Everybody joining the Forex market, whether they hope to launch a trading career or just for the thrill wants to know how much they c

In answering the ‘how much can I make day trading’ question, there are a few things you have to put into consideration. For instance, do you intend to trade manually, employ algorithms, or deposit into the managed PAMM accounts? Additionally, what is your strategy, your risk appetite, and how much do you intend to put as starting capital?

How much can I make day trading on different platforms?

Most traders whether pro-rated or beginners aren’t too keen on opening up to the world about how much they earn day trading. The following information is therefore based on thorough research on key day-trading rooms, and social trading websites. It is also worth noting that the earnings vary, and are dependent on a host of factors among them the strategy applied as well as the level of experience.

1. How much can you make as salaried professional trader?

The average salary for professional and salaried day traders working with registered investment firms across the United States is $89,496. Traders in New York however have the highest average incomes where experienced (above average day traders) earn between $250k and $500K per annum. Lesser experienced (average) traders on the other hand take home between $100k and $175k annually.

Some of the highest paying investment firms in the country include Citi Bank whose trader salaries range from $62k t0 $425k, Bank of America with day trader salaries ranging from $91k to $275k, and Morgan Stanley whose traders earn between $41k and $276k annually.

2. How much can you make day trading forex?

Case example: Assume you use a single trading strategy that only risks 1% of your trading capital per trade with the stop loss and take profits orders placed at 5 and 8 pips respectively resulting in a 60% win rate. If you deposited $10k into your account, you would be risking just $100 per trade. Now assume that you limit the number of your trades to 5 every day for the 20 days that the forex markets remain open per month and this s translates to 100 trades.

Let’s assume you decide to trade the all popular EURUSD pair whose pip movement equals $10 (for a standard lot). This means that you stand to gain $80 ($10×8) for every winning trade and $50 ($10×5) for every loser.

With an average 100 trades and a 60% win rate, this is how you calculate your earnings:

60% winning trades: 60x$80=$4800

40% losing trades: 40x$50=$2000

Profit for the month (inclusive of the brokerage fees and commissions): $4800-$2000=$2800.

You stand to earn $2,800 for every $10,000 you invest in the trade.

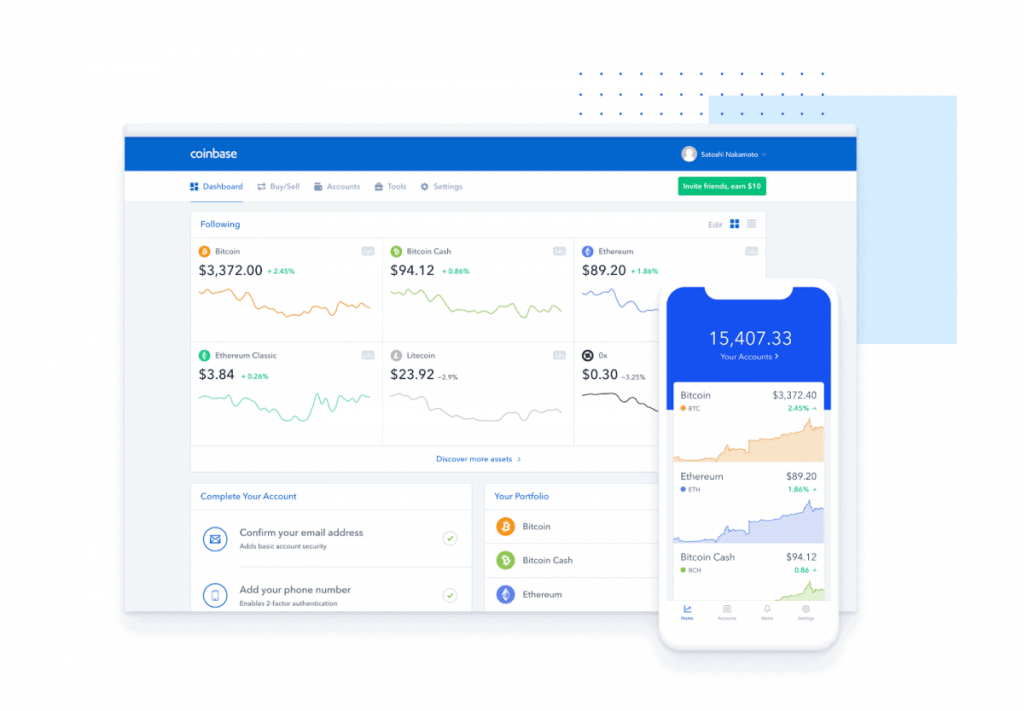

3. How much can you earn from Coinbase’s social trading platform?

Coinbase has two earning levels, the general traders and popular investor levels. The popular investor category includes the most successful traders on Coinbase social trading platform, from whom the rest, often referred to as copiers, can copy trades. If you open a trading account with the broker and make it to the popular investor category with an average monthly return of 15% and a capital base of $200k, you would be making $30k per month from your trades. You will also earn 2% of your copiers’ assets under management.

For example, if you had 1000 copiers with combined assets under management worth $1 million, you would earn an extra $20k in addition to earnings from your regular trades totaling to $50k per month.

If on the other hand, you open an account as a beginner or relatively experienced trader that juggles between copied trades and personal market involvement, you will make as much as your popular investor’s average ROI plus earnings from your individually analyzed trades.

For example: If you dedicated $2000 of your deposits to copy trading and followed a popular investor with a monthly average return of 15%, you will make $300 for the month. If you personally traded another $1000 and reported an average gain of 5%, (5% of $1000=$50) you stand to make $350 ($300+$50) for the month.

The downside to working as a popular investor with Coinbase is that you won’t receive the monthly profit share if your risk level extends beyond level six for more than an hour during the month.

To help get a clearer picture of how much day traders make, the images below shows the average return for some of the top traders in the last 1 year.

On average, these traders are making returns of between 5% to about 25%. Assuming you are copying such a trader, and considering such other factors as slippage and re-quotes. Then, you should be able to make anywhere between 5% and 20% on your investment. In this case, a trader with a capital of $25,000 will make between ($1,250 and $5,000).

4. How much do top rated Myfxbook trading systems make?

A review of some of the popular trading systems on Myfxbook paints an almost similar picture as that of Coinbase.

Here, the returns range from 6% to about 22% for the best managed portfolios. That shows for a day trader with the right skills and experience, returns of between 5% and 20% are possible.

Factors impacting the return on investment for a day trader.

1. Trading strategy and emotional balance

The state of your emotions when trading influences your ability to perfect and stick to a trading strategy which in turn determines how much you make day trading. This theorem is born of the fact that you need to constantly vet and improve your trading strategy regularly especially after a streak of losses. But achieving desired results and fine-tuning the strategy to reflect market dynamics will only occur if you eliminate the win or loss prejudice.

A proper strategy determines the market conditions that a particular trade, stock or currency must fulfill before you consider investing in it. However, emotional wrecks from consistent wins or loses may tempt you into abandoning a working strategy where wins encourage the entry into highly risky trades while fear of loss keeps you off lucrative deals until it is too late. Eliminating emotions from your trades is the first step to ensuring steady incomes to day traders.

2. Capital investment

Forex markets are no different from any other conventional business when it comes to capital investments. The more you put into it, the higher the potential rewards. Investments in different financial instruments will, however, give the trader an advantage over the rest.

For instance, $1,000 investment in stocks and a similar investment in forex or CFDs will yield different results. This is explained in the fact that CFDs trading and currency trading have access to high leverage which is not the case with stocks. How much you make day trading a particular industry is therefore dependent on your trading account deposits. Ideally, if you have $2,000 in a trading account, your earning potential will be lower compared to another trader with $10,000 balance in the same niche

3. Experience and risk management

How experienced are you in trading your preferred financial instrument or market? More importantly, are you familiar with the different risk management tools and features adopted by brokers in the field? These two play a key role in determining how much you make day trading.

Experience ensures that you have a working trading strategy and advanced understanding of the different factors influencing price, while risk management tools ensure you take profit and cut out losses at the most opportune moment.

Does your broker’s platform even have a stop loss feature? Plus, in the case of unprecedented market volatilities such as after major economic news like brexit, does the broker offer negative balance protection. Understanding the importance of such risk management tools goes a long way in guaranteeing the safety of your trades and in effect how much you make from the trade.

4. Choice of a broker

Your choice of a broker also has a direct impact on how much you make from your day-trading. Note that the brokers act as intermediaries between you and the market implying that the effectiveness of your orders is at the mercy of your broker. For instance, if your forex and CFD broker’s system lag too often, they will be exposing you to massive slippages and possible requotes that either eat into your profits or aggravate the incidence of loss by not executing the close trade on time.

Coinbase forex trading account has a maximum spread for popular currency pairs set at 3 pips and $25 fee per withdrawal. Some brokers have higher variable spreads with others imposing a deposit fee. And all these deductibles only serve to infringe on the actual amount that gets to the bank account.

5. Commitment to the trade

The amount of effort you put into the trade also has a direct impact on how much you take home. It is therefore imperative that you decide whether you want to day trade full time, part time or completely hands-free through expert advisors. The more time you spend trading, the higher your chances of perfecting your strategy that in effect increases your bottom line.

When trading full time, you will have more time at hand to advance your trading skills and strategy. A portion of this should be dedicated to practicing and trying out different strategies and styles in a demo account. You also have adequate time to keep tabs with the economic calendars and analyze news. This goes a long way in determining your win rate and in effect how much you make day trading.

6. Risk appetite

How aggressive are you in your trades? If there were no limit to the number of trades or the amount of dollars you can trade in a day, how far would stretch your luck? Aggressiveness and the number of trades executed have a significant effect on a retail day trader’s income. However, unlike in the conventional business world where more transactions are associated with more returns, moderation rules forex markets with low volume traders making sometimes making more than the high volume traders.

Executing a few trades, probably one or two a day, ensures you have ample time to analyze the markets and only settle on the most promising trades. The opposite is true for the more aggressive traders with higher risk appetite.

6. The financial instruments traded

Your choice of a financial instrument to trade also plays a crucial role in influencing how much you make as a day trader. For instance, stocks and equities require higher investments and are, therefore, considered rigid. CFDs and currency trades, on the other hand, are considered the most versatile and most flexible as they offer traders a myriad of diversification options.

And with the right strategy, emotional discipline, and moderate use of leverage, a CFD investor will make more money than their equities and stock counterparts. But this should not be enough to sway you into considering CFDs or currency trading as you will need CFD and forex trading expertise to back it up. Note that you will post more returns when trading your strengths than through trial and error.

How to improve your earnings potential

1. Consider managed accounts services:

Lack of enough time to analyze the markets or inexperience shouldn’t hinder your day trading ambitions or set you on a loss-making path as brokers now offer managed account services. Whether you want to day trade currencies, stocks, or CFDs, brokers in these fields have come up with different account management services aimed at ensuring you maximize the profitability of your day trading engagement without lifting a finger.

Managed account services include the Percentage Allocation Management Module (PAMM) offered by forex and CFDs brokers and ‘Separately Managed’ and ‘Wrap Accounts’ offered by the stock brokers. Each of these is created and operated by professional traders who must also deposit a significant portion of their money into the account. Whatever profit they make off the accounts is then shared by the manager and investors based on their initial investment.

2. Review trades to perfect strategy

Regularly reviewing your trading strategy remains one of the surest ways of improving both your win rate and risk to reward ratios and in effect maximizing your return on investment. It is, therefore, imperative that you keep reviewing your performance, looking back on both your losses and wins and identifying areas that need improvement. When you are not trading or analyzing the charts, you should be reviewing your trades and working towards enhancing the efficiency of your strategy.

Most brokers, like Coinbase, allow you to run both the demo and live accounts concurrently. Given that both have access to the real-time market activities, take advantage of the risk-free demo account environment to try out adjustments to your strategy before integrating them to your live trading account.

3. Stop trading news and ‘expert opinions”

No one amassed a great deal of wealth in the money and stock markets by trading news and hot tips. Neither will you. The most economic and corporate news can do is spur short-term market volatility that dies as fast it rises. Trading news is also a highly risky affair for most retail traders given that by the time you receive the news, either from your broker or newsfeeds, it is often too late. And chasing trends only serve to increase your chances of getting burnt.

Similarly, make it a habit of conducting own analyses and stop over-relying on the ‘expert traders’ peddling hot tips. Norman Augustine, an acclaimed trader argues that “if the stock market experts were so expert, they would be buying stock, not selling advice.” Remember that most of these ‘experts’ that traders look up to for trade analyses don’t even have a trading history that they can cling onto. And while your analyses won’t always be right, it presents you with a life lesson on how you approach next trades.

4. Master the art of entering and exiting trades

The entry and exit points have the greatest effect on how much you make from a particular trade. If you are to improve how much you make from day trading, you have to start by mastering the art of identifying perfect entry and exit positions for a given trade. This calls for a thorough understanding of the different analysis techniques that relate to your trading style.

For instance, if you are drawn to day trading currencies and CFDs, master the different technical analyses tools. And if you insist on swing or position trading stocks, ensure that you have a thorough grasp of fundamental analyses techniques. Most brokers like Coinbase have simplified the process by integrating several professional technical analyses tools in both their demo and live trading accounts.

Final word

Market volatility and different operational rules by brokers make it impossible to predict how much you will make day trading. Given that every passing day in the financial markets brings along its unique set of challenges, not even professional traders are able to estimate with utmost certainty how much they can earn from the investor funds in managed accounts. The trick, however, lies in ensuring that you keep adjusting your trading strategy, working towards higher win rates and even higher risk to reward ratios.