Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin’s recent surge in momentum is drawing renewed attention to the broader crypto market. Japan-based investment firm Metaplanet’s purchase of 1,004 BTC comes alongside signals from MicroStrategy’s Michael Saylor hinting at further accumulation. These back-to-back moves followed Bitcoin closing its highest-ever weekly candle at $106,500, just 3% below its all-time high. Analysts now suggest a major breakout could be on the horizon.

As anticipation builds for a sustained Bitcoin bull run, market sentiment is shifting rapidly. Investors are actively scouting for altcoins and emerging tokens that could benefit from rising liquidity and renewed interest. The article explores some of the top cryptocurrencies to buy now, as traders position themselves ahead of what many expect to be a significant market move.

Top Cryptocurrencies to Buy Now

SUBBD raised over $447,000 in its presale, reflecting early interest in its AI-powered creator platform. Meanwhile, Aave leads the Pendle Principal Tokens (PTs) market with $855 million in deposits, holding a 61% share. NEAR Protocol improved its performance with 600ms block times and 1.2-second finality.

In the broader market, Ripple expanded its payments platform in the UAE by partnering with Zand Bank and Mamo, following its DFSA license approval in March.

1. Chiliz (CHZ)

Chiliz (CHZ) is a digital asset that supports engagement between sports organizations and their fan bases. This blockchain-based platform allows users to influence team decisions through fan tokens. These tokens offer fans limited voting rights and access to exclusive experiences. At the same time, clubs benefit from added revenue and stronger community interaction.

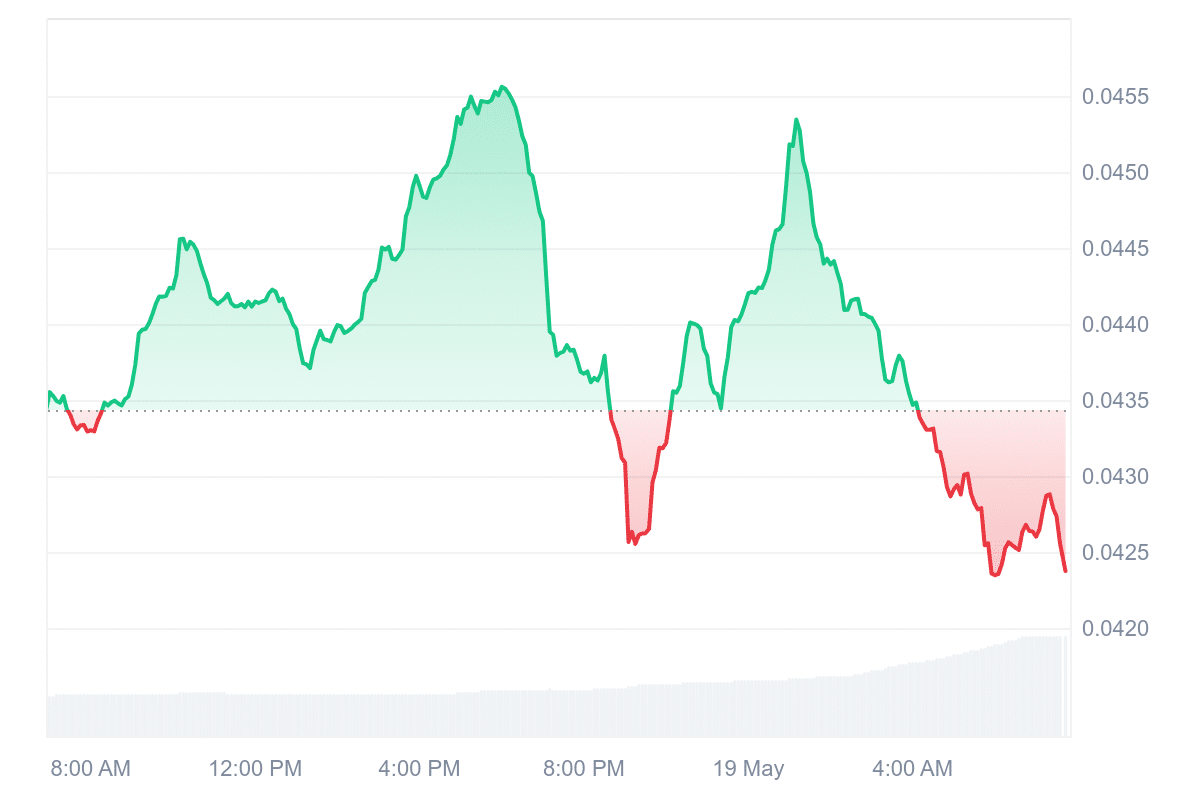

At the time of writing, CHZ trades at $0.04212, down 2.72% over the last 24 hours. However, it has gained 12.96% over the past month. Despite the short-term dip, the trading volume has surged, reaching nearly $61 million in the past day, an increase of over 136%.

The Relative Strength Index (RSI), a technical indicator used to assess momentum, stands at 42.56. This figure indicates neutral market sentiment, suggesting the token may continue to move sideways soon. Chiliz has also shown 17 positive trading days in the last month, or about 57%, reflecting some underlying buying interest.

Code it. Claim it.

Build your project on Chiliz Chain, complete bounties, and earn $CHZ rewards. Welcome to the future of SportFi – powered by YOU. 🫵

🌱 Sign up at Chiliz Greenhouse: https://t.co/8ZNIHznDIW pic.twitter.com/8r3iYWhoVA

— Chiliz – The Sports Blockchain (@Chiliz) May 18, 2025

The broader market sentiment currently leans toward greed, as measured by the Fear & Greed Index, which is at 74. Still, price prediction models for CHZ remain cautious, with a bearish outlook in the short term. Over the past 30 days, volatility has been relatively low at 8%, suggesting limited price swings and a stable trading environment.

2. SUBBD (SUBBD)

SUBBD is a new AI-powered platform for digital content creators looking for better tools to manage and monetize their work. It aims to simplify how influencers create content and earn revenue, addressing challenges like platform fragmentation and inconsistent monetization.

Do you have what it takes to run an AI creators account and potentially makes $$$ per month? 💸

What niche would your AI creator be in?

Featuring AI Creator: @itsselenalima pic.twitter.com/vQLttVCZUe

— SUBBD (@SUBBDofficial) May 15, 2025

So far, the project has raised over $447,000 in its presale phase, indicating growing interest from early supporters. The SUBBD token functions as the primary medium for all transactions. Instead of relying on traditional one-way models like donations or ad revenue, SUBBD builds a more interactive structure.

The platform currently supports over 2,000 creators with a combined audience of over 250 million. This early adoption reflects a need among creators for tools that offer control, quicker payments, and fewer fees. By integrating AI, SUBBD also promises to streamline content production, making it easier for creators to manage their workload and audience engagement.

Although still under development, SUBBD’s model follows broader trends in the digital economy, especially the move toward decentralized, community-driven ecosystems. Its combination of token-based support and AI-enhanced tools may offer an alternative to traditional platforms, where creators often face high fees and limited flexibility. As adoption grows, the utility and demand for the $SUBBD token will likely play a key role in the platform’s evolution.

3. Aave (AAVE)

Aave is a decentralized platform allowing users to borrow cryptocurrencies without relying on a centralized authority. It operates using smart contracts on multiple blockchain networks, including Ethereum, Polygon, and Avalanche. Users who deposit assets into Aave earn interest, while those who borrow pay interest. The system manages these transactions across a distributed network, reducing the need for traditional financial intermediaries.

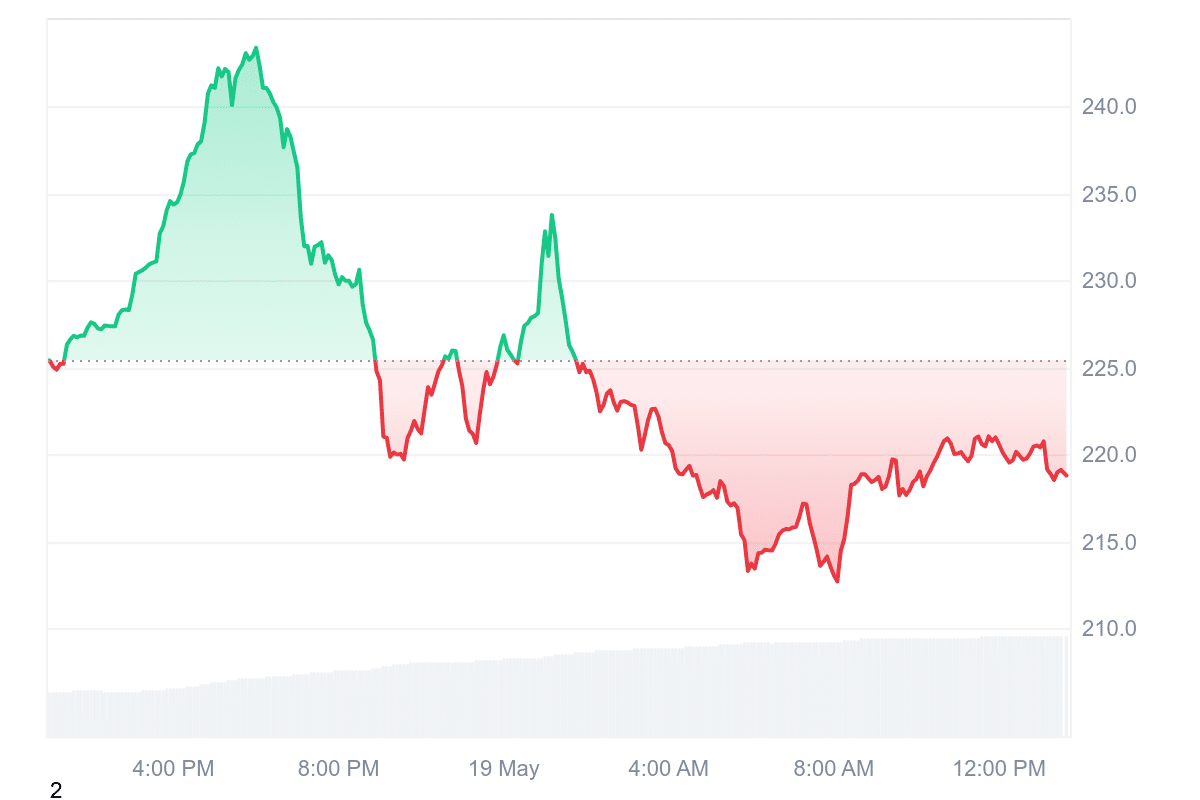

As of now, Aave holds the largest share of the market for Pendle Principal Tokens (PTs), with over $855 million in deposits and 61% of that specific market. Its broader activity is also notable, with a reported total value locked (TVL) of approximately $39 billion. This measure reflects the total amount of crypto assets held within the protocol.

Furthermore, AAVE is priced at $218.24, having gained 3.75% in the last 24 hours and surged 57.55% over the past month. Technical indicators suggest moderate momentum. The token trades 2.46% above its 200-day simple moving average, and its 14-day Relative Strength Index (RSI) sits at 52.73, signaling neutral market sentiment. Liquidity appears strong, with a 24-hour volume to market cap ratio of 0.3319.

Aave is now the largest market for @pendle_fi PTs.

Over $855M deposits and 61% marketshare. pic.twitter.com/HHIF1T2ftQ

— Aave (@aave) May 15, 2025

Recent performance includes 17 days of price increases over the last month. The overall sentiment from market participants remains bullish, and external indicators, like the Fear & Greed Index at 74, suggest growing investor confidence. Aave’s role in DeFi continues to evolve, supported by high usage and technical stability.

4. NEAR Protocol (NEAR)

NEAR Protocol is a decentralized blockchain platform designed to support applications and services for the open web. It focuses on scalability, speed, and usability, aiming to provide a user-friendly experience for both developers and end users.

Recent upgrades have improved NEAR’s performance. The platform now offers 600-millisecond block times and finality, when a transaction is confirmed permanently, within 1.2 seconds. This means transactions are processed quickly and securely, reducing wait times and increasing users’ confidence.

Furthermore, NEAR’s ecosystem is growing, particularly in the stablecoin segment. The total supply of stablecoins on NEAR now sits around $720 million, up 61% from the same time in 2024. This places NEAR among a small group of blockchains with over $500 million in stablecoin assets, suggesting increasing trust and usage within its financial ecosystem.

Blink and it's final.

NEAR Protocol just dropped 600ms blocks + 1.2s finality on mainnet. Blazing-fast performance and secure execution—finally, a chain that delivers both

Some chains talk about fast blocks. NEAR delivers real finality in 1.2 seconds.

No compromises. No… pic.twitter.com/3nQXBQ1E2w— NEAR Protocol (@NEARProtocol) May 13, 2025

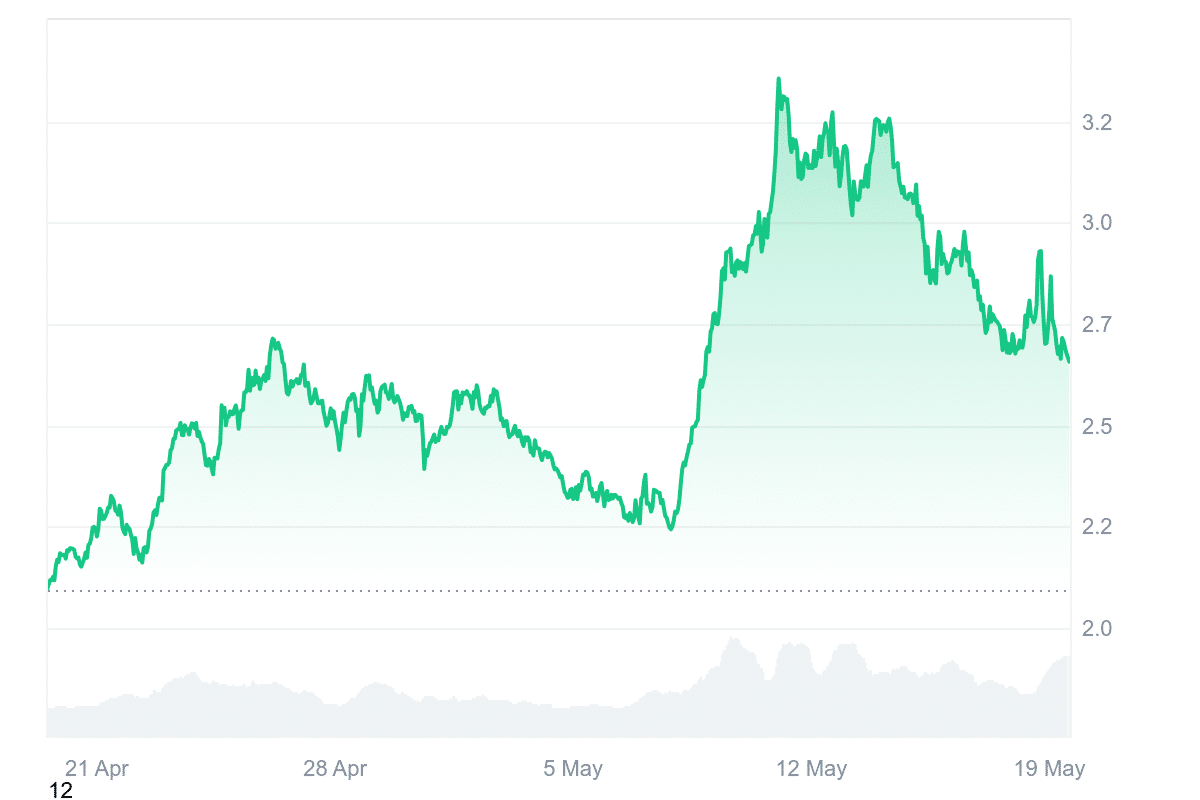

The platform’s native token is currently priced at $2.65, with a 26% gain over the past month. It has seen high trading activity, with 24-hour volume reaching $288 million, registering an 81% increase. This signals strong market engagement.

Additionally, it posted gains in 15 of the past 30 days. The 24-hour volume-to-market cap ratio of 0.2150 reflects healthy liquidity, making it easier for investors to enter or exit positions without major price shifts.

5. Cosmos (ATOM)

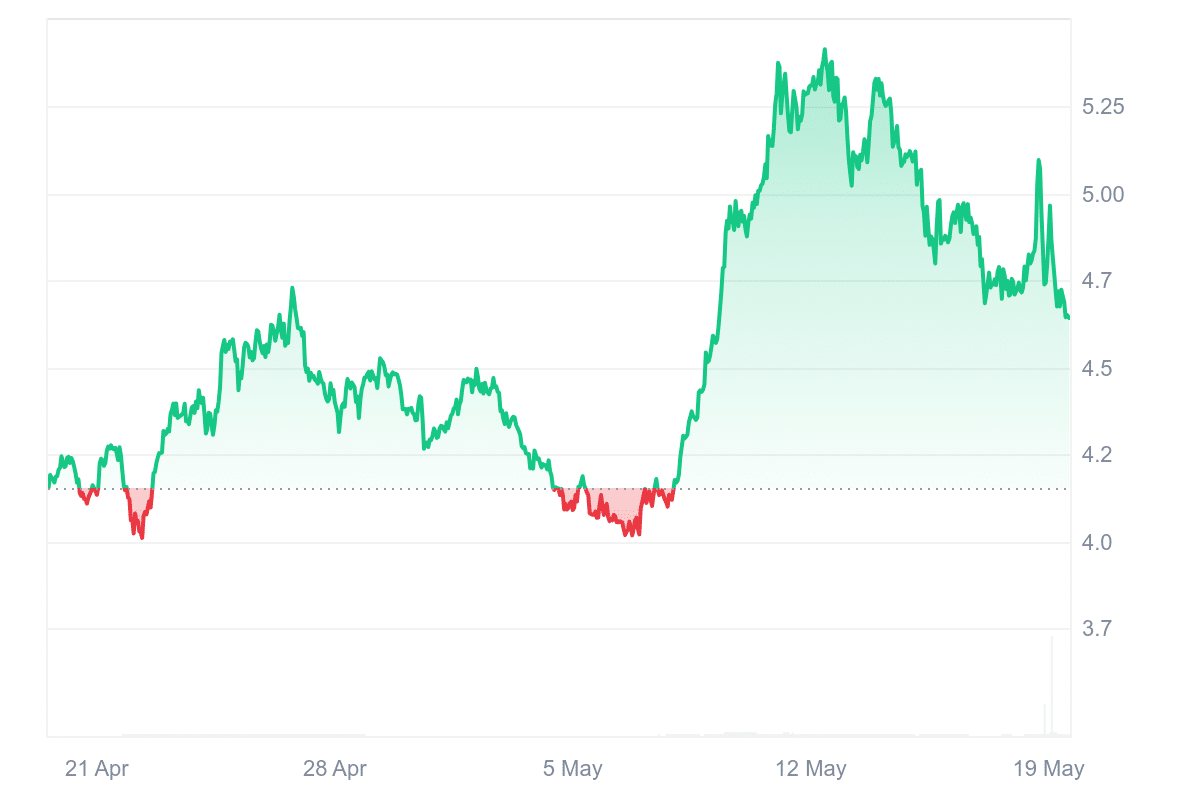

Cosmos (ATOM) is currently priced at $4.62 after a 4.54% decline over the past 24 hours. Despite this short-term dip, the token has posted a 10.74% increase over the past month, showing signs of recent upward momentum. During this period, Cosmos rose as high as $5.40 before retracing to its current level, suggesting market volatility in the short term.

The token’s liquidity remains solid, with a 24-hour volume-to-market cap ratio of 0.1661, indicating relatively active trading compared to its size. This ratio can signal healthy market interest and the ability to absorb trades without major price swings.

From a technical analysis perspective, the 14-day Relative Strength Index (RSI) stands at 61.30. An RSI between 50 and 70 typically points to neutral-to-mildly bullish conditions. In this case, it suggests that Cosmos is neither overbought nor oversold, which may lead to sideways trading in the near term.

Investor sentiment, however, appears cautious. Market signals are currently lean bearish, even as the broader crypto market shows a strong appetite, as reflected by the Fear & Greed Index at 74, which is categorized as “Greed.”

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage