Join Our Telegram channel to stay up to date on breaking news coverage

Solana’s Price has dropped 9% of its worth over the last month, as its infrastructure has had another big failure and one of its trading methods has been hacked for $100 million. As an outcome, 63% of an advisory group lost faith in the blockchain.

SOL’s present negative trend is consistent with the company’s longer-term downward spiral. However, why has the value of the SOL currency been declining, and whether the SOL currency also has a future?

Here, we analyse several Solana pricing forecasts for 2022 and beyond, as well as the project’s most recent advancements.

What exactly is Solana? The ecosystem of Ethereum alternatives

In contrast to many other well-known blockchains that function nowadays employing proof-of-work (PoW) or proof-of-stake (PoS) techniques, Solana was among the first to offer a proof-of-history (PoH) method, allowing the blockchain to run swiftly while being safe and decentralised.

Solana was founded in 2017 by Anatoly Yakovenko, a former Qualcomm (QCOMM) engineer and Dropbox (DBX) developer, with fellow colleague Greg Fitzgerald with the purpose of creating an open-source initiative that created a new, strong, peer-to-peer blockchain.

The Solana blockchain, according to its PoH algorithm, can handle 2,000 transactions per second, making it a contender to Ethereum (ETH), the second-largest crypto by market capitalization.

Due to its interoperability using smart contracts, which allow for the creation of decentralised apps, Ethereum has emerged as the leading company for decentralised finance (DeFi). However, the blockchain’s popularity has made it costly and sluggish to use, encouraging the rise of rivals such as Solana.

According to the platform’s official web page, it is “the world’s fastest blockchain as well as the fastest growing cryptocurrency ecosystem, with dozens of projects spanning DeFi, Web3, NFTs, and more.” It is not only fast, but its normal expenses are usually less than $0.00025.

What is the purpose of the SOL coin?

Solana runs on its own cryptocurrency. Inside the Solana network, SOL is used for staking as well as to pay processing fees and any transactions.

According to statistics, the total quantity of SOL tokens exceeded 510 million at the time of publishing this article, including over 357 million coins in circulation.

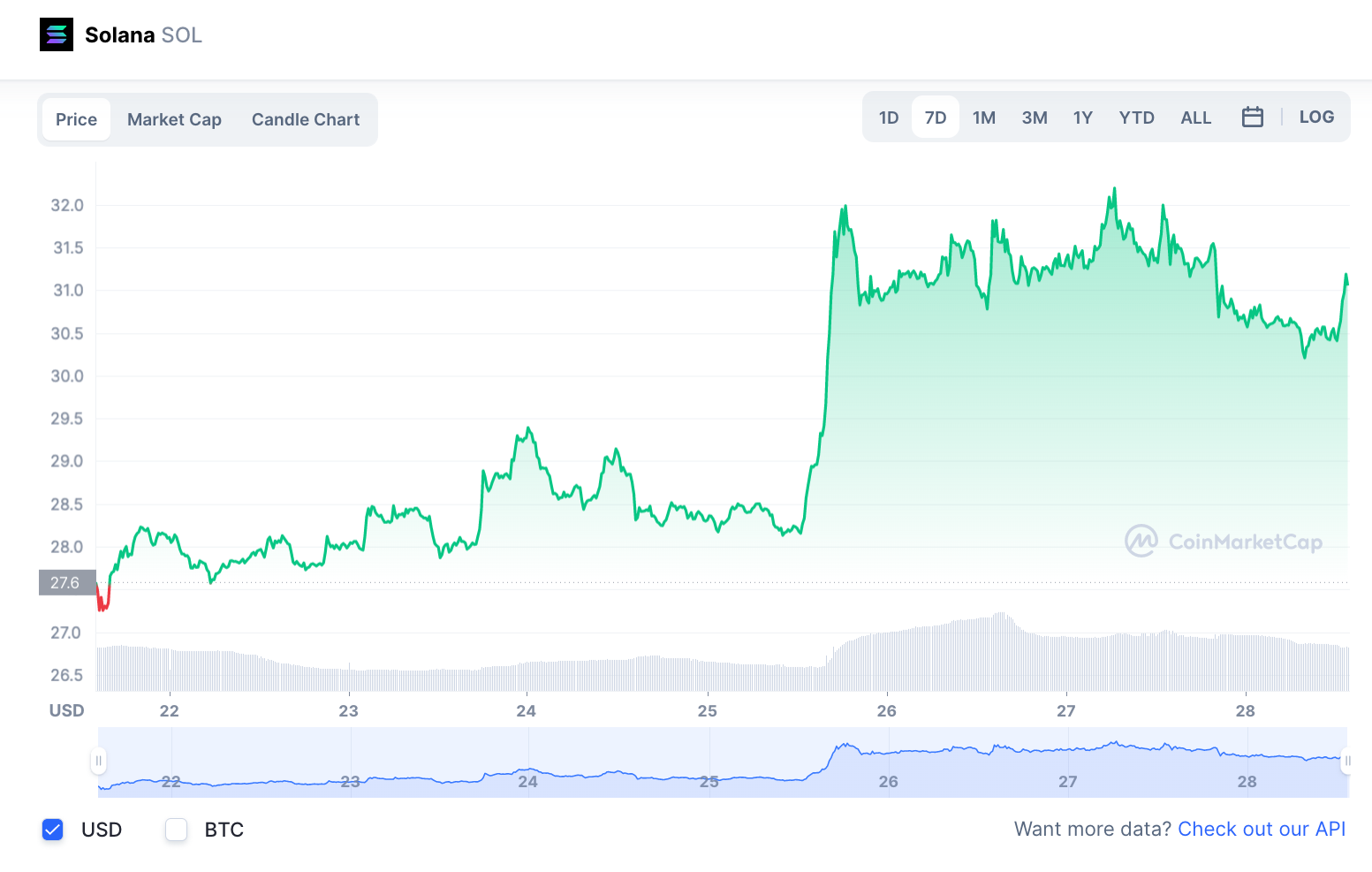

With the cryptocurrency trading at little more than $28, SOL had a market value of more than $11 billion, ranking this the 9th largest cryptocurrency, trailing Cardano (ADA) & Ripple (XRP) (XRP).

Solana’s Price Forecast for 2022-2030

As of October 27, 2022, CoinCodex’s fundamental SOL coin evaluation was bearish. According to the site’s brief SOL crypto price projection, the coin might have dropped by 8% reaching $28.98 beside November 26.

What is the future potential for the SOL coin? WalletInvestor, an algorithm-based forecasting tool, painted another bleak image in its Solana price estimate for 2022. The coin was expected to fall below $2.97 in a year, according to the website. It was also predicted that it will plummet beneath $0.50 by the close of 2027.

Solana cryptocurrency price prediction from DigitalCoinPrice remains positive. Based on past trends, the crypto data company predicted that the Solana price might reach $51.21 by 2023, rising above $32.17 in 2022. Its Solana price forecast for 2030 had the currency rise to $174.30.

CoinPriceForecast’s Solana coin price estimate was likewise positive, albeit with a much shallower rising trajectory. According to the forecast, the coin might be worth $39.66 even by end of 2022. According to the site’s Solana price forecast for 2025, the price might have dropped to $38.81 even by the close of the year.

In 2022, the average price, according to PricePrediction’s SOL price projection, might be $35.40. Based on its AI- powered scientific investigations, the site’s Solana price estimate for 2030 said that the price might then accelerate to $752.18.

What to consider while investing

When searching for SOL token price predictions, take into account that cryptocurrencies are still incredibly unpredictable, making it challenging to anticipate what a coin’s worth will be within a few hours, much alone a long-term goal price. As a result, both experts and algorithmic predictions can and do make errors.

If you’re pondering purchasing cryptocurrency coins or tokens, you should consistently accomplish your own research. Evaluate the most latest market dynamics, statistics, fundamental and technical analysis, and expert opinions before making any trading decisions. Remember that past outcomes are no assurance of future outcomes, and just never trade using funds you cannot risk losing.

SOL in News Lately

SOL has lately struggled as a result of a massive attack on a Solana-based loan system. $100 million was stolen from the DeFi network Mango Markets by a hacker, who is now keeping it hostage until the protocol settles the bad debt.

Its total value locked (TVL) on the Solana network has dropped since the Mango Markets breach. It fell from $1.32 billion on October 10 to $862 million three days later.

This revelation comes after another network breakdown, making it a rough month for Ethereum’s opponent. As stated by the Solana validator stakewiz.com, the network fell down on October 1 due to a “misconfigured node.”

According to a recently updated survey, 33% of an advisory group had lost faith in the blockchain as a result of these network disruptions. Another 30% of those polled were unsure.

This has resulted in negative pricing action for SOL this month. It was valued at $31.48 as of October 27, dropping 9% from the previous month.

SOL, on the other hand, had risen in the short term, rising 7% in the preceding seven days. This came after it was revealed that Tulip & UXD, two protocols affected more by the Mango Markets breach, had received their missing coins and were up and running.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage