Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price remains unchanged over the last 24 hours, rising a mere 0.8% to trade at $34,370 as of 2:00 a.m. EST.

The rally witnessed in the BTC price since Oct.13 appears to be fizzling out as the big crypto token turns down on the daily timeframe.

Bitcoin, however, remains bullish in the medium to long term. It is up 23% over the last 30 days and 17% over the last three months. The flagship cryptocurrency is also up 18% over the last six months and remains bullish in 2023 as its year-to-date (YTD) gains stand at a whopping 108%.

As BTC continues to maintain its stability, analysts project a positive outcome for the cryptocurrency going into 2024.

Jan van Eck, CEO of giant asset management firm VanEck, says that conditions are becoming extremely favorable for the cryptocurrency industry as 2024 draws near.

Speaking in a new interview on the Empire podcast, he says that Bitcoin has now been established as the main alternative to gold as a store of value. With the Fed changing its policy, the halving, and other uncertainties, Van Eck sees a “close to perfect trade” in the market moving into next year.

A must-watch episode w/ CEO @JanvanEck3 and @mleinweber2 from @MarketVector

📺https://t.co/Fbc3beOmvN https://t.co/eGUwuqO3md

— VanEck (@vaneck_us) October 31, 2023

“Bitcoin has now been established, which I think it has been and I’ve thought so for five years, as an alternative, just like silver has for platinum, to demand for gold as a store of value, then you’ve got an almost close to perfect setup as a trade”, Van Eck.

However, Van Eck also notes that the market never seems to price in the halving, which always leads to a bull market. He questions “Why don’t people anticipate this,” adding “There’s no accounting for the crowd.”

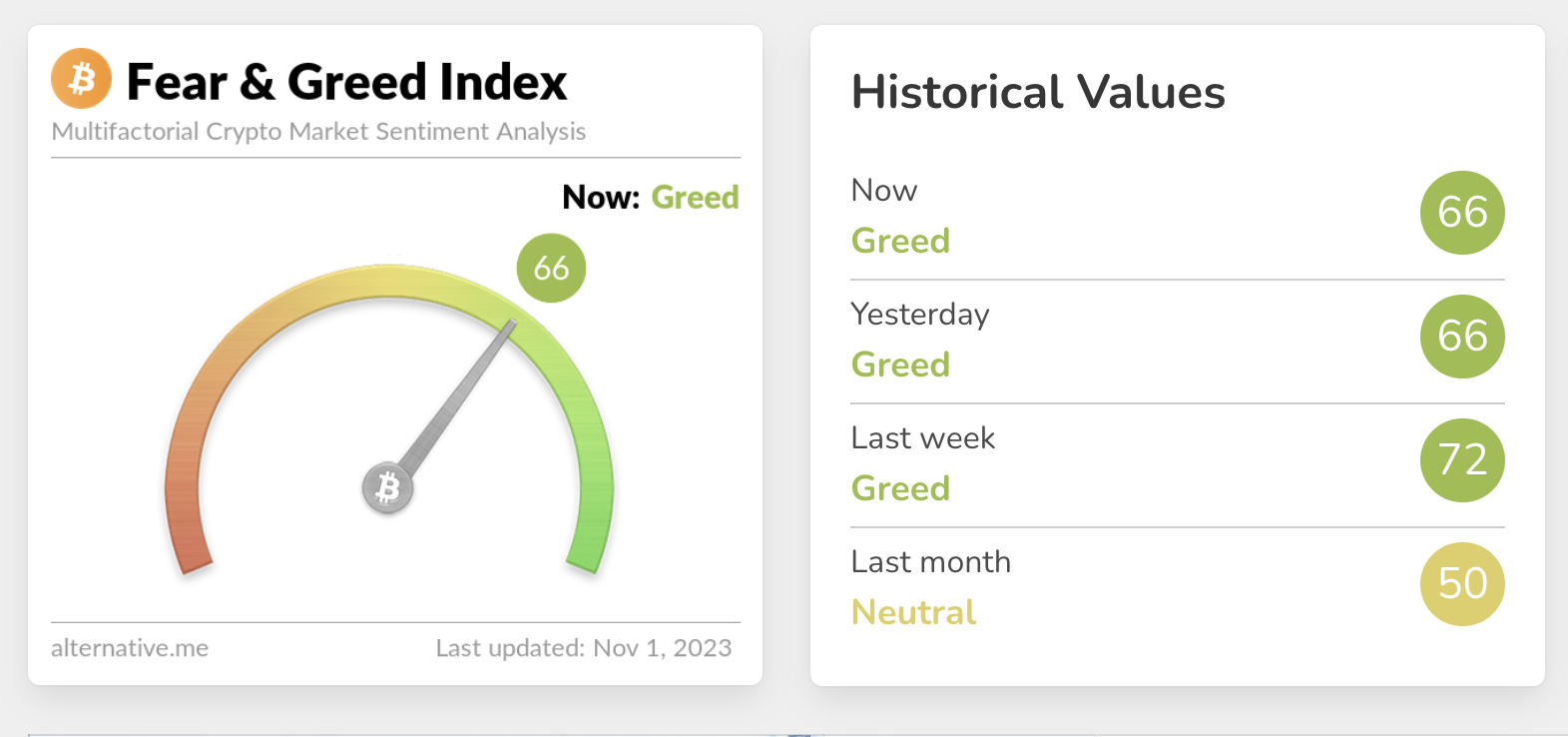

Van Eck’s views resonate with the sentiments currently prevailing in the market. According to data from Alternative, a platform that analyzes “emotions and sentiments” around crypto, the Bitcoin Fear and Greed Index is in the “Greed” zone at 66.

Bitcoin Fear and Greed Index

This indicates that the market is still bullish on Bitcoin which may, in turn, lead to its price increase. However, the firm warns that when “ Investors are getting too greedy, that means the market may be due for a correction.”

Bitcoin Price Forms a Pennant as Bulls Eye $40,000

BTC price action over the last nine days has led to the formation of a pennant technical chart on the daily timeframe (see below). With this technical setup, the expected breakout point is anticipated to be above the $34,780 level.

If this happens, the ensuing demand pressure could catapult Bitcoin price, first clearing the range high at $35,263 before attacking the resistance at the $36,000 psychological level.

In a highly bullish case, it could send it to the technical target of the pennant at $37,100 (a 6% increase) or to the $40,000 psychological level. Such a move would constitute a 16% climb above current levels.

BTC/USD Daily Chart

The Relative Strength Index (RSI) above 70 in the overbought region shows strong bullish momentum, coupled with the positive Moving Average Convergence Divergence (MACD) indicator and its associated histogram bars flashing green.

The rising moving averages and their position below the price also support the bullish outlook. They are reputed for enhancing the visual perception of an asset’s price movement. They also present areas of strong support on the downside.

On the other hand, profit booking could send Bitcoin price south, with bearish targets standing a $34,000, or to the start of the pennant at $32,053. In the worst-case scenario, BTC could drop back to revisit the $26,765 support floor.

With this outlook, it is impossible to overlook the RSI moving south, which points to a fading bullish momentum. This is coupled with the fact that at 78, BTC is massively overbought, increasing the chances for a correction.

BTC Alternatives

With Bitcoin price giving mixed signals in the immediate short term, investors could look into BTCMTX for better prospects on returns on their investments. It is cruising through the presale with speed, evidence of strong fundamentals that have attracted community support.

BTCMTX presents itself as a good alternative to Bitcoin, while at the same time positioning you to become a BTC owner. It is the native token of the Bitcoin Minetrix ecosystem. The platform has digitized and tokenized the entire BTC mining process, holding it on the cloud, and making it possible for anyone to own BTC.

Choosing #BitcoinMinetrix for effortless mining! 💎

Through cloud mining, bid farewell to worries about reselling equipment.#BTCMTX handles upgrades, enabling users to focus on their $BTC journey without the hassles of outdated hardware. ⚙️ pic.twitter.com/eT3BGAq4Wu

— Bitcoinminetrix (@bitcoinminetrix) October 31, 2023

Bitcoin Minetrix is in the presale stage, recording more than $2.9 million in collections so far. The BTCMTX token is auctioning for $0.0113, but this offer is limited to the next 22 hours as the price is about to increase with stage 3 concluding.

Visit Bitcoin Minetrix website to buy BTCMTX in the presale now.

Related News

- Bitcoin Price Prediction: BTC Edges Higher But Bitcoin Minetrix Looks Set To Explode

- Bitcoin Price Consolidates Before Targeting $40K As Pro Investors Buy Up $2.5M Of Bitcoin Minetrix

- Bitcoin Price Prediction: As BTC Wobbles, Bitcoin Minetrix Blasts Past $2 Million Raised

- Best Crypto to Buy Now

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage