Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has seen a sharp increase over the last 24 hours as the US Fed once again announced interest rate hikes. The coin previously dropped to $29k earlier this week.

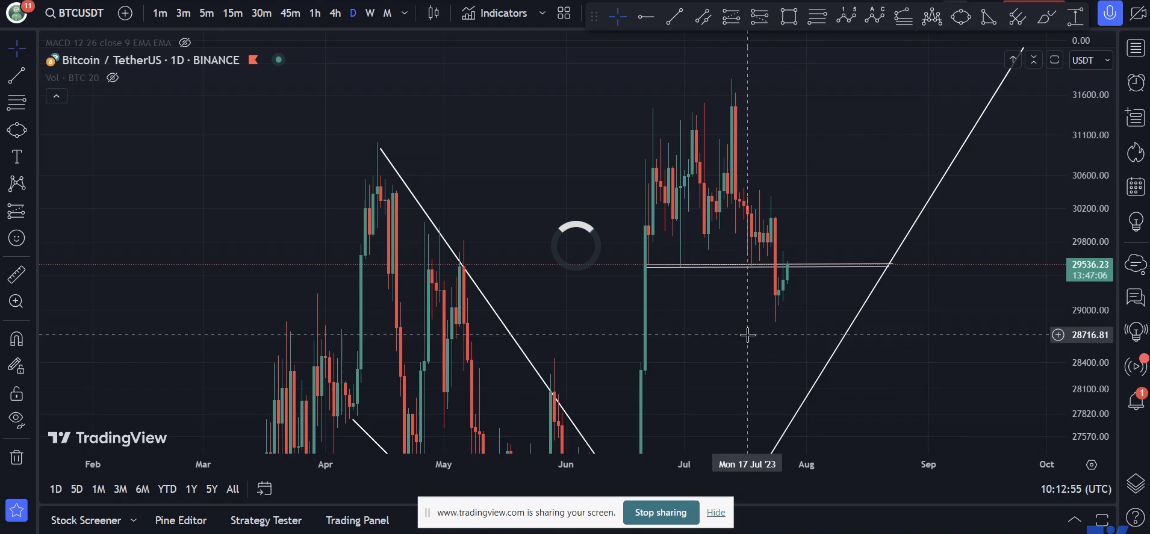

While some predicted that the $29k support will break, sending Bitcoin further down — the coin actually showed signs of slow recovery throughout the last week of July.

Bitcoin then spiked up late on July 26th after the US Federal Reserve decided that another interest rate surge is necessary to combat inflation.

Bitcoin’s surge was not massive, but it was sharper than previous attempts at recovery, sending the coin from under $29.25k to $29.7k within hours.

The coin’s price then corrected after hitting this resistance, sinking back to a new support at $29.3k, from where it bounced back up, making another attempt at $29.7k.

This time, however, the bullish wave lost its momentum after reaching $29.55k, and the price once again dropped. At the time of writing, the Bitcoin price sits at $29,366.

Bitcoin surges as the Fed boosts rates

The Fed’s new decision did not only affect Bitcoin but most other cryptocurrencies, as well. According to Sam Yilmaz, the co-founder of a crypto VC Bloccelerate,

Wednesday’s Fed meeting was probably the best that could have been expected from Bitcoin’s perspective as the perception remains that July’s hike to a 22-year high was either the peak of this tightening cycle—or we are very close to it.

The coin surged by around 1.2% following the Fed’s announcement. Right now, crypto traders are debating whether or not this is the last rate hike would also be the last or not.

In addition to the rate hike, the sector has also focused on the progress of proposed legislation, which intends to finally bring a regulatory framework for digital assets in the United States.

Friday might bring additional crypto volatility as the Bank of Japan comes to a rate decision

The industry has already seen the consequences of the US Fed’s rate decision, but this will not be the only impactful decision of this kind. This Friday, July 28th, the Bank of Japan is also expected to come to a rate decision.

The BoJ is expected to soften its grip on the nation’s bond marks, which could have a strong impact on the bond markets around the world.

Experts believe that exchange rates and liquidity conditions might be affected, and crypto analysts have voiced their opinion about the move potentially leading to greater Bitcoin volatility, as well.

The crypto industry has historically been sensitive to any changes in global liquidity conditions, so guessing that any kind of move might affect the crypto market is not out of the question.

Furthermore, Bitcoin has been experiencing a surprising lack of volatility over the last month, apart from a single price drop earlier this week. The coin never sits still for long, and market participants are waiting for it to blow up.

Robert F. Kennedy Jr. buys Bitcoin for his children

Another big news for Bitcoin came from the presidential candidate Robert F. Kennedy Jr. Known for his pro-Bitcoin speeches, Kennedy was taken as a crypto supporter, and earlier, he promised to protect the Americans’ right to own Bitcoin.

Now, he surprised the industry once again by backing up his claims. In an unexpected move, the presidential candidate revealed that he bought 14 BTC — 2 for each of his seven children.

During an interview with a crypto investor and podcaster, Scott Melker, Kennedy called Bitcoin the currency of freedom.

He said that the coin attracts people due to the decentralization and empowering nature of crypto assets.

— The Wolf Of All Streets (@scottmelker) July 26, 2023

Even so, his pro-Bitcoin stance attracted intense scrutiny from both the mainstream media and crypto industry experts. However, he still decided to buy BTC for his children despite the negative reactions.

What is next for Bitcoin?

Despite the recent Bitcoin surge, experts are still seeing signals that suggest that the coin’s price will go down, including ascending channel, a bear flag, and the M pattern that the coin has been forming lately.

Some have speculated that Bitcoin could disrupt the patterns and head back up if the US SEC finally approves a Bitcoin spot ETF proposal.

If it happens, it will undoubtedly have an impact on the coin’s price. However, the question is whether that impact would truly launch a premature bull run or just force the coin to briefly spike up and then correct and continue its natural cycle.

Evil Pepe presale to end in 6 days

A popular new meme coin, Evil Pepe (EVILPEPE), has finally reached a $1 million milestone in its presale. The presale, which started mere days ago, will only last for another 6 days. However, Evil Pepe has been attracting more and more money with each new day.

The project offers it token, EVILPEPE, at a price of $0.000333 per unit. Tokens can be bought with USDT or ETH. At the time of writing, EVILPEPE has raised a total of $1,068,565 and counting.

Its goal is tortoise a total of $1.99 million, and with six more days to go, this goal certainly seems possible, considering that the project has already passed 50%.

Evil Pepe is a project that encourages users to embrace their “evil side” and listen to that voice in their head that suggests making rash decisions, like investing in shitcoins.

That voice comes from Evil Pepe, which exists inside all of us, and the project invites users to come and blame it for all of their bad choices in a safe space.

Related

- Bitcoin’s ETF Rally Causes El Salvador’s Bonds to Skyrocket by 62%

- The Hidden Gem of Bitcoin Wallets! Bitamp’s Benefits!

- Bitcoin Price Still Flat at $29,000 Level While Evil Pepe Presale Shows BTC How to Pump

Most Searched Crypto Launch - Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards - pepeunchained.com

- $40+ Million Raised at ICO - Ends December

Join Our Telegram channel to stay up to date on breaking news coverage