If you bought some cryptocurrency and want to turn it back into regular money but aren’t sure how, you’re in luck. Buying crypto is as easy as ever now, but selling it can feel daunting, especially if you are new to the market.

Why sell crypto in the first place? Maybe you made a profit and want to lock it in. Perhaps you need cash for something else or simply want to get rid of a coin you don’t feel confident about. Even if you don’t already own crypto and are considering investing in it, you should know how to sell crypto before you dive in. Whatever your reason, this guide will help you learn how to sell cryptocurrency safely and smartly.

Best Methods to Sell Cryptocurrencies

Now that you are ready to sell your crypto assets, let’s talk about the main methods. Each of the following methods comes with its pros, cons, as well as transaction fees.

1. Centralized Cryptocurrency Exchanges

A centralized exchange (often called a CEX) is a website or an app where you can buy and sell crypto. The company that runs the exchange holds your digital assets for you. Think of this as a bank for crypto. You need to trust the exchange to keep your coins safe while you trade.

Centralized cryptocurrency exchanges like Binance, Coinbase, and Kraken are very simple to use. Since they are centralized, these platforms usually require you to create an account and verify your identity. The process is called “Know Your Customer” (KYC) and is required by law in most jurisdictions to prevent fraud and money laundering.

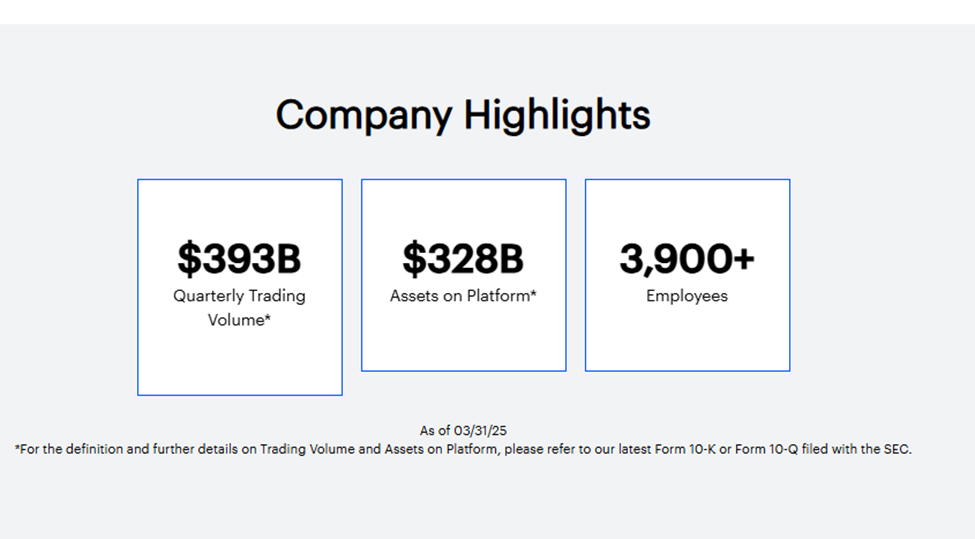

Trending exchanges like these three have high liquidity. Coinbase, for instance, processes billions daily and supports thousands of trading pairs. For traders, this means really fast and competitive cryptocurrency transfers and trades.

How to Sell Crypto on a CEX

- Create an account on a trusted exchange like Coinbase or Binance.

- Complete the verification process (ID, proof of address, etc.).

- Deposit your cryptocurrency into the exchange wallet (transfer it from your personal crypto wallet).

- Place a sell order: either at market price (instant) or set your own price (limit order).

- Once your crypto is sold, you can withdraw your fiat money to your bank account.

Fees on Centralized Exchanges

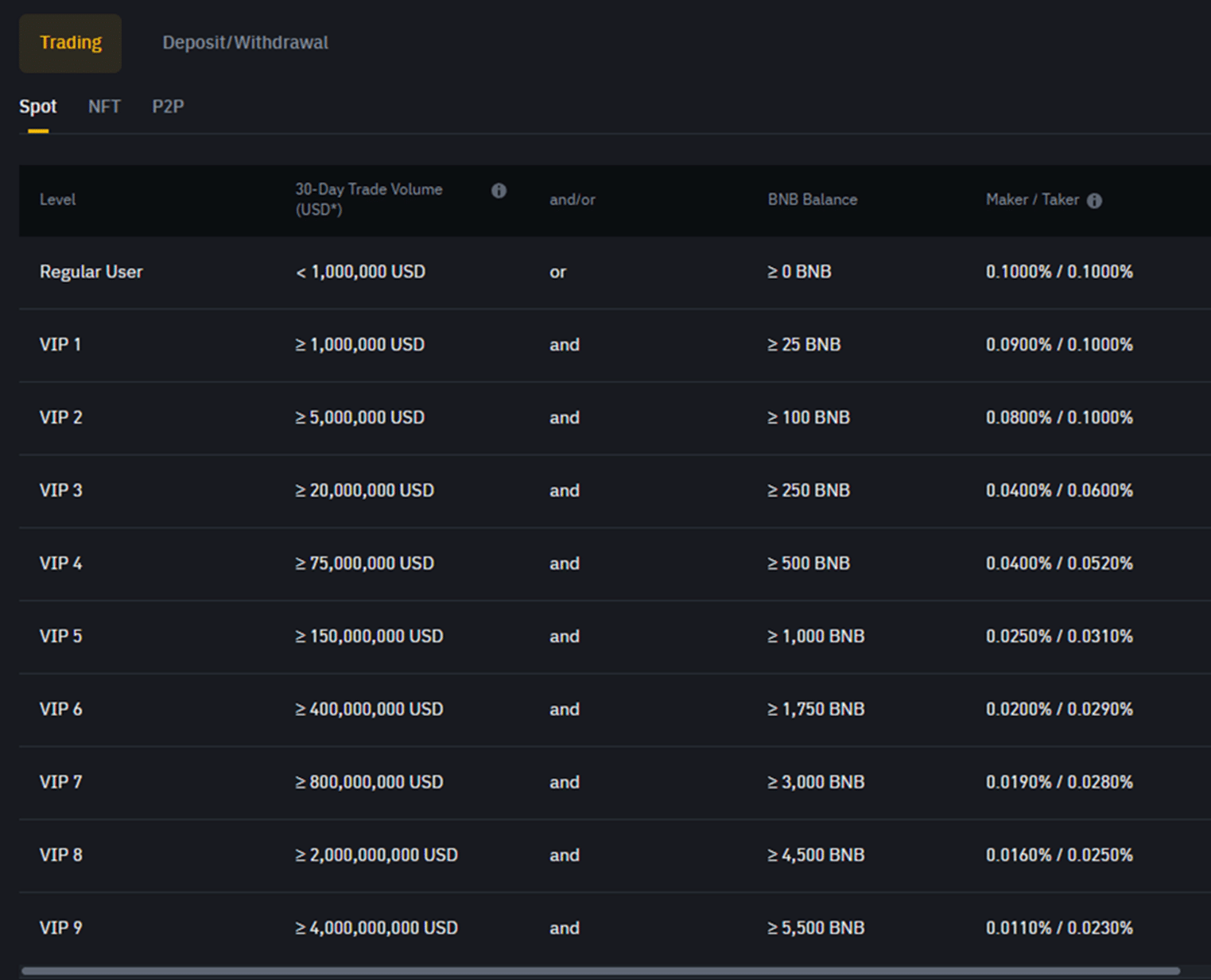

Trading fees on centralized exchanges generally range from 0.1% to 0.6% per trade, but this is not set in stone. Binance, for instance, charges a base 0.1% trading fee, one of the lowest in the industry. You can get an even lower fee based on your VIP level on the platform.

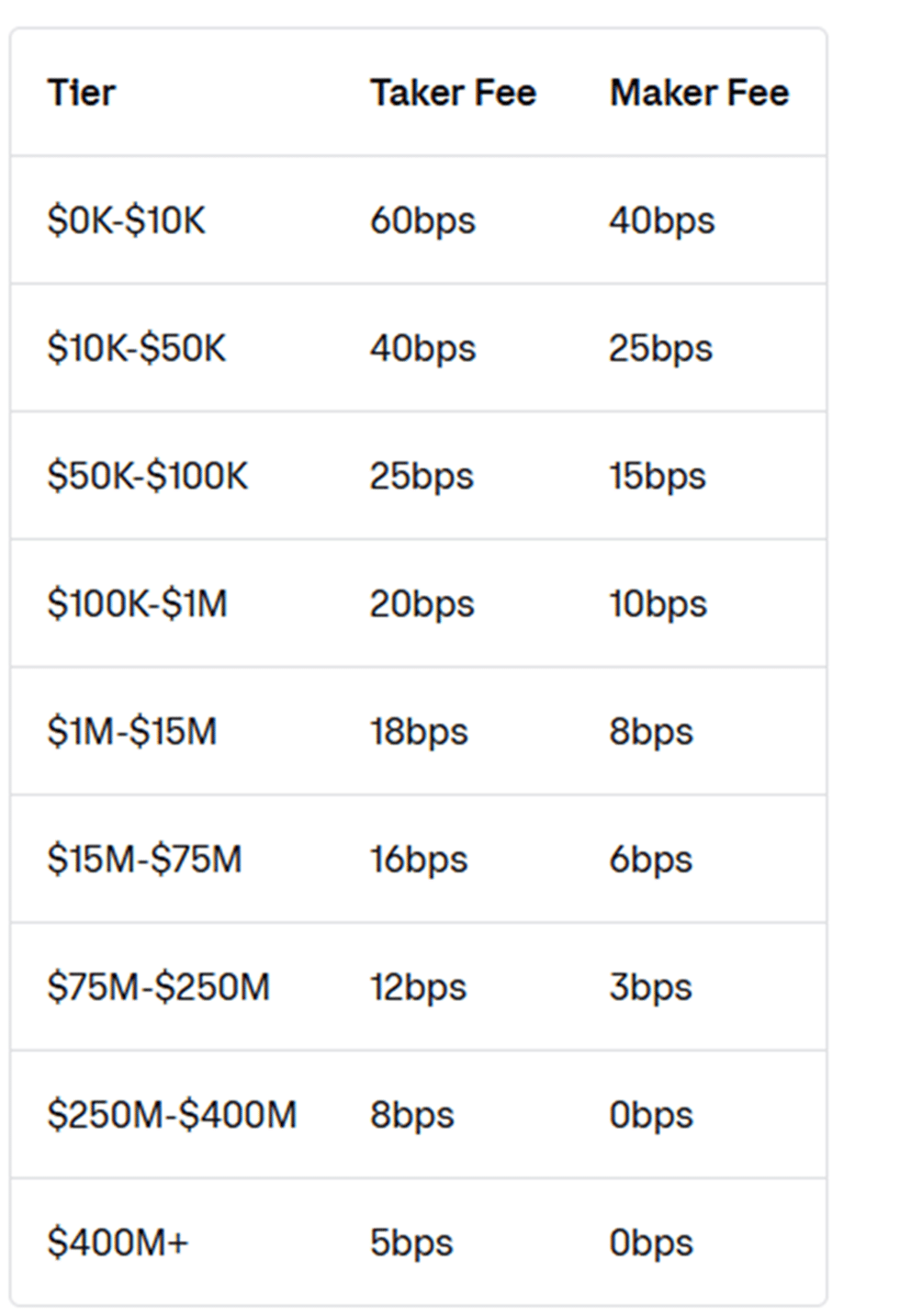

In comparison, Coinbase’s fees can be higher. They depend on whether you are using the main Coinbase platform, the Advanced Trade platform, or Coinbase One. The main platform has fees between 0.5% and 4.5%. In this case, too, the fees change for VIP traders based on their tier.

Withdrawal fees depend on the payment method you choose, as well as the currency. Bank transfers and wire transfers sometimes incur flat fees or small percentages, but every exchange is different, so make sure to check your preferred platform’s fee structure.

Pros and Cons of Using Centralized Exchanges

| Pros | Cons |

| Easy to use, especially for beginners | You must share personal information to use them (KYC) |

| Ability to cash out directly to your bank | You could lose control of your crypto while it’s on the exchange (custodial risk) |

| Regulated, with strong security measures and insurance on customer funds | Fees can add up, especially on smaller trades |

| High liquidity on top platforms, which means faster trades | Smaller selection of coins than DEXs |

2. Decentralized Exchanges (DEX)

A decentralized exchange will allow you to trade cryptocurrencies directly from your own wallet without a middleman holding your funds. On DEXs, trades happen via smart contracts on the blockchain. Popular DEXs include Uniswap (Ethereum) and PancakeSwap (Binance Smart Chain).

Decentralized exchanges only allow crypto-to-crypto trades. This means that you cannot sell your crypto directly for cash. However, you can use a DEX to swap your cryptocurrencies for stablecoins pegged to the USD, like USDC or USDT. If you are looking to get fiat for it, you must send your crypto assets to a centralized exchange or use another method.

How to Sell Crypto on a DEX

- Connect a crypto wallet like MetaMask or Trust Wallet to the DEX website of your choice.

- Select the cryptocurrency you want to swap (sell) and the one you want in return (buy). You can see the crypto prices.

- Confirm the swap transaction through your wallet.

- The new crypto will arrive in your wallet instantly.

Fees on Decentralized Exchanges

DEX trading fees typically range from 0.05% to 0.3% per swap, but once again, this is not written in stone. It will depend on the platform and the particular pool you choose. In addition to these fees, you must also pay “gas fees” for every transaction on the blockchain. Gas fees vary based on network traffic and the platform you are using.

For instance, Ethereum gas fees spiked to $30+ during the 2021 bull run. During quiet times, they have gone below $1. You can keep track of the gas fees at Etherscan.io. You should also make sure to set your slippage tolerance (often 0.5-2% for large, liquid tokens) before you complete your transaction to avoid front running and price slippage.

If you are looking for platforms with lower fees, PancakeSwap on Binance Smart Chain usually offers more attractive gas fees, around a few cents per transaction. However, if your coins aren’t already on the BSC network, you will need to use a crypto bridge to transfer them first, incurring additional gas fees.

Pros and Cons of Using DEXs

| Pros | Cons |

| You keep full control of your crypto, which makes it safer | Can only trade crypto for crypto, no direct cashouts |

| No need for personal ID verification | Gas fees can be high and unpredictable |

| Lower base fees compared to centralized exchanges | Some tokens may have low liquidity, which makes big sales harder |

3. Brokerages

A cryptocurrency brokerage is a platform that lets you trade crypto directly through their interface without needing to use an order book to interact with other traders as you would on a traditional exchange.

Think of this as using a currency exchange booth at an airport. You hand over your money, and they give you a set amount of foreign currency at a fixed rate. Crypto brokerages work similarly: they set the price and handle the transaction for you.

Brokerages like eToro, Robinhood, and SoFi often combine crypto services with traditional investing tools, which means that you can also trade stocks, ETFs, and commodities from the same dashboard.

Some brokerages like eToro allow limited withdrawals to external wallets, while others don’t allow any crypto withdrawals. Robinhood began offering crypto transfers in Europe in 2024.

How to Sell Crypto via a Brokerage

- Open an account with a brokerage that offers crypto trading.

- Buy or deposit cryptocurrency within the app.

- Sell your crypto directly on the platform, converting it into fiat inside your account.

- Withdraw fiat money to your linked bank account.

Fees on Brokerages

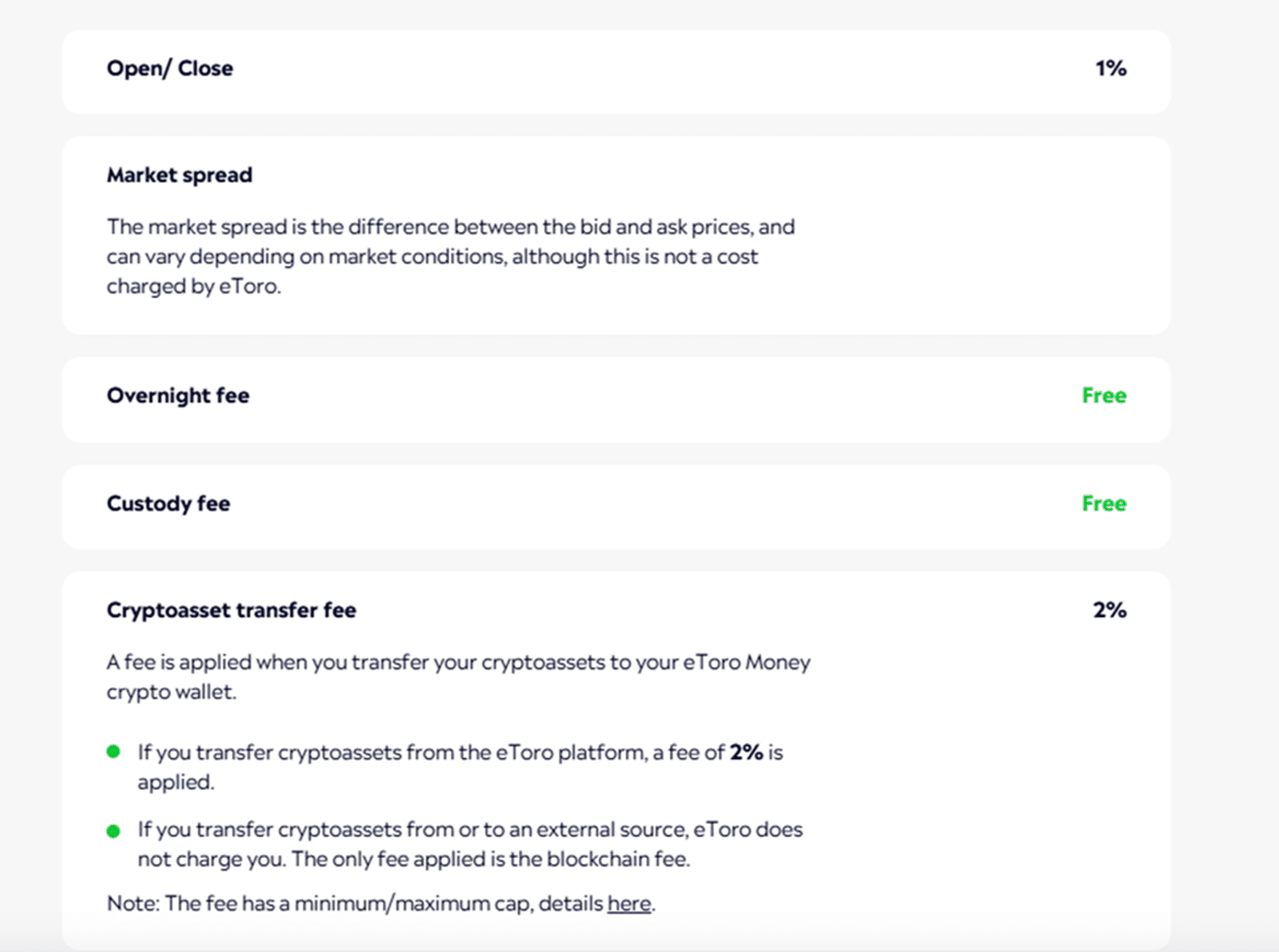

Most brokerages these days charge a commission. eToro, for instance, has a 1% fee when you open and another 1% fee when you close a crypto position. So, if you buy $1,000 worth of Bitcoin, you’ll pay $10 upfront. When you sell Bitcoin, you’ll pay another $10. In addition to this, the platform charges a 2% fee if you want to move your crypto to an external wallet, such as their eToro Money Wallet.

The SoFi brokerage charges 1.25% per transaction, and the spread is included in the price. Robinhood, on the other hand, charges no commission, but a spread applies.

Pros and Cons of Using Brokerages

| Pros | Cons |

| Simple interface, perfect for beginners and stock traders | Limited to supported cryptocurrencies |

| No need to manage wallets or private keys | On most brokerages, you cannot move crypto out of the platform, only fiat |

| Some brokerages now allow social trading or copy trading | Spreads and withdrawal fees might be hidden |

4. Cryptocurrency ATMs

A crypto ATM (also known as a Bitcoin ATM or BTM) is a physical machine that lets you buy or sell cryptocurrency using cash or a debit card. This is similar to a regular bank ATM, but instead of withdrawing or depositing fiat money from your bank account, you are exchanging it for cryptocurrency or vice versa.

Some crypto ATMs only support buying crypto, while others allow both buying and selling. As of 2025, there are over 38,000 crypto ATMs worldwide, with the majority located in the United States and Canada.

How to Sell Crypto on a Crypto ATM

- Find a crypto ATM that supports selling (use Coin ATM Radar).

- Scan your wallet’s QR code at the machine.

- Send the requested amount of crypto to the ATM’s address.

- Receive cash in hand immediately (it can sometimes take a few minutes).

Fees on Crypto ATMs

Crypto ATM fees are generally extremely high, ranging between 7% and 20% per transaction, making them rarely worth using. Also, most ATMs only support Bitcoin and some other major coins.

Pros and Cons of Using Crypto ATMs

| Pros | Cons |

| Instant cash payout, no bank needed | Very high fees compared to online methods |

| Sometimes offers more privacy (no ID required for small amounts) | Limited locations, mostly urban areas |

| Easy for people without bank accounts | Potential security risks with physical machines |

5. Peer-to-Peer Trading

Peer-to-peer (P2P) trading lets you sell cryptocurrency directly to another person without using a traditional exchange or brokerage as the middleman. You agree on the price, payment method, and terms with the buyer. The actual transaction goes through a P2P platform, which acts as a trusted middle layer and provides escrow protection. This ensures that no one is scammed during the trade.

How to Sell Crypto Using a P2P

- Register on a P2P platform and complete KYC if required

- List your cryptocurrency for sale, including price and payment methods

- When a buyer accepts, the platform holds your crypto in escrow.

- After the buyer pays you outside the platform, confirm receipt.

- The crypto is now released to the buyer.

Fees on P2P

P2P platforms often charge low fees, usually between 0% and 0.5%.

Pros and Cons of Using P2P

| Method | What It Is | How You Get Paid | Fees | Advantages | Examples |

| Centralized Exchange | Platform that matches buyers and sellers. You trade through a company. | Direct bank withdrawals | 0.1%-4.5% trading + withdrawal fees | High liquidity, fast trades, supports fiat, easy to use | Coinbase, Binance, Kraken |

| Decentralized Exchange | Peer-to-peer trading via smart contracts, no central authority | Receive another crypto | 0.05%-0.03% + blockchain gas fees | No KYC, more control over your funds, lower base fees | Uniswap, PancakeSwap, 1inch |

| Brokerage | Platform sets the price for you, like a currency exchange booth | Withdraw to bank account | 1%-2% or more (spread and commissions) | Beginner friendly, no need for wallets, integrates with stocks/ETFs | eToro, Robinhood, SoFi |

| Crypto ATM | Physical kiosk where you buy/sell crypto for cash | Immediate cash payout | 7%-20% per transaction | No bank needed, fast cash, accessible for unbanked users | CoinFlip, Bitcoin Depot, BitAccess |

| Peer-to-Peer (P2P) | Direct trading between users, the platform provides escrow for safety | Any method | 0%-0.5%, usually low | More payment options, private, low fees | Binance P2P, Paxful, LocalBitcoins |

How to Sell Cryptocurrencies With a Centralized Exchange

Now you already know the basics of selling crypto on a centralized exchange. Let’s now walk through the process step-by-step, seeing how this is the most widely used method among crypto holders.

Step 1: Pick the Best Crypto Exchange for You

Exchanges can vary dramatically, so making this choice is very important. Some are great for beginners, while others offer more advanced tools for pro traders. Some are more expensive, and others come with lower fees or better payment options. Here is what you should consider when choosing the right crypto exchange:

- Reputation and security: Choose well-known, regulated platforms with a good track record (e.g., Coinbase, Kraken, Binance). Look for 2FA and insurance on held funds.

- Supported countries: Not every exchange is available everywhere. For example, Binance isn’t available in the U.S. (though Binance.US is). Check if the platform supports your location.

- Available cryptocurrencies: Make sure it supports the crypto you want to sell. Some platforms only list popular coins like Bitcoin or Ethereum.

- Ease of use: Beginners may prefer simple interfaces like Coinbase. Advanced traders may want platforms like Binance with more charting tools.

- Withdrawal methods: Can you cash out to your bank? Does it support PayPal, Wise, or debit cards?

- Fees: Look at the trading fees and withdrawal fees. For instance, Coinbase charges up to 4.5% on its basic platform, while Binance is closer to 0.1%.

- KYC: All regulated CEXs will require you to verify your identity, but some (like Kraken or Bitstamp) may offer faster approval.

- Mobile app: If you plan to trade on your phone, check reviews of the mobile app.

Pro tip: If you are a beginner and want a clean and easy-to-use platform, we recommend Coinbase. If you want lower fees and more features, Binance and Kraken are strong choices.

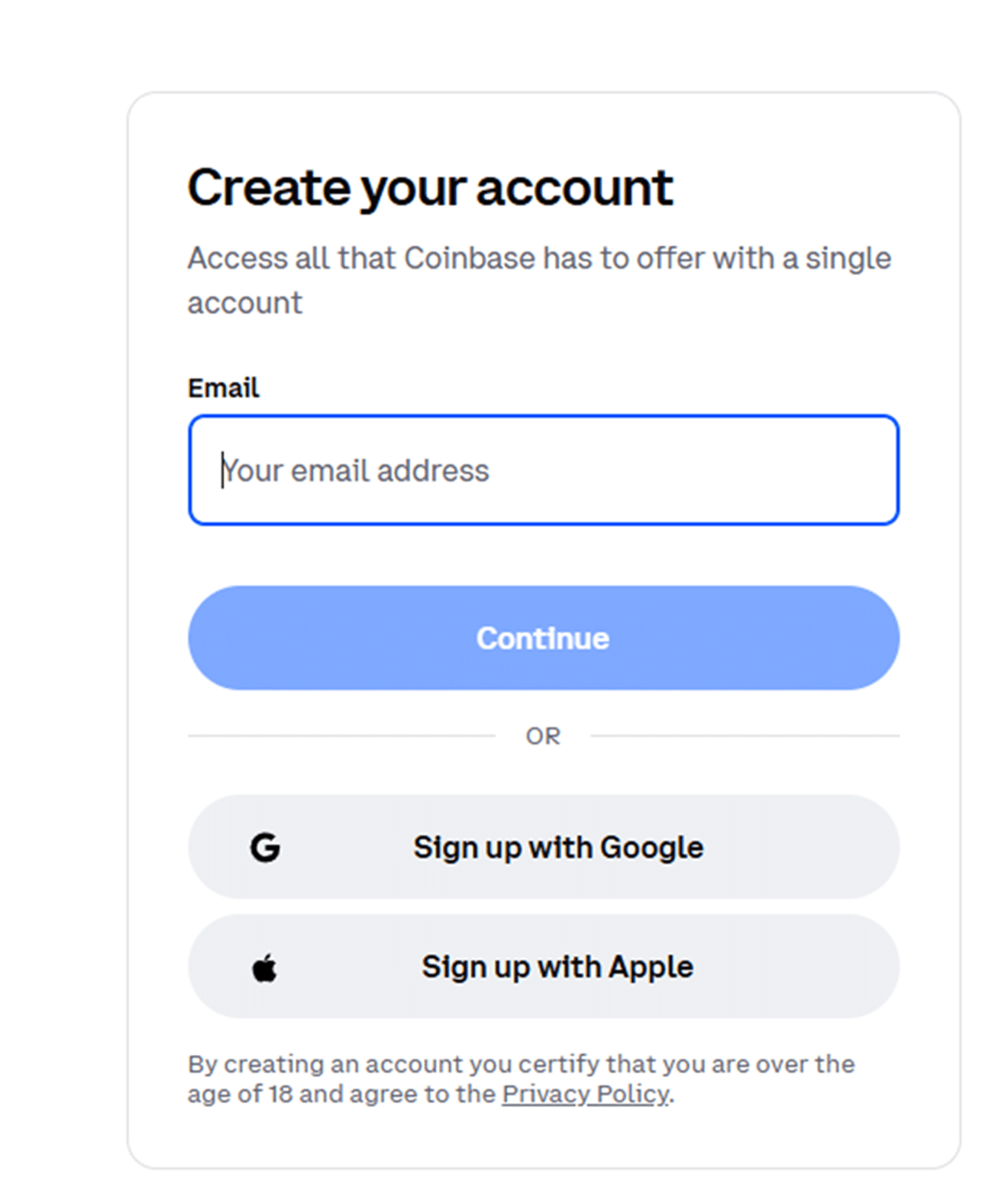

Step 2: Sign Up and Complete KYC

Now that you know which CEX you’ll use, it’s time to create an account. Once you do, the platform will ask you to go through an identity verification process, i.e., KYC. Let’s take Coinbase as an example to learn how to create an account.

First, click on “Sign Up.” Choose between ‘individual’ and ‘business’. Enter your email address or sign up with Google or Apple.

You’ll now receive a verification code at your email address, which you’ll need to enter into the dedicated field. Once you do this, create a password and enter your first and last name, as well as your phone number.

Coinbase is required by financial regulations to collect your personal data to validate your identity. To do this, you need to select your citizenship and validate the last four digits of your Social Security number. Make sure that the personal information you enter matches the details of your government-issued photo ID.

Coinbase accepts different identity documents based on location. You can find this info on their page.

Alternatively, you can download the Coinbase app and create your account there.

Step 3: Deposit or Transfer Crypto to the Exchange Wallet

If you already hold crypto on the exchange, you can skip this step. But if your crypto is stored in a private wallet or a hardware wallet, you need to transfer it to your exchange wallet first.

Simply log in to your exchange account and navigate to the wallet section. Then, do the following:

- Find the crypto you want to sell and click “Deposit” or “Receive.”

- Copy your wallet address provided by the exchange. This is where you’ll send your crypto.

- Open your personal wallet and select the option to send crypto.

- Paste the exchange wallet address, choose the blockchain network, and enter the amount.

- Confirm the transaction

Depending on the network, this can take from a few seconds up to 30+ minutes to arrive.

Pro tip: Always double-check the network and wallet address. If you send crypto to the wrong blockchain or address, it could be lost permanently.

Step 4: Sell Your Crypto

Once your crypto arrives in your exchange wallet, you are ready to sell it. In most cases, you’ll have two options for this:

- Market order: sell instantly at the current price

- Limit order: set your own price and wait for a buyer

Most platforms will show you the fees, the final amount you’ll receive, and the exchange rate before you confirm.

Step 5: Withdraw Fiat Currency to Your Bank

Now that you’ve sold your crypto, you are ready to move your fiat balance to your bank. Follow these steps to do it:

- Go to your wallet and click withdraw or cash out

- Choose the amount you wish to withdraw

- Choose your preferred withdrawal method

- Enter your bank details and confirm the transaction

Some exchanges may charge a flat fee or a percentage on withdrawals. For instance, Coinbase charges 0.15 € for SEPA and 1.49% for PayPal withdrawals. Kraken charges up to $4 for SWIFT withdrawals, depending on the country.

Conclusion

Selling cryptocurrency can feel confusing if you are doing this for the first time, but it doesn’t have to be. Now you know your options, and you can make an informed choice on what fits you best.

Each of the methods we described has its strengths. If you want speed and simplicity, a centralized exchange or a brokerage might be your best choice. If you prefer control and privacy, DEXs and P2P trading are a better fit. For quick cash, crypto ATMs are an option (though an expensive one).

Just remember to always check the fees and understand the risks. And of course, always choose a platform that is secure and well-rated. With a bit of care and some research, you’ll be able to cash out your crypto safely and smoothly.

FAQs

What is the easiest way to sell crypto for beginners?

The easiest way is through a centralized exchange or an ATM. CEXs guide you step-by-step and are simple to use, and ATMs offer rapid withdrawals.

Can I sell crypto without verifying my identity?

Yes, but only with certain methods. Decentralized exchanges and some P2P platforms will allow you to sell without KYC, but they don’t usually support fiat withdrawals. Some crypto ATMs also allow small transactions without an ID.

How long does it take to sell crypto and get my money?

This depends on the crypto platform you are using. Centralized exchanges usually take 1-3 business days to receive fiat. P2P trading may take minutes to hours, depending on the buyer. Crypto ATMs are usually instant or within a few minutes.

What are the typical fees for selling crypto?

This depends on which method you use to sell crypto. CEXs charge 0.1%-4.5%, DEXs charge 0.05%-0.3% and gas fees, crypto ATMs charge 7%-20%, and P2Ps charge 0% to 0.5%.

Is selling crypto taxable?

In most countries, selling crypto is taxable. Selling it for fiat or swapping it for another coin is a taxable event, and you may need to report gains/ losses. Check your local tax regulations or consult a tax professional.

References

- Investor Relations and Company Highlights – Coinbase

- Binance Trading Fees – Binance

- Coinbase Trading Fees – Coinbase

- Etherscan Featured Actions – Etherscan

- Robinhood Introduces Crypto Transfers In EU – Coindesk

- eToro Trading Fees – eToro

- Number of Crypto ATMs Worldwide – Coinatmradar

- Coinbase Accepted Identity Documents – Coinbase Help