Compound is a fast-growing cryptocurrency that allows users to earn interest on their crypto or borrow digital currencies. In this guide, we’ll cover everything you need to know about how to buy Compound.

[toc]How To Buy Compound – Quick Steps

Want to buy Compound without reading our complete guide? You can get started right away with these 4 quick steps.

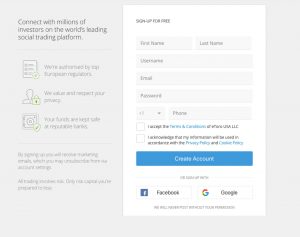

1. Open an account: We recommend using eToro to buy Compound. This crypto broker offers low fees and a wide range of deposit methods. Simply head to eToro and click ‘Join Now.’

2. Upload ID: Upload a copy of your driver’s license or passport to verify your identity.

3. Deposit Funds: Deposit at least $50 with a debit or credit card, PayPal, Neteller, Skrill, or bank transfer.

4. Buy Compound: Search for Compound, enter the amount you want to buy, and click ‘Open Trade.’

How To Buy Compound Online In 2021 – eToro Tutorial

The 4 steps above offer an overview of how to buy Compound using eToro. Here, we’ll dive deeper into the process and walk you through how to purchase COMP in less than 10 minutes.

Step 1: Open An Account

Head to eToro’s website and click ‘Join Now’ to open a new account. Enter a new username and password for your account, or set up your account using your Google or Facebook credentials.

Step 2: Upload ID

Next, eToro will ask you to verify your identity to comply with government Know Your Customer (KYC) requirements. Upload a copy of your driver’s license or passport and a recent bank statement or utility bill showing your address. The verification process typically takes less than 5 minutes and can be completed online.

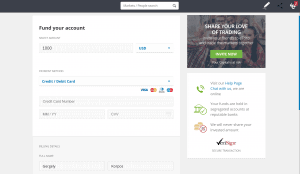

Step 3: Deposit Funds

The next step is to fund your new trading account. eToro requires a minimum deposit of $50 if you’re in the US and $200 in most other countries. You can pay by debit card, credit card, PayPal, Neteller, Skrill, or bank transfer.

Step 4: Buy Compound

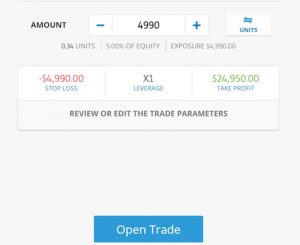

Use the search box at the top of the eToro dashboard to search for ‘Compound.’ Click ‘Trade’ when the coin appears to open a new order form.

Enter the amount of Compound you want to purchase (you must invest at least $25). You can set a stop loss or take the profit level for your trade. Once your trade is ready, click ‘Open Trade’ to buy Compound.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

67% of retail investor accounts lose money when trading CFDs with this provider.

Crypto assets are highly volatile unregulated investment products—with no EU investor protection.

How To Sell Compound

When you want to sell your Compound tokens, you can repeat Step 4. Choose ‘Sell’ instead of ‘Buy’ in the order form. Enter the amount of Compound you want to sell and click ‘Open Trade’ to sell your coins. You can use the funds to make another trade or withdraw them using eToro’s supported payment methods.

Where To Buy COMP

Many different brokers and cryptocurrency exchanges enable you to buy COMP. However, not every crypto exchange offers low fees or is entirely trustworthy, so choosing where you buy Compound is essential.

Let’s look at 3 of the best brokers you can use to buy COMP.

1. eToro – Best Crypto Exchange To Buy Compound

eToro makes it easy to start buying cryptocurrency because it requires just a $50 minimum deposit. You can fund your account with a bank transfer using a debit card, credit card, PayPal, Neteller, or Skrill. There are no deposit fees, although eToro does charge a small $5 withdrawal fee.

One of the best things about eToro is its social trading network, which is extremely helpful for trading cryptocurrencies like Compound. You can easily follow other crypto traders and learn about where the digital currency market is headed. eToro also supports copy trading so that you can mimic the moves of more experienced crypto traders.

Past performance is not an indication of future results.

eToro also offers a high-quality trading platform with dozens of technical indicators and drawing tools. You can follow the crypto market with a news feed and economic calendar, and all of the platform’s analysis features are available on iOS and Android through the eToro app. The only downside is that eToro doesn’t offer access to the Compound order book.

eToro is regulated by the UK’s Financial Conduct Authority (FCA) and is widely considered safe. The broker offers 24/5 customer support, so you can quickly get in touch if you need help with your account.

Cons

67% of retail investor accounts lose money when trading CFDs with this provider.

Crypto assets are highly volatile unregulated investment products—with no EU investor protection.

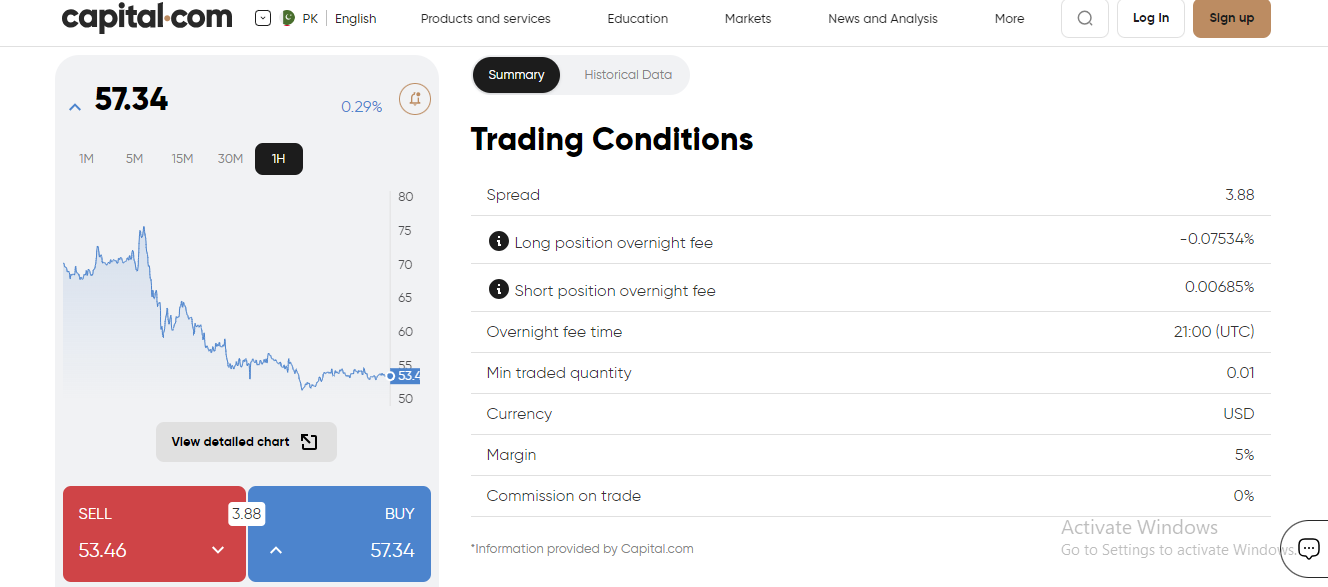

2. Capital.com – Trade Compound With CFDs

Capital.com is our top-recommended broker if you’re interested in trading Compounds through CFDs (contracts for difference). With CFD trading, you don’t own Compound tokens outright. Instead, you own a contract that lets you speculate on whether a Compound’s price will rise or fall.

The advantage of trading Compound CFDs with Capital.com is that you don’t have to worry about a crypto wallet or the security of your tokens. You can also trade with leverage – Capital.com allows you to buy Compound on margin up to 2:1. Another benefit is that Capital.com charges no commission for CFD trading, and spreads on Compound are typically less than 3% of your trade value.

Capital.com offers robust technical analysis tools, including a proprietary trading platform for web and mobile. In addition to various popular studies, the platform is outfitted with an artificial intelligence algorithm that automatically analyzes your trading activity and suggests ways to improve your win rate. Capital.com also provides access to an economic calendar, news feed, and professional research reports.

Capital.com requires just a $20 minimum deposit to open an account and start trading. The broker accepts a wide range of payments, including debit and credit cards, so it’s easy to buy Compound.

This CFD broker is regulated by the UK FCA and the Cyprus Securities and Exchange Commission (CySEC). Capital.com offers exceptional 24/7 customer support by phone, email, and live chat.

Cons

71.2% of retail investor accounts lose money when spread betting and trading CFDs with this provider.

3. Binance – Best Crypto Exchange for Advanced Compound Trading

Binance stands out in particular for its selection of cryptocurrency derivatives. You’re not limited to buying tokens like COMP – you can also purchase cryptocurrency futures or special leveraged tokens that increase the stakes of your trade. Remember that these cryptocurrency derivatives can be risky, so they should only be used by experienced traders.

Another advantage to Binance is its comprehensive trading platform, which is available for both web and mobile. You can access various customizable technical studies, the Compound order book, and the depth chart. That enables you to track changes in price momentum in real time and evaluate what’s driving price changes.

Binance charges a flat commission of just 0.10% for Compound trades, making it one of the cheapest exchanges. Even better, you can get a discount on your trades by holding BNB, Binance’s cryptocurrency, in your account. The platform also offers a digital wallet to help you manage your digital tokens.

One thing to keep in mind is that Binance is not regulated. The platform is widely considered safe but lacks some investor protections that regulated brokers must offer. Binance is also light on customer support, so you must be comfortable navigating the platform independently.

Cons

Your capital is at risk.

How Much Does It Cost To Buy Compound?

Unfortunately, trading Compounds isn’t free. Let’s examine how much each of our recommended brokers will charge you to buy a Compound.

| Compound Trading Fees | Deposit/Withdrawal Fees | Payment Methods | |

| eToro | 2.9% | $5 per withdrawal | Debit/credit card, PayPal, Skrill, Neteller, bank transfer, crypto transfer |

| Capital.com | 3% | None | Debit/credit card, Sofort, IDeal, MultiBanko, Trustly, WebMoney, Qiwi, Skrill, Neteller, bank transfer |

| Binance | 0.10% | None | Debit/credit card, bank transfer, crypto transfer |

What Is Compound?

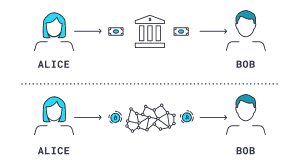

Compound is a cryptocurrency designed to enable users to earn interest on cryptocurrency deposits or to borrow cryptocurrency. This digital currency is leading decentralized finance, or DeFi, an application that seeks to replicate some of the functionality of traditional banks for cryptocurrency.

The compound was first launched in 2017 by former economists Robert Leshner and Geoff Hayes. The coin has its blockchain, but it’s built using the same technology as Ethereum: smart contracts. These digital contracts control interest rates for deposited crypto and borrowing and regulate how users can redeem their tokens.

Notably, there are several different aspects to Compound. The Compound cryptocurrency, COMP, is a digital token that gives holders voting power about the direction the Compound blockchain should take. COMP is what you would buy or sell to speculate on the price of Compound.

In addition, Compound offers ‘cTokens,’ which are virtual tokens that users receive in exchange for depositing cryptocurrency in a Compound-based digital savings account. So, if you were to deposit Ethereum (ETH) to Compound, you would receive ‘cETH’ in return. You can later redeem your cETH to get back the original amount of Ethereum you deposited, plus any interest your deposit earned.

Compound Analysis – Is It A Good Investment?

Compound is one of the most popular decentralized finance (DeFi) applications. This is an exciting new frontier for a digital currency that has only begun to take off – and the potential market is already estimated at over $100 billion.

The compound’s price should increase the more people that use the Compound blockchain to earn interest or borrow cryptocurrency. Given that traditional financial institutions are unlikely to offer crypto interest anytime soon, this is an important service that’s only likely to become more in demand.

Of course, there’s no guarantee that Compound will be the dominant cryptocurrency for DeFi. However, its popularity so far is a good sign. In a world with hundreds of cryptocurrency projects vying for attention, the one with the most name recognition has a major advantage.

With that in mind, Compound could be a worthwhile investment right now. Investors should keep a close eye on the DeFi space to see whether interest in Compound’s lending and savings offerings continues to pick up steam or whether competing crypto projects can steal investors’ attention.

Compound Price

In April 2022, the price of COMP, the native token of the Compound protocol, was around $171. However, during this period, the token faced significant challenges and encountered resistance, causing its value to decline steadily.

In June, the price of COMP dropped significantly to $28. However, a modest recovery followed, and the token was traded at around $36. It is worth noting that at the beginning of 2023, the price initially increased before stabilizing within a narrow range.

On May 12, 2021, a critical moment occurred in the price history of the Compound. The token reached its pinnacle value at $909.34. In contrast, on June 10, 2023, COMP hit an all-time low of $24.02. This particular amount marks the lowest recorded price since the previous record high. It is worth noting that the highest price point following this recent low was $82.89.

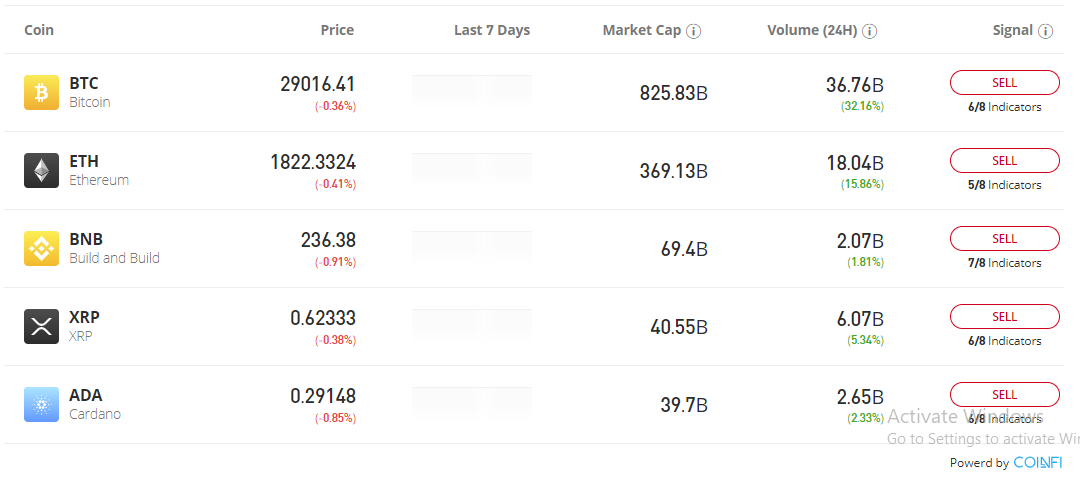

Currently, the prevailing market sentiment toward the Compound’s price prediction is leaning bearish. In line with this, the Fear & Greed Index—a measure of market sentiment—currently stands at 49, signaling a neutral stance.

Supply metrics for COMP indicate that the circulating supply currently stands at 7.27 million tokens out of a maximum supply of 10.00 million COMP. Importantly, there has been an annual supply inflation rate of 0.99%, resulting in the addition of 71,332 new COMP tokens over the past year.

The compound holds the 12th rank among DeFi Coins in market positioning. Additionally, it secures the 3rd position within the Yield Farming sector and ranks 31st among Ethereum (ERC20) Tokens.

The current trading price of the COMP token stands at $55.25, based on the latest data available. During the past 24 hours, the trading volume has surged to $292.63 million, contributing to an overall market capitalization of $416.03 million. Currently, the Compound holds a market dominance calculated at 0.04%. Notably, within the last 24 hours, the token’s price has experienced a decline of -1.42%.

Compound Price Prediction

According to prevailing Compound price projections, recent analysis suggests a bearish sentiment driven by various technical indicators. The Fear & Greed Index has dramatically dropped to 21.23, indicating extreme fear among investors. This cautionary state prompts sellers to exercise carefulness when considering the current moment for selling Compound.

On August 6, 2023, the current landscape of technical analysis tools reveals a conflicting mix of signals. Numerous indicators suggest an optimistic trajectory, while at the same time, there is a group of indicators pointing towards a pessimistic path. This contradiction reinforces a prevailing bearish sentiment to Compound’s price predictions.

In the past month, the Compound has experienced a slight increase of 0.40%. This suggests a potential modest recovery in the upcoming month. By the end of August, experts anticipate a significant rise of 113.02% in the Compound’s value, reaching approximately $121.82.

The Compound’s current trading stance sits below the 200-day simple moving average (SMA). There has been a consistent occurrence of selling signals related to the Compound and its 200-day SMA over the past 326 days, dating back to December 31, 2023. Despite aligning with a buy signal, the Compound’s value remains lower than the 50-day SMA.

Forecasts suggest that the 200-day SMA will soon decrease, causing the price to move towards an anticipated $46.66 by the end of December. Looking ahead to 2024, Compound’s short-term 50-day SMA predicts a projection of approximately $57.32.

The Relative Strength Index (RSI) currently stands at RSIValue, indicating that the COMP market is in a neutral position. This complex combination of technical signals presents a nuanced view, leaving investors facing uncertainty as they navigate the various challenges within the Compound ecosystem.

Investing In Compound Vs. Trading Compound

In addition to deciding whether the Compound is going up or down, you need to decide whether to invest in the Compound for the long term or trade its price fluctuations in the short term.

Since we think Compound has a bright long-term outlook, investing in this cryptocurrency for at least several years makes sense. The compound should hold its value reasonably well, mainly since existing users will likely stick with the cryptocurrency and DeFi platforms.

That said, you could trade Compound price movements. The coin has been highly volatile – in the 24 hours before writing, the coin’s price dropped by more than 10%. These ups and downs are likely to continue no matter how successful the Compound is, and they offer opportunities to profit.

Ways Of Buying COMP

There are several different ways you can buy COMP. Let’s take a look at what your options are and how they compare.

Buy Compound Through A Regulated Trading Platform

One of the best ways to buy Compounds is through a regulated trading platform like eToro. Government watchdogs oversee regulated platforms and Bitcoin brokers and must follow specific rules that protect investors. So, you can be sure that your funds are safe and that your trades are executed relatively when trading through a regulated platform.

Another benefit of using regulated trading platforms is their straightforward use. Brokers like eToro accept various payment methods, including debit and credit cards, bank transfers, or PayPal. They also offer desktop and mobile apps to trade Compound on the go.

Invest In Compound Via A Cryptocurrency Exchange

Another way to invest in Compound is through a crypto exchange like Binance. The benefit of using a cryptocurrency exchange is that they have a wide range of coins available. So if you want to use Compound to earn interest on another altcoin, you can find those coins at an exchange.

However, beware that many cryptocurrency exchanges are unregulated. Hackers have frequently targeted unregulated exchanges, and they don’t necessarily have safeguards to protect your funds.

Trade COMP On A CFD Trading Site

Finally, you can trade COMP through CFDs using a platform like Capital.com. When you’re trading CFDs, you can speculate on the future price of the Compound without actually owning the coin.

The benefit of this type of trading is that you don’t need to set up a crypto wallet. You can also trade on leverage and short-sell COMP if you think this coin’s price will drop. However, remember that CFD trading can carry extra fees if you hold positions for longer than one day. So it may not be the best option to invest in COMP for the long term.

The Best Compound Wallet

Are you looking for a Bitcoin wallet to store your Compound tokens? This is an essential decision since your wallet will impact how safe your assets are and how easy they are to access for trading.

Our favorite crypto wallet is eToro’s mobile wallet for iOS and Android. It supports more than 150 cryptocurrencies, including Compound. Better yet, eToro manages your private encryption key so your funds stay safe, and you simply need your eToro username and password to access them.

Another good option for holding Compound is the Binance Trust wallet. This wallet supports over 500 cryptocurrencies and instantly allows you to exchange between them using BinanceDEX, a decentralized exchange. In addition, the Trust wallet has a marketplace of DeFi apps like Compound, so you can borrow crypto or earn interest on your tokens.

Other secure wallet options for storing cryptocurrency include Mycelium and Exodus. Both are very safe and extremely easy to use. You can connect them to a hardware wallet like Trezor or Ledger for even more robust security.

Compound Reddit – Keep Up To Date With COMP

The Reddit Compound messageboard is one of the best places to stay updated with the latest COMP news. This is a popular spot for Compound traders and investors, and the Reddit discussion can significantly impact Compound’s price.

eToro – Best Crypto Broker to Buy Compound

The compound is one of the most popular DeFi cryptocurrencies. Since the start of 2021, the price has jumped over 520%, and COMP has room to run as more people turn to cryptocurrency investing.

Ready to buy Compound? You can invest today with eToro – just click the link below to get started!

67% of retail investor accounts lose money when trading CFDs with this provider.

Crypto assets are highly volatile unregulated investment products—with no EU investor protection.

FAQs

How is Compound different from Ethereum?

Compound is built using the same technology as Ethereum, but it has its blockchain. The compound is designed to enable saving and borrowing cryptocurrency. In contrast, Ethereum is primarily for enabling transactions.

What payment methods can I use to buy Compound?

With a broker like eToro, you can buy Compound using a debit card, credit card, PayPal, Neteller, Skrill, or bank transfer.

Can I buy Compound anonymously?

Some unregulated crypto exchanges allow you to buy Compound without providing information about your identity. However, beware that unregulated crypto exchanges do not have any investor protections.

What is a cToken?

A cToken is a token issued by the Compound blockchain when you lock a token like Ethereum to Compound. You can redeem your cToken to get your original cryptocurrency back, plus any interest you earned.

Do I need a crypto wallet to store Compound?

If you own Compound tokens outright, you will need a crypto wallet to store your tokens. If you trade Compounds via CFDs, you do not need a digital wallet.