Forex robots allow you to buy and sell currencies in a partially, or in some cases, fully automated manner. The underlying technology is typically supported by an algorithm that not only researches potential trading opportunities, but then places orders on your behalf.

The key problem is that most of these so-called ‘expert’ forex trading robots are nothing more than a scam, so you really need to know what red flags to look out for prior to parting with your money.

In this article, we explore the ins and outs of how the phenomenon works, and we also review the best forex robots of 2023.

On this Page:

What is a Forex Robot?

Forex trading robots are computer software designed to automate the process of researching the financial markets and then either send signals that you can then use to decide whether to trade or place trades on your behalf. The main concept is that you get to engage with the multi-trillion-dollar forex space without needing to have any trading skills or experience.

Forex trading robots are computer software designed to automate the process of researching the financial markets and then either send signals that you can then use to decide whether to trade or place trades on your behalf. The main concept is that you get to engage with the multi-trillion-dollar forex space without needing to have any trading skills or experience.

Similarly, forex robots are also ideal if you simply don’t have the time to trade. In terms of the underlying make-up, automated forex trading robots are typically governed by an algorithm that is programmed to follow a set of pre-defined conditions.

In most cases, the robot provider will utilize cutting-edge technologies like artificial intelligence and/or machine learning. These innovative technologies have the potential to outperform human capacities, which is why they are perfectly suited for buying and selling assets.

For example, a human trader only has the capacity to research one or two forex pairs at any given time and can only manually evaluate technical indicators one-by-one, which severally limits the potential scope of the investor.

In contrast, the best forex robots can scan thousands of scenarios each and every second, with virtually no limits to the number of pairs or technical indicators that can be used simultaneously. As and when the robot discovers a trading opportunity, they can then act accordingly and execute trades in milliseconds.

How do Forex Robots Work?

How a forex robot works can vary widely depending on the person that built the technology. With that said, the general process involves building a set of pre-defined ‘what-if’ conditions. This centres on market data such as volatility, trading volumes, market sentiment, and support and resistant lines. Once the ‘what-if’ condition has been triggered, this means that a trading opportunity has arisen.

In some cases, the trading robot will send out a real-time signal to members or subscribers of the provider. This will provide a full breakdown of what the trading robot has discovered, and what entry and exit orders the individual should place. Traders can then use this information to decide whether or not to place a trade. In other cases, the forex robot provider might offer an all-in service, meaning that trades will be placed on your behalf.

Are Forex Robots Scams?

By searching the internet for a ‘forex trading robot’, you will be presented with hundreds, if not thousands of providers. The vast majority of these providers have two things in common. Firstly, they all offer unprecedented win rates in excess of 80-90%, alongside huge double-digit monthly returns.

Secondly, and perhaps most pertinently, most of these providers are little more than a scam. While they offer working robots, the idea that bots are infallible and are guaranteed money makers is some way off the mark, and there is often no way of knowing whether or not these high win rates are valid until you actually part with your money.

Your best bet is to stick with providers that offer some sort of free trial, money-back guarantee, or demo facility. That way, even if you are required to pay a small amount upfront, you won’t end up losing vast sums of money.

Pros & Cons of Forex Robots

Pros:

Cons:

- Most, but not all, forex robot providers are scams.

- You will need to invest at least a few hundred dollars to get started.

- No guarantee that you will make consistent gains.

Best Forex Robots for 2023

Want to try out a forex robot for yourself? With heaps of providers active in the market, most of which promise guaranteed double-digit monthly returns, knowing which robot to go with can be a challenge. To help you out, we’ve reviewed many bots and picked out the best forex trading robots for 2023.

How to Get Started With a Forex Robot

Looking to start with our automated forex robot today? If so, we are now going to show you what you need to do to get your automated forex trading journey off on the right foot. We have decided to show you the process with the top-rated provider from our forex trading robots reviews, Algo Signals.

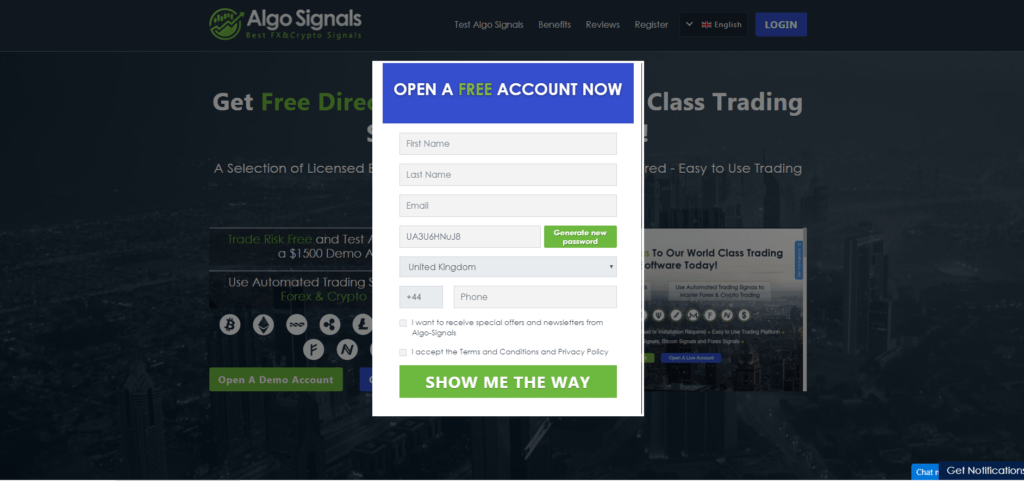

Step 1: Open an Account With Algo Signals

First and foremost, you’ll need to head over to the Algo Signals homepage and elect to open an account. You’ll need to provide a few basic personal details to get signed up.

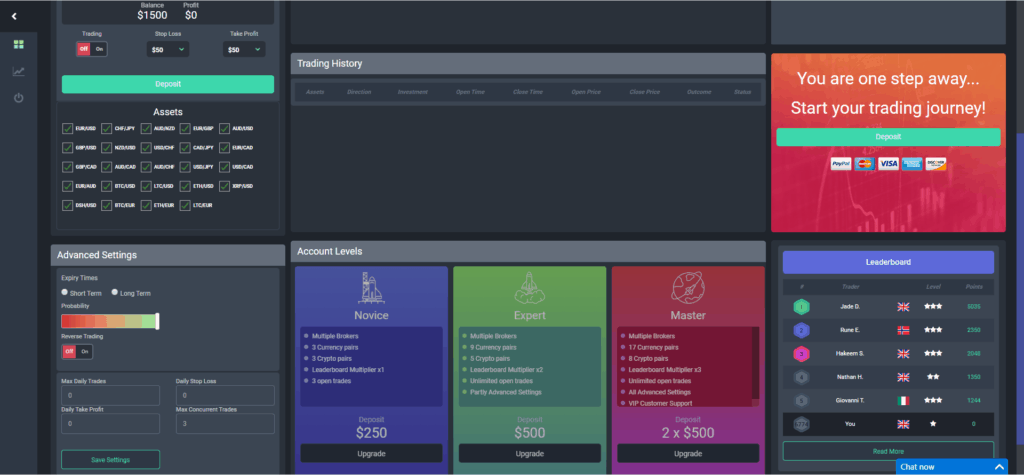

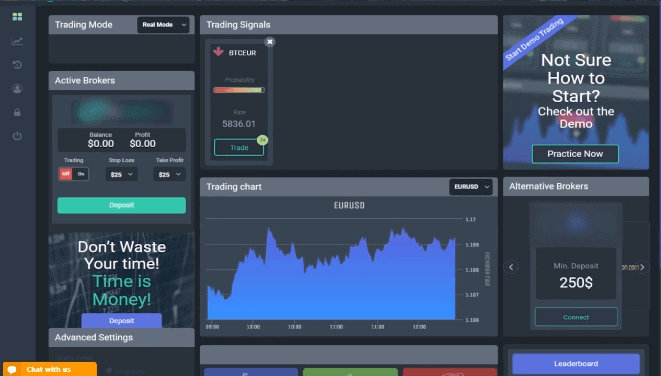

Step 2: Choose Your Trading Preferences

Algo Signals gives you a range of trading preferences to choose from, such as the types of financial instruments that you want exposure to, as well as the specifics surrounding stop-loss and take-profit orders. With that being said, if you have virtually no experience in the online trading scene, it might be best to opt for the fully automated service. This is where Algo Signals will trade on your behalf. We recommend using the demo to get used to the settings before depositing any money.

Step 3: Deposit Funds and Trade

In order to benefit from the forex robot offered by Algo Signals, you will need to fund your account. The platform accepts a range of everyday payment methods, and you’ll need to meet a minimum deposit of $250. Once you do, you’ll start receiving forex signals.

If you opted for the manual service, you will need to place the respective trades yourself. If opting for the automated service, Algo Signals will do this for you, meaning there is nothing else for you to do.

Finding the Right Forex Robot for you

No-two forex or Bitcoin robot are the same, so you need to spend some time evaluating what it is you are looking to achieve from an automated investment service and conducting some forex trading robot comparison. Most importantly, you need to ensure that your chosen trading software provider is credible, and not a scam artist that makes claims that are nothing more than hyperbole.

- Level of Automation Required

Your first port of call is to assess ‘how automated’ you actually want to go. For example, some people are apprehensive about allowing a third-party platform to place trades on their behalf. As such, they much prefer to utilize a forex robot for its high-level research, receive a signal, and then evaluate whether or not to act on it.

At the other end of the trading spectrum, some people crave an all-in, fully automated service. In other words, once a deposit has been made, you want the automated forex robot to place trades on your behalf, which means the bot does all the work for you.

- Validity of Claims

Anyone can build a website and market a forex robot that supposedly makes monthly returns of 80%, but most of these providers are nothing more than a scam. With this in mind, you should opt for a provider that offers some sort of a way to validate these results. This could be anything from a free 7-day trial to a money-back guarantee. A demo facility would also be useful, as this will allow you to test the automated signals out before making a financial commitment.

- Minimum Investment Amount

The vast majority of forex robot providers will ask you to meet a minimum deposit amount. Only then will you have unfettered access to their automated signals. As such, it might be best to stick with providers that have a reasonable account minimum.

After all, you don’t want to deposit $2,000 only to find that the platform was a scam. We find that something in the region of $200-$300 is industry-standard in the forex robot scene. Add this in with a 30-day money-back guarantee and you’re on the right path.

- Liquidity of Your Funds

Just as important, you should also ensure that the forex robot does not install lengthy redemption periods. This is where you are required to lock your funds away for a number of weeks or months. We would suggest using an automated forex trading robot provider that has no withdrawal restrictions in place and allows you to access your funds at any time.

- Payment Methods

You also need to assess what payment methods the forex robot supports. In an ideal world, you’ll be able to deposit and withdraw funds with your Visa or MasterCard, as the funds will be processed instantly. Some platforms only offer deposits and withdrawals in the form of cryptocurrencies. While this does allow instant payouts, it might not be suitable if you prefer to stick with real-world money.

- Tradable Currencies

Finally, you then need to look at what currency pairs the forex robot specializes in. In some cases, the robot will scan dozens of pairs across the majors, minors, and exotics. In other cases, the provider might prefer to focus on a select number of pairs. Either way, make sure that you understand what your money is being invested in.

Conclusion

Forex robots can potentially offer a number of benefits for the everyday investor. Not only do you get to trade currency pairs without having any knowledge or experience of the space, but you get to do so in a completely passive manner. In other words, once you have chosen a provider and loaded your account with some funds, the robot will take care of the rest.

With that being said, the biggest barrier that you will face in your search for a successful forex robot is validating the provider’s claims. This is because most providers in the space are nothing more than a scam, so it’s crucial that you act diligently.

If you are keen to get started with an automated trading service today, we would suggest one of the providers from our list of the best forex robots for 2023. At the forefront of this is Algo Signals, which partners with licensed forex brokers, gives you the option of semi-auto trading or an all-in fully automated service, and offers a $1,500 demo account.

FAQs

There are a number of forex robot providers that have a good track record in the space. However, the vast bulk of providers active in this marketplace are in fact scams. This is why you need to perform research before parting with your money.

You can potentially make money when using a trading robot, but the robot is only as good as the person that built the underlying technology. Automated forex robots cannot guarantee you a profit. This is why you should start off with small stakes when choosing a new provider, so that you can assess the credibility of the service.

There is no one-size-fits-all answer to this question, as it all depends on what you are looking for in a trading robot. For example, if you're looking for an all-in fully automated trading service, it might be worth exploring Algo Signals or the FX Master Bot. If you're more interested in fundamental analysis, then the News Spy is potentially more up your street.

While most forex robots are free to download, you'll usually have to deposit some money in order to access the platform's services, either at the platform itself or one of its partnered brokers.

Although minimum deposit amounts vary from provider-to-provider, this averages $200-$300. You may need to spend more to access all the features of an automated forex robot. Are forex trading robots scams?

Can I make money using a forex robot?

What is the best forex trading robot?

Are there any free forex trading robots?

How much money do I need to use a forex robot?