Join Our Telegram channel to stay up to date on breaking news coverage

Hong Kong is swimming against the global anti-crypto waves. As the rest of the world shies away from crypto due to its volatility and high risk, Hong Kong through its authorities is encouraging its finance sector to embrace it.

Hong Kong Pursues Global Crypto Hub Status

The city’s banking regulator, the Hong Kong Monetary Authority(HKMA), is urging financial institutions like HSBC and Standard Chartered to accept cryptocurrency exchanges as clients.

According to Financial Times sources, during a meeting last month, the authority asked UK-based lenders and the Bank of China why they did not accept cryptocurrency exchanges as clients.

In a letter dated April 27th, the HKMA advised the banks to avoid imposing an undue burden on prospective crypto clients during the due diligence process, particularly for those establishing a presence in Hong Kong to pursue regional possibilities.

The authority specifically demanded in the document that the institutions aid cryptocurrency companies, which it refers to as “virtual asset service providers,” in acquiring access to banking services.

The Asian city is on a quest to become the global crypto hub. As such, it has been making moves to lure crypto firms, from recruiting mainland Chinese enterprises to announcing plans to test the viability of a digital currency in its mortgage market.

Following the new set of crypto regulations, the city has also made plans to make Bitcoin purchasing, selling, and trading legal for all residents starting in June.

So far, what the world has shunned, Hong Kong has taken. For instance, two of the biggest cryptocurrency exchanges in the world, Binance and Coinbase, were sued this month by the US Securities and Exchange Commission on grounds that they had broken US securities laws.

In response, Hong Kong through lawmaker Johnny Ng, who is also a member of China’s top political advisory body, welcomed Coinbase and other cryptocurrency exchanges to establish themselves in the city.

I hereby offer an invitation to welcome all global virtual asset trading operators including @coinbase to come to HK for application of official trading platforms and further development plans. Please feel free to approach me and I am happy to provide any assistance. pic.twitter.com/bcIi1IjMlc

— Johnny Ng 吴杰庄 (@Johnny_nkc) June 10, 2023

Hong Kong Banks Take Cautious Route

However, the same enthusiasm has not been experienced in the city’s finance sector. While Hong Kong banks do not have a ban on crypto clients, they have been particularly hesitant about them.

This is natural because they are worried about facing legal consequences if the platforms they onboard end up being used for illegal operations like money laundering.

From HKMA’s perspective, banks are afraid. “There is resistance from a conventional banking mindset . . . we are seeing some resistance from senior executives at traditional banks,” HKMA said according to a source.

On the other hand, according to a senior executive, banks “are having to tread a fine line between on the one hand getting encouragement to support crypto and exchanges, but on the other hand, being aware of the US situation”.

Another bank executive added that they were split between wanting to support the development of the crypto industry in accordance with the policy of the Hong Kong government and fearing they may be taken to task on anti-money laundering or due diligence issues.

When asked about its stand concerning the issue, Standard Chartered stated that it was in regular communication with regulators on a variety of topics. HSBC, on the other hand, stated that it is in active dialogues with virtual asset players to exchange views on a range of topics, including but not limited to account opening.

Bright Future For Asian City

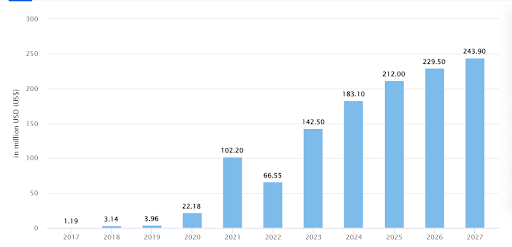

According to statistics by Statista, the cryptocurrency market in Hong Kong is projected to generate $142.5 million in revenue in 2023. The market is also expected to grow at an annual rate of 14.38% resulting in a projected total amount of US$243.90m by 2027.

Due to the change in attitude, policies, and regulations concerning crypto in the city, confidence in the domestic market has increased. As a result, numerous significant enterprises have applied for licenses.

For example, The Hong Kong-based subsidiary of the global trading platform, Huobi HK, has announced the launch of spot and managed services for local business and retail clients.

Related Articles

- New Coin Listing Dates & Tokens Set to Pump on Exchanges – Top 10+ List

- Penny Crypto LPX Soars Towards $1 Million – Could This Low Cap Gem Be the Next 100x Opportunity?

- ConsenSys, Developer of MetaMask, Challenges SEC’s Proposed Definition of ‘Exchange’ Citing Blockchain Misunderstandings

Join Our Telegram channel to stay up to date on breaking news coverage