easyJet (EZJ) is the number two low cost carrier (LCC) in the competitive European short haul market, behind Ryanair. Although easyJet has maintained its market lead, it has been an expensive battle against a slew of smaller short haulers. The current decline in airline stock valuations could bring about the inevitable consolidation of European airlines forecast by airline chiefs and analysts. easyJet is expected to come out a winner if the industry streamlines into fewer more profitable airlines.

If you want to invest in a leading LCC positioned to benefit from the restructuring of the European airline industry, this guide will explain how to buy easyJet stock, evaluate the best easyJet stockbrokers, and assess how European airline consolidation will affect the stock value.

On this Page:

Best U.S. Platform to Buy easyJet Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in easyJet and found the following broker to offer the best platform, lowest fees and most appealing bonus. Click the link below and get started today.

Best Non-U.S. Platform to Buy easyJet Shares

We found the following platform to be best-suited to traders outside the U.S. looking to invest in easyJet, offering competitive spreads and 0% commissions. Click the link below to start trading easyJet with this trusted, regulated broker.

How to buy easyJet shares

Although the process of signing up with a broker, depositing funds, and buying easyJet stocks is super-easy, we’ve outlined a step-by-step guide for those of you that need a bit of help. We’ve opted to show you the process with the broker eToro as an example, but a similar process will apply to most brokers.

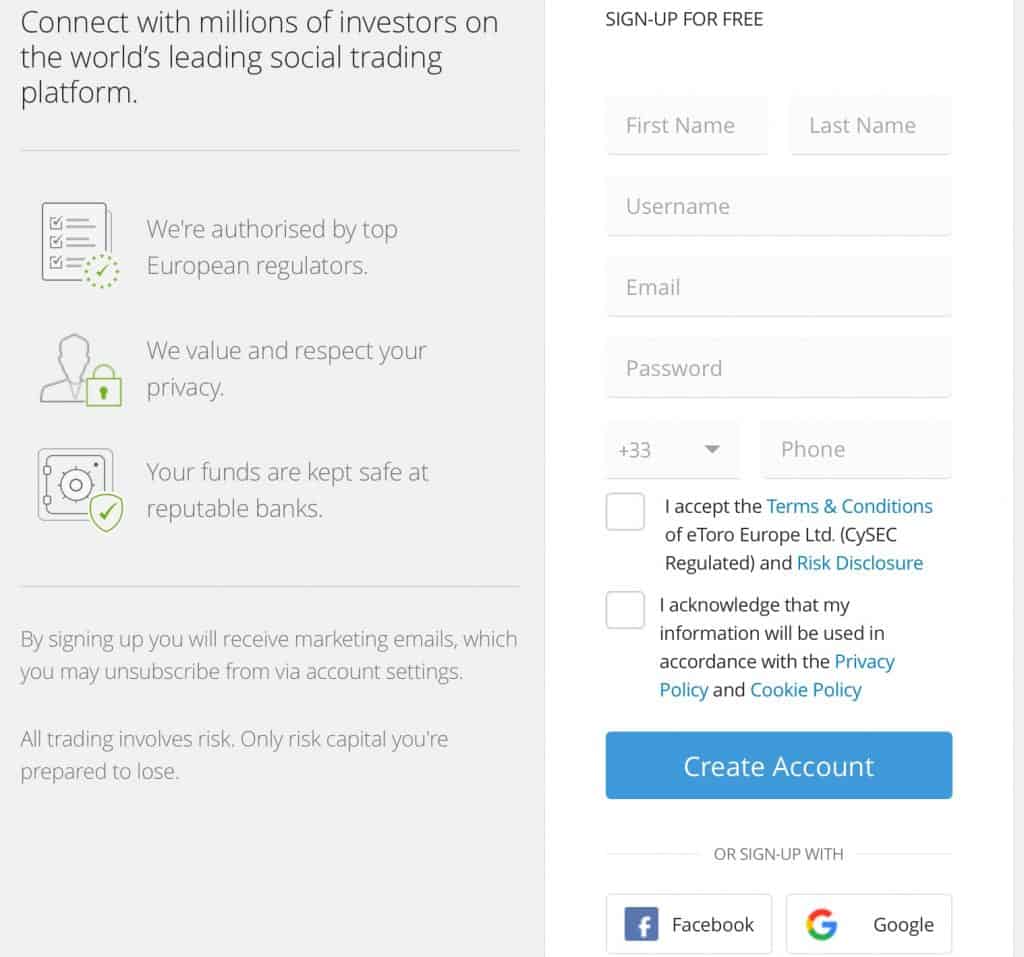

Step 1: Register your account with eToro

The first step to invest in EZJ shares is to sign up to our recommended broker eToro. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile.

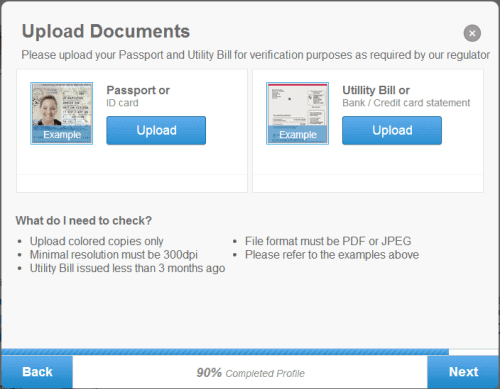

Step 2: Verify your identity

Attach and submit proof of identity for verification.

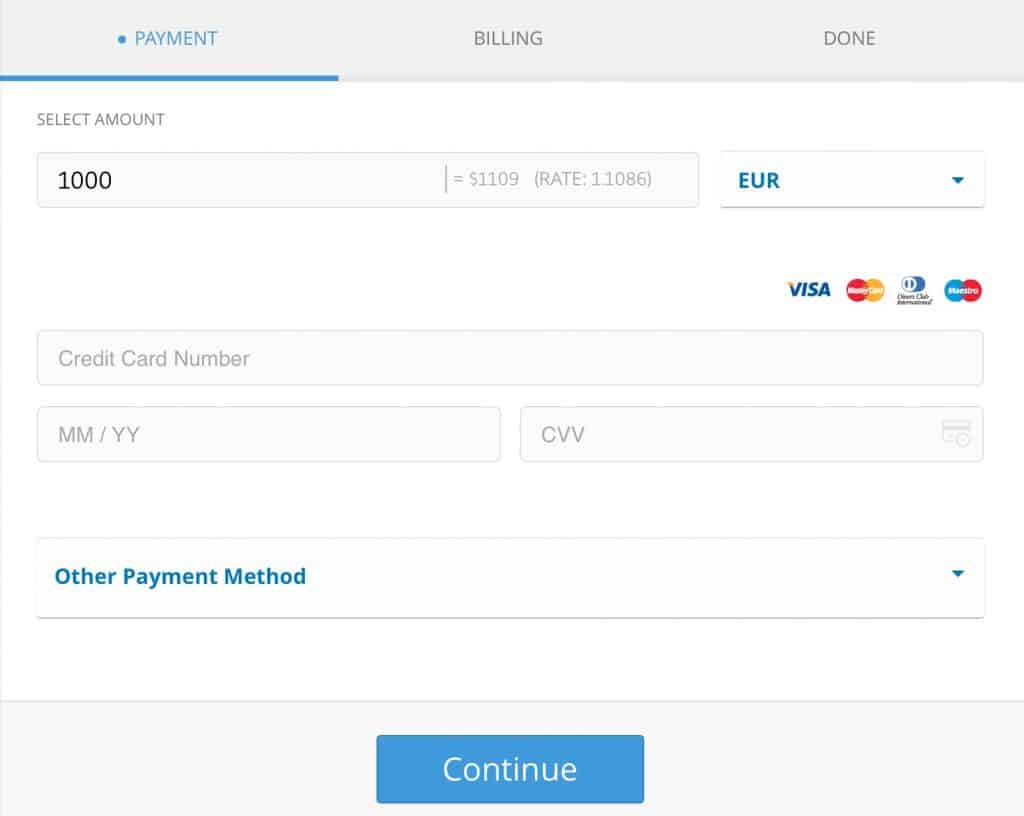

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

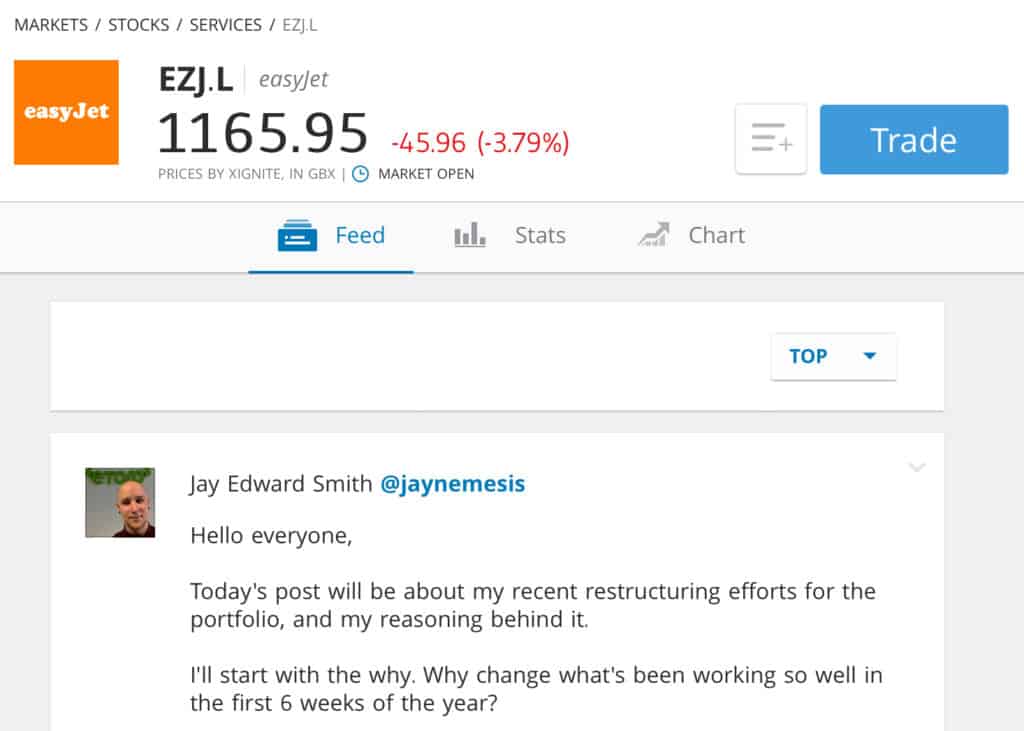

Step 4: Trade easyJet stock

On eToro, you can invest in easyJet through direct trading or social investing. Social investors can choose portfolios to copy based on performance and a risk score assigned to every trader portfolio on a scale of 1–6, 6 representing the highest risk. Here are three ways to invest in easyJet stock on the leading social trading platform.

Step 4A: Place an easyJet stock trade

To buy shares in EZJ, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The EZJ stock profile page provides social feeds, stats, charts and research. Social feeds provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

75% of retail CFD accounts lose money.

easyJet Stock Price History

Over the last three years, easyJet stock has returned 12.5 percent, versus -4 percent for airlines, to shareholders based on trailing returns. So far this year, though, EZJ stock is down 16.3 percent. The global airline industry has been hit hard by the coronovirus outbreak. Since the media started reporting infected passengers and deaths on the Diamond Princess cruise ship in January, the STOXX® Europe Total Market Airlines index has fallen 13 percent to 338.

Based on current valuations, the market is showing more confidence in easyJet’s ability to rebound from the coronovirus outbreak, French strikes and high fuel costs. EZJ has a price-to-earnings ratio of 18.9 versus 14.9 for the air transport sector (Stern). But expect some turbulence ahead. The forward P/E for EZJ stock is 15.7, versus 10.2 for the airline sector. What can we expect for the stock price going forward? Analysts have a median easyJet stock price forecast of GBX 1,419.10 (high GBX 1,800, low GBX 930), a 14.7 percent premium over the current stock price of GBX 1,237.50.

A Brief Overview of the History of easyJet

easyJet was started in 1995 by Greek-Cypriot entrepreneur Stelios Haji-Ioannou, who leased planes from British Airways out of London Luton Airport – a strategy that has proven unviable for some of its smaller competitors. In 1996, easyJet bought its first planes and began undercutting the big airlines on price – the European airline price wars had begun. Today, easyJet has a 30 percent European market share and carries 96 million passengers a year. The company went public on the London Stock Exchange in 2000.

By not offering connecting flights and charging for extras, easyJet has expanded by keeping costs low. The LCC has a number one or two position in most airports it flies out of. To finance growth, the super competitive airline industry has provided opportunities to buy airlines and assets cheap from defunct competitors. easyJet has bought TEA Basel (1998], GoFly (2002), assets of AirBerlin (2017), and airport slots of Thomas Cook (2018). easyJet now flies over 1,000 routes out of more than 30 countries.

easyJet Shares Forecast 2020–2024

easyJet’s positive performance in the first quarter of 2020 in a tough environment has positioned the company to create shareholder value over the next two years, says management. The launch of easyJet Holidays before Christmas took off. The bankruptcy of Thomas Cook has sent holidayers to easyJet’s new packaged travel deals. Seat bookings in the first quarter were up one percent, and for every one percent in seat growth, easyJet generated an 8.8 percent increase in revenues, or £58.60 per passenger.

Cost per seat (excluding fuel), however, increased 4.3 percent to £45.29. Profit before tax was down 26% to £427 million while profit per seat decreased by 32.9% to £4.07. Over this forecast period, easyJet plans to improve costs through operational efficiencies and more fuel efficient aircrafts.

2020 – Crowded European skies

As airlines confront a coronovirus overhang in 2020, LCCs will find it harder to lower prices without decreasing profit margins. easyJet is entering the new year with strong top line growth. In the first quarter, passenger growth was up 2.8 per cent to 22.2 million. Bookings for the first half of 2020 are up over last year, while revenue per seat growth is expected to increase by 5–9 percent. Even with rising fuel prices, easyJet plans to lower costs over the year. The outlook for EasyJet stock is low-to-median.

2021 – European airline consolidation

The inevitable consolidation of the European airline market has been predicted by the executives of the top five European airlines. This restructuring could begin in 2020 while the coronovirus epidemic and economic slowdown damper passenger traffic. Lower stock valuations will allow Ryanair, EasyJet and major airlines to swoop in and pick up cheap airline assets.The outlook for EasyJet stock is median-to-high.

2022 – Planes, trains, and robo-cars

More environmentally conscious consumers will prefer trains to airplanes with higher carbon emissions. A short haul flight burns 3.2 times more carbon emissions per passenger per kilometre than a train, and 22 times more than the Eurostar, which burns 6g (ICAO). France’s new eco tax on airplane tickets will increase the cost of plane tickets. The UK’s own high speed rail, connecting four major cities, has been greenlighted. A train trip from Manchester to London (an EasyJet route of 201 miles) will be cut from just over two to one hour. This trip will be possible when Phase 2 opens in 2035. Phase 1 between London and Birmingham opens in 2028.

Short haulers also face stiff competition from self-driving cars, which will be on the road in 2024. The longest U.K. journey was a recent 370-kilometre jaunt by a Nissan LEAF, 20 kilometres more than the popular Paris-to-London route. The outlook for EasyJet stock is low-to-median.

2023 – Investing in blue skies

In a recent survey, 11 percent of airline passengers said they would choose EasyJet because their flight is net zero carbon emissions (an economy-class return flight from Paris to Rome emits about 0.22 tonnes of CO2 per passenger (ICAO)). EasyJet became the first carbon neutral airline in 2019 by offsetting all its carbon emissions. Other airlines have cited 2025–2030 target dates to become carbon neutral. By 2022, EasyJet will have introduced 100 Airbus A320neo aircraft to its fleet of 316. The new aircraft is 15 percent more fuel efficient than the current fleet, saving on jet fuel costs and carbon emissions. The outlook for EasyJet stock is median-to-high.

2024 – Fewer birds in the sky

By 2024, we expect consolidation and bankruptcies in the European airline industry to produce fewer more profitable low cost airlines. Ryanair CEO Michael O’Leary foresees five major groups dominating 80 percent of the European air traffic– low cost carriers Ryanair and EasyJet, and Air France, Lufthansa and British Air parent IAG. The outlook for easyJet stock is median-to-high.

Should you Invest in easyJet?

Low cost carriers are driving growth in the European airline market. By passenger, easyJet is the number four airline in Europe with 96.1 million travellers in 2019, and number two LCC. Its main competitor Ryanair is the market leader with 152.4 million passengers, followed by major carriers Deutsche Lufthansa and British Airways (CAPA Center for Aviation). Noteworthy, the growth engine of these major carriers is their LCC subsidiaries – Eurowings and LEVEL, respectively.

The challenge is, all these airlines are in a vicious price war. As they lower prices to compete for LCC passengers, profits are being eroded. easyJet’s 2019 profits fell 3.5 percent to £430 million on £6.4 billion in revenue. But as with the U.S airline industry decades ago, consolidation could help the leading airlines move towards long-term profitability..

Pros of investing in easyJet stock

Cons of investing in EasyJet

Conclusion

Should you buy easyJet stock? easyJet Holidays is filling airplane seats, improving capacity and increasing revenue. This revenue will boost its cash flow, and thusly M&A war chest for future acquisitions. But how prepared is easyJet for the consolidation ahead? easyJet’s debt-to-equity – an important measure of financial strength in an industry with high bankruptcies – is 0.64 versus 0.12 for the global airline industry, well below the 1–1.5 considered a reasonable debt coverage ceiling.

easyJet currently pays a dividend of of 43.9 pence.

If you want to buy stocks in easyJet, we recommend doing so via a regulated online broker such as the ones listed below.

FAQs

easyJet has positive earnings but is considered to have high earnings volatility. In 2019, net income declined a modest -2.5 percent to £348 million, but in the previous four years increased or decreased between 17–30 percent. Fluctuating fuel prices are behind this volatility. Over the past five years, in easyJet’s two most profitable years 2015 and 2016, jet fuel prices were low. easyJet’s new planes will be 15 percent more fuel efficient, and should contribute to more consistent net income growth.

Faster high speed trains present increasing competition to short haul flights. Since the Eurostar was launched in 1996, the number of daily flights between Paris and London has declined 218 percent to 16,755 (OAG).

Over the past 10 years, fuel costs have comprised 20–30 percent of airline expenses. easyJet’s current fuel cost of around 20 percent of expenses is in line with the current average of 22 percent (Statista). easyJet’s expansion into holiday packages is allowing it to diversify into non-fuel price sensitive businesses.

easyJet is adding 100 A321neo aircraft to its fleet of 326. This plane will carry 26 percent more passengers, 285, and use 15 percent less fuel, allowing easyJet to save on fuel, carbon emissions and overall cost per passenger.

You can buy ESJ shares from online stockbrokers such as eToro. eToro provides an intuitive trading platform that make it easy to buy and sell stocks. After signing up online, type in the EZJ ticker, place your order and you will become an owner of easyJet shares. Is easyJet profitable?

How will new high speed trains affect European air travel?

How does jet fuel cost affect easyJet’s financial performance?

How will the new A321neo aircraft affect easyJet operating performance?

Where and how can you buy easyJet stock?