Join Our Telegram channel to stay up to date on breaking news coverage

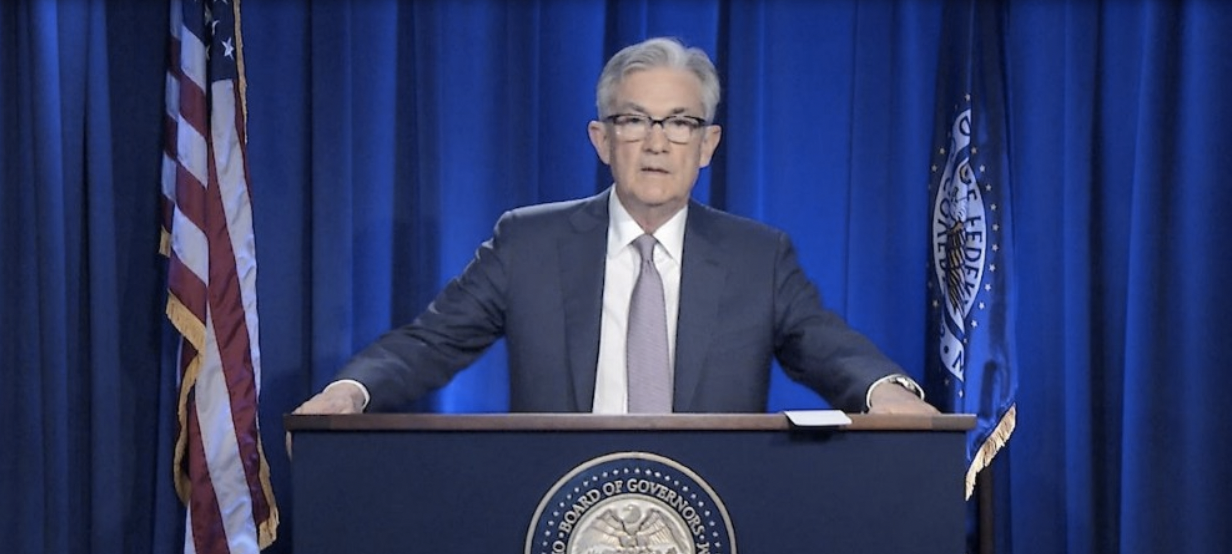

Federal Reserve Chair Jerome Powell has stated that interest rate reductions are likely to be implemented in a “few years.” During a press conference on June 14, 2023, Powell emphasized the central bank’s commitment to its dual mandate of promoting maximum employment and stable prices. The Federal Reserve aims to achieve price stability to ensure a well-functioning economy.

Powell said:

‘The Fed’s monetary policy actions are guided by our mandate to promote maximum employment and stable prices for the American people.’

Jerome Powell on Monetary Policy Tightening Measures

The Federal Reserve Chair asserted, that the Federal Open Market Committee (FOMC) has implemented significant monetary policy tightening measures since early last year, including raising the interest rates by 5 percentage points and reducing securities holdings.

However, Powell noted that the full impact of these measures has yet to be felt, and considering the uncertain time lags associated with monetary policy, the FOMC decided to maintain the policy on interest rates and continue reducing securities holdings.

Looking ahead, Powell stated that most FOMC participants expect further rate increases this year to bring inflation down to the target rate of 2 percent over time. The U.S. economy experienced a notable slowdown last year, with weak performance in the housing sector due to higher mortgage rates. Higher interest rates and slower output growth have also impacted investments in the business sector. Projections indicate subdued growth in the near future.

Powell said:

“We are highly attentive to the risks that high inflation poses to both sides of our mandate, and we are strongly committed to returning inflation to our 2 percent objective.”

Despite a tight labor market, signs of a better balance between labor supply and demand have emerged. The labor force participation rate has increased, wage growth has eased, and job vacancies have declined. FOMC participants anticipate that labor market conditions will gradually balance, alleviating upward inflationary pressures. The projected median unemployment rate for this year is expected to rise to 4.1 percent and 4.5 percent for next year.

Inflation remains a concern, as it has exceeded the 2 percent goal. Although some moderation has been observed since the middle of last year, various indicators indicate ongoing high inflation pressures. Projections indicate a median Personal Consumption Expenditures (PCE) inflation of 3.2 percent this year, 2.5 percent next year, and 2.1 percent in 2025. Core PCE inflation, which excludes food and energy prices, is projected to be higher, with a median projection of 3.9 percent for this year.

Powell assured that longer-term inflation expectations remain well anchored. The Federal Reserve’s actions are guided by their mandate to promote maximum employment and stable prices, and they remain vigilant about the risks posed by high inflation to their mandate, as expressed in their Wednesday tweet.

What Does This Mean for the Cryptocurrency Market?

The statement from the Federal Reserve Chair Jerome Powell regarding interest rate reductions does not explicitly mention the cryptocurrency market. However, changes in interest rates can have indirect effects on the digital asset space, as they impact investor sentiment and the overall economic environment. There are a few potential implications for the crypto market.

Interest rate cuts typically indicate a more accommodative monetary policy stance by the central bank. This can lead to increased risk appetite among investors and potentially drive funds toward higher-risk assets like cryptocurrencies. Lower interest rates may make cryptocurrencies more attractive compared to traditional investment options that offer lower returns.

Cryptocurrencies, particularly Bitcoin (BTC), have often been viewed as a potential hedge against inflation. If interest rate cuts are implemented to stimulate economic growth and potentially lead to higher inflation, some investors may see cryptocurrencies as an alternative store of value.

Changes in interest rates can contribute to market volatility, and the cryptocurrency market is known for its inherent volatility. Uncertainty or surprises in monetary policy decisions can trigger significant price fluctuations in cryptocurrencies. Traders and investors may closely monitor any statements or actions from the Fed for potential market-moving effects.

While not directly related to interest rate cuts, central bank actions can influence regulatory attitudes toward cryptocurrencies. The Federal Reserve’s stance on cryptocurrencies and blockchain technology can shape regulatory discussions and policies, which, in turn, can impact the cryptocurrency market’s development and adoption.

Related Articles

- Best Cheap Crypto to Buy 2023 – Low Cost Coins

- Web3 Freelancing and Recruitment Platform DeeLance Approaches $1.5 Million – Massive Price Surge Expected.

- Crypto Prime Brokerage FPG Halts Withdrawals After Suffering a $15 million Cyber Attack

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage