In this guide, we will review past Chia Coin’s market performance and compare it to the present. The goal is to present a potential prediction of XCH’s value.

Quick Background Of Chia Coin

Before jumping into the Chia Coin price predictions, let’s quickly review Chia Coin’s background and its price history. Chia Coin is the brainchild of Bram Cohen, the programming wizard behind the BitTorrent platform. According to its documentation, Chia officially registered as a business entity in 2017 as Chia Network Inc. The company develops smart transaction platforms to provide utility for its decentralized cryptocurrency, $XCH.

The Chia network uses the proof of space and time (POST) consensus algorithm concept. It works by validating that data held on a certain part of a storage device exists and can be recalled when it’s needed. Upon completing a storage and recall cycle, the owner of the storage device is rewarded with a token.

Chia is praised as the first blockchain-based cryptocurrency to use the “proof of space and time” concept instead of the “proof of work” (POW) used by Nakamoto.

Parent Company: Chia Network

Even though Bitcoin keeps asserting itself as the king of cryptocurrency, several other coins are also making headway in the crypto space. Ethereum, for example, grew from a lower market position to become the second most valuable coin in the industry. Solana, Dogecoin, Litecoin, and Bitcoin Cash are some of the other coins that also rose to prominence. However, some other lesser-known projects were also making headlines back in 2021, with massive price increases and community traction.

One breakout coin that took the industry by surprise is Chia Coin, which went from zero to more than $1900 in less than 3 years of inception. However, despite its meteoric rise, the Chia Coin also turned out to be one of the few coins that have witnessed a tremendous impact of price action over its lifetime. Right after the project marked its all-time high, the value of XCH saw a huge correction, with no reversals in view.

Would the coming years see Chia Coin investors smiling to the bank, or would it send Chia Coin prices spiraling into the abyss?

Welcome to the definitive Chia Coin price prediction. In this guide, we will review past Chia Coin market performances and compare them to the present. The goal is to present a prediction of XCH’s potential value. At the end of this guide, we’ll present some viable alternatives to Chia Coin. We’ve researched each of the comparative coins and found that they have the potential to yield significant profit in the coming years.

Chia Network Growth Journey

Since its inception in 2017, the Chia network has grown to comprise over 100,000 nodes in over 20 countries around the world. This number makes it the largest PST network in the world.

According to Dealsroom, Chia raised a series of unverified seed funds from angel investors before approaching venture capital funds. The first round of VC funding came from Greylock Partners, Andreessen Horowitz, and Naval Ravikant, totaling $3.4 million. Subsequent rounds of funding came from Slow Ventures, totaling $5 million.

In 2021, Chia Network raised a Series D from Andreessen Horowitz, True Ventures, Slow Ventures, Naval Ravikant, DHVC (Danhua Capital), Richmond Global Ventures, Breyer Capital, and Cygni Capital, totaling $61 million. The funding round brought the valuation of Chia Networks Inc. to a whopping $500 million.

Chia Coin Price History

Chia Coin has experienced considerable price fluctuations since its inception, reflecting both the project’s growth and the broader volatility inherent in the cryptocurrency market. Initially, the price began with a modest valuation just below $20, but it quickly gained momentum as news of its ICO spread within the community. This initial excitement propelled the price dramatically, leading to an all-time high of nearly $1,900 in early May 2021.

However, the subsequent broader market correction, often referred to as the 2021-2022 crypto shock, significantly impacted Chia Coin’s price. By mid-May 2021, the token had fallen to $561, though it briefly recovered later in the month, touching the $1,600 level. Despite this temporary resurgence, the price resumed its downward trend, closing 2021 at $160.16.

The challenging market conditions persisted into 2022, with Chia Coin’s value continuing to decline steadily. By mid-2022, the token had slipped to $64, reflecting widespread bearish sentiment across the crypto landscape. By December 2022, the price had settled around the $50 mark.

In 2023, Chia Coin’s price action displayed less volatility compared to previous years, with a trend of gradual gains. The token fluctuated between monthly gains of 0.3% and 9%, suggesting a phase of relative stability compared to its earlier extreme highs and lows. This reduced volatility indicated that Chia Coin was attempting to establish a stable base amid evolving market conditions, offering some cautious optimism for long-term holders.

As 2024 progressed, the price of XCH declined further, eventually breaking a strong resistance level around $23, with the token trading in the $15 range. However, given the unpredictable nature of the crypto space, the possibility of a reversal cannot be entirely dismissed, as market conditions can change rapidly.

In examining the broader picture, Chia Coin’s journey thus far is a mix of both opportunity and caution. For long-term investors, understanding this volatile history is crucial, as it highlights the impact of market dynamics on even promising projects. The recent stabilization of Chia Coin’s price suggests a potential for future growth, contingent upon the project’s ability to continue innovating and delivering on its vision for decentralized and efficient blockchain solutions.

Q4 2024

The recent months have been quite challenging for Chia Coin (XCH), with its value dropping below $20 and breaking critical support levels. Despite some general bullish sentiment in the broader crypto market, there doesn’t appear to be much in the way of a catalyst that could significantly drive XCH’s value upwards in the short term.

The lack of any strong, market-moving announcements from Chia Network, coupled with dwindling interest from investors, has left XCH struggling to find a positive price direction. However, given the overall market’s renewed interest in digital assets, there may be some potential for Chia to see a modest increase from its current lows if conditions remain favorable.

By the end of 2024, XCH could possibly see a slight rebound, reaching a more stable range around $25-$30, but any significant price movement will heavily depend on market momentum and renewed community interest.

2025

Moving into 2025, the future for Chia Coin seems to rest squarely on the development team’s ability to deliver meaningful updates and foster community engagement. As of now, there is little being done to set XCH apart from its competitors, and the project risks being overlooked in favor of more innovative and better-marketed alternatives. For Chia to regain its lost value, it will need to introduce new products, announce strategic partnerships, and actively engage the community to rekindle interest.

These strategic moves will be crucial, as Chia Network’s lack of active developments compared to other projects gives them a significant disadvantage. Without aggressive marketing and the introduction of fresh, market-relevant features, there is a low chance of Chia achieving any sustained growth.

However, should the team manage to excel in these areas, XCH could see another leg up, potentially reaching or even surpassing the $100 mark. This would require the successful delivery of new utilities and an increase in adoption that attracts both retail and institutional investors.

2030 And Beyond

When it comes to making predictions for Chia Coin beyond 2030, it is important to note the limited historical data available. This makes it challenging to form a concrete long-term outlook for XCH. While the coin boasts solid utility and aims to address some of the inefficiencies in blockchain technology, making it a fundamentally sound long-term project, it may not be enough to guarantee success in the coming years.

It is crucial for investors to remember that simply holding Chia Coin in their wallets may not yield the best outcome. The key will be to remain vigilant, closely monitoring market developments and price movements.

Should there be a significant rise in the adoption of cryptocurrencies as a whole, and an increase in the use of XCH within the DeFi and NFT sectors, there may be a chance for the token to experience a substantial pump, potentially revisiting previous highs. However, such an outcome cannot be guaranteed, and investors should always be mindful of the risks involved in this rapidly evolving market.

Chia Coin Price: Red Flags

First, Chia Coin is not built on scalable infrastructure. Therefore, the future prices may not match the likes of Ethereum, Bitcoin, or other major cryptocurrencies. Competition from established competing cryptocurrencies may put downward pressure on the performance of Chia Coin in the market, which may also reduce the performance of the coin in the market. Government policies and data control could also prevent the execution of “Proof of Space and Time” in the future. Such policies spell an immense threat to the fundamentals of Chia Coin’s workings.

Therefore, it’s only logical to place the potential rise of the Chia coin at an average of $700+. The price could exceed that amount or fall below the mark. However, it’s unlikely that investors will record thousands of dollars in returns per unit of XCH.

Chia Coin Utility

How Chia Coin is deployed in everyday life may also contribute to its future price. Below is a quick highlight of the various ways the Chia Coin, Chia Network, and Chialisp are being used worldwide.

Chia Farmers Rewards

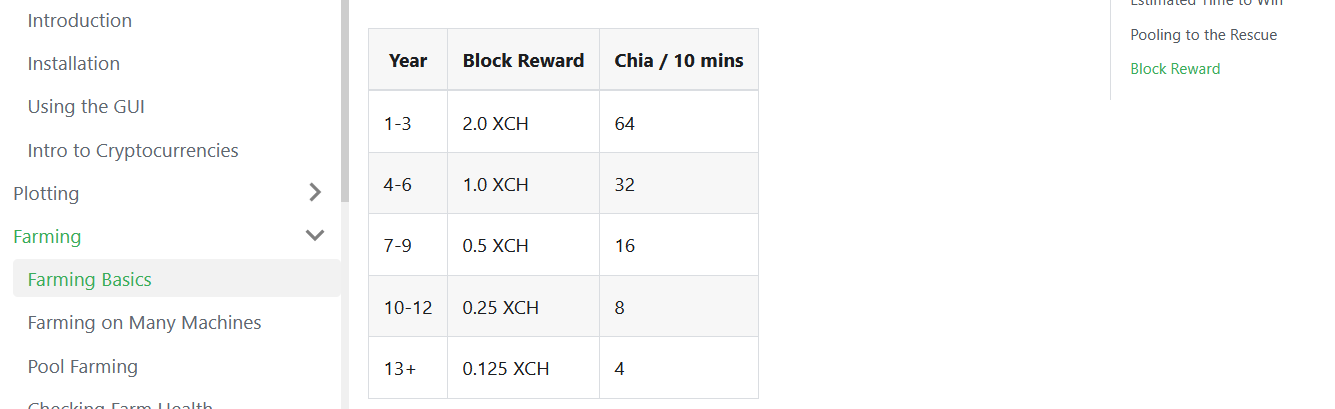

Chia Coin uses a unique mining process. Major cryptocurrencies use hash methods to generate proof of work that results in the mining of cryptocurrencies. Chia coins, on the other hand, use the Proof of Space and Time method. The mining process is referred to as “farming,” and each farmer gets XCH for participating in the network. The bigger the network, the more utility there is for Chia Coins.

DeFi

Due to its inbuilt smart contract, Chialisp developers are executing DeFi projects on the Chia blockchain, which happens to have a cheaper GAS fee and require fewer infrastructure investments. Also, it is more stable than the available alternatives.

Digital Transactions

Chia Coin is gaining traction in the decentralized economies. With presence in over 20 countries, certain transitions are now happening in XCH, especially across the network. The coin may enter mainstream transactions as the network expands its operations. The success of the IPO would also open new markets and expand its adoption.

dApp Development

Just like its use in DeFi, Chia blockchain and Chailisp are being extensively deployed in decentralized applications. The Chia Network dApp programming platform is still in the development phase and will soon start seeing deployment across Web 3.0.

Asset Tokenisation

The use of smart contracts in non-fungible tokens (NFTs) would pave the way for Chia coins in the future. Analysts believe that the lapses of established NFT platforms like Ethereum and Solana may pave the way for newer-generation smart contract platforms like Chialisp. But nothing much is happening in that space yet. The coming years may be very different ones.

Other Factors That May Contribute to the Growth of the Chia Coin

Besides utility, the following strengths can also work in favor of the chia coin, pushing its value beyond the $500 mark or even cracking a new all-time high.

Great Founder

Bram Cohen is considered one of the best protocol developers of our time, if not the best. With his track record in the industry, it’s easier for investors to trust his ability to develop a world-class project that would stand the test of time. He has pledged to commit another 10 years of his career to working at Chia Network, contributing his skills, experience, and expertise to the development of the project.

Great Leader

Earlier this year, Chia Network brought in a new crop of experts who have done so well in tech and finance. The new CEO, Gene Hoffman, has successfully raised over $155 million in his career as a business leader. His expertise also holds a promising future for Chia Network.

Great Team

Besides the CEO, other hands came onboard as the leaders of the company. Each person on the leadership team has world-class skills at what they do. Looking at their track records and contributions to their industries, one can only conclude they’ll take the company to its peak.

First-mover Advantage

Being the first proof-of-space-and-time platform to hit the internet is another area that gives the Chia network immense strength over other competing platforms. It has gained the name and secured the brand as the initiator of the new trend.

Patents and Proprietary Technology

Chia holds three patents in the blockchain sector, and it has two others in progress. With these patents under its belt, it would prevent other movers from gaining speed to catch up and neutralize its growth.

Will Chia Coin Disappear Soon?

In 2022, analysts predicted that Chia Coin would lose all its value and vanish from the market forever. Contrary to these predictions, the coin managed to survive one of the worst downturns in the history of the cryptocurrency sector. Previously, it also endured a major crash that wiped out nearly 98% of its value. Despite these turbulent years, Chia Coin remains in the market.

However, if the project’s value continues to deteriorate without any proactive efforts from the community and developers to initiate meaningful changes, there is a strong possibility that the earlier analysts’ predictions could come true. The token has already lost more than 99% of its value over the past four years, and without active measures to rejuvenate it, there is a real risk that Chia Coin could fade away entirely.

Should You Invest in Chia Coin in 2024?

The best time to purchase any coin is when it’s relatively new and has not yet experienced major volatility. Chia Coin has gone through two major periods of volatility and has endured over six months of downward price movement. While the coin may hold huge potential and opportunity in the future, it may not be an ideal short-term investment in 2023’s volatile economy. Below is the most recommended coin that shows immense growth potential. However, we’re not disputing the potential of Chia Coin.

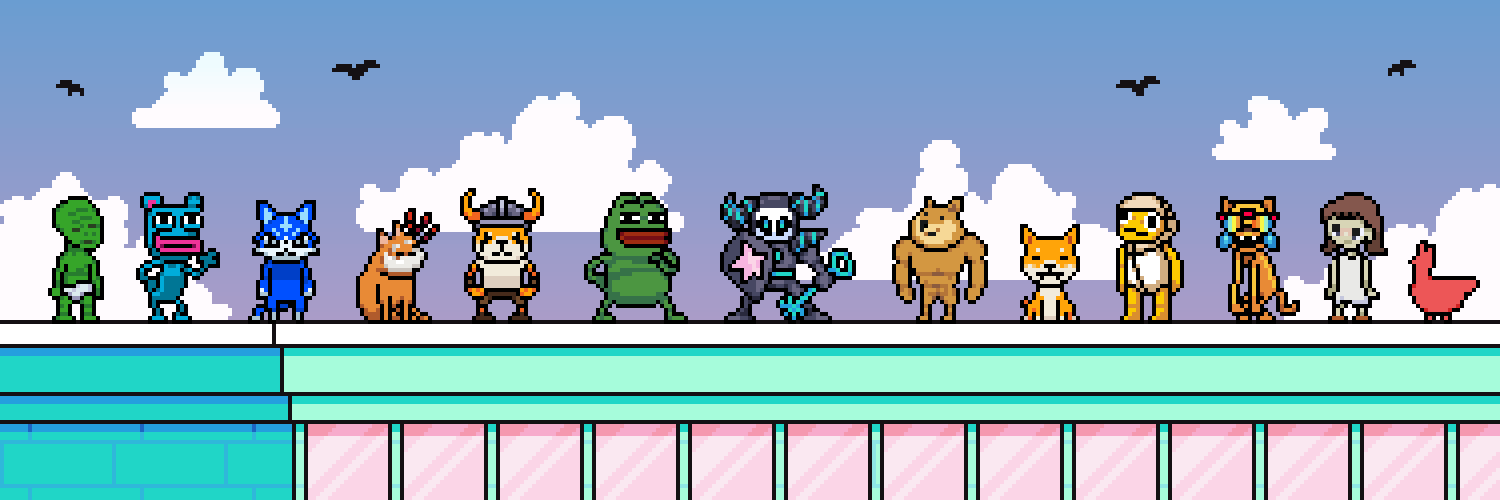

Crypto All-Stars

Crypto All-Stars is a brand new project that brings together some of the most popular memecoins under one ecosystem. While most projects merely feature memecoin mascots and such in their designs, Crypto All-Stars integrates them into its primary use case through the “MemeVault”—a staking protocol that allows holders to stake leading memecoins, such as Dogecoin, Shiba Inu, Floki Inu, and more, all in one place.

To incentivize early participation, the developers offer three times the staking rewards for those who purchase and stake STAR during the presale. Crypto All-Stars has already garnered attention with an impressive presale performance, raising over $2 million in just a few weeks. The project has been audited by SolidProof, ensuring transparency and security for investors.

In addition to strong staking features, Crypto All-Stars also boasts a visually appealing website, featuring iconic memecoin mascots that resonate with the broader memecoin community. This, combined with aggressive marketing and media attention, has helped the project attract substantial interest. The project is featured on popular youtube channels like 99Bitcoins, which claim that the STARS token could be a massively profitable opportunity for potential investors.

Crypto All-Stars has allocated 25% of its token supply for staking purposes, ensuring a sustainable staking ecosystem. For those looking for a unique memecoin project with high staking rewards and broad community appeal, Crypto All-Stars could be a great option worth considering.

Conclusion

We speculated on a potential Chia Coin price prediction in this guide. Having gone through the company’s background and its current performance, one would not be wrong to conclude that there’s a bright future ahead of the company. However, new investors can secure their asset portfolio by investing in other upcoming crypto assets like Crypto All-Stars, which has been discussed above.

These assets have positioned themselves to tap into markets that are worth billions of dollars. As blockchain, the metaverse, and Web 3.0 become mainstream, each of these coins will see a tremendous increase in value. Chia coin would also witness a price increase down the line, but it’s best to hold XCH as a long-term investment rather than a short-term investment.

FAQs

Why is the Chia Coin price dropping?

Chia's recent price drop is due to multiple factors. One could say that overall market conditions are to blame. However, its price action has also turned bearish due to events in 2023 that led to 30% of its staff being laid off.

How old is Chia Coin?

Chia Coin was launched between March and August 2017. As of the time of this writing, Chia Coin has been around for 7 years. much newer than most cryptocurrencies but showing so much resilience.

How can I buy Chia coins?

hia Network uses a peer-to-peer transaction system backed by stablecoin. Users need a stable Prime account to successfully fund the XCH wallet. Therefore, the first step is to set up stable prime access. Once the account is ready, you can then download the Chia wallet from the website and fund the wallet through your stable Prime account.

How are new Chia Coins (XCH) created?

Chia Network uses the term 'farming' to denote the coin mining process. In simple terms, the process involves storing and securing Chia blockchain data in unused spaces of storage and making it available on demand. Users who engage in this process are referred to as 'XCH farmers.' Every 10 minutes, the system issues 64 XCH to 32 farmers in return for participating in the network. The tokens go through a periodic halving every three years.

What is Proof of Space and Time (POST)?

Proof of Space and Time is a much newer consensus algorithm that requires a prover to send data that shows that certain amounts of disc space have been reserved over time. Once the verification goes through, the system rewards participants with digital tokens. It depends heavily on the efficient use of storage spaces. However, the algorithm has received backlash for reducing the life span of storage devices.