Join Our Telegram channel to stay up to date on breaking news coverage

Altcoins have largely lagged behind Bitcoin throughout 2025, with BTC dominance climbing to 64% and overshadowing much of the market. However, momentum may be shifting. Analysis from Alphractal highlights emerging signals that resemble historical setups for altcoin rallies. Ethereum’s recent gains, coupled with Bitcoin’s slowing pace, suggest a potential rotation of capital into altcoins.

While these patterns don’t guarantee outcomes, they often precede wider market moves. As investors look for strategic entry points, attention is turning to high-potential crypto assets poised to benefit from an upswing. Below, we outline some of the best crypto to buy right now based on current market dynamics and technical strength.

Best Crypto to Buy Right Now

Sonic is priced at $0.4138, reflecting a 4.74% increase in the past day. Meanwhile, Jupiter has signed a strategic agreement with Kazakhstan’s Astana International Exchange (AIX) to introduce a dual listing system. Also, the SNORT project has attracted over $393,000 through its ongoing presale, signaling strong early-stage interest and growing investor traction.

1. Sonic (S)

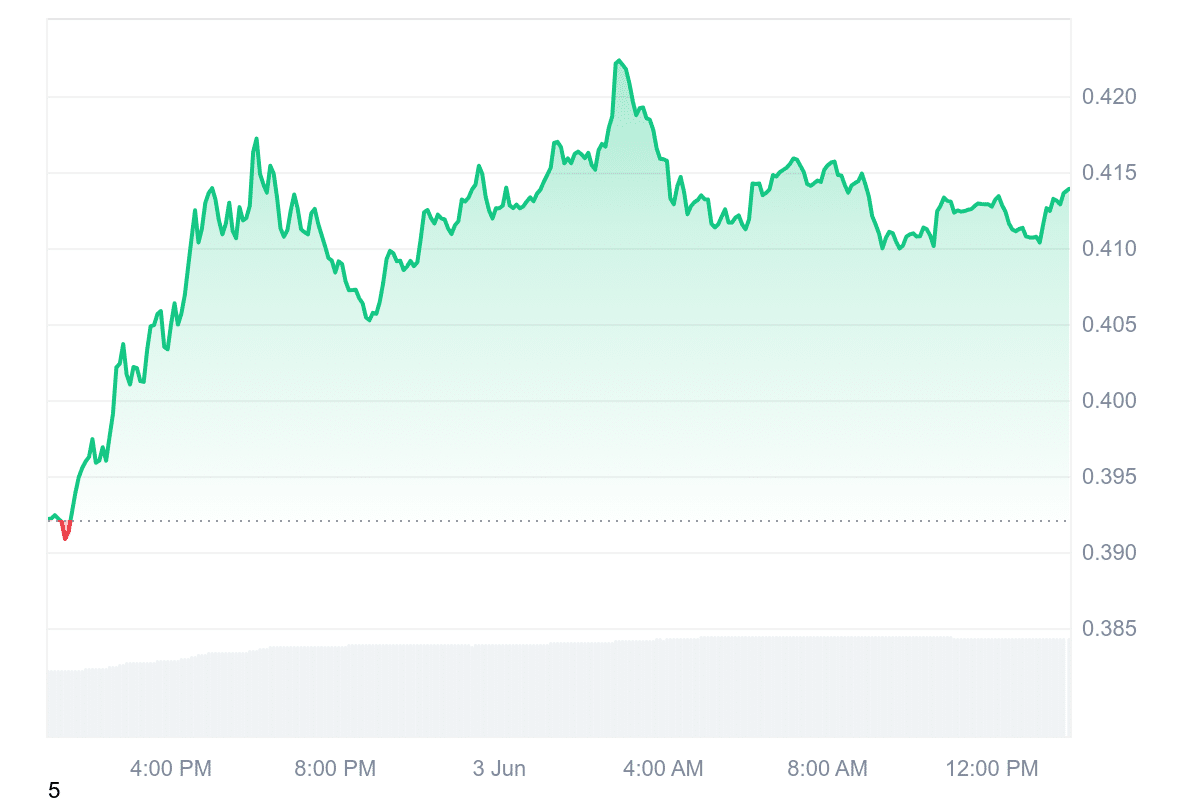

Sonic is currently trading at $0.4138, posting a 4.74% gain over the last 24 hours. Despite this short-term upward movement, the overall price prediction sentiment remains bearish. Sonic’s 24-hour volume-to-market-cap ratio is 0.1155, suggesting high liquidity relative to its size.

Additionally, the 30-day volatility is measured at 12%, which indicates moderate but stable price movement for a crypto asset. Furthermore, market attention is turning toward the highly anticipated Sonic (S) airdrop, scheduled for launch in June 2025.

This event will distribute 190.5 million $S tokens to promote ecosystem activity and reward community engagement. Managed by Sonic Labs, the airdrop is designed to support both users and developers by incentivizing sustained participation in the network.

The first season of the $S airdrop will be distributed in two phases.

💧 25% Liquid

A quarter of your allocations will be instantly claimable for liquid $S.🧊 75% Vested

The rest vests over 270 days as tradeable NFTs with early-claim burns.🔗 https://t.co/5pUtkpXkNU pic.twitter.com/gopzZ1Gcvp

— Sonic Labs (@SonicLabs) June 2, 2025

The distribution structure is set to unfold in two phases. The first 25% of each participant’s allocation will be immediately available for claiming in liquid $S tokens. The remaining 75% will be distributed over 270 days as tradeable NFTs, which can be claimed early but with a burn penalty.

This dual-phase approach is intended to balance immediate liquidity with long-term ecosystem stability, ensuring that token recipients remain engaged over time without creating excessive sell pressure.

While short-term sentiment around Sonic remains cautious, the upcoming airdrop introduces a structured incentive model that could attract renewed interest and participation from both retail users and developers.

2. Four (FORM)

Four is currently trading at $2.68, showing a 22.32% gain over the past month. The token has experienced moderate yet consistent momentum, with 16 green days out of the last 30, indicating growing interest. Over the past 24 hours, trading volume surged to $17.11 million, up 65.03%, suggesting heightened activity and investor attention.

With a volume-to-market-cap ratio of 0.0358, Four demonstrates relatively high liquidity based on its cap, supporting smoother price execution and potential for continued movement.

Despite recent gains, Four remains 11% below its all-time high, signaling room for recovery should market conditions remain favorable. The 30-day volatility sits at a relatively low 8%, pointing to stable price behavior compared to more volatile assets in the crypto space.

Furthermore, sentiment surrounding the token is currently neutral, suggesting that investors are adopting a wait-and-see approach. However, the overall market sentiment is tilted toward “Greed,” as reflected by a Fear & Greed Index reading of 64. Four is showing healthy signs of market interest with stable volatility, increasing trading activity, and solid liquidity.

3. Jupiter (JUP)

Jupiter has recently entered into a strategic partnership with Kazakhstan’s Astana International Exchange (AIX), aiming to develop a dual listing framework for companies. Under this initiative, firms can conduct a traditional IPO on AIX while simultaneously issuing tokenized shares on the Solana blockchain through Jupiter and Intebix.

This dual approach is designed to expand capital-raising opportunities and improve access to both institutional and retail investors. It also enables greater liquidity and transparency through blockchain-based assets, potentially reducing operational inefficiencies associated with traditional equity markets.

We're excited to advance our Global Unified Markets vision together with @SolanaFndn and Astana International Exchange (AIX).

Jupiter and AIX, Kazakhstan's Stock Exchange, have signed a memorandum aimed at developing a dual listing — allowing companies to go public through a… pic.twitter.com/2nUkMisKck

— Jupiter (🐱, 🐐) (@JupiterExchange) May 29, 2025

The dual listing mechanism represents a significant step forward for blockchain integration in traditional finance. By bridging centralized exchanges and decentralized token markets, this initiative positions Jupiter as a key player in the tokenization of real-world assets.

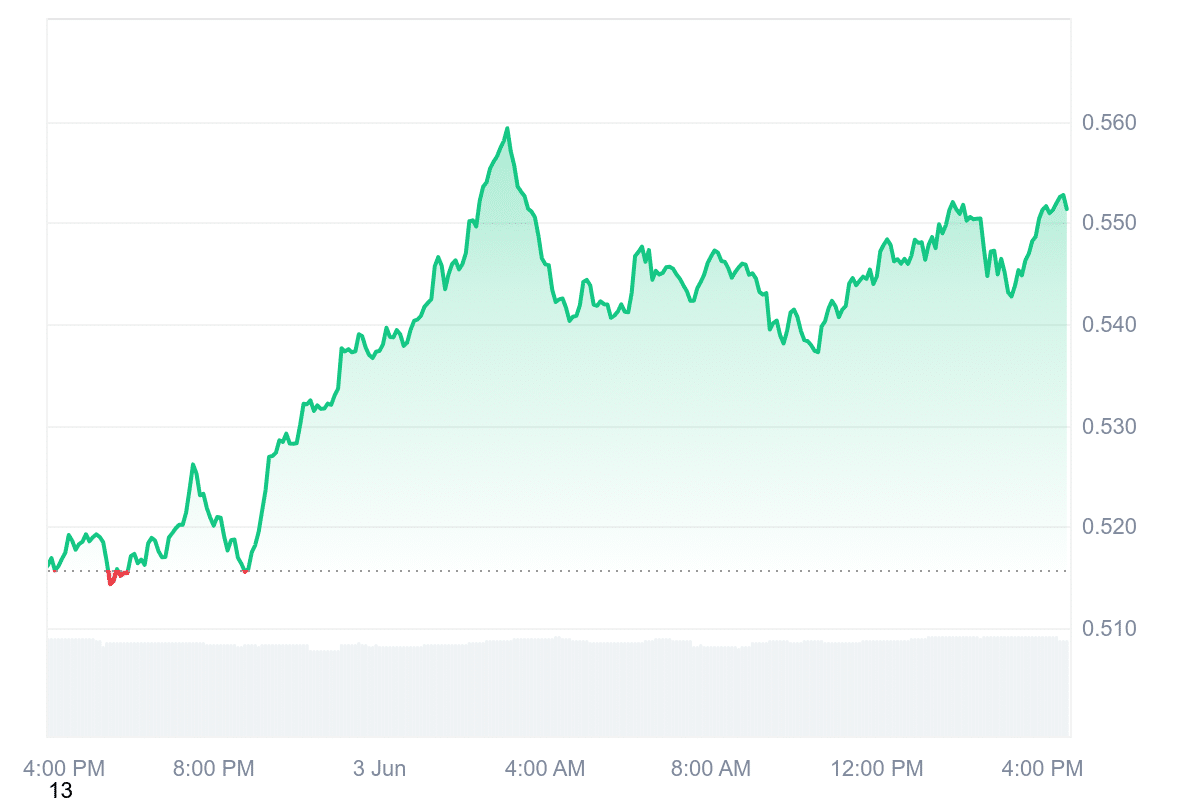

Jupiter’s native token, JUP, is currently trading at $0.5486, reflecting a 27.88% gain over the past month. The token’s market capitalization has reached $1.61 billion, marking a 6.36% increase, while daily trading volume stands at $52.2 million, up 2.20%. This uptick in volume suggests growing investor interest and confidence, likely fueled by recent developments and Jupiter’s expanding ecosystem on the Solana blockchain.

4. SNORTER (SNORT)

Snorter (SNORT), a meme-infused trading bot built on Solana and integrated with Telegram, has quickly captured investor attention. Since launching its presale, the project has raised over $393,000, with momentum accelerating rapidly. Initially pulling in $150,000 on day one, the figure has grown steadily, reflecting growing interest in both the bot’s utility and its humorous branding.

The crypto trading bot market was valued at over $41 billion in 2024, and Snorter is positioning itself as a unique contender by combining high-speed swaps, a user-friendly design, and the appeal of meme culture. Hosted entirely within Telegram, the bot offers a seamless experience with near-instant execution and low-cost trades, charging just 0.85% per transaction. This undercuts popular alternatives, such as Maestro, BonkBot, and Trojan.

Snorter is built for performance, offering access to trading across Solana and future multichain support. It aims to simplify trading for both experienced users and newcomers, offering an intuitive interface alongside powerful functionality.

The presale is currently priced at $0.0941 per SNORT token and follows a tiered pricing model. As each tier fills, the price increases, providing early participants with access at the most favourable rates. The flexible payment options, including major cryptocurrencies and credit cards, also lower the barrier to entry.

5. Aave (AAVE)

Aave (AAVE) is currently trading at $269.78, marking a 7.34% gain over the past 24 hours. With sentiment leaning bullish and the Fear & Greed Index at 64 (Greed), the market outlook appears optimistic. The asset is trading 26.7% above its 200-day simple moving average of $213.30, indicating sustained upward momentum.

The 14-day Relative Strength Index (RSI) stands at 52.73, placing AAVE in a neutral zone that suggests potential sideways trading in the near term. Aave has recorded 17 green days in the past 30 days, with a relatively moderate 30-day volatility of 13%, signaling price stability.

Its 24-hour volume-to-market cap ratio is 0.2137, reflecting strong liquidity relative to its market capitalization. A key development is the launch of the AAVE Umbrella Security Module, designed to enhance decentralized finance (DeFi) risk mitigation. This new framework replaces the previous AAVE and stkABPT model and introduces a more dynamic, auto-managed structure for managing bad debt.

The module enables stakeholders to stake aTokens as a buffer against debt events, streamlining the process of maintaining financial stability across multiple DeFi platforms. With improved technical indicators, strong liquidity, and innovative developments, Aave continues to show promise in the DeFi sector.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage