Join Our Telegram channel to stay up to date on breaking news coverage

In a gaming arcade, you must first exchange your cash for arcade tokens in order to use the games featured inside. Within the arcade’s small-scale economy, these tokens serve as the equivalent of dollars. You may be able to sell your tokens back for real money at the end of your visit to the arcade’s fantastical world.

The cryptocurrency counterpart of an arcade token is a stablecoin. The stablecoin issuer essentially accepts one unit of money in exchange for a blockchain entry with the same value. In other words, $1 is equal to $1 $USDC or $1 $USDT. Then, entities can carry out more trades, loans, transfers, and other transactions using these dollar equivalents to buy other cryptocurrencies directly on the blockchain.

The stablecoin issuer gets to keep the actual dollars and get any interest generated on these assets in return for establishing a dollar equivalent that can be used on the blockchain. To guarantee that the value of their reserves always equals the value of the stablecoins they have issued, the issuer, however, explicitly undertakes to store all of these assets in safe and liquid assets. In other words, a stablecoin issuer ought to operate similarly to a straightforward money market fund.

On the cryptocurrency market, there are three large stablecoins with a combined market valuation of $130 billion.

The market capitalization of all cryptocurrencies is approximately 14%. Together, these three stablecoins account for >99% of the market’s liquidity.

With a market value of $65 billion at the moment, Tether is the most valuable stablecoin, followed by Circle ($43 billion) and BUSD ($22 billion). Tether also (typically) dominates the market in terms of daily trading volume. With the exception of a brief window after the FTX failure when BUSD volume surged, Tether’s volume routinely outpaces the volume of the other two stablecoins by a large factor.

To put it another way, Tether is the main provider of dollar liquidity in the bitcoin markets. What assets are backing these stablecoins, then? This brings up a significant point. And is it feasible that only a portion of these stablecoins are backed?

Each stablecoin is backed by what?

USD Coin ($USDC)

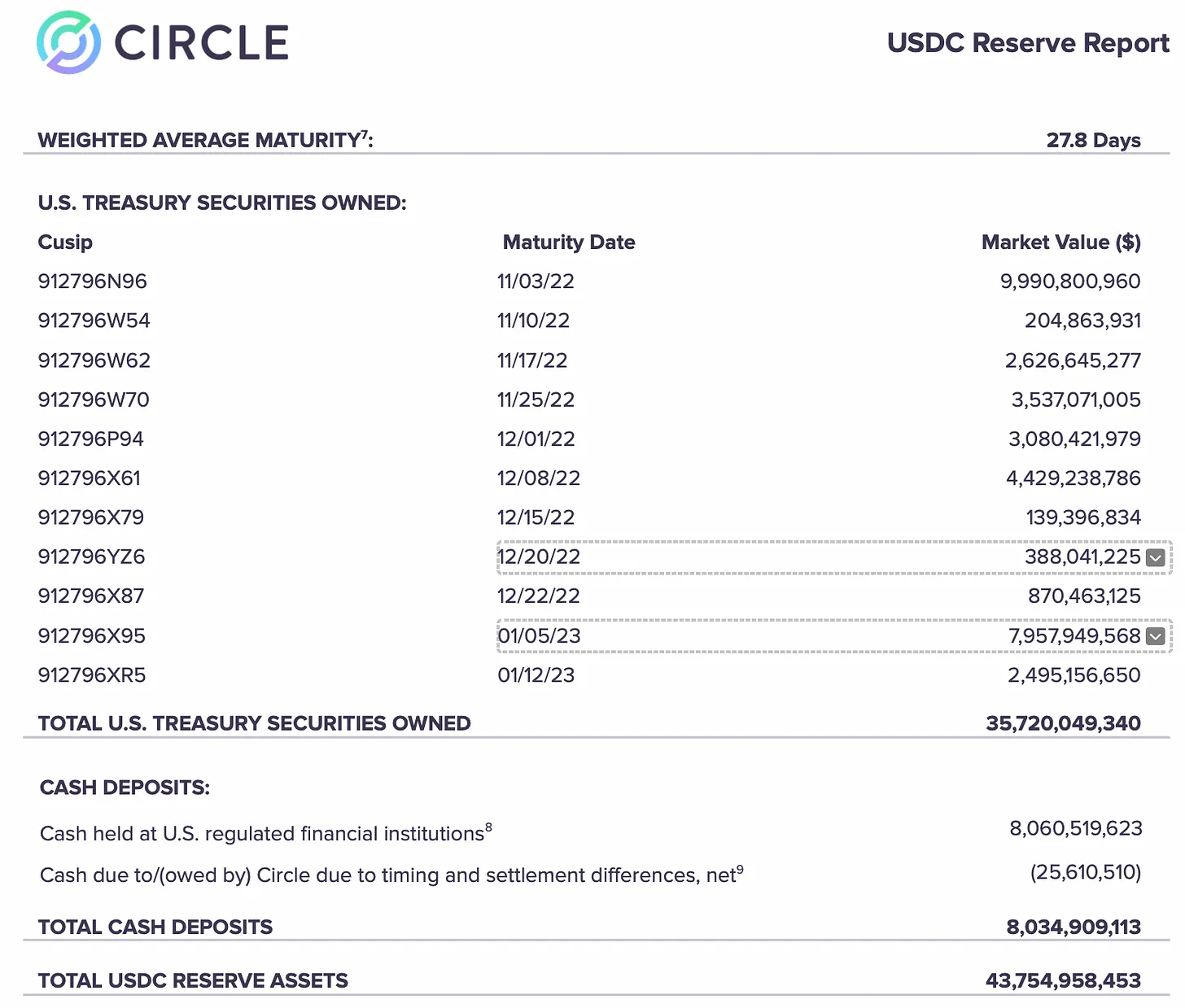

Circle Internet Financial, LLC, a U.S.-based business with a money transmitter license, is the issuer of USDC. The market value of USDC is at $43 billion. Although Circle has never released an audited financial report, their accounting firm, Grant Thorton, does give monthly “attestations.” As of October 31, 2022, the most current report reveals that USDC is fully reserved, mostly with Treasury securities (82%) and cash (18%). Circle claims that “U.S.-regulated financial institutions” are where they keep all of their funds.

It should be noted that the USDC attestation lists the Committee on Uniform Securities Identification Procedures number and market value for each issue of Treasury securities purchased.

Despite the warning that these accounts have not been audited, Circle’s disclosure offers a respectable amount of information regarding the assets supporting its reserves. They maintain a comparatively straightforward portfolio of liquid and low-risk assets that are simple to liquidate in the event that stablecoin holders desired to exchange their stablecoin for dollars.

Binance BUSD ($BUSD)

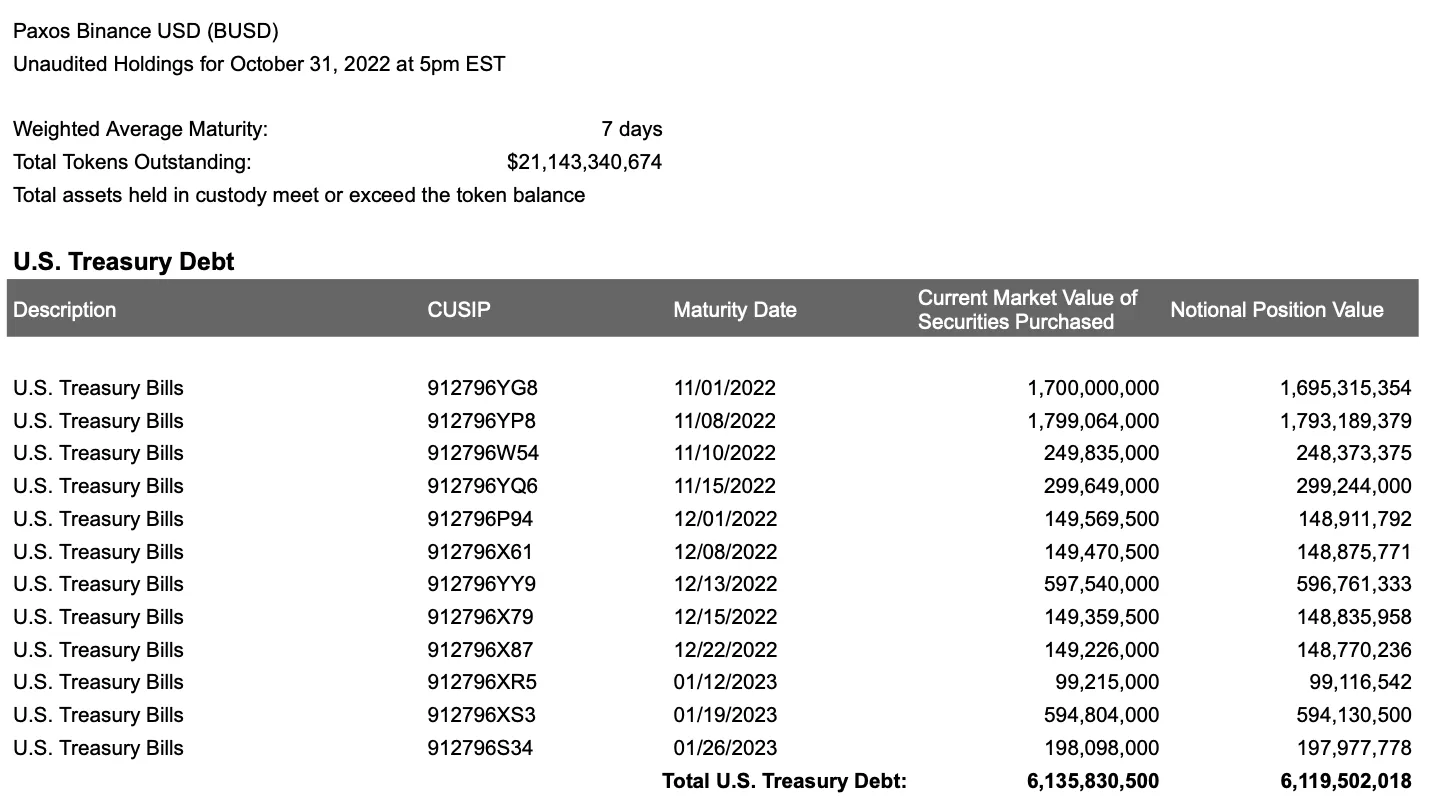

The stablecoin is really issued by the Paxos Trust Company, LLC, a New York-based financial institution that specializes in working with cryptocurrencies, even though Binance USD bears the name of the largest exchange in the world. The reserves that underpin BUSD, which has a market valuation of $22 billion right now, are held by Paxos. Similar to USDC, Paxos publishes monthly unaudited reports outlining the reserve breakdown:

BUSD was backed by a combination of US Treasury debt ($6.1 billion or 29% of market cap), Treasury reverse repurchase agreements ($14.2 billion or 67% of market cap), and cash ($870 million or 4% of market cap) as of their attestation from October 2022.

The cash part of the money are reportedly stored at US-regulated banks, according to Paxos and USDC. Once more, the BUSD reports give detailed information about the reserves supporting the stablecoin. The stablecoin’s reserves also have a straightforward structure and are entirely made up of low-risk assets, just like USDC.

Tether ($USDT)

The Tether stablecoin is the market’s most established and valuable stablecoin. Despite the fact that Tether and Bitfinex are officially independent organizations, it is owned by the same people that manage the Bitfinex exchange. We’ll demonstrate how the difference between these two businesses and the alleged split between the FTX exchange and Alameda Research are comparable.

Tether is expressly prohibited from conducting business in the state of New York, in contrast to Circle and Paxos, both of which have a license to do so. It was established that Tether had misled about the reserves supporting USDT, and as a result, they were forced to pay $18 million in a settlement with the NY AG. It comes out that Tether’s claimed 1:1 backing with US dollars was a deception at several stages throughout its history. Additionally, Bitfinex and Tether frequently combined their resources, pooling money to avoid bankruptcy.

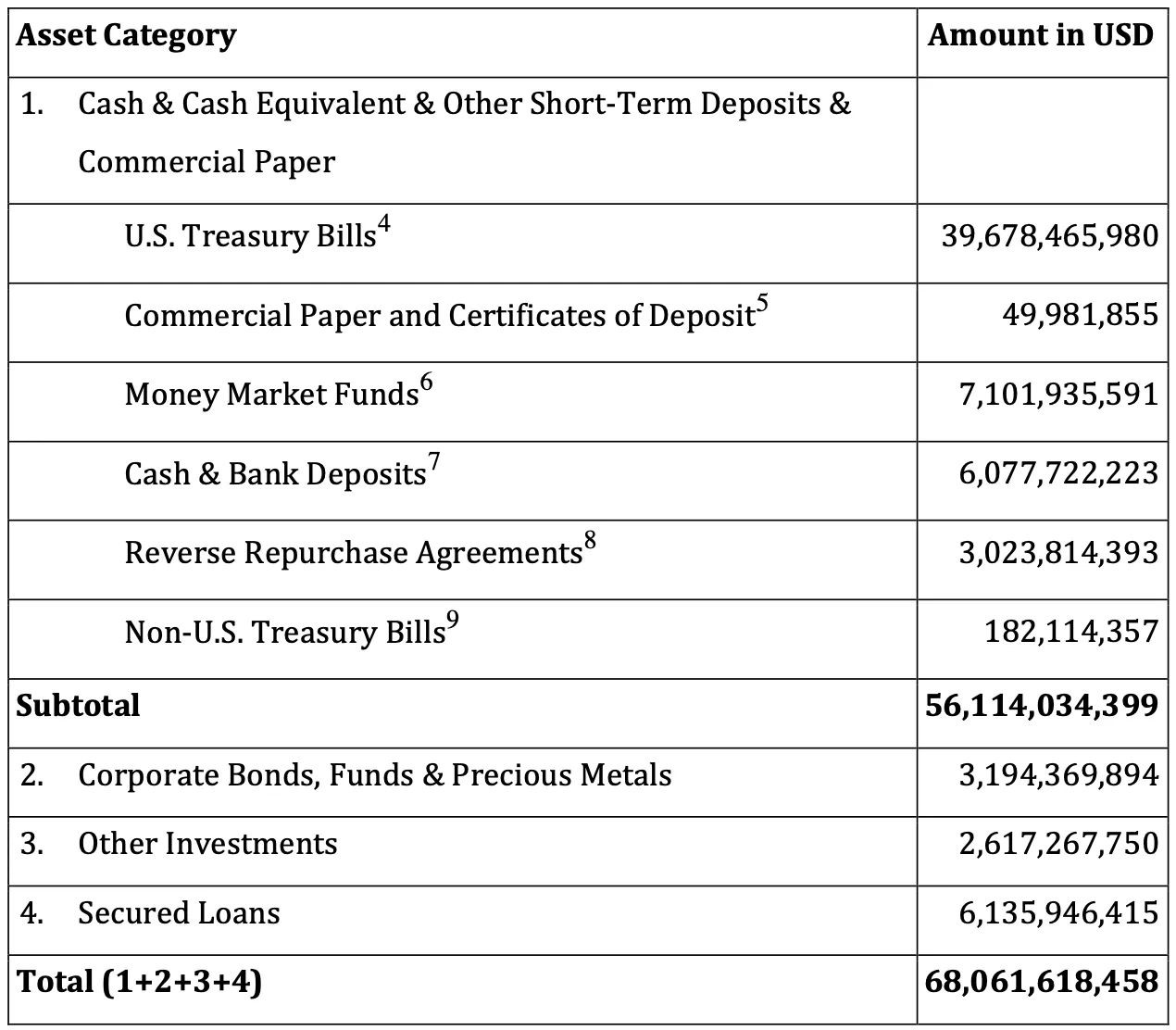

Anyway, let’s move over the completely pointless history and look at Tether’s most current attestation, which is valid through September 30, 2022:

Wow, that sure does differ significantly from the financial information provided by Circle and Paxos. 67% of their reserves are made up of cash and Treasury notes. 10.3% more of the reserves, or $7.1 billion, are kept in money market funds. Tether withholds information about where it conducts its banking or how much of each type of Treasury debt it owns.

Notably, “other investments,” “secured loans,” and “business bonds, money, and precious metals” account for $11.9 billion (18%) of these reserves. “Reverse repurchase agreements” account for another $3 billion (4.4%) of total holdings. These are not assets backed by the Treasury, in contrast to the reverse repo agreements stated on BUSD’s balance sheet. These are instead:

agreements that have been entered into directly or indirectly by means of the purchase of structured notes or fund vehicles, where the ultimate issuer or guarantor of the agreement has a rating of A-2 or better.

These secured loans go to whom? Tether doesn’t inform us, therefore we are unsure. We are aware that at least one of the previous creditors was the Celsius Network, which Tether eventually liquidated in June 2022 for more over $900 million.

What collateral does this loan have? Tether doesn’t inform us, therefore we are unsure. We know that Tether issued USDT based on Bitcoin-backed loans because to its agreement with Celsius.

What “other assets” amount to $2.6 billion for Tether? Tether doesn’t inform us, therefore we are unsure. Some of these assets, according to a recent Semafor study, are venture capital investments Tether made in (presumably worthless) businesses:

It also owns $2.6 billion in “other investments,” according to the September report. It’s not totally clear what’s in them, but they are likely venture stakes in other crypto companies held by its owners and affiliates, according to a global investigations firm commissioned by a hedge fund betting against the price of Tether. Semafor reviewed the findings of its report that found Tether holds equity stakes in more than a dozen crypto startups.

Semafor was able to verify some but not others. We confirmed that the crypto exchange that owns Tether invested, either through itself or an affiliate, into: an online-betting site called Betfinex; Dazaar, a data-sharing service; Dusk Networks, whose software turns financial investments into tokens; a crypto trading platform called Rhino; Shape Shift, a crypto wallet; Blockstream, a blockchain infrastructure company; Netki, a digital-ID company; and Keet.io, a video-chat app.

Clearly, Tether’s disclosures and reserve strategy diverge greatly from those of its key rivals. They don’t provide nearly as much detail in their attestations as Circle or Paxos do. Their plan is much more intricate, and Tether freely acknowledges to having a balance sheet with more riskier assets. Additionally, it seems that at least some of Tether’s reserves are kept in very risky venture capital ventures that may be worth much less than what Tether says they are.

Tether reportedly acknowledged lying about their reserves

Tether paid fines of $18 million and $41 million in 2021 to resolve legal actions brought by the New York Attorney General (NYAG) and the Commodities and Futures Trading Commission (CFTC). It was established in those agreements that Tether had repeatedly misled regarding the assets supporting their coin. In fact, these settlements showed that over a number of years, Tether was fully backed on average 28% of the time. According to the NYAG’s statement on the agreement:

The OAG’s investigation found that, starting no later than mid-2017, Tether had no access to banking, anywhere in the world, and so for periods of time held no reserves to back tethers in circulation at the rate of one dollar for every tether, contrary to its representations.

One particularly heinous incident from 2018 was revealed in these agreements. To manage its cash, the Bitfinex exchange used a shadow bank with a location in Panama named Crypto Capital Corp (CCC). Notably, there was no written contract involved in the agreement between CCC and Tether. Unfortunately for Tether, CCC also had economic relationships with the cartels. The U.S. DOJ closed it down, seizing its assets, including about $850 million in Bitfinex customer cash. Bitfinex transferred Tether’s reserves to its own accounts to offset the losses:

On November 1, 2018, Tether publicized another self-proclaimed ‘verification’ of its cash reserve; this time at Deltec Bank & Trust Ltd. of the Bahamas. The announcement linked to a letter dated November 1, 2018, which stated that tethers were fully backed by cash, at one dollar for every one tether. However, the very next day, on November 2, 2018, Tether began to transfer funds out of its account, ultimately moving hundreds of millions of dollars from Tether’s bank accounts to Bitfinex’s accounts. And so, as of November 2, 2018 — one day after their latest ‘verification’ — tethers were again no longer backed one-to-one by U.S. dollars in a Tether bank account.

This was, of course, in the past. Despite the fact that Tether and Bitfinex are still run by the same people, have they changed for the better?

Maybe not. Even if we accept Tether’s present attestations as true, its own statistics show that Tether has either been insolvent numerous times over the previous year or has frequently needed recapitalization!

According to the legendary software consultant and financial author Patrick McKenzie:

The Consolidated Reserves Report alleges that Tether’s reserves included, as of September, $2,617,267,750 of “Other Investments (including digital tokens)” and $6,135,946,415 of Secured Loans.

These assets must have been impaired in the last six weeks. If they are not, Tether would have a legitimate claim to being the best risk managers. Not in crypto, no, in the history of the human race.

The risk-on assets are 12.86% of the reserves, via simple division. Their equity is 0.36% of assets. (No, I did not forget to multiply by a hundred when converting to percent.)

If their risk-on assets were impaired by more than about 2.86%, Tether must have (by their own numbers) needed recapitalization. Again.

Tether has managed to avoid losses on every single blowup over the past year, from 3AC to Celsius to FTX, while lending money to other cryptocurrency companies. This is true even though Alameda Research was USDT’s biggest contributor.

“Trust, don’t verify” is Tether’s motto

Many people, including important media outlets, have questioned Tether’s integrity and the resources supporting their coin. Given Tether’s extremely restricted disclosures and history of lying about stated reserves, it would seem legitimate to pose these issues.

Tether’s answer to these inquiries consistently follows a similar pattern of hysterical denial and denunciation rather than offering additional facts and clarification:

Would it not be simpler if they were instead fully transparent about where their reserves actually are?

Related

- Bitfinex Exchange Review – Features, Fees, Pros & Cons

- Binance’s stablecoin switch may be an attempt to gain further control over the crypto market

- Maker is Looking to Move Away from Centralized Stablecoins

Join Our Telegram channel to stay up to date on breaking news coverage