Stock trading can be a good way to make a return on your money, but if you’re a beginner, you may feel overwhelmed. You never know which are the best trading platforms, or how trustworthy they are. So how do you get started?

Read on to find out the answers to all these questions in this comprehensive guide for beginner traders. We will cover everything you need to know about stock trading including how to buy, trade, sell and hold stocks and evaluate the best platforms; as well as provide useful tips for new investors, and the terminology all stock traders need to know.

Step 1: Choose your stock trading platform

The first step to trading stocks is to choose a reputable online stock broker platform where you will feel adept and secure placing your trades. Some of the most important factors to consider when choosing a stock broker are cost, regulation and stocks available to trade. In order to make profitable investments, you will need to choose a stock broker with low fees. You should also choose a regulated platform to ensure fund protection, and other added security features. Finally, you should consider a broker with a good range of stocks to choose from, as this will allow you to build a diversified portfolio and offset risk.

Step 2: Open your stock trading account

Once you’ve picked your stock broker, it’s time to trade stocks.

Register with your chosen stock broker

Fill in your name and email, then select individual, joint or IRA as the type of brokerage account to open.

Most brokers will require you to enter your personal information such as name, address, phone number, birthdate, country of citizenship, and security question and answer. Some may also ask for your marital status, number of dependents, and Social Security number for tax purposes. This is necessary to ensure that the investor is not an employee of a securities business, a director of a major corporation, or a senior political figure.

Specify your experience level

You will then be prompted to provide some information about your previous experience trading stocks, as well as your investment objective, time horizon, liquidity needs, and risk tolerance. Indicate whether or not you want a margin account, allowing you to borrow money from the broker to trade securities.

Verify your identity

Most platforms will then ask you to attach and submit proof of identity and a utility bill for verification. The KYC process can be completed within a matter of minutes, or can take a couple of days, so be prepared in case you need to wait.

Deposit funds

You will then be able to deposit funds into your account to begin live stock trading. The deposit process can be done via wire transfer from a bank. We recommend that you deposit via bank transfer in the base currency of the investor’s home country so that currency conversion fees won’t be charged. The transfer could take up to three days. Some platforms accept deposits from SOFORT and Trustly deposit service providers, which can take as little as 30 minutes.

Step 3: Buy stocks

Once your deposit is reflected in your account balance, stock trading can begin. You can buy stocks outright or open a margin account and trade using leverage. Some brokers will lend you money to trade up to 5x (10x–20x for professional traders) your account balance. It is important to keep in mind that margin trading allows you to increase your potential gains, but if the trade turns against your position, your potential losses are also magnified.

Before you begin trading with real money, taking these few steps will help you reduce your risk of losses. Firstly, ask yourself whether you have a good understanding of the essential terms you need to know in stock trading. Once you feel confident that you understand the basics, consider which stocks to buy and invest in. Finally, choose a stock trading strategy and stick to it. For information on all these points, continue reading this guide. We explain the essential terminology, how to find hot stocks to buy and how to decide on a strategy that will work for you.

If you’re ready to trade, here’s how to place your order:

- Navigate to your stock trading account and search for the name of the stock you wish to buy in the search bar.

- Click on TRADE

- Select whether you wish to Sell (short) or Buy (long)

- Specify the amount of capital you wish to invest in this trade. If you want to buy the physical stock in full, select 1x (no leverage). If you want to use leverage, select your leverage multiplier.

- Set your Stop Loss

- Set your Take profit amount

- Once ready, click on SET ORDER. Your trade will be executed immediately and you will own the stock you purchased. If using leveraged trading, your trade will be processed as CFDs.

Learn the essential stock trading terminology

When you’re starting out with stock trading, it’s crucial that you are familiar with the different trading terms, terminology and jargon used. Here are a few of the most important definitions every investor should know.

How to Do Fundamental Research on a Stock

Warren Buffet is famous for advising investors to “invest in what you like and what you know.” But if the company does not have strong fundamentals, the successful value investor will not invest in it. Fundamental analysis is used to determine if a stock is undervalued or overvalued relative to its industry group and the broader market. Investors look at growth in revenues, earnings, profit and operating margins, expenses and other measures of financial performance to get a snapshot of past performance.

While no 100% accurate stock prediction tools exist, past performance together with management and analysts growth estimates for the company and industry can provide an indication of future performance. If you look at company and analysts hits and misses on quarterly earnings forecasts, you will find that they are usually very close to actual financial performance.

Once you have chosen your investment strategy, choosing the right fundamental stock analysis ratios becomes easy. Ratios are calculated over a certain time period (quarterly, annually, trailing 12 months).

Value Stocks

Value stocks are stocks currently trading below their intrinsic value with the expectation that the stock price will move in line with the intrinsic value in the future. Value investors seek low price-to-earnings and price-to-book ratios to identify stocks with strong fundamentals that are trading below their intrinsic value.

Growth Stocks

Growth stocks typically have a five-year average growth rate of 10 percent or more. Though typically small-to-medium sized stocks, Amazon (Find out more about how to buy Amazon stock) and Facebook (FB) are examples of growth stocks that quickly grew into high market capitalization stocks. Growth investors seek high price-to-earnings and price-to-book ratios to identify stocks that are increasing profits and/or revenues at a faster-than-average rate. If a growth stock has not yet recorded a profit, price-to-sales or price-to-cashflow ratios may be compared to those of industry peers.

10 Key Stock Valuation Ratios

Price-to-Earnings (P/E) – Stock Price/Total Earnings – A measure of how much profits a company is earning per share, a P/E within the lower 10 percent of an industry group would indicate the stock is undervalued relative to its peer group.

Price-to-Earnings Growth (PEG) – (P/E/annual earnings per share growth) – The PEG considers future earnings growth, and therefore can be a more reliable measure than P/E. A PEG of less than one indicates the stock is under valued. Estimates of growth rates can vary significantly.

Price-to-Book (P/B) – Stock Price/Book Value Per Share (total assets – total liabilities) The P/B is what the company would be worth in bankruptcy after all the debt was paid off. Value stocks typically have a low book value.

Debt-to-Equity (D/E) (Debt/Equity) – The D/E ratio is a measure of the leverage of a company. A company with high D/E has a higher risk of insolvency.

Dividend Payout Ratio (DPR) (Dividend per Share (DPS)/EPS) – Value stocks often return profits to shareholders in the form of dividend payouts. The stock of companies with consistent and steadily increasing dividend payouts tend to perform better. Growth stocks tend to reinvest capital in the business, and mergers and acquisitions rather than pay dividends.

Earnings Per Share (EPS) (Net Income – Dividends/Weighted Average Common Shares Outstanding) – A measure of profits made per share, look for 5–15 percent growth over at least five years.

Price-to-EBITDA (Price/EBITDA) – Although the profit margin (Sales – Expenses) is a measure of profitability, it does not necessarily reflect operating efficiency. EBITDA (earnings before interest, taxes depreciation and amortization) strips out non-operating expenses to provide a picture of operating efficiency. Look for a price-to-EBITDA that is above the five-year average.

Return on Equity (ROE) (Net Income/Shareholder’s Equity) – ROE provides an indication of how effectively a company is using its investments to grow earnings. Look for an ROE that exceeds the five-year average ROE.

Price-to-Cash Flow (PCF) (Stock Price/Cash Flow Per Share) – Some analysts consider this metric more important than the PE. A company without cash will go out of business. When compared to other companies in an industry, a low PCF indicates a company is undervalued.

Price-to-Sales (P/S) (Total Shares/Market Capitalization) – The P/S tells you how much sales a company is generating per share. A P/S ratio less than 1 is excellent, and between 1 and 2 very good (Investopedia).

Calculating all these ratios may seem like a lot of work. Fortunately, most online investment sites (Yahoo, Investors.com, Morningstar.com etc.) provide these ratios for publicly listed companies. Better still, you can create stock screens with all your preferred valuation ratios and a list of stocks that meet your criteria will be generated for you.

Which stocks should I trade?

Once you’ve settled on where to trade and buy shares of common stocks, the next question is – which stocks and when? Choosing which shares involves fundamental analysis and deciding when to trade requires technical analysis.

You will also need to consider recent news, earnings reports and analyst estimates.

Luckily, we have carried out the research for you, and identified the best stocks to trade using our own fundamental and technical analysis. Read on for our top stock picks for 2021.

Boeing (BA)

Boeing (BA) lost 15% of its market value from March 1st to March 15th 2019, which included the crash of Ethiopian Airlines 737 Max 8. Boeing may be worth a closer look. According to the Wall Street Journal, “such accidents, however tragic, do surprisingly little damage to the business of selling aircraft.” Analysts project Boeing’s earnings growth to continue at over 20%, and based on five-year dividend growth, the stock is selling at a deep discount to its intrinsic value. Technically, Boeing has not yet retreated to its 200-day moving average, so most investors who have bought the shares over the last year still have potential to profit.

Airbus SE (EADSY)

While Boeing retreated, Airbus SE (EADSY) advanced. Airbus analysts also predict greater than 20% growth, but since the stock is selling at a significant multiple to its intrinsic value, Airbus is no bargain. Airbus, which closed 2018 at $23.78 per share, had risen 40% by March 15th. On the chart, Airbus broke through its 200-day moving average in January and went on to establish a new all-time high.

JPMorgan Chase & Co. (JPM)

Barclays PLC (BCS)

Barclays PLC (BCS) is the second-largest bank in England after HSBC Holdings (HSBC), which was founded in Hong Kong. Barclays’ low share price does not indicate value as it is selling at over 23 times current earnings, and both earnings and dividend growth have been negative. Barclays’ chart shows the price trend flattening, but the 200-day moving average seems to be approaching the share price rather than the other way around. Check out our guide to buying Barclays stock here.

Verizon Communications Inc. (VZ)

Verizon Communications Inc. (VZ) was formed as the result of a 1999 merger between Bell Atlantic and Vodafone (VOD). Verizon had over 150 million subscribers as of the fourth quarter of 2018, 10 million more subscribers than AT&T and more than twice as many as T-Mobile US. Very much like an electric utility, its revenue is secure—no one gives up their phone. It pays an attractive dividend that has been growing and is trading at a discount to its discounted cash flow intrinsic value. Verizon looks on the verge of entering a solid uptrend, trading above both its 200-day and 50-day moving averages.

Vodafone Group PLC (VOD)

Vodafone Group PLC (VOD) has been in the wireless telephone business as long as wireless telephones have been available, but lately it has struggled to produce profits. Earnings growth has been negative, but they do pay an attractive and growing dividend that is double the US 10-year Treasury and a multiple of the UK 10-year Gilt. The VOD chart indicates no sign of share price recovery.

Decide on a stock trading strategy

We would recommend you also decide on a plan of action before trading in stocks. A good stock trader is a disciplined stock trader, and a disciplined stock trader has a trading and risk management plan. Your stock trading strategy should help you make profits while offsetting risks.

First and foremost, determine your risk tolerance. Both day traders and active traders have a much higher risk tolerance than a buy-and-hold long-term investor. They often use highly leveraged short selling strategies – selling securities they have borrowed on margin from their stock broker in the expectation that the stock price will decline – to maximize their gains. The day trader is a higher risk taker than the active trader holding positions for days or weeks.

Once you know your risk tolerance (how much you can afford to lose), determine whether you consider yourself an active trader or a day trader. Both types of traders use technical analysis tools to predict future price trends, and when to get in and out of the market.

An active trader is an investor who does not necessarily trade every day. The main goal of the active trader is to profit from short-term events.

Day trading, however, involves placing dozens of trades in a single day.

Below, we review some of the most common stock market trading strategies.

Day trading

The day trader has several positions open at any one time and ensures all their positions are closed before the market closes. As a day trader, you may buy 100 shares of a given stock for $50. A few minutes later, when the stock moves up to $60, you might sell, resulting in a $1,000 profit on the trade. Day traders typically look for low entry points in the morning, and exit later in the same day, when the stock price has gone up.

Swing trading

In swing trading, as opposed to day trading, positions are held for longer than a single day. With this strategy, the trader attempts to make profits over a period of a few days to several weeks. Swing traders use technical analysis tools to identify trading opportunities and the right time to exit – when a sufficient price movement warrants a reasonable profit.

To trade stocks using a swing trading strategy, you will need to select large-cap stocks (shares of a company with a market cap of more than $5 billion), which tend to swing between high and low within a matter of days or weeks.

Scalping

Scalping is a trading style best-suited to investors who like to grab small profits fast and move onto the next opportunity. As you can see from the chart above, rather than holding a stock for hours, days, or weeks, as a scalper, you will attempt to make profits within as little as a few minutes.

Scalpers use technical indicators to identify short-term opportunities. For a scalping strategy, you will need to be able to read complex charts and identify trends quickly. Given the speed, you will also need a strict exit strategy because one wrong trade could wipe out all your small gains.

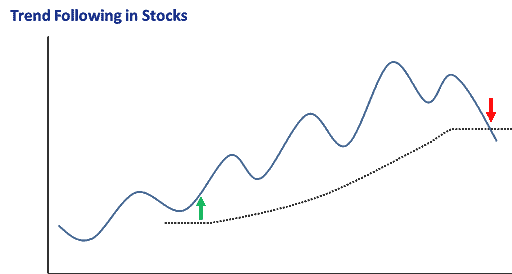

Trend following

In trend following, the investor buys a stock when its price trend goes up, and sells the stock when its trend goes down. Traders use four main technical indicators in this strategy : moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index) and On-Balance Volume (OBV). The aim of these indicators is to alert traders of a trend formation. The investor will act on the trend, assuming that the stock price is likely to follow a given pattern, and decide whether to sell or buy.

Position trading

If you’re looking to hold a stock for a long period of time such as months or even years, then position trading should be your strategy of choice. In this strategy, stock traders will ignore short-term market fluctuations and focus on a long-term capital appreciation goal. This could be a suitable strategy for the investor who does not wish to trade often, or simply doesn’t have the time to do so. As always, however, position trading will require the trader to analyse price charts and use technical indicators to make smart stock predictions. Position traders tend to analyse support levels and resistance levels to decide whether to close or hold their position.

This trading strategy has a great potential for profit, as generally the risk of losses is reduced over long- versus short-term trading horizons.

How much money can you make with stock trading?

There is no one-size-fits-all answer as to how much money you can make when trading stocks online, as this will depend on a number of factors. At the forefront of this is the performance of the company itself, as well as the underlying economy.

For example, if the company that you have invested in is growing at a faster rate than it did in the previous year, then it’s likely that the value of your stocks will go up. Similarly, if the US economy is performing well – as it has done in recent years, then again, it’s possible that your returns will increase.

With that said, before we can assess the types of returns possible in dollars and cents, we need to explore how stock trading profits are realized – capital gains and/or dividends.

Capital Gains

The first avenue that will allow you to make money when trading stocks is in the form of capital gains. In its most basic form, capital gains occur when you sell your investment at a higher price than you paid.

- For example, let’s say that you purchased shares in Nike PLC in 2016.

- When you originally purchased the stocks you paid $65 per share.

- You purchased 100 shares, meaning that your total investment was $6,500.

- Four years later in 2021, Nike stocks are priced at $88 per share.

- If you were to sell then, you would be looking at stock trading profits of $23 per share ($88-$65).

- As you bought 100 shares, your capital gains amount to $2,300 ($23 x 100 shares).

As you can see from the above example, your capital gains amounted to $2,300. This means that over the course of 4 years, your ROI (Return-on-Investment) equates to 35%. This would represent an excellent investment. With that being said, we also need to look at dividends, as this increases the amount of stock trading returns that you can make.

Dividends

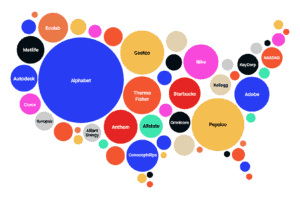

On top of capital gains, you also stand the chance of making additional stock trading profits via dividend payments. We say “chance”, as not all companies pay dividends. Examples of leading blue-chip companies that do not distribute dividend payments includes the likes of Alphabet (parent company of Google), Facebook, and Verisign.

Nevertheless, dividends are a way for publicly listed companies to share their profits with shareholders. They are typically paid every three months, and the amount is determined by the board – based on recent financial results. Let’s look at a quick example so you can see how dividends allow you to increase your stock trading returns.

- You hold 100 shares in British American Tobacco, which are currently priced at $40 per share.

- The company performed well in Q1 2021, so it announces that it is planning to pay dividends at an annualized rate of 4%.

- At the current share price of $40, this amounts to $1.60 per share (4% of $40).

- As you hold 100 shares in British American Tobacco, you will be entitled to $160 in dividends ($100 x $1.60).

As you can see from the above example – and making the assumption that British American Tobacco continued to pay the same dividend rate throughout 2021, you would make stock trading returns of 4% per year on this particular investment. However, you also need to factor in your capital gains, too.

For example, if British American Tobacco increased its share price to $44 at the close of 2021, this would represent an increase of 10%. As such, your total stock trading returns would amount to 14% (4% dividends + 10% capital gains).

What stock trading returns should I expect?

So now that you know the two revenue streams that will allow you to earn stock trading profits, we now need to assess how much money you are likely to make. As we noted earlier, it’s impossible to give you an exact figure, as the stock markets go through cycles.

By this, we mean that your investment will go up and down in value on a daily basis. Moreover, while some companies might perform well in the markets, others might not.

With that being said, the best way to gauge how much money you can make when stock trading online is to look at historical returns of leading indices.

S&P 500

- The S&P 500 is an index that tracks the 500 largest companies listed on the US stock markets (NYSE and NASDAQ)

- Since its inception in 1926, the S&P 500 has made average annual returns of 10%

Dow Jones

- Launched way back in 1896, the Dow Jones is an index that tracks 30 US publicly listed companies

- The index tracks companies from multiple industries, so it’s a good way to gauge the strength of the wider US economy

- Since its inception in 1896, the Dow Jones has made average annual returns of 5.42%

FTSE 100

- The FTSE 100 tracks the largest 100 companies that are listed on the UK’s London Stock Exchange

- Between the years of 2008 and 2018, the FTSE 100 grew by 74%

- This amounts to average annual returns of 5.7%

It is important to note that although the above stock market indices have performed well in the long run, there have, and always will be, certain years when stocks go down. This is why you are best advised to view stock trading returns as a long-term investment.

What can I do to minimise loss of capital when trading stocks?

Stop-loss and Take Profit orders are risk management tools that all traders should know how to use before they start trading. Used correctly, they allow traders to maximize profits and minimize losses.

Stop-loss order

A stop-loss limit order should be placed 10% below the price at which you bought the stock. This will ensure that your losses are limited to 10%. When your stop-loss is reached, the position will automatically close.

Take profit order

A take profit command will close your position automatically when the asset you are trading reaches a price point you specified. This will allow you to avoid losses in the event the position turns against you.

Negative balance protection

Negative balance protection ensures you do not lose more funds than you deposited. This is important in leveraged trading, where you could multiply your agains, but also risk bigger losses. As an example, if you deposited $100 into your account and bought a stock with 4:1 leverage, your position would be $400. However, if the stock price drops, you will suffer a loss. If this loss is more than the $100 you deposited and the broker you have chosen does not offer negative balance protection, you will owe money to the broker. If the broker offers negative balance protection, you will only have to pay your balance – the maximum ($100) – and no more than that.

Brokers offering negative balance protection include Plus500 and Markets.com. Plus500 also offers a Financial Services Compensation Scheme for UK customers, which ensures that if the company goes bust, your funds will be recovered.

11 stock trading tips

Most traders lose money because they trade on instinct. Good traders are disciplined. They develop trading strategies and risk levels and stick to them. These tips will help you become a disciplined trader.

Start small: Don’t risk all your capital at once. Start with a small investment, and practice on a free demo for a few weeks before trading for real money.

Establish your goals: How much profit will you be happy to take home? If you’ve hit your profit targets, don’t get greedy – close your position and enjoy what you’ve earned.

Determine your risk tolerance: How much are you prepared to risk? Stock trading can be volatile, so remember not to risk more than you can afford.

Build your stock portfolio: Even if you make a bad trade, having a diversified portfolio could increase your returns by not only offsetting losses but also providing steadier growth in value.

Time your trades and keep records: Write your trades down and keep a record. When were the shares purchased, why and what was the result? If you can keep track of your trades, when you lose, you will learn a lesson and do better next time.

Cut your losses: You may not make profits on every single trade so be prepared to take some losses. Most traders lose money because they hold onto losing positions for too long.

Stay calm during market volatility: Investing in stocks can be stressful, but do not sell on every price swing. Even if the trades are profitable, the high trading fees will erode your gains.

Stick to your stock trading strategy: Sure, you will need to adapt quickly to market fluctuations, but if you have a clear strategy in place, and are confident about it, stick with it. Remember, successful traders are disciplined traders.

Limit how often you check your portfolio: If you’ve decided to buy and hold stocks, resist the urge to check your portfolio obsessively and instead, opt for doing your stock research and following long-term trends.

Look for a platform with educational resources: Look for a platform with an education center with articles explaining how to trade the various asset classes and general investing strategies. Ally Invest, for instance, includes two stock screeners: one for fundamental and technical research, and the other for backtesting an investing strategy.

Conclusion

In terms of risk versus reward, many investors around the world have generated positive returns trading stocks. Over the last 10 years, the Standard and Poor’s 500 Index has returned over 16%. Since its inception in 1976, the Vanguard 500 Index Fund Investor Shares (VFINX) has returned 10.72%. At that rate, money doubles every seven years.

If you’re looking to trade stocks, by following our advice on how to develop prudent research, trading and risk management practices, you will improve the chance that your investments will be profitable. Before you get started, however, do consider the risks, and take time to learn the terminology and select a suitable trading strategy. It is equally as important to select a reputable broker that gives you access to a free demo account, educational resources, research and data, great customer service and affordable fees, all under the safety net of a financial license.

If you’re ready to get started, select one of the recommended brokers below.

Useful Resources

Of Benjamin Graham’s The Intelligent Investor Warren Buffett says in its preface, “I read the first edition of this book early in 1950, when I was 19. I thought then that it was by far the best book about investing ever written. I still think it is.”

Burton G. Malkiel, in his A Random Walk Down Wall Street, recently updated but first written in 1973, attempts to persuade investors to avoid buying individual securities and instead invest in index funds. Though this fourteenth edition is released during an index investing revolution, the active trading versus passive investing debate rages on. The book covers technical and fundamental analysis, modern portfolio theory, behavioral finance, and portfolio construction; all with the intention of presenting the futility of each.

William J O’Neil’s How to Make Money in Stocks combines fundamental and technical analysis into one package, which he terms CANSLIM: Current earnings, Annual earnings, New products, markets, or high stock prices, Shares outstanding, Leader or laggard, Institutional interest, and Market conditions. His daily publication, Investor’s Business Daily and its Investors.com website apply CANSLIM and its momentum theories to everyday market developments.

FAQs

Short selling involves selling securities borrowed from a broker dealer in the expectation the price of the security will decline. A margin account allows a trader to borrow money at a multiple to their account balance. A trader wishing to trade stock short with a $1,000 account balance and 3x leverage, for example, could place a trade for $3,000. If the price of the security rises instead of falls, however, the trader must buy the securities at the higher price to complete the trade at the lower price, thereby losing the difference.

Stock trading hours are as follows: New York Stock Exchange 09:30-16:00, Tokyo Stock Exchange 09:00-11:30 12:30-15:00, London Stock Exchange 08:00-16:30, Hong Kong Stock Exchange 09:30-16:00

Margin requirements stipulate how much a brokerage firm will lend and at what interest rate. In the United States, the maximum a firm may lend on common stock is 50% of the value of securities currently held. The individual firm sets the interest rate.

Yes. A margin account allows you to borrow funds from a broker and use leverage to increase the amount of a trade. As with any loan, interest is charged. For the duration of the loan, daily interest will be charged and deducted from your brokerage account monthly.

In the United States, the Securities Investor Protection Corporation (SIPC) provides protection for accounts up to $500,000 (including $250,000 for claims of cash) per client. In Britain, The Financial Services Compensation Scheme (FSC) provides protection for up to £85,000.

To open a brokerage account in the United States, an investor must be a citizen or a legal permanent resident of the United States, be at least 18 years old, have a Social Security Number (SSN) or Taxpayer Identification number (TIN) and a U.S. street address

Any portfolio of publicly traded securities can be transferred. It is up to the receiving firm to process the transfer and determine which securities it will accept.

In the U.S., if you execute four or more day trades within five business days and these stock trades represent more than 6 percent of your margin account, you will be designated a pattern trader by FINRA. Pattern traders must maintain a minimum balance of $25,000.

Yes. A Corporate or Partnership Account can be registered with the incorporation details or partnership agreement of the company. What is short selling?

What are the stock trading market hours?

What are margin requirements?

Is interest charged on a margin account?

How are my accounts protected?

If I’m not a U.S. citizen, can I still open a stock trading account?

Can I transfer my current stock trading portfolio?

Can I start day trading with a $100?

Can a business or legal entity also become a client and trade stocks with an online broker?

A-Z of Trading Pages