Join Our Telegram channel to stay up to date on breaking news coverage

Crypto markets experienced a slight shift in momentum after a stagnant period of two weeks. The trigger for this change came from concerns about UK inflation and a warning from Janet Yellen regarding the US debt ceiling stalemate, which spooked investors and sent prices plummeting on Wednesday.

UK Inflation and US Debt Ceiling Stalemate Impact Crypto Markets, Bitcoin Hovers Below $26.5K

The release of the latest minutes from the Federal Open Market Committee (FOMC), later in the day, revealed a lack of consensus among US central bankers regarding the continuation of interest rate hikes. Unfortunately, this revelation did little to instil confidence in the market.

Bitcoin, the dominant cryptocurrency in terms of market capitalization, recently hovered around the $26,440 mark, signalling a decrease of roughly 3% within the previous 24-hour period. This value approached its lowest level since May 12, when it fell below the $26,000 threshold.

During this period, Bitcoin has been grappling with low trading volume and volatility as market participants grapple with uncertainties surrounding US government debt, crypto regulations, and macroeconomic factors. Prior to Wednesday, Bitcoin had been range-bound between $26,500 and $27,500.

Ruslan Lienkha, chief of markets at fintech platform YouHodler, highlighted the impact of “increased tension in financial markets” on equities and digital assets.

Lienkha pointed out that concerns over a possible default by the US government had put pressure on US stock indexes, with no visible progress in negotiations just 10 days before a potential agreement is required. The uncertain climate has led financial institutions to restructure their assets and prepare for a potential default, further intensifying pressure on market participants.

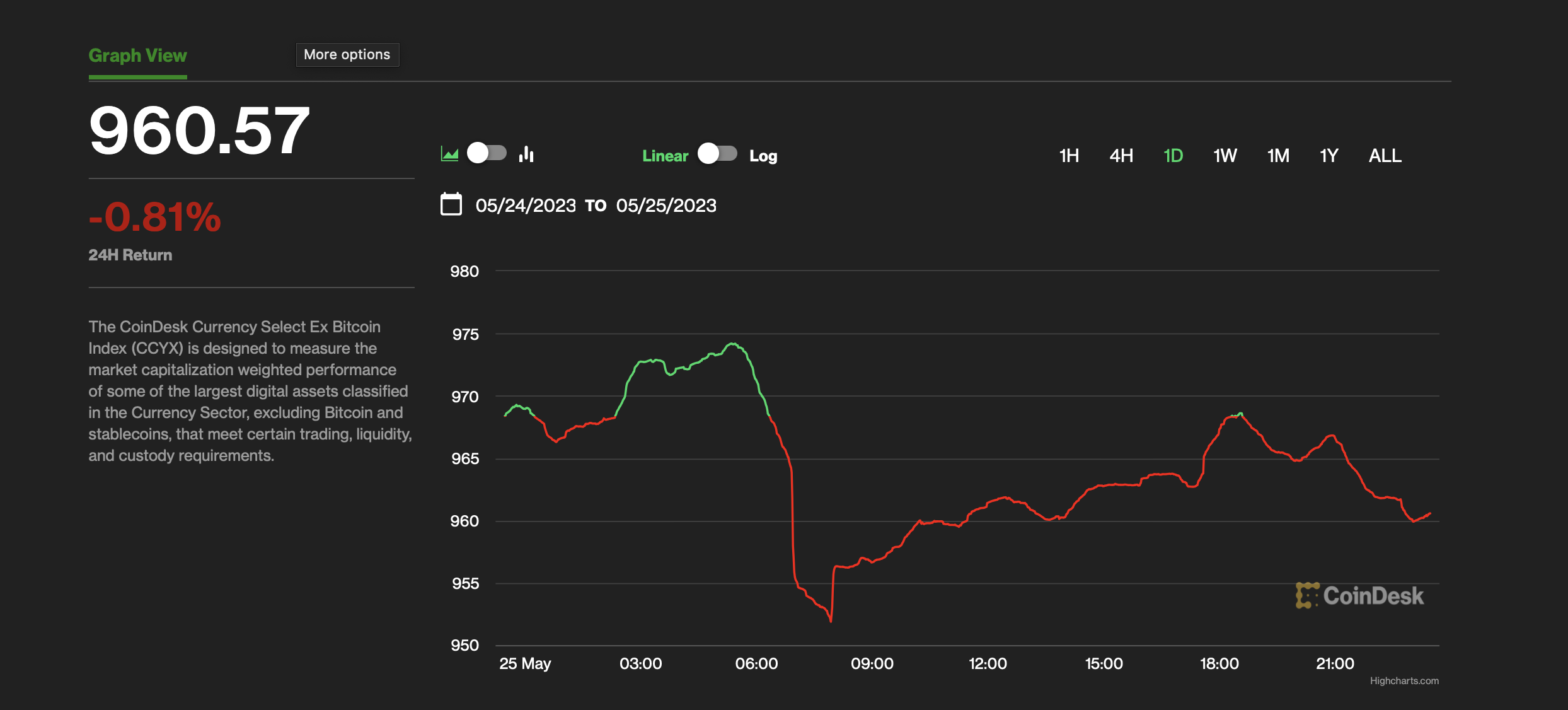

Ethereum, the second-largest cryptocurrency, was recently valued at around $1,808, indicating a decrease of roughly 2.6% from the previous day. Most major cryptocurrencies experienced losses on Wednesday, with LTC and SOL, the token of the Solana smart contracts platform, seeing declines of over 5.2% and 3.6% respectively.

The Bitcoin Trend Indicator remained in a downtrend, reflecting waning investor optimism. Analysts believe that Bitcoin will likely remain stagnant until a new catalyst emerges.

On Wednesday, major stock indexes faced similar struggles, temporarily restoring the correlation between equity and crypto pricing. The tech-focused Nasdaq, S&P 500, and Dow Jones Industrial Average (DJIA) all declined by nearly 1%.

Although the two asset classes have been diverging in recent months, Yellen’s repeated warnings this month about the possibility of the US “running out of money” without a debt limit agreement seemed to affect all markets.

Earlier in the day, cryptocurrencies experienced a sharp decline following the release of the UK’s latest Consumer Price Index (CPI) figures. The CPI for April rose to 6.8%, surpassing the expected 6.2% and reaching its highest level since 1992. This disappointing inflation data suggested that the Bank of England would need to continue its current pattern of interest rate hikes, which generally discourages crypto markets.

Glen Goodman, renowned author of “The Crypto Trader,” said that Bitcoin had exhibited a strengthened correlation with the price of gold, a conventional asset considered a safe haven. Nevertheless, he emphasized the absence of a persistent driving force that could adequately explain investor choices when it comes to purchasing or selling Bitcoin.

“We haven’t yet discovered one main narrative that everybody can rally around; instead, we have identified several possible reasons,” said Goodman. “The only problem is that people haven’t converged on a single narrative. We’re waiting for events, such as a global economic disaster like the collapse of the US dollar, that would prompt everyone to rally around one narrative.”

Fueling Bitcoin’s Next Rally – Key Catalysts for a Jumpstart

The momentum of this year’s cryptocurrency surge has waned, and even the grand Bitcoin conference failed to conceal concerns about the original digital currency’s struggle to regain its previous heights.

The recently concluded Bitcoin 2023 conference in Miami attracted approximately 15,000 attendees, less than half of the previous year’s turnout. In contrast to the festive atmosphere of the past editions, industry analyst John Todaro described this year’s event as more of a formal “industry conference” in a research note.

The subdued ambiance comes as no surprise, given Bitcoin’s recent performance. While it experienced a 60% surge at the beginning of the year, its price has since plateaued around $26,500, which is significantly below its peak in November 2021. Last year, the token faced significant setbacks as the crypto market grappled with declining prices, bankruptcies, and fraudulent activities.

The volatility and stagnant prices have left many market participants feeling trapped in an uncertain state. Fundstrat analyst Sean Farrell noted in a research note that this situation has created a sense of being “stuck in no man’s land.” To reestablish itself and potentially reach new highs in 2023, Bitcoin must overcome three key obstacles.

Firstly, the Federal Reserve’s tightening measures need to cease. Bitcoin isn’t suggested to be a safe haven asset but rather a risk-on asset that shares similarities with pre-revenue venture capital investments, rather than traditional havens like cash or gold.

The token’s price is largely influenced by changes in Federal Reserve expectations. If the Fed alters its course, it could serve as a crucial catalyst for Bitcoin’s growth, according to Riyad Carey, a research analyst at crypto-data provider Kaiko.

Secondly, the Bitcoin “halving” event must recapture its previous allure. In May 2024, the Bitcoin network is expected to undergo a significant change. This event, which occurs approximately every four years, halves the rewards for miners, limiting token supply and potentially increasing its value.

While such events are typically anticipated and priced into the market, they have historically coincided with price surges. Investors and industry players are already aware of this upcoming halving, but its potential impact on prices remains a topic of interest.

Finally, institutional investors must become more comfortable with owning cryptocurrencies. Despite the initial moves by companies like MicroStrategy and Tesla to include Bitcoin in their balance sheets as a hedge against inflation, widespread institutional adoption has yet to materialize. This lack of interest from corporations and professional investors has weighed down Bitcoin’s price.

The resolution of ongoing court cases that could clarify the legal status of Bitcoin and other tokens may provide regulatory clarity. However, even with regulatory assurances, the price decline of Bitcoin over the past year and a half has shaken the confidence of companies and institutional investors.

Riyad Carey acknowledges that Bitcoin’s fundamental value proposition has been scrutinized, highlighting its failure to keep up with inflation or preserve its value effectively.

Related Articles

Join Our Telegram channel to stay up to date on breaking news coverage