UPDATE – FTX has filed for Chapter 11 bankruptcy – we advise against attempting to open an account at FTX and recommend eToro instead which has been unaffected by the crypto market crash. We have also moved our FTX affiliate links to eToro which is a far safer option at this point.

The rising popularity of cryptocurrencies has led to an increased presence of many crypto exchanges in the industry, which is why it becomes important to have a detailed look regarding the services, features, pros, and cons of every crypto exchange.

Read ahead as we review the FTX, a cryptocurrency exchange that allows you to trade in derivatives markets.

This in-depth FTX review will sail you through the various products and services available, supported marketplaces, functionalities, and fees associated with trading on the exchange.

How does FTX exchange work?

This centralized crypto exchange provides a web platform and a mobile application for buying, selling, and trading cryptocurrencies. There are two types of FTX platforms. Clients outside of the United States can access the main FTX platform. It has a broader selection of coins and more features, such as crypto derivatives trading. Except for New York, customers in the United States can access the more basic FTX US service.

Different services provided to users on the FTX platform

Once users have registered for an FTX account and verified their identity, they can deposit funds via ACH bank transfer or wire transfer. After the deposit is received, users can use the funds to purchase any of the cryptocurrencies available on this platform.

FTX also supports crypto staking on its platform through which users could grow their crypto holdings. One could know which assets are available for staking from one’s FTX account and then could stake its crypto to earn approximately 8% in rewards.

Which other products does it offer?

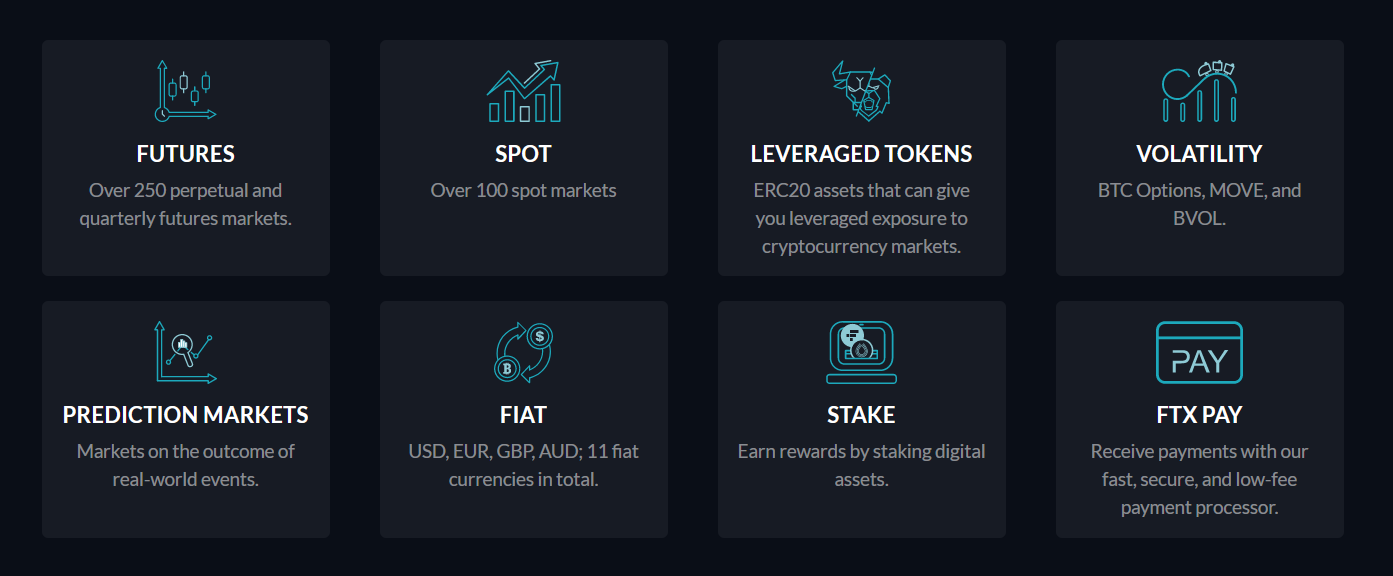

Futures

The option of trading Futures is one of the best tradable products on FTX. Futures are derivative instruments that bind the parties to exchange an asset on a predetermined date and price. Leverage is also available while trading cryptocurrency futures.

On FTX, you can leverage most of the platform’s derivatives contracts up to 101x.

The fact that FTX has introduced futures for lesser-known cryptocurrencies with small market values is noteworthy. The majority of these digital assets, crucially, are not available for trading via futures contracts on any other exchanges.

The FTX platform has attracted a distinct mix of traders and speculators due to this. FTX now offers over 80 coins for future contracts. BitMEX, one of the most popular cryptocurrency exchanges for derivatives trading, only offers futures contracts for 13 distinct digital coins. It’s also worth noting that FTX offers Perpetual Futures trading.

These are non-expiring futures contracts. On the other hand, perpetual futures prices are changed every hour to keep up with the value of the underlying asset.

Leveraged Token

Leveraged tokens are a type of financial instrument only available on FTX. They’re ERC20 assets that reflect the underlying digital coin’s real-world valuation.

FTX currently has four types of leveraged tokens available:

BULL is +3x

BEAR is -3x

HEDGE is -1x, and

HALF is +0.50x.

To maintain the intended leverage, the BULL, BEAR, and HEDGE tokens automatically rebalance themselves throughout the day. To put it another way, if you make a profit, the tokens will reinvest it.

If you lose money, the tokens will sell a portion of your investment in order to lessen their leverage. This eliminates the risk of liquidation when dealing with leveraged coins. Because the rebalancing is automated, the trader saves time and effort by not having to manually manage their exposure.

Options

Options are derivatives similar to futures for people who are new to trading. The primary distinction is that the contract holder is not obligated to buy the underlying asset when it expires. Instead, options allow you the opportunity, but not the responsibility, to purchase an asset.

On FTX, only Bitcoin choices are currently available. You can create your own options contract and submit it to the exchange for a quote. Within 10 seconds, FTX will make you an offer. It is then up to you to determine whether you wish to accept or reject this offer.

You can also wait a little longer to see if any new deals appear. The Request for Quote will disappear after 5 minutes if you do not accept any offer.

MOVE Contracts

MOVE contracts are a new type of volatility contract accessible on FTX. These are the percentage changes in an asset’s value over a given period of time. For example, if ETH moves $100 in a single day, the MOVE contract will be worth $100.

If traders believe the asset will move significantly in either direction, they might open a long position on a MOVE contract. On the other hand, if you believe the asset will remain generally stable, you can open a short position. MOVE contracts are available in three trading periods: daily, weekly, and quarterly.

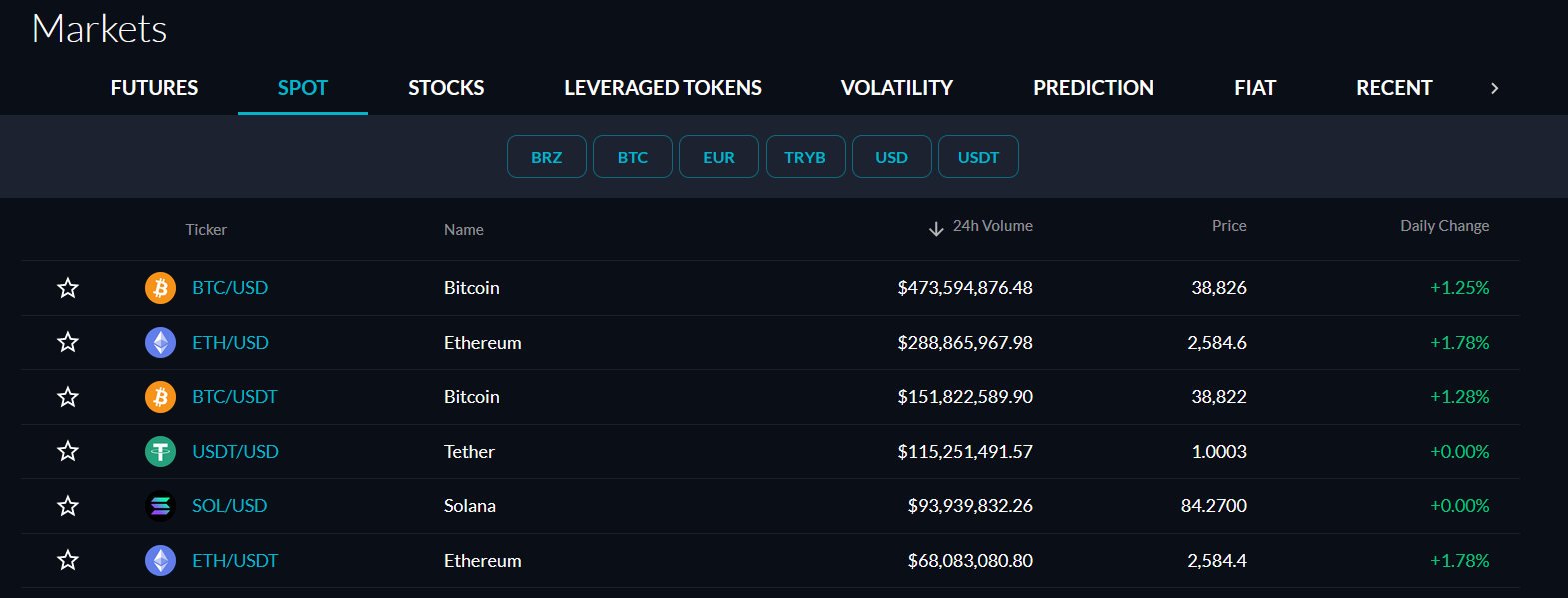

Spot Markets

Users can buy cryptocurrencies and then trade them using standard methods such as market-matched orders. BTC, ETH, LINK, FTT, BCH, BNB, USDT, BTMX, TRYB, PAXG, and XAUT are just a few of the popular digital cryptocurrencies that may be traded on the spot market.

Prediction Markets

Prediction markets are bets on what will happen in the actual world. In contrast to similar products, FTX prediction market contracts settle at either 0% or 100%. (in other words, they are win or lose).

They allow users to do business in more traditional ways. It works similarly to traditional betting. Any real-world event can be bet on. You’ll either win, and the contract will settle at 100%, or you’ll lose, and the contract will drop to 0%.

One well-known example is the ability to wager on who will win the upcoming elections. A contract will be issued to each candidate. Each candidate’s buy-in price will be different, and it will be determined by their chances of winning. They have the option of making each contract longer or shorter.

Your capital is at risk.

Trading fees on FTX

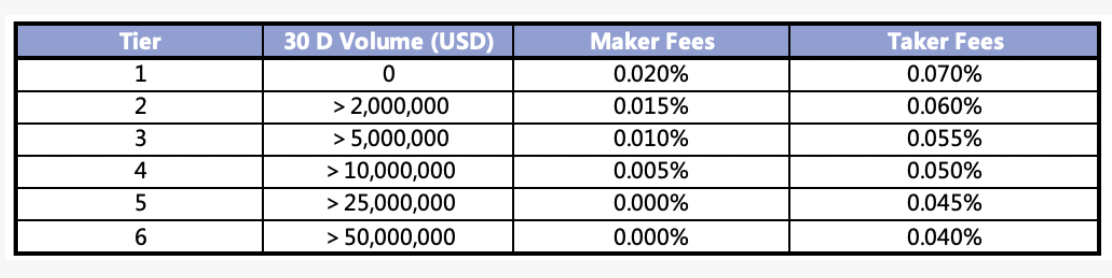

Because the fees in FTX are low, customers are drawn to it. The maker and taker fees start at 0.10 percent and 0.40 percent, respectively. Its initial rates are better and lower than those offered by other cryptocurrency exchanges.

High-volume traders can also qualify for lower fees through FTX.

User Interface on the FTX Website

FTX has many features, and it recognizes that new users can have trouble finding them. The exchange provides an overview guide to help with this. Important information is also displayed prominently on the FTX website.

For individuals interested in staking FTX’s token, FTT, for example, the exchange clearly lays out the regulations. It specifies that unstaking takes 14 days and that unstaking tokens will not be counted for staking rewards. According to the document, users who want to unstake swiftly can pay a charge.

Clean UI of the FTX Platform

There are numerous articles categorized by topic that describe FTX’s various offerings, terminologies, and policies. Take, for example, margin trading. For FTX, this is a crucial product.

Given the intricacies of margin trading, FTX does an excellent job of defining its terms. What causes a margin call is one of the most common questions among those engaging in margin trading.

What is FTX Native Token aka FTT?

FTT is the native cryptocurrency token of the crypto derivatives trading platform FTX, which provides its holders with a number of advantages on the site.

The weekly burning and buyback of FTT tokens, a proxy dividend for holders, lower FTX trading fees, FTT as collateral for futures trading, socialized earnings from the insurance fund, and so on are some of the advantages.

What is FTX Over-The-Counter (FTX OTC)?

For traders who wish to purchase or sell big sums of cryptocurrency, FTX has its own OTC trading desk. The OTC Trading desk connects buyers and sellers so that cryptocurrencies may be exchanged at a set price and at a certain time, regardless of market volatility.

Users can obtain quotes using the FTX OTC Portal, and higher transaction volumes get preferred prices. Outside of the spread, there are no costs.

How secure is the FTX platform?

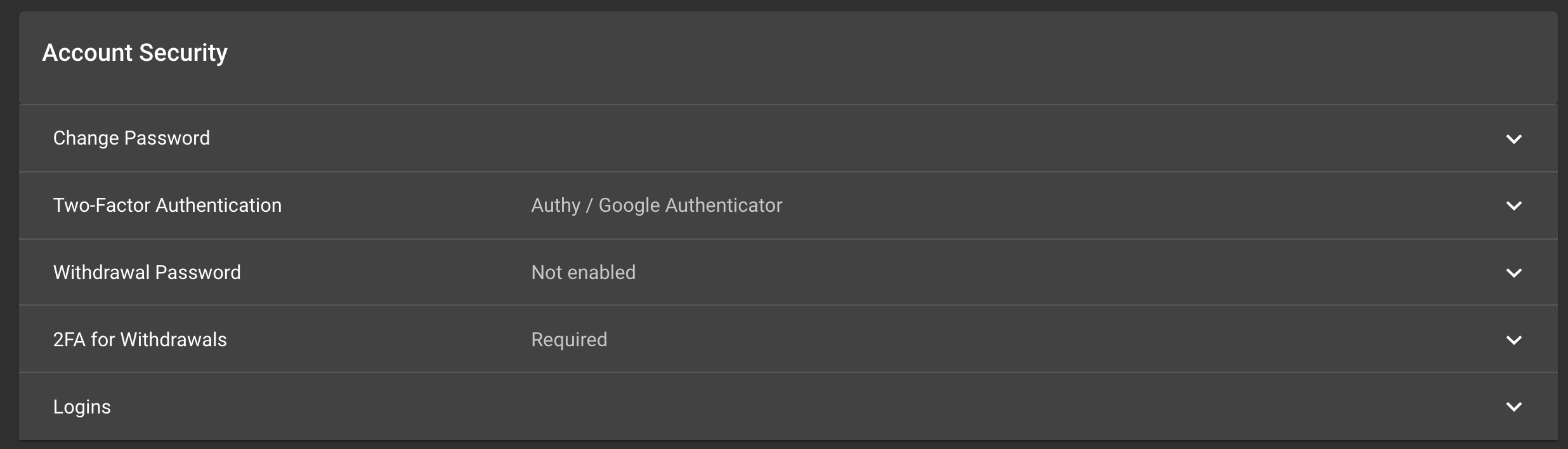

FTX is a secure cryptocurrency exchange with all of the expected security measures. FTX has also teamed with Chainalysis to monitor suspicious cryptocurrency transaction alerts in the Chainalysis ‘Know Your Transaction (KYT) product. It is a real-time anti-money laundering (AML) compliance solution for cryptocurrency transactions.

FTX Platform employs different security methods

This, in combination with FTX’s thorough assessment of big or questionable deposits and withdrawals, provides an extra degree of security. FTX requires users to use complicated passwords so hackers can’t break them easily.

FTX has a custom-built hot and cold wallet solution, full external backup of all hot wallet funds, two-factor authentication (2FA) for each account, optional 2FA and password for crypto withdrawals, and relationships with industry-leading custodians, among other security features.

Advantages of FTX Platform

User-friendly platform

The FTX team has worked hard to create a platform that is user-friendly for traders of all skill levels. It is immediately apparent when you visit the FTX homepage. The platform includes a sleep interface that can be set to light, dark, or black modes.

The majority of information about what FTX has to offer can be found on the webpage without having to sign up. You can also take advantage of a comprehensive series of articles, user manuals, and tutorials on how to use this platform. FTX also has a mobile app with trading tools and features for someone who is interested in making money with his skills in trading.

Access to a wide variety of cryptocurrencies and other financial assets

FTX allows users to choose from a wide range of cryptocurrencies. It offers over 275 different cryptocurrencies, which sets it apart from other platforms. FTX.US, on the other hand, is more limited, as it only supports 22 cryptocurrencies, including Bitcoin, some altcoins, and stablecoins.

The platform supports crypto staking and margin trading

FTX also allows its users to participate in crypto staking, earning rewards based on the amount staked. On your holdings, you can earn up to 8%. You can unstake your cryptocurrency if you want to trade it.

Margin trading is available to qualified users with a minimum account balance of $100,000 on FTX. Users in the United States can gain up to ten times the leverage. But because it creates the possibility of liquidity, this carries higher risks. If you’re a newbie, you should avoid utilizing it.

Low trading fees

Among the most appealing aspects of FTX are its low transaction fees. Fees for makers and takers begin at 0.10 percent and 0.40 percent, respectively. Taker fees are applied to orders that are entered instantly, while maker fees are applied to orders that are not entered immediately.

Availability of the FTX debit card

The FTX debit card is a virtual card that the exchange offers. You may use FTX.US to make online transactions using your balance. If the user’s balance is insufficient to pay for the purchases, FTX also enables the conversion of other coins to US dollars. The card’s characteristics may alter in the future.

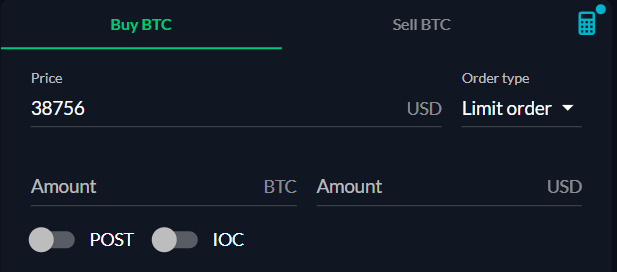

Multiple trading options

In addition to the standard market orders, FTX offers its users some exciting trading options through which they can make money. For example, users can make use of various advanced order types, such as stop-loss limit orders, take profit, stop-loss market orders, take profit limit orders, and trailing stop.

Secured exchange

FTX, like every other cryptocurrency exchange, emphasizes security as a top priority. FTX has a digital wallet in which you can keep your digital assets for this purpose.

The platform also encourages users to enable two-factor authentication, which will necessitate a password to gain entry to your trading funds as well as when withdrawing funds.

FTX NFT Marketplace

FTX has a marketplace for purchasing non-fungible tokens (NFTs). These tokens are famous among digital art collectors because they prove ownership of digital assets. NFTs can be bid on and purchased on FTX and FTX US. Users can also mint (create) their own NFTs and sell them at the bidding process. You can read our detailed review of the FTX NFT marketplace.

Disadvantages of FTX Platform

Concerns with regulation

Regulation is, in general, the most significant disadvantage of many US exchanges. Many NFTs resemble securities and alternate between consumer and financial items. This means there will be some confusion about whether it will be covered under a particular regulation or not.

Offers very little in the USA

US has a lower crypto selection, with FTX accounting for less than a tenth of the coins. There are no leveraged crypto coins or futures available. The platform offers very little to US customers.

Some major cryptocurrencies are missing.

Both FTX and FTX US are missing the major cryptocurrencies. Cardano (ADA), Chainlink (LINK), Avalanche (AVAX), Tether (USDT), Polkadot (DOT), Stellar (XLM), Dogecoin (DOGE), Litecoin (LTC), Sushiswap (SUSHI), Uniswap (UNI), and TRON are just a few examples (TRX)

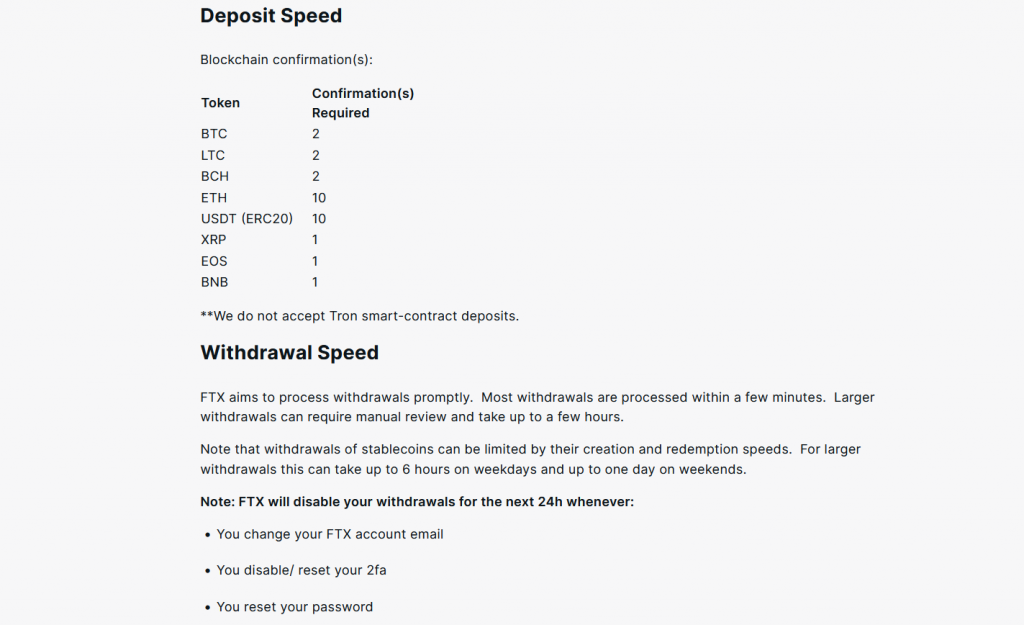

Deposits and Withdrawals

FTX accepts fiat deposits and withdrawals in a wide variety of currencies, including USD, EUR, GBP, AUD, CHF, HKD, SGD, CAD, and ZAR, as well as many cryptocurrencies, including BTC, ETH, BNB, LTC, etc.

At FTX, except for Silvergate SEN, wire transfers are processed only on weekday evenings, and it could take a whole day for the USD wire transfers to process, while non-USD transfers could take a long time. Users could make a fiat deposit and withdrawal from their FTX wallet by using the fiat currency of their choice.

Read more about the deposits and withdrawal policies of FTX here

They also have an option of converting their fiat currencies to USD with the help of the ‘CONVERT’ option in their wallet. All fiat transfers are managed by a third-party OTC desk, and dealing in fiat is restricted to Level 3 KYC verified accounts.

Customer Support

When it comes to handling customer queries, FTX has made sure that users can reach them via a variety of channels. To begin, FTX has prepared a detailed collection of guides and articles on the exchange’s various features. If you are unable to find answers to your questions in these guidebooks, the live chat box is always open. You can also write emails directly to the customer support team.

Interestingly, FTX has made sure that it caters to its diverse user base through various social media channels, such as Facebook, YouTube, and a lot more. Apart from it, there are Telegram and WeChat groups for various languages where customers can interact with other traders in the FTX community.

Comparisons with other crypto exchanges

FTX vs. Coinbase

FTX has considerably lower trading fees than Coinbase and the majority of the top cryptocurrency exchanges. Even as Coinbase Pro has a much more competitive fee schedule than the standard Coinbase platform, FTX performs better. FTX employs a tiered fee structure in which the amount you pay is determined by your 30-day trading volume.

FTX’s international platform offers over 270 cryptocurrencies, but FTX US has a much-limited selection of just over 20. With over 90 cryptocurrencies available to buy, Coinbase falls somewhere in the middle.

FTX offers a custodial wallet where you can store your purchased cryptocurrency and exchange cryptocurrencies to and from other wallets. The disadvantage of custodial wallets is that the exchange controls your cryptocurrency because it has access to your private keys.

If you want complete control over your cryptocurrency, you must first transfer it to your own external wallet. Coinbase offers an external wallet that is both custodial and non-custodial. Both FTX and Coinbase place a high value on security and have proven track records. Each of these crypto exchanges performs admirably in terms of security.

FTX vs eToro

FTX is a cryptocurrency exchange based in Antigua and Barbuda that began operations in 2019 and allows users to buy and sell more than 47 cryptocurrencies. eToro is a multi-asset platform that allows you to invest in stocks and cryptocurrency as well as trade derivatives.

Unlike FTX, eToro also enhances the user trading experience by providing tools such as copy trading, smart portfolios, and a lot more.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

FTX vs. Binance

Binance has a smaller selection of cryptocurrencies that you can obtain for margin trading, as well as a smaller selection of trading pairs. For those that like to reap the benefits of these features, FTX offers a wide array of options and more trading pairs. For example, FTX provides derivatives such as MOVE contracts, perpetual contracts, and even futures contracts.

In terms of fees, both platforms provide comparable services. Binance charges 0.1 percent for all spot trading transactions, regardless of currency. FTX also charges a 0.1 percent fee for all spot trading transactions, but the amount will vary depending on the coin being traded, as each has a different fee structure.

Binance, on the other hand, has a much lesser withdrawal fee than its competitor, as these are determined based on the coin being withdrawn from or deposited into your account.

Your capital is at risk.

How to buy Crypto on the FTX App?

Users can easily buy, sell, or trade any crypto on the official mobile application of FTX exchange, which is known as Blockfolio. Given below are the steps you are required to follow for purchasing any cryptocurrency on the FTX app:

Step 1: Click on the cryptocurrency that you want to purchase. Make sure your Fiat wallet has enough currency to buy the amount of cryptocurrency you want. On the cryptocurrency’s chart screen, click Buy.

Step 2: Make sure the currency selector suggests that you are purchasing the token in your default fiat currency. On the keypad, specify the amount you want to trade. You can also choose to use a proportion of your fiat wallet. If you don’t have enough money to make your desired buy, you can deposit now. Select Review.

Step 3: Examine the specifics of your purchase. If everything appears to be in order, slide to submit. A confirmation screen will appear. Click on ‘Done’ to review your new cryptocurrency balance in your wallet.

Your capital is at risk.

How to sell crypto on the FTX App?

For selling any cryptocurrency on the FTX app, make sure you follow these steps:

Step 1: Select the currency you want to sell by tapping on it. Select Sell.

Step 2: Make sure the top of the screen says you’re selling the coin for your predefined fiat currency. On the keypad, enter the amount you want to trade. Alternatively, you can trade a proportion of your portfolio. Select Review.

Step 3: Examine the specifics of your sale. If everything appears to be in order, slide to submit. A confirmation screen will appear. Click on ‘Done’ to review your new fiat balance in your fiat wallet.

Your capital is at risk.

Conclusion

FTX is also constantly improving and expanding at a rapid pace. With truly exciting financial products and services, the platform hasn’t ever disappointed traders. Since its launch, its reputation has only risen; during times of market volatility, FTX has established itself to be one of the only centralized exchanges to keep up – when Binance, Coinbase, and others have experienced downtime, FTX has shone.

FTX is a good option for investors looking for liquidity. The platform includes several exchange-exclusive characteristics, such as leveraged tokens and prediction markets.

Overall, FTX is the right crypto exchange for all those crypto enthusiasts who are interested in advanced features, such as margin trading. Apart from offering competitive trading fees, this exchange also allows its users to make money by staking their cryptocurrency holdings.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Is FTX a good crypto exchange?

FTX is a decent crypto exchange that offers low crypto trading fees with a wide variety of cryptocurrencies to all its users. The exchange also provides some advanced trading features to its traders, such as the option of trading between cryptocurrencies and multiple fiat currencies.

Can US citizens use the FTX crypto exchange?

FTX does not permit trading on its platform by residents of the United States of America. FTX US, a separate trading platform, operates in the United States and holds a number of US regulatory licenses.

Do you need to go through the KYC process to trade on FTX exchange?

Yes, users have to complete the KYC process for trading on this exchange.

Does FTX exchange offer a crypto wallet?

FTX offers a custodial wallet where you can store your purchased cryptocurrency and transfer cryptocurrencies to and from other wallets.

Does FTX available on mobile phones?

Yes, FTX has a mobile application known as Blockfolio, where users can easily buy, sell, or trade in cryptocurrencies at their own convenience.