Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is experiencing a surge in price and demand, reminiscent of trends seen during the 2016 U.S. presidential election. As we approach the 2024 election, betting markets estimate that former President Donald Trump has a 54.6% chance of being re-elected. This prospect has generated optimism among investors, particularly regarding potential regulatory changes that may benefit Bitcoin. Such developments are contributing to a positive market outlook.

In addition, the growing interest in Bitcoin is further supported by recent investments in Bitcoin exchange-traded funds (ETFs), bolstering the cryptocurrency’s upward momentum. Furthermore, various tokens across different blockchains have also shown significant rallies. This review will explore the top cryptocurrencies to buy now.

Top Cryptocurrencies to Buy Now

Solana is gaining popularity in the market, drawing in more users and participants to its ecosystem. Meanwhile, Flockerz has recently made waves by raising $1.2 million in its initial coin offering (ICO). Additionally, Solana has introduced a stablecoin called sUSD, which U.S. Treasury Bills back through Solayer.

1. Solana (SOL)

Solana is an open-source blockchain platform that supports decentralized finance (DeFi) applications and emphasizes fast transaction processing. Known for its low processing times, Solana has gained traction in the market, attracting a growing number of users and participants within its ecosystem.

This engagement increase reflects interest in Solana’s technology and its potential for addressing various financial applications. The platform has seen steady development, recently introducing a U.S. Treasury Bill-backed stablecoin, sUSD, by Solayer. This stablecoin adds to Solana’s expanding set of tokenized financial products, indicating a broader interest in creating diverse financial tools on the blockchain.

Welcome sUSD — a U.S. Treasury Bill-backed stablecoin on Solana by @solayer_labs! pic.twitter.com/BJIyqyy3mM

— Solana (@solana) October 29, 2024

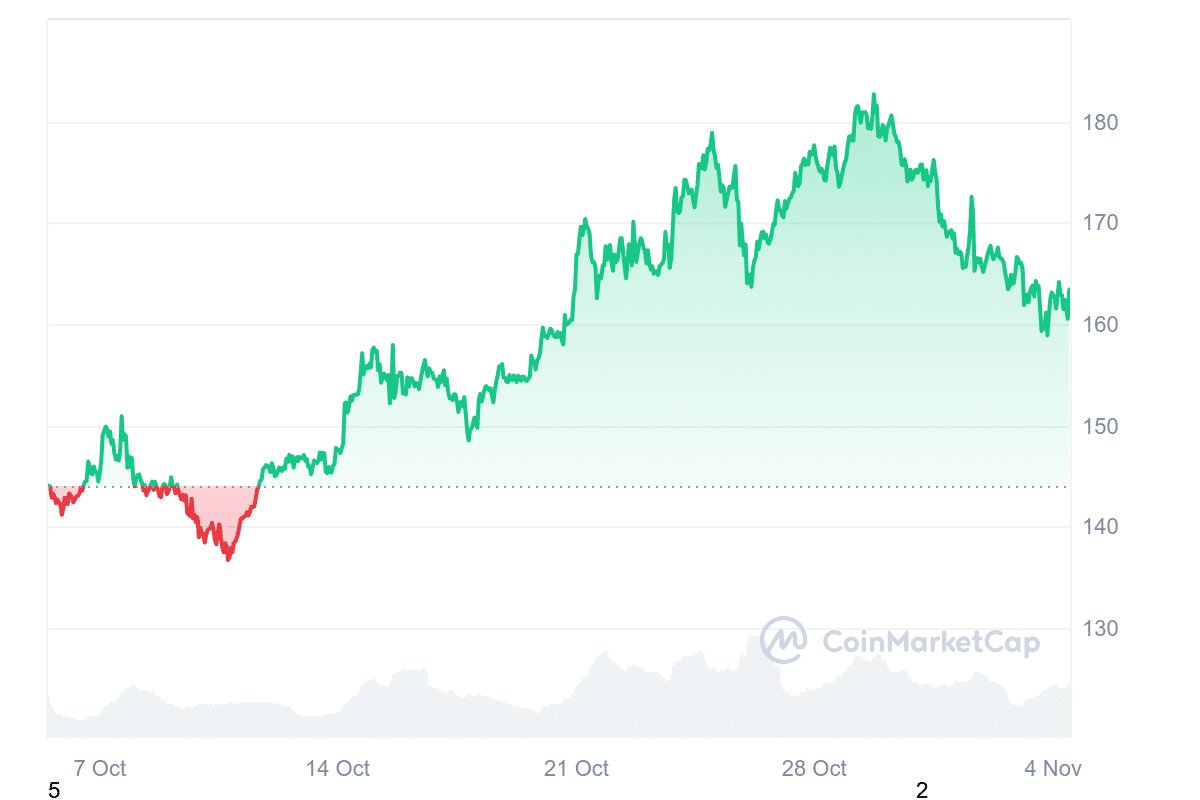

Moreover, Solana’s token (SOL) is priced at $161.91, with a 0.83% decline in the last 24 hours. Meanwhile, the token has witnessed an overall 12.6% increase over the past month. Market sentiment remains neutral, while the Fear & Greed Index shows 69, suggesting a “greed” environment.

Solana is trading 14.12% above its 200-day simple moving average (SMA) of $141.54. The token has seen 15 days of gains in the last month, supported by strong liquidity relative to its market cap. These indicators suggest a consistent level of activity and ongoing interest in Solana’s ecosystem.

2. Chainlink (LINK)

Chainlink has recently made significant strides in decentralized finance (DeFi) by expanding its services across multiple blockchain platforms. In a notable move, the platform deployed 34 services across 14 blockchains, clearly indicating its expanding presence and strategic growth in this space.

The platform’s integration with Ethereum Layer-2 solutions such as Arbitrum and Base, alongside major Layer-1 networks like Solana and Hedera, highlights Chainlink’s broadening reach. These integrations are intended to make Chainlink’s tools more accessible, thereby promoting the growth of its ecosystem across various blockchain networks.

Furthermore, Chainlink is advancing interoperability through its Cross-Chain Interoperability Protocol (CCIP). This protocol aims to enable secure asset transfers between blockchains, fostering connectivity and collaboration among different platforms, which could enhance Chainlink’s influence within the DeFi sector.

$3T+ AUM fund administrator @ApexGlobalGroup is using #Chainlink’s infrastructure for tokenized assets.

Apex Group & Chainlink are collaborating to help funds use CCIP, Data Feeds, & PoR to enhance asset liquidity, utility, & transparency.#RoadToSmartCon pic.twitter.com/zLI7AYjvXC

— Chainlink (@chainlink) October 31, 2024

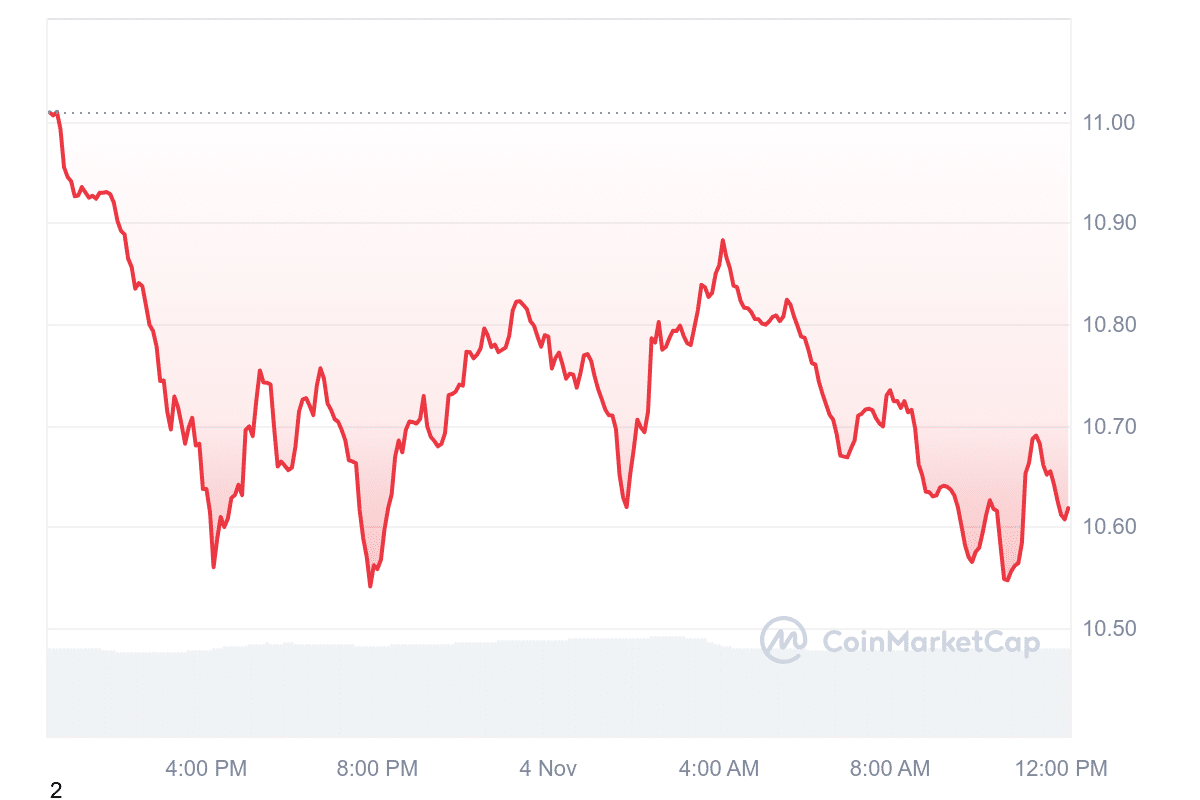

On the market side, Chainlink’s token, LINK, is currently priced at $10.61, reflecting a 3.61% decline. Despite some price fluctuation over the past month, LINK has seen 15 green days in the last 30 days, with a solid volume-to-market cap ratio of 0.0668, which indicates stable liquidity relative to its market size.

Meanwhile, while LINK’s price has seen ups and downs, Chainlink’s continued contributions to blockchain technology demonstrate its steady role in DeFi’s growth. The platform’s commitment to interoperability and expansion places it among the top cryptocurrencies to buy now.

3. Nexo (NEXO)

Nexo is a digital asset platform focused on helping users manage, grow, and secure their cryptocurrency holdings. The platform provides competitive yields on flexible and fixed-term savings, crypto-backed loans, advanced trading options, liquidity solutions, and a crypto debit/credit card. Backed by industry expertise, a sustainable business model, global licenses, and strong security measures, Nexo aims to promote steady financial growth with 24/7 customer support.

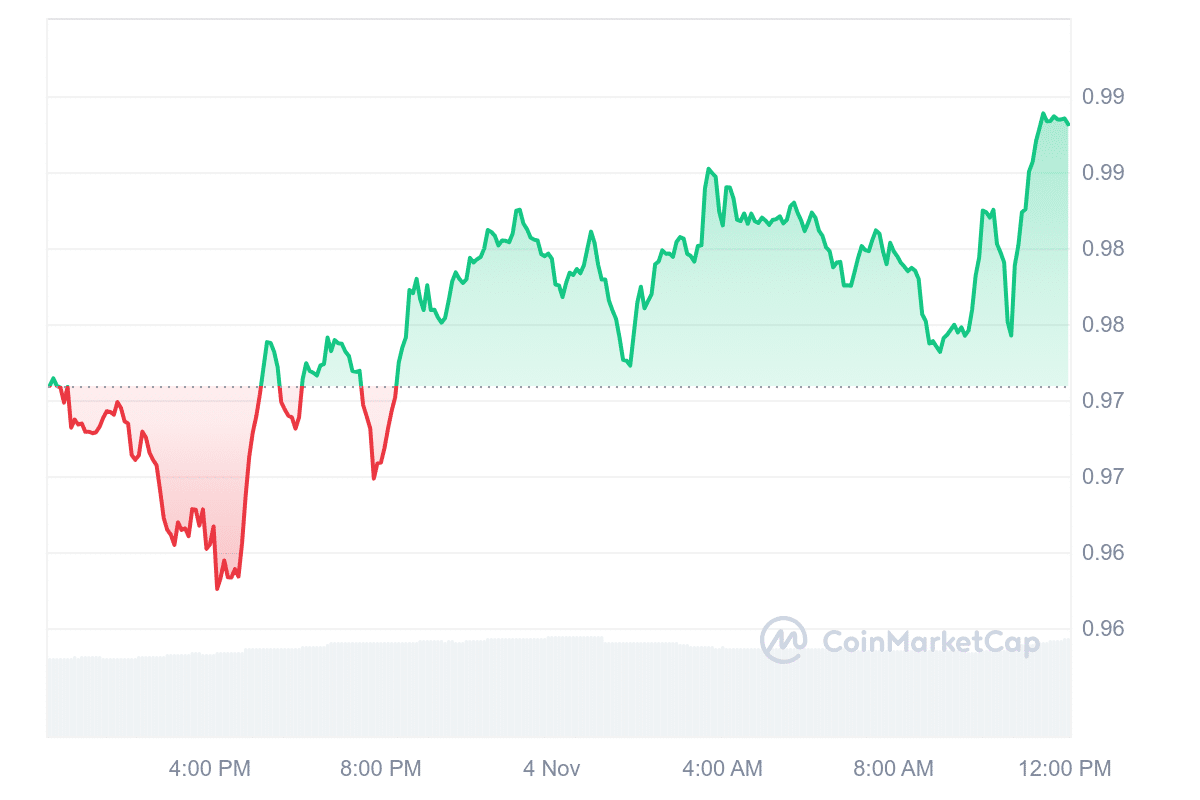

Meanwhile, Nexo’s token is priced at $0.9836, reflecting a 1.31% increase over the past 24 hours. Over the past week, it has risen 0.20%, with a significant 24.32% boost in trading volume, reaching $3.81 million, indicating renewed investor interest. While the short-term price outlook remains bearish, the Fear & Greed Index registers at 69, showing a general market sentiment of greed.

The Nexo token is trading above its 200-day simple moving average (SMA), standing 6.32% higher than the SMA value of $0.9304, which suggests moderate upward momentum. However, the 14-day Relative Strength Index (RSI) is at 46.19, indicating a neutral position, which could imply limited short-term volatility.

Furthermore, the token has performed well in USD and ETH, with 17 “green” trading days out of the last 30. Moreover, Coincodex forecasts a potential 34.78% price increase by December, potentially reaching $1.3278.

4. Flockerz (FLOCK)

Flockerz (FLOCK) is a new meme coin that has recently gained attention, raising $1.2 million during its initial coin offering (ICO). Launched to appeal to meme coin investors, Flockerz aims to differentiate itself in the crowded market. Currently, FLOCK tokens are available at a presale price of $0.0059334, though this rate is expected to increase.

One notable feature of Flockerz is its “Vote-To-Earn” mechanism, which offers token holders the chance to earn rewards by engaging in project decisions through FlockTopia, the platform’s decentralized autonomous organization (DAO). This setup allows users to participate in choices related to project development, marketing, and token management, setting Flockerz apart from typical meme coins that lack user-driven decision-making features.

Additionally, FLOCK offers a staking option with an annual percentage yield (APY) of 1340%, although this rate may decline as more tokens are staked. Several crypto influencers have supported Flockerz, which may help enhance its reach in the cryptocurrency community.

🥂We're toasting to $1M! 🥂

Along with this mega milestone comes BIG news.

🔥TELEGRAM OPENS IN 3 DAYS!🔥

⌛October 26th at 15:00 CET. https://t.co/4cM18DEytN⌛ pic.twitter.com/o5vz6Nkfrb

— Flockerz (@FlockerzToken) October 23, 2024

The project’s expanding social media presence suggests growing interest among potential investors. Furthermore, Flockerz combines popular meme coin attributes with a participatory governance model and staking rewards, which may attract investors looking for a more interactive experience.

5. GateToken (GT)

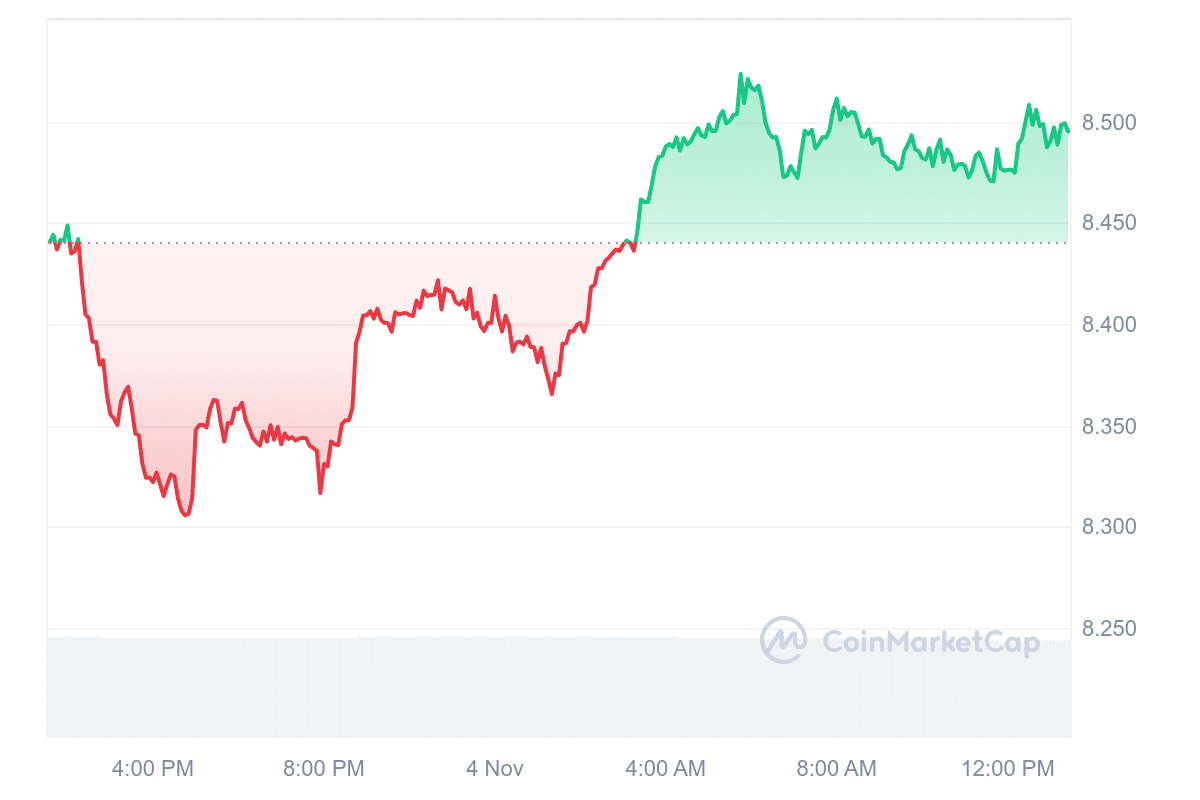

GateToken is currently valued at $8.50, with a daily trading volume of $3.22 million and a market cap of $771.33 million, giving it a market dominance of 0.03%. Over the past 24 hours, its price has risen by 0.54%, though the overall market sentiment remains bearish. The Fear & Greed Index, however, suggests a high level of market optimism, showing a score of 69 (greed).

Over the past year, GT has experienced a 120% price increase, outperforming 71% of the top 100 cryptocurrencies and exceeding the performance of major assets like Bitcoin and Ethereum. The token’s current price is above its 200-day simple moving average (SMA) of $4.16, marking a gain of 103.93% over this benchmark. The 14-day Relative Strength Index (RSI) stands at 55.36, indicating a neutral position that could suggest some stability, with potential for sideways movement in the near term.

GT’s performance has also been favorable compared to its initial sale price, with 16 positive trading days in the last 30 days, reflecting a 53% rate of green days. Additionally, GateToken’s yearly inflation rate is at -8.23%, signaling a reduced circulating supply over time. GateToken’s growth trajectory has surpassed key indicators like the 200-day SMA and has demonstrated resilience through positive returns over the past year.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage