Join Our Telegram channel to stay up to date on breaking news coverage

The ChatGPT artificial intelligence program appears to have chosen a side in the age-old argument between bitcoin and gold as a wise investment. The well-known generative text engine is hailed by financial analyst Peter Schiff for allegedly favoring gold. After all, “AI is pretty intelligent,” he wrote in a tweet on Wednesday. It did not advise investing in Bitcoin.

Instead of Bitcoin, ChatGPT opts to add gold in its “recession-proof” portfolio

The investor cited a story from the previous week that discussed ChatGPT’s notion of a “recession-proof” portfolio. According to the document, which was printed in “Gold IRA Handbook,” ChatGPT advised a 20% allocation to gold and other precious metals to lessen the effects of any single market slump. Without mentioning Bitcoin, the rest of its fictitious portfolio was made up of bonds (40%) “conservative” equities (30%), and cash (10%).

Yet, the AI bot’s response might not always be a criticism of cryptocurrencies or a support for gold. ChatGPT said that the decision of whether to purchase Bitcoin or Gold ultimately relies on your financial objectives when explicitly questioned it on April 6 about “Gold or Bitcoin.”

According to the report, “Gold is a tangible asset that is regarded as a safe-haven investment during periods of economic instability. Gold is a restricted resource that is difficult and expensive to mine, giving it a certain sense of scarcity and intrinsic worth. Bitcoin, which “is not backed by any tangible asset or government” and is “considered by many to be a speculative investment,” was contrasted with historical money by the bot. The report concluded:

“Gold may be a better option for individuals searching for a reliable, long-term investment, whereas Bitcoin may be more appropriate for those looking for a high-risk, high-reward investment opportunity.”

However, it should be emphasized that the corpus of knowledge on which ChatGPT is built is only up to date through 2021 and most likely excludes the considerable up- and down-movements in the price of Bitcoin that have occurred subsequently.

Investors in both gold and bitcoin are doing very well this year, with each asset up 10% and 68% so far. According to a tweet from Schiff on Thursday, the former just broke over a multi-year resistance mark around $2,000 per ounce, which might now act as the “launch pad for a moonshot.”

#ChatGPT AI is pretty intelligent after all. It didn't recommend any allocation to #Bitcoin.https://t.co/mnhRN2TmFm

— Peter Schiff (@PeterSchiff) April 6, 2023

Due to their strong monetary characteristics, particularly their scarcity, which theoretically makes them immune to inflation or monetary debasement like fiat currencies, gold and bitcoin are frequently compared as types of money. Both assets saw a rise in value in March after the Federal Reserve injected hundreds of billions of dollars back into the banking system to support Silicon Valley Bank’s depositors and avert similar bank failures.

While Schiff seizes the chance to increase his gold holdings, an army of Twitter Bitcoiners—including his own son—remain in opposition. When asked about gold’s recent advances, Spencer Schiff responded,

Long-term, bitcoin is a lot better buy than gold. In the long run, bitcoin is probably going to demonetize gold. I have no notion about the short term because I don’t trade and just think about the long term.

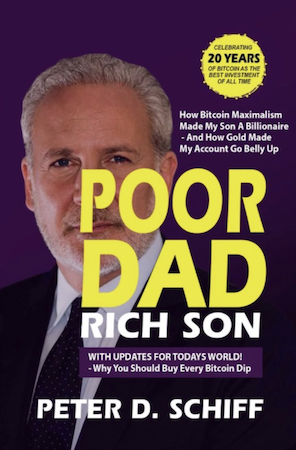

During the 2020-2021 crypto bull run, Schiff was often criticized and even ridiculed for his staunch opposition to bitcoin and his promotion of gold, which barely rose during that time, compared to the crypto market. He was sometimes the subject of memes on the popular site Reddit “Poor Dad, Rich Soon”, a comical play on words on Robert Kiyosaki’s best-selling book.

It will remain to be seen which of these two major assets will be in the real winner in the long term and intermediate term. For now, given the sharp decline in cryptocurrencies and other assets, and seeing how precious metals have maintained their values, the jury is still out on how things will unfold in the times ahead.

Related

- ChatGPT version 4 successfully passes SATs being in the top 10% of the cohort

- Clamor For ChatGPT Sends AI-Related Crypto Coins Soaring

- Generative AI Hype In The Silicon Valley

Join Our Telegram channel to stay up to date on breaking news coverage