Huobi Global is a leading name in the cryptocurrency exchange space. It was founded in 2013 and has an influential presence in markets across Asia.

Huobi is being preferred by investors for its wide range of features. It is an impressive ecosystem of digital assets facilitating spot trading, derivatives trading, crypto loans, staking, crypto yield products, and various other offerings.

In the sections ahead, we would discuss every aspect and function of this platform to give you a comprehensive review.

History and origin

This platform was founded in 2013 by Leon, an alumnus Tsinghua University, It was acquired by the Huobi Group on May 15, 2013. On August 1, Huobi launched a simulation trading platform, and on September 1 the Bitcoin trading platform launched.

During 2013 it received angel investments from Dai Zhikang and Zhen Fund. While in 2014, Huobi raised a $10 million venture capital investment from Sequoia Capital.

In December 2013, it became China’s largest digital asset trading platform after its trading volume exceeded 30 billion yuan, In Aug 2014, it reached a new milestone by acquiring Bitcoin wallet provider Quick Wallet.

In September 2017, the Chinese government banned initial coin offerings (ICOs) and trading on domestic cryptocurrency exchanges and rendered many people’s holdings effectively worthless including those of users on Huobi’s exchange. In response to this move of the Chinese Government, Huobi adjusted its business and organizational structure to promote global expansion.

In October 2017, the platform expanded its operations into Korea with a new headquarters in Seoul made commenced trading facilities in March 2018.

In November and December 2017, Huobi expanded to Singapore and Tokyo respectively. In March 2018, it announced that it will be launching in the United States.

In August 2018, by acquiring a 74% stake in Hong Kong electronics manufacturer Pantronics Holdings it became a listed entity under the Hong Kong Stock Exchange.

In November 2020, Huobi launches Huobi Labuan to realize a regulated crypto exchange in Malaysia. In September 2021, it announced that it would stop serving customers in mainland China due to new regulations.

Pros and Cons

- Impressive platform for trading

- Top-level security; has been operating for almost a decade without any hacks or security concerns

- Grid trading bot

- Enables as well as margin trading

- Supports crypto staking

- The main exchange supports over 100 cryptocurrencies and tokens

- Alternative HADAX exchange that lists various altcoins

- Active customer support facility

- Does not offer social trading /copy trading unlike eToro

- 2% maker/taker fee; higher than Coinbase Pro and Binance

- Does not support fiat deposits/ withdrawals unlike many other platforms

- Exhaustive process of account registration

Your capital is at risk

Huobi- What does it offer?

Huobi is described as a ‘digital asset exchange’ instead of simply a cryptocurrency exchange. It has its headquarters in the Republic of Seychelles. The exchange supports cryptocurrencies and ICO tokens.

It aims to contribute to the development of the Blockchain economy and believes that the crypto market will welcome fresh categories of digital assets in the future. The Huobi holding company that handles the exchange was founded in Beijing. It then relocated to Singapore after the banning of fiat to cryptocurrency trading and ICOs by the Chinese government.

The exchange has offices in various locations that include Hong Kong, the United Kingdom, South Korea, and Japan. Although the exchange platform was forced to move out of China, the move has not affected its presence. In fact, it has grown significantly ever since with millions of users now using the platform.

Around half of the accounts on the platform are believed to be from mainland China. Huobi also has its own cryptocurrency token named the HT. It runs on the Ethereum blockchain. Instead of launching the token through an ICO, it has been given away to account holders as a loyalty scheme.

They could use it to pay for service-fee packages that are on the platform. These tokens could also be used to vote for new tokens that are supposed to be added to the alternative HADAX platform. Only within 14 days after its launch, $300 million worth of HT was reportedly sold.

Huobi has been one of the oldest operating crypto platforms just like various other platforms such as eToro. This is why it is a long-established name in crypto. Huobi, also known as Huobi Global has a reputation of never being hacked.

It did not have any reported security issues over the years as far as user data or funds are concerned. Huobi does not compromise with information or funds in any manner. In fact, when the Bitmart exchange was hacked, the communities of Huobi and Shiba Inu came together to offer support.

With Huobi, you can participate in spot as well as margin trading. Along with buying crypto on the platform, you can short crypto on the platform or take a long position by using leverage. The exchange platform offers up to 200x leverage on some assets. This is more than many other crypto exchanges available in the crypto market.

One feature because of which Huobi stands apart is its crypto trading bot that uses a ‘grid trading’ system. It reportedly has a 44% backtested 7-day annual yield. The platform weekly updates this ROI performance data. It also provides high-yield crypto staking of up to 50% APY on various assets along with offering a welcome bonus and crypto loans.

It is also preferred by users for its alternative HADAX platform. The platform’s founder and CEO, Leo Li states, “We can’t evaluate every new cryptocurrency because there are simply too many of them. HADAX gives investors the choice to vote for tokens they believe are worth trading.”

Many consider HADAX as something similar to the London Stock Exchange’s AIM exchange. Like AIM supports smaller companies that do not meet the criteria to be listed on the main stock exchange, HADAX allows users to vote for cryptocurrencies that they think are worthy of investment.

The alternate platform supports smaller cryptocurrencies and ICO tokens. Users can use their HT tokens to vote for new altcoins and tokens that they feel should be added to the platform.

The Huobi exchange has something called the ‘Huobi Labs’. This is its own Blockchain incubator that invests in Pre-ICO Blockchain start-ups.

Features explained

Exchange Platform

The Huobi exchange platform is one of the best trading platforms of various financial markets globally that comes with impressive technical features. Features like charting, price feeds, market depth data, profiles of individual cryptocurrencies, etc. are laid out with precision and all of this ensures a user-friendly trading interface.

The alternative HADAX market is a space that supports smaller altcoins and tokens. It has the same functionalities and professional platform interface, making user experiences comprehensive and exciting.

Huobi is considered one of the most impressive platforms for trading cryptos. It is a platform that has emerged quickly as a preferred name that strikes the right balance of providing features and experiences that enhance the engagement of advanced users and an interface that assists novice traders to enter the trading market with ease.

The ‘Smartchain’ analysis and research service sections of the platform are added functionalities that make it stand out among many other available exchanges. It is a value-added feature of the platform that has over 50 different indicators, providing adequate research and insights on a variety of blockchain assets.

Supported Cryptocurrencies

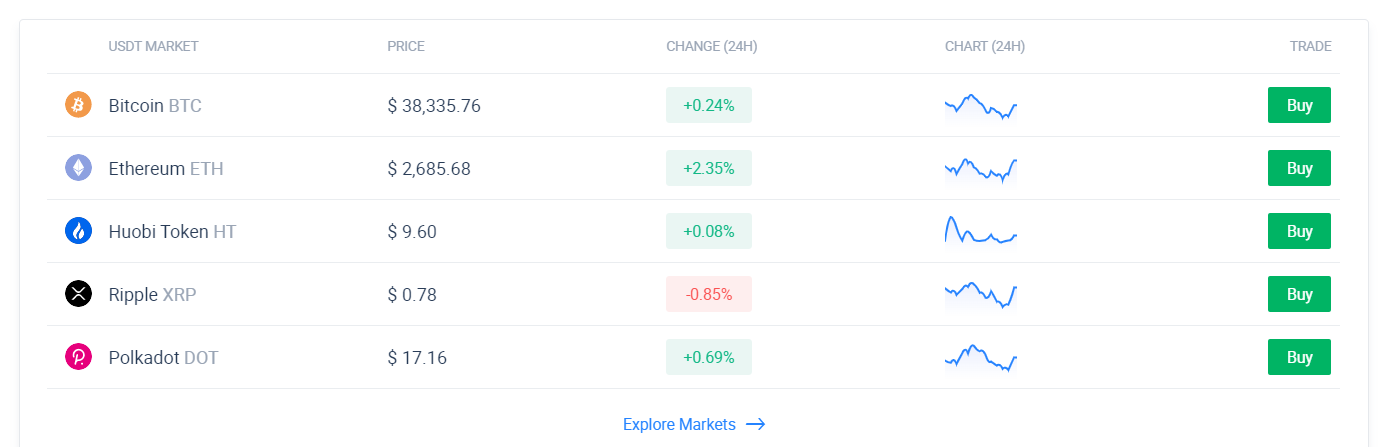

Huobi is known to support the trading of over 400 cryptocurrencies. It keeps adding new assets to the exchange platform.

Different Crypto supported on the Platform

Below are some of the most popular digital tokens and currencies available for traders on this platform:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Dogecoin (DOGE)

- Litecoin (LTC)

- Huobi Token (HT)

- Huobi USD (HUSD)

- Monero (XMR)

- Uniswap (UNI)

- Tron (TRX)

Exchange Markets

The wide range of options in terms of cryptocurrencies and tokens supported across the Huobi and the HADAX alternative exchange has generated widespread acclamation for the platform.

There are over 400 cryptocurrencies and tokens listed on the main exchange. The alternative HADAX exchange supports the trade of many small altcoins and tokens.

One disadvantage of Huobi and HADAX is that both these platforms do not support fiat currencies. This is because of regulatory pressures from mainland China as the majority of the platform’s users are still from this region. To offer the price stability of fiat currencies, it uses Tether’s fiat proxies.

Your capital is at risk

Huobi Grid Trading Bot

Grid Trading is a trading strategy adopted by traders among the many strategies available on various platforms. With gird trading, you can short and long high automatically in a specific price range. Grid Trading robots assist users to execute the strategy without any errors.

As long as the crypto price is not distorting the set range, the grid trading bot continues to trade. In case the price breaks, grid trading will be suspended. As soon as the crypto returns to the set price range, the bot will continue its operations.

Important components Huobi Trading Bot

- The Lower Limit: It refers to the lowest price of the grid. The bot will not place orders if the market price crosses this limit.

- The Upper Limit: The highest price of the grid. If the market price crosses this limit, the bot will not place orders.

- Grid Number: It is counted by splitting the price range into multiple smaller fields.

- Take-Profit Price: The Take Profit Price is the price at which the Huobi bot automatically closes the order and takes a return before the price comes down. The Take-Profit price should always be higher than the highest price.

- Stop-Loss Price: The stop-loss price setting must be less than the lowest price. Whenever the trading crypto price falls to the Stop Loss Price, the bot starts selling the assets at a loss to prevent higher losses.

- Profit Margin Per Grid: It is calculated based on the backtesting after setting the parameters.

- Knowledge Test: Passing the knowledge test is mandatory before using the Huobi grid trading bot.

Different modes with Huobi trading bot

The two modes of Huobi Grid Trading bot are Manual and Auto-

- Manual Mode: In this mode, the traders manually set the grid parameters. These include upper and lower limits, grid number, digital assets that need to be invested in, etc. In manual mode, it is also possible to set the Stop Loss and Trigger Price. The manual mode is more suitable for seasoned traders with significant trading experience.

- Auto/ AI Mode: In this mode, the Huobi in-built system sets the most appropriate parameters. These are decided according to the Auto mode’s historical data. As a trader, you only need to set the investment price in this mode. The AI mode does not allow fixing the Stop Loss. Novice traders and beginners with no experience or limited knowledge of the trading space can opt for this mode.

Huobi Trading Bot: Fees

The in-house crypto bot of Huobi does not charge any fee. Only trading fees are applicable..

Huobi Trading Bot: Withdrawal Limit

The withdrawal limit for verified users is 100 BTC and for unverified users is 1 BTC, respectively.

Supported Trading Pairs

Currently, Huobi Global has 32 trading pairs, including the top pairs like BTC/ USDT, ETH/ USDT, and HT/ USDT. In April 2021, Huobi added around ten trading pairs to Grid Trading, including MATIC/ USDT. The maximum amount each trading pair a user can invest is 5,000,000 USDT.

Steps to use the Huobi Grid Trading Bot

- Log in to your Huobi account.

- On the top menu, click on “Spot Trading” and then “Trading bot.”

- Select “Trading bot” from the drop-down list.

- Select the pair you want to trade.

- In the Auto section on the right-hand side, enter the parameters.

- Huobi mentions the minimum investment amount in the investment textbox for that particular coin.

- Click on “Continue.”; A dialog box will appear

- Read the details and other instructions and then click on “Confirm.”

Huobi trading bot: the risks

There are certain risks of using the Huobi trading bot. As every trading platform/ feature and asset comes with investment risks, the same is with this feature. The risks are as below-

- If the trading pair’s prices go below the set range, the grid trading bot will stop placing orders. It will thus incur losses. Also, in case you have set a stop-loss price, the grid strategy comes to a close if it gets triggered.

- If the price rises beyond the set range, the grid bot will stop executing orders, and it will resume placing trade orders only when the price falls in the range. In this case, you will not earn any profit when the price rises.

- Another risk of the grid trading bot at Huobi is that it places an order according to the set price range and grid quantity. Some users may set the grid quantity very low. In such a scenario, as the price fluctuates between the two points, an automatic order will not be performed by the system in case of a low capital use efficiency.

Pros and Cons of Huobi Trading Bot

- Over 30 crypto pairs for trading bot

- No fee is charged for using the feature

- Ensures high security

- The bot is in the initial stage

- No varieties offered

Your capital is at risk

Security

Huobi is known for keeping industry-standard security features in place. Like many other regulated platforms, Huobi also comes with commendable security features. It is known to take significant cyber security measures to protect the exchange and the traders operating on it.

Built on an advanced distributed system architecture, the exchange is highly secure. Over 98% of assets are kept in cold storage wallets that come with multi-signature. This does not allow accessibility of the stored cryptocurrencies online.

In the last many years of operation, the exchange has not experienced any breach in security. It can thus be counted among the safest exchange platforms available in the trading space. With such measures and features, it guarantees the highest standards of cryptocurrency.

Apart from holding funds in multi-signature cold wallets, Huobi has a 20,000 BTC Security Reserve Fund. This was set “to cope with extreme security accidents”. This shows the extent to which the platform has taken measures to make sure that funds and user information are secure and out of reach of potential hackers.

Huobi has been facing many challenges as far as regulation is concerned. Huobi Global is an unregulated entity in the Republic of Seychelles. This essentially means that the exchange may not be operating under jurisdictions even though users there are granted access to the platform.

An announcement with regard to regulations made by Huobi in November 2021 was that it was closing accounts of users based in Singapore as it needed to comply with the country’s local laws. This made Singapore a restricted jurisdiction on the exchange.

For crypto spot trading in Gibraltar, the platform has recently received regulatory approval. It already holds a distributed ledger technology (DLT) provider license from the Gibraltar Financial Services Commission (GFSC).

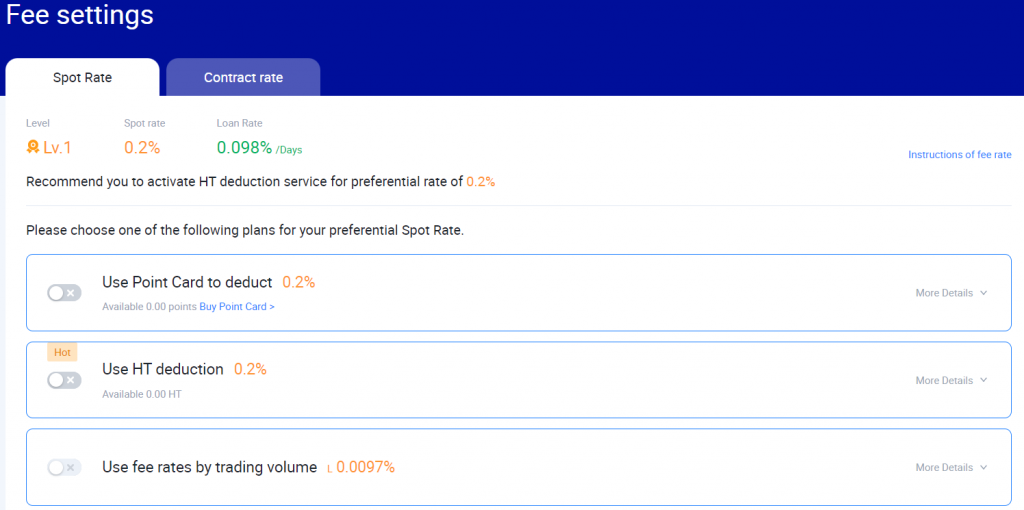

Fees

All deposits and withdrawals across accounts on the Huobi platform are made in cryptocurrencies. Although the exchange earlier supported Yuan and USD deposits and withdrawals, it had to discontinue transactions in fiat currencies as a response to the Chinese government’s crackdown. It does not charge any fees for deposits.

Trading on the platform has a flat 0.2% taker and a maker fee. This might dip to 0.1% on a sliding scale based on trading volumes. Huobi’s fee structure is considered better than many other leading platforms available to investors globally.

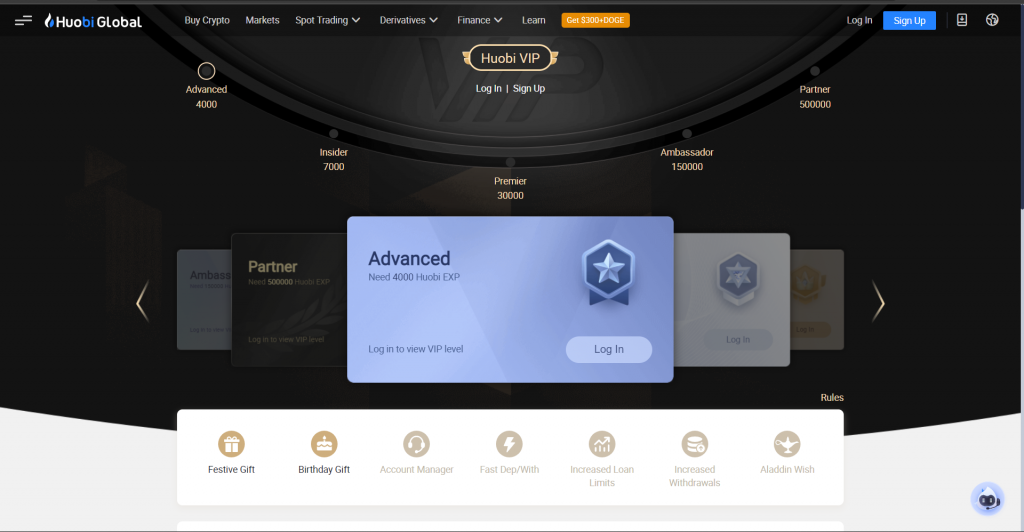

Huobi’s VIP membership

The VIP trading group of investors is offered discounts by Huobi. This depends on different levels of membership.

When the membership level is higher, the discount also goes up. The calculation is listed below-

- VIP 1 – 10%

- VIP 2 – 20%

- VIP 3 – 30%

- VIP 4 – 40%

- VIP 5 – 50%

Experience of Trading

Huobi Global is available as a web-based platform and a mobile app supported on both Android and iOS devices. As mentioned earlier, the platform offers VIP account tiers. This is decided on the basis of a user’s number of Huobi Experience (EXP) points collected.

EXP is earned and accumulated as per trading volume and cryptocurrency holdings that users have on the platform. Based on the last 30 days’ collection of the number of EXP, a user receives account tiers that include Advanced, Insider, Premier, Ambassador, or Partner. VIP account holders have various benefits.

These range from gifts, increased limits, a personal account manager, etc.

Customer Support

Huobi offers excellent customer support. This is available in English and Mandarin. Users can reach the customer service agents via telephone (in of the many country offices it has) and through email tickets. It also has an online chat support facility.

The platform also has several social networks and messaging app communities. These are additional spaces where you could put your queries across. Generally, the executives take between 2 to 3 hours to respond to email tickets. The exchange has reliable customer service agents, who are well-trained and offer the required assistance to users.

Compatible Platforms

Huobi can be accessed and is available on web-based platforms and a mobile app so that you can participate in on-the-go trading of cryptos. The exchange platform is available for Windows, Android, Mac, and iOS devices.

Social Engagement

In April 2021, Huobi Group announced a $1 million BTC and fiat currency commitment to UNICEF. This was to contribute to innovations and blockchain development that would impact children. Huobi gives away funds to the UNICEF CrytoFund and UNICEF’s Innovation Fund through Huobi Charity Limited.

Both of these funds seek to secure cryptocurrency and finance open-source technologies that would lead to social welfare and particularly impact children.

Huobi Charity’s vision is to contribute to the impact of crypto on children’s wellbeing. It also wants to address global social concerns like education, poverty, and healthcare.

From the donation, 7 BTC estimated at $350,000 would be given to the UNICEF CryptoFund. The rest of the fund will go to the UNICEF Innovation Fund to contribute to the creation of a digital financial future.

Customer Satisfaction

Many users find the Huobi platform complex. Although the regulatory challenges of the platform have added to some resistance, many users across the globe find it suitable to trade cryptos.

Some users have reported issues related to funds withdrawals. Some users also shared that the platform allowed GBP deposits but restricted UK-based investors from trading cryptos.

Huobi account

The account interface on the platform is simple and convenient. There are certain factors to consider like the version of Huobi and the user’s geographical location. Huobi’s international site only works outside the US. America-based users can use Huobi US or HBUS.

Users fund it difficult and confusing to find the right international website amidst huobi.com, Huobi.pro, hbus.com, and hbg.com. As far as the privacy and security of users and funds are concerned, Huobi has two-factor authentication for registering and creating an account. This is significant to prevent fraudulent account creation or other activities.

Opening your Account with Huobi

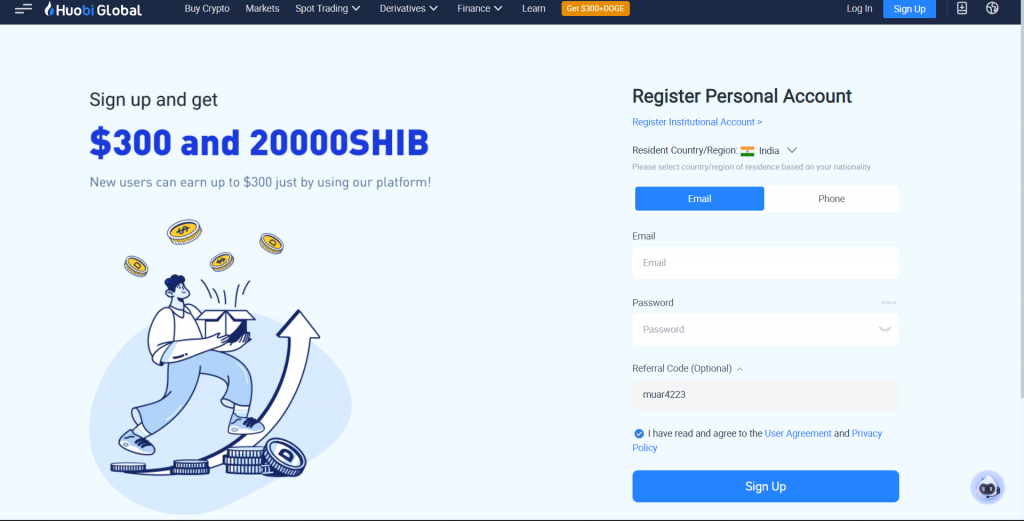

Opening an account with Huobi is a hassle-free process.

You just need to follow these simple steps to get yourself registered in no time:

- Visit the official site of Huobi

- Click on “Sign Up” in the top right corner.

- To sign up and create an account on Huobi, you must enter an email address and a password.

- After filling in, click on “Sign Up.”

- You will receive a verification code in your email

- Verify your email address with the help of the confirmation email that you receive from Huobi.

- Once the email address has been verified, you can easily access the platform and explore the wide range of features and products offered by it.

- Now log into your account and click on your profile in the top right corner.

- From the drop-down list, select “Identification.”

- Upload your document and scan your image for the verification process.

- You will get verified within 24 hours.

With the basic registration, you can participate in low trading and withdrawal limits. If you wish to increase those limits, you must complete the ID verification by uploading a government-issued identification document. This verification process takes only a few minutes.

Huobi provides rewards that are paid in cryptocurrency. These are deposited into the account of users when people sign up, complete ID verification, and deposit funds.

Your capital is at risk

Payment Methods

Huobi ensures flexibility and a wide range of choices in payment methods to users. Although Huobi does not offer fiat deposits directly, you can make instant fiat-to-crypto deposits by using the Banxa service.

It is available for all Huobi users except for the ones based in China and the US. You can use this service on the buy crypto page.

The service is available for users in over 150 countries and they can conveniently use this option to purchase cryptocurrency via multiple methods of payment. These payment methods are listed below:

- Visa/ Mastercard for users across 150+ countries

- POLi/ PayID/ BPAY/ Newsagent/ Australia Post for Australia-based users

- Countries that support Apple Pay is available

- SEPA/ Sofort-Klarna for the European Union-based users

- Faster Payments the United Kingdom-based users

- iDEAL for Netherlands-based users

- Interac for users who are based in Canada

Huobi Token

The platform’s own token Huobi Token (HT) is a virtual currency used as an accounting unit on the platform. This token, besides being traded on this platform, is traded on other platforms and exchanges as well.

It runs on the Ethereum Blockchain and meets the EPC-20 standard. HT price was given out as a loyalty scheme to account holders as a part of the loyalty scheme.

HT gives users many advantages like the right to slash the crypto trading fees on the exchange in half, allowing users to engage in governance decisions regarding the exchange, and participating in several CEOs.

Fee reduction on Huobi using HT is an easy process. Users must hold HT tokens in their wallets. They need to select the option to use HT from the token configuration panel for trading fees.

Additionally, there are VIP memberships available to users that they can book to reduce the same fees to a maximum of 65%.

Houbi Earn/Staking

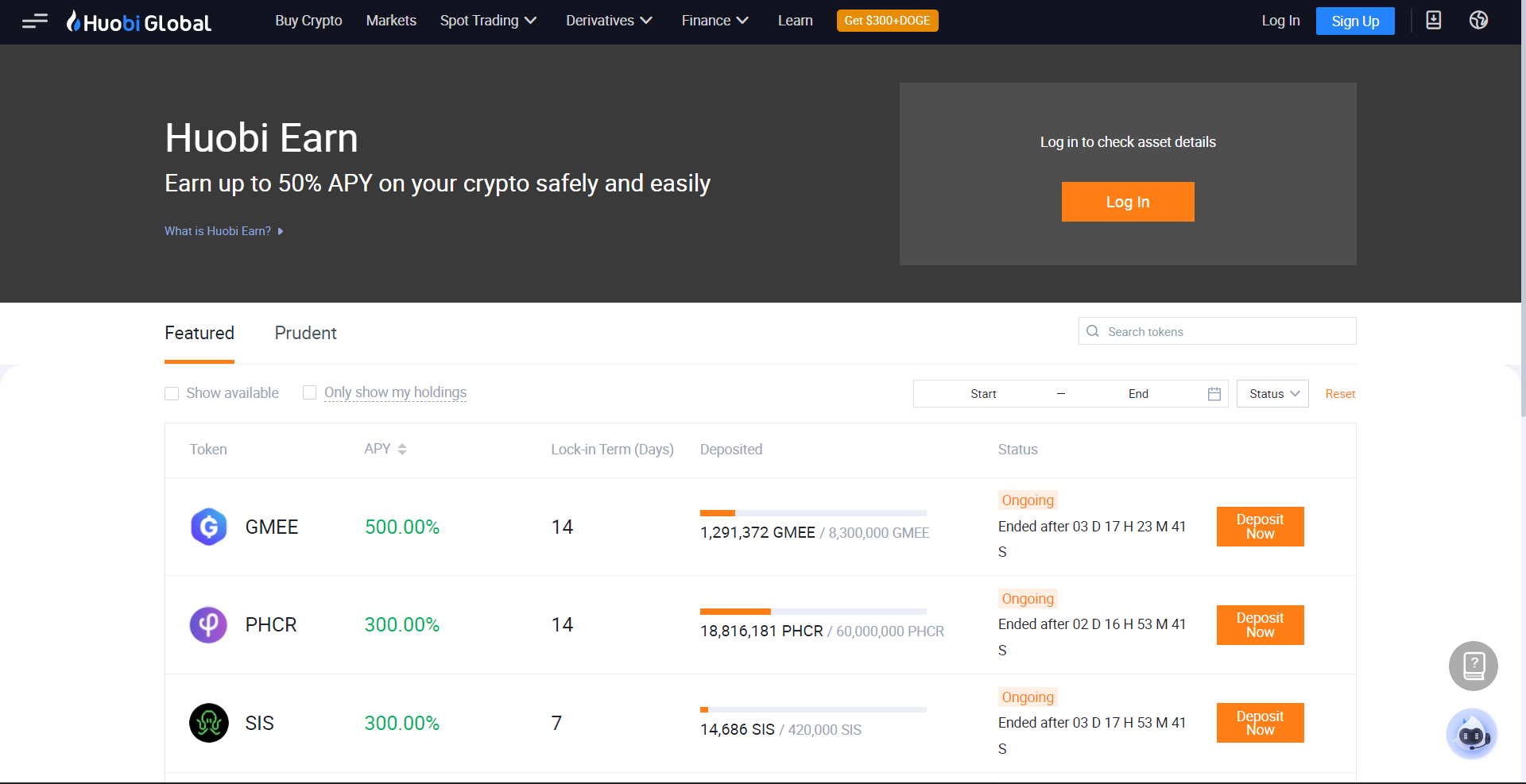

Huobi Earn is an investment product of Huobi Global that users can use to earn passive income on the crypto assets that they hold. The tool offers flexible and fixed staking services to users along with structured earnings.

So, users can use this tool and subscribe to flexible earnings or fixed earnings and transfer portions of their holdings accordingly. This will have added benefits for them rather than simply holding on to their assets on the platform.

It offers staking services for Proof-of-Stake with the objective of preventing the depreciation of coins. Your earnings can be redeemed easily without any extra fees or redemption penalties.

Your capital is at risk

How can you use Huobi Earn?

- Login to your Huobi account.

- Click “Finance” on the top menu.

- Select EARN from the drop-down menu.

- Following this, select Flexible, Fixed or Featured staking term as per your suitability.

- Select your desired token.

- Enter the amount you wish to deposit.

- You have the option of choosing to activate Auto Transfer.

- Read and agree to the terms carefully.

- Click “Subscribe.”

Huobi Flexible Term

By opting for Flexible Earnings, you can earn daily-APY without lock-up periods. This provides added flexibility to users as far as their cryptos are concerned. When you go for Flexible terms, you have lower risks since the tokens can be withdrawn at any moment.

Owing to this reason, the APYs are not as high as in the case of fixed earnings. So, when you opt for flexible terms, your cryptos are locked up for a flexible time period. You also have the option of “auto-transfer”.

If you opt for this option, the amounts that are in your exchange account will be transferred automatically into the earnings account. This happens at 6 pm every day.

Huobi Fixed Term

As the name suggests, Fixed Term allows you to lock your tokens for specific time periods. The risks are higher with the fixed term as you do not have the option of withdrawing your tokens until the closure of the pre-decided period. This also means that there is scope for higher rewards or APYs.

When the stipulated period of the fixed term ends, the deposited amount in your account along with the earned interest on the cryptos are redeemed and transferred automatically to your Exchange account.

First-timer Staking

On the first-timer page, anyone that’s interested in staking their crypto can try it by holding cryptos for a locked-in term of 7 days.

The APY, up to 88% will attract new users and show them the power of crypto staking. The APY will drop if the users choose to stake more crypto on the fixed or flexible rating.

Huobi ETH2.0 Staking

The ETH2.0 proof-of-stake and ETH2.0 one-click function was launched by Huobi in Jan 2021. You can use this function to pledge ETH as BETH with just one click. This is how you can participate in ETH 2.0 proof-of-stake mining. You may check the rules and additional relevant information on Huobi’s website.

Huobi PrimePool

Huobi PrimePool is another feature that can be used by investors to stake the latest and trending coins. It has a comprehensive list of different cryptos so that users can easily choose a coin to stake by going for different interest lock-up periods.

Huobi Wallet

Huobi Wallet is a secure and professional DeFi Wallet. It is a multi-coin wallet, which gives the users 100% control of their private keys. That means, it never has any access o the private keys of the users.

The private keys of your wallets are stored locally on your phone through multiple encryption algorithms to ensure the security of digital assets. It provides multiple secure wallet backup options to prevent loss or theft of holdings. IT supports 20 wallet types.

It is available as the Huobi Wallet application. Users can download the Android and iOS versions of this application from the respective online app stores.

Huobi Referral Program

Huobi Referral Program allows its customers to earn commissions by referring other users. When an existing user refers the platform to another user, the referee gets a 40% fee as a cashback once the referred investor starts to trade. If you invite a user to the platform, you may receive the earned funds either in USDT or as Points.

Huobi Invite has a complete list of traders who have been referred to the platform by existing users. They also have a leader board which is visible on the invite page.

You may visit the Huobi website for more details on the Huobi invite program

Comparison with other Cryptocurrencies exchanges

Huobi vs eToro

Regulation

While Huobi is not a regulated platform, eToro is a highly regulated platform. Both these exchanges are popular cryptocurrency platforms. eToro is available in the United States while Huobi Global platform is not available to US-based users.

Huobi is more suitable for advanced traders and eToro is beginner-friendly. Both are preferred by investors for the variety of features they offer. Huobi has many indicators for advanced technical analysis, while eToro is not chosen by seasoned investors looking for advanced technical analysis.

Both the platforms offer top-notch security features. eToro’s security and safety are due to the wide regulations it has from various jurisdictions.

Huobi offers almost the same level of security despite not being a regulated platform. Both eToro and Huobi are among the most trusted platforms in the industry. These aspects attract many investors and they prefer the two exchange platforms for hassle-free trading.

Unique features

Huobi’s unique features include its grid trading bot. eToro’s unique features are copy trading, social trading, and copy portfolio tools.

Leverage, deposits, withdrawals, fee

Huobi offers up to 200x leverage for certain cryptocurrencies. eToro offers 30:1 for major currency pairs, 20:1 for non-major currency pair, major indices, and gold, 10:1 for commodities except gold and non-major equity indices, 5:1 for individual equities, 2:1 for cryptos.

Both Huobi and eToro do not have deposit charges. eToro has currency conversion charges (except for USD).

Trading on Huobi has a flat 0.2% taker and maker fee, while eToro charges spread. The dip in charge on Huobi might go down to 0.1% on a sliding scale based on trading volumes. eToro has flat $5 withdrawal charges.

eToro enables instant deposits through Paypal, Neteller, Skrill, etc. while Huobi does not support fiat deposits.

KYC

Although both these platforms have KYC, the process on eToro is more comprehensive compared to that on Huobi. The basic KYC on Huobi lets you trade lower amounts and for increased limits, you will have to upload the required documents and verify your identity. On eToro, the complete KYC is mandatory for all.

Compatibility

Both the platforms have web-based accessibility which can be viewed on a desktop or a Mac. They also have mobile apps available for Android and IOS devices.

Customer Support

The two exchanges have active and committed customer support services. The customer support service on both platforms can be acquired through various channels including live chat. While beginners prefer eToro to other platforms, Huobi is mostly chosen by advanced traders with more trading experience.

Huobi vs Bybit

Regulation

Both Huobi and Bybit are not regulated. These exchanges are popular among cryptocurrency enthusiasts. Huobi Global and Bybit are not available for traders based in the United States.

Huobi and Bybit both are more suitable for advanced traders. Although these platforms might be opted for by beginners, they might find it difficult to navigate through the exchanges. The two platforms have many tools and indicators suitable for advanced technical analysis when it comes to trading.

Both the platforms have advanced security features. Huobi and Bybit offer industry-standard security features despite not being regulated. These are among the reliable platforms in the industry across the globe.

Due to such features, both platforms have been able to attract investors throughout the world and ensure the required safety of funds as well as of user information.

Unlike Huobi, Bybit commits to zero downtime. It repeatedly handles 100,000 transactions per second. This aspect makes the platform faster than Huobi and other leading platforms across the industry. Users prefer Bybit over other comparable platforms so that they can trade without any interruptions.

Unique features

Huobi’s unique features include its grid trading bot, while Bybit does not have a trading bot.

Leverage, deposits, withdrawals, fee

Huobi offers up to 200x leverage for certain cryptocurrencies while Bybit offers crypto derivatives exchange up to 100x leverage.

Huobi and Bybit do not have deposit charges. Bybit has a Dual Price Mechanism, protecting investors from trade/ price manipulation. They can set stop-loss and derive profit simultaneously on Bybit while placing a limit order.

Trading on Huobi has a flat 0.2% taker and a maker fee. It might go down to 0.1% on a sliding scale based on trading volumes. Bybit has varying withdrawal charges based on assets (e.g., it is 0.0005% for BTC).

Huobi does not support fiat deposits. Bybit does not handle fiat deposits directly.

KYC

Huobi has both a basic KYC process and a comprehensive one when you wish to increase your limits and acquire other features on the platform. Bybit effectively has no KYC process. You will have to complete its KYC process only when you want to withdraw 2 BTC per day. Huobi as well as Bybit have user-friendly interfaces.

Compatibility

The Huobi and Bybit have web-based platforms that are accessible on a desktop or a Mac, and mobile apps for Android as well as IOS devices.

Customer Support

Both exchanges have dedicated customer support. The customer support service of Bybit operates 24/ 7. Huobi has an active live chat option when it comes to acquiring custom support services. Owing to their indicators and tools, both platforms are preferred more by seasoned investors than by beginners.

Huobi vs Binance

Like Huobi, Binance is a cryptocurrency exchange preferred by advanced traders. Binance offers a wide range of currencies and futures. It is known for charging low fees and having advanced trading tools just like Huobi.

It lists various cryptocurrencies on the platform. Binance has many ways of depositing funds into user accounts while Huobi does not allow fiat deposits. If you use Binance, you can go for either crypto-to-crypto or fiat-to-crypto trading.

Binance and Huobi are not available for users in the U.S. Binance have varying charges for trading. Huobi has a flat 0.2% taker and maker fee for trading. The dip might go down to 0.1% on a sliding scale based on trading volumes. The highest spot trading fee is 0.1% on Binance.

Features

While Huobi offers a grid trading bot, Binance provides attractive passive income methods (but these involve many risks). Traders on Binance can earn up to 30% APR on certain cryptos by opting for the staking program. By putting assets into a flexible savings account. Users can have consistent rates on Binance.

Investors with good trading experience can add liquidity to token pairs to earn income on Binance. You must understand the risks well before you participate in these programs. Binance has decentralized finance (DeFi) tokens, Bitcoin (BTC), altcoins, etc. Huobi has its alternate platform HADAX, which has many altcoins.

Leverage

Binance offers leveraged tokens so that investors can multiply their positions. Huobi offers up to 200x leverage for certain cryptocurrencies. There are risks involved while using leverage and you must opt for the feature by understanding the risks thoroughly.

Regulations

Huobi and Binance are not regulated. Binance has received the attention of regulators in the U.K., Japan, Canada, Singapore, and Thailand.

User-friendly

Although both these platforms have user-friendly interfaces, they are suitable more for advanced traders. Binance has a huge market selection and in-depth dashboards. Huobi has advanced indicators for technical analysis. Moving smoothly across these platforms will need experience in the trading space.

Huobi vs Coinbase

Regulation

Huobi is not a regulated platform.

Coinbase complies with the applicable jurisdictional laws and regulations where it carries out its operations. United States Coinbase, Inc., has the license to operate in most U.S. jurisdictions. Coinbase has money transmission licenses. It covers US dollar wallets and transfers in most states and digital currency wallets and transfers in some states.

Coinbase is registered with FinCEN as a Money Services Business. It complies with financial services and consumer protection laws that include The Bank Secrecy Act, The USA Patriot Act, most states’ money transmission laws, and corresponding regulations.

Unique features

Huobi has a grid trading bot. Coinbase provides a wide selection of cryptocurrencies to users and it has Coinbase Pro which is an additional platform attached to Coinbase. It has many advanced trading options including many charting tools, real-time order books, has lower fees, etc.

Leverage, deposits, withdrawals, fee

While Huobi offers up to 200x leverage for certain cryptocurrencies, Coinbase does not offer margin trading.

Huobi does not have deposit charges. The withdrawal charges on Coinbase vary according to cryptocurrencies. Trading on Huobi has a flat 0.2% taker and a maker fee. It might go down to 0.1% on a sliding scale based on trading volumes. There is no fee when you spend USDC with your Coinbase Card.

It has a flat 2.49% transaction fee on all purchases made with other cryptocurrencies. This also includes ATM withdrawals. Huobi does not support fiat deposits.

KYC

The KYC process is required on both Huobi and Coinbase platforms. This process ensures the users’ safety and keeps their finds protected. It also prevents others from registering and creating fraudulent accounts or hacking.

Compatibility

Both Huobi and Coinbase platforms are available on a desktop or a Mac. They also have mobile apps for Android and IOS devices. While Coinbase Pro is attached to Coinbase, HADAX is the alternate platform of Huobi.

Customer Support

Both exchanges have committed customer support services. Coinbase customer support service operates 24/ 7. Huobi has an active live chat facility. Both Coinbase and Huobi phone support and various other channels.

eToro vs Kraken

Huobi is not a regulated platform.

Kraken complies with the legal and regulatory requirements in the jurisdictions where it operates. It is regulated by FinCEN, Kraken Bank is regulated by the Wyoming Division of banking.

It is registered with the FSA (Japan), and as a Money Services Business (MSB) with FinCEN (USA) and FINTRAC (Canada). It is regulated by the FCA (UK) and the AUSTRAC (Australia).

Unique features

While Huobi has a grid trading bot, Kraken has a comprehensive security approach, crypto pricing benchmarks, account management services, over-the-counter personalized services, etc.

Leverage, deposits, withdrawals, fee

Kraken offers margin trading up to 5x leverage, While Huobi offers up to 200x leverage for certain cryptocurrencies. Huobi does not have any deposit charge. Kraken has varying withdrawal charges based on the cryptocurrency.

KYC

The KYC process is mandatory for Kraken and Huobi. While Huobi has the basic KYC and the complete KYC for added features and increased limits, Kraken offers different levels of verification as per the account type- Starter, Express, Intermediate, and Pro.

Compatibility

Both these platforms, Huobi and Kraken can be accessed on the web using a desktop or a Mac. They are also available on mobile apps for Android and IOS devices.

Customer Support

Huobi and Kraken offer active customer support. These are various channels of communication like live chat, phone support, email, etc.

Your capital is at risk

Is Huobi Legitimate?

Like other platforms, Huobi has the scope for improvements. Owing to its long-established reputation, it may be considered a legitimate platform. Many traders have positively reviewed the platform based on their trading experiences.

Although Huobi is not regulated, it has a good security mechanism. It also has HADAX, its alternate platform. On this platform, users can vote for cryptocurrencies that are worth investing in according to them. The alternate platform supports smaller cryptocurrencies and ICO tokens.

Users can vote for new altcoins and tokens by using their HT tokens. These tokens are then added to the platform based on their voting. Huobi has attracted millions of investors globally because of its interesting features and services.

Huobi offers up to 200x leverage on select cryptocurrencies. It has multi-signature cold wallet storage makes it preferable to other platforms in the industry. It has a mandatory KYC process. The platform should opt for regulation from various jurisdictions which will add to its credibility and reliability.

Since the crypto market and exchanges are becoming more and more dynamic, it would be better for the platform to have regulations and licenses like others such as eToro to add to their reputation. It will also help the platform to expand its operations in many more countries.

Huobi’s movement from China to elsewhere

Huobi became very popular as an exchange platform and emerged as one of the biggest crypto exchanges in China. It offered enough liquidity to Bitcoin traders.

The change in the regulatory norms in China forced Huobi out of the country. In 2017, it had to move the crypto trading services in the platform abroad. The company subsequently set its base in Seychelles, setting a new headquarter in the Republic of Seychelles.

It then focused on expanding its presence and operations to other Asian markets and throughout the globe. Huobi Global has been growing its clientele outside of China since then. It has now become one of the most liquid crypto exchanges globally.

A report by Bitwise Asset Management in 2019 had made accusations against Huobi Global of inflating its reported trading volumes by participating in wash trading.

Denying the accusations, Huobi announced that it had taken adequate measures to prevent wash trading on the platform. After a few weeks of the report released by Bitwise, Huobi witnessed a dip in its trading volumes.

Owing to regulatory challenges, Huobi Global’s U.S. arm, HBUS closed in late 2019. In the year 2021, it was also forced to add Singapore to its restricted jurisdictions list. Huobi also announced the closure of its Beijing-based entity, informing remaining users in mainland China of the closure of accounts by the end of 2021.

Despite various setbacks, Huobi is proving to be an attractive crypto-asset platform, composed of its own blockchain, Huobi Eco Chain; the Huobi Token (HT); a dollar-backed stable coin called HUSD; and more. It now reportedly serves millions of users across more than 170 countries.

Volatile Crypto Market

The volatility of the crypto market is not a new notion for people who have experience in trading cryptos. Crypto assets are highly volatile in nature and they have the tendency to fluctuate every passing minute.

In just a matter of a few minutes, the price of a cryptocurrency can shoot up or down unimaginably. Bitcoin’s price rose over 100% in just six months last year, with its all-time high reaching $68,000 in price.

Critics consider these as important parameters when we are trying to understand why cryptocurrencies cannot replace fiat currencies. Experts have always recommended users safely invest in these currencies and carry out substantial research before investing in any digital asset.

Since the crypto market and other investment options are highly volatile in nature, you should only invest an amount that you are ready to lose in the worst-case scenario.

Cryptocurrencies are exciting for investors simply because they are unpredictable. Although you may engage in many processes to speculate a cryptocurrency and predict its price, the exercise does not go beyond mere speculation. This is one reason why you should go for a reliable exchange platform so that your investment is free from other unwanted risks like a fraud.

No exchanges can guarantee profit for your crypto investment. The regulated and the trusted ones can make the trading experience hassle-free and enable you to engage in trading by using exciting tools and features.

Cryptocurrency Storing

Like other assets, cryptocurrencies also need to be stored. Since they are lines of computer code, storing them in a physical location is not possible. If you want to store your crypto funds, you will need a crypto wallet. Along with storage, crypto wallets also allow you to execute trades, monitor market trends, and make crypto-to-crypto swaps.

How to choose the right crypto wallet? Well, it involves a lot of research and the consideration of various factors. To make sure that your digital assets are secure, you must go for the best crypto wallets available for mobile as well as desktop.

You can opt for either cold or hot storage based on your requirements. Read our reviews on crypto wallets for a detailed understanding.

Cryptocurrencies Selling

Selling your cryptocurrencies is another task you might need help with. Whether you no longer want to hold your crypto asset or you want to encash the profits made with the investment, there are different ways of selling cryptos.

The process is the same as buying cryptos. Since your holdings are in your crypto digital wallet, you can initiate the withdrawal request without any hassle.

Although you have many means of selling your cryptos, the safest way would be to rely on exchanges like Huobi. With a trusted exchange, you can easily withdraw your holdings and the process is executed without added risks.

How do we select the Best Broker and how does Huobi stand out?

Huobi is one of the best platforms to start with your trading journey. It makes the process seamless by guiding you step-by-step throughout the trading/investing process along with a guide on what not to do on the platform.

If you are a newbie in the world of digital currencies, Huobi is the best platform to begin with. It comes with fewer technicalities involved.

Some important points to consider before choosing Huobi:

- Fees

It is the most important parameter to consider while choosing a broker. You must know how much the broker is charging for trading, deposits, withdrawals, etc.

Trading commissions add to the disappointment of investors many a time. Although it is an industry norm to offer commission-free trades, not many platforms practice it. You should also look for hidden fees and inactivity charges so that you can go for the right broker.

- Methods of Payments

Payment methods are another necessary parameter. The more payment channels an exchange platform offers, the easier it becomes to fund your account. While some brokers allow you to buy cryptos through PayPal, others do not support fiat currency while depositing.

Some may not accept credit cards and other wallet options. Bank transfers mostly take more time than depositing with credit cards. You must look for these offerings while selecting the right broker.

- Crypto Range

You should also consider the range of cryptos offered by brokers. The more cryptos a broker offers, the better will be the liquidity. There are platforms like Huobi that offer over 400 cryptocurrencies to trade.

Some platforms also enable crypto CFDs. In this case, you do not have to worry about the underlying asset’s custody. Try to look for brokers that offer such provisions.

- Security and Safety

Security and safety are parameters that should never be compromised. You should look for brokers that are regulated and brokers that offer unmatched security even if they are not regulated. You will come across some unregulated exchanges like Huobi that have existed in the market for almost a decade.

It offers an industry-standard security mechanism that is better than many other platforms to ensure the safety of funds and information of investors. You should look for regulatory bodies giving licenses to brokers and opt for the ones that are licensed/ regulated.

There are brokers that are not regulated but comply with the laws and norms of the local jurisdictions where it operates.

- Minimum Deposits

Minimum deposits are important. You must know the lowest required amount that a broker sets for you to make deposits. This is a good way to judge a broker especially when you are starting with crypto trading. You should always start with a lower amount rather than investing a huge capital

- Trading Tools

Trading tools are becoming more relevant for investors. The industry standard is being raised by many brokers that offer outstanding tools. These are offered to deliver the best possible experience to traders and to follow the latest market trends.

These also allow new traders to develop their skills and put their strategies to test. Grid trading bot is one of these features offered by Huobi.

- Customer Support

Many traders may not need much customer support, but it is crucial while taking care of unforeseen situations. The cryptocurrency space is still evolving and many traditional investors are not equipped with the mechanisms of the crypto market. Active customer support is vital in this regard.

This makes the trading process and experience seamless. Many brokers offer support in different languages and 24/7. The channels of support include phone support, live chat, emails, ticket query, etc. The required technical support is a factor responsible for the decisions of investors.

- Ease of use

The ease of use is another yardstick to consider while choosing a trading platform. Can you use the platform without any support? Are you able to navigate quickly around the trading platform? Are you able to make use of market trends and invest by using various tools? Well, these are important questions to ask when you are deciding on a broker.

Not having a user-friendly exchange can be a setback. Whichever broker you choose, it must be trader-centric and offer smooth trading experiences. Huobi is considered as one of the most user-friendly crypto platforms for beginners with no trading experience.

- Analytical tools

Cryptocurrency trading needs analytical tools. There are exciting tools offered by many trading platforms. These help in ensuring seamless expertness and guide your investment decisions. These also make it easier for you to select the cryptocurrency class and deploy various strategies during your investment.

These parameters help while you search for the best broker. To get the best trading platform advice, you must check out reviews of customers on different brokers. You must take cryptocurrency trading seriously and utilize every opportunity to opt for the most suitable exchange platform.

There are many trading platforms with fantastic offerings and you should do your research to go for one as per your needs and expectations.

Your capital is at risk

Responsible Crypto Investment

Bitcoin is the first cryptocurrency that was launched in 2009 and we have seen an upward graph for this coin. This is not the case with every cryptocurrency.

It is difficult to predict the price of crypto assets or any other holdings as the entire investment market is highly volatile. Experts suggest that you should not be investing more than 2% of your total capital in cryptos.

Investing in crypto assets has many risks and you must be cautious while buying or selling cryptos. Although no strategy is a guarantee of earning profits with crypto investments, there are ways with which you can minimize your risks.

Joining platforms that empower traders by offering them interesting tools for trading is one way of making sure that you start on an appropriate note. Bitcoin has attracted millions of retail and institutional investors who have enthusiastically become a part of the crypto bandwagon, but, not all altcoins are moving in a similar direction.

Below are some points to be considered while you engage in responsible crypto-investment:

Research

The crypto market is evolving at a rapid pace. Millions of investors are joining the crypto ecosystem and looking for opportunities to earn profits by investing in cryptocurrencies.

There are many altcoins that are seeing the light of the day every year. It is difficult to decide which currencies will sustain. When Dogecoin was launched no one probably predicted it to be as popular as it is today.

Before you move ahead with your crypto investment, you must engage in substantial research regarding specific cryptos and the investment market in general. Seasoned traders dedicate a specific time frame to follow news and updates regarding currencies that they invest in.

You need to be aware of the developments of the ever-evolving crypto space so that you make an informed decision every time you think of investing in an asset.

Investors can learn about cryptocurrency from Huobi’s Learning Platform

There are numerous websites and social media channels that contain news and developments regarding crypto assets and the investment market. The movement of a cryptocurrency also depends on its relevance across social media. We have seen many crypto assets rise and fall owing to the attention and criticism of influential entrepreneurs and celebrities.

You must utilize the news and media trends revolving around cryptocurrencies to strategize your investment. It is a good idea to follow major financial channels that contain the coverage of crypto developments and the opinions of experts.

Although it is difficult to say which cryptos will perform better in the future, it is beneficial to stay updated on the developments. Technology is evolving at a remarkable pace and the entire digital investment space is being influenced by the advancement in technology.

The fundamentals behind cryptos are also important when you are making an investment decision. Remember that the price and value of some cryptocurrencies are more than others because of their substantial store of value and prospects for future usage.

Diversify Your Portfolio

Diversifying your crypto portfolio is another way to minimize investment risks. When you invest in various altcoins apart from the top-performing BTC and ETH, you basically distribute your funds across assets rather than investing them in just one cryptocurrency.

When you diversify your portfolio, you have more chances of being recovered from losses in case the value of one cryptocurrency in your portfolio goes down. There are interesting tools that you can use while opting for a portfolio wherein the exchange will manage the portfolio on your behalf.

Investors who do not have much time to follow and track the movement of the cryptocurrencies they have invested in making use of such portfolios. Cryptos should comprise a small fraction of your total capital investment. Even this small fraction should be diversified in order to minimize the risk of losses.

Know Your Risk Appetite

Cryptocurrencies are highly volatile assets. Seasoned investors always suggest others to invest only an amount that they are ready to lose. This is because there shall always be a probability of the entire asset going down. If the value of a cryptocurrency can spike within a few hours, it can also go down within the same timeframe or even quicker.

Your risk appetite is important as it varies from individual to individual. Just because you have a certain amount of funds as a capital investment does not mean that you will bet the entire amount. Start slow and invest only a small amount to gain exposure and experience.

It is important that you bring down your risk exposure as much as possible so that you do not incur huge losses. Earning profits by investing in cryptocurrencies may take months or even years and it is important that you are patient with your investment. You should know whether the cryptocurrency you invest in has a bear or a bull tendency.

It will help you to accordingly decide on your investment and make an informed strategy regarding how long you should keep your holdings.

Buying v. Trading Cryptocurrency

As per Tradingview’s monthly chart for February 2022, the total crypto market cap opened at $1.72 trillion. The yearly open of 2022 was $2.19 trillion against $760 million in 2021.

This means that the crypto markets rose in valuation by hundreds of percent throughout 2021. As per many crypto analysts and experts, the bull tendency of the cryptocurrency market will continue in 2022.

Investors are always looking for the opinions of experts on buying and trading cryptocurrencies. Should you buy cryptocurrencies and keep them for a longer-term?

Various tools on Huobi to trade and invest in Crypto

Should you long your cryptocurrencies within a few days of buying them? Is it profitable to engage in intraday cryptocurrency trading? There are questions that depend on many factors. Some of these are your budget, time constraints, risk appetite, etc.

If you want to go for intraday trading, options for low market cap altcoins may be more suitable than going for coins that are priced higher. For your long-term investment strategies, it is advised that you consider buying more established cryptos like BTC and Ethereum.

What is the difference between buying and trading cryptocurrencies? If you go for buying cryptos, you are opting for a mid to long-term investment. This often comes with lower rewards and risks. It also means that when you buy these cryptocurrencies, you will own the underlying asset that will enable you to make payments if necessary.

Trading cryptocurrencies is a short-term investment. This involves both higher rewards and risks. You trade cryptos with virtual contracts for differences (CFDs) and do not own the underlying assets. This is based on high speculation.

Your capital is at risk

Conclusion

Huobi is an exchange that has many significant objectives it wishes to fulfill. It is rapidly expanding its international presence. In the cryptocurrency market, the exchange has few rivals. It is a popular trading platform and offers a wide variety of cryptocurrency coins and tokens.

The alternative HADAX market was a clever move by Huobi and it has generated a huge inflow of users.

The registration process might be slightly complex for traders of some specific regions apart from China, Hong Kong, or the UK. It has competitive fees and does not charge any fee on deposits. One setback could be that it does not offer deposits with fiat currencies.

Its long-standing reputation is what adds to its credibility in the crypto market. It will probably improve its services to include as many countries as possible and make investing in cryptos on the platform easier and more convenient.

There are more positive reviews of the platform than there are criticisms. Huobi can be easily assumed to have an overwhelming presence in the crypto market in the upcoming years. We will have to see for ourselves if it proves to be at the top of dominant cryptocurrency exchanges across the globe.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Where does Huobi operate?

Huobi is based in the Republic of Seychelles. It has a strong operational presence in Asian markets. It has offices in Hong Kong, South Korea, the UK, and Japan. It recently announced the closure of the account of residents of Singapore and included the country in its restricted jurisdictions’ list.

Who are the rivals of Huobi?

Huboi’s main rivals are eToro, Binance, Coinbase, Kraken, Bitfinex, Bithumb, Coincheck, KuCoin, etc.

Why did Huobi exit from China?

Huobi was forced to exit from China because crypto trading was banned on the mainland by the Chinese government. Huobi then relocated to Singapore and eventually moved to the Republic of Seychelles.

Does Huobi have users from across the globe?

Huobi has attracted millions of global users despite being pushed out of China by the government. It has received wide support from traders across the world. Huobi is yet to gain a reputation that is comparable to eToro, Binance, or Coinbase.

How can I open an account with Huobi?

Opening an account with Huobi is easy and hassle-free. You need to visit their website and click on the desired button to open your account. You will have to complete the basic KYC to start trading on the platform. If you want to enjoy increased limits and more features, complete KYC is required.

Can I invest in bitcoin using Huobi?

Yes.

What is HADAX in Huobi?

HADAX is the alternate platform of Huobi. The platform enables users to vote for cryptocurrencies using their HT tokens (Huobi’s native token). Users vote for smaller coins which are eventually included in the exchange.

How much money should I invest in cryptos?

Experienced investors suggest investing no more than 1% of your investment portfolio in cryptocurrencies. Some experts say if you have the required capital and are willing to take the risks, then you can extend up to 2-3% of your total investment on cryptos.

Where does Huobi not operate?

Huobi had its US version HBUS, which stopped operating. It also stopped its operations in Singapore and included the country on its restricted jurisdictions’ list. Huobi is trying its best to expand to as many countries as possible and attain regulations and licenses from various jurisdictions.

Is Huobi safe for crypto trading?

Despite being an unregulated platform, Huobi has served the crypto market for over a decade with optimal security measures. The platform has not been hacked or faced any serious security breaches since its inception. Its robust security mechanism is one of the main reasons for it being a popular cryptocurrency platform in the market.

Is Huobi suitable for new investors?

Huobi claims to be suitable for new investors. Although it has charting tools and a wide range of indicators that are more useful for traders looking to carry out advanced technical analysis, it is used by many new investors owing to its safety and hassle-free interface.

Is Huobi available for mobile phones?

It has a mobile app that can be used by both Android and iOS users.

Can I get refund coupons on Huobi?

The fee refund coupons on Huobi remain valid for 14 days from the date of their issue. You must collect your coupon before using them and the uncollected coupons automatically expire after the deadline.

What is cross margin mode on Huobi?

Cross-margin mode on Huobi Futures means that for all open positions of a digital currency, the same digital currency asset will be used as a margin. For your open positions of BTC contracts, all the BTC in your account will be used as a margin. In case you open more than one position, then the margin will be shared by all of these open positions. You can mutually offset the profits/ losses of positions of a digital currency.

Can I make cash withdrawals for my contract account?

No, you cannot withdraw cash for your contract account as Huobi currently does not support cash withdrawals. You can transfer your assets via an exchange account for the same.