Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) price dropped once again on late Wednesday, June 14th, after previously trying to breach the resistance at $26k. The drop came suddenly, but it also happened around the same time when the US Federal Reserve announced the long-expected pause on interest rate hikes.

The Bitcoin price quickly sank to $25k per coin, but it did not stop there. Instead, it also broke this support, reaching the low of $25,830. This is the first time Bitcoin has dropped to these levels in three months. The last time BTC was under $25,000 per coin was on March 16th, almost three months earlier.

At the time, the coin saw a bull run that exceeded $30k. This time, however, the price has seen a series of drops caused by various events that negatively impacted the asset, including the SEC’s lawsuits against Binance and Coinbase.

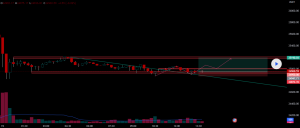

According to experts, Bitcoin’s current situation is one of the best scalp position situations on the range. Some have pointed out certain positive indicators to keep an eye on, such as reversal candles and trend line breaks.

Another analyst suggested that Bitcoin is forming a pattern that they call Trio Retest. Commenting on the price action, the analyst known as theSignalyst said that BTC had been bullish medium-term trading inside the rising broadening wedge. Now, it is approaching the trendline that acts as non-horizontal support.

The analyst seems to believe that the coin’s bearish behavior is only short-term trading and that it is rapidly approaching the oversold zone. With that being the case, the analyst expects the coin to see bullish reversal setups, such as a double bottom pattern, trendline break, and alike.

Did Bitcoin price drop because of the Fed?

Bitcoin’s new price drop is believed to be the consequence of the recent Federal Reserve announcement. The Fed said that it would pause interest rate hikes, which come after 15 months of constant rate increases, meant to combat rising inflation.

According to data, the price of Bitcoin crashed by 4% in a span of only 30 minutes following the announcement. The announcement did not come as a huge surprise, given that the market almost unanimously expected a rate pause, but it still hit Bitcoin hard.

Furthermore, Fed Chair Jerome Powell also added that this is not a permanent end to the rate hikes. He wanted to clarify that they will return in the future, which tends to blunt investor excitement for risk assets, such as Bitcoin and altcoins. Josh Gilbert, a market analyst at eToro, said that a lot of the positivity seen from risk assets this year was built on the expectation that inflation will fall while interest rates will peak.

He added,

Inflation is moving in the right direction, but the comments from Jerome Powell signify that rates could stay higher for longer, which would put Bitcoin on the back foot.

Binance launches cloud mining products for BTC mining

Another interesting development came from Binance. Despite the regulatory crackdown on Binance.US and Coinbase, the exchange decided to launch a Bitcoin mining cloud service. The service starts operating today, June 15th, and it is open to users interested in mining BTC, but lack the equipment to do so on their own.

#Binance is launching a new batch of Cloud Mining products for #BTC mining.

Complete your subscription to Cloud Mining products and start accumulating rewards!

Find out more 👇https://t.co/lH2jTwOxKs

— Binance (@binance) June 15, 2023

Since such equipment involves ASIC miners, many who are interested in owning Bitcoin are expected to subscribe to the new mining platform.

Wall Street Memes raised over $7 million

Other than Bitcoin, one of the hottest assets in the market right now is a cryptocurrency that has not even properly launched yet. The asset in question is Wall Street Memes (WSM) — a new meme coin holding a presale.

The token was inspired by WallStreetBets — a subreddit of amateur investors who stood up against institutional investors in 2021. At the time, institutions were shorting stocks of several companies, threatening to destroy them along the way. WallStreetBets started buying the stocks, which ended up costing institutions a lot of money.

Now, the effort is immortalized through a new meme coin which attracted much attention. The project raised over $7.1 million as of the time of writing, and it continues to attract users. Right now, each WSM token is available at $0.0289, which will remain its price for another two days. After that, the price will jump to $0.0292. Those who decide to purchase it can do si using USDT, ETH, or their card.

Related

- Hong Kong Monetary Authority Urges Banks To Sign Crypto Exchanges As Clients

- Why Bitcoin Whales Are Staying Calm Despite SEC-Triggered Crypto Market Sell-off

- How to Buy Bitcoin Online Safely

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage