Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin miners are looking towards the next halving, probably due in April next year, with fears of the 50% cut in their earnings but hopes of a BTC price bounce, as has happened after previous halvings.

Estimates are that Bitcoin will have to break and hold above $50k after the halving just for mining to remain profitable for crypto miners.

Halving May Not be Good News For Everyone

The cryptocurrency community is gearing up for the next Bitcoin halving event. In the past this event has been tied to exponential surges in the Bitcoin price.

According to Bloomberg, the 2012 halving saw BTC jump by a massive 8450%. 2016 saw BTC go up by 290%, and in 2020, the world’s leading cryptocurrency pumped by 560%.

1-Month Candle Chart Bitcoin

As you can see from the chart, although the upswing took some time, the surge did happen. And following 2020’s halving, Bitcoin reached its all-time high.

What is Halving?

Halving is an event that occurs every four years. It involves halving the amount of Bitcoin which crypto miners can mine. So while they are currently rewarded with 6.25 bitcoins per block, which is equivalent to $188,668 at the current Bitcoin price, the next halving will reduce that by a half, to 3.125 blocks, leaving crypto miners with a reward of only $94,334 per block.

The thinking behind a halving is quite simple. By constantly reducing the level, the rarity of Bitcoin will increase, as there will be fewer available. And as only 21 million Bitcoins will ever be created, by making them harder to get hold, it should maintain if not boost its value.

But why limit Bitcoin to 21 million BTCs? Why not just keep making them? Quite simply, Satoshi Nakamoto, Bitcoin’s creator, believed by capping Bitcoin production it would be immune to the inflationary issues that afflict traditional currencies. So, rather than make more and more Bitcoins, lowering their value, setting a limit should keep its value relatively stable.

High Operating Costs For Low Returns For Crypto Miners

One of the biggest issues that could stem from the halving is low returns.

Bankless Times reports that there are currently one million miners actively mining Bitcoin, and around half of them will have to suffer due to inefficient mining activities, according to Jaran Mellerud, a crypto mining analyst at Hashrate Index.

According to him, the break-even electricity price for the most common mining machine is $0.06/kWh after halving. But around 40% of miners have operating costs that exceed this price.

In the US, which is home to the bulk of Bitcoin miners in the world, crypto miners currently need to spend $17k on electricity bills to mine one Bitcoin, according to BeInCrypto.

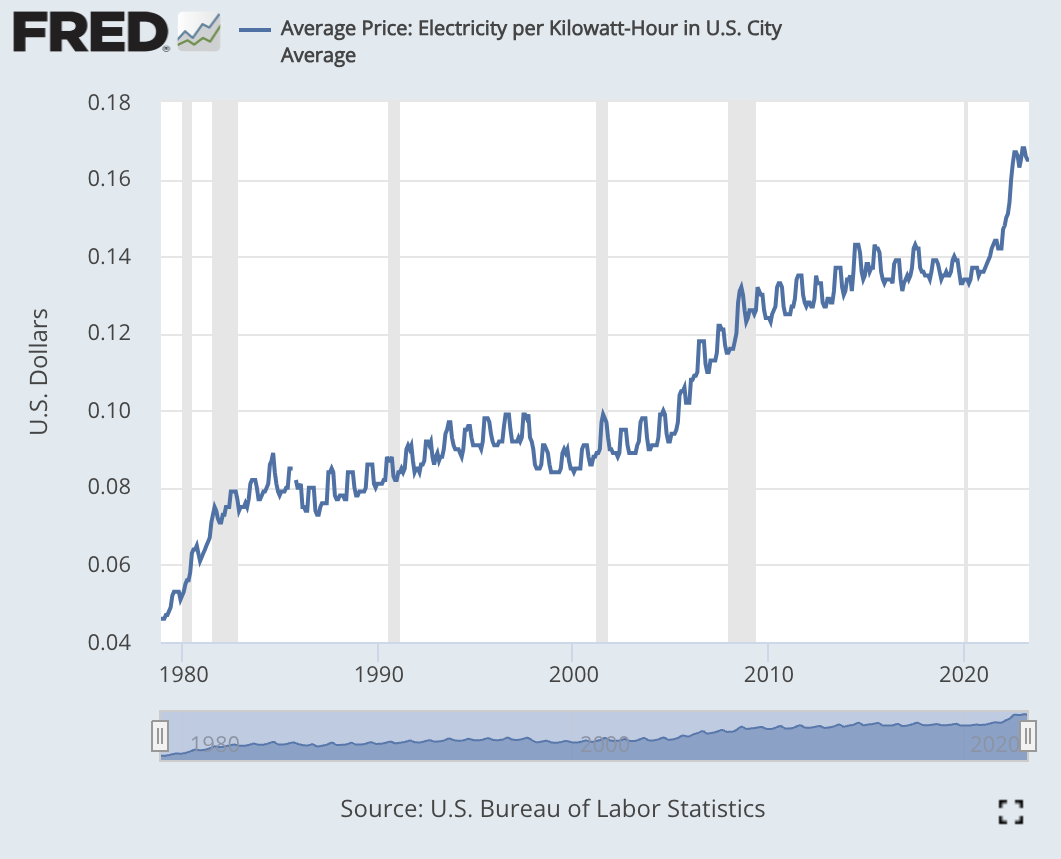

And while the recent surge in the Bitcoin price has lifted it 80% higher YTD, electricity prices have also increased.

In the past two years alone, the average price of electricity in the US has risen from around $0.14kWh to about $0.17kWh.

More Sophisticated Pricing Strategies on the Cards for Many Miners

Many Bitcoin miners have taken steps to protect themselves, reaching out to their power providers to lock in power prices and reduce their outlays.

Kevin Zhang, Senior Vice President of the crypto mining firm Foundry, stated that miners have started to become more “sophisticated with their power costs”.

Companies have gone as far as to secure credit deals with exchanges.

Coindesk reported that Hut 8 Mining Corp, for instance, has cut a credit deal worth $50 million with a unit of Coinnbase Global Inc. to protect its Bitcoin treasury.

Zhang has also stated that the Bitcoin price needs to move up to at least $50k to $60k if miners want to see the same profit margins as this year.

However, while it is not clear if Bitcoin will reach that price point in 2024, Chengpang Zhao, the CEO of Binance, has stated through his Twitter space that the year after Bitcoin halving is generally a bull year.

Related

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage