1INCH is an ETH-based token that drives the 1inch network, which seeks to determine efficient exchanging routes across all DEXes – decentralized exchanges allow users to trade tokens without the involvement of a middleman. 1inch collects token values from decentralized exchanges to find the best rates for users.

The first protocol of the 1inch Network is a decentralized exchange (DEX) aggregating platform that searches deals across different liquidity sources and offers consumers better rates than any single exchange. The 1inch Aggregation Protocol uses the Pathfinder method to identify the optimum pathways among around 60+ liquidity providers on Ethereum, 30+ liquidity sources on Binance Smart Chain, and 30+ liquidity providers on Polygon, Optimistic Ethereum, and Arbitrum.

The 1inch Aggregation Protocol has achieved $80 billion in total trading activity on the Ethereum platform alone in just over two years of operation. The 1inch Liquidity Protocol is a next-generation automatic market maker (AMM) that safeguards customers from front-running threats while also providing liquidity.

On this Page:

How to Buy 1inch

- Choose a cryptocurrency exchange – we recommend Binance

- Create an account

- Search for ‘Floki Inu’ in the platform

- Select your payment method

- Enter how much Floki Inu you want to buy

- Confirm your trade

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Where to Buy 1Inch – Best Platforms

Before we go into how to buy 1Inch in the UK, you must first locate the appropriate broker or exchange. Below, you can compare the finest cryptocurrency brokers and exchanges and their features, fees, and payment options in 2024. You may even modify your investment amount and cryptocurrency to check how much each broker costs!

Binance – Best Exchange to Buy 1Inch

Binance is one of the largest cryptocurrency exchanges in daily transaction volume, with over $20 billion in daily transactions. It gives you access to hundreds of assets as well as a smooth trading environment that makes it simple to generate money.

Binance’s is a cryptocurrency exchange only, most notable its features include minimal fees, extensive charting choices, and hundreds of cryptocurrencies.

Binance employs two-factor authentication (2FA) verification and FDIC-insured deposits in US dollars (USD). Furthermore, Binance employs device management in the United States to secure its consumers and address whitelisting and cold storage.

Fees: When it comes to commission structure, Binance stands out. Fees usually start modest and only become lower from there. Binance employs a volume-based pricing approach and offers further discounts using its proprietary coin. However, if you’re used to the uncomplicated world of typical brokerage prices, you’ll have to say goodbye to such fantasies here.

In general, you’ll pay a 0.1 percent commission when you trade. However, the exchange’s volume-based pricing approach, based on your 30-day trading activity, can help you save money. Binance has 11 price levels, denoted as VIP 0 through 10, based on your 30-day volume. Furthermore, Binance employs a maker-taker mechanism, which rewards those who add liquidity to the market (makers) and penalizes those who diminish liquidity (at greater trading volumes) (takers).

Binance listed the 1Inch token on December 25, 2020, and it offers to trade on 1Inch (1INCH). Moreover, Binance has opened trading for 1INCH/BTC and 1INCH/USDT.

Pros & Cons of the Binance platform:

- Over 500 coins are available for trading.

A broader selection of cryptocurrencies - More staking options – Binance Earn feature

- All of the chart indicators used by professional traders are available to them.

- Margin trading – long or short on leverage

- A wide range of transaction types are available.

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copy trading

Your Capital is at Risk

2 – Coinbase

Coinbase is one of the world’s largest cryptocurrency exchanges, with over 43 million verified users from over 100 countries and over $90 billion in Coinbase user accounts.

Coinbase allows you to buy and trade cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and over 50 more. This is one of the most popular exchanges with the most users.

Mobile App: Coinbase is an easy-to-use and highly functional mobile app that allows users to purchase, sell, and manage their bitcoins anywhere. It has a rating of 4.7 stars on the Apple App Store and 4.4 stars on the Google Play Store.

A platform for advanced trading: Coinbase’s regular desktop site is sufficient for most people who want to purchase, sell, and spend cryptocurrency. However, the Coinbase Pro desktop trading platform is available to active traders. Customers can browse real-time order books, use charting tools, and rapidly place their orders on that site.

Creating a Coinbase account: Signing up for Coinbase is as easy as creating a new bank or brokerage account online. To open a completely verified account, you must input your contact information, particularly your Social Security number.

New account holders must provide a photo of a government ID to prove they are who they are. If you’ve heard that cryptocurrency transactions are anonymous, this is proof that Coinbase may track your transactions for tax and regulatory purposes. After you’ve created your account and authenticated your details, you’ll be able to purchase and sell cryptocurrencies up to the limitations of your Coinbase account.

Pro Coinbase: Coinbase Pro appears to be designed specifically for professional traders, yet anyone with a Coinbase account can access and utilize the pro version. In addition, it provides more trade types, notably limits and stop orders, which are not available on the main Coinbase platform.

Fees: Coinbase is secretive about its pricing and fees, and it recently pulled its whole cost structure from the Coinbase online support area. On the other hand, costs are displayed on the trade screen before you enter a transaction, so you know what you’re paying before you enter a trade. The following are the fees you may anticipate paying on the main Coinbase platform:

Trade Size Coinbase Fee

$10 or less $0.99

$10 to $25 $1.49

$25 to $50 $1.99

$50 to $200 $2.99

Trades above $200 have a percentage-based fee rather than a flat fee.

Coinbase listed the 1Inch token on April 07, 2021, and it offers to trade on 1Inch (1INCH). Moreover, Coinbase has opened trading for 1INCH/USD, 1INCH/BTC, 1INCH/EUR, and 1INCH/GBP.

Pros & Cons of the Coinbase platform:

- Choosing a cryptocurrency

- Minimums are low.

- The best mobile app

- The platform for advanced trading

- Provides free cryptocurrency in exchange for learning about new digital tokens.

- Provides a Coinbase debit card that may be used to spend cryptocurrency anywhere. Visa cards are accepted.

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

Your Capital is at Risk

3 – Bitfinex

Bitfinex is a famous cryptocurrency exchange where traders may buy, sell, and trade a vast range of digital coins. The platform, situated in Hong Kong, was first founded in 2012.

Since the platform delivers a good selection of chart analysis instruments, intermediate and expert traders will most likely use Bitfinex’s trading space. Other than cryptocurrencies, Bitfinex supports bank transfers for depositing and withdrawing funds.

Bitfinex is one of the few exchanges that permits you to short cryptocurrencies and use leverage trading tactics. Bitfinex is a third-party cryptocurrency exchange that connects buyers and sellers. To access the platform, you must first create an account and deposit money. Once your account is funded, you will purchase over 100 coins, ideal for people looking for a broad portfolio.

If you want to hold your cryptocurrencies as a long-term investment, you may store them in your Bitfinex account online or withdraw them to a private Bitcoin wallet.

Fees – Bitfinex charges a 0.1% fee on deposits and withdrawals via bank transfer. If you require funds within 24 hours, you can pay a 1% expedited fee. Alternatively, bitcoin withdrawal costs differ by coin.

Bitfinex listed 1inch (1INCH) on May 07, 2021, and enabled trading against USD and USDt.

Pros & Cons of the Bitfinex platform:

- Established since 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

Your Capital is at Risk

4 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that offers its eight million members various trading options. Spot, margin, futures, and peer-to-peer trading, as well as lending and staking, are all examples.

KuCoin provides a high level of security and over 400 cryptocurrencies. It is a user-friendly exchange with a simple layout despite its extensive functionality. In addition, the exchange has some of the lowest costs in the cryptocurrency business.

KuCoin is a well-known name in the cryptocurrency market, having established itself as a unique one-stop shop for all cryptocurrency activities. Since its inception in August 2017, the exchange has grown to cover over 200 cryptocurrencies and over 400 markets, making it one of the most vibrant crypto hubs online.

It provides bank-level security, a slick interface, a user-friendly UX, and a wide range of crypto services, including margin and futures trading, a built-in P2P exchange, the capacity to purchase crypto with a credit or debit card, instant-exchange benefits, the capacity to earn crypto by lending or staking via its Pool-X, the option to experience in new initial exchange offerings (IEOs) via KuCoin Spotlight.

Founders – The Co-Founder and CEO of KuCoin is named Johnny Lyu, who raised $20 million in round funding from IDG Capital and Matrix Partners in November 2018. KuCoin was listed as one of the Best Crypto Exchanges of 2021 by Forbes Advisor 2021.

Deposits – Only cryptocurrency deposits and withdrawals are accepted.

Trading Fees – The platform charges 0.1 percent to both makers and takers, making it one of the cheapest cryptocurrency exchanges online.

KuCoin listed 1inch (1INCH) on December 26, 2020, and supported trading on 1INCH/USDT.

Pros & Cons of the KuCoin platform:

- Ability to buy crypto with fiat

- 24/7 customer support

- User-friendly exchange

- Low trading and withdrawal fees

- Wide range of altcoins

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

Your Capital is at Risk

5 – Bybit

More particularly, the Bybit team contains ex-Morgan Stanley, Tencent, and other well-known institutions, all of which can be found on LinkedIn.

Founders – Ben Zhou founded the company in March 2018. He was the general manager of XM, a forex brokerage firm before becoming the exchange’s CEO. Ben Zhou put together an A-team of investment banking and fintech professionals who had formerly operated for Alibaba, Tencent, Morgan Stanley, and other well-known firms.

Trading – Bybit supports five cryptocurrencies for trading: BTC, ETH, EOS, XRP, and USDT. Each asset will have its own wallet by default, but Bybit will calculate your overall equity in BTC.

Bitcoin, Ethereum, and USDT, as well as 45 fiat currencies, are accepted by the Fiat Gateway. Market takers pay 0.075 percent, while market makers pay -0.025 percent.

Pros & Cons of the Bybit platform:

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Up to 100x leverage on crypto

- Educational resources

- Not available in the US

- Crypto derivatives are extremely risky

- Not suited to spot trading

Your Capital is at Risk

What is 1Inch?

Serjez Kunz and Anton Bukov, two Russian technologists with experience in smart contract security, developed the 1inch Network in May 2019. Kunz and Bukov participated in the ETHNewYork Hackathon, testing arbitrage bots and strategy.

Their first product is the 1inch Aggregation Protocol, which they developed during the ETH NY hackathon. As its name implies, the aggregation protocol is a DEX aggregator that searches for trades across many marketplaces, delivering better rates than anyone exchange.

Liquidity was first obtained via Bancor, Kyber, and Uniswap, and since then, the 1inch Network has raised over $14.8 million in funding and expanded to support nearly 80 regions across numerous chains.

Founders of 1inch Network

Sergej Kunz and Anton Bukov established the 1inch Network during the ETHGlobal New York hackathon in May 2019. The two had formerly met during a Kunz’s YouTube channel (CryptoManiacs) live stream. They began participating in hackathons together, earning a prize at a Singapore hackathon and two significant awards from the ETHGlobal.

Sergej Kunz previously worked as a senior developer at product pricing aggregator Commerce Connector, programmed at communication agency Herzog, oversaw projects at Mimacom consultancy, then worked full-time in DevOps and cybersecurity at Porsche. Anton Bukov began his career in software development in 2002, then moved on to decentralized finance (DeFi). Among his other projects are gDAI.io and NEAR Protocol.

Is it Worth Buying 1Inch in 2024?

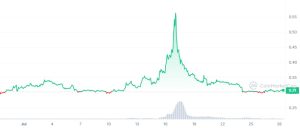

1INCH, the DeFi token powering the 1inch Network, has demonstrated solid performance in the past years and is expected to sustain its upward momentum. In the previous week, the token achieved a three-month peak, experiencing a significant surge to nearly $0.60 due to heightened trading activity.

According to data from CoinGlass.com, the open interest in 1INCH futures on Binance experienced a remarkable surge. In just one day, it soared from around $8.6 million to over $46 million, indicating a significant increase in leveraged positions, on July 17th.

In the 1inch Network, one notable development is the introduction of Token plugins. This innovation in the DeFi space empowers users by providing ERC20 extensions that allow them to enhance their assets’ capabilities. Users can connect to on-chain smart contracts and track balance changes through these Token plugins.

Token plugins, introduced by #1inch's co-founder Anton Bukov (@k06a), are the game-changer in #DeFi!

These ERC20 extensions allow holders & liquidity providers to expand their asset possibilities by connecting to on-chain smart contracts.

Read more ⤵️ https://t.co/zbXVRnwSz6

— 1inch Network (@1inch) July 27, 2023

The plugins developed in this context function without restrictions, allowing individuals to create and deploy them freely. These plugins offer users multiple benefits without any associated risks, empowering them to engage with multiple farms simultaneously without having to depend on trust.

To further enhance the DeFi and Web3 ecosystem, the 1inch Network is seeking funding through its 1inch Events Grant Proposal. This proposal aims to sponsor several prominent crypto-related conferences and hackathons during Q3 & Q4 2023. Some of these events include ETHCC, Eth Global Paris, Permissionless, and more.

The grant, valued at $1,988,682 in USDC, will cover various expenses associated with the events. The proposal has garnered strong community support, boasting an approval rate of 99.68% as of July 27th. A final decision on the proposal will be made by the end of the month.

🚨 New @1inch Proposal Voting Alert: [1IP-34] 1inch Events Grant Proposal & [1IP-35] Amendment to the Recognized delegates program

🗳️ Vote & join the discussion: [1IP-34] —https://t.co/cGt3XSHYi6

[1IP-35] — https://t.co/qnr9ngaTMZ#DAO #DeFi #1inch— 1inch DAO (@1inchDAO) July 27, 2023

However, experts and analysts expressed their belief regarding the future value of 1Inch tokens, attributing it to the significant growth potential of 1inch DEX aggregation technology. They believe this technology will significantly impact the pricing of 1Inch tokens.

Will the Price of 1Inch Up in 2024?

The circulating supply of these tokens is kept at 1 billion 1INCH. Its current market capitalization is $313 million. As a result, the token is predicted to rise to $1.21 by the end of this year.

Wallet Investor – Wallet Investor has a neutral outlook on the price forecasts of 1Inch. It is unlikely that 1Inch would be hitting the mark of $1 this year.

Digital Coin Price – As per their projections, 1Inch will be priced at $0.68 by the end of this year. Its value will increase to $0.79 by 2024; in 2025, it will touch the mark of $1.11.

GOV Capital – They have a neutral outlook towards this crypto. Per their projections, 1Inch would maintain its current price level this year.

Reddit Community – 1Inch is expected to have a good run this year. It may reach the value of $1.80 by the end of this year.

Coin Arbitrage Bot – Their forecast for 2023; the price of 1Inch is expected to be 0.38426. It will almost get double in 2024 when this crypto will be trading for a value of 0.76591. In 2025, the token will surpass the value of 1.34341.

When you’re considering an investment, follow these things:

Do you want to buy 1Inch but aren’t sure how cryptocurrencies work? Cryptocurrencies can be an exciting investment opportunity, but novice investors risk losing money if they are deceived by scammers or back a new coin with no track record.

This section will cover what you should know before investing in the Bitcoin market.

Fees – When trading cryptocurrencies like 1INCH or any other coin, choosing a broker with reasonable fees is critical, as fees quickly increase. Get a review of the broker’s prior performance and fee structure before deciding on a trading platform. Include withdrawal and deposit fees, transaction costs, and trading fees if possible.

Safety – To prevent unauthorized access to your funds, the best broker should have sufficient safety and security standards in place.

Support – A reputable broker also has a solid customer service department to assist you with your every need.

Timing: Because digital assets are volatile, Bitcoin and Ethereum can change substantially overnight. Usually, cryptocurrency traders try to “buy the dip,” which means they buy more cryptocurrencies when their value falls.

Purchasing Cryptocurrencies Using Traditional Techniques: New investors are catered to by cryptocurrency exchanges like Coinbase and Binance. These exchanges allow you to buy virtual currencies with a debit card, credit card, or bank account. Payment methods such as PayPal, Skrill, and Neteller are also available as deposit methods.

Beware of Scammers: Social media may be excited about a new investing strategy that promises big gains from obscure crypto assets. Others make overblown forecasts about the price of Bitcoin. Unfortunately, people in the Bitcoin industry have lost billions of dollars to Ponzi scams. Thus, be wary of con artists and do your homework before investing in cryptocurrency.

Create a Business Plan: Successful investors plan their cryptocurrency holdings. This can include placing a limit order, which means their Bitcoin will be automatically sold if prices hit a certain level. Some cryptocurrency platforms allow you to emulate the moves of expert cryptocurrency traders. Copy a trader whose risk tolerance is compatible with yours.

Buying 1Inch as a CFD Product

Contracts for difference (CFDs) are financial derivatives that enable traders to speculate on short-term price swings. Some advantages of CFD trading include trading on margin and going short (sell) if you believe its prices will fall or long (buy) if you believe prices will rise.

CFDs provide numerous benefits and are tax-efficient in the UK, so there is no stamp duty to pay. Please remember that tax treatment varies depending on individual circumstances and may vary or differ in jurisdictions outside the United Kingdom.

CFD trades can also be used to hedge an existing physical portfolio. For instance, investors can trade at home or on the go; trading platforms are particularly adaptable to traders of all skill levels.

Lately, CFD trading has made its way into the cryptocurrency market. With that being said, 1Inch is also available as a CFD product. If you’re struggling in following bitcoin trading with the exchange where to keep your crypto funds, you may use CFDs to profit from 1Inch.

We recommend trading altcoins with leverage on Binance or CryptoRocket. Binance supports more altcoins, including 1Inch. However, CryptoRocket supports fewer altcoins and currently has 40.

At the moment, Cryptorocket isn’t offering leveraged trading on 1Inch. However, they are consistently listing new coins.

There is a 1Inch/USD trading pair on derivatives broker Capital.com; we also recommend that platform. You have more flexibility when you trade with CFDs because you are not connected to the asset; you have only bought or sold the underlying contract. CFDs are also a more established and regulated financial product.

However, it is worth mentioning that the heightened volatility of Bitcoin, when combined with leveraged trading, can result in exaggerated winnings and losses. Make use of strict risk management strategies and stop and limit orders.

Your Capital is at Risk

Taxation on 1Inch Earnings

Cryptocurrency is the new world from which investors can now profit. As a result, regulatory organizations such as the Securities and Exchange Commission (SEC) in the United States are attempting to regulate the burgeoning business.

The Internal Revenue Service (IRS) has also attempted to establish a cryptocurrency taxing framework. Currently, the agency treats digital assets as real estate, putting them in the capital gains tax category. Furthermore, there are some instances where virtual currencies are recognized as income, resulting in the imposition of income tax by the taxation authority.

What are crypto assets?

Cryptocurrency is a payment method that may be exchanged for products and services online. Many businesses have developed their currencies, known as tokens, which can be exchanged for the business’s goods or services. For example, consider them to be arcade tokens or casino chips. To access the good or service, you must first swap actual dollars for cryptocurrency.

Cryptocurrencies operate on blockchain technology. Blockchain is a decentralized system that manages and documents transactions across numerous computers. The security of this technology is part of its allure.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21 and IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals with bitcoin as a capital asset but not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

In the United States, the following occurrences are taxed as property gains:

- Exchanging your cryptocurrency for fiat currency

- Using cryptocurrencies to make purchases

- Swapping one cryptocurrency for another – whether through an exchange or a peer-to-peer (P2P) channel

Taxable occurrences that are subject to income taxes include:

• Block rewards from cryptocurrency mining

Crypto assets obtained from liquidity pools (LPs) or staking

- Receiving crypto for services done

- Obtaining crypto through an airdrop

- Earning interest from lending to decentralized finance (DeFi) platforms

You should be aware that you can deduct your capital gains tax through trading losses. Depending on how long you keep an asset, you can save up to $3,000 in income taxes.

How to Calculate Capital Gains Tax?

Over the last year, the cryptocurrency market has risen exponentially, and government authorities are taking note. Given the recent boom in the non-fungible token (NFT) sub-sector, the IRS wants a piece of the crypto pie. The amount of tax you pay is primarily decided by your income tax rate and the time you’ve held on to your digital assets. This will help you calculate the following:

Short-Term Capital Gains Tax: The amount of short-term capital gains tax you owe is primarily decided by the length of time you’ve invested in cryptocurrencies. If you have made gains or losses from trading or owning cryptocurrency for less than a year, it will be taxed at a regular tax level.

Losses incurred throughout that fiscal year could be valuable. For instance, a tax-loss harvesting plan allows you to deduct up to $3,000 in taxes. You can also postpone your taxes until the following year.

Long-Term Capital Gains: If you’ve been trading cryptocurrencies for over a year, you may be eligible for long-term capital gains. You will pay taxes ranging from 0% to 20%, depending on your income. The income tax brackets are presented on this site.

Automated Trading With Robots

Cryptocurrencies are notorious for being extremely volatile, with prices shifting substantially even within minutes. Traders can also participate in bitcoin trading from anywhere in the world and at any time of day. When combined, these variables limit the effectiveness of human bitcoin trading in various ways.

First, many investors cannot react rapidly enough to market fluctuations to execute the best transactions that are theoretically accessible to them. Slowdowns in exchanges and transaction times aggravate the situation.

Secondly, traders do not have the time to devote to the cryptocurrency markets to make the greatest trades constantly. To do so, bitcoin exchanges worldwide must be monitored 24 hours a day, seven days a week.

Fortunately, there are answers to these problems for many investors. Bots, or automated systems that conduct trades and execute transactions on behalf of human investors, are one of the key solutions. Bots are, without a doubt, a contentious market component, and there are justifications for utilizing them and reasons to avoid them.

- Cryptocurrency traders utilize bots to take advantage of the cryptocurrency markets, which are open 24 hours a day, seven days a week.

- Trading robots have an advantage over investors in that they can react faster.

- Meanwhile, most investors do not have the time to get the best trade, which bots can constantly do.

- The arbitrage bot is a sort of bot that seeks to profit from price differences between exchanges.

As the name implies, a trading robot is an automated software that can research and trade financial markets. The underlying technology frequently enhanced by machine learning and artificial intelligence can outperform human capabilities.

Decreasing Risk in 1Inch Investment:

Traders should find strategies to protect themselves from large losses. If you wish to limit your risks, follow these guidelines:

By using a stop loss, you can avoid emotional stops.

One of the best tactics for traders to reduce their risk exposure in the markets is to use a hard stop loss with each transaction. Don’t merely consider a stop-loss; execute the order to prevent a little loss from becoming a long-term losing position.

Unless it’s extreme, leverage is an ally.

A high-leverage approach can enable a trader to make a lot of money quickly. However, if the market moves against your trade, it can result in large losses that wipe out your trading cash.

Volatility in the market

To begin with, some volatility is advantageous since it helps traders profit from little price swings. For example, if a market does not move, no one will trade it. As a result, trading in a market with little volatility might occasionally result in losses. Not only from the market but also from the high transaction costs.

Determine your level of risk tolerance

The amount of money at stake in each transaction is a personal preference that involves placing a stop-loss order. We do not favor a rigorous 1% or 2% standard. We believe that a trader should examine the size of his trading capital, how much money he is willing to risk and then compute the percentage of the trading account. It’s frequently far lower than 2% and possibly less than 1%. Then, trading mathematics takes over, and you either have enough to cover a few little losses, or you don’t.

1Inch Price Predictions: Where Does 1INCH Go From Here?

In the DeFi sector, 1INCH can be a profitable investment option. As per the price prediction for 1Inch, crypto is expected to reach the mark of $1.21 by the end of this year. Considering this, 1Inch is an attractive investment avenue from a long-term perspective.

1Inch Price Prediction 2023

The token is expected to run well on its price charts this year. It is projected to close this year at a value of $1.21.

1Inch Price Prediction 2024

It is predicted that 1INCH will reign over the crypto kingdom with a performance estimated at $1.43, even though a jaw-dropping potential does not exist, and that bulls will ride the crypto market.

1Inch Price Prediction 2025

This year could be a watershed moment for the 1INCH coin, with the price exceeding $2 by all accounts. Precisely, no critical reasons like pandemics or recessions are predicted to rock the foundations of global economies this year, and it is believed that most of the damage done to the coin will be on the road to repair work in all global economies.

1Inch Price Prediction 2026

Considering the volatility factor, expert token traders always aim for long-term gain rather than short-term gain. With a little patience and keeping their hopes up in the long run, investors can expect a turnaround by the end of 2026, when the coin’s adoption will expand dramatically, and 1INCH will no longer be a naive entrant in the world of cryptocurrencies. Still, a seasoned player can cross the price of $2.51 on the chart, making it quite profitable.

Summary

1Inch is an exchange aggregator that searches decentralized exchanges for the best cryptocurrency prices for traders, and its 1INCH utility and governance token power it. 1INCH powers the platform’s decentralized “instant governance” concept and supports liquidity mining via token staking.

1INCH is one cryptocurrency with a bright future that will drive the market price. Riding the crypto wave will conquer the digital kingdom, and as a means of payment, it will reign for a long time.

Our recommended exchange, Binance, can assist you if you’re ready to invest. It only takes three minutes to create an account and purchase 1Inch safely.

It would be best if you also kept the following in mind:

- 1Inch is an extremely risky cryptocurrency; therefore, investing in and trading 1Inch necessitates substantial research and effort.

- You should only use registered brokers and exchanges when investing. Furthermore, only invest what you can afford to lose.

- You should also get information regarding 1Inch from review sites and web specialists.

Your Capital is at Risk

FAQs

Any risks in buying 1Inch now?

1INCH is one cryptocurrency with a bright future that will drive the market price. Riding the crypto wave, it will conquer the digital kingdom, and as a means of payment, it will reign for a long time. Since it's already trading near double bottom support at $0.55, there's less risk in buying the 1inch token now.

Should I buy 1Inch?

Yes, indeed. The price-performance of 1INCH on the chart will be quite bullish, say for at least five years, making it an attractive investment. The movement of the 1INCH price may be meticulously tracked. Users are urged to review the daily price projections and perform calculations based on market predictions when trading 1INCH on exchange.

Where can I spend my 1Inch?

The INCH token is available on several major cryptocurrency exchanges, as well as on 1inch's own exchange. Binance, Captial.com, and Coinbase support 1INCH. Binance is the largest market for trading 1INCH for Bitcoin, whereas the 1INCH exchange is the top market for trading Tether. Thus, you can convert your 1Inch token into different altcoins to buy and sell products and services via e-commerce or retail.

Is it safe to buy 1Inch?

1inch places a high priority on security, ensuring the safety of all users' funds and transactions. Leading industry audits teams such as OpenZeppelin, Consensys diligence, SlowMist, Haechi Labs, Coinfabrik, Certik, Hacken, Scott Bigelow, Mix Bytes, and Chainsulting audited 1inch smart contracts.

Will 1Inch ever hit $25?

Considering the volatility factor, expert token traders always aim for long-term gain rather than short-term gain. With a little patience and keeping their hopes up in the long run, investors can expect a turnaround by the end of 2026, when the coin's adoption will expand dramatically, and 1INCH will no longer be a naive entrant in the world of cryptocurrencies. Still, a seasoned player can cross the price of $2.51 on the chart, making it quite profitable.