Join Our Telegram channel to stay up to date on breaking news coverage

Approximately a year ago, a few crypto industry heavyweights made sassy debuts on the Super Bowl ad lineup, airing pricey ads with slogans like “Don’t miss out” (FTX) and “Fortune favors the brave” (Crypto.com).

Then the cryptocurrency market crashed and FTX filed for bankruptcy.

Currently, businesses in the sector as a whole are utilizing marketing and PR initiatives to protect their brands, separate themselves from questionable players like FTX, and, in many cases, portray a friendlier face to both investors and regulators.

As owners of valuable assets, they are confronted with a tremendous reduction in trust, according to Tom Wason, global principal at Wolff Olins, a brand strategy company that has worked with leading cryptocurrency firms. According to him, businesses in the space are attempting to maintain their current levels of growth—or survival—while reassuring both the government authorities under pressure to control them and the crypto devout.

According to Mr. Wason, their marketing must also advance in tandem. He likened the slew of Super Bowl commercials from the previous year to the dot-com startup commercials from the 2000 Super Bowl, “where VC money [was] being burned for recognition.”

Changing the strategy

Advertisement spending by cryptocurrency marketers has significantly decreased long before the FTX bankruptcy in November. Companies were forced to rethink their approach as a result, and they did so.

Trading company OKX recently abandoned its plans to purchase a Super Bowl LVII advertisement as FTX started to take over the news cycle. The company’s choice to skip this month’s Super Bowl was explained by Haider Rafique, the company’s global chief marketing officer, as “Consumers are responding better to continuous campaigns that promote openness and trust.” Last week, Ad Age was the first to break the news about OKX’s choice.

However, according to measurement company iSpot.tv, the top-spending firms Coinbase Global Inc. and eToro Group Ltd. increased their expenditure on broadcast TV advertisements to $2.8 million and $1.9 million, respectively, in December. Although the quantities are lower than they were a year ago, they have increased from tiny amounts in the recent past.

To adapt to the environment, they modified their messaging.

Soon after FTX filed for bankruptcy, Coinbase responded with a “Trust us” full-page print advertisement in The Wall Street Journal. Additionally, a brand-new tagline, “Ignore the noise. Keep expanding,” it said in a December advertisement that emphasized reliability qualities (as a listed, routinely audited corporation) and directly countered the bad news cycle.

According to Chief Marketing Officer Kate Rouch, Coinbase wants to demonstrate its faith in cryptocurrencies “while preserving our position as the most trusted brand in the market.”

Another cryptocurrency exchange, Bittrex Global GmbH, repositioned itself in December with a campaign that called it “the world’s most secure regulated digital asset exchange” and ended with the new tagline, “Here today. Here tomorrow.”

According to Oliver Linch, CEO of Bittrex Global,

one of people’s main anxieties is that people who participate in cryptocurrencies are here now, gone tomorrow, and they may or may not have stolen your money with them.

Now, he remarked, “it resonates more true than ever.” Since a 2021 campaign with the slogan “Don’t let them tell you what to trade” that targeted so-called meme stock investors, Bittrex Global’s marketing has advanced. He continued, “The company now places a strong emphasis on reliability, and boring is not a bad thing.”

The “Originality Is Overrated” campaign from EToro, which also started airing in December, distinguishes the platform by utilizing social media-like features and makes the case that crowdsourced insights may still be valuable to investors.

Throughout this year, EToro will continue its marketing initiatives, according to U.S. Chief Executive Lule Demmissie. “We believe that now is the ideal time to act. When things are a little difficult for people, you show up, she added.

Attempting to prevent the spread of contagion

A few exchanges have pretended nothing has changed in the cryptocurrency world, implying that they remain aloof from the haze that has engulfed the industry.

The first brand campaign for Binance Holdings Ltd. was unveiled in November, and Cristiano Ronaldo’s NFT collection served as the campaign’s centerpiece. However, the campaign was created before FTX’s bankruptcy filing on November 11th, according to Binance.

According to Chief Strategy Officer Patrick Hillmann, future marketing would concentrate on the company’s products rather than separating Binance from FTX and other dubious rivals or directly addressing the rising scrutiny of its own business.

To increase awareness of its platform, which is currently unavailable in the United States, OKX has continued to purchase advertisements on Twitter and TikTok and broadcast its initial “What Is OKX?” campaign on CNBC streaming properties. The commercial, which also includes a centaur, space invaders, a wrestler, and race vehicles, pays homage to crypto’s early hipster-fantasy sensibility. The company’s objective, according to Mr. Rafique, is to concentrate on responsible investing without specifically addressing the recent upheaval.

In recent weeks, many cryptocurrency players have also increased their expenditure on lobbying and public relations, either by hiring new firms or broadening the scope of their existing firms, according to executives.

Decentralized finance-based businesses, which allow users to transact in assets directly with one another on the blockchain as opposed to utilizing an intermediary platform like FTX or Coinbase, are attempting to establish themselves apart from centralized exchange companies.

Speaking to media sources like Bloomberg News in recent weeks, Chief Executive Antonio Juliano of dYdX, a decentralized exchange that deals in a kind of speculative crypto derivative known as perpetuals, has attempted to better describe and promote so-called DeFi among the wider business world.

In order to head up its lobbying efforts and fend off the “possible regulatory blowback” brought on by FTX’s bankruptcy, the company also hired Rashan A. Colbert, a former staffer to Sen. Cory Booker (D, N.J.), in December, as head of policy, according to Mr. Juliano.

He stated:

I think there has been a tremendous demand for that across the entire crypto sector, especially after the FTX collapse.

C+Charge Presale

An exciting project worth mentioning has already secured pre-sale funding of $800,000. C+Charge is cryptocurrency business for electric vehicle charging.

The team has stated today that the structure of the presale pricing ladder, which sees the $CCHG token climb in price over the course of the presale, is changing in reaction to the project receiving a lot of interest.There used to be four stages to the presale; now there will be eight, dividing the fundraising into more manageable portions.

Presale stages

Stage 1 of the fundraising campaign finished yesterday at $780,000 instead of the $2 million that had been anticipated. Pre-sale for the project is currently in Stage 2.

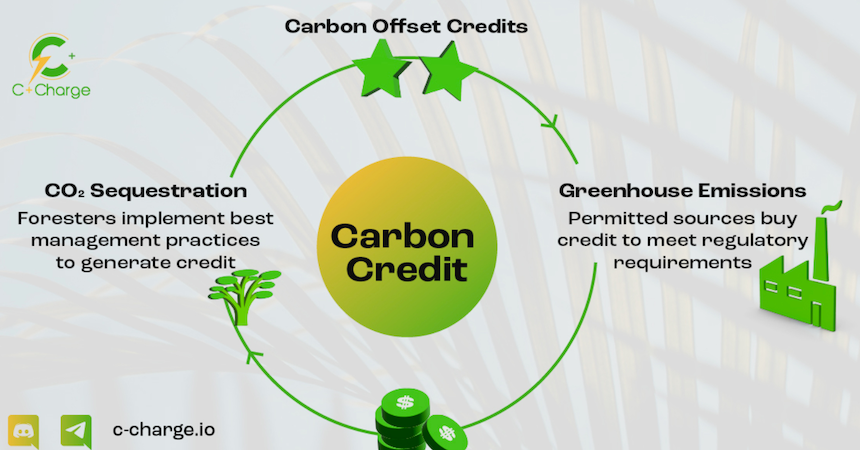

The well-liked green cryptocurrency project is a peer-to-peer payment system that makes carbon credits available to EV drivers and aids in the expansion of the network of charging stations they rely on.

Demand for the coin is rising as more investors learn about the project since C+Charge is the right answer at the right time. To avoid the first of the seven price increases that will occur as each round of the presale is completed, prospective purchasers of the CCHG token must act quickly.

The Stage 1 price increased by 11.5% in Stage 2, from $0.01300 to $0.01450. Stage 3 is now only seven days away, on February 15, when the price will climb by 10.3% to $0.0160.

By addressing these issues, C+Charge concentrates on use cases that are future-proof:

1. For the first time, electric vehicle drivers will receive carbon credits for recharging their batteries.

Isn’t it time that everyone had access to carbon credits when they topped off their electric cars? Sadly, that isn’t the case right now. Before the introduction of C+Charge, there was no platform that allowed EV drivers to earn carbon credits for each battery charge they made. C+Charge seeks to entice long-term investors who are committed to financing the fulfillment of this profitable use case that will help the environment.

Nevertheless, it is important to remember that Stage 1 investors would end up with a nominal profit of 80%.

Additionally, when you pay for EV charging with the CCHG token, those tokens are later taken out of circulation, creating a deflationary price-supportive mechanism.

2. Improving the payment process across charging networks

There are various competing methods of measuring payments nowadays. Drivers use the CCHG token to make payments with C+Charge instead of installing pricey Point of Sale (PoS) hardware. C+Charge replaces these with a single, simple-to-use universal payments system.

In addition, EV owners will be able to accumulate Goodness Native Tokens (GNT), a sort of carbon credit, in addition to CCHG through its relationship with Flowcarbon. Invesco, a16z Crypto, Samsung Next, and other venture capital firms support the GNT token, which stands for a verified voluntary carbon credit. One ton of greenhouse gases can be released with one carbon credit.

3. Advantages for taxing network owners and managers

As previously indicated, blockchain technology lowers the cost of maintaining the stations by doing away with pricey PoS, but it can also send accurate real-time data on each station’s status and carry out diagnostic activities.

In order to manage their fleet, C+Charge becomes a crucial tool for, example, municipalities or those providing residential community charging solutions.

It also gives EV owners a way to accurately track the presence of fully functional charging stations.

Additionally, as the platform is entirely blockchain-powered, all an EV driver needs to interact with it is an internet connection and the C+Charge app.

4. C+Charge increases the uptake of EVs and democratizes carbon credits.

Despite the fact that EV sales have been rising, carbon credits are not being utilized as broadly as they should be as a driving force behind EV adoption. The way that carbon credits are skewed towards large enterprise to the detriment of others, including EV drivers, is another factor impeding the implementation of a sufficient and accessible charging infrastructure.

Even worse, big businesses frequently employ carbon credits as a polluting-related tax. This prevents them from having to implement low- or non-carbon emission solutions, allowing them to keep generating carbon and other greenhouse gases.

Those who create or consume products that enable the use of less carbon are the winners in the existing carbon credit system, while EV drivers are unfairly excluded.

Selling carbon credits to polluters can bring in millions of dollars for EV manufacturers like Tesla.

The goal of C+Charge is to democratize carbon credits so that EV owners who are attempting to do the right thing but are not getting the benefits they are due a larger portion of the carbon credit revenue, which was estimated to be $851 billion in 2022.

By 2027, the carbon credit market will be worth $2.4 trillion, making it extremely profitable to allow EV vehicles access.

Related

- FTX movies and TV shows currently in production

- The FTX investigation widens as prosecutors contact former executives

- Netflix, Binance, the Wall Street Journal, and filing shows are all owed money by FTX

Join Our Telegram channel to stay up to date on breaking news coverage