Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin managed to display quite an outstanding performance this month, but the weekly low of $22.3k raised some scepticism towards Bitcoin’s price action for months to come. In this article, we’ll address whether bitcoin will meet a rebound, taking into account the numerous factors at play.

Market Growth Cause Increased Mining Revenue For Bitcoin

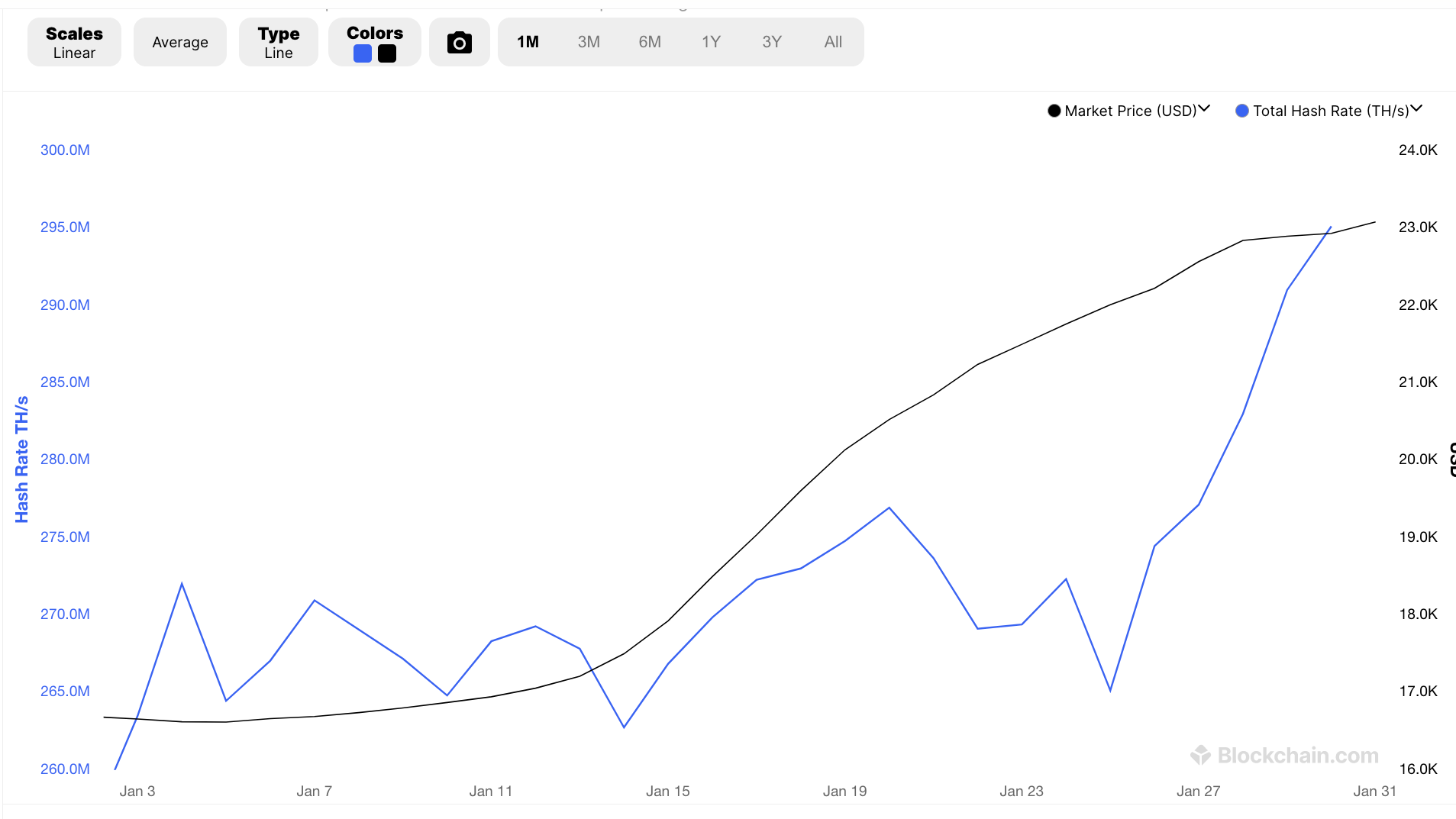

The mining of Bitcoin is showing signs of growth, with revenues from payouts and transaction fees experiencing a 50% increase in the first month of 2023. Despite the falling profits below $14 million in late December 2022, this recent increase in income measured in U.S. dollars is an indicator that Bitcoin is still on track for a sustainable recovery. Over the course of 30 days, profits in Bitcoin mining rose from $15.3 million on January 1st to roughly $23 million.

The hash rate of Bitcoin continues to reach new heights as more miners are joining to provide energy and ensure the security of the network. With approximately 300 exahashes per second, Bitcoin operates independently from any central authority. However, the proof-of-work consensus method used in Bitcoin is facing criticism for its high energy consumption, but efforts are being made to use renewable energy for Bitcoin mining operations to address this concern.

The positive momentum of Bitcoin was faced with uncertainty on January 30th as the market environment was tense, but the first three weeks of 2023 saw a significant rise in the price of bitcoin. The bull run drove the price from its low of $16,499 on January 1st to $23,200, as reported by CoinMarketCap, representing an increase of 47%. Despite the strong comeback seen in the fourth week, the BTC showed signs of volatility in the face of numerous global events.

Overall, the mining industry of Bitcoin is showing signs of growth, with a 50% increase in income measured in U.S. dollars. Despite the challenges faced in the past, the hash rate continues to reach new records, and efforts are being made to power the mining operations with renewable energy. Despite the uncertainty in the market, the price of bitcoin saw a significant increase in the first three weeks of 2023, but signs of volatility remain in the face of major world events.

Institutional Investment To Pull Bitcoin Up From Bottom

In January, Bitcoin saw a 40.5% increase in value, reaching above $22,500 on January 20. The rise in Bitcoin’s value reflects the overall improvement in the stock market, which has been boosted by China lifting its COVID-19 restrictions.

Major entertainment and e-commerce companies recorded massive gains during this time. It is expected that Apple will announce a massive $96 billion in earnings for 2022 on February 2, surpassing Microsoft’s $67.4 billion profit.

According to a study by Matrixport, 85% of recent Bitcoin purchases were made by American institutional investors, indicating that major players remain interested in cryptocurrency. Despite the 49% rise in price from the November 21 low of $15,500, Bitcoin has still dropped 39% in the past year.

On the other hand, the USD Coin premium, which measures the difference between China-based peer-to-peer trades and the US dollar, is at 3.7%. It declined from a discount of 1% two weeks ago, indicating increased demand for stablecoin buying in Asia. The futures premium for Bitcoin, a favourite among professional traders, has remained neutral since January 21, with an annualized premium of over 4%.

However, the market is cautious of the Federal Reserve’s interest rate hike campaign. The pivot from this campaign in 2023 could impact stock market performance and reduce Bitcoin’s appeal as an option for inflation protection. Although current economic indicators suggest a moderate correction, traders are monitoring the Fed’s actions closely.

Leading indicators show that the correction is sufficient to ease inflation, but the market is cautious of any potential shifts from the Federal Reserve’s interest rate hike campaign. This pivot, if it occurs in 2023, could limit stock market performance and reduce the appeal of Bitcoin as a means of protection against inflation. Traders are keeping a close eye on the Fed’s moves to better understand the market’s future.

Bitcoin Market Dominance Indicates A Rebound

The dominance of Bitcoin over other digital assets reached a new high in January 2023. The Bitcoin dominance index, which tracks the proportion of Bitcoin’s market capitalization compared to the rest of the crypto market, stood at 44.82% on January 30th, its highest level since June 2022.

Investors generally flock to Bitcoin during bear markets due to its greater liquidity and stability compared to alternative cryptocurrencies, which has contributed to its growing market share. Currently, Bitcoin has risen 38% so far this year, outpacing the 30% gain by the second-largest cryptocurrency, Ethereum.

Technical analysis suggests that the Bitcoin dominance index may continue to increase in the coming weeks as it reclaims its 50-week exponential moving average. One market analyst predicts the index could reach 46%, in line with the upper trendline of a large descending channel pattern.

The current trend in the crypto market suggests that the Bitcoin dominance index may increase further in the short term, however, the long-term outlook is uncertain. There is a bearish argument that the index may decline after testing its resistance level, as has happened previously.

On the other hand, if the token continues to hold its support area, it may see a rebound rally and increase its share in the market, potentially up to 20%. As for Bitcoin’s performance on Jan 31st, the token reached a low of $22.7k, while it recovered through the day trading at $23,160 at the time of writing. Suggesting that the weekly low encountered by bitcoin was only for a short while and the token may very well be on an upward trajectory from here.

Conclusion

Increased mining revenue from Bitcoin, along with increasing dominance in the market and positive support from institutional investors indicates that Bitcoin is on its way to a rebound, tracing back to the monthly high it achieved in January. With that being said, a bunch of other factors such as changes in the prospects of interest rates may slow down this much-anticipated rally.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage