Join Our Telegram channel to stay up to date on breaking news coverage

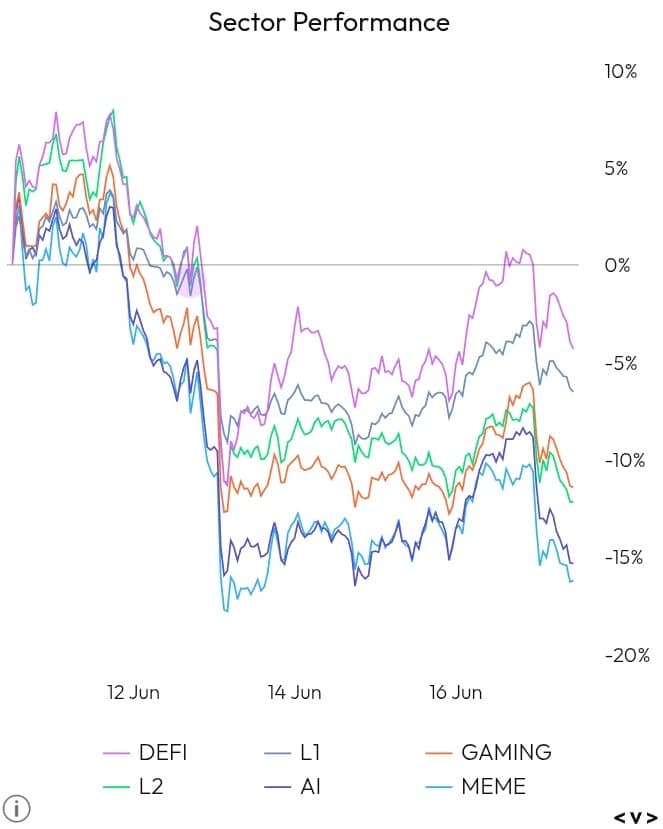

Artificial intelligence is quickly becoming crypto’s most transformative frontier—no longer just a trend but a backbone for next-gen applications. AI tokens, built to power decentralized models, intelligent agents, and machine-driven data systems, are gaining serious ground. As of June 2025, the total market cap for AI-related tokens has climbed to over $26 billion, reflecting the rising demand for smarter infrastructure across Web3.

The top performing AI tokens in this rapidly evolving space are NEAR Protocol, Injective, The Graph, and Theta Network. Each is leveraging AI to deliver real-world functionality—from confidential machine learning and AI-enhanced trading to intelligent indexing and edge-powered video delivery. We explore what sets these projects apart, how their ecosystems evolve, and why they’re leading the charge in crypto’s AI-powered future.

Biggest AI Token Today – Top List

NEAR Protocol is a high-performance Layer 1 blockchain known for its user-friendly design and scalability. Injective is a decentralized Layer 1 protocol for finance, offering fast execution and native support for order-book trading. The Graph is key for querying blockchain data and is essential for AI-led blockchain applications. Theta Network delivers decentralized video streaming and is now enhancing its services with AI. Let’s fully uncover why these tokens are ranked among the top performing AI tokens in today’s market.

1. NEAR Protocol (NEAR)

NEAR Protocol is a high-performance Layer 1 blockchain known for its user-friendly design and scalability. It’s increasingly positioned as a foundational layer for AI-integrated applications, enabling developers to deploy intelligent, permissionless dApps to learn, adapt, and interact. NEAR’s ecosystem embraces AI to enhance developer tooling and user experiences.

The NEAR token fuels transaction fees, staking, and governance. It’s essential for securing the network, incentivizing validators, and allowing token holders to vote on protocol upgrades. As AI tooling grows within the ecosystem, NEAR’s utility will continue to expand.

Near Protocol trades at $2.24, showing a 2.2% gain over the last 24 hours. In the past 30 days, it has seen 16 green days (53% of the time). Its 24-hour price range has been between $2.18 and $2.48, indicating short-term strength amidst recent volatility and consolidation.

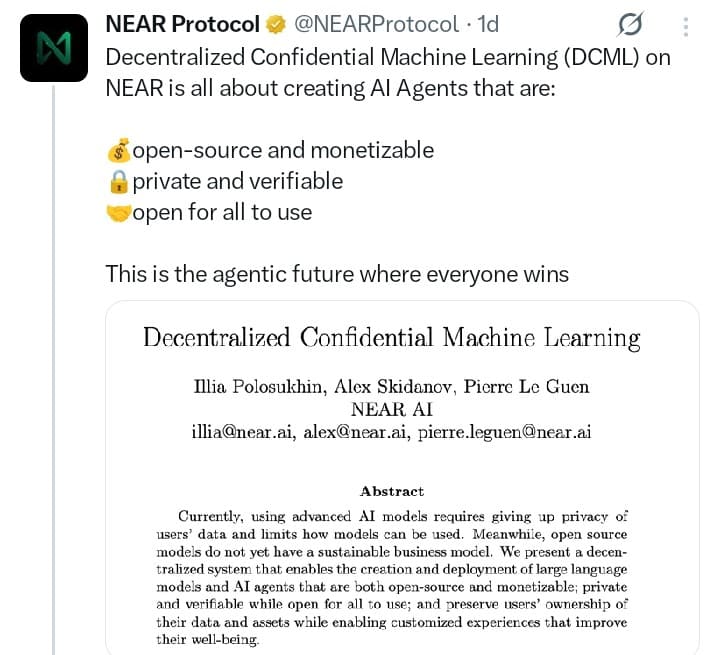

NEAR Protocol recently spotlighted Decentralized Confidential Machine Learning (DCML)—a privacy-focused system enabling monetizable, private AI agents built with open-source tools. These AI agents can operate securely within decentralised environments, protecting data while offering developers opportunities to earn.

This showcases NEAR’s strategic push to merge AI innovation with strong data privacy. For investors, it highlights a platform primed for next-gen AI adoption—blending utility, security, and revenue potential. That combination positions NEAR as a standout contender in the evolving Web3 and AI landscape.

2. Injective (INJ)

Injective is a decentralized Layer 1 protocol tailored for finance, offering lightning-fast execution and native support for orderbook-based trading. Recently, it’s gained traction for integrating AI into its trading infrastructure — optimizing liquidity, strategy automation, and real-time risk analysis. This AI edge makes Injective a standout in the DeFi x AI crossover space.

The INJ token powers governance, staking, and protocol fees. It’s used to pay for dApp execution, secure the chain, and reward participants. As AI tools become embedded across Injective’s ecosystem, the token gains new relevance in automated, intelligent finance.

Injective is priced at $11.56, showing a 1.15% increase in the last day. It has also seen 17 “green days” in the past month (57% of the time). Its price has moved between $11.44 and $13.78 in the last 24 hours, suggesting a modest recovery within its AI-enhanced trading ecosystem.

On Injective, liquidity isn't fragmented across applications.

Our plug-and-play modules create a cohesive financial ecosystem where capital efficiency improves with every new EVM, WASM, and SVM application launched onchain. pic.twitter.com/GR32QnKO1K

— Injective 🗽 NYC Summit – June 26th (@injective) June 15, 2025

Injective recently highlighted its standout feature: liquidity isn’t fragmented across apps. Thanks to its plug-and-play modules, every new EVM, WASM, and SVM app launched on Injective shares in a cohesive financial ecosystem, boosting overall capital efficiency.

This means any app on Injective taps into a deep, unified pool of liquidity—no more isolated silos. It’s a strong indicator of efficient capital use and robust network design for investors. That shared-liquidity structure supports healthier DeFi activity and positions Injective well for long-term growth.

3. SUBBD Token (SUBBD)

SUBBD is an AI-driven platform transforming content monetisation within the creator-subscriber space. It combines AI tools with Web3 technology, empowering creators to manage and monetise their content efficiently, bypassing intermediaries. Featuring AI live streams, voice generators, and a 24/7 personal assistant, SUBBD presents a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055675, having raised over $672,000, the token provides exclusive benefits, VIP access, and a 20% annual return through staking. A tenth of the total supply is designated for airdrops and rewards.

SUBBD has garnered attention on prominent cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, underscoring its growing presence in the AI and Web3 domains. The platform’s expanding influence is evident, with the launch of the AI Personal Assistant enhancing creator-fan engagement and support. As AI and Web3 reshape digital content, SUBBD is at the forefront of the future of creator earnings.

4. The Graph (GRT)

The Graph is the go-to indexing protocol for querying blockchain data, and it’s rapidly becoming essential in AI-led blockchain applications. By structuring data access for AI models, The Graph enables faster, more efficient training and deployment of decentralized AI. It serves as the connective tissue between blockchains and machine intelligence.

The GRT token is used to incentivize indexers, curators, and delegators. It facilitates data querying, ensures protocol security, and governs the ecosystem. As AI projects rely more on structured blockchain data, GRT becomes increasingly vital.

The Graph (GRT) is trading at $0.0887, up 1.5% today, though it’s down 9% over the past week. Its 24-hour price has ranged between $0.087 and $0.10. This activity reflects continued interest in its AI-backed indexing services, even with broader market challenges.

You can now query any Subgraph and all Token API endpoints via MCP 🔥

This means no complex infrastructure, no backend setup, just direct access to blockchain data via natural language queries.Why this matters:

🧠 Anyone can ask a question, not just developers. Access to…— The Graph (@graphprotocol) June 12, 2025

The Graph recently announced the release of Subgraph MCP: Cline, a community-driven subgraph management platform. The tweet links to more details about Cline and Claude upgrades, signaling continued subgraph governance and tooling development.

As one of the top performing AI tokens, this upgrade enhances how subgraphs are managed and curated, empowering developers and indexers with better governance controls. For investors and ecosystem participants, stronger tooling means more reliable data infrastructure, boosting confidence in projects built on The Graph and strengthening the foundation for long-term growth.

5. Theta Network (THETA)

Theta Network is a decentralized video delivery and streaming infrastructure pivoting toward AI-powered enhancements. It uses AI for real-time content optimization, intelligent video delivery, and advanced analytics, offering Web3 media platforms a smarter backbone. This AI layer makes Theta uniquely suited for next-gen digital experiences.

The THETA token supports governance and staking for validator and guardian nodes. It’s also critical in ensuring the performance and scalability of the network. With AI transforming video infrastructure, THETA is positioned at the intersection of streaming and smart technology.

Coming soon – the @PhilaUnion to launch a fan-facing AI agent powered by Theta EdgeCloud in their upcoming mobile app!

Fans can get the app via QR codes around the Union stadium, making it easy to access the AI agent for ticketing and team info.https://t.co/EyBqRyMAPO https://t.co/hLakuOyQvx

— Theta Network (@Theta_Network) June 12, 2025

Theta Network is trading near $0.72. It has seen a 3% gain in the last 24 hours but is down 11% from its highs of last week. Its daily price has moved between $0.70 and $0.80. This suggests investors are showing renewed interest in AI-integrated video streaming solutions.

Theta Network recently announced that Major League Soccer’s Philadelphia Union will soon launch a fan-facing AI agent powered by Theta EdgeCloud in their upcoming mobile app.

This partnership highlights Theta’s practical application of decentralized AI and edge computing within sports and fan engagement. It signals real-world adoption and ecosystem growth for investors, boosting confidence in Theta’s technology and its potential to drive long-term network value.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage