Constructed to streamline digital asset transactions, Bitcoin Profit portrays itself as a platform dedicated to cryptocurrency trading. This review outlines the trading features, range of cryptocurrency tokens, and withdrawal speeds purportedly available on the platform.

Bitcoin Profit Review 2024 – Overview

- Supported assets: Cryptocurrency, Stocks, Forex, Commodities

- Success rate: Not available

- Multiple Payments: Not mentioned

- Deposit/Funds withdrawal: Not mentioned

- Customer Service: Available to all registered traders

- Made our Best Bitcoin Robots List? No

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

What Is Bitcoin Profit?

Bitcoin Profit claims to provide a cryptocurrency trading platform facilitating user registration and initiation of trading activities with some of the leading digital currencies. The platform purportedly addresses the increasing demand for such trading services amidst observed market dynamics in the crypto sphere in 2024.

Following the significant bull run in 2021, the crypto markets experienced a downward trend throughout 2022, including notable assets like Bitcoin and Ethereum, attributed to uncertain economic circumstances compounded by the pandemic backdrop. However, Bitcoin reportedly regained momentum in 2023, recording a noteworthy rise of over 40%.

As stated on Bitcoin Profit’s website, members are purportedly enabled to engage in trading activities involving Bitcoin (BTC) and select altcoins through its trading interface, contingent upon an initial minimum deposit of $250 to access trading features.

Information gathered from other Bitcoin Profit reviews suggests the platform claims to facilitate rapid withdrawal processing, promising fund returns within a 24-hour timeframe. Additionally, Bitcoin Profit purportedly asserts a no-trading-fee policy and provides a dedicated customer support service for user assistance.

However, the absence of customer testimonials and comprehensive information on the trading platform’s website poses challenges in verifying some of the claims made by Bitcoin Profit. Hence, individuals considering investment in Bitcoin Profit are advised to thoroughly review all terms and conditions before proceeding.

Bitcoin Profit Profit Pros and Cons

The following points outline the purported advantages and drawbacks of the platform, as claimed by its website.

Pros

- Withdrawals processed within 24 hours

- No additional trading fees are charged

- Allows trading of Bitcoin and multiple altcoins

Cons

- Limited information provided about trading tools on the platform website

- Requires a hefty minimum deposit of $250

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

How Does Bitcoin Profit Work?

The website for Bitcoin Profit asserts that, unlike many other crypto trading platforms, it mandates users to pay before gaining access to its trading dashboard, where trading tools, price charts, and indicators are purportedly available. According to the website’s claims, users can only evaluate the platform’s functionality after completing a minimum payment of $250. Creating an account is described as straightforward, requiring only basic details such as name and email address for registration.

On the Bitcoin Profit website, a list of cryptocurrencies purportedly available for trading is provided, including Bitcoin (BTC) and several top altcoins like Ethereum (ETH), Dash (DASH), Binance Coin (BNB), and Cardano (ADA), among others.

The platform’s website also asserts that Bitcoin Profit is SSL (Secure Sockets Layer) secured, a standard security measure for internet connections that purportedly safeguards against online scams and prevents the theft of funds.

Bitcoin Profit Features

The following sections outline some of the critical features purported by Bitcoin Profit, as per the information provided on its website.

Commission-Free Trading

Bitcoin Profit purportedly claims to impose no commissions on trades. While platforms typically derive revenue from spreads when not charging commissions, Bitcoin Profit purportedly does not levy additional fees for spreads, trading expenses, or subscription charges.

Access to Top Crypto Assets

Bitcoin Profit purportedly asserts that all its members have access to round-the-clock cryptocurrency trading. Alongside major cryptocurrencies, the platform purportedly allows trading alternative coins such as DASH, Zcash, Ethereum Classic, etc.

Bitcoin Profit Account Fees

According to the website, Bitcoin Profit asserts that its platform maintains transparency regarding deposits, withdrawals, and fees, claiming that these processes are transparent and refundable. It is purported that users can withdraw funds after live trading sessions without encountering hidden fees or charges within the platform’s payout system.

Bitcoin Profit Minimum Deposit

The website asserts that Bitcoin Profit requires a minimum deposit of $250, which purportedly can be paid via credit/debit card or e-wallet. According to the website’s information, this cost is higher than what is typically seen on other leading trading platforms. The website suggests that potential investors should consider their trading budget before investing.

Bitcoin Profit Compatible Devices

The website for Bitcoin Profit states that users can access its trading platform through various devices. Although it does not offer a dedicated trading app, Bitcoin Profit claims to be accessible through web-based browsing on mobile devices. The proprietary trading platform is said to be accessible on devices such as laptops, desktops, iPads, and tablets.

Is Bitcoin Profit a Scam?

