Moderna Inc. is a biotechnology and pharmaceutical company based in the United States. The company develops vaccines and therapeutics based on messenger RNA. The medicine made by Moderna is used to treat immune-oncology, cardiovascular diseases, infectious diseases, and auto-immune diseases.

The company was founded in 2010 and had headquarters in Cambridge, Massachusetts. The name of the company was changed to Moderna, Inc. from Moderna Therapeutics Inc. in August 2018. Moderna has been recently under the spotlight due to the development of its vaccine against the coronavirus.

After the Pfizer-BioNTech vaccine, the vaccine created by Moderna is said to be the most effective at preventing coronavirus infection. The efficacy rate of the Moderna vaccine varies from 91% to 95% as it uses mRNA technology. After successfully developing an efficient vaccine against the coronavirus, Moderna saw a sudden spike in share prices in November 2020. Since then, the share price of Moderna has skyrocketed and recently reached its all-time high at $496 level.

Increased prices of Moderna shares have recently attracted many new investors, and people are looking for ways to get benefits from them. The stocks of Moderna are listed in the United States. However, people from the UK can also purchase Moderna shares. The process and complete guidelines for buying Moderna Shares online in the UK are mentioned below.

On this Page:

Step 1: Find the Best Brokers to Buy Moderna Stocks in 2024

Being an American company, Moderna is publicly listed on NASDAQ, and investors can find hundreds of UK-based brokers that can give access to this stock exchange.

Being an American company, Moderna is publicly listed on NASDAQ, and investors can find hundreds of UK-based brokers that can give access to this stock exchange.

Before selecting a broker, one must ensure that he chooses a cost-efficient stockbroker with other unique features.

While doing so, some essential things should be considered, such as registration with Financial Conduct Authority (FCA). Some of the top UK-based stockbrokers are mentioned below for a better understanding of the procedure.

1. eToro –Buy Moderna Stocks Online without Commission

eToro is a 100% commission-free broker based in the United Kingdom. It was first launched in 2007, and since then, it has expanded its business throughout the UK. With more than 13 million active traders, eToro is a well-known stockbroker in the UK.

Furthermore, it does not charge any commission fees to its investors. eToro is licensed by the FCA, ASIC, and CySEC and is partnered with the FSCS. This platform provides a traditional way of buying shares and offers CFDs that provide leveraged trading with low margin requirements.

It means investors do not only enjoy the benefits of commission-free trading, but they can also avoid monthly/annual charges by choosing eToro. The broker provides trading through 17 different stock exchanges with more than 1700 equities, including NASDAQ, which can enable the online buying of Moderna shares in the UK.

Initial Deposit

Initial Deposit

The minimum investment of $50 means that investors can enjoy the leverage trading facility. In simple words, investors have a chance to own a fraction of a share if they want, and they can also buy shares worth more than the amount deposited through CFD.

Copy trading is also a feature provided by eToro to its customers, which can help beginner traders mirror an experienced investor’s portfolio.

Various Payment Methods

Traders can use various payment methods through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller. Another exciting service offered by eToro is that investors can also buy and sell a fraction of stocks. For all newbies, it means traders can buy a fraction of stocks and have no need to buy a single share of a company with their share trading account eToro.

Regulation

eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the Financial Services Compensation Scheme (FSCS) that protects the first £85,000 of investors’ funds in case of the broker’s bankruptcy.

Buying and selling on eToro can be done online as well as on mobile through their application. The opening process of an eToro account is straightforward and takes about a couple of minutes. The payment can be deposited in various ways, including debit/credit cards, e-wallet, bank transfer, and Paypal.

Pros & Cons of the eToro platform:

- eToro offers copy & social trading

- ASIC, FCA, and CySEC regulated

- Offers to buy CFDs along with the shares.

- Commissionless shares trading.

- User-friendly GUI (graphical user interface) stockbroker.

- Renowned mobile trading app.

- eToro accepts Skrill, VISA, Neteller, and PayPal.

- Performing advanced technical analysis can be challenging for pro-traders.

67% of retail CFD accounts lose money when trading with this provider.

2. Capital.com – Trade Moderna Share (CFDs) Commission-Free

Capital.com is a global CFD brokerage with subsidiaries in the United Kingdom, Cyprus, and Belarus.

Over 2 million traders call it home, and it has processed over $18 billion in transaction activity.Investors who seek more flexibility in their investments can choose a UK-based trading platform at Capital.com.

It is a CFD specialist platform that offers leveraged trading as well as short-selling. Moderna share CFDs can be traded through Capital.com by putting only 20% of the margin.

Over 3,000 of the most liquid assets are spread across five sectors, making it an appealing option for all sorts of traders.

Initial Deposit

Captial.com requires a minimum deposit of $20 to get an account open. Client funds are fully separated at RBS and Raiffeisen; accounting behemoth Deloitte audits two of Europe’s largest financial institutions and accounts. Through its Prime Capital division, this broker also caters to institutional clients, implying a large liquidity pool. Captial.com offers only a proprietary trading platform.

Another interesting service offered by Capital.com is that it offers services at a meager cost compared to other brokers. Along with commission-less trading, Capital.com also charges meager spread fees. The spread charged on Moderna stock CFDs currently stands at $0.17.

CFD stock trading is recommended only for experienced investors, but Capital.com offers to help newbies with educational materials, including a trade learning mobile app. Like other brokers, it also accepts payments through debit/credit cards, bank transfers, or e-wallets. It also offers demo-account trading for risk-free trade learning. It is also regulated by the FCA.

Pros & Cons of the Capital.com platform:

- Provides 100s of UK and US-listed shares trading

- Trade learning mobile app

- AI assistance to identify weak points in trading

- Provides daily trade ideas.

- Advance trading with charts and analysis interface

- 100% commission-free

- It does not support custom trading strategies.

72% of retail CFD accounts lose money when trading with this provider.

Step 2: Research Moderna Shares

Moderna’s stock performed exceptionally well in 2020, and credit goes to their efforts with a potential COVID-19 vaccine. However, one should keep in mind that Moderna isn’t the only company trying to develop a cure, so you should weigh the risks before investing.

To put it another way, if Moderna is unable to deliver its vaccine to a wider market, the value of your investment is likely to plummet. With this in mind, you should conduct some additional research on the company before making a stock purchase.

You’ll discover some crucial considerations to make below to assist with clearing the mist.

History of Moderna Share Price

Moderna became a public listed company in December 2018. During its first year of going public, Moderna Inc. faced losses of about $514 million in 2019. However, the share price of Moderna started increasing in the following years. Due to its progress in developing the vaccine for coronavirus, the share price of Moderna Inc. has increased rapidly throughout 2020 and 2021.

Both years have seen tremendous growth in the share price of Moderna, and the main credit goes towards the successful development of the coronavirus vaccine.

After completing Phase 1 & 2 trials, Moderna started selling vaccines for $32-37 per dose in November 2020. After completing stage 3 trials in December, the Moderna vaccine received authorization from the US FDA on December 19, 2020, with an efficacy of about 94.5% against the coronavirus. Since then, the prices of Moderna shares have skyrocketed. It also received approval from Europe and the UK in January 2021 and entered into phase-1 clinical trials in March 2021.

Moderna share price chart on eToro

All these signs of progress in vaccine development kept adding to the value of Moderna shares, and the share price, which was at $18 at the start of 2020, reached $362 in July 2021. In August 2021, the vaccine created by Moderna received full approval from the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) for use in children aged 12 to 17 years, and the share prices reached their all-time high near $500 at $496.

Information about Moderna Shares Dividend

Investment in Moderna shares is not recommended for investors who are seeking dividends. The reason is that Moderna has never paid a dividend and has no plans to do so in the foreseeable future. Moderna is not only a fresh and young company related to being public; it also invests a large sum of money and its cash flows into research and development.

Should I Buy Moderna Shares?

The answer to this question is very tricky, as people are more inclined toward high-yielding investments. There is no doubt that Moderna shares have shown tremendous growth over the period of just 2 years. It seems like investors from the healthcare sector primarily focus on the firms with the successful creation of a vaccine against coronavirus. Moderna is one of the major pharmaceutical firms that has successfully created a COVID-19 vaccine with more than 90% efficacy. Very few vaccines fall under this category, as the leading one is the Pfizer & BioNTech vaccine.

However, there are now various companies around the globe that are claiming to have successfully developed the coronavirus vaccine. The thing that makes the Moderna vaccine unique is the mRNA technology used for making the vaccine.

Moderna generated about $1.9 billion

Furthermore, the sale of the Moderna vaccine during the first quarter of 2021 generated about $1.9 billion against the $8 million revenue generated during the same time frame last year. The massive revenue generation of the company was attributed to the commercial sale of its COVID-19 vaccine. The company revealed that during the first quarter of 2020, the company suffered a $124 million loss, and in Q1 of 2021, the company generated a net income of $1.2 billion.

Moderna is expecting total sales in 2021 to reach $20 billion, and this expectation is based on the manufacturing of 800 million to 1 billion doses. Moderna has revealed that it has already signed a contract for about $12 billion in vaccine sales and has more options for $8 billion. The company has plans to increase its manufacturing capacity to 2-3 billion next year. Moderna has made a total sale of about $5.9 billion in the first half of 2021, and for the second half, it is expecting a sale of $20B. For the next year, 2022, the sale is expected to reach $12B.

Considering the above-mentioned figures, the rising demand for Moderna vaccine, and the growth in expected sales, one should definitely try and invest in Moderna shares if he is not looking for the dividend.

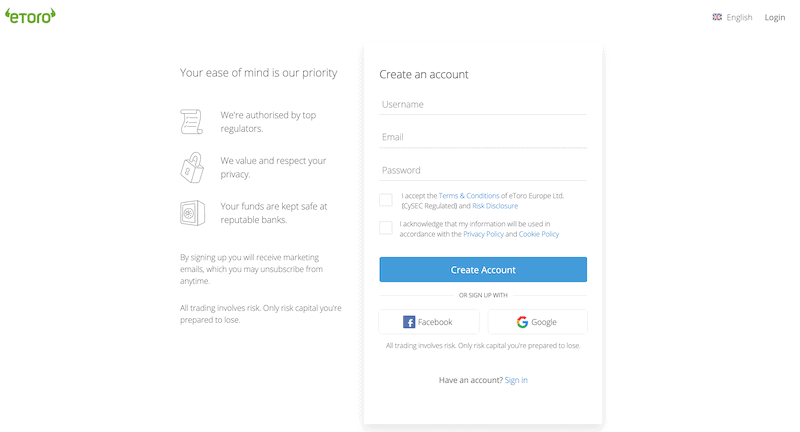

Step 3: Opening an Account and Funds Deposit

The next step in purchasing Moderna shares in the United Kingdom is to open an account with a stockbroker who will give you access to the NASDAQ. The process of opening an account with a top broker in the United Kingdom, eToro, is mentioned below.

The first step is to open the website of eToro and then register for a trading account by clicking on the “Join Now” button at the center of the screen.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

Moderna share price chart on eToro

After providing the information, investors will be required to prove their identity through their driver’s license or copy of their passport. Another requirement will be to issue a recent copy of the utility bill or bank account statement. After uploading these documents, the next step will be to deposit funds into the account.

Minimum Deposit: $200 or £160

The minimum amount or the desired amount can be deposited through:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

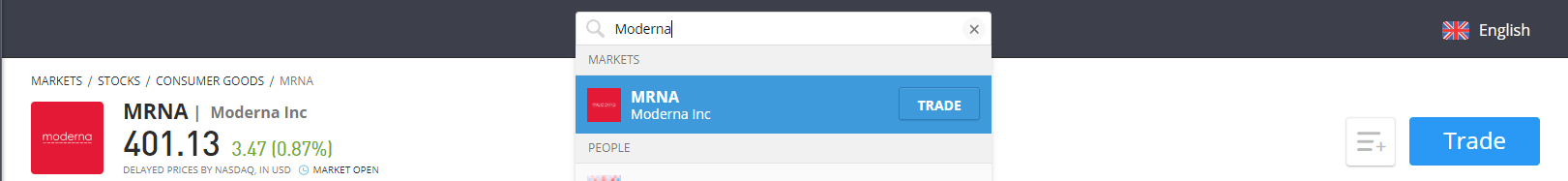

Step 4: Buy Moderna Stocks Online via the eToro Platform.

Once the account has been funded, investors can now begin the process of purchasing Moderna shares. The method of buying stocks via eToro is straightforward to follow. Let’s take a look:

- The process starts with logging into the account by entering the username and password.

- Type Moderna or MRNA in the search box.

- The popped-up search results will bring forward a list, and investors will have to click on the desired stock.

Moderna share price chart on eToro

Then, click on the ‘Trade’ button and enter the desired amount of money you want to invest in the shares. Finally, clicking on ‘Open Trade’ will execute the function, and investment in Moderna Shares will be made successfully.

Should I Buy or Sell Moderna Shares?

Recently, the easiest and smartest thing would be to buy the shares of Moderna as the company is experiencing substantial growth. It is expected to continue for a couple of years until the pandemic is fully lifted. Many countries have started vaccinating their citizens. However, some backward and third-world countries are still struggling to receive even a single dose of vaccine.

Furthermore, Moderna has already revealed its expected sales growth for the upcoming years. Thus, it still can grow. So, investors will go for the buying option for Moderna Shares.

However, if investors believe that the company has reached its full potential regarding coronavirus vaccine sales or is overvalued, they can opt for the sell option. Meanwhile, some unfortunate experiences with the Moderna vaccine, like the recent one in Japan. It could prompt investors to sell options for Moderna shares in the short term. The two Japanese regions have recently suspended Moderna vaccine shots after more contaminated vaccine batches were reported. Any news of such kind could mean investors can short-sell Moderna shares and still earn a profit.

Conclusion

Moderna Shares offer a high risk/high-profit proportion, which means investors should keep their stakes at a minimum. The minimum investment requirement while using eToro is $50, and investors can adjust this amount according to their risk-bearing capacity. The commission-free service of eToro also makes it easier for investors to earn higher profits, and in this way, investors can earn big profits from their smaller investments.

FAQs

Moderna has revealed its expected sales growth for the upcoming years, which means it still can grow. So, investors will go for the buying option for Moderna Shares.

Our top broker recommendation is eToro as they are regulated in multiple countries, the easiest to make a deposit onto and simplest to use for beginner investors and traders. Is it a good time to buy Moderna stocks?

Where can I safely buy Moderna stocks online?