising profile. However, it is prudent to be aware of both the benefit and the risk of trading crypto. The volatility of the market is a fact that traders should be aware of. Sometimes the market gets extremely volatile and unpredictable, prudent investors should avoid the market during these periods. If you want to invest in Crypto market, you should ensure you learn as much as you can about the crypto market and develop a tested strategy which you will follow. Loss while trading should be expected and hence you must learn to be patient, keep your emotions in check, and follow your proven strategy while trading. Solana is one of the largest cryptocurrency with a market capitalization of over $61 billion. It is a rising cryptocurrency that every cryptocurrency enthusiast should have in holding. It is easy to buy and sell Solana with some of the top exchanges which have been listed above. You can easily store Solana on either hardware-based digital wallet which are safer or web-based digital wallet which are more accessible while ensuring you take proper precautions. As long as you choose the right broker for you, you can have a great time trading Solana especially with the aid of tools such as automated trading. You can sell your Solana tokens when you make profit. Here are some key things to note before selling your Solana in 2021

In this guide, we recommend selling Solana via an exchange, such as Binance, for safety. Although there are other ways through which you can sell. Peer to Peer is an alternative, but it can be more risky.

When you use a good broker such as the ones mentioned on this page, you can sell SOL is minutes with a limit order or instantly with a market order.

Several brokers are available to sell Solana, however some are considered by expert traders to be the best. These include Coinbase and Binance.

Check local government websites for info on taxation and capital gains tax. That comes into play when you sell Solana, not when you buy or hold.

You need an exchange that allows payment to your bank or third party payment service in order to sell your Solana for USD.

Exchange brokers where Solana is sold includes Coinbase, Binance, Crypto.com, etc.

To sell your Solana, you need an account with an exchange broker, then you can transfer the Solana you want to sell to the wallet on the exchange and then sell it there instantly using market order.

In order to sell your Solana for cash, you should add a withdrawal channel on the exchange platform you are trading with and choose your desired currency. When withdrawing your cash, the exchange will pay your cash into your bank account or through third party payment services.

Unfortunately, PayPal only supports four cryptocurrencies. These include Bitcoin, Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC).

Some wallets allows you to sell your Solana natively on the wallets. You just need to add a payment service and follow the steps to sell Solana on these wallets.

You can also swap your Solana for other cryptocurrencies on brokers including those discuss led above. The value of the swap is based on the current value of Solana and the cryptocurrency you are buying. On this Page:

How To Sell Solana

Step 1: How to Buy Solana (SOL)

Step 2: Know When To Sell

Step 3: Know The Total Value Of Your Portfolio

Step 4: Close All Active Positions

Withdrawal Requirements and Exchange Rates

Taxation On Cryptocurrency In The US

Best Crypto Exchanges

Storing Solana in the Best Wallets

When is the Best Time to Sell my Solana

Guide to Automated Trading

How to Invest Reasonably in Crypto

Summary

Should I Sell Solana in 2021?

FAQs

Where to sell Solana?

How easy is it to sell Solana?

What are the Best Brokers for Selling Solana?

What Are The Taxes For Selling Solana?

Where to Sell Solana For USD?

What Exchanges Sell Solana?

How to Quickly Sell Solana

How to Sell Solana For Cash

How To Sell Solana On PayPal

How To Sell Solana From Wallet

How to Sell Solana For Other Cryptocurrencies