Join Our Telegram channel to stay up to date on breaking news coverage

Waves ($WAVES) has impressed the cryptocurrency market with a remarkable trading volume surpassing $500 million.

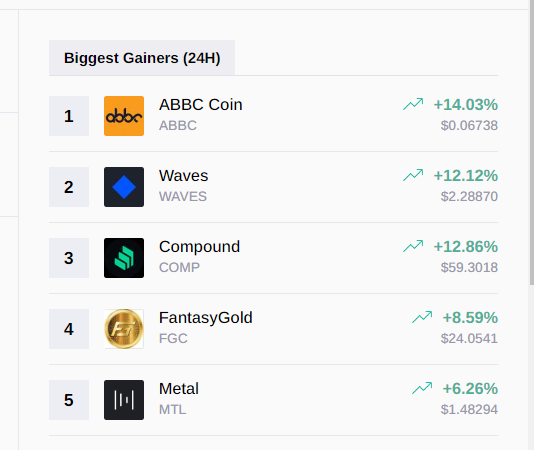

It has secured notable positions on various platforms, including 2nd rank on the Daily Gainers list on CryptoSlate. It also ranks first place on Gate.io’s daily volume gainers list. Nevertheless, traders hold mixed views on the prospects of Waves. While some remain cautiously optimistic, others highlight clear uncertainties.

The coin’s performance and divergent opinions from traders make Waves an intriguing asset to watch in the market.

WAVES Achieves Prominence on Multiple Platforms as Trading Volume Surges

WAVES gained significant attention and recognition in the cryptocurrency market on July 10. It has secured the second position on the Daily Gainers list on CryptoSlate.

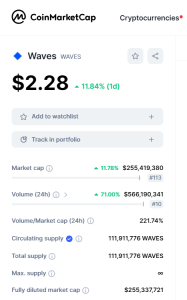

Notably, the trading volume of WAVES surpassed $500 million in a single day. According to Coinmarketcap, this propelled the token’s presence on various trending lists across the market.

Further emphasizing its popularity, WAVES ranked first on Gateio‘s daily volume gainers list. This denoted an impressive 322% surge in trading volume within a single day.

https://twitter.com/gateiovolume/status/1678213465658257409

Meanwhile, it is important to note that Nami Insurance ranked WAVES as the third most volatile trading pair in the last 24 hours

Experts at CoinGape also rank WAVES token high, securing a position on the list of trending coins for the day. The accumulation of such recognition across multiple platforms highlights the growing prominence and interest surrounding WAVES in the cryptocurrency market.

💎 Trending Gems: Discover the Coins Creating Buzz Today! 🚀

🔔 Stay up-to-date with latest #CryptoUpdate, follow @CoinGapeMedia! 🔥#PEPE #SHIB #CAKE #BTC #SOL #XVG #ETH #KAS #WAVES #AVAX #OKB #MSR #KNC #Cryptocurency pic.twitter.com/SSMTtSlNrk

— Crypto News (CoinGape) (@CoinGapeMedia) July 10, 2023

Experts on Twitter also share the optimism about WAVES. These accounts have notable followers, making them a credible source of information.

Bullish Outlook for WAVES ($WAVES) Supported by Technical Indicators

A trader, @arief-ahm4d, provided a Waves ($WAVES) strategy. It is based on his analysis of various technical indicators and patterns. He identifies a double bottom formation on the weekly chart, signaling a potential reversal.

Additionally, he observes a breakout from a downtrend line, currently undergoing a retest. The trader also recognizes the significance of the $1.8 level as a support for the price. Despite encountering unsuccessful bullish biases in other cryptocurrencies, he maintains an optimistic outlook for Waves.

– Double bottom on weekly

– Breakout from downtrend line ( now retesting )

– Successfully claimed $1.8 as a supportlately, my bullish bias in some coins are failed

HIGH RISK !!!Risk under your control pic.twitter.com/8YpVIuz6YG

— arief_ahm4d | KIMA 🐉 $MON $BEYOND @ricyofficial (@arief_ahm4d) July 6, 2023

Analyzing the 3D chart, he notes consolidation below the MA 50, indicating a period of price stabilization. Anticipating a potential breakout above $2.5, he expects significant gains. The trader highlights a 16% rise from his entry point, indicating a positive performance thus far.

Furthermore, the daily and three-day charts exhibit bullish signals with closures above their respective moving averages. This further supports his position. However, he remains cautious due to the inherent high risk involved in trading Waves.

Potential Short Position Opportunity in WAVES/USDT

There could be a potential opportunity for a short position in the M5 chart of the WAVES/USDT trading pair. This is based on an analysis shared by @tradersyrax, who identified a specific decision price of $2.2552. It indicates that if the price fails to surpass this level, it will trigger the opening of a short position.

$WAVES 5m

– i will try this short position.

Risky. #WAVES pic.twitter.com/usLXhVNxwf

— Nihilus (@nihilus_XBT) July 10, 2023

The stated target for this short position is set at 1.8882. A stop-loss price of 2.4483 stands to manage risk. This indicates the price level at which the position would be closed to limit potential losses.

It is important to note that this analysis and trading plan are attributed to @tradersyrax on Twitter. Therefore, it should be considered within the context of individual risk tolerance and personal trading strategies.

WAVES/USDT Breaks Descending Trend with 58% Surge

Based on the analysis conducted by another analyst, the daily chart of WAVES/USDT has experienced a breakout from a descending trend. Since breaking out of the descending trendline, prices have surged significantly by +58%.

https://twitter.com/Trade_With_Dan/status/1678365526462980099

However, @trade-with-dan remains uncertain about the future direction of the price. It is unclear whether the pump has concluded or if there will be further upward movement in the upcoming days.

$WAVES: Critical Support Retest with Potential for Big Move

The analysis by @trader-hamza1 suggests that Waves ($WAVES) is currently at a critical juncture. The daily chart has closed above a significant support level, indicating a potentially bullish signal.

$waves last chance here , daily closed above support and retesting support hold and big move ahead of us if lose then rekt $waves #waves #wavesusdt pic.twitter.com/QSnHuLUTCH

— hamza (@trader_hamza) July 9, 2023

The price is now retesting this support level, and it is crucial for it to hold. If the support level fails, it could lead to significant losses or being “rekt.” This is slang for experiencing substantial financial losses. On the other hand, if the support holds, it suggests the possibility of a substantial price movement in the upward direction.

Price Analysis: WAVES/USDT H4 Chart Indicates Potential for Further Gains

The analysis of the four-hour chart for WAVES/USDT reveals that the price has reached the edge of its established price range from June 25. Although there was a previous breakout, the price failed to close above this range. A breakthrough, marked by the purple highlighted area, would signal the potential for future gains. The presence of the 50 EMA above the 100 EMA indicates that there are still potential gains to be had.

Additionally, the MACD histograms above the zero line are increasing in volume, indicating growing bullish pressure. The RSI is approaching the overbought zone but still has room for further gains. The initial resistance is expected at $2.367. A break above it could extend the gains towards the recent highest level of $2.893. On the downside, the price level of $2.037, where the EMA 50 is located, provides initial support.

While WAVES is trending on multiple platforms today with its $500M trading volume, another coin is also gaining market attention. This is DLANCE, the ticker for the Deelance ecosystem.

WAVES Alternative

Deelance’s ongoing presale continues to make impressive strides, having raised over $1.509 million thus far. With the next milestone set at $2.3 million, it seems inevitable that this target will soon be achieved. Deelance represents a paradigm shift in the freelancing and work landscape, leveraging blockchain technology to empower employers and employees.

https://twitter.com/deelance_comAMA/status/1673688116555657216

By providing equal power and opportunities to work from anywhere in the world, Deelance aims to level the playing field. The project invites investors to participate in the presale, offering a discounted price of $0.043, which will soon increase to $0.048. This early involvement promises potential windfalls and a first-mover advantage.

Also Read:

- Celo Price Prediction for Today, March 29: CELO/USD Looks for a Breakout Above $0.75

- ENJ Is Struggling To Break a Resistance Level While DeeLance Has Experts Talking

- As Halving Looms, Bitcoin Miners Are Weighing Up Their Options

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage