Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price closed strongly above the horizontal support at $31,405 on the weekly timeframe, signaling a strong bullish trend.

In the last 24 hours, the king of cryptocurrency is up almost 1%, coming out of the weekend with momentum intact, and recording a 25% increase in 24-hour trading volume. It is up almost 12% in the last seven days.

#Bitcoin's weekly #candle has closed above the #resistance area, which is considered a positive sign for the #market. It is possible that we may now witness a test of the #support area before the next upward movement. As long as #BTC maintains its position above the $30,500 level… pic.twitter.com/IWpHuu9CWD

— Crypto VIP Signal™ (@CryptoVIPsignal) October 30, 2023

With the tables turning for the market, many traders now believe it is the right time to buy BTC ahead of the potential bull run beginning November 2023.

The majority of experts believe that now is the right time to buy #BTC, with similar conclusions but different viewpoints

According to leading analysis Glassnode, Bitcoin's rally could continue in November 2023#CryptoNews #BTC #altcoins pic.twitter.com/xMgrplp8bv

— ansneverans (@XueeiN) October 30, 2023

The weekly close is important for the BTC price, confirming the break above the most important resistance in Bitcoin’s history.

#Bitcoin: I can NOT mention enough how important the weekly close will be tonight!

This close will confirm the break above the most important resistance to break in BTC history!

In two days we will see the monthly close. If above $32‘000 it’s the nail in the coffin for bears! pic.twitter.com/J1UpEcBb9P

— MMCrypto (@MMCrypto) October 29, 2023

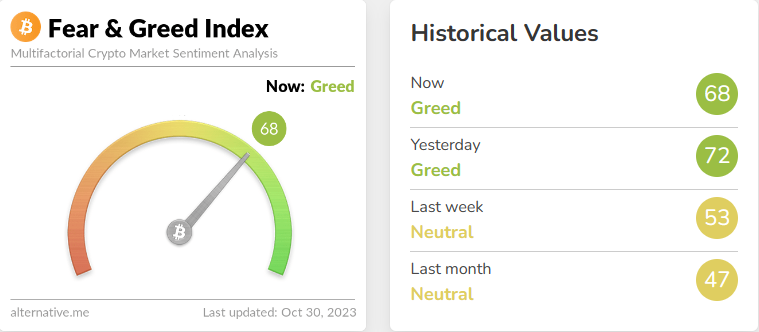

Meanwhile, the crypto fear and greed index shows that the market is in a state of greed at 68, increasing the odds for an upward movement.

Bitcoin Price Bullish Driver

Bitcoin price bullish momentum comes ahead of November 1, when Federal Reserve Chair Jerome Powell will be providing direction concerning interest rates. In the previous meeting at the Economic Forum of New York, he addressed rising yields on long-term US treasuries, while alluding that the Fed could potentially see its way to pausing interest rate hikes during the Wednesday meeting.

Nevertheless, the expected pause hinges on inflation data, such that inflation suddenly soaring could delay the pause, inspiring more rate increases. On the other hand, if inflation does not rise, then the pause could be implemented.

Powell’s assertions came out as being mildly dovish, causing the US Dollar (USD) to sell off. Bitcoin, known to be negatively correlated or inversely proportional to the USD, saw marginal gains.

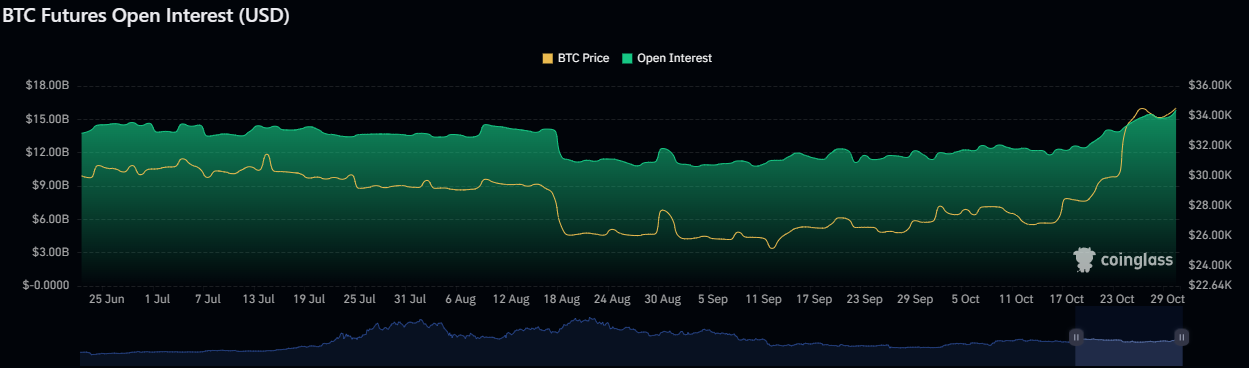

With this, there are a lot of mixed feelings among BTC traders, culminating in a steady rise in open interest. At the time of writing, the sum of all long and short positions for BTC price is $15.83 billion.

Bitcoin Price Outlook With BTC Looking Unstoppable

With Bitcoin price weekly candle closing strongly above the horizontal support at $31,405, the BTC bullish momentum appears unstoppable, with the $35,000 psychological level now in sight.

The crossover of the Moving Average Convergence Divergence (MACD) indicates bullish momentum, suggesting Bitcoin price uptrend may not be done just yet. It points to a possible continuation of the current upward movement, either from the current price of $34,300 or after a retest of the horizontal support at $31,405. However, this will only be true if the price holds above the $30,500 level.

In the same way, the Relative Strength Index (RSI) at 69 points to strong momentum, with its overall upward movement suggesting increasing buying pressure. Further, the Awesome Oscillator (AO) remains positive, recording green histogram bars. With this outlook, a continuation of the uptrend for Bitcoin price remains highly likely.

Increased buying pressure above current levels could see Bitcoin price breach the $32,246 resistance level and test the supply zone. This extends from $40,273 to $46,931. A flip of this supply barrier into a bullish breaker could open the skies for BTC to foray above the $50,000 psychological level, collecting sell-side liquidity (SSL) residing above.

In a highly bullish case, Bitcoin price could extrapolate the gains to the second supply zone extending from $61,987 to 65,594. This would potentially kickstart the next bull run cycle.

Converse case

On the other hand, profit takers and smart money remain the biggest threat to Bitcoin price upside potential. Smart money looking to make a profit could catch BTC longs off guard through market manipulation.

Manipulation in full power. That's the Market for me currently. But it's still possible to see #BTC over $40k till end of the year

— Crypto Revolution Masters (@revolut20) October 29, 2023

Caution is advisable, going forward, because a pullback could see millions of long positions liquidated. Such a directional bias could send Bitcoin price below the key support of $31,405, or worse, see BTC lose the support offered by the ascending trendline at around the $28,000 psychological level.

In the dire case, Bitcoin price could slum further, potentially reaching the $25,000 psychological level. A decisive weekly close below this level could invalidate the bullish outlook.

Meanwhile, investors are looking at BTCMTX, a Bitcoin derivative expected to benefit from the overflows of a BTC rally with 10X growth potential.

Promising Alternative To Bitcoin

BTCMTX is the powering token for the Bitcoin Minetrix ecosystem, selling for $0.0113 per token. So far, presale collections have reached $2.705 million, out of the $3.385 million target. Notably, the price will increase again in three days after stage four ends, meaning now is the time to buy BTCMTX.

#BitcoinMinetrix is now in Stage 4! 🪙 pic.twitter.com/QNRIzrauTf

— Bitcoinminetrix (@bitcoinminetrix) October 28, 2023

The hallmark of the Bitcoin Minetrix ecosystem is to give everyone a chance to own BTC. To do this, it has decentralized and tokenized the entire process, lowering the entry barriers. Specifically, it has eliminated chances of swindles, and hassles, relating to expensive hardware, heat, noise, and space.

At #BitcoinMinetrix, we're democratising mining, ensuring safety, and easy access to the lucrative world of #BTC. 🛡️💰

With cloud mining and staking, we put the control over the mining journey into the user’s hands. 🌐🔒 pic.twitter.com/p5bDqkysOg

— Bitcoinminetrix (@bitcoinminetrix) October 28, 2023

BTCMTX is touted as a stake-to-mine crypto presale, where token holders stake their BTCMTX holdings for mining credits. When you redeem these credits, you get mining hash power, thus cloud mining.

Understanding #CloudMining for $BTC ⛏️💻

Cloud mining allows individuals to engage in #Bitcoin mining without owning or maintaining the equipment.

Discover the benefits:

💰 No upfront hardware expenses.

🔧 Minimal expertise is required.

🌟 Potential for passive rewards. pic.twitter.com/XktSxqwWoW— Bitcoinminetrix (@bitcoinminetrix) October 29, 2023

It is worth it to note that BTCMTX is among the top three initial coin offerings (ICOs) to buy in October 2023. Do not miss out for any reason.

Visit Bitcoin Minetrix to buy BTCMTX in the presale here.

Also Read:

- The Top 3 ICOs to Buy in October 2023 – Bitcoin Minetrix, TG.Casino, and Meme Kombat

- Traders Flock To New Crypto Presale With Launch of Stake-to-Mine Protocol – $BTCMTX

- New Stake-to-Mine Crypto Presale With Potential For High Returns

- Experts Predict This New Stake-to-Mine Crypto Could 10x at Launch – The Future of Cloud Mining?

- First Stake-to-Mine Crypto Presale Raises $2.2 Million – Get in Early on the Next Big Crypto Project

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage