Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) price started experiencing massive volatility in mid-March, navigating the bearish market, tough regulatory corridors, crises in traditional finance, and US macroeconomics as the authorities worked through the US inflation numbers.

Bitcoin price flipped in favor of the bulls on May 17, to record a 1.5% uptick and break above the $27,400 level before pulling back. The move was attributed to shifting sentiment after United States President Joe Biden commented about the country’s debt crisis. As part of his assertions, the president expressed his confidence in bringing an end to the stalemate with Republicans with the goal of avoiding a default.

Assessing The Possibility Of Fed Chair Powell’s Words Arousing Bitcoin Price

Federal Reserve Chair Jerome Powell is expected to deliver interest rate guidance for June’s monetary policy meeting. The Fed is widely expected to keep interest rates steady as fears of a recession are deepening amid tight credit conditions by US regional banks.

If the Fed indicates plans for another rate hike, it could elicit a negative reaction from BTC traders and push the asset’s price lower. If there will not be any rate hikes, or the Fed indicates plans for a lower rate hike, it would spell positive for BTC price this week, based on historical data.

Nevertheless, Bitcoin price is at risk of a dip this month after a wave of strong U.S. economic data, renewing the possibility of June’s interest rate hike. This comes after the U.S. industrial output and retails sales jumped 0.5% and 0.4% respectively last month, indicating consumer spending is holding up even in the face of strong economic forces.

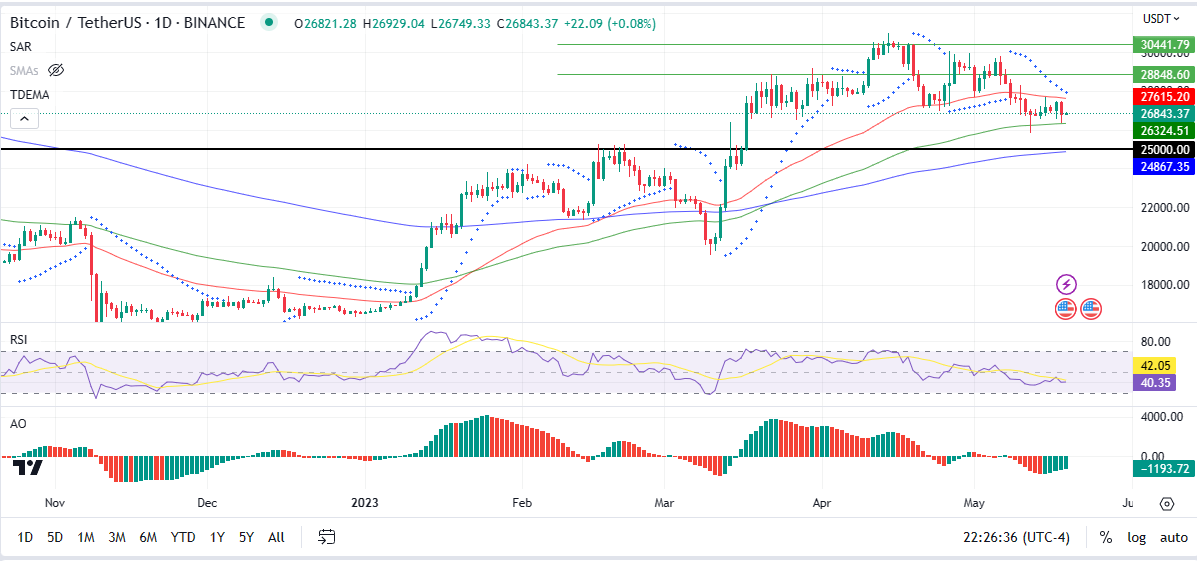

Considering Bitcoin trades inversely to the United States Dollar (USD), it faces danger should the strength index of the USD resume. Accordingly, Bitcoin (BTC) price faces the threat due to prospects of another rate hike this coming month, which continues to elevate U.S. Treasury yields. This in turn boosts appetite for the dollar and explains why chart technicals in the one-day chart below point to a bearish target at around $25,000 by June. Notably, the $25K level is an important psychological price level for the dollar.

Bitcoin Price Prediction With 10% Losses In Sight

As shown, Bitcoin price faces robust selling pressure from the 50-day Exponential Moving Average (EMA) at $27,615. This supplier congestion level could repel the king crypto and initiate a break below the immediate support presented by the 100-day EMA at $26,324. Next, BTC could tag the $25,000 target before an extended leg down potentially meeting the next supplier cohort around the 200-day EMA at $24,867 in the extreme scenario.

The bearish thesis draws support from the Parabolic SAR after it flipped above the Bitcoin price on May 8. Whenever this trend-following indicator tracks the price from above, it is interpreted as a bearish outlook for the concerned asset.

Conversely, an increase in buyer momentum could see Bitcoin price flip the 50-day EMA at $27,615 into support and use it to tag the $28,848 resistance level. A decisive flip of this barricade into support could invalidate the bearish outlook, setting the trajectory for a run-up past $30,000 and tag $30,441 by June.

In support of the bullish narrative is the Awesome Oscillator (AO) indicator, which was green and approaching the mean line to show buyers were approaching the market.

BTC Alternative

Shift your gaze from Bitcoin price and consider DLANCE, the ticker for the DeeLance ecosystem. Released in March, it is a next-generation freelancing and recruiting platform uniquely delivering decentralized Web3 technology. The project aims to become the future of freelancing, given its ability to revolutionize how freelancers link with potential buyers on the Metaverse and Web3 spaces.

The project is in the presale stage and has already raised upwards of $929,420 USDT. With just under three weeks to the next stage, now is the best time to buy DLANCE.

Exciting News DeeLancers!👨💻$DLANCE is now TRENDING on Reddit! 🚀🙌https://t.co/8yKF6MWUiT

Presale is live – grab some $DLANCE now!⬇️✨https://t.co/XHnTqVzMLN#Reddit #crypto #token $DLANCE pic.twitter.com/VX1P6dpNIF

— DeeLance (@deelance_com) April 25, 2023

DeeLance is a freelancing and recruitment platform using Blockchain Technology. The decentralized platform has revolutionized how freelancers connect with potential employers. Among its key highlight features include simplicity, convenience, and that it presents a decentralized system without relying on intermediaries. Owing to these unique characteristics, this innovative project is a positive development for the freelance industry.

Further, the DeeLance ecosystem is developing an interactive non-fungible token (NFT)-powered metaverse platform that will bring businesses and freelancers together. Observers have already passed it as a revolutionary project set to transform the recruitment industry.

Read More:

- Bitcoin Price Rises To $27,300 – How Will The Debt Ceiling Debate Influence BTC?

- Bitcoin Price Holds At $27,000 – $28,000 Likely Today For BTC?

- How to Buy Bitcoin Online Safely

- ADA Price Prediction – Cardano’s Push to Voltaire Era Draws It Closer to Full Deployment?

Join Our Telegram channel to stay up to date on breaking news coverage