Forex EAs (Expert Advisors) allow you to trade in an automated manner via pre-programmed software. The software works like a Bitcoin Robot, it will buy and sell orders on your behalf, as per the underlying conditions it has been programmed to follow, meaning you can trade forex without having to do any of the work. But how do you find the best forex EA for you?

In this article, we review the best forex EA platforms of 2023. We also explore the ins and outs of how the process works and provide helpful tips on how to choose the right EA.

On this Page:

What is a Forex EA?

A Forex EA is a piece of software that has been programmed to trade on your behalf. Otherwise referred to as a ‘forex robot‘ or ‘automated system’, EAs take away the manual side of trading.

A Forex EA is a piece of software that has been programmed to trade on your behalf. Otherwise referred to as a ‘forex robot‘ or ‘automated system’, EAs take away the manual side of trading.

Instead, the underlying software will place buy and sell orders for you, fully in-line with the conditions it has been instructed to follow. The best forex ea platforms are commonly based on complex algorithms and technologies like artificial intelligence and machine learning

This in itself comes with a number of benefits. For example, no longer do you need to worry about the emotional side effects of forex trading, as the software bases its decisions on a ‘what-if’ algorithm. If the software is programmed to buy a major currency pair when the RSI (relative strength index) hits 30, this is exactly what it will do.

Similarly, the forex EA essentially allows you to trade 24 hours per day, subsequently allowing you to access several global markets without needing to worry about fatigue. This means you can trade forex without having to put in the many hours of research required if you were to do things manually.

In terms of how to choose a forex EA, you typically have two options. If you have an element of knowledge in programming, you can build an advisor yourself. This will ensure that the forex EA mirrors your trading strategies like-for-like. If you don’t know how to build trading software code, then you can purchase a pre-programmed EA robot from heaps of online sources.

When it comes to the fundamentals, there are generally two stakeholders that help facilitate the forex EA process. Firstly, you will need to choose the best trading platform which is fully compatible with forex EA software, like MT4 or MT5. Secondly, you will also need to use an online forex broker that is compatible with the aforementioned trading platforms. After all, you will be placing real-world buy and sell orders on your chosen forex pairs.

Best Forex EAs of 2023

If you like the sound of what a forex EA can do for your long-term investing goals, you now need to find a provider that meets your needs. On the one hand, having hundreds of providers to choose from gives you ample choice. On the other hand, this can make it difficult to know which forex EA to go with.

To help you along the way, below we’ve reviewed our picks for the best forex EAs of 2023.

Regulated Platforms That Support Forex EAs

So now that you have a few options in the forex EA robot department, you need to start thinking about your chosen online broker. As we noted earlier, there are two key metrics that you initially need to look out for. Firstly, you need to ensure that the forex broker offers support for MetaTrader 4 or 5. Secondly, you then need to clarify whether or not you are able to use your forex EA robot with the broker.

With this in mind, below you will find our top-rated (regulated) platforms that support the best forex EAs.

How to Choose the Right Forex EA for you

There are literally hundreds, if not thousands of forex EA providers active in the online space. Most of these providers make super-bold claims on the guaranteed returns they can make for you, when in truth, this rarely comes to fruition. As such, you need to do your homework on your chosen forex EA prior to taking the plunge.

This means that you need to do your research to find the best EA for forex. To help you out, we’ve listed some of the considerations that you need to make when choosing an EA for your forex trading.

- Verifiable Results

One of the most important metrics to look out for is whether or not you are able to verify the EAs stated results. For example, it’s all good and well if the provider claims to have made average returns of 80% per month since it was launched, but how do you know if this is true?

Crucially, the only way for you to determine this is to choose a forex EA that has partnered with a platform like MyFXBook. This is where they connect their MT4/5 account with the platform, which in turn, releases the trading results of the EA in question.

