Feeling bullish on the UK bank and looking to find out how you can invest in Lloyds today? If so, we welcome you to read our guide on how to buy Lloyds stocks. We’ll give you a step-by-step breakdown of what you need to do, as well as list our recommended brokers to invest in LLOY.

Best U.S. Platform to Buy Lloyds Stocks

Are you based in the US and wondering which brokers give you access to stocks in UK banking firms like Lloyds? If so, we would recommend checking out the credentials of SEC- regulated platform Stash. The mobile stockbroker lists a good variety of stocks and shares, and you won’t pay any fees or commissions other than the $1 monthly membership fee. Moreover, not only is the platform US-friendly, but you can easily deposit funds with a debit/credit card, bank account.

Best Platform to Buy Lloyds Shares outside the U.S.

If you’re not a US resident and you’re looking for the easiest way to buy Lloyds shares, it might be worth exploring the merits of Plus500. The CFD broker allows you to go both long and short on Lloyds, so you can even make money if you think the share price is due to decline. Plus500 is regulated by the UK’s FCA, it does not charge any commissions, and you can deposit and withdraw funds with heaps of everyday payment methods.

How to Buy Lloyds Stocks in the U.S.

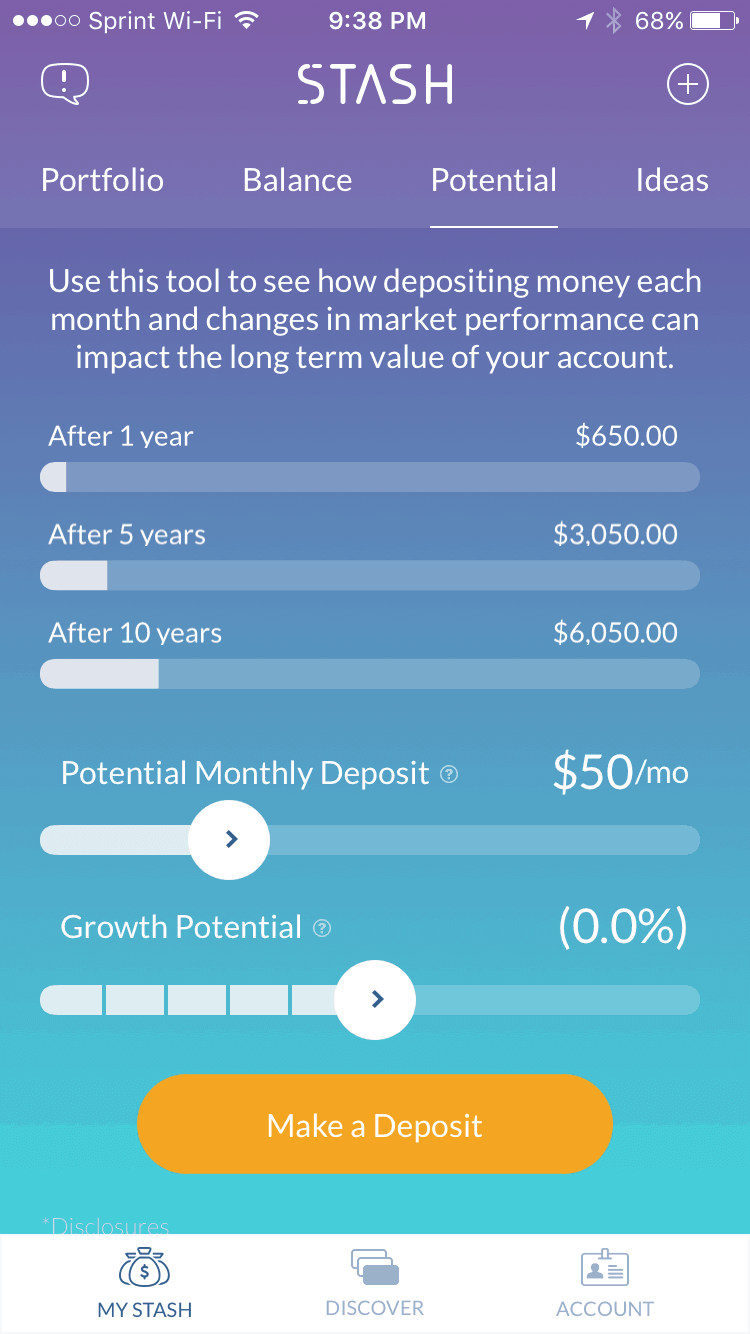

Based in the US and want to buy Lloyds stocks today? If so, your options are going to be somewhat limited, as you need to find a broker that is both US-friendly and gives you access to the UK stock markets. With that being said, Stash meets both of these criteria. Moreover, the platform allows you to trade on the go with as little as $5 – all with a tiny commission of $1 per month.

