Join Our Telegram channel to stay up to date on breaking news coverage

Best-selling online collectibles creators have reacted to a decline in the value of cryptocurrencies and digital assets by looking for other sources of income, such as utilizing cartoons to market tangible goods and establish entertainment franchises. Last year, when individuals purchased animal collections like Bored Ape Yacht Club, Cool Cats, and Pudgy Penguins, digital objects known as non-fungible tokens exploded into popular culture.

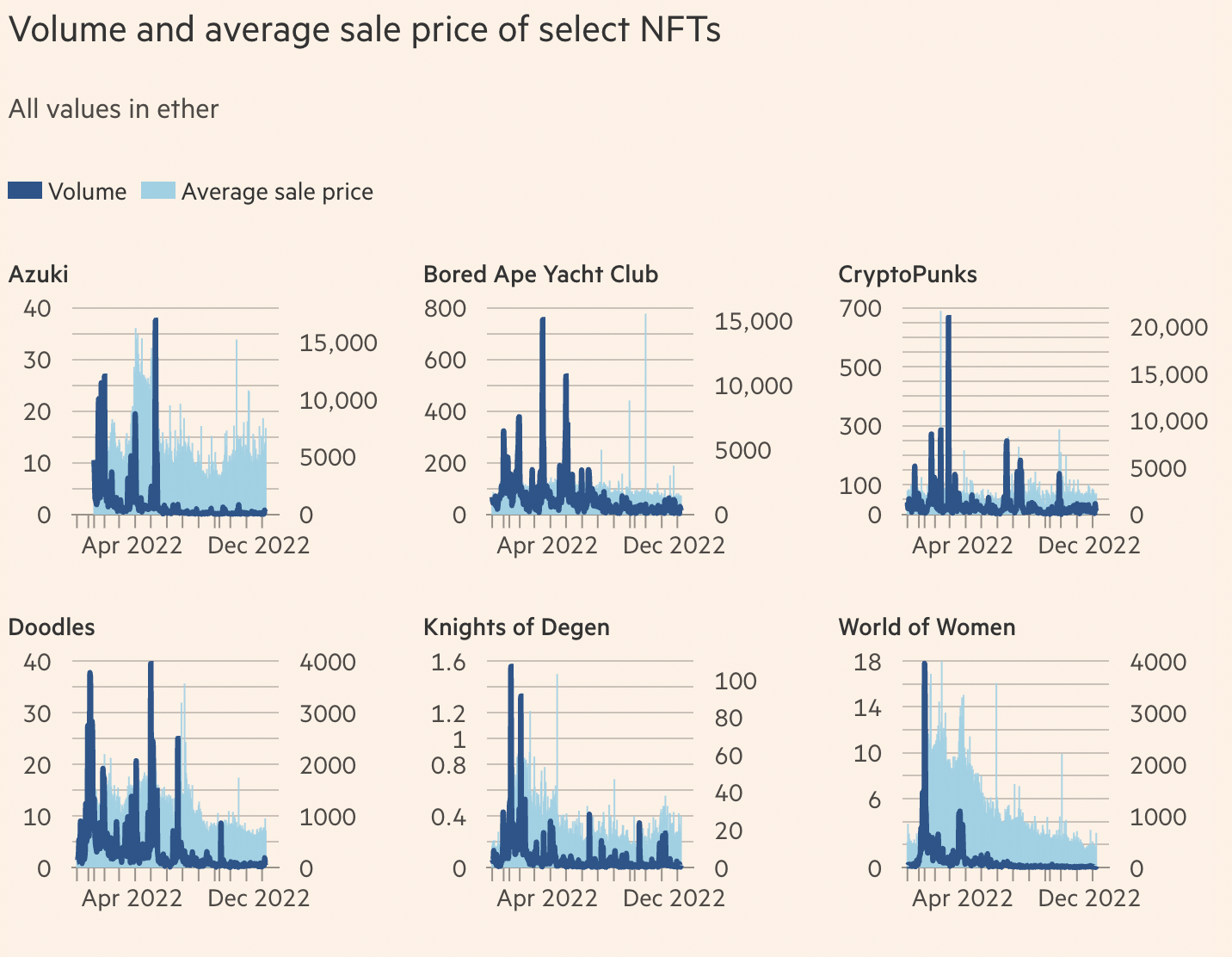

People spent billions of dollars purchasing NFTs from marketplaces like OpenSea, aided by celebrity endorsements and social media buzz. The market, however, has fallen precipitously since April as a result of a sell-off in the larger cryptocurrency market, which has been shaken by a number of high-profile scandals, including the demise of the cryptocurrency exchange FTX and the TerraUSD stablecoin in May. The majority of this year’s $36 billion in sales—more than $19 billion—was spent on NFTs between January and March 2022, according to Chainalysis.

Since then, spending each month has decreased by more than 87%, to just over $442 million in November. Just over a third of the high in January 2022 remain active NFT buyers and sellers today. According to research organization Nansen, the quantity of new NFTs on the Ethereum blockchain has decreased by around 60%. NFTs are also being “minted” far less frequently.

As a result, producers of well-known NFT collections are now seeking for methods to grow their brands into actual ventures, such selling goods unrelated to so-called blockchain technology, which stores transaction records on a distributed digital ledger.

Drew Austin, co-founder of Knights of Degen, a sports-themed NFT project and one of the investors behind cryptocurrency group WAGMI United, which recently acquired English football club Crawley Town, said that

If sales are not predictable, consistent [and] recurring revenue, [then] you have to figure out how are you going to diversify your revenue streams and expand.

Some analysts doubt that NFT manufacturers will establish lucrative businesses beyond the sale of digital art. According to Claire Enders of Enders Analysis, “the core model of NFTs didn’t function.” The bubble that caused it to pop has burst, and it won’t do it again. Pharrell Williams, a musician and producer, was recently hired as the chief brand officer of Doodles, a prominent NFT initiative. Pharrell Williams uses his music to create live animations of the Doodles characters.

The group is creating both an album and a video series. According to Julian Holguin, CEO of Doodles,

we’re headed into… a little bit of a slower economic situation in the next couple of years, and the thing that truly wins out in those times is entertainment.

“We [can] produce really wonderful stories that connect with people and just put smiles on people’s faces,” the author says, “despite the fact that entertainment is incredibly saturated and consumers’ attention is really fragmented.”

The former Billboard executive has been seeking to broaden the Doodles intellectual property into live events, music streaming, and tangible items by partnering with well-known performers through his relationships in the music industry. Another initiative, Pudgy Penguins, has agreements in place to use its NFTs to create cute toys and kid’s books, with a portion of the proceeds going to the token holders. It is one of the rare collections where the average cost of its NFTs increased by more than threefold in December, to almost $5,700.

According to Luca Schnetzler, CEO of Pudgy Penguins,

Every generation has had its great penguin IP from Pingu to Club Penguin to Happy Feet… there’s a massive chance for the next great penguins to infiltrate not only the metaverse but the actual world.

A minor league American football team, celebrity meet-and-greets, IPA beer, and a future line of vodka-based sauces are just a few of the investments Knights of Degen has made. The group claimed that Disney’s business strategy served as its inspiration. “Disney began by developing Mickey Mouse, and from there came the theme park, the television shows, the motion pictures, the merchandise, the toys, and all of these other things. We sort of want to follow the same path,” added Austin.

Numerous items are being launched using content from Yuga Labs’ brands, the parent business of some of the most well-known NFT collections, including Bored Ape Yacht Club, CryptoPunks, and Meebits. The owners of NFTs can use the images linked with the tokens as they like without the company’s knowledge or approval because Yuga gives away IP rights with its tokens.

This has caused a rush of companies to create related Yuga products, including everything from a burger joint to specially created Tiffany’s pendants. “The community has been enabled and encouraged from the beginning to commercialize its ape intellectual property, and almost immediately, apes began to appear on hot sauces, food trucks, in music videos, and more. According to Yuga Labs, decentralization of IP is an effective method for fostering community.

One of the greatest winners from the spike in interest in NFTs last year has been Yuga Labs. The company was valued at $4 billion at the beginning of this year after raising $450 million in a fundraising round led by Andreessen Horowitz.

In the meantime, it made $300 million in April by offering NFT “deeds” for up to 55,000 virtual pieces of land in “Otherside,” its future metaverse game. However, the average cost of a deed in the Otherside has virtually halved to about $3,300. Despite this, the Otherside land collection is still one of the most traded on the NFT marketplace OpenSea.

The brand has been able to grow thanks to related ventures with Yuga imagery as well as various celebrities showcasing their cartoon apes on social media, like Snoop Dogg, Justin Bieber, and Madonna. A class-action complaint against Yuga claims that the start-up collaborated with celebrities to “artificially inflate and distort prices” for NFTs. Any wrongdoing has been refuted by Yuga Labs.

However, other analysts are skeptical that the brands will be able to take off in the real world because confidence in cryptocurrencies is waning and NFT values are falling. They can never develop into a Disney-type brand once there is a discrepancy between the valuation and the offering, according to Claire Enders.

Key moments in the NFT industry in 2022

26 FEBRUARY Crypto donations pour in like crazy in response to Russia’s invasion of Ukraine, helping Kyiv’s war operations.

MARCH 23 Axie Infinity, a well-known cryptocurrency game, had its blockchain compromised, and over $600 million was taken.

APRIL 30 The last-ditch effort and peak for the NFT market this year before its decline, Yuga Labs orchestrates a tokenized “deeds” sale to land in their upcoming virtual world, which sells out in a $300 million release that sets a record.

MAY 8 Investor trust is damaged by TerraUSD’s $40 billion fall, which also causes a steep decline in cryptocurrency prices.

15 SEPTEMBER The price of Ethereum briefly increases as the proof-of-stake consensus algorithm replaces proof-of-work on the Ethereum blockchain, which powers many well-known NFTs.

6 NOVEMBER The collapse of the FTX cryptocurrency exchange and the resignation of its CEO Sam Bankman-Fried shook the market for cryptocurrencies.

Related

- Why NFTs Were Just Launched as a Payload to the International Space Station

- How to Avoid NFT Scams

- Apple clarifies App Store rules on NFTs and crypto exchanges

Join Our Telegram channel to stay up to date on breaking news coverage