Filecoin is a decentralized platform that allows anyone to rent computer storage space. Anyone can also purchase network storage. Allowing anyone on the planet to join the network can generate a massive source of data storage. As more and more systems become automated, it will be necessary to meet the increased demand. The platform now has a network capacity of more than 2.5 billion gigabytes, making it the industry’s most extensive decentralized storage solution. Filecoin rewards developers who use its network to expand the network’s ecosystem. So far, Filecoin has awarded 45 grants to developers.

Grayscale launched its Filecoin Trust earlier this year and invested $1.5 million. Because of its rapidly expanding ecosystem, Filecoin is well-positioned to thrive in this cryptocurrency bull market. On the Filecoin platform, storage providers and purchasers use the Filecoin coin. Buyers must pay providers in Filecoin to have their data stored, and data providers must stake Filecoin to join the network. By compelling storage providers to stake FIL, the network can financially punish bad actors on the network.

If you’re looking for the simplest ways to invest in the Filecoin cryptocurrency, this article on how to buy Filecoin will help you find the answers. We’ll recommend the best investing platform for purchasing Filecoin.

How to Buy Filecoin

- Choose an exchange supporting the FIL token; Bitstamp is the one we recommended.

- Open and verify your trading account.

- Deposit into your account.

- Search for Filecoin on the platform and choose you trading pair.

- Enter the amount of FIL you want to buy, confirm your order, and click “Buy”.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Best Exchange to Buy Filecoin in November 2024

Filecoin is an open-source, decentralized data storage system, a peer-to-peer network of nodes that can store and distribute data.

Filecoin offers benefits like:

1) Security: Filecoin uses cryptography to ensure that files are not tampered with or lost.

2) Decentralization: The storage is distributed across nodes, so a single attack cannot take it down.

3) Cost Efficiency: This decentralized system has no centralized authority, so there are no middlemen, which means less cost for the users.

Our list of crypto platforms to buy FIL in 2024 includes their features, fees, and the reasons for their exclusivity. Bitstamp has established itself as the most popular platform for purchasing Filecoin cryptocurrency. The platform is secure, reasonably priced, and ease-of-use.

1 – Bitstamp – Best Platform for Buying Filecoin

Bitstamp is a cryptocurrency exchange based in Luxembourg founded in 2011 by Nejc Kodri and Damijan Merlak. This seasoned cryptocurrency exchange provides a low-cost Bitcoin marketplace aimed mostly at professional investors and large financial institutions. Bitstamp was established two years after the creation of Bitcoin, making it one of the original Bitcoin exchanges in the crypto market.

Bitsamp is ideal for experienced investors looking for a high-quality Bitcoin trading platform. Nonetheless, it is a fantastic platform for customers who want to buy digital assets once and deposit them in Bitsamp’s web cold storage wallet.

Payment Fee: Unlike most digital asset exchanges, Bitstamp’s payment fees are low. When it comes to deposits, the United Kingdom provides two options. The first option is to make an international wire transfer with a 0.05 percent fee (very low compared to other crypto platforms). The second option is the free Faster Payments option.

The withdrawal charge is also less than the industry standard: 0.1 percent for international wire transfers and 2 GBP for Faster Payment. The one disadvantage of Bitstamp is the excessive fee they charge for credit card cryptocurrency purchases – 5% on any amount.

Minimum Deposit: Unlike most online trading platforms, Bitstamp does not require a minimum deposit to open an account. However, like Bittrex, it has a $50 USD/EUR/GBP minimum order amount, whereas other exchanges may have a substantially higher minimum order size.

Bitstamp trading fees: Bitstamp is often regarded as a low-fee exchange, particularly for high-volume traders. For a daily volume of less than $10,000, the highest trading cost is 0.5 percent (above the average in the industry, which is around o.25 percent ). However, when the investor’s total number of transactions increases, the costs decrease significantly. As a result, if your revenue exceeds $20,000,000, your fees might be as low as 0%. Individual investors could expect to pay a fee of about 0.1 percent when utilizing Bitstamp.

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Around-the-clock phone support.

- Available in over 100 countries.

- No margin trading.

Your Capital is at Risk

2 – Huobi

Huobi Global, headquartered in Singapore, was founded in 2013. Initially based in China, the company relocated to Singapore following China’s cryptocurrency ban. The exchange calls itself a digital asset exchange rather than a cryptocurrency exchange. It supports ICO tokens and allows trading in over 350 cryptocurrencies.

According to the company, the future development of the blockchain economy will result in the creation of new categories of digital assets. Houbi Global has three platforms: one for the entire world, one for Houbi Japan, and one for Houbi Korea. The platform provides up to 5% leverage for margin trading. Huobi Global’s fee structure is very reasonable and comparatively low.

Deposit – The minimum deposit fee is $100 USD; other fees vary by currency, such as deposit, transaction, and withdrawal.

Fee – Those who want to buy cryptocurrency with a credit or debit card must pay a higher fee to Houbi. Maker and taker fees are charged at a flat rate of 0.2 percent. It can also fall to as low as 0.1 percent, depending on the scale volumes.

Houbi Global provides email, phone, online chat, a ticket system, and social media platforms for customer support. It offers a variety of security features, such as 2-factor authentication, cold storage, account freezes, and Bitcoin reserves.

On October 15, 2020, Huobi listed Filecoin and FIL/USDT as the trading pair that have been made available.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

Your Capital is at Risk

3 – Crypto.com

In 2016, Crypto.com, a global cryptocurrency exchange, was created. It is headquartered in Hong Kong and currently services over 10 million dealers in more than 90 countries, enabling you to purchase and sell over 250 cryptocurrencies with cheap trading costs. The unique selling feature of the Crypto.com platform is that it allows customers to stake their cryptocurrencies. By staking or storing them in a crypto.com wallet, users can earn up to 14.5 percent p.a. income. Aside from trading, the exchange provides other services, like staking rewards, Visa card advantages, NFT trading, DeFi products, etc.

The exchange also provides access to several instructional guides via its university portal. This platform is suitable for those who wish to do more with their cryptocurrencies than just hold them.

Security – Crypto.com employs several security measures, including MFA, which stands for multi-factor authentication. It also employs whitelisting to protect customer accounts. The platform employs compliance monitoring to prevent hacks and losses and stores customer deposits offline in cold storage.

On dollar balances, the Crypto.com exchange provides $250,000 in FDIC insurance. Crypto.com provides customer service via email, live chat, and a help page.

Cashback – Besides the Obsidian Card, Midnight Blue Card, Ruby Steel Card, and others, Crypto.com offers five prepaid Visa cards. These cards are accepted anywhere Visa is accepted and guarantees a certain percentage of cash back on purchases. Under certain conditions, the Obsidian card offers the highest cashback rate of 8%. The Midnight Blue card provides 1% cashback, while the Ruby Steel card provides 2% cashback. There is no annual fee for using the card, and ATM withdrawals are also free, depending on the card.

Deposit – This platform’s minimum account balance is $1. The Maker/Taker fees range between 0.04 and 0.40 percent. Credit/debit card purchases are charged at 0% or no fee during the first 30 days of account opening. In addition, users can earn up to $2000 for each friend they refer.

Cryptot.com listed Filecoin (FIL) on 10th December 2020. Users of the Crypto.com App can now purchase FIL at an actual cost in USD, EUR, GBP, and 20+ fiat currencies and spend it at over 60M merchants worldwide via the Crypto.com Visa Card.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

Your Capital is at Risk

4 – Bybit

Bybit is a cryptocurrency trading platform that offers a variety of tools to help crypto traders make the best decisions. The platform is available on the web, mobile, in Chinese, and in English. Bybit was founded by a team of cryptocurrency traders with over ten years of experience in the crypto space. Its co-founder, Sam Kim, is also a partner and head of business development at the Bittrex exchange.

The company describes itself as “the first decentralized cryptocurrency trading platform powered by artificial intelligence.” It aims to provide convenience, efficiency, and safety to its users by offering a variety of tools on its platform. The platform is designed to allow traders to access and trade the most liquid digital assets globally.

Bybit AI-powered bot makes all the trading decisions for its users based on a proprietary model that has delivered consistent profits since its inception. The company offers two primary trading options for its users: a “market maker” and a “market taker” solution. The market maker is only available on the web version of the platform. It has instant deposits, fast execution, low fees, and 24/7 availability.

Leveraged trading: Bybit exchange’s main product offering is perpetual futures with a leverage ratio of 100:1. This implies that they intend to compete with established exchanges such as Binance and Phemex, which offer comparable non-expiry futures contracts.

Fee – Market takers are charged 0.075 percent, while market makers are charged -0.025 percent. As a result, market makers will be compensated when they initiate a transaction. Because of the low fee, market makers are likelier to be active and fill the order book.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

Your Capital is at Risk

5 – Binance

With more than $20 billion daily transaction volume, Binance is one of the most active cryptocurrency exchanges. It provides access to hundreds of assets and a friendly trading environment, simplifying profiting.

Binance’s most distinguishing features are low fees, a comprehensive charting interface, and compatibility with hundreds of coins. Binance is a cryptocurrency-focused exchange that does not offer copy trading, FX, commodities, or other financial services.

Binance employs two-factor authentication (2FA) and FDIC-insured deposits in US dollars (USD). Binance also protects its customers through device management in the United States, address whitelisting, and cold storage.

Fees: Fees range from 0.015 to 0.10 percent for buying and trading, 3.5 percent or $10 for debit card purchases, whichever is greater, and $15 for US wire transfers.

Binance added Filecoin (FIL) to its platform on October 15, 2020, and launched trading for several crypto pairs, including FIL/BTC, FIL/BNB, FIL/BUSD, and FIL/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is limited.

- High fees for credit card deposits

- No copy trading

Your Capital is at Risk

6 – Coinbase

Coinbase was founded in San Francisco and is primarily considered one of the most prominent Bitcoin trading platforms in terms of the user base. Coinbase was the first large cryptocurrency exchange in the United States to go public, debuting on the Nasdaq in April at $381, valuing the exchange at $99.6 billion fully diluted.

Coinbase lets you buy and sell cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and over 50 more. It can also be used to convert between cryptocurrencies and to transfer and receive cryptocurrency. Coinbase displays the current bitcoin price and trend, as well as your portfolio and industry news, similar to stock trading apps. Use the Coinbase Pro exchange to trade, which charges less than the Coinbase leading site. Coinbase Pro is more akin to a broker.

Limit and market orders for Compound can be placed on the Coinbase Pro exchange. The maker/taker fee is 0.5 percent for the first $10,000 in volume exchanged in 30 days, after which it drops to 0.35 percent. You can trade cryptocurrency for free without paying a maker fee if your 30-day volume exceeds $300 million.

On December 9, 2020, Coinbase listed FIL with open trade for trading pairs such as FIL/USD, FIL/EUR, and FIL/BTC.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from the bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

Your Capital is at Risk

7 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that offers its eight million customers various trading options. Derivatives include spot, futures, margin, peer-to-peer (P2P), staking, and lending.

The cryptocurrency platform KuCoin claims to offer the highest level of security and a selection of approximately 400 different cryptocurrencies. Despite its extensive feature set, it is a simple exchange with a straightforward user interface. KuCoin also has one of the lowest transaction fees in the cryptocurrency industry.

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the most well-known cryptocurrency exchanges in the world. KuCoin has evolved into one of the most well-known cryptocurrency exchanges. It has over 8 million registered users from 207 countries and territories worldwide.

KuCoin received $20 million in round A funding from IDG Capital and Matrix Partners in November 2018. Forbes Advisor named it one of the Best Crypto Exchanges of 2021 in 2021.

Deposit and Withdrawal

KuCoin does allow fiat currency purchases of bitcoin, but only through a third-party application. Payments are accepted via credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. The fees, on the other hand, could be exorbitant.

You will also be required to buy a specific amount of one currency immediately. For example, you could spend $200 on Tether (USDT), a stablecoin linked to the US dollar. Tether can then be used to buy additional currencies. You couldn’t just put down $200 and wait for the right moment to invest it. Other exchanges allow you to deposit money and decide how and when to spend it.

Transaction Fees for KuCoin

Kucoin’s trading fee structure is simple. The platform charges 0.1 percent for both makers and takers, making it one of the most affordable Bitcoin exchanges online. If you own the platform’s native Kucoin tokens, you can further reduce your fees.

Kucoin listed Filecoin on its exchange on October 17, 2020, with the trading pair FIL/USDT.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

Your Capital is at Risk

8 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange where users can buy, sell and trade digital coins. The Hong Kong-based portal was established in 2012.

Intermediate and professional traders are more likely to use Bitfinex’s trading area because it has a robust set of chart analysis tools.

Aside from cryptocurrencies, wire transfers are the only way to deposit and withdraw funds. Bitfinex, like Coinbase, is one of the few platforms that let you short cryptocurrencies and use leveraged trading strategies.

Founders: Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange, providing customers worldwide with digital asset trading services.

Giancarlo Devasini has been Bitfinex’s Chief Financial Officer since 2013 and has played an essential role in the company’s expansion. Giancarlo Devasini began his medical career in 1990 after receiving his Doctor of Medicine degree from Milan University.

Is Bitfinex a registered exchange?

Bitfinex Securities Ltd., a blockchain-based investment product provider, has opened a regulated investment exchange (Bitfinex Securities) in the AIFC to provide members with greater access to various financial products. As a result, Bitfinex is entirely unregulated. Despite having its headquarters in Hong Kong, the corporation is registered in the British Virgin Islands.

Fees and deposit limits: Bitfinex charges a 0.1 percent fee for bank transfer deposits. For example, if you deposit $10,000, you will be charged a fee of $10. If you fund your account with cryptocurrency, you will be charged a small fee based on your selected coin.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. If you require funds within 24 hours, you can pay a 1% expedited fee. Alternatively, bitcoin withdrawal fees vary depending on the coin.

Bitfinex listed Compound (COMP) on August 26th, 2020, and opened trading for COMP/USD and COMP/USDT.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

Your Capital is at Risk

What is Filecoin (FIL)?

Filecoin may be more appealing than purchasing Amazon S3 storage buckets or DropBox space and locked into the same cloud storage contracts. Anyone with the proper infrastructure can buy and sell storage on the Filecoin network while setting prices and creating contracts. So let us see how it goes.

Filecoin (FIL) is a cryptocurrency that powers the Filecoin network, a decentralized peer-to-peer file storage network that aims to allow anyone to store, retrieve, and host digital data. FIL tokens are used as payment for these services and as an economic incentive to ensure that files are reliably stored over time. Filecoin is a decentralized storage network in which anyone can rent storage space. Similarly, anyone can purchase network storage. Instead of entrusting essential data to a single company, it can be divided and stored on computers worldwide.

Juan Benet published the whitepaper Filecoin: A Cryptocurrency Operated File Storage Network in 2014, the first term “Filecoin” was used. The proposed blockchain network is similar to Bitcoin, but nodes in the network can store data, which is guaranteed by a proof-of-retrievability component. Protocol Labs is the creator of Filecoin.

Filecoin is sometimes an incentive layer built on top of IPFS. This means users are encouraged to rent out their storage space by receiving payment in FIL tokens. So, can you send Christmas photos to Mars or Venus using Filecoin? No, not yet. IPFS is a peer-to-peer data storage and retrieval protocol designed with a more decentralized approach. Unlike HTTP or HTTPS, it does not rely on centralized servers to store data.

In their 2017 ICO, Filecoin raised more than $250 million, a record. Following that, the Filecoin mainnet was launched in October 2020.

How does Filecoin (FIL) work?

The Filecoin infrastructure is a distributed, peer-to-peer network that aims to provide a new way for companies and individuals worldwide to store data. For instance, people who have spare storage space can become storage miners, essentially in charge of keeping data on the Filecoin network. To store and access data, clients must pay FIL tokens.

Another type of participant is the retrieval miner. They, as expected, allow data retrieval between clients and storage miners and are compensated with a tiny amount of FIL for their efforts. For instance, Filecoin uses end-to-end encryption, and storage providers cannot access the decryption keys. Instead, files are maintained safely across numerous storage locations because it is a distributed system.

So, what distinguishes Filecoin from its centralized competitors? First, it provides a peer-to-peer cloud storage service for enterprises and consumers. The buyer may benefit because several sellers offer the same goods (storage) at varying prices. While you may not always have enough storage for your data, you may occasionally have excess that you can sell. That is Filecoin’s commitment.

Is it Worth Buying Filecoin (FIL) in 2023?

In the ever-evolving landscape of cryptocurrencies, the question on many investors’ minds is whether Filecoin (FIL) remains a viable option in 2023. A comprehensive analysis of its journey thus far suggests a positive outlook. Filecoin’s strategic approach and clear purpose position it to significantly impact the cryptocurrency sector, defying challenges and maintaining its trajectory toward success.

Filecoin, which emerged in August 2017, has endured the volatile crypto market, including the infamous crash of 2018. Initially peaking at $10.30 in January 2018, its value subsequently plummeted. By 2019, Filecoin (FIL) had dwindled to a modest $2. However, signs of recovery appeared in June 2020 with a marginal rebound to $12.10.

In an unexpected turn of events, investors in Filecoin experienced a surge of prosperity in 2021, when the cryptocurrency soared to its all-time high of $237.24. However, this remarkable achievement was soon overshadowed by a drastic decline as the token’s value plummeted to under $35 by the end of the year. Despite this setback, Filecoin demonstrated resilience and gradually recaptured lost ground, eventually reaching $95 before encountering significant correction.

In 2022, alongside the broader cryptocurrency market, Filecoin faced significant challenges due to recurring contractions. However, reports in 2023 indicate a promising resurgence as the platform’s storage capabilities witnessed increased utilization during the second quarter of the year.

As of the most recent data, Filecoin’s current price is $4.12, accompanied by a 24-hour trading volume of $57,880,684. It reflects a 0.50% increase in value within the last 24 hours. Presently occupying the 31st spot on CoinMarketCap’s rankings, Filecoin boasts a live market capitalization of $1,820,251,555. The circulating supply of Filecoin stands at 441,388,572 FIL coins, while the maximum supply remains undisclosed.

Despite the challenges and developments Filecoin has faced over time, its methodical approach and consistent growth trajectory indicate that investing in FIL in 2023 shows promise. However, like any investment, potential investors are advised to conduct thorough research and carefully consider the volatile nature of the cryptocurrency market before making any decisions.

Will the Price of Filecoin (FIL) Go Up in 2023?

The performance of Filecoin (FIL) in 2023 has garnered attention from market observers amidst the rapidly evolving cryptocurrency landscape. Notable growth and strategic developments have positioned FIL to impact the market in the upcoming months potentially.

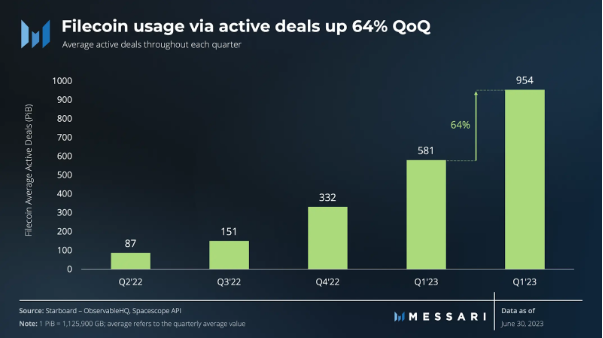

Filecoin, a decentralized storage network, has displayed robust performance in the second quarter of 2023. The storage market, a pivotal aspect of Filecoin’s ecosystem, witnessed a remarkable 64% increase in active deals compared to the previous quarter. This growth in activity is set against a backdrop of a 12% decrease in storage capacity, an intriguing phenomenon that has prompted discussions about the underlying factors.

A closer examination reveals that the increase in storage utilization has played a significant role in shaping this narrative. In just a single quarter, the usage of storage surged from around 4% in Q1 to nearly 8% in Q2. This sharp rise indicates a greater level of engagement with the platform and an escalating demand for its storage services.

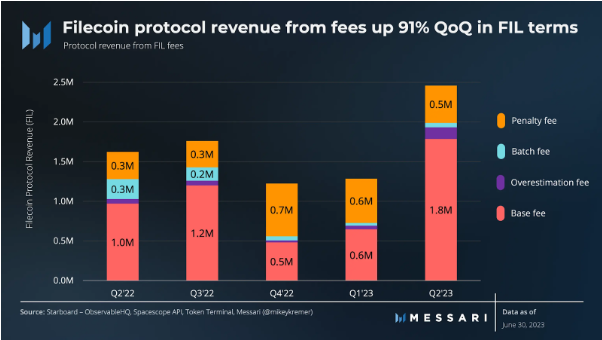

Filecoin has made significant financial progress, demonstrating impressive results. In the second quarter of 2023, fee-generated revenue experienced a substantial 91% increase (equivalent to a 67% increase in USD terms). This revenue surge can be attributed to two primary factors: a remarkable 64% surge in active storage deals from the previous quarter and a notable escalation of 60% in the number of prominent dataset clients.

One of the pivotal developments in Filecoin’s trajectory has been the integration of the Filecoin Virtual Machine (FVM). By introducing Ethereum-style smart contracts through the FVM, Filecoin has diversified its applications, enabling functionalities like liquid staking, perpetual storage, and decentralized computing. This strategic move opens doors to novel use cases, expanding Filecoin’s reach and potential.

The near-term roadmap for Filecoin reveals substantial initiatives. A comprehensive release of the Integrated Programming Capability (IPC) is anticipated in Q3 2022, accompanied by an array of developer tools and informative documentation.

The Axelar Integration project aims to enhance Filecoin’s interaction with the broader blockchain ecosystem. This integration allows developers from various blockchains to access FVM’s capabilities, improving data storage, funding, verification, and fee management.

Stepping back to evaluate long-term goals, Filecoin envisions significant advancements. These plans encompass Layer 2 capabilities, hierarchical consensus, and Sealing-as-a-Service, all geared towards enhancing the platform’s performance. By forging strategic partnerships and fostering collaborations within the data infrastructure community, Filecoin aims to strengthen its position and facilitate sustained growth.

The culmination of these developments, coupled with Filecoin’s expanding functionalities, is poised to impact FIL’s price trajectory significantly. The collective effect of market engagement, technological advancements, and strategic partnerships can potentially steer FIL’s value in the cryptocurrency landscape 2023 and beyond.

Filecoin Price Predictions: Where Does FIL Go from Here?

Among Layer 1 projects, Filecoin holds the 18th position in terms of market capitalization. As for the sentiment surrounding Filecoin’s price prediction currently leans towards bearish, while the Fear & Greed Index stands at 54, indicating a neutral sentiment. Read our predictions if you want to invest in digital cryptocurrency and get a high return.

Filecoin Price Prediction 2023

The technical analysis for Filecoin’s price predictions in 2023 is quite promising. According to those predictions, Filecoin’s price will keep increasing yearly. The maximum level that Filecoin’s price can reach during 2023 is $9.09, while the average price of the coin predicted for the whole year is $7.96.

Filecoin Price Prediction 2024

While different technical indicators give other numbers for Filecoin’s price during 2024, most agree on its growth. According to them, Filecoin’s price will hit $10 eventually, with a maximum price level of $13.46. Filecoin will be traded at $11.56 on average throughout 2024.

Filecoin Price Prediction 2025

The technical analysis of the FIL token indicates that Filecoin’s maximum price for 2025 can reach $19.65. The minimum price of the token will be $11.25, while the average price is expected to be $11.56.

Filecoin Price Prediction 2026

According to the technical analysis, FIL can grow to $28.97 as its highest price for 2026. It is expected to be traded at $25.63 annually, while the minimum price will be $24.76.

Summary

Filecoin is a cryptocurrency expected to grow in value and provide a good return on investment. Filecoin is the first and largest decentralized storage network, where users can rent their unused hard drive space to earn tokens. Filecoin has an open-source, free, and robust platform for developers to build applications and data services of all types. The Filecoin ICO was the most successful in history, with over $250 million raised in just 15 minutes. This ICO was so successful because it solved everyone has problem – how we store our data.

Filecoin is a fantastic answer to the world’s file storage and retrieval inefficiencies. It also empowers the customer, who is less likely to be tied by contracts with large corporations. Filecoin is already in the wild, with a working mainnet and a developed set of utilities. The success of the Filecoin ecosystem will be determined not just by its usage within the cryptocurrency community but also by its ability to lure new people into the world of Web 3.0.

The future growth potential of the Filecoin token appears to be very promising, and if you are interested in purchasing this token, we recommend using the Bitstamp platform. It is a well-seasoned platform, operating since 2011, and offers low fee deposits with a variety of deposit options.

Your Capital is at Risk

FAQs

Any risks in buying Filecoin now?

Depending on whether you want to trade or hold Filecoin, it could be a good investment right now. This statement is a little perplexing, but there is no obvious remedy given Filecoin's recent decrease. Even though some price analysts anticipate the price will grow next year, the price may struggle to break over the resistance level. As a result, predicting whether or not the price will rise again is impossible. Holding may not be the greatest option to make rapid money. However, if you trade, you can profit from market fluctuations and make rapid money.

Is it safe to buy Filecoin?

Filecoin is poised to make a significant impact on the cryptocurrency industry, thanks to a well-thought-out strategy and goal. Filecoin will overcome all obstacles to remain a popular token on the crypto exchange. On a pessimistic scale, this digital asset may not blow the roof off the cryptocurrency market, but it will undoubtedly stand solid on its feet.

Will Filecoin ever hit $100?

In terms of pricing, Filecoin has a lot of room to rise. The value of FIL is projected to rise in the future. According to specialists and business analysts, Filecoin might reach a high of $30 by 2025.