Step 1: Create your Stash Invest account

You’ll need to create your account by entering your email address and password after clicking the “Get Started” button on its website. If you want to download the Stash Invest app, go to the App Store and install it.

Step 2: Fill out your profile

You’ll need to provide your basic information by answering some questions. By getting your answers to these questions, Stash Invest will be able to better guide you in making investment decisions. Remember to be as honest as possible when answering these questions.

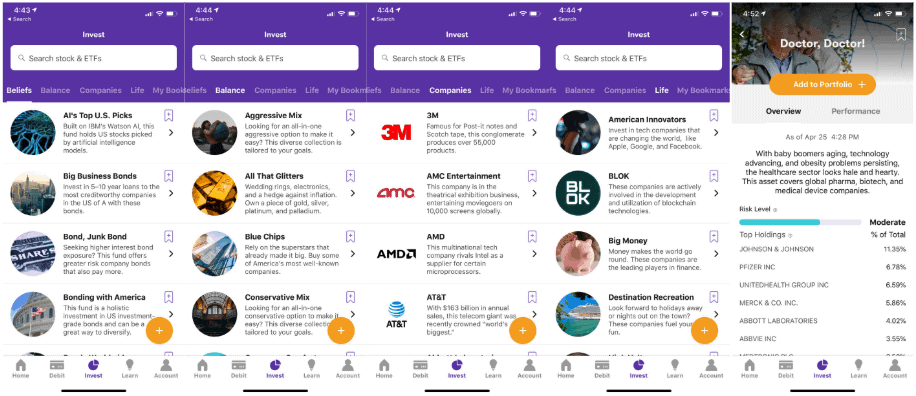

Step 3: Check your investment options

Based on your answers, Stash Invest will give you investment options that are aligned to your risk tolerance.

Step 4: Deposit funds

After that, you will be ready to deposit funds using bank transfer or debit/credit card payments.

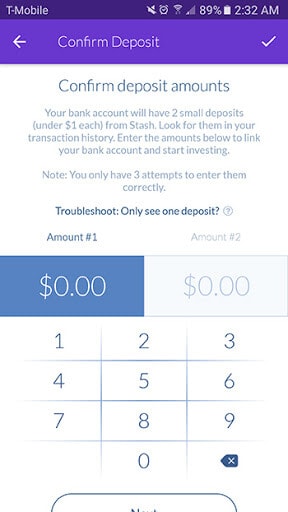

Step 5: Authentication & Verification

The Stash platfom being regulated by the SEC will then require some verification to prove that your profile matches up with your documentation.

Step 6: Buy Lloyds stocks

Search for the LLOY stock, enter the amount you want to invest then click the “Buy” button.

How to Buy Lloyds Stocks Outside the U.S.

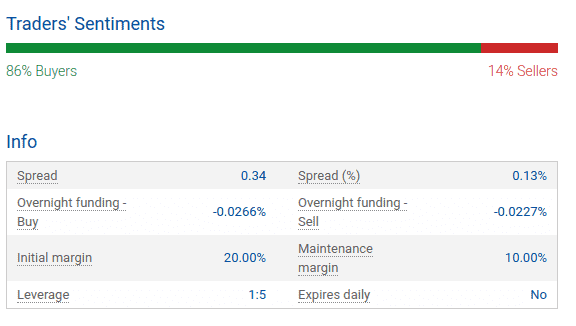

Are you looking to buy shares in Lloyds, but based outside of the US? If so, we would suggest checking out Plus500. The UK-based broker is regulated by the FCA, and its parent company is listed on the UK stock exchange. Moreover, the broker does not charge any fees or commissions when purchasing stock CFDs, so the only cost that you need to be made aware of is the spread.

Nevertheless, here’s what you need to do to buy Lloyds shares with Plus500 today.

Step 1: Open an Account With Plus500

You will first need to visit the Plus500 homepage and open an account. You will need to enter some personal information, such as your name, address, date of birth, and contact details. At the next stage of the application, you will be asked some questions about your financial standing. This will include your income band and the approximate size of your net worth. This is to ensure that you have the financial means to trade online.

As per anti-money laundering laws, you will also need to verify your identity. Known as the KYC (Know Your Customer) process, this will require you to upload a copy of your ID. This can be a passport or driver’s license. In some cases, Plus500 might also ask for a proof of address – which can be a utility bill or bank statement.

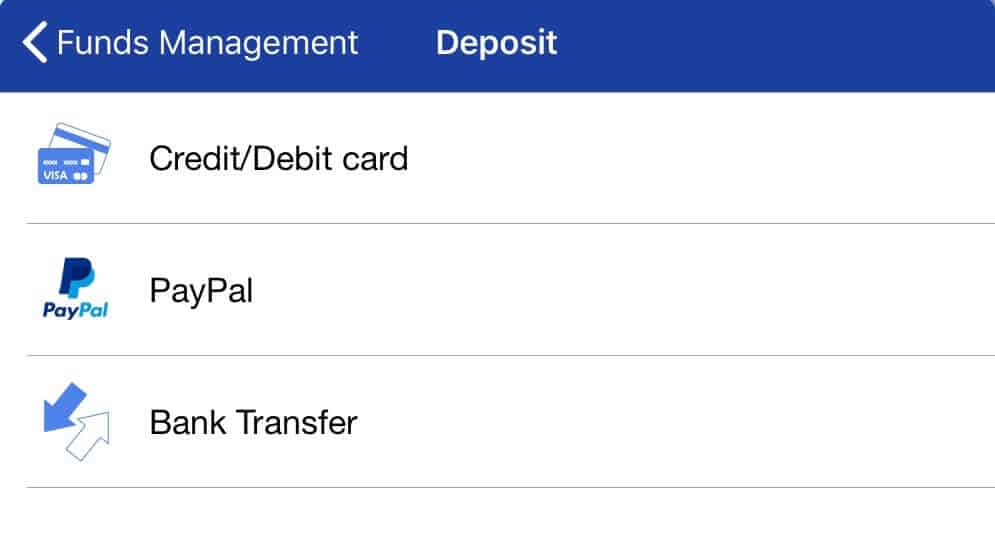

Step 2: Fund your Plus500 Account

You will now need to deposit some funds into your newly created account. Plus500 offers heaps of supported payment methods. This includes a conventional debit or credit card, PayPal, or a bank transfer.

Step 3: Consider Lloyds CFDs

Now that you have deposited funds into your Plus500 account, you are now ready to buy some shares. Take note, Plus500 is a CFD broker, meaning that you will not be able to purchase Lloyds shares in the traditional sense. On the contrary, CFD merely allows you to speculate on the future price of the asset. As such, you won’t be entitled to dividends or any other investor rights.

On the flip side, CFDs offer a much more cost-effective way to buy shares in Lloyds, and the buying and selling process is much more convenient. Furthermore, and perhaps most importantly, CFDs allow you to go short. This means that you can speculate on the future price of Lloyds shares going down.

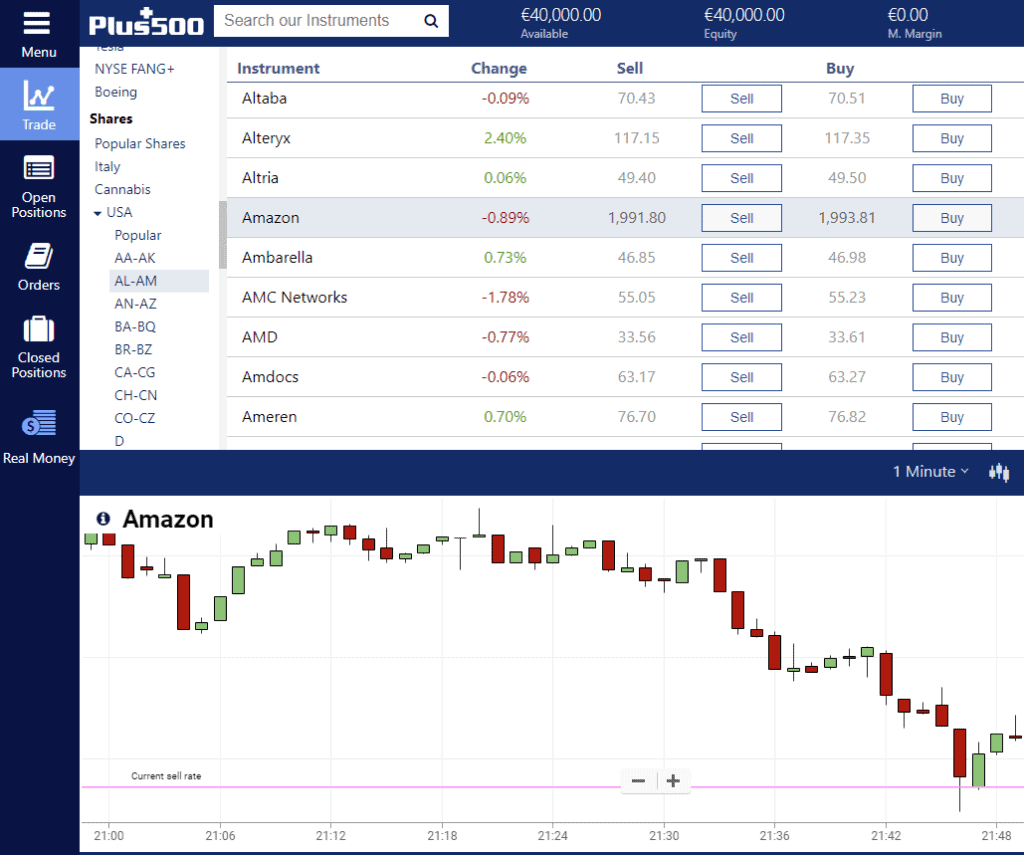

Step 4: Buy Lloyds Stocks at Plus500

If you’re ready to buy Lloyds shares in the form of CFDs, you will need to search for the company in the search box at the top of the screen. You will then be able to view the current market value of the shares – which covers both the buy and sell price. If you want to go long, you need to click on ‘buy’. Similarly, if you want to go short, click on ‘sell’.

Once you’ve decided which way you think the markets will go, you will then need to enter your stake. Finally, decide whether you want to place a market order or limit order. The former means that your order will be executed at the next available price. If you want to set a specific entry price, you’ll need to go for a market order.

About Lloyds Banking Group

Lloyds Banking Group is a major UK financial institution that stems its route back to the 17th Century. The high street bank is involved in a number of financial sectors – including retail banking, investment banking, and corporate banking. Like the vast majority of British banks operating on the high street, Lloyds was hit extremely hard when the financial crisis came to fruition in 2008. As such, its share price is worth just a fraction of what it once was.

While there is no guarantee that it will ever recover to its former glory, this does mean that you have the opportunity to buy Lloyds shares on the cheap. This is further amplified when you consider the uncertainties of Brexit, so there’s no knowing how the bank will deal with new market conditions moving into 2020 and beyond. With that being said, the management team at Lloyds has made some promising improvements in recent years. Not only are profits stabilizing, but costs are being managed in a much more systematic manner.

Should you Invest in Lloyds Banking Group?

Before you take the plunge and purchase shares in Lloyds, it is well worth brushing up on your knowledge in the company. After all, by buying shares in the UK bank, you are speculating that the value of the company is going to increase in the coming months or years. Nevertheless, in order to gauge whether or not Lloyds is a good investment, we need to take a quick drip down Memory Land.

Before you take the plunge and purchase shares in Lloyds, it is well worth brushing up on your knowledge in the company. After all, by buying shares in the UK bank, you are speculating that the value of the company is going to increase in the coming months or years. Nevertheless, in order to gauge whether or not Lloyds is a good investment, we need to take a quick drip down Memory Land.

As was the case with most financial institutions in 2008 – both in the UK and overseas, the financial crisis hit banks hard. Before the crisis came to fruition, Lloyds shares were priced around the 393p mark. Fast forward to today, and those very same shares are worth just a fraction of its 2008 value, at 55p per share. This represents a 12-year loss of approximately 86%. Furthermore, and perhaps most importantly – the woes of Lloyds shareholders go back long before the financial crisis.

For example, it was way back in 1998 that the bank last reached its all-time high, with a share price of 662p. However, it is important to note that it’s not all doom and gloom for Lloyds – at least in the short-term. For example, the bank is still making steady profits, and the management team have taken a tighter grip on operating costs. As such, if you’re feeling positive on the future direction of the bank, you have the chance to obtain shares at a heavily discounted price – at least in comparison to its pre-2008 value.

Pros of Investing in Lloyds

Cons of Investing in Lloyds

Conclusion

In summary, we hope that by reading our guide you are able to make an informed decision as to whether or not Lloyds shares represent a good investment. If you do, we have shown you what you need to do to buy Lloyds stocks today – with examples covering brokers both inside and outside the US.

Ultimately, the financials do not look overly promising at Lloyds. With profits and income on the decline, and the shares still worth a small fraction of pre-2008 levels, the hallmark high street bank is a risky investment. However, if you do feel confident in the future direction of Lloyds, you can still buy shares at a heavily discounted price.

FAQs

The brokers that we have recommended in this guide support multiple payment methods. This includes a debit/credit card, bank transfer, and an e-wallet like PayPal and Skrill.

In a time not so long ago, you were forced to purchase whole shares. However, you can now buy fractional shares, meaning that you can invest as much or as little as you like.

In the third quarter of 2019 - which was when Lloyds last published its latest financial results, the company saw a drop in profit of 97%. This was due to its £1.8 billion PPI claim commitments, taking profits down to just £50 million.

The easiest way to sel your Lloyds stocks is through the broker you purchased them from.

If you buy the stocks through a broker like Stash and don't apply any leverage, you will own the asset 100% - meaning you'll be entitled to dividends. However, if you invest through a CFD broker, you won't get any dividends. What payment methods can I use to buy Lloyds stocks?

What is the minimum number of Lloyds shares that I can buy online?

How much profit did Lloyds make last year?

How do I sell my Lloyds stocks?

Will I get dividends if I buy Lloyds stocks?