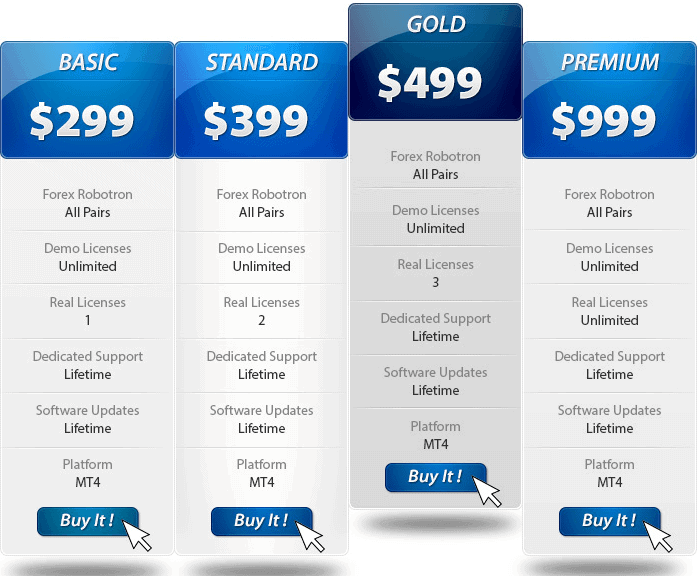

- Pricing

It’s important to remember that the pricing of the best forex EA providers generally reflects their results. After all, would you rather pay $300 for a forex EA that makes you money, or $25 for a bot that makes you a loss? Generally speaking, you get what you pay for in the world of automated systems. With that said, you don’t want to be forking out heaps of money if you have no way of verifying the EA’s historical track record!

- Compatibility

You need to assess what trading platforms the forex EA is compatible with. In the vast majority of cases, the EA will work with MetaTrader 4 (MT4). If you prefer to use Meta Trader 5 (MT5), then you will need to find an EA robot that is compatible. Similarly, you also need to ensure that your chosen broker allows usage of forex EAs, as not all do.

- Payments

You will need to pay to obtain a forex EA. After all, providers are not going to spend countless months or years perfecting the robot, only to give it away for free. With that said, check to see what payment methods the provider supports. You usually get the option of a debit/credit, though some of the best forex EA providers accept e-wallets like PayPal.

- Trading Strategies

Each Forex EA will have its own trading strategy. For example, while some will focus on indicators like the RSI or Exponential Moving Averages, others will utilize a strategy that centres on Fibonacci Retracement Levels. Either way, you need to have a firm understanding of how the forex EA operates to avoid going into this in the dark.

- Customer Support

It’s absolutely crucial that you choose a forex EA provider that offers ongoing support. After all, there might come a time where you need to make some adjustments to your bot. As such, explore what customer support channels the EA provider offers, as well as the days and working hours they’re operational.

How to Get Started With a Forex EA

Like the sound of forex EAs, but not too sure where to start? Below you will find a Layman’s step-by-step on how you can get your forex EA strategy started today!

Step 1: Choose a Forex EA

Your first port of call will be to choose a forex EA that meets your needs. Refer to the section above for some handy tips on how to choose a forex EA that meets your long-term investing goals.

If you don’t have time to perform your own research to find the best EA for forex, you’ll find our top picks further up on this page.

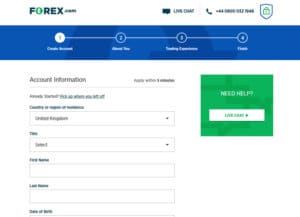

Step 2: Open an MT4/5 Forex Broker Account

Next, you’ll need to choose an online forex broker that:

- Offers full support for MT4/5

- Allows you to trade with a forex EA

Once you have found a suitable broker, you’ll need to open an account. This will require a range of personal information from you, such as your name, date of birth and email.

As you will be using a trusted regulated broker, you will also need to verify your identity. This requires two documents in particular – a government-issued ID (passport or driver’s license) and a proof of address (utility bill or bank account statement).

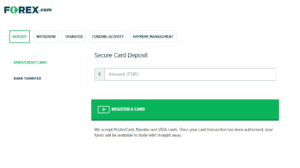

Step 3: Deposit Funds

You will now need to deposit some funds at your chosen forex broker. This is to ensure your forex EA is able to place buy and sell orders on your behalf.

Payment methods typically include:

- Debit Cards

- Credit Cards

- E-Wallets

- Bank Wire

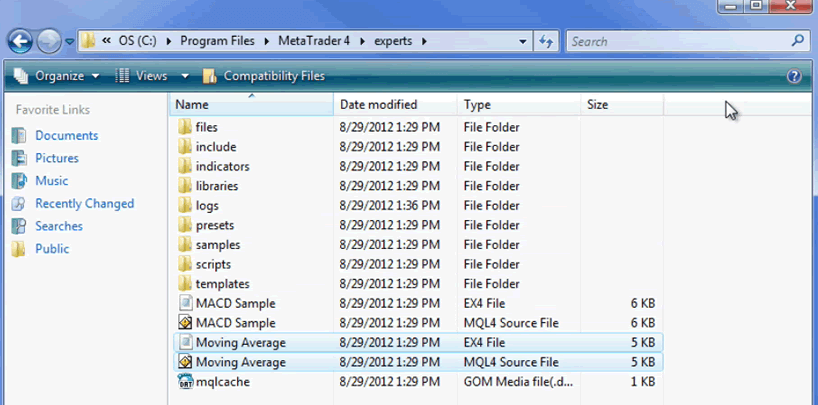

Step 4: Download MT4/5 and Install Forex EA

Now that you have a fully-funded, verified forex brokerage account, you will now need to download MT4 on to your device. Crucially, the forex EA will not be able to trade on your behalf via the browser-based version of MetaTrader.

Once you have downloaded MT4/5, you will then need to link the platform with your forex EA.

- Find the location on your device that you download the forex EA

- Copy the file

- Head over to the MetaTrader folder on your device

- Open the ‘Experts’ folder

- Paste the EA robot file that you previously copied

Step 5: Activate Forex EA

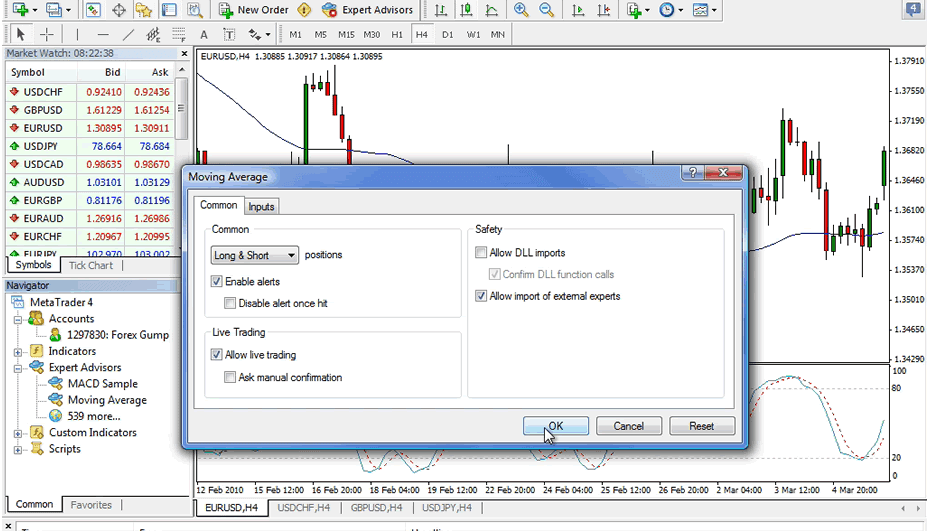

You will now need to activate your forex EA. Open up your MT4/5 platform and click on the ‘Expert Advisors’ button (beneath Navigator on the left-hand side of the screen).

After that, click on the ‘+’ button, and look for the forex EA that you downloaded and transferred into your MT4 folder. You then need to drag the EA into the main charting area of your MT4/5 screen.

Finally, a pop-up box will then appear asking you to confirm your settings. You will need to tick the ‘Allow Live Trading’ box if you want your bot to trade in real-world conditions.

Conclusion

In summary, the vast bulk of the forex EA space is dominated by providers that claim unprecedented monthly returns. In truth, unless you have a way to verify these claims, you should probably avoid the provider in question. With that said, there is still a good number forex EAs on the market that offer transparent trading results.

If you do find a credible provider, you stand the chance of trading on a full-time basis without needing to lift a finger. Just make sure that you do your homework before parting with your money – and never trade with more than you can afford to lose!

FAQs

A forex EA (Expert Advisor) is a piece of software that places buy and sell orders on your behalf. The bot is required to follow a set of pre-defined conditions. You will need to link your forex EA up with either MT4/5, which in turn, needs to be linked with a regulated online broker.

There is no one size fits all answer to this question, as no-two forex EAs are the same. For example, while some focus on low-risk scalping strategies, others will utilize a more aggressive system.

There are two costs in particular that you need to consider. First and foremost, forex EAs typically charge a one-time fee for the software, which averages at around $200-$300. Secondly, you will also need a fully-fledged trading account, which will also come with a minimum deposit.

Yes, but whether or not a free forex EA can make you money remains to be seen. Think about it - would you spend countless months building a forex robot from the ground-up, only to then give it away for free? Even the best free forex EA providers are likely not very reliable.

There is never any guarantee that your forex EA will not lose your money. This is especially the case during volatile market conditions, where its standard technical strategies might be rendered ineffective. What is a forex EA?

What is the best forex EA?

How much money do I need to use a forex EA?

Are there any free forex EAs?

Are forex EAs reliable?