Join Our Telegram channel to stay up to date on breaking news coverage

Renewed momentum in the crypto market is drawing investor attention, with Bitcoin nearing the $100,000 mark following news of a potential major trade deal involving the U.S. and U.K. This surge, triggered by comments from U.S. President Donald Trump and further supported by reports from major outlets like the New York Times and BBC, has injected optimism into the digital asset space.

As global sentiment shifts, investor interest again turns to digital assets with strong fundamentals, recent upgrades, or ecosystem growth. This article highlights some of the top cryptocurrencies to invest in now.

Top Cryptocurrencies to Invest in Now

VeChain has entered a collaboration with 4ocean, a marine conservation group, to tackle ocean pollution using blockchain technology. Meanwhile, ARB is priced at $0.3315, reflecting an 8.06% gain over the past day. In addition, the SOLX project has secured over $33 million from its ongoing ICO.

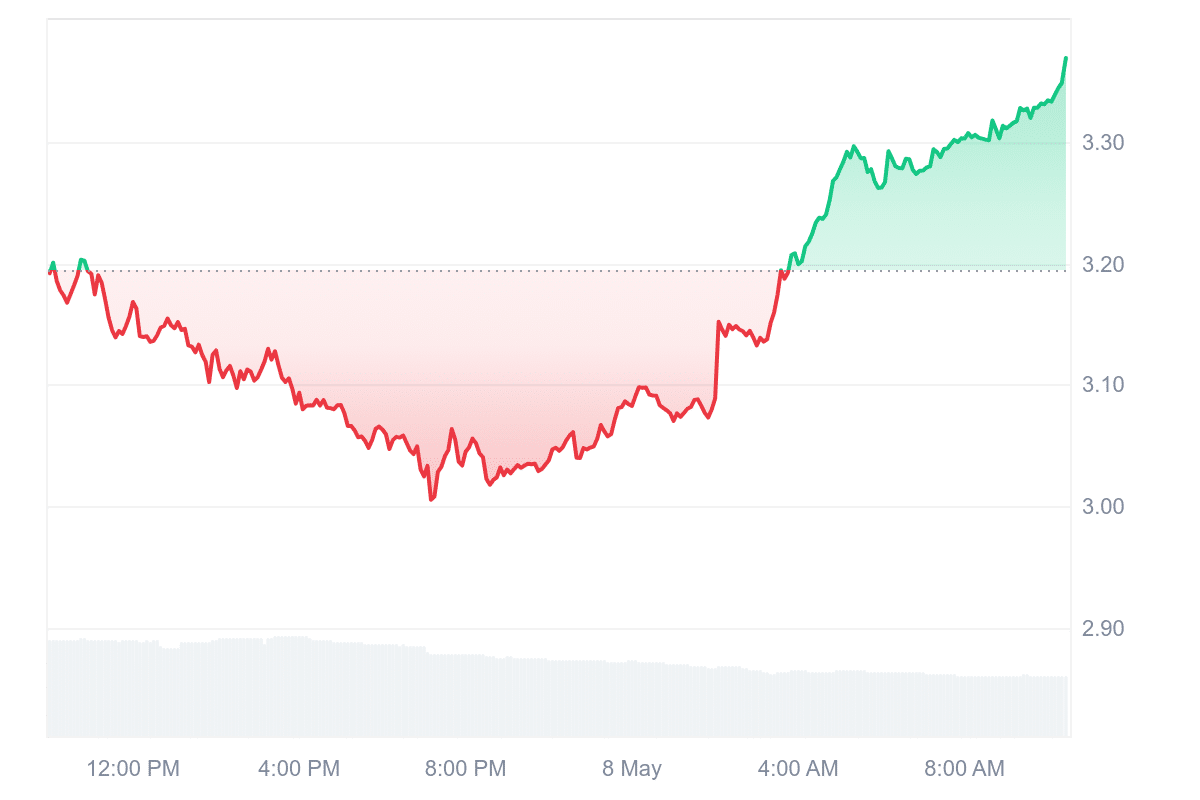

1. Convex Finance (CVX)

Convex Finance is a decentralized finance (DeFi) platform designed to optimize rewards for users providing liquidity on Curve, a major decentralized exchange for stablecoins. Instead of staking directly on Curve, users can stake their liquidity provider (LP) tokens on Convex. This setup allows them to earn enhanced CRV rewards and a portion of Curve’s trading fees, creating a more efficient way to participate in the Curve ecosystem.

Furthermore, Convex acts as a layer on top of Curve, offering better yield opportunities for CRV holders and liquidity providers without requiring them to lock their assets directly in Curve. Currently, Convex Finance trades at $3.36 and has gained 6.23% in the past 24 hours. Its market cap is $326.49 million, and the 24-hour volume-to-market cap ratio of 0.0594 suggests relatively healthy liquidity.

The platform has seen 21 green trading days in the past month, signaling positive momentum. However, the Relative Strength Index (RSI) of 36.15 indicates a neutral technical position, suggesting that the price could either consolidate or continue sideways soon.

Sentiment around the token is generally optimistic, with a “Greed” score of 65 on the Fear & Greed Index. The outlook remains bullish, though such sentiment may reflect short-term speculation. As Convex continues to serve as a key player in maximizing returns within the Curve ecosystem, its role in the broader DeFi sector will likely remain relevant for yield-focused participants.

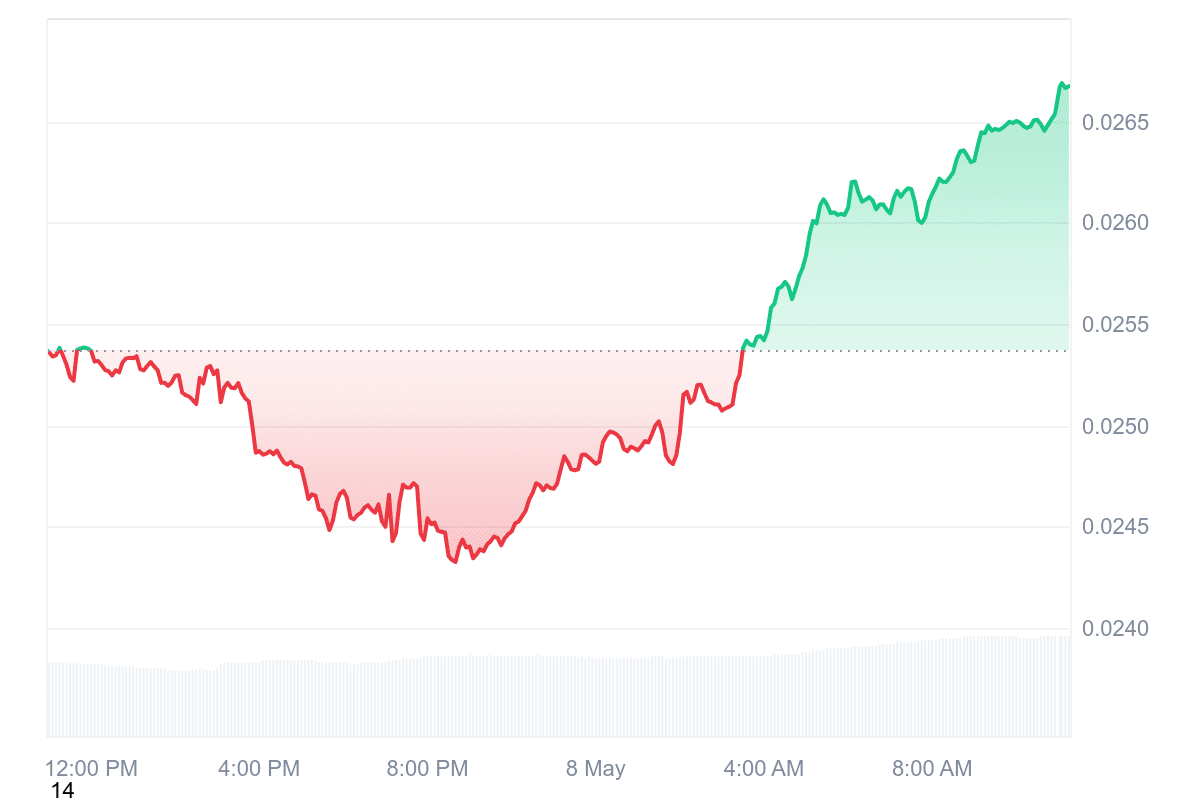

2. VeChain (VET)

VeChain has partnered with 4ocean, a marine conservation organization, to address ocean pollution through blockchain-based solutions. The collaboration targets removing 300,000 pounds of waste by 2025, equal to around 14.4 million single-use plastic bottles. This initiative goes beyond simple cleanup efforts and emphasizes accountability by using blockchain technology to create permanent digital records of each waste collection activity.

These records, known as “Proof of Sustainability,” ensure that every cleanup is transparently documented and verifiable by the public. This approach helps counteract greenwashing, where companies may exaggerate their environmental efforts. Blockchain’s role here is critical, as it prevents alteration of records, reinforcing trust in reported environmental impact.

The initiative began with a cleanup event in Miami, backed by the UFC Foundation. Participants in these efforts will be rewarded with $B3TR tokens, an incentive designed to motivate continued involvement in environmental preservation.

VECHAIN RENAISSANCE IS COMING.

On July 1st, we launch Stargate – our new staking program – complete with $15M in $VTHO bonuses.

ARE YOU READY?

Watch the Renaissance Live Premiere & learn everything you need to know.

Going live at 7PM UTC!

Link: https://t.co/6chI6MyfhO pic.twitter.com/jjEHPJaGOQ

— VeChain (@vechainofficial) May 1, 2025

Meanwhile, VeChain trades at $0.02669, up 5.87% intraday. It shows healthy liquidity, with a 24-hour volume to market cap ratio of 0.0474. However, its technical indicators remain neutral. The RSI at 36.27 suggests potential sideways trading. Current 30-day volatility is 9%, remaining below average. Overall sentiment around the token remains cautious, despite broader market optimism.

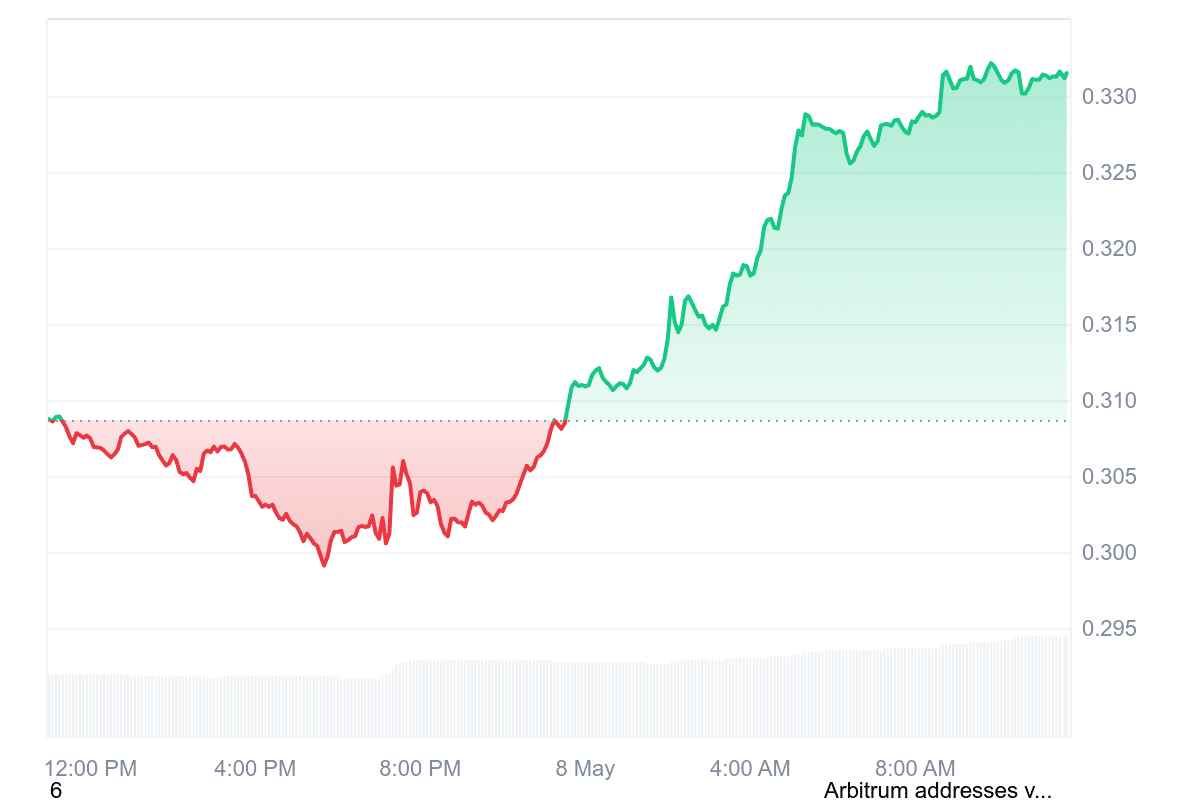

3. Arbitrum (ARB)

Arbitrum is a Layer 2 solution built to improve Ethereum’s speed and reduce transaction costs. It works by moving most of the transaction processing and data storage away from the Ethereum mainnet, using optimistic rollups. This means transactions are first processed off-chain and only settled on Ethereum if challenged, reducing congestion and costs while relying on Ethereum’s security.

The network’s native token, ARB, plays a key role in governance. Through the Arbitrum DAO, ARB holders can vote on how the platform evolves, such as deciding on new features or how funds are used. This move to decentralized governance reflects a broader trend in the crypto space to shift decision-making to the community.

At the time of writing, ARB trades at $0.3315, marking an 8.06% increase in 24 hours. Its market cap is approximately $1.57 billion, with daily trading volume around $180 million, suggesting strong liquidity. The token has seen 15 positive trading days over the past month, showing a balanced pattern of market activity.

Current indicators, including a Relative Strength Index (RSI) of 47.77, suggest neutral momentum, meaning the price may not see sharp changes soon. The Fear & Greed Index reading of 65 indicates that market sentiment leans toward optimism.

Volatility remains moderate, with a 30-day rate of 7%, which suggests some price fluctuation but not excessive instability. Arbitrum offers a technically solid and actively used platform, with current market metrics reflecting a cautious but engaged investor base.

4. Solaxy (SOLX)

Solaxy (SOLX) is a Layer-2 project built on the Solana blockchain, aiming to improve transaction reliability and network scalability. During high-traffic periods, Solana users often experience delayed or stuck transactions. Solaxy addresses this issue using rollup technology, which bundles many off-chain transactions and submits them as a single entry to the Solana mainnet. This reduces congestion without compromising the accuracy or finality of the data.

HyperSpeed Achieved!🔥🚀

33 Million Raised! 🛸🪐 pic.twitter.com/HgswKcnnVM

— SOLAXY (@SOLAXYTOKEN) May 3, 2025

So far, the project has raised over $33 million through its ongoing presale. At the current stage, SOLX tokens are priced at $0.001714, although this rate is set to increase as the presale progresses. Investors can participate using various payment options, including cryptocurrencies like ETH, USDT, and BNB, or traditional credit and debit cards.

Solaxy’s early development has already reached the testnet phase. Developers can experiment with the network and evaluate its performance before the mainnet launch. The project has also introduced a dedicated block explorer, offering insight into transaction activity on the testnet. This level of visibility at such an early stage allows for greater accountability and user trust.

5. Sei (SEI)

Sei is undergoing notable architectural changes as part of its effort to streamline its blockchain network. A new proposal submitted through the Sei Improvement Proposal (SIP) process suggests shifting to an EVM-only (Ethereum Virtual Machine) design. This move aims to simplify the network’s infrastructure, improve developer experience, and better utilize Sei’s parallelized EVM execution.

The SIP process allows community members and stakeholders to contribute feedback and participate in shaping the protocol’s development. Alongside architectural changes, Sei recently integrated Frax’s sfrxUSD stablecoin. This addition allows users to convert frxUSD to sfrxUSD directly on the network, increasing stablecoin utility within its growing DeFi ecosystem.

SIP-3: A proposal from @Sei_Labs to streamline Sei's architecture to an EVM-only model has been submitted through the Sei Improvement Proposal process.

This proposal aims to enhance developer experience, simplify infrastructure, and fully leverage Sei's parallelized EVM… pic.twitter.com/nxQ9cGYXj2

— Sei 🔴 (@SeiNetwork) May 7, 2025

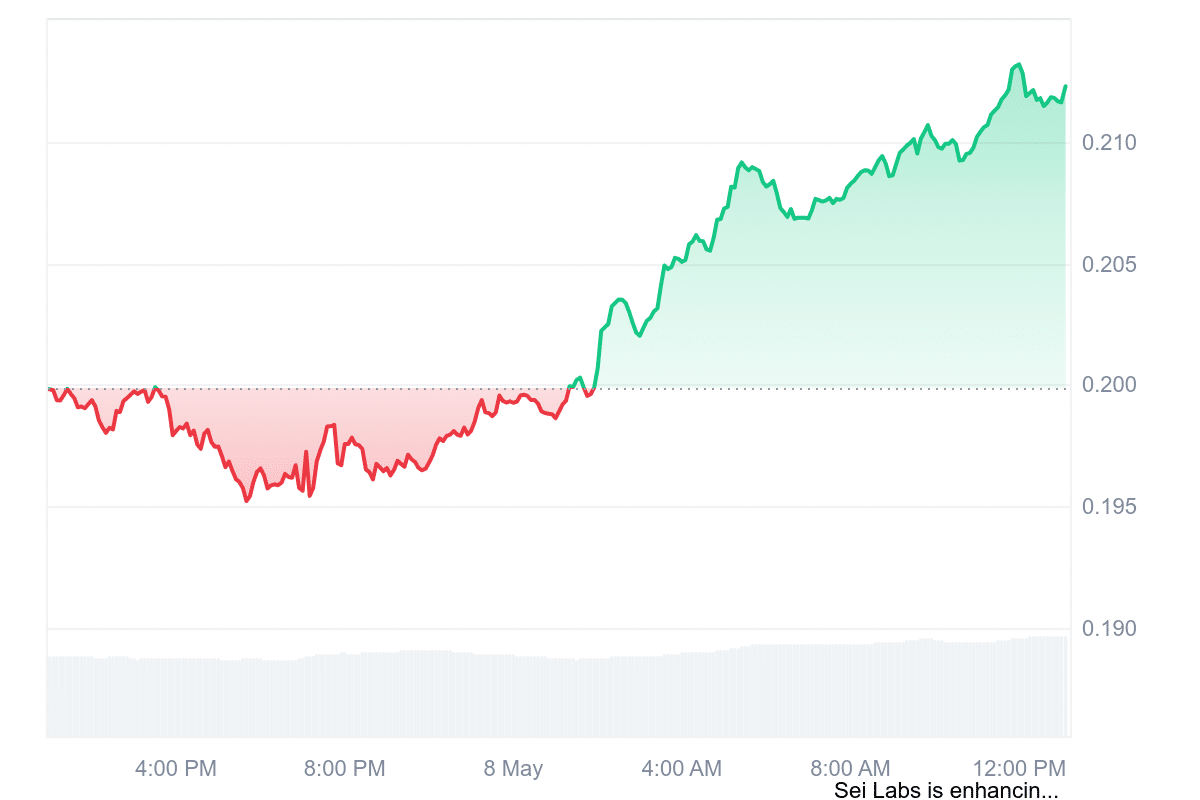

Sei is currently priced at $0.2122, showing a daily gain of 6.45%. Its 24-hour trading volume relative to market cap is 0.1324, which indicates strong liquidity. The Relative Strength Index (RSI) stands at 48.79, reflecting a neutral trend and suggesting the asset may continue to trade sideways.

Sentiment around Sei remains neutral, although external indicators like the Fear & Greed Index currently show a reading of 65, pointing to mild optimism in the market. Price forecasts suggest a possible increase, with some models predicting a rise to approximately $0.68.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage