Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market has been experiencing high volatility following a significant drop in Bitcoin’s price. Traders are adopting a cautious approach as they await the U.S. Federal Reserve meeting. Uncertainty prevails, impacting Bitcoin and other cryptocurrencies.

Cryptocurrency Market Experiences Volatility Following Bitcoin’s Dip

A day after Bitcoin experienced a significant drop, sending it to a three-month low, the cryptocurrency market continues to exhibit volatility.

Uncertainty among investors has resulted in a lack of momentum in the price of Bitcoin and other major alternative cryptocurrencies. This uneasiness has further led to Tether’s stablecoin, USDT, straying from its intended value of $1. The current situation reflects the impact of various factors on the market.

Bitcoin, the largest cryptocurrency by market cap, has been trading at approximately $25,550 over the past 24 hours. Despite remaining relatively flat during this period, it spent most of Thursday in negative territory.

The dip below the $25,239 threshold on Wednesday was the first time Bitcoin fell below this level since mid-March. The decline was likely a response to the Federal Reserve’s commitment to a hawkish monetary policy, even though the central bank paused interest rate hikes for the first time in 14 months.

For weeks prior to this, bitcoin had been hovering around the $26,000 mark.

Bitcoin Traders Cautious Ahead of Fed Meeting Amid Expectations of Unchanged Rates and Future Increases

Bitcoin traders are adopting a cautious approach ahead of the U.S. Federal Reserve meeting, expecting interest rates to remain unchanged but with indications of potential future increases.

The Fed’s previous rate hikes and balance sheet reduction had a negative impact on risk assets, including cryptocurrencies. Traders are pricing in the possibility of another rate hike in July but have reduced expectations for rate cuts later in the year.

Options data suggests a bearish sentiment in the market, with puts on Bitcoin trading at higher prices than bullish calls. While recent inflation data allows the Fed to keep rates steady, both headline and core inflation remain above the central bank’s target, limiting room for the tightening cycle to end.

Positive real interest rates tend to negatively affect zero-yielding assets like Bitcoin, which has been historically negatively correlated with real yields. Traders may not rely on post-Fed moves in the stock market as an indicator, given the weakened correlation between Bitcoin and equity indexes.

A hawkish skip by the Fed could be seen as dovish relative to expectations, potentially leading to lower rates and a bitcoin rally, but not necessarily a significant price movement.

Ether and Tether Follow Bitcoin’s Bearish Trend

The second-largest cryptocurrency by market value, Ether (ETH), has also shown sluggishness in recent days. Its price has remained relatively unchanged, currently hovering around $1,655, mirroring the trends observed on Wednesday. Similarly to Bitcoin, ETH experienced a three-month low during this period. However, there is volatility, which means the volume is still strong.

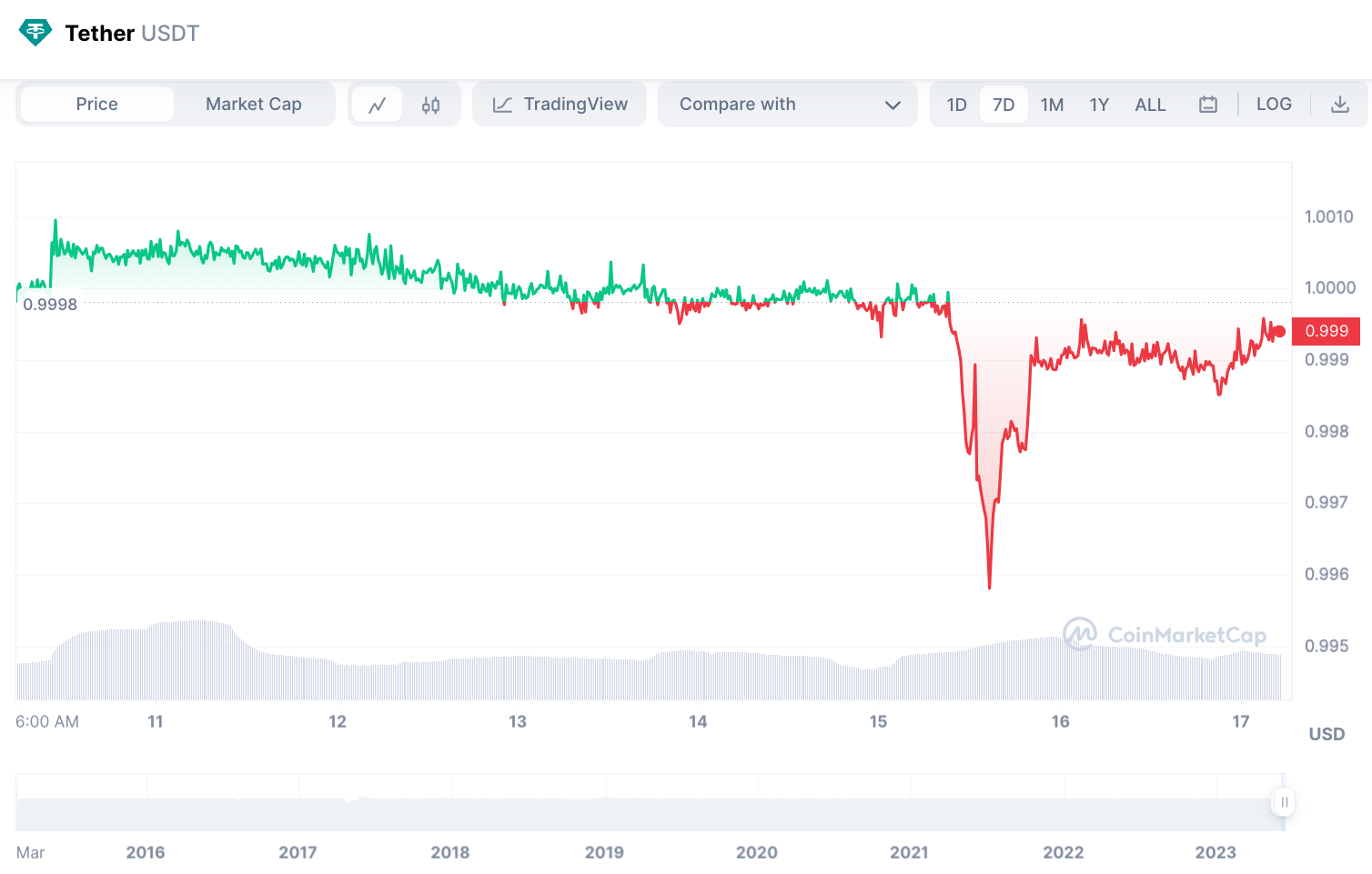

Apart from Bitcoin and Ether, the market downturn has also impacted Tether’s USDT stablecoin. On Thursday, USDT experienced a deviation from its intended peg of $1, primarily driven by a sell-off occurring on popular platforms such as Uniswap and Curve pools.

According to CoinMarketCap data, USDT briefly dropped to as low as $0.9968 before subsequently recovering to its current trading value of $0.999.

The uncertainty surrounding regulatory concerns and Tether’s stability has further heightened nervousness among investors. This is especially significant given Tether’s increased dominance in recent months. The de-pegging of USDT has had a severe impact on the markets.

Market Sentiment and Challenges Ahead

The decline in the cryptocurrency market over the past two days has led to a decoupling from U.S. equities, which experienced positive trends on Thursday. Investors drew confidence from encouraging economic indicators, such as increased consumer spending in May, suggesting that a recession may not be imminent.

The tech-heavy Nasdaq Composite and S&P 500 indices rose by 1.1% and 1.3%, respectively. However, cryptocurrencies have not followed the same upward trend and have remained stagnant or declined.

Vineeth Bhuvanagiri, the managing director of EMURGO Fintech, draws comparisons between the current market climate and the situation in 2019. He notes that back then, there was significant volatility within a certain range, leading to mixed emotions among market participants.

Bhuvanagiri points out that uncertainties regarding interest rate hikes, declining economic growth, and potential challenges in the banking sector could continue to unsettle the crypto markets. He suggests that survival will likely be the primary strategy for most participants until the macroeconomic conditions stabilize.

The coming months are expected to be volatile, requiring caution and adaptability from investors.

Related Articles

- Crypto Market Outlook Today

- Interest Rate Cuts Still “Couple of Years Out” – Fed Chair Jerome Powell

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage