Join Our Telegram channel to stay up to date on breaking news coverage

In the fast-paced world of cryptocurrency, the market has seen an impressive trading volume of $ 590.44B in the past 24 hours. With sentiment leaning towards Bullish and the Fear & Greed Index hitting an outstanding 82 (Extreme Greed), excitement is palpable. While 67% of cryptocurrencies have enjoyed gains, 33% have experienced losses.

Today’s top gainer is RBN, with Ribbon Finance prices soaring by 71.95% in just 24 hours. On the flip side, Dogwifhat took a tumble, witnessing a significant -21.10% drop in price.

In this article, we’ll go deeper into the crypto market, exploring four impressive top gainers for today: Cosmos, Hedera, The Graph, and Aave. We’ll analyze their recent performance, highlighting what differentiates them from other crypto projects.

Biggest Crypto Gainers Today – Top List

Cosmos innovates blockchain scalability and interoperability. Its modular framework and Interblockchain Communication protocol simplify development. On the other hand, Hedera prioritizes speed and stability through hashgraph consensus. Also, both The Graph and Aave cater to DApp developers. GRT indexes cross-chain data, offering enhanced accessibility and query capabilities. Meanwhile, Aave revolutionizes decentralized lending on Ethereum, introducing innovative features such as flash loans and liquidity pool token trading. Let’s go into the details of these fantastic coins.

1. Cosmos (ATOM)

Cosmos is a blockchain project addressing some of the industry’s most challenging issues, including scalability and interoperability. By offering a modular framework and an Interblockchain Communication protocol, it aims to simplify blockchain development and facilitate communication between different networks. ATOM tokens, earned through a hybrid proof-of-stake algorithm, play a vital role in securing the Cosmos Hub and governing the network.

The project’s unique approach has positioned it as a leader in the industry, earning it the title “Blockchain 3.0.” With a focus on modularity and scalability, Cosmos strives to make blockchain technology more accessible and efficient for developers and users.

ATOM trades at $ 13.67, with a recent surge of 11.09% in the last 24 hours. Despite outperforming only 21% of the top 100 crypto assets over the past year, Cosmos maintains a bullish investor sentiment, with a Greed/Fear Index reading 82 (Extreme Greed). However, caution is advised as the cryptocurrency appears overbought, with a 14-day Relative Strength Index (RSI) of 80.13.

The interchain presence is strong in the new @Grayscale Dynamic Income Fund (GDIF) – highlighting a growing interest in the ever-expanding interchain ecosystem!

GDIF includes 4 blockchains built with the Interchain Stack: @cosmoshub, @osmosiszone, @CelestiaOrg, and @SeiNetwork. https://t.co/OWrZZWcIbl

— Cosmos – The Interchain ⚛️ (@cosmos) March 5, 2024

The latest news surrounding Cosmos involves the launch of the Grayscale Dynamic Income Fund (GDIF), which allows for staking cryptocurrencies to generate income. ATOM is among the assets included in the fund, highlighting its significance in the staking ecosystem. This development could further enhance Cosmos’s outlook as investors seek opportunities to earn passive income through staking.

2. Hedera (HBAR)

Hedera is a public network facilitating decentralized applications (DApps) for individuals and enterprises. It’s engineered to address the limitations of traditional blockchain platforms, prioritizing speed and stability. Launched in September 2019 following an initial coin offering (ICO) in August 2018, Hedera’s native token (HBAR) plays a dual role. Firstly, it powers Hedera’s smart contracts and file storage services. Secondly, HBAR holders can stake their tokens to bolster network security.

Hedera Hashgraph, unlike conventional blockchains, employs a novel consensus mechanism called hashgraph. This innovation enhances transaction speed, reduces costs, and ensures scalability. Core services include the Consensus Service (HCS) and Token Service (HTS), empowering users with timestamping, order negotiation, and tokenization capabilities. Notably, Hedera boasts an average transaction fee of $0.0001 and finalizes transactions in under five seconds.

1/ Hey #hedera_devs! A new #HIP is being proposed to make token airdrops frictionless on Hedera.

This improvement would apply to both fungible and non-fungible tokens.

Join the conversation at:https://t.co/Rj7pbXhPOj

— Hedera for Developers (@hedera_devs) March 6, 2024

HBAR’s recent performance metrics indicate an 11.53% price increase in the last 24 hours, with a 113% increase over the past year. It outperformed 54% of the top 100 crypto assets but underperformed compared to Bitcoin and Ethereum. Currently trading 73.88% above the 200-day SMA, HBAR’s 14-day RSI suggests neutrality, with 60% positive days in the last 30 days. Despite its high liquidity, it exhibits moderate volatility at 17%.

3. Sponge V2 (SPONGE)

Sponge V2, the latest sensation in crypto, has made a grand entrance onto the Polygon network, sparking widespread interest with its innovative play-to-earn (P2E) game. This integration offers lightning-fast transactions and minimal fees, amplifying the thrill of gaming. Moreover, Sponge V2’s staking feature promises lucrative returns, with Polygon network participants enjoying an astonishing 7,000% ROI, surpassing Ethereum’s 200%.

Excitement is palpable within the Sponge community as they set their sights on surpassing the token’s previous all-time high of $0.0012. Optimism is running high with a revamped staking model, integration with Polygon, and the imminent launch of a play-to-earn racing game. Adding fuel to the fire is speculation surrounding Justin Sun, the renowned founder of TRON, and his potential involvement with Sponge V2. His past dealings with meme coins and recent Ethereum transactions have the community buzzing with anticipation for potential market gains.

🧽 Ride that $SPONGE wave! 🌊 LFG 🚀#MemeCoin #AltGem #Crypto #100x pic.twitter.com/2PkqBon0tF

— $SPONGE (@spongeoneth) March 6, 2024

What truly sets Sponge V2 apart is its upcoming P2E game, promising players the chance to race as beloved cartoon characters and earn SPONGE tokens for their triumphs. As SPONGE tokens gain momentum on the Polygon network, they’ve become the talk of the town, with investors eagerly eyeing the possibility of a staggering 100x ROI.

4. The Graph (GRT)

The Graph introduces a groundbreaking protocol designed to index data across blockchains, catering to the needs of decentralized application (DApp) developers. Founded by Yaniv Tal, Jannis Pohlmann, and Brandon Ramirez, The Graph originated from their experience building DApps on Ethereum. Recognizing the challenge of navigating vast amounts of data, they developed a protocol to index blockchain data, starting with Ethereum.

This system operates through Graph Nodes scanning the blockchain database, filtering relevant information into ‘subgraphs.’ These structured descriptions are accessible to developers via the Graph Explorer and are stored on the InterPlanetary File System (IPFS). Developers leverage GraphQL querying language to request data facilitated by indexers and curated by users with technical expertise.

The Graph helps developers build faster, spend less, & increase the resilience of their dapps.

— The Graph (@graphprotocol) March 6, 2024

Unique to The Graph is its incentivized network, where stakeholders such as indexers and curators play vital roles. Indexers, responsible for retrieving data, stake GRT tokens and set their fees, while delegators stake tokens to guide indexers’ selection. Curators, also staking GRT, enhance data quality through a bonding curve mechanism.

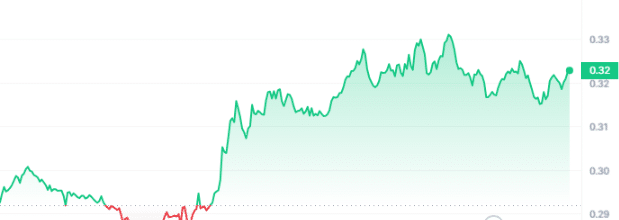

This top gainer’s recent performance reflects its growing popularity and potential. With a 138% increase in price over the past year, it has outperformed 60% of the top 100 crypto assets. However, it trailed behind both Bitcoin and Ethereum during the same period. Currently priced at $0.322625, The Graph experienced a spike of 10.59% in the last 24 hours. Despite its positive trajectory, caution is warranted, as indicated by a neutral sentiment and moderate volatility.

5. Aave (AAVE)

Aave is an Ethereum-based decentralized lending protocol that facilitates interest earning and cryptocurrency borrowing in a decentralized marketplace. Users can choose from 22 ERC-20 tokens for lending and borrowing. The platform offers innovative features like flash loans and liquidity pool token trading, setting it apart in the DeFi space. Launched as ETHlend in 2017, Aave rebranded in 2018 and later migrated LEND tokens to AAVE tokens in October 2020. With a successful 2020, Aave emerged as a significant DeFi player.

It distinguishes itself by its user-friendly interface and unique offerings. Flash loans, for instance, enable instant, unsecured loans within a single Ethereum transaction. This feature allows for arbitrage opportunities and refinancing strategies. Additionally, Aave introduced a lending market for liquidity pool tokens, incentivizing liquidity provision in platforms like Uniswap. These features enhance Aave’s utility and attract diverse users to its platform.

Despite recent successes, Aave’s price movement reveals mixed outcomes. While the current price sits at $124.60, indicating a surge of 10.41% in the last 24 hours, Aave faces challenges. Over the past year, it underperformed Bitcoin by -44.65% and Ethereum by -31.80%. However, it outperformed 41% of the top 100 crypto assets. Moreover, Aave trades 57.55% above the 200-day SMA, suggesting a relatively bullish trend. Investors exhibit extreme greed with a Greed/Fear Index 82, despite recent price volatility and neutral RSI.

Aave V3 market on @Scroll_ZKP, deployed by @bgdlabs, has been approved by governance and is now live!

— Aave Labs (@aave) February 12, 2024

Taking our gaze off the top gainers for today, let us peep into the happenings in the global crypto market. The Runestone, a monumental inscription on the Bitcoin blockchain, is making waves as it hits the auction block, boasting the largest ordinal by block size to date. With bidding underway and proceeds set to support network fees and benefit Bitcoin miners, the race to claim this historic piece of digital art is heating up ahead of the Mar 08 deadline.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage