Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price, trading at $34,411 at 6:30 a.m EST, continues to hold its recent gains after legendary hedge fund manager Stanley Druckenmiller said, ”I don’t own Bitcoin, but I should.”

While the price is down 0.2% on the day, the 24-hour trading volume for BTC is up 35%. In the month, BTC is up almost 30%, with $35,000 within reach.

While momentum seems to be waning for Bitcoin price after a hard pump across October, there’s still hope for a further upward trajectory. This is because based on historical data going back ten years to 2013, November has always been Bitcoin’s best-performing month.

Uptober has been great, but the party may not be over just yet.

November is historically #Bitcoin's best performing month. pic.twitter.com/kaMMt7pgZz

— Miles Deutscher (@milesdeutscher) October 25, 2023

Druckenmiller says Bitcoin has established itself as a brand and likened it go gold as a store of value.

“I was surprised that Bitcoin got going, but you know, it’s clear that the young people look at it as a store of value because it’s a lot easier to do stuff with,” he said. “Seventeen years, to me, it’s a brand.”

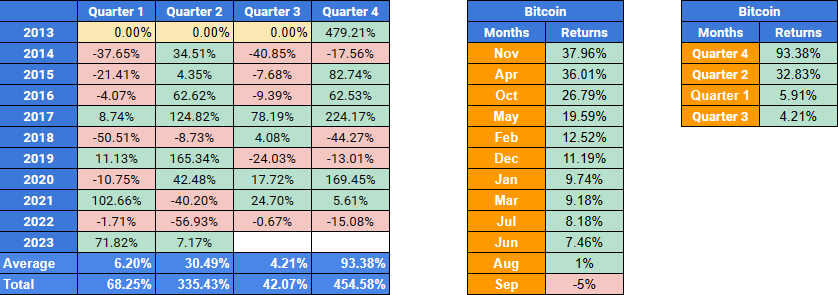

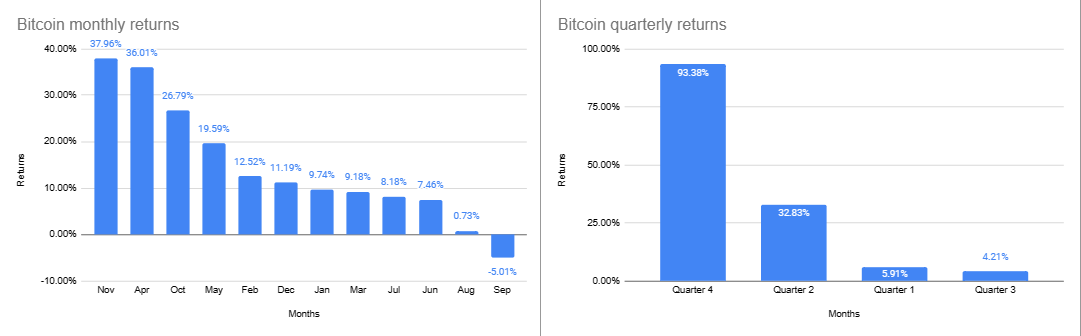

As indicated in the tabulation below, the fourth quarter (Q4) has seen BTC record the best returns. Similarly, November also takes the helm on metrics of best monthly returns. It shows 37.96% returns followed by April with 36.01%. The worst month in terms of returns has been September over the last decade. August follows close by with only 1% in returns.

The data above is best represented in the bar graph below, suggesting that the interesting part of Bitcoin price action may just be starting.

The main drivers for the bullishness we currently enjoy constitute three themes. The first is the Spot Bitcoin Exchange-Traded Fund (ETF) narrative. Second, Federal Reserve chair Jerome Powell’s speech recent speech at the Economic Forum in New York. Third, the much-anticipated BTC halving is expected to kickstart the next Bull Run cycle. For an in-depth evaluation of how these are bullish drivers, see this earlier article here.

Crypto Market In A State Of Greed

Meanwhile, the market is in a state of greed, at around 68, as investors look to ride the expected rally. With this stance, buyer momentum is on the wheels. If sustained, BTC could record another hard pump in November.

Good morning, traders⚡️

• BTC ≈ 34,300

• Fear and greed index – 66 (greed)

• BTC dominance – 53.70%#airdrop #crypto #traiding #marketupdates #BTC #bitcoinETF #bitcoinprice #bitcoinnews pic.twitter.com/bNT18L8hf7— AmberAlpha (CryptoNick) (@cryptonick_foun) October 31, 2023

Bitcoin Overweight To Be Maintained In November, GSG Digital

According to research and insights by GSG, BTC overweight could be sustained across November. GSG is a Singapore-based company specializing in investment, research, trading, operations, legal, and compliance.

Spot #BTC #ETF headlines drove Oct's market sentiment, and BTC interest remains high. In Nov, we maintain BTC overweight and increase #ETH exposure. Also upped exposure to #Solana, reduced positions in weak sectors. Dive deeper into the Nov GSGM+ report: https://t.co/TzdUzBUSKA pic.twitter.com/1zsQYGfXmT

— GSG (@gsg_digital) October 31, 2023

The researcher attributes this to hype around the spot BTC ETF, with the market anticipating a launch soon given optimistic chatter across crypto X.

Bitcoin Price Prognosis As Uptober Paves Way For A Possible Movember

November could be a better month than October, given the historical performance. Some onlookers extrapolate the Uptober vibe to a new phrase, “Movember” (Morevember).

So technically speaking, and I'm not technical at all when it comes to this type of thing, but that would make it Morevember I presume?

— DahVeeDeh (@Inter0pBoutique) October 25, 2023

The odds continue to favour the bulls, with Bitcoin price comfortably holding above the $30,000 psychological level. Exchanging hands for $34,260, BTC could be coiling up for another move north. Potentially, it could breach the $35,000 psychological level this time. For a confirmed uptrend, BTC must stretch to break and close above the $35,325 resistance level. This barrier was last tested on May 8 when the Terra ecosystem was exploding under the unscrupulous leadership of Do Kwon.

As long as Bitcoin price holds above the ascending trendline, BTC market value could continue north. It could reach the $39,246 resistance level before a foray into the enviable $40,000 psychological level.

The Relative Strength Index (RSI) is still above the 70 level, which shows BTC is massively overbought. While its southbound trajectory is concerning, it does not warrant selling BTC for as long as it does not cross 70 to the downside. Investors should not be surprised if the RSI bounces above the 70 level and deviates north again. Alternatively, the RSI could break below before correcting back shortly after, pointing to the works of smart money looking to catch traders off guard.

The Awesome Oscillator (AO) indicator is also in the positive territory, showing bulls are in the driver’s seat of the BTC market. This favors the upside.

Conversely

Considering the RSI is moving towards the south, and the AO is showing red histograms, buyer momentum for BTC is falling as bears or sellers gain ground. If they overpower the bulls, Bitcoin price could correct south.

Increased selling pressure could see Bitcoin price drop below the $31,495 support level, or extend the slump below the $30,000 psychological level, losing the support due to the trendline in the process.

In the dire case, the fall could see Bitcoin price fall to tag $25,320, with such a move constituting a 25% fall below current levels.

With October now in the rear mirror for Bitcoin price, investors looking to ride the expected Bull Run should look at BTCMTX.

It is a stake-to-mine cryptocurrency with analysts very excited, anticipating 10X in growth potential as its launch date draws near.

Bitcoin Alternative

BTCMTX is the native cryptocurrency for the Bitcoin Minetrix project, which traders are flocking to as they look to benefit from BTC’s anticipated run. The token is selling for $0.0113 with presale collections now recording a stark $2.825 million out of a $3.385 million target. Buy BTCMTX using ETH, USDT, or your bank card here.

#BitcoinMinetrix hits another major milestone! 🌟

Successfully raising more than $2,600,000. pic.twitter.com/hP6PLnjUcI

— Bitcoinminetrix (@bitcoinminetrix) October 30, 2023

The project is committed to making Bitcoin mining accessible even to the ordinary folk, which explains why it has decentralized and tokenized the entire process. All barriers have been eliminated and risk aversion measures established to ensure a safe place for all users.

#BitcoinMinetrix envisions a rejuvenated cloud mining environment that aligns stakeholding and cloud mining.

With transparency, autonomy, and security, #BitcoinMinetrix aims to pioneer tokenized cloud mining, offering a dependable $BTC mining avenue for all. 🪙⛏️ pic.twitter.com/4Vh03aonId

— Bitcoinminetrix (@bitcoinminetrix) October 30, 2023

With stage 4 due to end in 2 days, interested investors should take advantage of the current price of $0.0113 before the price increases. Please note: Stage four tokens are selling out, just as fast as they did in the previous stages! Do not let this pass you by.

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- First Stake-to-Mine Crypto Presale Raises $2.2 Million – Get in Early on the Next Big Crypto Project

- Crypto YouTuber Crypto Jimmy Shares Valuable Insights into New Crypto Platform Bitcoin Minetrix

- Bitcoin Price Prediction: BTC Looks Unstoppable And That Means This Bitcoin Derivative Is Poised To Explode

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage