101Investing is a CySEC regulated broker that is offering investors to trade on more than 350 assets via its own proprietary trading platform, the 101Investing WebTrader, and the MT4. In addition, this broker offers users an extensive range of features and trading tools including high leverage, a free demo account, and a 1-click trading option.

If you wish to know more about Investing101, this guide is for you. We cover the trading platforms offered by the broker, features and tools, fees, spreads, payment methods, regulatory framework, and more.

On this Page:

101Investing – Top CFD Broker with Low Fees

74% of retail traders lose money when trading CFDs.

What is 101Investing?

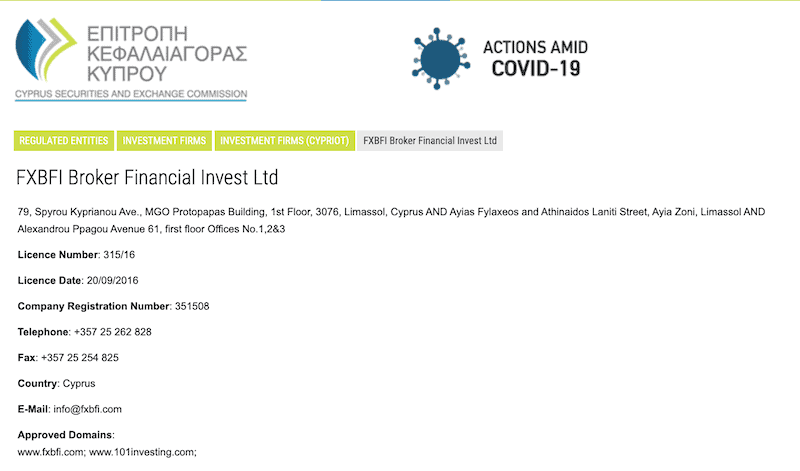

Founded in 2016, 101Investing is a forex CFD platform for both newbies and experienced traders. This broker is a subsidiary company of the well-known online platform FXBFI and is regulated by the Cyprus Securities and Exchange Commission (CySEC) and complies with the MiFID. The broker CySEC license number is 315/16.

Investors at 101Investing get access to 350 assets across different markets that include forex, cryptocurrencies, commodities, indices, metals, and stocks. The broker mostly takes pride in offering the highest level of data protection as well as a comprehensive education and market analysis section. Moreover, 101Investing offers users to trade on the most popular trading platform in the market, the MetaTrader4 (MT4).

The company behind 101Investing is located at 79 Spyrou Kyprianou Ave, MGO Protopapas Building, 1st floor, Limassol, Cyprus, and Ayias Fylaxeos and Athinaidos Laniti Street, Ayia Zoni, Limassol and Alexandrou Ppagou Avenue 61, first-floor Offices No.1,2&3.

What Shares Can You Buy on 101Investing?

As mentioned above, 101Investing offers an extensive range of financial products that include stocks. This broker enables investors to trade on approximately 75 stocks from US stock exchanges. As such, investors get access to popular stocks like Facebook, Amazon, Google, Tesla, Baidu, Wal-Mart, Yandex, and many more.

Share trading at 101Investing involves a leverage ratio of 5:1 for retail clients and 30:1 for those who apply for the professional trading account.

What CFDs Does 101Investing Offer?

101Investing offers a decent variety of CFDs trading products to choose from that include FX currency pairs, indices, stocks, commodities (energy and metals), and cryptocurrencies.

All in all, the broker offers more than 350 popular assets in the form of CFDs. These include:

- Forex CFDs – 47 FX currency pairs including majors (EUR/USD, GBP/USD, USD, JPY), minors, and exotic pairs.

- Stock CFDs – 75 major US stocks with zero commission and low spreads. These include Facebook, Boeing, Alibaba, Berkshire Hathaway, Cisco, eBay, Intel, Microsoft, Pfizer, and more.

- Indices CFDs – A range of 15 market indices including the S&P 500, Nikkei 225, CAC 40, Euro Stoxx 50, US Dollar Index, and the Volatility SP500 Index Future (CBOE).

- Commodities CFDs – 101Investing covers the most popular commodities including gold, silver, Brent oil, coffee, sugar, wheat, corn, Soybean, etc.

- Cryptocurrencies CFDs – The broker offers a huge range of more than 50 crypto coins with a leverage ratio of 2:1. These include Bitcoin trading, Ethereum, DASH, Bitcoin Gold, IOTA, Litecoin, Ripple, etc.

101Investing Fees & Commissions

One of the key points of 101Investing in comparison to other CFD platform in the market is its low-cost trading and maintenance fees. The Cyprus-based broker ensures that clients do not have to pay any hidden charges or unexpected commissions, and trading is on a commission free basis. This means investors will only pay the built-in spreads when they get in and out of a position.

Below you will find all the fees that you need to consider before joining this broker.

Deposit and Withdrawal Fee

Unlike many online brokers operating in the industry, 101Investing does not charge any deposit nor withdrawal fees. With that in mind, 101Investing may charge a withdrawal fee if the client withdraws an amount of less than €100.

Rollover/Overnight Fees

Like any other CFD brokerage firm in the market, 101Investing charges an overnight interest rate for positions kept open overnight. This is a fee that is deducted from the value of the position in case the investor decides to keep the position open after 00:00 GMT.

As for swaps/rollover pricing, 101Investing discloses rates for all instruments on its website, and our review reveals that it is one of the most cost-effective brokers out there in terms of overnight fees.

Inactivity Fee

This is one of the negative points of this broker. 101Investing charges a pricey inactivity fee of €80 per month after 61 days of inactivity, €120 per month after 91 days of inactivity, €120 per month after 121 days of inactivity, €120 per month after 151 days of inactivity, €200 per month after 181 days of inactivity.

101Investing Spreads

Finally, the most crucial factor when choosing a CFD broker is the spreads. For those unaware, the spread is essentially the difference between the buy and sell price and is, in fact, the only fee you are paying when you enter into a position.

101Investing offers variable spreads, meaning the buy and sell price of an asset fluctuates when the market becomes volatile. For example, if the spread between the buy and sell of the EUR/USD price is on average 0.7, the spread might decline in times of high volatility.

Overall, the broker offers very competitive spreads that are below the average in the industry. For example, the spread for the EUR/USD is as low as 0.7 pip, which is way below the industry’s average of 1-1.3 pips.

101Investing Leverage and Short-Sell Requirements

One of the benefits of trading with a broker like 101Investing is the leverage ratio it offers and the ‘not so strict’ requirements for short selling assets. Obviously, investors at 101Investing have some limitations as to how much leverage they can apply as the leverage varies depending on the asset and the chosen account type. For example, 101Investing allows investors to trade with a leverage of 30:1 on FX currency pairs and 2:1 on cryptocurrencies. This is because 101Investing complies with the rules and regulations of CySEC, and as a result, the broker must restrict leverage ratios for retail clients.

Nonetheless, below you’ll find the leverage ratio provided by 101Investing based on products and markets (for retail clients):

- FX Currency pairs – 30:1 for majors, 20:1 on minors and exotic currency pairs

- Commodities – 20:1

- Indices – 10:1

- Stocks – 5:1

- Cryptocurrencies – 2:1

In addition, 101Investing offers a higher leverage ratio for those who are able to prove their high proficiency level of trading. In this case, professional investors may get a leverage of up to 500:1.

It’s also worth mentioning that 101Investing does not have any restrictions when it comes to short selling. This means you can speculate that the price of an asset will decline in value with the same leverage ratio as you can when entering into long-buying positions.

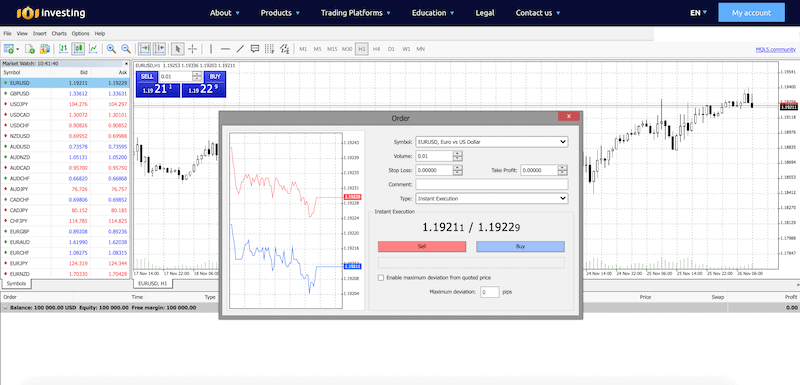

101Investing Trading Platform

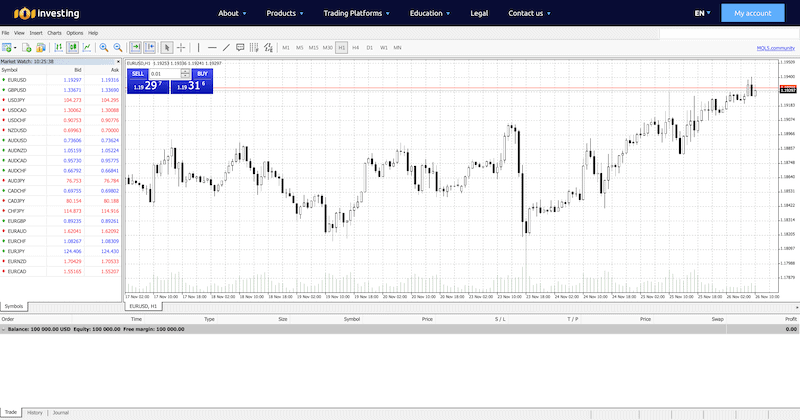

When it comes to trading platforms, 101Investing offers investors to choose between its own proprietary 101Investing WebTrader platform or the popular MT4.

Generally, The 101Investing platform is very convenient and more suited for beginners and intermediate traders. The proprietary software is compatible with any web-browser and does not require any installation. On top of that, the platform is fully customised and offers a variety of more than 30 professional analysis tools.

While the 101Investing web-based platform is a solid solution for beginners who are looking for an easy to use platform, some may prefer the popular MetaTrader4 due to its unique features that include huge variety of plugins and the ability to utilise automated trading. This is by far the most popular trading platform in the market, which is also available on any web-browser as well as on a mobile app.

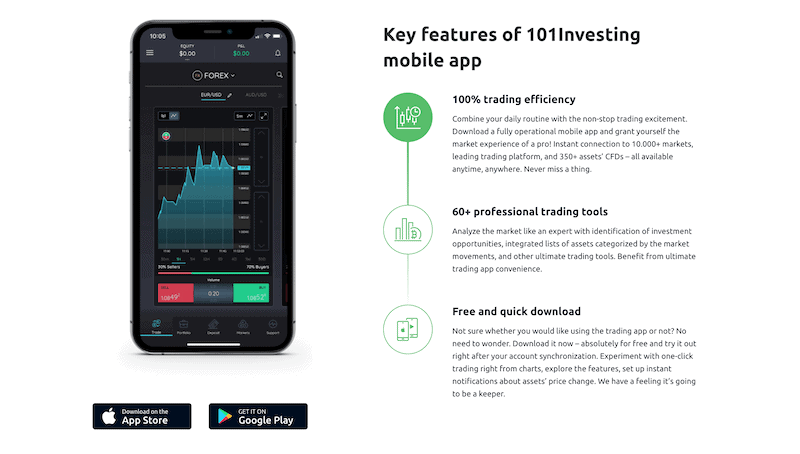

101Investing Mobile App

On top of its two web-trading platforms, 101Investing also offers mobile trading apps for both the 101Investing platform and for the MT4 (both platforms are available on the App Store and Google Play).

While some investors prefer the familiar MT4 platform, we must mention that we were very impressed by the award-winning 101Investing mobile trading app. On this trading app, investors get access to over 350 assets, 9 chart timeframes, more than 60 professional trading tools, and an education and market analysis center.

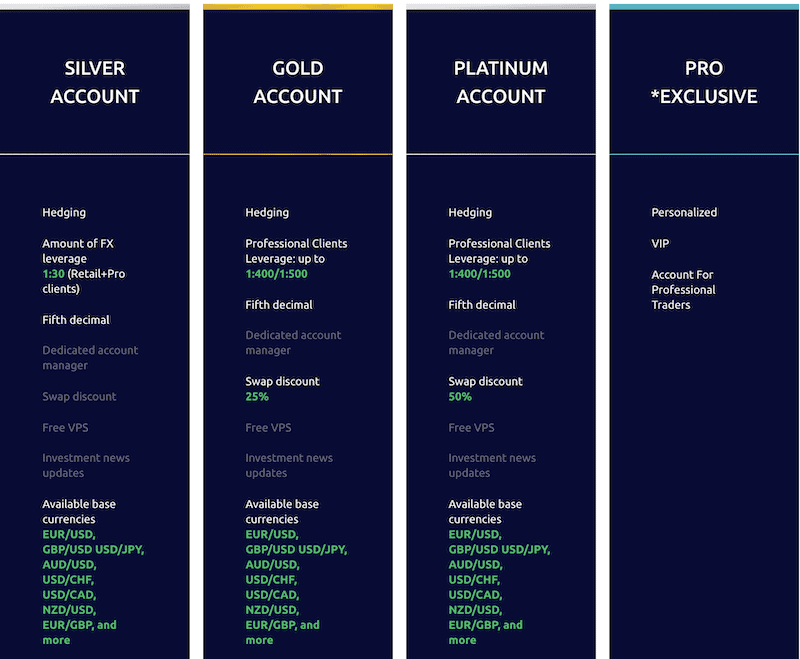

101Investing Account Types

101Investing offers several trading account types – The Silver account, Gold account, Platinum account, and Pro Exclusive account. Each account was specifically created for a different level of trading. As such, if you are a beginner it would be best for you to start with the Silver account, however, experienced traders can choose between the Gold, Platinum, and Pro Exclusive account type. Here are some of the differences in the account types offered by 101Investing.

As mentioned above, 101Investing also offers an unlimited demonstration account with a balance of €10,000.

Islamic Account

If you are looking for an Islamic no-swap account, 101Investing also offers to traders who may have to comply with the Sharia law to trade CFDs with no interest and swap charges on overnight positions. Some of the key features of 101Investing Islamic account include:

- No overnight interest rate fees

- No hidden costs

- No time limit for holding overnight positions

- No spread widening

- High leverage of up to 400:1

101Investing Demo Account

101Investing gives new clients the option to open a demo account and try it out before risking real capital. The demo account allows potential investors to use virtual trading funds in trading, and get familiar with the platform and the trading features offered by the broker.

In order to utilize the demo account, you’ll have to navigate to the ‘Client Arena’ and click on the ‘Set Up Practice Account’ button. Take note that the demo account comes pre-loaded with a balance of €10,000, and leverage of 30:1.

Research, Analysis and Education at 101Investing

This is an area in which the 101Investing excels. The broker offers plenty of educational and market analysis resources including articles, webinars, VOD, eBooks, tutorials, and courses.

As for market analysis tools, 101Investing has an ongoing daily news section, a trading signals service, an economic calendar, and an earnings reports calendar for US stocks.

Overall, 101Investing has made an effort to provide the necessary tools for newbies as well as for more professional traders. Our review found that 101Investing is one of the top platforms when it comes to research and market analysis tools.

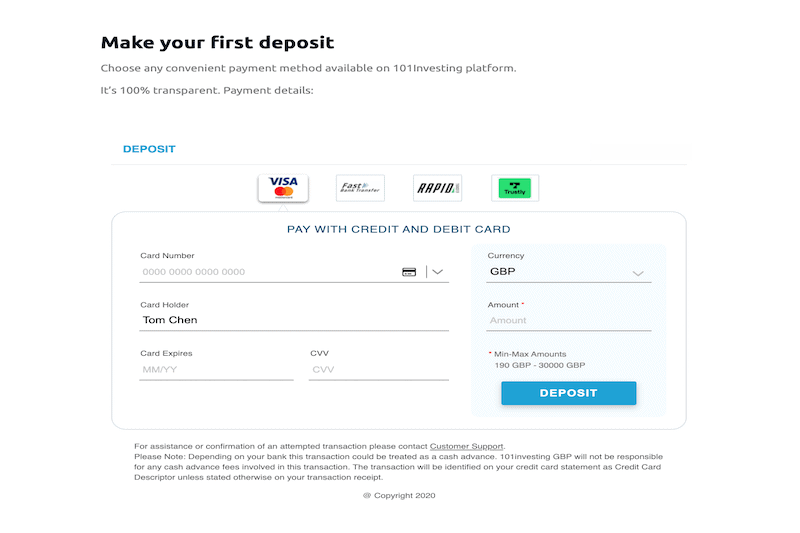

Payment Methods at 101Investing

In terms of funding your account, 101Investing offers three methods to add funds: These include:

- Credit or Debit Card – Visa, MasterCard

- Bank transfer – FAST bank transfer, RAPID.

- E-wallet – Trustly

101Investing Minimum Deposit

The minimum deposit with 101Investing is 100 USD/GBP/EUR if you decide to deposit funds via a debit credit card or via an electronic wallet. If depositing via wire transfer, the broker maintains a minimum amount requirement of 1000 USD/GBP/EUR. 101Investing does not have any restrictions regarding the maximum amount a client can deposit.

Customer Service at 101Investing

101Investing ensures that investors get a professional customer service support via a submit ticket form, email, phone number, and live chat. On the negative side, the 101Investing team is not available 24/7, and offers support between Monday to Friday 8:00-18:00 GMT.

In addition, the broker has a comprehensive FAQ section with plenty of information about the account creation process, terms and conditions, deposit and withdrawal, fees, details about live and demo accounts, and more.

Is 101Investing Safe?

Although 101Investing is a relatively new broker, it is already considered as a safe and secure online trading platform. One of the key strengths of 101Investing is the user-privacy protection and the security features it offers. The broker uses top security features that include firewalls and SSL software, servers in SAS 70 certified data centers, encrypted transactions and communication data servers, and Level 1 PCI compliance service moderation.

In terms of regulation, 101Investing is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 315/16. On top of that, the broker is a member of the Committee of the European Securities and Markets Authority (ESMA).

As for the safety of funds, 101Investing holds all clients’ funds in segregated accounts of trusted global banking institutions. Another crucial factor for investors is that 101Investing is also is a member of the Investor Compensation Fund (the “Fund”) for Clients of Cyprus Investment Firms (CIFs) under the Investment Services and Activities and Regulated Markets Law of 2017 L.87(I)/2017. This means that clients are secure in case the broker is unable to fulfil its financial obligations towards its clients.

Join 101Investing – Steps Required

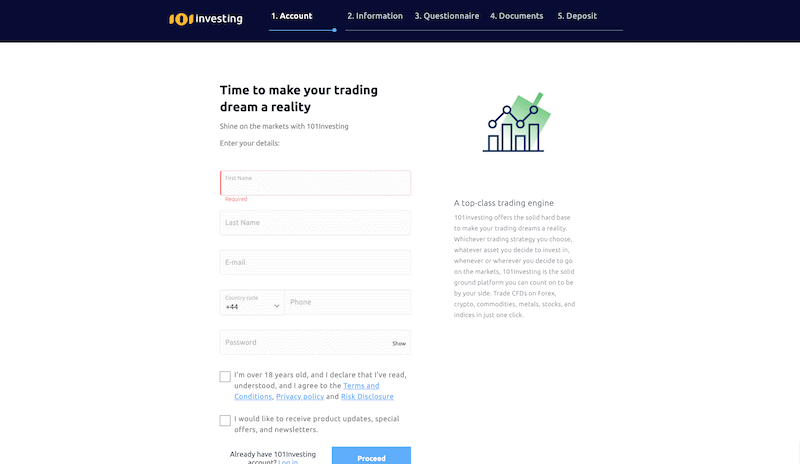

Opening an account at 101Investing is fairly simple. Below you’ll find the step-by-step process required to open an account and start trading with this broker.

Step 1: Open an Account

First, you need to sign up for a free online trading account with 101Investing. To do that, you’ll have to submit some personal information in the sign-up registration form, and complete a questionnaire that includes 25 question about your occupation, financial status, and trading experience. Bear in mind that you can complete the registration process from your desktop or on the 101Investing mobile app.

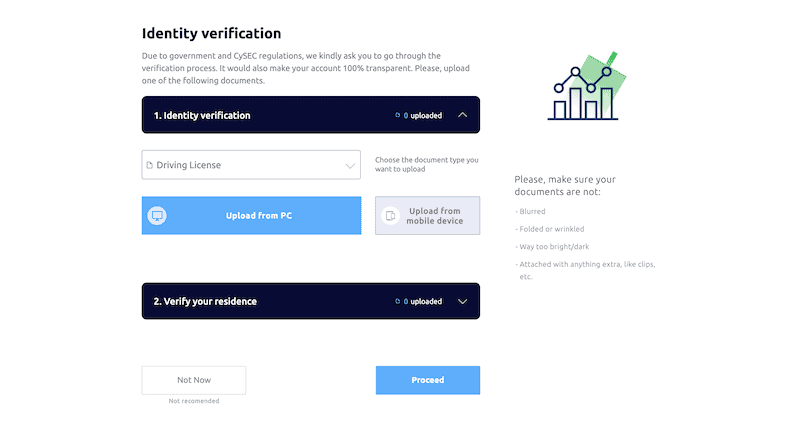

Step 2: Upload ID

As 101Investing is CySEC regulated broker, it requires new users to verify their identity. As such, the broker requires investors to upload a copy of either a valid International Passport, National ID card or Driver’s License and a utility bill or bank statement in your name and address dated within the last 6 months. The verification can be completed when you register for the first time, but you can also skip this step and upload the documents at a later date.

Step 3: Make a Deposit

As soon as your account has been approved by 101Investing’s support team and you are ready to start trading the live market, you can then fund your account.

As we mentioned earlier, the broker maintains a minimum deposit of 100 USD/GBP/EUR. You can make your deposit via credit or debit card, bank transfer or e-Wallet.

Step 4: Start Trading

That’s it – Once you have completed the registration process and made your first-time deposit, you can start trading. In order to place your first order in the market, double click on the instruments you wish to trade on. Then, you’ll see an order box where you need to set a volume, the type of order, and stop loss and take profit orders.

101Investing Pros and Cons

Pros

- A range of two trading platforms for newbies and experienced traders

- 101Investing offers very competitive spreads and low trading fees

- Good selection of US shares and cryptocurrencies

- A comprehensive education and market analysis section

- Uses top security features to protect clients’ data

- Four types of accounts

- Offers Islamic account

- Regulated by the CySEC

Cons

- Does not offer trading on Exchange Traded Funds (ETFs)

- High inactivity fee

- Getting access to the demo account is a bit complicated

101Investing Review – The Verdict

Finding a reliable forex and CFD broker is not an easy task. New brokers constantly come and go, and it’s often hard to know whether a certain broker is regulated and can be trusted. Following this review, we could say that 101Investing has gained the necessary licenses, reputation, and security tools in order to offer a great all-in-one solution for trading purposes.

Since its foundation, 101Investing has succeeded to acquire STP/NDD connection to top liquidity providers that provides extremely tight spreads and removes the conflict of interest between the client and the broker. On top of that, investors have access to over 350 assets via two top trading platforms, which can be traded on a zero-commission basis.

101Investing – Top CFD Broker with Low Fees

74% of retail traders lose money when trading CFDs.

FAQs

What is 101Investing?

101Investing is an online trading platform that offers investors various trading instruments via two advanced trading platforms.

Is 101Investing a regulated broker?

Yes. 101Investing is regulated by CySEC and complies with the rules and requirements of the The Markets in Financial Instruments Directive (MiFID).

Is 101Investing available in my country?

101Investing offers online trading services in most countries worldwide with the exception of countries such as Japan, Canada, Hong Kong, USA as well as certain EU Member States (i.e. Belgium and France).

Does 101Investing have a mobile app?

Yes, 101Investing offers a mobile app for both platform - the 101Investing mobile app and the popular MT4. These are available on Google Play and the AppStore.

What is the minimum deposit at 101Investing?

101Investing has a minimum deposit requirement of 100 USD/GBP/EUR.