Based on the information on its website, Bitcoin Profit presents itself as a platform designed for crypto trading, offering users the ability to buy and sell various cryptocurrencies. However, the platform’s transparency appears limited, as critical information remains undisclosed.

According to Bitcoin Profit’s claims, feedback on client review platforms like Trustpilot is scarce, with fewer than 30 reviews available, raising questions about the platform’s credibility. Additionally, details regarding the ownership of Bitcoin Profit still need to be discovered. Furthermore, prospective users may find that accessing information about the platform’s trading features requires a minimum deposit.

Given these observations, it is prudent for individuals considering Bitcoin Profit to evaluate the associated risks thoroughly. Potential investors should conduct comprehensive research and assessment to ascertain whether the platform aligns with their trading objectives and preferences.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

Bitcoin Profit Customer Support

Based on information gathered from Bitcoin Profit reviews, the trading platform reportedly provides access to a customer support team. Allegedly, members can avail themselves of this service around the clock for assistance with account-related matters or general inquiries. The customer support team is said to be reachable through email and live chat channels.

How to Use Bitcoin Profit

Interested in trading with Bitcoin Profit? According to the website, users can determine whether to engage in trading activities after reviewing the platform’s terms and conditions. If the decision is affirmative, the following steps are recommended:

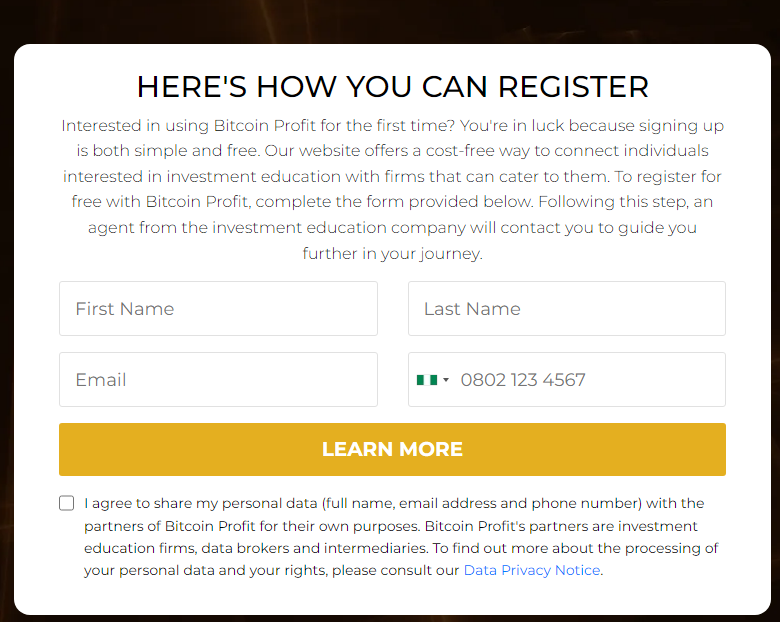

Step 1: Registration

According to the platform’s instructions, to establish a new account, individuals are advised to visit the Bitcoin Profit trading website to establish a new account.

Upon reaching the page, the website suggests creating a new account by providing personal details such as first and last name, phone number, and email address.

Step 2: Deposit

Once the account registration is completed, users are informed they can proceed to make the minimum deposit. The website claims this deposit can be facilitated through various payment methods, including debit/credit cards and e-wallets like PayPal.

Step 3: Commence Trading with Bitcoin Profit

Upon successfully processing the payment, the website asserts that users can begin trading with Bitcoin Profit. Users are encouraged to select their preferred cryptocurrency and initiate trading through the platform.

How to Delete Bitcoin Profit Account

Based on assessments from other platform evaluations, it is purported that users can close their Bitcoin Profit accounts via the menu interface. Nonetheless, Bitcoin Profit does not provide further details regarding the procedure for closing an account.

Are There Celebrity Endorsements of Bitcoin Profit?

The website for Bitcoin Profit reportedly asserts that it has received celebrity endorsements, though these assertions lack substantiated evidence. Potential users are advised to evaluate the platform based on its features, security measures, and user testimonials rather than solely relying on unverified assertions of celebrity endorsements.

Who Are the Founders of Bitcoin Profit?

Upon reviewing the Bitcoin Profit website, the platform does not disclose any details regarding its founders. Speculations have arisen regarding the possible participation of celebrities in its creation, though the validity of these assertions remains unverified. More information about the creators or the team behind Bitcoin Profit needs to be available.

Bitcoin Profit Payment Methods

The website for Bitcoin Profit asserts that deposits, withdrawals, and fees are transparent and refundable, purportedly ensuring users’ comprehension of the platform’s financial procedures. According to the website’s claims, upon the conclusion of a live trading session, funds can allegedly be withdrawn without encountering any concealed fees or charges within the platform’s payout system.

Allegedly, withdrawals are swift, typically processed within 24 hours, purportedly enabling users to access their earnings promptly. As per the assertions made on the website, there are purportedly no minimum or maximum withdrawal limits on the platform. Bitcoin Profit supposedly refrains from imposing any account, deposit, withdrawal, or trading fees. However, the platform’s broker partners may impose trading commissions or spreads.

The Verdict

Our analysis of Bitcoin Profit has examined the assertions put forth by the crypto trading platform. According to multiple online reviews and customer feedback, Bitcoin Profit allegedly lacks transparency regarding its operational procedures. Information regarding the platform’s owners and its trading tools should be on its website. Therefore, individuals are advised to conduct thorough research independently and deliberate carefully before deciding whether or not to engage in trading activities with Bitcoin Profit.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

Bitcoin Profit Alternatives

There may be better choices for traders seeking alternatives beyond conventional training or educational programs than Bitcoin profit. Here’s a brief overview of alternative options that can help traders achieve superior results without the need for extensive training programs or courses.

Investing Early in New Crypto Presales or Icos

Venturing into presale cryptocurrencies presents a burgeoning opportunity in the market, promising substantial rewards alongside inherent risks. While some presale projects may skyrocket, transforming investors into millionaires, others may falter soon after launch. The key lies in identifying promising tokens before their debut on exchanges.

Effective participation in presale investing demands adept research and information-gathering skills. It serves as the crucial compass for staying ahead in this dynamic landscape. Although presale investing harbors the potential for lucrative returns, uninformed decisions could lead to entanglement in unprofitable ventures.

Presale projects typically divulge project details on their websites and within their community circles. Therefore, access to comprehensive information significantly amplifies an investor’s chances of selecting a winning endeavor.

For investors wary of extensive engagement on social platforms like Twitter or Telegram, InsideBitcoins’ presale articles are a valuable source of information. Offering insights into promising crypto projects backed by active communities and competent teams, it serves as a beacon for potential success.

Embarking on the presale journey entails initiating research with the resources provided, then delving deeper into social media and credible platforms to enhance one’s understanding and decision-making process.

Networking With Professional Traders

Establishing a robust professional network is pivotal for traders aiming to enhance their prospects of success. Across all industries, those with extensive networks of experts tend to excel. Mentors play a crucial role in fortifying the skills of their mentees, a principle especially pertinent for newcomers to the crypto realm.

Navigating the high volatility of the crypto market poses significant risks for inexperienced traders. However, aligning with a seasoned mentor can mitigate potential losses during the initial trading phases.

Regrettably, connecting with willing experts willing to aid newcomers is time-consuming. Even when found, accessing their guidance may prove financially prohibitive.

Alternatively, traders can explore social media platforms for cost-effective networking opportunities. Among these, Facebook, Twitter, and Reddit emerge as prime candidates. Discord Servers also offer avenues to engage with communities of proficient traders. Notably, Jacob Crypto Bury’s Discord Server stands out.

This platform hosts over 22,000 traders worldwide, with thousands remaining active throughout the day. Distinguished by its commitment to regularly disseminating premium market insights and trends, it is an invaluable resource for novices seeking to grasp fundamental concepts and glean insights from seasoned traders.

Automated Copy Trading in Crypto Exchanges

No trading tools or systems can substitute for a solid foundation of trading knowledge. However, employing inappropriate tools, platforms, or trading systems can significantly detract from one’s trading journey and outcomes, irrespective of one’s proficiency level.

Therefore, instead of opting for the Bitcoin Profit offer, a more suitable option could be exploring the social trading methods offered by platforms such as Bybit and OKX. What sets these platforms apart is their provision of a comprehensive environment where users can not only trade but also learn, network, and enhance their trading experience seamlessly.

FAQs

Does Bitcoin Profit have insurance or safeguards in case of hacking or other security breaches?

According to the website claims, Bitcoin Profit implements robust security measures to protect its platform and users' funds. Additionally, they claim to have insurance coverage to provide added protection in case of any security incidents.

Are there any restrictions on withdrawing funds?

Bitcoin Profit claims to offer flexible withdrawal options for its users without significant restrictions. However, users are advised to review the platform's withdrawal policies, as processing times may vary depending on the chosen withdrawal method and regulatory requirements.

What is the minimum investment required to start using Bitcoin Profit?

According to the claims made on the website, the minimum investment required to start using Bitcoin Profit is $250. This initial investment is said to provide users with access to the platform's features and the ability to engage in cryptocurrency trading.

Can I invest using fiat currency on Bitcoin Profit?

Bitcoin Profit website claims to support various payment methods, including fiat currency deposits such as bank transfers and credit/debit cards, in addition to cryptocurrency deposits. This flexibility purportedly allows users to fund their accounts in their preferred currency and start trading cryptocurrencies.