Join Our Telegram channel to stay up to date on breaking news coverage

Federal Reserve Chair Jerome Powell’s upcoming speech has generated significant anticipation and speculation within the financial community. His statements hold immense importance and possess the potential to impact various sectors, including the cryptocurrency market.

Traders and investors eagerly await Powell’s remarks. They seek valuable insights into the future trajectory of monetary policy and its potential ramifications for Bitcoin and other cryptocurrencies. Nevertheless, Bitcoin (BTC) price has started to show signs of recovery ahead of Powell’s speech.

Fed Chair Powell to Testify on June 21 at House Panel

Federal Reserve Chair Jerome Powell is scheduled to appear before the House of Representatives Financial Services Committee. This hearing marks the first day of a two-day congressional session. It will focus on the Federal Reserve’s semi-annual report on US monetary policy.

Powell will present his semi-annual monetary policy report to the House Financial Services Committee on June 21.

He will also appear before the Senate Banking Committee on June 22. Powell is anticipated to reiterate cautious remarks while keeping the possibility of future rate hikes open. This follows last week’s hawkish turn during the Federal Open Market Committee (FOMC) meeting.

As the market remains sensitive to rate hike speculations, Powell’s testimony has the potential to induce volatility. This is particularly if he provides new insights into the Fed’s future actions.

Market Expectations of Rate Hike Pause

Following the release of last week’s encouraging US Consumer Price Index (CPI) data, markets anticipate a pause in rate hikes. The CPI figures for May 2023 indicated a cooling down of inflation rates.

This further fueled the ongoing discussion surrounding whether the Federal Reserve will halt the rate hikes. The development aligns with the Fed’s objective to implement monetary tightening measures to achieve a target inflation rate of 2%.

Markets may witness upward trajectory in Wednesday trades following sharp gains in the US markets after the country’s inflation moderated, thus raising hopes that the Fed may take a dovish stance in the wake of cooling inflation. pic.twitter.com/1iBMfuKXhd

— Chris Wealth Management Pvt Ltd (@chriswealthman1) June 14, 2023

New York Fed President John Williams expressed the view that it is premature to make any policy shifts. This is despite the current market expectations for a potential pause in rate hikes.

He anticipates a decline in inflation from approximately 3% this year to around 2% in 2022 and 2023. Williams’ remarks leave the markets without clear guidance, as uncertainty persists regarding the Federal Reserve’s future actions.

New York Fed President John Williams says it’s too soon to say whether Fed is done raising rates #Ainvest #Ainvest_Wire #rate #interest #ratehiking

View more: https://t.co/RoG3eime4L pic.twitter.com/tc9C806911— AInvest Wire (@Ainvest_Wire) May 9, 2023

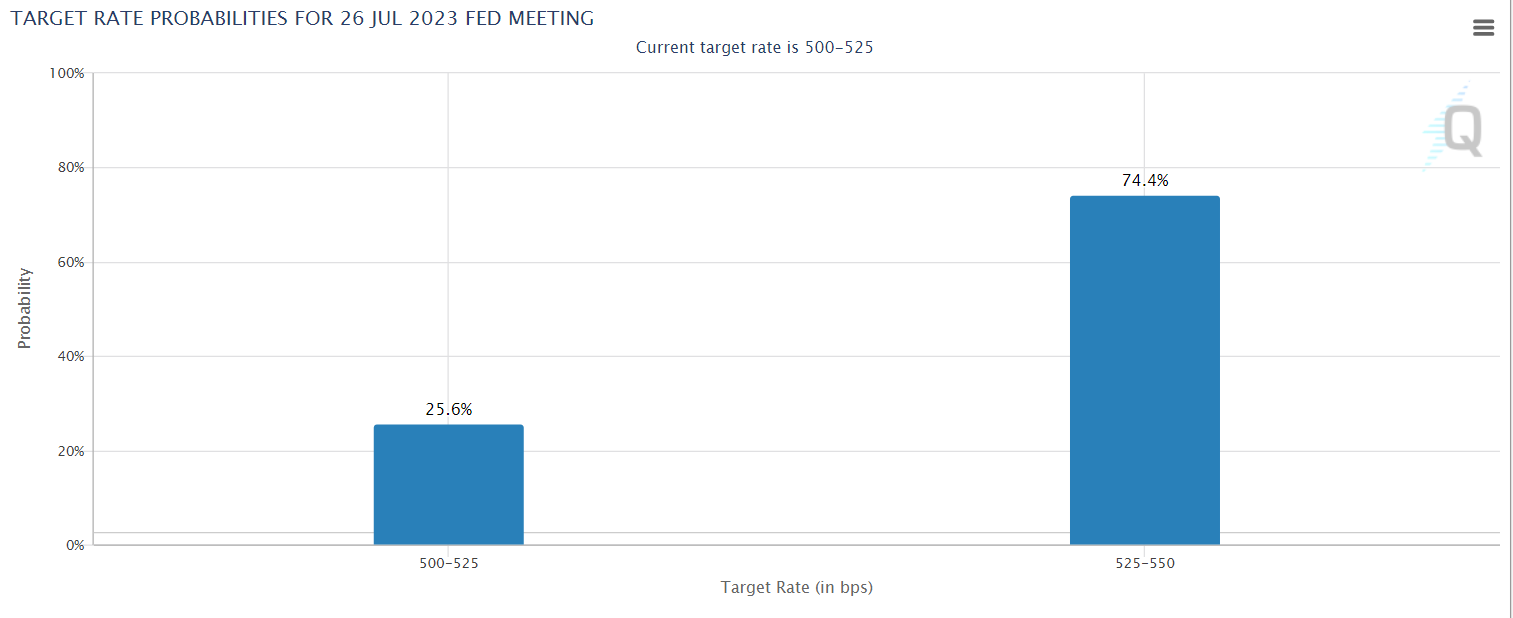

Meanwhile, the CME FedWatch Tool suggests a 74.4% probability of a Fed rate hike in the July meeting with. It gives a 25.6% probability of no change in the Fed policy in the upcoming FOMC meeting.

This matches the recent expectations from the Deutsche Bank, which anticipates the Federal Reserve to implement an additional rate hike in July. This would constitute a terminal rate increase to 5.3%.

DEUTSCHE BANK ARE NOW EXPECTING THE FED TO DELIVER ONE MORE RATE HIKE IN JULY, BRINGING THE TERMINAL RATE TO 5.3%.

— Stockeys (@Stockeys1) June 5, 2023

The Summary of the Latest Powell Speech

The Federal opted to maintain interest rates at their current level during the latest FOMC meeting on June 15. The decision was unanimous.

Nevertheless, Federal Chair Jerome Powell indicated that additional rate increases may be necessary later this year. The Fed’s dot plot outlines individual members’ rate projections.

Based on the updated dot plot, there is a more elevated outlook for peak rates compared to the March release. The median forecast now stands at 5.6%, with nearly all members concurring on the likelihood of further hikes.

Despite this, the Fed remains committed to achieving 2% inflation. The full impact of previous rate hikes on the economy has yet to fully manifest. Despite signs of progress, the labor market remains robust, prompting the Fed to exercise caution. Uncertain about the extent of tightening conditions resulting from recent troubles in the banking sector, the Fed will continue to rely on data to guide its decisions. To bring down inflation, a deceleration in economic growth is deemed necessary.

Disappointingly, the Fed’s preferred measure of inflation, core PCE inflation, is not demonstrating significant progress. Despite these challenges, Powell remains optimistic about the possibility of achieving a soft landing. Rate cuts are not anticipated within the year and may not materialize for several years. Currently, market expectations indicate a 70% probability of a 0.25% rate hike in July.

POWELL SPEECH SUMMARY⚠️

1. The Federal Reserve voted unanimously to pause, keeping interest rates as they are. However, Powell forecasted that further rate hikes are likely needed this year.

2. The Fed’s updated dot plot was released with Fed members forecasting higher peak… pic.twitter.com/S59td9YlJH

— Macro Dose (@macro_dose) June 15, 2023

BTC/USD Short-term Price Prediction

The daily chart analysis of BTC/USD indicates a significant positive momentum. The price movement has reached the upper band of a descending channel that has been in effect since April.

Moreover, BTC/USD has surpassed the 50-day Exponential Moving Average (EMA). This coincides with the 61% Fibonacci Retracement level (calculated from the lowest point on March 10 to the highest point on April 14). The initial resistance is situated at the upper band of the descending channel. A decisive breakout and subsequent candlestick close above this level would likely pave the way for further gains. The next target would be the 78% Fibonacci Retracement level at $28,615.

The Moving Average Convergence Divergence (MACD) indicator exhibits robust and positive histograms positioned above the zero line. This indicates the presence of bullish pressure.

These above factors, collectively, suggest a favorable short-term outlook for BTC. However, if prices fail to breach the upper band of the descending channel, a reversion to the $25,336 level is conceivable. This particular level holds critical significance, located at the 50% Fibonacci retracement and having previously served as a notable support and resistance level.

It is worth noting that the above support level has successfully prevented price declines since mid-May. Additionally, the 200-day EMA coincides with this level, accentuating the potential for substantial losses if a breach occurs.

While the technical indicators currently signal short-term bullishness, it is advisable to await a confirmed breakout. This will be ascertained upon a decisive close above the upper band of the descending channel before considering a long position.

Alternative to Bitcoin for Investment – yPredict

As Bitcoin is showing signs of recovery, one interesting new project is gaining traction with market participants, yPredict.

yPredict, an AI-powered crypto market platform, has recently made a significant announcement that is garnering attention. The platform has unveiled its first artificial intelligence model, which will be freely available for a limited time. This model, known as the Backlink Model, has been meticulously trained on over 100 million links.

This enables it to accurately predict the backlink profiles necessary for desired keywords. Users can now rely on yPredict’s precise backlink recommendations, eliminating the need for guesswork.

yPredict’s first model is live and It’s available to use for free, for a limited time.

Link: https://t.co/vT15zTcmL1

Blog: https://t.co/m5tVkclzaO pic.twitter.com/SJwT7AAwlB— yPredict.ai (@yPredict_ai) June 15, 2023

The yPredict team expresses gratitude for the overwhelming response to their initial model release. Within two days, they received an impressive influx of over 5,000 queries. The dedicated team is diligently upgrading their servers to provide uninterrupted usage and enhance performance. Users can expect an even smoother experience as yPredict scales up its infrastructure to meet the growing demands.

Stay tuned for further updates and enjoy the upcoming lightning-fast performance of the platform.

🎉 Thank you all for an incredible response to our first model release! 🚀 We’re thrilled to announce that we’ve already received over 5,000 queries in just 2 days! 🙌🔥

To ensure uninterrupted usage and lightning-fast performance, our dedicated team is currently upgrading our… pic.twitter.com/igCyWakyzO

— yPredict.ai (@yPredict_ai) June 19, 2023

This latest product launch marks yPredict’s expansion beyond cryptocurrency analysis and predictions. In fact, earlier this month, the platform revealed its plans to develop a solution for content-creation teams. Initially recognized as a platform specializing in crypto analysis and market predictions, yPredict is now generating excitement.

This is because of its ability to create innovative products across various industries by merging artificial intelligence and Web3 technologies.

📣 Attention SEO professionals and digital marketers! Discover the groundbreaking yPredict Backlink Estimator! 🚀 Say goodbye to guesswork and embrace a data-driven approach to link-building strategies.

📊 Our powerful model, trained on 1 billion+ rows of data from top… pic.twitter.com/5KLZRO6Lpp

— yPredict.ai (@yPredict_ai) June 16, 2023

YPRED Presale Reached Closer to $2.5M

This fusion of technologies is also evident in yPredict’s ongoing token presale. With the presale of its native token, YPRED, underway for several weeks, yPredict has successfully raised over $2.49 million. Investors eager to partake in this trending crypto project are urged not to delay. Considered one of the most promising crypto initiatives of the year, yPredict’s presale has gained significant momentum.

🚀 Exciting news! 📈 yPredict ($YPRED) soars higher, raising nearly $2 million. 🙌

Amidst Bitcoin and Ethereum’s price movements, investors are turning to yPredict on Polygon for risk hedging. 📊yPredict is the world’s first all-in-one AI-powered analytics platform for… pic.twitter.com/CHgD7rH4oj

— yPredict.ai (@yPredict_ai) June 2, 2023

Once the presale reaches $2.9 million, the token’s price will increase by 11% to $0.1 from the current $0.09. The presale’s hard cap stands at $6.5 million, a target that could be achieved within a few weeks if the current momentum persists. Following the presale, the token will be listed on leading exchanges at $0.12. As a result, early presale buyers stand to gain a remarkable 33% return on their investment.

Related News

- Bitcoin Price Prediction as the Coin Stabilizes above $26k Following Blackrock’s Bitcoin ETF Filing

- Interest Rate Cuts Still “Couple of Years Out” – Fed Chair Jerome Powell

- yPredict’s Presale Skyrockets to Over $2 Million as Revolutionary AI-Powered Crypto Price Prediction Platform Introduces Cutting-Edge Content Editing System

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage