Join Our Telegram channel to stay up to date on breaking news coverage

IG Group is the first publicly traded company in the UK to provide direct trading of cryptocurrencies, such as Bitcoin and Ethereum, to ordinary investors. This action, which was made in collaboration with the digital asset platform Uphold, gives users access to 38 tokens and is a big step in the UK’s acceptance of digital assets on a larger scale. Given that 12% of UK adults already possess cryptocurrency, up from 4.4% in 2021, the project supports government efforts to regulate the sector.

What happens when speed, innovation, and community power come together on one of the blockchain ecosystems with the quickest growth rate? Three names are taking center stage on Base Chain due to the influx of initiatives redefining what is possible: Venice, Cookie, and Keeta.

Most Trending Cryptocurrencies on Base Chain Now

The most trending cryptocurrencies on Base Chain now aren’t merely tokens riding the frenzy. Each of them offers a unique approach to solving practical issues. Keeta is developing a high-speed cross-chain infrastructure combining blockchain technology and real-world assets. Cookie is transforming digital marketing into a decentralized revenue source for consumers, and Venice is redefining on-chain communication and identity.

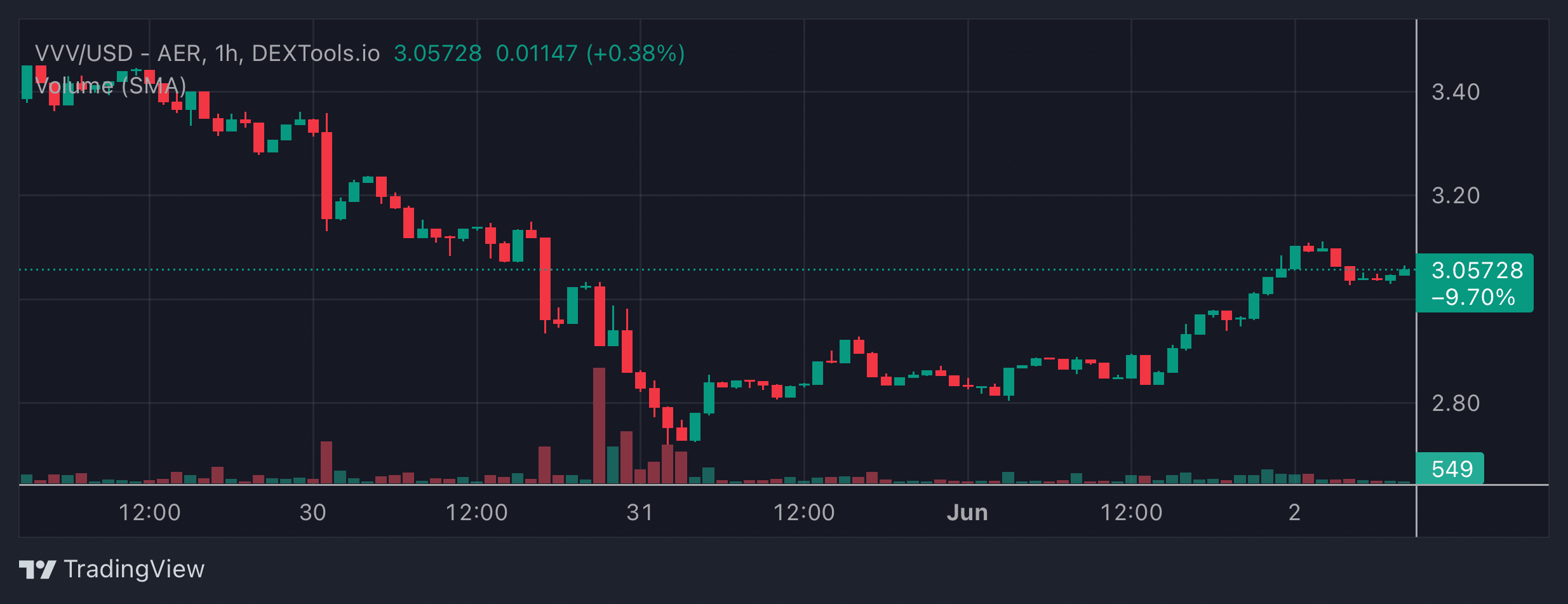

1. Venice (VVV)

AI users frequently encounter issues with data privacy, censorship, and lack of transparency at a time when centralized organizations primarily manage these services. These platforms raise questions regarding control and surveillance because they have the ability to store user data, restrict content, and function without community oversight. Venice is a decentralized AI platform that puts user privacy and autonomy first, addressing these problems head-on. Venice uses blockchain technology to guarantee that AI interactions are confidential, unrestricted, and decentralized, enabling individuals to interact with AI as they see fit.

Venice stands out for its creative use of staking to gain access to AI. Staking VVV tokens grants users proportionate, ongoing access to Venice’s AI inference capabilities without charging a price for each request. Moreover, Venice has an unmatched dedication to privacy. Its decentralized governance and privacy-first philosophy enable community members to influence the platform’s development, promoting a more open and transparent AI environment.

Want to host your own chat interface with Venice API?

You can chat with any model, even those that have been retired from the Venice app

Check out our n8n workflow tutorial for the steps (link below) pic.twitter.com/S1G6baptF6

— Venice (@AskVenice) May 29, 2025

VVV is classified as a mid-cap cryptocurrency with a market capitalization of $93.29 million. The reported $504.91K 24-hour trading volume indicates moderate liquidity and investor interest in the coin. Of the 71.36 million VVV coins that might be produced, 30.51 million are currently in circulation, meaning that 42.8% of the total supply is actively traded.

With over 850,000 registered users and 70,000 active users per day, the platform’s popularity and the need for decentralized AI services are evident. The first-ever airdrop aimed at AI agents occurred in January 2025 when Venice introduced the VVV token on Ethereum’s Layer-2 Base network, allocating 50 million tokens to users and AI initiatives. Additionally, the DeepSeek R1 671B model was incorporated into its API, giving customers access to cutting-edge AI capabilities while upholding stringent privacy regulations.

2. Cookie (COOKIE)

Cookie is transforming digital marketing by tackling the privacy issues and inefficiencies common in conventional Web2 marketing. The usual methods frequently waste up to 95% of advertising budgets on uninterested people and misuse user data. By developing a decentralized, open, and user-focused marketing environment, cookie uses blockchain and artificial intelligence (AI) to address these problems.

The core of Cookie’s innovation is its distinct strategy for user engagement and data monetization. Users maintain control of their data and receive incentives for participating in marketing efforts, guaranteeing that value is shared equitably among all parties involved. By focusing on marketing audiences, this technique not only increases user trust but also boosts marketing efficacy.

Authenticity > Farming

$COOKIEs will drop to Cookie OGs with the most referral SNAPS.

Got an OG badge yesterday?

Check your https://t.co/lR5PC53eTO profile, you’ll see a pop-up if you got a reward. More projects are rewarding their OGs too. pic.twitter.com/2h9sY0MLft

— Cookie DAO 🍪 (@cookiedotfun) May 29, 2025

The Relative Strength Index (RSI) is at 40.92, which indicates a neutral market. Moving averages point to a bearish trend: The 200-day SMA at $0.146885 and the 50-day SMA at $0.183817 indicate sell signals. According to some projections, the token might be worth up to $0.7862 by the end of 2025, while others expect a more cautious average price of $0.2517.

Since its June 13, 2024, launch, COOKIE has reached significant milestones, including the acquisition of $5.5 million in finance from well-known venture capital organizations like Spartan Group and Animoca Brands. Through agreements with more than 170 companies, the platform has integrated COOKIE into several marketing and blockchain infrastructures.

3. Keeta (KTA)

In the present blockchain environment, Keeta tackles several important problems. One of the main issues is the inability of various blockchain networks to communicate and transfer assets seamlessly. By serving as a unifying layer for direct cross-chain transactions, Keeta’s technology facilitates communication between several blockchains. This architecture increases the potential use cases for blockchain technology and improves the user experience by enabling safe and effective asset movement across many networks.

Regarding application cases, real-world assets (RWAs) like bonds, commodities, and real estate can be tokenized and traded using Keeta’s infrastructure. Previously exclusive to institutional investors, this capability democratizes access to investment possibilities and creates new channels for asset liquidity. Furthermore, Keeta’s compliance-friendly architecture guarantees it can satisfy regulatory standards, making it a desirable choice for companies wishing to incorporate blockchain technology into their daily operations.

Of the maximum production of one billion KTA coins, 400 million are now in circulation, meaning 40% of the total supply is actively traded. According to an analysis of recent pricing movements, KTA has shown significant volatility. On June 1, 2025, the token hit its highest point ever, $0.9837, and on March 8, 2025, it fell to its lowest point ever, $0.00682. The price has risen by over 706.62% in the last 30 days, demonstrating significant upward momentum.

Recent developments include strategic alliances to broaden the Keeta ecosystem’s functionality and reach as one of the most trending cryptocurrencies on Base Chain. Most notably, Keeta and Xend Finance have partnered to provide fractional, dollar-based assets, such as US equities and real estate, in a smooth, blockchain-powered format. As it gives customers in emerging nations access to secure, dollar-based assets, this collaboration is essential for mitigating the effects of inflation and local currency devaluation.

What Might Be The Next Top Trending Crypto?

Interest in cutting-edge initiatives like BTC Bull has increased as a result of Bitcoin’s recent spike above $105,000. The purpose of this Ethereum-based meme coin is to mimic Bitcoin’s price fluctuations while providing holders with special incentives.

Don’t ask questions. Just inhale. pic.twitter.com/grH2j1VwI0

— BTCBULL_TOKEN (@BTCBULL_TOKEN) June 1, 2025

Its incentive structure is what makes it so appealing: BTC Bull intends to give Bitcoin airdrops to BTCBULL holders who keep their tokens in designated wallets when the price of Bitcoin hits certain price milestones ($150K, $200K, and $250K). The project also implements token burns whenever the price of Bitcoin rises by $25K, which might raise the token’s value by lowering its supply.

BTCBULL‘s tokenomics are set up to facilitate sustained expansion. To ensure ongoing participation and awareness in the cryptocurrency field, a portion of the 21 billion tokens in total are set aside for marketing, milestone burning, and community awards.

BTCBULL is a compelling option for investors seeking exposure to Bitcoin’s development while benefitting from other advantages. Its combination of material rewards and meme culture provides a novel viewpoint on the cryptocurrency market.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage